Koronadal-City-ICT2.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

POPCEN Report No. 3.Pdf

CITATION: Philippine Statistics Authority, 2015 Census of Population, Report No. 3 – Population, Land Area, and Population Density ISSN 0117-1453 ISSN 0117-1453 REPORT NO. 3 22001155 CCeennssuuss ooff PPooppuullaattiioonn PPooppuullaattiioonn,, LLaanndd AArreeaa,, aanndd PPooppuullaattiioonn DDeennssiittyy Republic of the Philippines Philippine Statistics Authority Quezon City REPUBLIC OF THE PHILIPPINES HIS EXCELLENCY PRESIDENT RODRIGO R. DUTERTE PHILIPPINE STATISTICS AUTHORITY BOARD Honorable Ernesto M. Pernia Chairperson PHILIPPINE STATISTICS AUTHORITY Lisa Grace S. Bersales, Ph.D. National Statistician Josie B. Perez Deputy National Statistician Censuses and Technical Coordination Office Minerva Eloisa P. Esquivias Assistant National Statistician National Censuses Service ISSN 0117-1453 FOREWORD The Philippine Statistics Authority (PSA) conducted the 2015 Census of Population (POPCEN 2015) in August 2015 primarily to update the country’s population and its demographic characteristics, such as the size, composition, and geographic distribution. Report No. 3 – Population, Land Area, and Population Density is among the series of publications that present the results of the POPCEN 2015. This publication provides information on the population size, land area, and population density by region, province, highly urbanized city, and city/municipality based on the data from population census conducted by the PSA in the years 2000, 2010, and 2015; and data on land area by city/municipality as of December 2013 that was provided by the Land Management Bureau (LMB) of the Department of Environment and Natural Resources (DENR). Also presented in this report is the percent change in the population density over the three census years. The population density shows the relationship of the population to the size of land where the population resides. -

Philippines Mindanao Response Humanitarian Situation Update 17 June 2011

Philippines Mindanao Response Humanitarian Situation Update 17 June 2011 This report is produced by OCHA in collaboration with humanitarian partners. It was issued by OCHA Philippines. It covers the period from 13 May to 16 June 2011. The next report will be issued on or around 18 July. I. HIGHLIGHTS/KEY PRIORITIES • Widespread rains over eastern and southern Mindanao have caused flooding and flashfloods in nine provinces of Mindanao, affecting 120,038 families (611,196 individuals). • The Senate has approved the postponement of August 2011 ARMM elections to synchronize it with the 2013 national and local elections. • The members of the Mindanao Humanitarian Team are undertaking the Mid Year Review of the Mindanao Humanitarian Action Plan. I. SITUATION OVERVIEW NATURAL DISASTERS Flooding in Regions X, XI, XII and ARMM Widespread rains over eastern and southern Mindanao due to the presence of Low Pressure Area have caused flooding and flashfloods in nine provinces in Mindanao, affecting 120,038 families (611,196 individuals). NDRRMC (15 June) reported that 48 municipalities, five cities, and 395 barangays in four regions (X, XI, XII and the Autonomous Region in Muslim Mindanao (ARMM)) have been affected by flooding. A total of 3,130 families (12,875 individuals) are in four Evacuation Centers (one in Malaybalay City, Bukidnon Province and three in North Cotabato). NDRRMC further reported that 7,023 hectares of agricultural crops have been damaged by flooding Residential area along Main road of Barangay in Mindanao, of which 5,391 hectares (or 77 per cent) are in Tamontaka 2, Cotabato City. Photo: Courtesy of Maguindanao. -

