Annual Report 2013 2 Annual Report 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

About Manetci

ABOUT MANETCI ManeTCI is one of the leading companies in the construction industry developing projects in Albania, founded in 2002. Since its beginning, ManeTCI has brought a different concept to the civil and industrial constructions improving the society’s standards of living. ManeTCI is best acknowledged for projects such as Universe Shopping Mall (QTU), Tirana East Gate (TEG), Rolling Hills Luxury Residences, Green Coast Resort and Residences etc., which are considered as innovative projects not only in the construction sector but also impacting the lifestyle. ManeTCI is part of the Balfin Group, the largest investment group in Albania and one of the largest in the region. MISSION To develop and build high-value projects with indisputable quality and high standards for the benefit of our customers, partners and the community. VISION To be a leader in the construction and real estate investment industry in Albania and the region. WE BUILD VALUES Quality Partnership Innovation We are proud to have introduced We make sure to build trusted We are committed to build new quality standards in the partnership relations by defending values by bringing innovative Albanian market. The indisputable and respecting the interest of concepts in Albania. Our projects quality we undertake is evidenced our clients, partners and the have introduced in the Albanian in dozens of projects considered community in general. market the concept of shopping as the benchmark of the malls, premium residential contemporary standards. communities, elegant and touristic residences. Customer Service / Integrity Satisfaction This principle guides us in the Best customer satisfaction is the work quality-oriented approach reward of our work, which we within the foreseen deadlines achieve by providing professional and in compliance with the rules sales services. -

Ftese Per Oferte

Invitation to quote INVITATION TO QUOTE Dear Sir/Madam, 1. You are invited to present your price quotation(s) for Property Insurance services. Please see attached Annex A “Financial Quotation”. Annex B “List of Tirana Bank Branches and ATM Networks”. Annex C “List of Tirana Bank Properties”. 2. You can provide to us an estimation cost for the mentioned services which will be subject of a separate review procedure and signature of the respective contract by parties included, for the best offers. Based on the “Invitation to Quote” you should present your offer, after you have read carefully each articles specified, as parts of your assessment. 3. Your quotation(s) should be addressed in a closed envelope, and submitted to: Procurement Unit Tirana Bank, Head Office Rr. "Ibrahim Rugova", Envelope should be superscribed with “Quotation for Tender” 4. THE DEADLINE The deadline for receipt your quotation (s) by the Purchaser at the address indicated above is: 24.01.2020 -12:00 a.m. 5. TECHNICAL SPECIFICATIONS - Your offer should include: a- Financial Offer (Price) b- Technical Offer c- Legal documentations - Contract duration will be for 1 year -Deductibles: 500,000All 6. PRICE You should deliver a financial quotation for: Your are requested to give your financial offer as described in Annex A. Price (% per Sum Insured ) should be VAT and every other taxes or expenses included. - 1 - Invitation to quote 7. Technical Offer Your offer should Include: a- Details on the reinsurance agreement i.e.: -reinsurance company, -minimum amount reinsured, -duration of the reinsurance agreement, - risk coverage of the reinsurance agreement, - Premium Return Policy (Policy Cancellations and Return Premiums/refund of premiums paid), in cases of cancelation of property insurance. -

From Small-Scale Informal to Investor-Driven Urban Developments

Mitteilungen der Österreichischen Geographischen Gesellschaft, 162. Jg., S. 65–90 (Annals of the Austrian Geographical Society, Vol. 162, pp. 65–90) Wien (Vienna) 2020, https://doi.org/10.1553/moegg162s65 Busting the Scales: From Small-Scale Informal to Investor-Driven Urban Developments. The Case of Tirana / Albania Daniel Göler, Bamberg, and Dimitër Doka, Tirana [Tiranë]* Initial submission / erste Einreichung: 05/2020; revised submission / revidierte Fassung: 08/2020; final acceptance / endgültige Annahme: 11/2020 with 6 figures and 1 table in the text Contents Summary .......................................................................................................................... 65 Zusammenfassung ............................................................................................................ 66 1 Introduction ................................................................................................................ 67 2 Research questions and methodology ........................................................................ 71 3 Conceptual focus on Tirana: Moving towards an evolutionary approach .................. 72 4 Large urban developments in Tirana .......................................................................... 74 5 Discussion and problematisation ................................................................................ 84 6 Conclusion .................................................................................................................. 86 7 References ................................................................................................................. -

