ACIL Allen Energy Report for Draft Determination

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Western Downs

Image courtesy of Shell's QGC business “We have a strong and diverse economy that is enhanced by the resource sector through employment, Traditional Resources - infrastructure and Western Downs improved services." The Western Downs is known as the “Queensland has the youngest coal- Paul McVeigh, Mayor Energy Capital of Queensland and is fired power fleet in Australia including Western Downs now emerging as the Energy Capital of the Kogan Creek Power Station, and an Regional Council. Australia. abundance of gas which will ensure the State has a reliable source of base load This reputation is due to strong energy for decades to come.” investment over the past 15 years by the Energy Production Industry - Ian Macfarlane, CEO, Mining is the second most productive (EPI) into large scale resource sector Queensland Resources Council industry in the Western Downs after developments in coal seam gas (CSG) As at June 2018, the Gross Regional construction, generating an output of 2 and coal. Product (GRP) of the Western Downs 2.23 billion in 2017/18. Gas and coal-fired power stations region has grown by 26.3% over a In 2017/18, the total value of local sales 2 feature prominently in the region with twelve-month period to reach $4 billion. was $759.2 million. Of these sales, oil a total of six active thermal power The resource industry paid $58 million and gas extraction was the highest, at 2 stations. in wages to 412 full time jobs (2017-18). 3 $615.7 million. Kogan Creek Power Station is one of The industry spent $136 million on In 2017/18 mining had the largest Australia's most efficient and technically goods and services purchased locally total exports by industry, generating advanced coal-fired power stations. -

Ensuring Reliable Electricity Supply in Victoria to 2028: Suggested Policy Changes

Ensuring reliable electricity supply in Victoria to 2028: suggested policy changes Associate Professor Bruce Mountain and Dr Steven Percy November 2019 All material in this document, except as identified below, is licensed under the Creative Commons Attribution-Non- Commercial 4.0 International Licence. Material not licensed under the Creative Commons licence: • Victoria Energy Policy Centre logo • Victoria University logo • All photographs, graphics and figures. All content not licenced under the Creative Commons licence is all rights reserved. Permission must be sought from the copyright owner to use this material. Disclaimer: The Victoria Energy Policy Centre and Victoria University advise that the information contained in this publication comprises general statements based on scientific research. The reader is advised and needs to be aware that such information may be incomplete or unable to be used in any specific situation. No eliancer or actions must therefore be made on that information without seeking prior expert professional, scientific and technical advice. To the extent permitted by law, the Victoria Energy Policy Centre and Victoria University (including its employees and consultants) exclude all liability to any person for any consequences, including but not limited to all losses, damages, costs, expenses and any other compensation, arising directly or indirectly from using this publication (in part or in whole) and any information or material contained in it. Publisher: Victoria Energy Policy Centre, Victoria University, Melbourne, Australia. ISBN: 978-1-86272-810-3 November 2019 Citation: Mountain, B. R., and Percy, S. (2019). Ensuring reliable electricity supply in Victoria to 2028: suggested policy changes. Victoria Energy Policy Centre, Victoria University, Melbourne, Australia. -

