Longfor Properties Co. Ltd. 龍湖地產有限公司 (Incorporated in the Cayman Islands with Limited Liability) Stock Code: 960

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Company Report: Longfor Properties (00960 HK) Van Liu 刘斐凡 Equity Research Equity 公司报告:龙湖地产 (00960 HK) +86 755 23976672 [email protected]

股 票 研 究 Company Report: Longfor Properties (00960 HK) Van Liu 刘斐凡 Equity Research Equity 公司报告:龙湖地产 (00960 HK) +86 755 23976672 [email protected] 28 March 2017 Benign Prospective Fundamentals with Strong Contracted Sales, Reiterate "Buy" 强劲合约销售下的良好基本面展望,重申“买入” 公 2016 underlying net profit missed our expectation. Top line increased by 司 Rating: Buy 15.6% YoY to RMB54,799 mn. Underlying net profit increased 7.0% YoY to Maintained 报 RMB8,169 mn. 评级: 买入 维持 ( ) 告 The Company is expected to have sustainable revenue growth with Company Report Company stable margins. Contracted sales are likely to experience fast growth despite 目标价 policy tightening. Rental income is expected to grow fast. In addition, a quality 6-18m TP : HK$15.07 Revised from 原目标价: HK$13.22 land bank, appropriate unit land cost (27.6% of ASP in 2016) and low funding costs could result in stable margins. 股价: HK$13.120 Share price The Company is expected to maintain a healthy financial position. We estimate net gearing ratios to gradually decline in 2017-2019 and to maintain Stock performance below 60.0%. 股价表现 We think that Longfor deserves a low NAV discount. We revise up our target price from HK$13.22 to HK$15.07, representing a 24% discount to its 2017E 证 NAV, 7.0x 2017 underlying PER and 1.1x 2017 PBR. Therefore, we reiterate "Buy". Risk: lower-than-expected contracted sales and absent rental income 券 growth. 研 究 2016 年核心净利低于预期。总收入同比增长 15.6%到人民币 54,799 百万元。核心净利同 比上升 7.0%到人民币 8,169 百万元。 报 公司预计获得在稳定利润率下的可持续收入增长。尽管政策收紧但合约销售很有可能快速 告 增长。租金收入将快速增长。另外,有质量的土储,合适的单位土地成本(2016 年销售单 Equity Research Report Research Equity 价的 )以及低的财务成本能导致稳定的利润率。 27.6% 公司能够维持一个健康的财务状况。我们预测净资产负债率在 2017-2019 年逐渐降低并维 Change in Share Price 1 M 3 M 1 Y 股价变动 1 个月 3 个月 1 年 持在 60.0%以下。 Abs. -

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Longfor Properties Co. Ltd. 龍湖地產有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 960)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Longfor Properties Co. Ltd. 龍湖地產有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 960) ANNOUNCEMENT OF ANNUAL RESULTS FOR THE YEAR ENDED DECEMBER 31, 2016 FINANCIAL SUMMARY • Contracted sales increased by 61.6% to RMB88.14 billion as compared with that of last year. • Revenue increased by 15.6% to RMB54.80 billion as compared with that of last year, of which the rental income from the property investment business increased by 35.2% to RMB1.91 billion. • Profit attributable to shareholders was RMB9.15 billion. Excluding effects, such as minority interest and valuation gains, core net profit increased by 11.8% to RMB7.76 billion as compared with that of last year. Gross profit margin increased by 1.7% to 29.1%. Core net profit margin attributable to shareholders was 14.2%. • The net debt to equity ratio (net debt divided by total equity) was 53.9%. Cash in hand was RMB17.36 billion. • Total consolidated borrowings amounted to RMB57.87 billion. Average cost of borrowing decreased from 5.74% to 4.92% per annum. Average maturity period of loan was 5.90 years. • Fully diluted earnings per share were RMB1.57. The Board recommends a final dividend of RMB0.466 per share, representing an increase of 30.5% as compared with that of last year. -

A Contextual Transit- Oriented Development Typology of Beijing Metro Station Areas