Doing Business in Albania

DOING BUSINESS IN ALBANIA CONTENTS 1 – Introduction 3 2 – Business environment 4 3 – Foreign Investment 7 4 – Setting up a Business 28 5 – Labour 35 6 – Taxation 41 7 – Accounting & reporting 49 8 – UHY Representation in Albania 50 DOING BUSINESS IN ALBANIA 3 1 – INTRODUCTION UHY is an international organisation providing accountancy, business management and consultancy services through financial business centres in 100 countries throughout the world. Business partners work together through the network to conduct transnational operations for clients as well as offering specialist knowledge and experience within their own national borders. Global specialists in various industry and market sectors are also available for consultation. This detailed report providing key issues and information for investors considering business operations in Albania has been provided by the office of UHY representatives: UHY ELITE SH.P.K Rr. Ibrahim Rrugova P17, H3, Apt.12 (3rd floor) Tirana , Albania Phone +355 69 40 66946 Website www.uhy-elite.com Email [email protected] You are welcome to contact Artan Xhiani ([email protected]) for any inquiries you may have. A detailed firm profile for UHY’s representation in Albania can be found in section 8. Information in the following pages has been updated so that they are effective at the date shown, but inevitably they are both general and subject to change and should be used for guidance only. For specific matters, investors are strongly advised to obtain further information and take professional advice before making any decisions. This publication is current at August 2020. We look forward to helping you do business in Albania. -

Nipt Emri I Subjektit J61804007C GOLLOBORDA S.D.A J61804009S HIDROMONTIMI J61804013A ALBECO J61804014I FLORA KO J61804015Q MIQESIA SH.P.K

Nipt Emri I Subjektit J61804007C GOLLOBORDA S.D.A J61804009S HIDROMONTIMI J61804013A ALBECO J61804014I FLORA KO J61804015Q MIQESIA SH.P.K. J61804021O UNICON J61804025A SHOQERIA ANONIME "MIELLI" J61804029J EDGLIS J61804031V E. H. W. J61804032G MAJESTIC INTERNATIONAL J61804038I Invest Real Estate J61804040U ITAL.TRE.DI.93 J61805006W IMI - FARMA J61805010E SAFIR DISTIC. A.S. J61805012U B U Z J61805506G G, I. G. J61805508W FERRA & CO J61805509H PASTRIMI DETAR J61805512E ADRIA J61805519O DIMEX J61805523T PRO DRU J61805541R DALIVA J61806001K ALIMPEKS -TIRANA J61806005T EUROFARMA TQ TOLICA J61806006E BEHARI J61806008U JAPAN-XHIMI J61806015D GOLDEN EAGLE J61806018E ERICA ALBANIA CERAMICHE J61807005B INTERNACIONAL J61807012H APOLON -5 J61807016Q ALMA - KONFEKSION - IMPORT - EKSPORT J61807019R C & B INTERNATIONAL CO J61807020V Aquila Group J61807028Q ALBAWOOD J61807030F VELLEZERIT KAJTAZI J61807503P Teuta Konstruksion J61807505I ADRIATIK J61807506Q FLORYHEN J61810004I NIMIKO J61810016I FRATARI CONSTRUKSION J61810018B EUROCOL J61810020N A.G.B. J61810021V ARMET J61810030U A.I.S. J61810051T TIRANA BUTAN GAS SH.A. J61810062L ALBAVIN TIRANA J61810501O ARME-L J61810504P DYRRAKIUM J61810511V ALBEL SA J61810517A ALBANIA TRADING COMPANY J61810523V HELIO J61811001M RO -AL J61811007O LEONE J61811009H AULIVIA J61811015F A.C.C. J61811017V EDIL - CENTRE J61811019O KLES J61811020S SALBATRING INT J61811023T DV-ALBTURIST HOTELIERS J61811029V ALBACO SHOES J61811035T LORENZO-TIRANA J61811036E PAOAS J61811037M A G C J61811043K ALB AM J61811054C KALAMA J61811504U SHTYPSHKRONJA -

1 Farka Lake Park Revitalization in the City Outskirts of Tirana a Thesis Submitted to the Faculty of Architecture and Engineer