DEPARTMENT of EDUCATION REGION XII City of Koronadal, Philippines Telefax No

REPUBLIC OF THE PHILIPPINES DEPARTMENT OF EDUCATION REGION XII City of Koronadal, Philippines Telefax No. (083) 228-8825; email: [email protected] Website: depedroxii.org January 16, 2018 REGION MEMORANDUM No.01 s. 2018 1st REGIONAL INTEGRATED AWARDING CEREMONY TO: Schools Division Superintendents Asst. Schools Division Superintendents All Other Concerned Personnel 1. To recognize exemplary performances of schools in terms of partnership, provision of inclusive education and child-centered community education, the Department of Education-Region XII shall hold an “Integrated Regional Gawad Parangal” on January 24, 2018 – 10:00AM at the Convention Center of The Farm @ Carpenter Hill, Koronadal City. 2. Working on the theme, “Transcending Barriers Toward Inclusive Education,” the activity aims to give due recognition to school heads, program focal persons and stakeholders for their exemplary performance in implementing the different DepEd Programs and Projects for SY 2017-2018 such as: a) Brigada Eskwela Best Implementing Schools, b) School-Based Feeding Program Outstanding Implementers, c) Barkada Kontra Droga Best Implementers, d) Gawad Siklab Best Implementers, and e) 2015 PBB Outstanding Performance. 3. Awardees by category shall receive the following: Programs and Projects Rank Awards to be received Brigada Eskwela Best 1st, 2nd and 3rd placers Plaques/Trophies of Implementing Schools Recognition Finalists Certificates of Recognition School-Based Feeding 1st, 2nd 3rd placers Plaques of Recognition, Program Outstanding Certificates -

Biocultural Diversity of Sarangani Province, Philippines: an Ethno-Ecological Analysis

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Elsevier - Publisher Connector Available online at www.sciencedirect.com ScienceDirect Rice Science, 2015, 22(3): 138í146 Biocultural Diversity of Sarangani Province, Philippines: An Ethno-Ecological Analysis 1 2 1 3 Florence Lasalita ZAPICO , Catherine Hazel AGUILAR , Angelie ABISTANO , Josephine Carino TURNER , 4 Lolymar Jacinto REYES (1Science Department, College of Natural Sciences and Mathematics, Mindanao State University-Fatima, General Santos 9500, the Philippines; 2Graduate School, Crop Science Cluster, University of the Philippines Los Baños, College, Laguna 4031, the Philippines; 3Galing Foundation Incorporated, Dole Philippines Agrarian Reform Beneficiaries Cooperative Inc. Homes, General Santos 9500, the Philippines; 4Sociology Department, College of Social Sciences and Humanities, Mindanao State University-Fatima, General Santos 9500, the Philippines) Abstract: This paper discussed effects of lowland-associated influences on upland ecology, food security and biocultural diversity in the Sarangani farming communities of the Philippines. In the uplands of Sarangani Province, the conservation of traditional rice varieties, the centrality of rice in tribal life, and the continued observance of planting rituals attest to its cultural significance and convey a common desire for cultural preservation and community solidarity. Economic and socio-political pressures had transformed tribal communities, although vestiges of traditional farming systems are still being practiced in remote sitios (villages). Changing land use patterns had also resulted in shrinking farm sizes and consequently in food insecurity in the Sarangani uplands. Extractive industries (i.e. logging, mining and charcoal making) and swidden farming were observed to cause widespread environmental degradation, while modern agriculture had undermined the capacity of indigenous peoples to survive because of their complete dependence on lands and resources. -

Real Impact: Be Secure Project

REAL IMPACT: BE SECURE WATER SECURITY FOR RESILIENT ECONOMIC GROWTH AND STABILITY USAID’s Real Impact series highlights examples of water sector projects around the world. Each issue provides from-the-field insights about successful approaches, challenges faced, and lessons learned. OVERVIEW storms. Further complicating the situation are the approximately 20 typhoons that hit the country Location: Philippines annually. Duration: 2012–2017 Total USAID Funding: $21.6 million Responding to these challenges, USAID’s Water Security for Resilient Economic Growth and Stability Primary Implementing Partner: AECOM (Be Secure) Project works in six selected sites to increase sustainable access to water and wastewater treatment services and resilience to water stress and extreme CHALLENGE weather. The Philippines has emerged as one of the fastest Province Cities / growing economies in Southeast Asia, with GDP Municipalities growth averaging 6 percent between 2010 and 2016. Basilan Isabela City, Maluso Despite the growth, poverty still persists, exacerbated by 15 million Filipinos lacking access to clean water, Leyte Tacloban City, Ormoc and 26.5 million with little or no access to sanitation City facilities. Iloilo Iloilo City Maguindanao Cotabato City Much of the population is vulnerable to changing Misamis Oriental Cagayan de Oro City weather patterns that include less rain, longer Zamboanga Peninsula Zamboanga City dry seasons, increased flooding, and more violent partnership, the water district upgraded its maintenance department and GIS division, ensuring the sustainability of the NRW program beyond the term of USAID’s support. Be Secure works with water districts to design efficient, new water systems. Equipped with project-procured feasibility studies, Cagayan de Oro and Cotabato cities can now determine the best sites to tap additional water sources as they prepare to meet future demand. -