A CONTEXTUAL TRANSIT- ORIENTED DEVELOPMENT TYPOLOGY OF BEIJING METRO STATION AREAS YU LI June, 2020 SUPERVISORS: IR. MARK BRUSSEL DR. SHERIF AMER A CONTEXTUAL TRANSIT-ORIEND DEVELOPMENT TYPOLOGY OF BEIJING METRO STATION AREAS YU LI Enschede, The Netherlands, June, 2020 Thesis submitted to the Faculty of Geo-Information Science and Earth Observation of the University of Twente in partial fulfilment of the requirements for the degree of Master of Science in Geo-information Science and Earth Observation. Specialization: Urban Planning and Management SUPERVISORS: IR. MARK BRUSSEL DR. SHERIF AMER THESIS ASSESSMENT BOARD: Dr. J.A. Martinez (Chair) Dr. T. Thomas (External Examiner, University of Twente) DISCLAIMER This document describes work undertaken as part of a programme of study at the Faculty of Geo-Information Science and Earth Observation of the University of Twente. All views and opinions expressed therein remain the sole responsibility of the author, and do not necessarily represent those of the Faculty. ABSTRACT With the development of urbanization, more and more people live in cities and enjoy a convenient and comfortable life. But at the same time, it caused many issues such as informal settlement, air pollution and traffic congestions, which are both affecting residents and stressing the environment. To achieve intensive and diverse social activities, the demand for transportation also increased, the proportion of cars travelling is getting higher and higher. However, the trend of relying too much on private cars has caused traffic congestion, lack of parking spaces and other issues, which is against the goal of sustainable development. Transit-oriented development (TOD) aims to integrate the development of land use and transportation, which has been seen as a strategy to address some issues caused by urbanization. -

730661007 HCN Horizons China High Dividend

Summary of Investment Portfolio (continued) Horizons China High Dividend Yield Index ETF (HCN:TSX) Summary of Investment Portfolio As at March 31, 2020 % of ETF's Asset Mix Net Asset Value Net Asset Value Global Equities $ 9,616,772 100.73% Cash and Cash Equivalents 100,527 1.05% Other Assets less Liabilities (170,187) -1.78% $ 9,547,112 100.00% % of ETF's Sector Mix Net Asset Value Net Asset Value Hong Kong Broad Equity Index $ 9,616,772 100.73% Cash and Cash Equivalents 100,527 1.05% Other Assets less Liabilities (170,187) -1.78% $ 9,547,112 100.00% Summary of Investment Portfolio (continued) Horizons China High Dividend Yield Index ETF (HCN:TSX) Summary of Investment Portfolio (continued) As at March 31, 2020 % of ETF’s Top Holdings Net Asset Value Global X Hang Seng High Dividend Yield ETF 100.73% Cash and Cash Equivalents 1.05% Top 25 Securities % Weighting in In the Underlying Index*—Hang Seng High Dividend Yield Index Underlying Index Nine Dragons Paper Holdings Ltd. 4.35% China International Marine Containers (Group) Co. Ltd. 3.37% Kingboard Holdings Ltd. 3.30% Shenzhen International Holdings Ltd. 3.13% Xinyi Glass Holdings Ltd. 3.06% Yuzhou Properties Co. Ltd. 2.89% China Minsheng Banking Corp. Ltd. 2.72% Guangzhou R&F Properties Co. Ltd. 2.65% Lee & Man Paper Manufacturing Ltd. 2.63% China Petroleum and Chemical Corp. (Sinopec) 2.56% China Everbright Ltd. 2.38% Logan Property Holdings Co. Ltd. 2.38% Bank of China Ltd. 2.34% Agricultural Bank of China Ltd. -

