Gptartwork to Datapackcome

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Building a More Sustainable City

Building a More Sustainable City Official and Everyday Practices of Urban Regeneration in Charlestown, NSW K. Ruming, K. Mee, P. McGuirk and J. Sweeney Department of Geography and Planning, Macquarie University Centre for Urban and Regional Studies, University of Newcastle Building a More Sustainable City: Official and Everyday Practices of Urban Regeneration in Charlestown Residents Report August 2015 Kristian Ruming, Kathy Mee, Pauline McGuirk and Jill Sweeney Department of Geography and Planning, Macquarie University Centre for Urban and Regional Studies, University of Newcastle Contacts: Dr Kristian Ruming Dr Kathy Mee and Professor Pauline McGuirk Department of Geography and Planning Department of Geography and Environmental Studies Macquarie University NSW 2109 University of Newcastle NSW 2308 Phone +61 (0)2 9850 8314 Phone Kathy: +61 (0)2 4921 6451 Fax +61 (0)2 9850 6052 Phone Pauline: +61 (0)2 4921 5097 Email [email protected] Email [email protected] Email [email protected] All photographs by J. Sweeney. CONTENTS Introduction 4 Survey Results Summary 5 Resident Interviews Development in Charlestown 8 Charlestown Square 11 Outside the Square 14 Charlestown’s Future 18 Concluding Comments 19 Ethical Statement The ethical aspects of this study have been approved by the Macquarie University Ethics Review Committee (Human Research). If you have any complaints or reservations about any ethical aspect of your participation in this research, you may contact the Ethics Review Committee through the Director, Research Ethics (phone 9850 7854; email [email protected]). Any complaint you make will be treated in confidence and investigated, and you will be informed of the outcome. -

Uniform Information

UNIFORM INFORMATION The McDonald College prides itself on being one of the most prestigious performing arts schools in the country and it is important that our students of all ages understand that it is part of their discipline to come dressed and groomed appropriately for class. All students taking a Classical Ballet class with us must come with their hair in a ballet bun, and boys must look presentable. Below is a list of our Uniform requirements for specific levels. We are proud to have a strong business relationship with the internationally renowned brand of dance wear BLOCH. The McDonald College and BLOCH have been in partnership for over 30 years and generously provides our families with an exclusive Privilege Card Program which offers discounts on all BLOCH products purchased in-store. • Pre School students – 5% Pink Discount Card • Preliminary Level and up – 10% Bronze Discount Card For a list of BLOCH stores in NSW please see below: YORK STREET 117 York Street, Sydney NSW 2000 Tel: (02) 9261 2856 BONDI JUNCTION Shop 2, 25-33 Bronte Rd, Bondi Junction NSW 2022 Tel: (02) 9369 5924 CHARLESTOWN Shop 1090, Charlestown Square, Pearson Street, Charlestown NSW 2290 Tel: (02) 4943 6811 CHATSWOOD Shop 520, Westfield Chatswood, 1 Anderson Street, Chatswood NSW 2067 Tel: (02) 9412 1550 HORNSBY Shop 2063-2069, Westfield Hornsby, 236 Pacific Highway, Hornsby NSW 2077 Tel: (02) 9477 4955 MIRANDA 537 Kingsway Miranda NSW 2228 Australia Tel: (02) 9525 9190 PARRAMATTA Shop 1112A, Westfield Shopping Centre, 159-175 Church St, Parramatta NSW 2150 Tel: (02) 9635 9315 ROUSE HILL GR045, 10-14 Market Lane, Rouse Hill, NSW 2155 Tel: (02) 8882 9415 WARRINGAH MALL Shop 313, Warringah Mall, Condamine Street, Brookvale NSW 2100 Tel: (02) 9905 0088 More information: bloch.com.au PRE SCHOOL BALLET Our youngest ballerinas are welcome to wear any colour and style of leotard they like. -