Dole Stanfilco.Makilala

Dole-Stanfilco in the province of North Cotabato is a highly responsible agricultural company committed to run its operation in a family like manner working hand in hand with its workforce to achieve industrial peace. Anchored with its Core Values… Integrity, Quality, Value, Loyalty, Commitment, Respect, Results. Dole-Stanfilco is a subsidiary of California- based Dole Food Company. Dole sources bananas, fresh pineapples, papaya and other fruits and vegetables from the Philippines. Dole-Stanfilco is now part of the Singapore-based Dole Asia Holdings of Itochu Corporation after its acquisition during the first quarter of 2013. Stanfilco is a pioneer of Philippine banana export industry. It was on year 2000 where Dole-Stanfilco expanded in North Cotabato. Stanfilco is considered as fresh product division of Dole Philippines Inc. Stanfilco-North Cotabato Zone currently employs 1, 516 workers of which 4% of it are 0-4 years of service, 2% 5-6 years, 20% 9-10 years, 25% 11-12 years, and 49% 13-14 years of service. Dole-Stanfilco’s organizational structure shifted from a traditional form to a Circular form, where it aims to get rid of the traditional social barriers. Dole Stanfilco as an innovative, excellent and technology driven company is a member of the Philippine Banana Growers and Exporters Association. It also has linkages and partnership to civil society Organizations, NGO’s and kasilak Dev’t. Foundation Inc. in the implementation of its Corporate Social Responsibility Programs. Dole-Stanfilco is also affiliated with PMAP, LMC organization like the Association of Industrial Peace Advocates – Socsksargen(AIPA-S) and implement programs under the Dept. -

Chapter 3 Socio Economic Profile of the Study Area

CHAPTER 3 SOCIO ECONOMIC PROFILE OF THE STUDY AREA 3.1 SOCIAL CONDITIONS 3.1.1 Demographic Trend 1) Population Trends by Region Philippine population has been continuously increasing from 48.1million in 1980, 76.3 million in 2000 to 88.5million in 2007 with 2.15% of annual growth rate (2000-2007). Population of both Mindanao and ARMM also showed higher increases than national trend since 2000, from 18.1 in 2000 to 21.6 million in 2007 (AAGR: 2.52%), and 2.9 in 2000 to 4.1million in 2007 (AAGR: 5.27%), respectively. Population share of Mindanao to Philippines and of ARMM to Mindanao significantly increased from 23.8% to 24.4% and 15.9% to 24.4%, respectively. 100,000,000 90,000,000 Philippines Mindanao 80,000,000 ARMM 70,000,000 60,000,000 50,000,000 40,000,000 30,000,000 20,000,000 10,000,000 0 1980 1990 1995 2000 2007 Year Source: NSO, 2008 FIGURE 3.1.1-1 POPULATION TRENDS OF PHILIPPINES, MINDANAO AND ARMM Population trends of Mindanao by region are illustrated in Figure 3.1.1-2 and the growth in ARMM is significantly high in comparison with other regions since 1995, especially from 2000 to 2007. 3 - 1 4,500,000 IX 4,000,000 X XI 3,500,000 XII XIII ARMM 3,000,000 2,500,000 2,000,000 1,500,000 1,000,000 1980 1990 1995 2000 2007 year Source NSO, 2008 FIGURE 3.1.1-2 POPULATION TRENDS BY REGION IN MINDANAO As a result, the population composition within Mindanao indicates some different features from previous decade that ARMM occupies a certain amount of share (20%), almost same as Region XI in 2007. -