The Best of Hangz 2019

hou AUGUST 呈涡 The Best of Hangz 2019 TOP ALTERNATIVE BEAUTY SPOTS THE BEST CONVENIENCE STORE ICE-CREAMS TRAVEL DESTINATIONS FOR AUGUST TAKE ME Double Issue WITH YOU Inside Do you want a behind the scenes look at a print publication? Want to strengthen your social media marketing skills? Trying to improve your abilities as a writer? Come and intern at REDSTAR, where you can learn all these skills and more! Also by REDSTAR Works CONTENTS 茩嫚 08/19 REDSTAR Qingdao The Best of Qingdao o AUGUST 呈涡 oice of Qingda 2019 City The V SURFS UP! AN INSIGHT INTO THE WORLD OF SURFING COOL & FRESH, Top (Alternative) WHICH ICE LOLLY IS THE BEST? 12 TOP BEACHES BEACH UP FOR Beauty Spots SUMMER The West Lake is undoubtedly beautiful, but where else is there? Linus takes us through the best of the rest. TAKE ME WITH YOU Double Issue 郹曐暚魍妭鶯EN!0!䉣噿郹曐暚魍旝誼™摙 桹䅡駡誒!0!91:4.:311! 䉣噿壈攢鲷㣵211誑4.514!0!舽㚶㛇誑䯤 䉣墡縟妭躉棧舽叄3123.1125誑 Inside Life’s a Beach Creative Services 14 redstarworks.com Annie Clover takes us to the beach, right here in Hangzhou. Culture 28 Full Moon What exactly is the Lunar Calendar and why do we use it? Jerry answers all. Follow REDSTAR’s Ofcial WeChat to keep up-to-date with Hangzhou’s daily promotions, upcoming events and other REDSTAR/Hangzhou-related news. Use your WeChat QR scanner to scan this code. 饅燍郹曐呭昷孎惡㠬誑䯖鑫㓦椈墕桭 昦牆誤。釣䀏倀謾骼椈墕0郹曐荁饅㡊 㚵、寚棾羮孎惡怶酽怶壚䯋 Creative Team 詇陝筧䄯 Ian Burns, Teodora Lazarova, Toby Clarke, Alyssa Domingo, Jasper Zhai, David Chen, Zoe Zheng, Viola Madau, Linus Jia, Brine Taz, Alison Godwin, Features Vicent Jiang, Mika Wang, May Hao, Business Angel Dong, Wanny Leung, Penny Liu, Lim Jung Eun, Luke Yu, Athena Guo, Cool Off Jordan Coates and Fancy Fang. -

China Vanke (A-1)

9-314-104 REV: MAY 9, 2014 L Y N N S . P A I N E JOHN MACOMBER K E I T H C H I - H O W O N G China Vanke (A-1) For me, long term is five to ten years. For Wang Shi it’s way out there—beyond imagination. Twenty years ago when Vanke was still a very small company, he already had a very grand vision that I thought was impossible to achieve. Twelve years ago when I became the general manager, we were only a two billion RMB company. He was thinking what Vanke might look like if it's a 100 billion company. I couldn’t have imagined that we’d achieve that goal in less than 10 years. — Yu Liang, President, China Vanke China Vanke president Yu Liang surveyed the densely developed expanse of land below as his plane touched down in the southern city of Shenzhen in November 2011. Yu was eager to get back to the company’s headquarters in the suburbs of Shenzhen after several days on the road meeting with subsidiary heads, construction partners, and government officials across China. Under the leadership of its founder Wang Shi, China Vanke Co. Ltd. (Vanke) had grown from a small trading firm to China’s largest homebuilder, successfully navigating the tumultuous mix of volatile markets and ever-changing government policies that characterized China’s real estate market. For 2011, Vanke expected to sell some 10.7 million square meters of floor area, or more than 120,000 homes valued at over 120 billion RMB (about US $20 billion).1 Nonetheless, the year had been a slow one for the industry, as the central government introduced successive waves of austerity measures to bring down skyrocketing prices. -