Smart Living Starts Here

Smart living starts here Smart living starts here This brand new development, neighbouring with Chisholm and Thornton, is your opportunity to invest in an architecturally designed estate, in the most accessible Hunter location. Chisholm Gardens has a range of dwellings to cater to the wide demographic of tenants and home buyers. With two and three bedroom villas & townhouses in single level adaptable or double storey, the variety suits most lifestyles; singles, couples, young families, downsizers, seniors and home owners who simply don’t want to worry about maintaining a large parcel of land. In close proximity to transportation and major education facilities in both Maitland & Newcastle as well as a childcare facilties just around the corner. Located opposite Homeworld, with SMSF option, you wont regret investing in this central thriving location. It’s an investment in smart living. Key Features 2 & 3 bedroom Villas 2.5 hp split-system air conditioner and townhouses Landscaped common areas, Single level adaptable designs gardens and BBQ areas Gourmet kitchen featuring Automatic panel-lift garage door modern stainless steel appliances Contemporary concrete patios, (cooktop, rangehood, dishwasher, driveways and footpaths fan-forced under-bench oven) and laminated cupboards Self Managed Super Fund suitable Home Styles Chisholm Gardens has a range of dwellings to cater Complete to the wide demographic of tenants and home buyers. Turn-Key Package The Acheron (TYPE A1) 3 Bedroom Villa Living 134.4m2 Portico 2.8m2 Garage 33.8m2 Dwelling size -

New South Wales

New South Wales Venue Location Suburb Bar Patron 2 Phillip St Sydney Westfield Kotara Kotara BEERHAUS 24 York St Sydney 108-110 Jonson St Byron Bay El Camino Cantina Manly Wharf Manly 18 Argyle St The Rocks 52 Mitchell Road Alexandria 118 Willoughby Rd Crows Nest ICC Sydney Darling Harbour Fratelli Fresh Entertainment Quarter Moore Park 11 Bridge St Sydney Westfield Sydney Sydney Munich Brauhaus 33 Playfair St The Rocks Rockpool Bar & Grill 66 Hunter St Sydney Rosetta Ristorante 118 Harrington St The Rocks 33 Cross Street Double Bay Sake Restaurant & Bar Manly Wharf Manly 12 Argyle Street The Rocks Spice Temple 10 Bligh St Sydney 108 Campbell Parade Bondi Beach Macarthur Square Shopping Centre Campbelltown Castle Towers Castle Hill Charlestown Square Charlestown Chatswood Central Chatswood Stockland Greenhills East Maitland Manly Wharf Manly Westfield Miranda Miranda The Bavarian Entertainment Quarter Moore Park Westfield Penrith Penrith Rouse Hill Town Centre Rouse Hill Stockland Shellharbour Shellharbour World Square Sydney Westfield Tuggerah Tuggerah Stockland Wetherill Park Wetherill Park Wollongong Central Wollongong The Cut Bar & Grill 16 Argyle St The Rocks Page 1 of 2 12 Shelley Street, Sydney, NSW 2000, Australia. ABN 92 108 952 085. Victoria Venue Location Suburb El Camino Cantina 222 Brunswick St Fitzroy Munich Brauhaus 45 South Wharf Promenade South Wharf Rockpool Bar & Grill Crown Melbourne Southbank Rosetta Trattoria Crown Melbourne Southbank 121 Flinders Lane Melbourne Sake Restaurant & Bar 100 St Kilda Rd Southbank Spice -

For Personal Use Only Use Personal For

10 February 2020 2019 Annual Result Property Compendium GPT provides its 2019 Annual Result Property Compendium which is authorised for release by the GPT Group Company Secretary. -ENDS- For more information, please contact: INVESTORS MEDIA Brett Ward Grant Taylor Head of Investor Relations & Corporate Communications Manager Affairs +61 437 994 451 +61 403 772 123 For personal use only Level 51, MLC Centre, 19-29 Martin Place, Sydney NSW 2000 www.gpt.com.au 2019 Annual Result2018 INTERIM PropertyRESULT Compendium PROPERTY COMPENDIUM For personal use only Contents Retail Portfolio 3 Office Portfolio 28 Logistics Portfolio 75 For personal use only Retail Portfolio Annual Result 2019 For personal use only CasuarinaFor personal use only Square Northern Territory 4 Casuarina Square, Northern Territory Casuarina Square is the dominant shopping destination in Darwin and the Northern Territory. The centre is located in the northern suburbs of Darwin, a 15 minute drive from Darwin’s Central Business District (CBD) and 20 minutes from the satellite town of Palmerston. The centre incorporates 198 tenancies including two discount department stores, two supermarkets, cinema and entertainment offer. The centre is also complemented by a 303 bed student accommodation facility operated by Unilodge. Casuarina Square is home to one of Australia’s largest solar rooftop systems after installation of the 1.25MW (megawatt) system in 2015. Key Metrics as at 31 December 2019 General Current Valuation Ownership Interest GPT: 50%, GWSCF: 50% Fair Value1 GPT: $248.0m -