NRG Energy Successful in Bid for Flinders Power in South Australia

NRG Energy Successful in Bid for Flinders Power in South Australia August 2, 2000 MINNEAPOLIS, Aug 02, 2000 (BUSINESS WIRE)---NRG Energy, Inc. (NYSE:NRG) announced today it has been named the successful bidder in the South Australian Government's electricity privatization auction for Flinders Power, South Australia's final generation company to be privatized. NRG agreed to pay (Aus.) $313 million ($180 million U.S.) cash for a 100-year lease of the Flinders Power assets. Flinders Power includes two power stations totaling 760 megawatts (MW), the Leigh Creek coal mine 175 miles north of the power stations, a dedicated rail line between the two, and Leigh Creek township. The lease agreement also includes managing the long-term fuel supply and power purchase agreement for the 180-MW Osborne Cogeneration Station. NRG expects to close the transaction in early September. "Flinders gives NRG a strong position in the vibrant South Australian power market," said Keith G. Hilless, NRG Asia-Pacific managing director and CEO. The power stations are the 240-MW Playford Power Station and the 520-MW Northern Power Station, both located in Port Augusta on the Spencer Gulf--approximately 190 miles north of South Australia's capital city, Adelaide. The Playford and Northern power stations use pulverized coal-fired steam turbine generation technology. Northern is a baseload facility and is the lowest-cost generator in South Australia, while Playford is a peaking facility. "Flinders Power confirms our long-term commitment to the Australian power generation market," commented David H. Peterson, chairman, president and CEO of NRG. "This project is right in line with NRG's strategy of acquiring assets that complement our core portfolio and represent a variety of dispatch levels." Flinders Power, which NRG will operate, is the only generator in South Australia to own its own fuel source. -

Compliance and Operation of the NSW Greenhouse Gas Reduction Scheme During 2010 Report to Minister

Compliance and Operation of the NSW Greenhouse Gas Reduction Scheme during 2010 Report to Minister NSW Greenhouse Gas Reduction Scheme July 2011 © Independent Pricing and Regulatory Tribunal of New South Wales 2011 This work is copyright. The Copyright Act 1968 permits fair dealing for study, research, news reporting, criticism and review. Selected passages, tables or diagrams may be reproduced for such purposes provided acknowledgement of the source is included. ISBN 978-1-921929-27-4 CP61 Inquiries regarding this document should be directed to a staff member: Margaret Sniffin (02) 9290 8486 Independent Pricing and Regulatory Tribunal of New South Wales PO Box Q290, QVB Post Office NSW 1230 Level 8, 1 Market Street, Sydney NSW 2000 T (02) 9290 8400 F (02) 9290 2061 www.ipart.nsw.gov.au ii IPART Compliance and Operation of the NSW Greenhouse Gas Reduction Scheme during 2010 Contents Contents Foreword 1 1 Executive summary 3 1.1 What is GGAS? 3 1.2 What is IPART’s role? 4 1.3 NSW Benchmark Participants’ compliance 5 1.4 Abatement Certificate Providers’ compliance 5 1.5 Audit activities 6 1.6 Registration, ownership and surrender of certificates 6 1.7 Projected supply of and demand for certificates in coming years 7 1.8 What does the rest of this report cover? 7 2 Developments in GGAS during 2010 8 2.1 Changes to the GGAS Rules 8 2.2 Closure of GGAS to new participants 9 2.3 Cessation of Category A Generating systems 10 2.4 IPART internal review of GGAS 10 2.5 Inter-department review of GGAS 10 2.6 GGAS in the national climate policy context -

Maintaining a Reliable Electricity Supply to Southern (South West and South East) Queensland

FINAL REPORT 5 June 2009 Maintaining a reliable electricity supply to Southern (South West and South East) Queensland Disclaimer While care was taken in preparation of the information in this document, and it is provided in good faith, Powerlink accepts no responsibility or liability (including without limitation, liability to any person by reason of negligence or negligent misstatement) for any loss or damage that may be incurred by any person acting in reliance on this information or assumptions drawn from it, except to the extent that liability under any applicable Queensland or Commonwealth of Australia statute cannot be excluded. This document has been prepared for the purpose of inviting information, comment and discussion from interested parties. The document has been prepared using information provided by a number of third parties. It contains assumptions regarding, among other things, economic growth and load forecasts which may or may not prove to be correct. Powerlink makes no representation or warranty as to the accuracy, reliability, completeness or suitability for particular purposes, of the information in this document. All information should be independently verified before assessing any investment proposals. DOCUMENT PURPOSE For the benefit of those not familiar with the National Electricity Rules (Rules) and the National Electricity Market (NEM), Powerlink offers the following clarifications on the purpose and intent of this document: 1. The Rules require Powerlink to carry out forward planning to identify future reliability of supply requirements and to issue this type of document for “proposed new large network assets”. 2. The Rules require Powerlink to identify, evaluate and compare both network and non-network options (including generation and demand side management) to determine which can address the future supply requirements at the lowest cost to the market and hence to electricity consumers. -