FARKA LAKE PARK REVITALIZATION IN THE CITY OUTSKIRTS OF TIRANA A THESIS SUBMITTED TO THE FACULTY OF ARCHITECTURE AND ENGINEERING OF EPOKA UNIVERSITY BY IDI BALLA IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF INTEGRATED SECOND CYCLE STUDY PROGRAM IN ARCHITECTURE JULY, 2016 1 I hereby declare that all information in this document has been obtained and presented in accordance with academic rules and ethical conduct. I also declare that, as required by these rules and conduct, I have fully cited and referenced all material and results that are not original to this work. Idi Balla Signature: iii ABSTRACT FARKA LAKE PARK REVITALIZATION IN THE CITY OUTSKIRTS OF TIRANA Idi, Balla M.Sc., Department of Architecture Supervisor: Msc. Artan Hysa Co-Supervisor: Msc. Egin Zeka Air pollution is nowadays the biggest problem for the environment in the world and also the biggest challenge to deal with for saving our planet. The last decade has been very harmful for the environment, with modern industries being developed, which release dangerous gases, like: motor vehicles industry, power stations, factories, landfills, etc. Even in Albania, the air pollution is enormous and this pollution is mostly caused by vehicles which work with a diesel engine. In Tirana, with the new territorial reform which took place in 2015, there are roughly 100 lakes inside the city boundaries and their belonging parks that surround these lakes and the majority of them are not being harnessed. These green areas are located mostly in the outskirts of the city, while inside the city there is a notable lack of attention for parks and green spaces. -

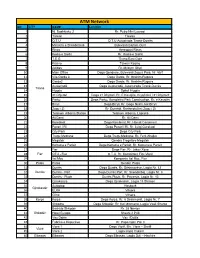

ATM Network NO CITY NAME Location 1 Nj

ATM Network NO CITY NAME Location 1 Nj. Bashkiake 2 Rr. Petro Nini Luarasi 2 Taiwan Taiwan 3 Q.T.U Q.T.U Autostrada Tiranë-Durrës 4 Ministria e Shëndetsisë Bulevardi Bajram Curri 5 Rinas Aereoport Rinas 6 Kodra e Diellit Rr. Kodra e Diellit 7 T.E.G Tirana East Gate 8 Kasino Taiwan Kasino 9 Adidas Rr. Myslym Shyri 10 Main Office Dega Qendrore, Bulevardi Zogu i Parë, Nr. 55/1 11 Vila Garda 3 Dega Garda, Rr. Ibrahim Rugova 12 Garda2 Dega Garda, Rr. Ibrahim Rugova 13 Autostradë Dega Autostradë, Autorstrada Tiranë-Durrës Tiranë 14 Hygeia Spitali Hygeia 15 21 Dhjetori Dega 21 Dhjetori, Rr. E Kavajës, Kryqëzimi i 21 Dhjetorit 16 Parku Dega Parku, Kompleksi Park Construction, Rr. e Kavajës 17 Brryli Dega Brryli, Rr. Gogo Nushi, tek Brryli 18 Zogu i Zi Rr. Durrësit, Rrethrrotullimi Zogu i Zi 19 Telekom Albania Station Telekom Albania, Laprakë 20 Ali Demi Rr. Ali Demi 21 Kombinat Dega Kombinat, Rr. Hamdi Cenoimeri 22 Pazari i Ri Dega Pazari i Ri, Rr. Luigj Gurakuqi 23 City Park Dega City Park 24 Tregu Medrese Dega Tregu Medrese, Rr. Ferit Xhajko 25 Megatek Qendra Tregëtare Megatek 26 Komuna e Parisit Dega Komuna e Parisit, Rr. Komuna e Parisit 27 Fier Dega Fier, Rr. Jakov Xoxe 28 Fier QTU - Fier Q.T.U, Rr. Kombëtare Fier-Vlorë 29 Ital Mec Kompania Ital Mec, Fier 30 Patos Patos Qendër Patos 31 Durrës Dega Durrës, Rr. Dëshmorëve, Lagjia Nr. 12 32 Durrës Durrës - Port Dega Durrës Port, Rr. Skendërbej, Lagjia Nr. 3 33 Durrës - Plazh Durrës Plazh, Rr. -

Real Estate Market in Albania

REAL ESTATE MARKET IN ALBANIA FEBRUARY 2011 1 Contents REAL ESTATE MARKET IN ALBANIA ..........................................................................3 Industry Overview .......................................................................................................3 Economy Overview .......................................................................................................3 Geography .......................................................................................................................3 MAJOR DEVELOPMENTS ...............................................................................................3 Regulations .....................................................................................................................3 Leading Companies .......................................................................................................3 SUPPLY ...............................................................................................................................4 Residential Real Estate ................................................................................................4 Office Real Estate ..........................................................................................................4 Retail Real Estate ..........................................................................................................5 Industrial Real Estate ...................................................................................................5 DEMAND ............................................................................................................................5 -