State Shop List Address

STATE SHOP LIST ADDRESS COLES STORE WODEN PLAZA Keltie Street Phillip 2606 ACT COLES STORE HYPERDOME Hyperdome Shopping Centre Cnr Pittman Street & Ankertell Street Tuggeranong 2900 ACT ACT COLES STORE WANNIASSA 12 Sangster Place Wanniassa 2903 ACT COLES STORE CANBERRA CIVIC Shop EG24 Canberra Centre Cnr Bunda & Petrie Streets Canberra ACT 2601 Canberra 2601 ACT COLES STORE AMAROO 11 Pioneer Street Amaroo 2914 ACT COLES STORE ALEXANDRIA (COL) 23 O'Riordan Street Alexandria 2015 NSW COLES STORE LAVINGTON Border Shopping Centre Cnr Griffith Road & Urana Road Lavington 2641 NSW COLES STORE STANHOPE GARDENS Sentry Drive Stanhope Gardens 2768 NSW COLES STORE RHODES Rider Boulevard Rhodes Waterside 2138 NSW COLES STORE FIGTREE Figtree Shopping Centre Cnr Gladstone Street & Princess Highway Figtree 2525 NSW COLES STORE ROSELANDS Roselands Shopping Centre Roselands Avenue Roselands 2196 NSW COLES STORE SOUTH CITY SHOPPI Tanda Place South Wagga 2650 NSW COLES STORE MT DRUITT Westfield Shopping Town Carlisle Avenue Mount Druitt 2770 NSW COLES STORE BEGA Cnr Parker Street & Carp Street Bega 2550 NSW COLES STORE WARATAH Turton Road Waratah 2298 NSW COLES STORE FAIRFIELD Fairfield Forum Shopping Centre Cnr Station Street & Ware Street Fairfield 2165 NSW COLES STORE EPPING Rawson Street Epping 2121 NSW COLES STORE NOWRA Cnr Kinghorne Street & Junction Street Nowra 2541 NSW COLES STORE MIRANDA Parkside Plaza Shopping Centre Wandella Road Miranda 2228 NSW COLES STORE THE ENTRANCE Lakeside Plaza The Entrance Road The Entrance 2261 NSW COLES STORE LITHGOW -

Annual Report 2001 LR

ANNUAL REPORT 2001 HAVE IT NOW I so deserve this and this and this The Directors are pleased to present the Annual Report of Michael Hill International Limited for the year ended 30 June 2001. R.M. Hill Chairman of Directors M.R. Parsell CONTENTS Chief Executive Officer/Director 2 Company Profile Dated 23 August 2001 2 Results in Brief 5 Trend Statement 7 Chairman’s Letter 8 Report of the Directors 12 CEO Review of Operations 15 Corporate Governance Statement 17 Risk Management Statement 19 Corporate Code of Conduct 21 Board Members’ Profiles 22 Auditors’ Report 23 Financial Statements 36 Directors’ Interests in Transactions 37 Shareholder Information 38 Share Price Performance 40 Store Outlets - Australia 41 Store Outlets - New Zealand 42 Notice of Annual Meeting 44 Corporate Directory 44 Management Directory 44 Financial Calendar 1 COMPANY PROFILE RESULTS IN BRIEF MICHAEL HILL INTERNATIONAL operates Michael Hill 2001 2000 Jeweller - an Australasian retail jewellery chain with 115 TRADING RESULTS stores between Australia and New Zealand as at 30 June •Group revenue ($000’s) 189,168 181,983 2001. The Company began in 1979 when Michael Hill •Group surplus after tax ($000’s) 10,039 9,939 opened the first store in the New Zealand town of - First half 7,745 7,494 Whangarei, some 160 kilometres north of Auckland. - Second half 2,294 2,445 A unique retail jewellery formula that included FINANCIAL POSITION dramatically different store designs, a product range devoted •Total assets ($000’s) 91,331 82,394 exclusively to jewellery and almost saturation levels of high •Total shareholders’ funds ($000’s) 49,568 42,587 impact advertising elevated the Company to national prominence and record sales. -