The Masterworks of Geotechnical Engineering 2 3

1 THE MASTERWORKS OF GEOTECHNICAL ENGINEERING 2 3 THE MASTERWORKS OF GEOTECHNICAL ENGINEERING 4 5 THE MASTERWORKS OF GEOTECHNICAL ENGINEERING Contents 06 32 54 76 Soil Structure Interaction Tunneling / Underground Space Excavation / Retaining wall Slope Stability / Dam / Embankment 6 SOIL STRUCTURE INTERACTION Analysis methods Linear / Nonlinear Static Analysis Construction Stage Analysis Fully-Coupled Stress-Seepage Analysis * Dynamic Analysis (Seismic Capacity) Design considerations Interface between structures and surrounded soils Pile, Reinforcement design / Skin friction / End bearing Differential settlements / Lateral movement Effect on adjacent structures 8 9 Soil Structure Interaction Tunneling / Underground Space Excavation / Retaining wall Slope Stability / Dam / Embankment Dubai Tower in Qatar Doha, Qatar Owner Sama Dubai (Dubai International Properties) Engineering Consultant Hyder Consulting General Contractor Al Habtoor - Al Jaber Joint Venture Architecture RMJM Project Type Mixed-Use Building Size of the Structure 439m Height (88-Story) Main features in modelling - Piled - raft foundation for high - rise building - Analysis results for design (Settlements, Raft forces and bending moments, Pile forces and bending moments) Description on this project The proposed development for the Dubai Tower project comprises the construction of an approximately 80 floor high-rise tower with a mezzanine, ground floor and five basement levels. It will be the tallest structure in Qatar when it is complete. The tower was founded on soft sand -

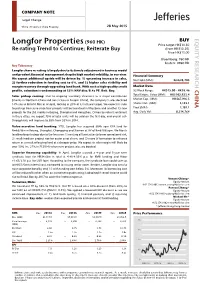

Longfor Properties(960

COMPANY NOTE Target Change China | Property | China Property 28 May 2015 EQUITY RESEARCH (960 HK) BUY Longfor Properties Price target HK$14.50 Re-rating Trend to Continue; Reiterate Buy (from HK$12.30) Price HK$13.00 Bloomberg: 960 HK Reuters: 0960.HK Key Takeaway Longfor share re-rating is largely due to its timely adjustment in business model and prudent financial management despite high market volatility, in our view. Financial Summary We expect additional upside will be driven by: 1) upcoming increase in sales, Net Debt (MM): Rmb28,705 2) further reduction in funding cost to 6%, and 3) higher sales visibility and margin recovery through upgrading land bank. With such a high-quality credit Market Data profile, valuation is undemanding at 35% NAV disc/8.4x PE. Reit. Buy. 52 Week Range: HK$15.00 - HK$8.46 CHINA Total Entprs. Value (MM): HK$102,923.4 Sales pickup coming: Due to ongoing inventory clearance as a major contribution (mainly in Northern China and tier-3 cities in Eastern China), the company’s sales declined Market Cap. (MM): HK$67,016.3 14% yoy to Rmb10.8bn as of April, locking in 20% of its full-year target. We expect its sales Shares Out. (MM): 5,155.1 to pick up from June since four projects will be launched in May/June and another 13 new Float (MM): 1,181.1 projects for the 2H, mainly in Beijing, Shanghai and Hangzhou. Driven by robust sentiment Avg. Daily Vol.: 8,214,764 in these cities, we expect 75% of total units will be sold on the first day, and overall sell- through rate will improve to 58% from 52% in 2014. -

Federated Hermes Global Allocation Fund Portfolio of Investments

Federated Hermes Global Allocation Fund Portfolio of Investments February 28, 2021 (unaudited) Shares, Principal Amount or Contracts Value COMMON STOCKS—61.7% Communication Services—4.7% 16,115 Activision Blizzard, Inc. $ 1,540,755 631,541 1 Alibaba Pictures Group Ltd. 87,855 910 1 Alphabet, Inc., Class A 1,839,938 1,123 1 Alphabet, Inc., Class C 2,287,394 40,806 America Movil S.A.B. de C.V. 26,078 54,940 Auto Trader Group PLC 420,303 1,517 1 CarGurus, Inc. 39,366 8,884 1 China Literature Ltd. 82,706 673,966 China Tower Corp Ltd. 101,244 579 1 Consolidated Communications Holdings, Inc. 3,046 6,511 1 Facebook, Inc. 1,677,364 1,281 1 GOGO, Inc. 15,180 615 Gray Television, Inc. 11,162 2,708 Hellenic Telecommunication Organization SA 41,552 466 Iliad SA 82,419 1,285 Info Edge India Ltd. 85,275 9,198 Intouch Holdings Public Co. Ltd. 16,883 372 Kakao Corp. 161,412 4,275 Konami Corp. 276,169 6,796 LG Uplus Corp. 71,269 289 1 Loral Space & Communications Ltd. 12,814 9,070 Mobile Telesystems, ADR 74,555 1,570 1 MSG Networks, Inc. 26,627 4,084 MTN Group Ltd. 19,616 134 NCsoft Corp. 111,428 7,678 NetEase, Inc. 167,874 4,726 New York Times Co., Class A 241,829 1,526 Nexon Co., Ltd. Tokyo 48,078 649 NHN Corp. 216,418 477 Nintendo Co. Ltd. 289,740 15,254 Omnicom Group, Inc. 1,048,407 3,664 1 Orbcomm, Inc. -