Gladstone Region Major Industry & Infrastructure Providers

Gladstone region Major Industry & Infrastructure Providers CONTENTS NRG Gladstone Power Station 2 Central Queensland Ports Authority 3 Gladstone Area Water Board 5 Queensland Rail 6 Queensland Gas Pipeline 7 Boyne Smelters Limited 8 Cement Australia (Qld) Pty Ltd 9 Queensland Energy Resources Limited 11 Comalco Alumina Refinery 11 Queensland Alumina Limited 12 Orica Australia Pty Ltd 14 Austicks and Frost Enterprises 15 Industry Profiles: January 2005 The Gladstone Region NRG GLADSTONE POWER The station was sited to take advantage of seawater for cooling and to be near to Central STATION Queensland’s vast coal reserves. The station’s six-megawatt turbogenerators each output 16,200 volts to transformers that convert the power to a level suitable for transmission at 132,000 or 275,000 volts. CUSTOMERS The Gladstone Power Station sells most of its electricity to Boyne Smelters under a long-term contract. The station remains inter-connected with the Queensland Electricity grid and the remainder of the power generated is committed to OWNERSHIP AND OPERATION the state. The Gladstone Power Station is a world class COAL SUPPLY power station providing safe, reliable low cost electricity to customers. Since 1994 the station More than four million tonnes of coal each year has been operated by NRG Gladstone Operating are railed to the station from coalfields in Central Services on behalf of the joint venture Queensland. participants, Comalco Ltd (42.125%) and NRG Energy Inc (37.5%), as well as SLMA GPS Pty Coal is stockpiled after unloading, then reclaimed Ltd (8.50%), Ryowa II GPS Pty Ltd (7.125%) and from the stockpiles by either of two stacker YKK GPS (Queensland) Pty Ltd (4.75%). -

Power System Incident Report Trip of 8811 Calvale – Tarong 275Kv Line

POWER SYSTEM INCIDENT REPORT TRIP OF 8811 CALVALE – TARONG 275KV LINE, TARONG UNIT 2 AND COLUMBOOLA 132KV CB 73562 ON 05 NOVEMBER 2009 PREPARED BY: ESOPP DOCUMENT NO: 1.0 VERSION NO: 1.0 FINAL 1. INTRODUCTION At approximately 17:49hrs on Thursday 5th of November 2009, severe thunderstorms were experienced in the vicinity of Calvale – Tarong 275kV lines (Bureau of Meteorology - BOM issued a Severe Thunderstorm Warning) and one of the Calvale – Tarong lines - 8811 experienced a single phase trip and auto-reclose. The No.2 generating unit at Tarong Power Station (TPS) tripped from 350MW of load at around the same time. At approximately 17:50hrs, one of the 132kV feeders from T194 Columboola substation (Ergon Energy) to Condamine power station also tripped but there was no generation at Condamine power station at the time1. This report has been prepared under clause 4.8.15 of the National Electricity Rules to assess the adequacy of the provision and response of facilities and services and the appropriateness of actions taken to restore or maintain power system security. Information for this report has been provided by Powerlink, Tarong Energy, Ergon Energy and QGC Sales Pty. Ltd. Additional information has been obtained from AEMO’s Energy Management System and Market Management System. All references to time in this report refer to Market time (Australian Eastern Standard Time). 2. SUMMARY OF EVENTS At approximately 17:49hrs on Thursday 5th of November, severe thunderstorms were experienced in the vicinity of Calvale – Tarong 275kV lines. A market notice was issued at 13:47 hrs, reclassifying loss of 8810 & 8811 Calvale – Tarong double circuit 275kV lines as a credible contingency from 1345 hrs onwards. -