Albania 2019

Albania 2019 1 Table of Contents Doing Business in Albania ______________________________________________ 5 Market Overview _____________________________________________________________ 5 Market Challenges ___________________________________________________________ 6 Market Opportunities _________________________________________________________ 6 Market Entry Strategy _________________________________________________________ 7 Political Environment __________________________________________________ 8 Selling US Products & Services __________________________________________ 9 Using an Agent to Sell US Products and Services _________________________________ 9 Establishing an Office ________________________________________________________ 9 Franchising ________________________________________________________________ 11 Direct Marketing ____________________________________________________________ 11 Joint Ventures/Licensing _____________________________________________________ 11 Selling to the Government ____________________________________________________ 11 Distribution & Sales Channels _________________________________________________ 12 Express Delivery ____________________________________________________________ 12 Selling Factors & Techniques _________________________________________________ 13 eCommerce ________________________________________________________________ 13 Trade Promotion & Advertising ________________________________________________ 13 Pricing ____________________________________________________________________ 13 Sales -

Nipi I Berishës, Përjashtohet Nga Policia, Emërohet Diplomat Dritan Berisha Së Bashku Me Vëllain Në 2006 Qëlluan Me Pistoletë Një Djalë Nga Vlora

Faqe 3 Faqe 13 NGA ALBA MALLTEZI Buxheti, Blushi: E keni hypur Bashkia e Tiranës harron Çlirimin BLOG/Periferi Skënderbeun mbi një lopë festime vetëm në 28 nëntor Faqe 11 Faqe 14-15 Happy kryeministër Hetimet e prokurorisë: 14 mijë Vali Duka: Deklarata e Pavarësisë dhe dy miqtë e mi qytetarë, ankesa për faturim energjie mbase në arkivat jugosllave Faqe 2 Tani jemi edhe online www.shqiptarja.com LEKË 20 NR. 20 E shtunë, 26-11-2011 Emërimet nepotike në administratë, djali i vëllait të kryeministrit ‘rehabilitohet’ Nipi i Berishës, përjashtohet nga policia, emërohet diplomat Dritan Berisha së bashku me vëllain në 2006 qëlluan me pistoletë një djalë nga Vlora. Olldashi i përjashtoi nga policia. Tani gjendet diplomat së bashku me gruan në ambasadën tonë në Romë Lajmi Editorial NGA LORENC VANGJELI Nipi i kryeministrit Berisha është rikthyer në Ministrinë e Brendëshme, e cila e kishte përjashtuar mëse 5 Rrush & vite më parë për thyerje të rëndë të disiplinës, pas një incidenti me armë kumbulla në mes të Tiranës. Për më tepër ai figuron oficer Kontakti në zyrën ryeministri Berisha ishte për vizitë konsullore të ambasadës shqiptare Kzyrtare në Norvegji dy javë më parë. në Romë, si strukturë e Ministrisë Ka disa muaj që e krahason Shqipërinë së Brendëshme. me Norvegjinë. E ribëri dhe dje në Kuvend kur tha se “... Shqipëria është një Norvegji e vogël në gadishullin e Ballkanit”. TIRANE Një javë më parë ndodhej po për vizitë Në foto: në Izrael. Do të duhet të pritet më shumë ARBEN ROZHANI Kryeministri Berisha me nipin se disa muaj që të bëhet krahasimi me e tij Dritan Berisha (majtas) Izraelin. -