Children in Armed Conflict: Philippines

CHILDREN IN ARMED CONFLICT: PHILIPPINES Processes and Lessons Learned | 2009-2017 Action Plan on the Recruitment and Use of Children in Armed Conflict United Nations and the Moro Islamic Liberation Front FOREWORD The successful implementation of the UN-MILF Action Plan was a significant milestone in the international community’s global commitment to fulfil the rights of children in situations of armed conflict. The eight-year implementation started in 2009 and ended in July 2017 with the disengagement of nearly 2000 children and the delisting of the MILF- BIAF from the annexes of the UN Secretary General’s Report. Reaching its completion was challenging and required tremendous effort by all involved. I am pleased to acknowledge the commitment of the Government of the Philippines and the MILF leadership toward ensuring compliance with the provisions of the Action Plan. Particular appreciation is also owed to the Office of the Special Representative of the Secretary General for Children and Armed Conflict for its oversight and guidance, and to the United Nations in the Philippines. We also recognize the large number of our civil society partners in Mindanao who worked tirelessly on the ground to achieve the results highlighted here. This report acknowledges their special contributions. This report is a valuable resource, locally and internationally, for understanding how to effectively implement a plan that has successfully stopped and now prevents recruitment and use of children by armed groups. However, while we celebrate this success, we must not forget that armed groups in Mindanao and many other locations around the world are still recruiting and using children in their struggles. -

CHAPTER IV the JAPANESE INTERREGNUM, 1942-1945 A. The

CHAPTER IV THE JAPANESE INTERREGNUM, 1942-1945 This chapter deals with the Japanese occupation of Koronadal Valley. An alien invading force would radically change the direction of developmental process in Koronadal Valley, particularly Buayan. From an envisioned agricultural settlement serving a major function for the Commonwealth government, Koronadal Valley was transformed into a local entity whose future direction would be determined by the people no longer in accordance with the objectives for which it was established but in accordance with the dynamics of growth in response to changing times. It is ironic that an event that was calamitous in itself would provide the libertarian condition to liberate Koronadal Valley from the limiting confines of Commonwealth Act No. 441. But more than structural change, the Japanese interlude put to test the new community. The sudden departure from the scene of the two titans of the community - General Paulino Santos and Mayor Abedin - raised the urgent need for the people left behind to take stock of themselves and respond to the difficult times sans the guiding hands of its leaders. A. The Southward Thrust of Japan to Mindanao To the people of the valley, the war was received with shock, fear and trepidation. It was like a thief in the night coming when everybody was unprepared. One settler recalled: “We were afraid when we heard over the radio that the Japanese are coming. We immediately evacuated and left behind our farms and animals. We hid in the mountains of Palkan, proceeding to Glamang and then to Kiamba. Our hunger drove us to dig sweet potatoes from the farms that we passed by. -

Committee Report No. &

ESS OF THE REPUBLIC } 1 6 JUL 25 :i :: :;;:, 1 COMMITTEE REPORT NO. & 2 Submitted jointly by I Government; and Constitutional Amendments, Revision of Codes and Laws on taking into consideration Re : House Bill No. 4192MSenate Bill No. 2213 Recommending its approval without amendment. Sponsors : Senators Lim and Gordon. MR. PRESIDENT: The Committees on Local Government; and Constitutional Amendments, Revision of Codes and Laws to which were referred House Bill No. 4192, introduced by Representative Mangudadatu, entitled: *AN ACT REAPPORTIONING THE PROVINCE OF SULTAN KUDARAT INTO TWO (2) LEGISLATIVE DISTRICTS” consideration No. 2213, introduced by Senator Recto, entitled: “AN ACT REAPPORTIONING THE PROVINCE OF SULTAN KUDARAT INTO TWO (2) LEGISLATIVE DISTRICTS” have considered the same and have the honor to report these back to the Senate with the recommendation that these be approved without amendment. Respectfully submitted: A Chairmen: RI H J.GORDON ?dmmittee on ConstitutionalAmendments, Committee on Local Government evision of Codes and Laws Member, Committee on Constitutional Committee on Local Government Amendments, Revision of Codes and Laws COMMITTEE REPORT on HBN 4192 and SBN 2213 (Two Legislative Districts of Sultan Kudarat) 2 Vice-Chairmen: Amendments, Members: &?+fa4d%*P& , RAMON 6. MAGSAYSAY JR. Committee on Local Government Committee on Local Government / MANUEL "LITO" M. LAPID on Local Government CtWk"@ MPA-ERA AS. CAYETANO on Local Government Committee on [oca/ Government on Constitutional Amendments, Committee on ConstitutionalAmendments, -

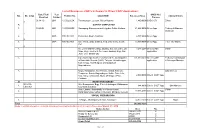

List of On-Process Cadts in Region 12 (Direct CADT Applications) Date Filed/ Year CADC No./ No