Gig S0'z$ £102

X ~ 4+ b . (t. d ~ % e | eaaNi9NaziviLNaniant1s0 [)' ivilnanianitasow s yinvHisny - -/ j a »"! P ils. al SHL. < te: Whys - 1Vd@IN39 NOILIG3 JOA gg on 'g unr £102 s0'z$ gig "py eel mmad Adelaiq A 2108 Ovg| Australia f a j - n z | ' : v Join o ur buildings team Mott M acDonald is a global management, engineering and development consultancy with 15,000 staff working on projects in 140 countries. Our award-winning work is founded on a culture of excellence, quality and innovation, contributing to cost-effective, functional and sustainable solutions. We're industry leaders in the use of building information modelling (BIM) for planning, design, project delivery and operation. Everywhere we work, our local offices are supported by the skills and resources of the global Group, ark, N ew 4 providing our clients with local service and world class solutions. Carlaw P In t he buildings sector, our work spans civic, commercial, education, health, leisure, retail, sports and transport projects. Across them all, we produce imaginative and distinctive solutions that invite corporate and civic pride. Our m ultidisciplinary services Engineering - civil, structural, mechanical, electrical and public health, fire protection, and fagades Project, programme and design management ESD and building energy consulting Vertical transportation Hydraulic design Modelling and analysis We're s eeking skilled, motivated engineers and project managers to join fast-expanding buildings teams in our offices across Australia. To f ind out more about career opportunities at Mott MacDonald visit www.careers.mottmac.com.au \fista, S ingal pore "f FROMHE T PRESIDENT a ENGINEERS A USTRALIA The d iversity advantage Marlene K anga [email protected] a u stralia's rich multicultural society has a significant competitive a dvantage, providing opportunities to foster diverse perspectives and ideas. -

The Calculation of Energy Costs in the BRCI for 2010-11

The calculation of energy costs in the BRCI for 2010-11 Includes the calculation of LRMC, energy purchase costs, and other energy costs Prepared for the Queensland Competition Authority Draft Report of 14 December 2009 Reliance and Disclaimer In conducting the analysis in this report ACIL Tasman has endeavoured to use what it considers is the best information available at the date of publication, including information supplied by the addressee. Unless stated otherwise, ACIL Tasman does not warrant the accuracy of any forecast or prediction in the report. Although ACIL Tasman exercises reasonable care when making forecasts or predictions, factors in the process, such as future market behaviour, are inherently uncertain and cannot be forecast or predicted reliably. ACIL Tasman Pty Ltd ABN 68 102 652 148 Internet www.aciltasman.com.au Melbourne (Head Office) Brisbane Canberra Level 6, 224-236 Queen Street Level 15, 127 Creek Street Level 1, 33 Ainslie Place Melbourne VIC 3000 Brisbane QLD 4000 Canberra City ACT 2600 Telephone (+61 3) 9604 4400 GPO Box 32 GPO Box 1322 Facsimile (+61 3) 9600 3155 Brisbane QLD 4001 Canberra ACT 2601 Email [email protected] Telephone (+61 7) 3009 8700 Telephone (+61 2) 6103 8200 Facsimile (+61 7) 3009 8799 Facsimile (+61 2) 6103 8233 Email [email protected] Email [email protected] Darwin Suite G1, Paspalis Centrepoint 48-50 Smith Street Darwin NT 0800 Perth Sydney GPO Box 908 Centa Building C2, 118 Railway Street PO Box 1554 Darwin NT 0801 West Perth WA 6005 Double Bay NSW 1360 Telephone -