Curriculum Vitae

Curriculum Vitae Warren Smith Managing Director (Founder & 34 Years with Practice) Phone: +61 2 8234 8614 Fax: +61 2 9290 1295 Mobile: 0408 229 149 Email: [email protected] Nationality: Australian Experience § 1981 – Current Warren Smith & Partners Hydraulic, Fire and Civil Engineers Level 1, 123 Clarence Street, Sydney NSW 2000 Managing Director § Design Management of Engineers § Design overview of Hydraulic Systems § Project Management § Expert Witness Reports § Implementation and Management of QA System Education § Plumbing & Building Services Certificate § Member of AHSCA, Institute of Plumbing Australia & American Society of Plumbing Engineers Key Projects Some of the more significant projects currently in progress and successfully undertaken and completed by Warren include:- Commercial § Barangaroo South Commercial Towers C2, C3, C4 & C5 § Darling Walk Redevelopment, Harbour Street, Sydney § 161 Castlereagh Street, Sydney § Mid City Centre Redevelopment, 420 George Street, Sydney § 126 Phillip Street, Sydney § 101 George Street, Parramatta § Abigroup Head Office, 924 Pacific Highway, Gordon Commercial Refurbishments § 265 Castlereagh Street, Sydney § The Law Society – 170 Phillip Street, Sydney § Darling Park, Tower 1 § No. 1 Chifley Square, Sydney Commercial Fitouts § Barangaroo South – Westpac Fitout § Barangaroo South – KPMG Fitout § Barangaroo South – PwC Fitout § Barangaroo South – Lend Lease Fitout § Barangaroo South – HSBC Fitout § Barangaroo South – Servcorp Fitout § Barangaroo South – Marsh Fitout Retail § Top Ryde -

ADELAIDE Melbourne NEWCASTLE SYDNEY BRISBANE

OzHarvest BOOK OF THANKS Annual Report 2013 THANKs a million ozharvest is constantly surrounded by magnificent individuals and organisations from volunteers, in-kind sponsors, food and financial donors and ambassadors who give their services, time money, food or goods so generously. This support allows OzHarvest to continue doing what we do — that is rescue food, redistribute it to people in need and continue to educate people about food waste, the environment, sustainability and food security. We must recognise some incredible organisations that go above and beyond and continue to help us, so that we can help our most vulnerable Australians. As we have thousands of supporters who are so important and who we would like to recognise, we have again created this Book of Thanks to acknowledge each and every one of you. Please forgive us if we have missed your name, and please do tell us so that we can ensure it appears in our Book of Thanks next year. Thank you everyone for everything you’ve done for OzHarvest. Without your help — we would not exist. There are some extra special superheroes we must mention. GOODMAN+ Apex pacific services MACQUARIE GROUP FOUNDATION CANTARELLA BROS / VITTORIA COFFEE caltex australia Woolworths city of sydney FRUIT BOX Qantas harvest hub accor bain & company THYNE REID FOUNDATION bob & pete’s NIB FOUNDATION Allens Lawyers klein family foundation Sargent’s pies foundation Wood Foundation Aldi Wesley mission brisbane crittah ozsale droga federal australian government ernst young COSTco liquid ideas pages ken hall gastronomy frost* group FDC ADELAIDE FINANCIAL DONOR Zero Waste SA /Wood Foundation /Westpac /West Torrens Library Service /Volvo Group Australia Pty Ltd /Volunteering SA&NT Inc. -