Zyra Të Këmbimit Valutor / Foreign Exchange Bureaus

ZYRA TË KËMBIMIT VALUTOR / FOREIGN EXCHANGE BUREAUS 1. ZYRA E KËMBIMEVE VALUTORE “JOARD” SH.P.K., TIRANË Licenca Nr. 1, datë 01.10.1999. Administrator: Josif Kote Adresa: Rruga “Ded Gjon Luli” Nr.2, Tiranë. Telefon: 04 2233 158 Fax: Mobile: 2. ZYRA E KËMBIMEVE VALUTORE “A.M.A.” SH.P.K., DURRËS Licenca Nr. 2, datë 01.10.1999. Administrator: Idlir Hoxha Adresa: Zyra 1: Lagjja nr. 9, rruga “Aleksandër Goga”, pallati nr. 530 ( pranë Muzeut të Dëshmorëve), Durrës. Zyra 2: Lagjja nr. 4, rruga “9 Maji”, godinë 4 katëshe, kati I, Durrës. Telefon: 052 225183 / 228088 Fax: 052 230670 Mobile: 0682033030 3. ZYRA E KËMBIMEVE VALUTORE “AGLI” SH.P.K., TIRANË Licenca Nr. 5, datë 01.10.1999. Administrator: Agim Cani Adresa: Zyra 1: Rruga “Islam Alla”, nr.1, Tiranë. Zyra 2: Rruga “Kavajës”, pranë ish pasticeri Rinia, Tiranë. Telefon: 04 2255 517 Fax: Mobile: 4. ZYRA E KËMBIMEVE VALUTORE “ILIRIA ‘98” SH.P.K., TIRANË Licenca: Nr. 12, datë 25.02.2000 Administrator: Ali Topalli, Edmond Ymeri, Ilir Janku Adresa: Zyra 1: Sheshi “Austria”, pranë Teatrit të Kukullave, Tiranë. Zyra 2: Rruga “Dëshmorët e 4 Shkurtit”, pranë KESH, Tiranë. Zyra 3: Parku Rinia, Kompleksi Tajvan, Tiranë. Zyra 4: Rrruga e Durrësit, pranë ish kafe Florës, Tiranë. Zyra 5: Rruga e Elbasanit, nr. 31/1, Tiranë Zyra 6: Rruga e Barrikadave Zyra 7: Kashar, Autostrade Tirane-Durres, Km 12, Qendra Tregtare City Park, Tirane Zyra 8: Rruga’’Sami Frashëri’’, Pallati 55/4, Përballë Drejtorisë së Policisë, Tiranë Zyra 9: Rruga “Kavajës”, Përballë Ministrisë së Kulturës Rinisë dhe Sporteve, Tiranë. -

Global Net Ështe Një Kompani E Themeluar Më 4 Tetor 2010 Me Numer Rregjistrimi L02205042V

Global Net ështe një kompani e themeluar më 4 Tetor 2010 me numer rregjistrimi L02205042V. Objektivi kryesor i saj është tregtimi me shumicë dhe pakicë i sistemeve të sigurisë si sistemi vëzhgimit, telefonisë, vjedhjes, mbrojtes nga zjarri dhe shërbimeve të telekomunikacionit të tilla si: projektim, instalim etj. Misioni dhe Vizioni Ne synojmë ti shërbejmë klientëve tanë në mënyrat më të mira të mundshme duke ofruar produkte dhe shërbim cilësor. Ekipi dhe stafi ynë ka qëllim të sjellë ndryshim, te vlerësojmë klientët tanë dhe të qëndrojë me premtimet tona për të punuar në mënyrë profesionale dhe të kontribuojnë në një zhvillim ekologjikisht të sigurt dhe të qëndrueshëm. 1. Stafi administrativ dhe struktura organizative Stafi administravi është një faktor i rëndësishëm në performancën e kompanisë. Stafi i kualifikuar është një komponent kyç në konsolidimin e kompanisë dhe në realizimin e projekteve. Për këtë arsye, kompania që në fillimet e saj dhe në vijim i ka kushtuar vëmendje të veçantë jo vetëm në përzgjedhjes së punonjësve, por edhe trajnimit të tyre dhe motivimit. Struktura e kompanisë është si më poshtë: 1. Departamenti i Menaxhimit dhe Shitjes. 2. Departamenti i Projektimit 3. Departamenti i Mirëmbajtjes dhe Instalimit 4. Departamenti i Financës 5. Departamenti Ligjor 6. Departamenti i Burimeve Njerezore Global Net sh.p.k , Rruga Dytesore TR-DR, Km1, Qendra e Biznesit Pajtoni, Tirana, Albania Tel: +355 4 246977 Fax: +355 4 270448 e-mail: [email protected] www.globalnet.al 2. Aktiviteti dhe Produktet a. Sistemi i Vëzhgimit me Kamera ( CCTV ) Sistemet e vëzhgimit me kamera mund të përdoren për të monitoruar njerëzit që hyjnë dhe dalin nga ndërtesat, lëvizjen e personelit në brendësi të ndërtesave.