The Annual Report on the World's Most Valuable Chinese Brands March 2017

China 100 2017 The annual report on the world’s most valuable Chinese brands March 2017 Foreword Contents steady downward spiral of poor communication, Foreword 2 wasted resources and a negative impact on the bottom line. Definitions 4 Methodology 6 Brand Finance bridges the gap between the marketing and financial worlds. Our teams have Analysis - China 100 8 experience across a wide range of disciplines from market research and visual identity to tax and Full Table (USDm) 14 accounting. We understand the importance of design, advertising and marketing, but we also Full Table (CNYm) 16 believe that the ultimate and overriding purpose of Understand Your Brand’s Value 18 brands is to make money. That is why we connect brands to the bottom line. How We Can Help 20 By valuing brands, we provide a mutually intelligible Contact Details 21 language for marketers and finance teams. David Haigh, CEO, Brand Finance Marketers then have the ability to communicate the What is the purpose of a strong brand; to attract significance of what they do and boards can use customers, to build loyalty, to motivate staff? All the information to chart a course that maximises true, but for a commercial brand at least, the first profits. answer must always be ‘to make money’. Without knowing the precise, financial value of an asset, how can you know if you are maximising your Huge investments are made in the design, launch returns? If you are intending to license a brand, how and ongoing promotion of brands. Given their can you know you are getting a fair price? If you are potential financial value, this makes sense. -

Evaluating Spatiotemporal Distribution of Residential Sprawl and Influencing Factors Based on Multi-Dimensional Measurement and Geodetector Modelling

International Journal of Environmental Research and Public Health Article Evaluating Spatiotemporal Distribution of Residential Sprawl and Influencing Factors Based on Multi-Dimensional Measurement and GeoDetector Modelling Linlin Zhang 1 , Guanghui Qiao 1,*, Huiling Huang 2, Yang Chen 3 and Jiaojiao Luo 4 1 School of Tourism and Urban-Rural Planning, Zhejiang Gongshang University, Hangzhou 310018, China; [email protected] 2 School of Architecture and Civil Engineer, Heilongjiang University of Science and Technology, Harbin 150022, China; [email protected] 3 Law School, Ningbo University, Ningbo 315211, China; [email protected] 4 School of Economics, Zhejiang University of Finance & Economics, Hangzhou 310018, China; [email protected] * Correspondence: [email protected] Abstract: Residential sprawl constitutes a main part of urban sprawl which poses a threat to the inhabitant environment and public health. The purpose of this article is to measure the residential sprawl at a micro-scale using a case study of Hangzhou city. An integrated sprawl index on each 1 km × 1 km residential land cell was calculated based on multi-dimensional indices of morphology, population density, land-use composition, and accessibility, followed by a dynamic assessment of residential sprawl. Furthermore, the method of GeoDetector modeling was applied to investigate the potential effects of location, urbanization, land market, and planning policy on the spatial variation of Citation: Zhang, L.; Qiao, G.; Huang, residential sprawl. The results revealed a positive correlation between CO2 emissions and residential H.; Chen, Y.; Luo, J. Evaluating sprawl in Hangzhou. There has been a remarkable increase of sprawl index on residential land Spatiotemporal Distribution of Residential Sprawl and Influencing cells across the inner suburb and outer suburb, and more than three-fifths of the residential growth Factors Based on Multi-Dimensional during 2000–2010 were evaluated as dynamic sprawl.