Sydney Strategic Model Re-Estimation: Mode-Destination Model

EUROPE Sydney Strategic Model Re-estimation Mode-Destination Model James Fox, Bhanu Patruni, Andrew Daly For more information on this publication, visit www.rand.org/t/RR1130 Original date of publication December 2010 Published by the RAND Corporation, Santa Monica, Calif., and Cambridge, UK R® is a registered trademark. © Copyright 2015 Transport for New South Wales RAND Europe is an independent, not-for-profit policy research organisation that aims to improve policy and decisionmaking in the public interest through research and analysis. RAND’s publications do not necessarily reflect the opinions of its research clients and sponsors. All rights reserved. No part of this book may be reproduced in any form by any electronic or mechanical means (including photocopying, recording, or information storage and retrieval) without permission in writing from the sponsor. Support RAND Make a tax-deductible charitable contribution at www.rand.org/giving/contribute www.rand.org www.rand.org/randeurope Preface RAND Europe were commissioned by the Transport Data Centre (TDC) (now known as Bureau of Transport Statistics, and referred to as BTS) of the New South Wales Ministry of Transport (now known as Transport NSW) to re-estimate the travel demand model components of the Sydney Strategic Transport Model (STM). The STM was designed by Hague Consulting Group (1997). In Stage 1 of model development (1999–2000), Hague Consulting Group developed mode-destination and frequency models for commuting travel, as well as models of licence ownership and car ownership. In addition, a forecasting system was developed incorporating these components. In Stage 2 of model development (2001–2002), RAND Europe, incorporating Hague Consulting Group, developed mode and destination and frequency models for the remaining home-based purposes, as well as for non-home-based business travel. -

2016 Annual Result

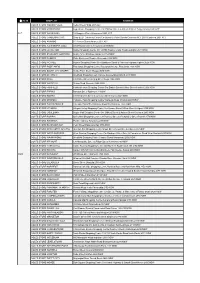

2016 ANNUAL RESULT Property Compendium Contents Retail Portfolio 3 GWSCF Portfolio 18 Office Portfolio 35 GWOF Portfolio 50 Logistics Portfolio 85 2016 ANNUAL RESULT Retail Portfolio Casuarina Square Northern Territory 4 Casuarina Square, Northern Territory GPT Casuarina Square is the premier shopping destination in Darwin and the Northern Territory. The centre is located in the northern suburbs of Darwin, a 15 minute drive from Darwin’s Central Business District (CBD) and 20 minutes from the satellite town of Palmerston. The centre includes two discount department stores, two supermarkets, a variety of specialty stores and a cinema entertainment offer. The centre is also complimented by a 303 bed student accommodation facility operated by Unilodge. Casuarina Square is also home to one of Australia’s largest solar rooftop system’s after installation of the 1.25MW (megawatt) system in 2015. A new entertainment and leisure precinct named “The Quarter” was successfully launched in July 2016. The project saw the introduction of 12 new dining tenancies and a Timezone entertainment centre. Key Metrics as at 31 December 2016 General Current Valuation Ownership Interest 50% GPT Fair Value1 $313.0m Co-Owner 50% GWSCF Capitalisation Rate2 5.75% Acquired (by GPT) October 1973 Valuation Type External Asset Type Regional Centre Income (12 months) $17.6m Construction/Refurbishment Completed 1973 / Refurbished 1998 Centre Details Sales Information Total GLA 54,700 sqm Total Centre Specialties Number of Tenancies 196 Sales Turnover per Square Metre $8,529 -

For Personal Use Only Use Personal for Good Leasing Progress Continued at the MLC Centre, with Six New Leases Concluded

THE GPT GROUP ANNOUNCES 2 May 2016 March Quarter Operational Update The GPT Group (GPT) today announced its operational update for the March 2016 quarter. Key Highlights . Retail specialty MAT sales growth of 5.9 per cent . 17,900 sqm office leases signed and a further 9,600 sqm of deals at Heads of Agreement for the quarter . Standard & Poor's raised its long-term rating to 'A' and the short-term rating to 'A-1' CEO and Managing Director Bob Johnston said it had been another solid quarter of activity for GPT, with continued positive trading conditions across its retail, office and logistics portfolios. Overall, the portfolio continues to benefit from the strong NSW and Victorian economies. “The Group has a strong balance sheet position, as reflected by S&P’s recent upgrade of GPT’s long and short term credit rating to A/A-1. We remain on target to deliver our earnings guidance for the full year of between 4 to 5 per cent EPS growth,” Mr Johnston said. Retail Following strong comparable specialty moving annual turnover (MAT) growth of 6.5 per cent for 2015, growth moderated slightly in the 12 months to 31 March to 5.9 per cent. Specialty sales growth in the first quarter of 2016 was 3.0 percent. Our Melbourne Central, Highpoint and Rouse Hill shopping centres continued to outperform, reflecting their strong market positions. Australian Bureau of Statistics data for the 12 months to February showed retail sales growth in Victoria remained well above the national average, while sales growth in NSW had moderated from its 2015 highs.