List of On-process CADTs in Region 12 (Direct CADT Applications) Date Filed/ Year CADC No./ No. No. (orig) Petition No. LOCATION Est. Area (Has.) Claimant ICC/s Received Funded Process 06-14-10 2011 12-0022-LSK Tanansangan, Lutayan, Sultan Kudarat 1,480.0000 CADC-073 B'laan 7 A. SURVEY COMPLETED 1. 04-29-04 2004 12-0025-ESK Salumping, Esperanza and Legodon Sultan Kudarat 21,228.0000 Direct App. Teduray & Manobo Dulangan 1 2. 2005 RXII-SC-008 Polomolok, South Cotabato 2,507.0000 Direct App. 5 3. 2008 RXII-SC-009 Sitio Yama, Uhay & Blacol, Ned, Lake Sebu, South 19,000.0000 Direct App. T'boli Tao-Mohin Cot 8 4. So. Lower Balnabo, Brgy. Bawing, Sos. Ulo Cabo, Ulo 3,247.2270 Direct CADT B'laan Supo, Brgy Tambler & So. Lower Aspang, Brgy. San application Jose, Gen. Santos City 5. Upi, South Upi, Southern portions of the municipalities 201,880.0000 Direct CADT Teduray/ Lambangian of Datu Odin Sinsuat (DOS), Talayan, Guindulongan, application & Dulangan Manobo Datu Unsay, Shariff Aguak and Ampatuan, Maguindanao 6. Brgys. Bongolanin, Don Panaca, Sallab, Kinarum, Obo-Manuvu Temporan, Basak, Bagumbayan, Balite, Datu Celo, Noa, Binay, & Kisandal, Muni. Of Magpet, Prov. 2,000.0000 Direct CADT App. Cotabato B READY FOR SURVEY NCIPXII- Sitio Sumayahon, Brgy. Perez & Indangan, Kidapawan 1. 644.0000 Direct CADT App. Obo-Manuvu COT-AD- City North Cotabato 024 Brgy. Landan, Municipality of Polomolok and B'laan 2. 17,976.4385 Direct CADT App. Barangays Upper Labay, Conel and Olimpog, General Santos City,SouthSOCIAL Cotabato PREPARATION 1. 28 Brgys., Municipality of Glan, Sarangani 24,977.7699 Direct CADT App. -

Sustainable Fisheries Management Plan for the Sarangani Bay and Sulawesi Sea

Sustainable Fisheries Management Plan for the Sarangani Bay and Sulawesi Sea REGION 12, PHILIPPINES SUBMITTED BY THE USAID OCEANS AND FISHERIES PARTNERSHIP Ins e rt About the USAID Oceans and Fisheries Partnership The USAID Oceans and Fisheries Partnership (USAID Oceans) is a five-year activity that works to strengthen regional cooperation to combat illegal, unreported, and unregulated (IUU) fishing and conserve marine biodiversity in the Asia-Pacific region. USAID Oceans is a partnership between the U.S. Agency for International Development (USAID), the Southeast Asian Fisheries Development Center (SEAFDEC), and the Coral Triangle Initiative for Coral Reefs, Fisheries and Food Security (CTI-CFF) that works with public and private sector partners across Southeast Asia to develop and implement electronic catch documentation and traceability systems, improve sustainable fisheries management using an Ecosystem Approach to Fisheries Management, address human welfare and gender equity concerns, and develop public-private partnerships in support of these efforts. For more information, visit www.seafdec-oceanspartnership.org or contact info@oceans- partnership.org. About this Document The Sustainable Fisheries Management Plan for the Sarangani Bay and Sulawesi Sea is an Ecosystem Approach to Fisheries Management (EAFM) Plan for the the Sarangani Bay and parts of the Sulawesi Sea that comprise the provinces of South Cotabato, Sarangani, and Sultan Kudarat, including Cotabato City and General Santos City (SOCCSKARGEN)—also known as Region 12 in the Philippines’ 16 administrative regions. This document is intended to provide a framework for fisheries management within the Sarangani Bay-Sulawesi corridor for adoption and implementation by relevant governmental agencies, local government units, non-governmental partners, academic and research institutions, and the fishing industry sector that altogether will benefit from effective fisheries management and biodiversity conservation in SOCCSKSARGEN and other regions of the Philippines.