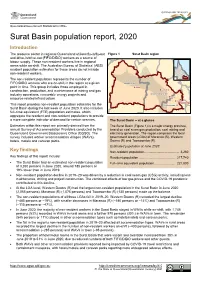

Surat Basin Population Report, 2020

Queensland Government Statistician’s Office Surat Basin population report, 2020 Introduction The resource sector in regional Queensland utilises fly-in/fly-out Figure 1 Surat Basin region and drive-in/drive-out (FIFO/DIDO) workers as a source of labour supply. These non-resident workers live in regional areas while on-shift. The Australian Bureau of Statistics’ (ABS) resident population estimates for these areas do not include non-resident workers. The non-resident population represents the number of FIFO/DIDO workers who are on-shift in the region at a given point in time. This group includes those employed in construction, production, and maintenance at mining and gas industry operations, renewable energy projects and resource-related infrastructure. This report provides non-resident population estimates for the Surat Basin during the last week of June 2020. It also includes full–time equivalent (FTE) population estimates, which aggregate the resident and non-resident populations to provide a more complete indicator of demand for certain services. The Surat Basin – at a glance Estimates within this report are primarily derived from the The Surat Basin (Figure 1) is a major energy province, annual Survey of Accommodation Providers conducted by the based on coal seam gas production, coal mining and Queensland Government Statistician’s Office (QGSO). The electricity generation. The region comprises the local survey includes worker accommodation villages (WAVs), government areas (LGAs) of Maranoa (R), Western hotels, motels and caravan parks. Downs (R) and Toowoomba (R). Estimated population at June 2020: Key findings Non-resident population ....................................... 3,260 Key findings of this report include: Resident population ........................................ -

Powerlink Queensland Revenue Proposal

2018-22 POWERLINK QUEENSLAND REVENUE PROPOsaL Supporting Document Powerlink Queensland Asset Management Plan (Volume 3 - Area Plans) © Copyright Powerlink Queensland 2016 Delivering better value ASSET MANAGEMENT PLAN 2015 Volume 3 – Area Plans Prepared by: Strategy and Planning Investment and Planning December 2015 Objective ID: A2265341 DISCLAIMER This Asset Management Plan has been produced to provide general information about the development of Powerlink’s network and is a summary of the best view of asset investment strategies at the time of writing. In many cases, the projects listed in the Asset Management Plan have been selected from a large number of future scenarios and are the result of preliminary investigations. As well as the need for future analysis to evaluate system and asset conditions and alternatives, there are processes described in the National Electricity Rules that need to be followed before projects can be approved. It is possible that projects listed here may change in scope or timing, be replaced by other projects or deemed unnecessary. Business decisions and actions should not be made solely on the basis of information contained here. The Asset Management Plan does not replace any current business or approval processes. Risk costs continue to be enhanced and at this stage should not be used to solely prioritise projects or prioritise projects between asset classes as currently not all risks have been modelled which leads to some risk costs being understated. Similarly some asset risks are based on desktop analysis at an asset fleet level rather than based on individual asset condition, depending on the timing of the anticipated investment need. -

Surat Basin Population Report, 2019

Queensland Government Statistician’s Office Surat Basin population report, 2019 Introduction The resource sector in regional Queensland utilises fly-in/fly-out Figure 1 Surat Basin region and drive-in/drive-out (FIFO/DIDO) workers as a source of labour supply. These non-resident workers live in regional areas while on-shift. The Australian Bureau of Statistics’ (ABS) resident population estimates for these areas do not include non-resident workers. The non-resident population represents the number of FIFO/DIDO workers who are on-shift in the region at a given point in time. This group includes those employed in construction, production, and maintenance at mining and gas industry operations, renewable energy projects and resource-related infrastructure. This report provides non-resident population estimates for the Surat Basin during the last week of June 2019. It also includes full–time equivalent (FTE) population estimates, which aggregate the resident and non-resident populations to provide a more complete indicator of demand for certain services. The Surat Basin – at a glance Estimates within this report are primarily derived from the The Surat Basin (Figure 1) is a major energy province, annual Survey of Accommodation Providers conducted by the based on coal seam gas production, coal mining and Queensland Government Statistician’s Office (QGSO). The electricity generation. The region comprises the local survey includes worker accommodation villages (WAVs), government areas (LGAs) of Maranoa (R), Western hotels, motels, and caravan parks. Downs (R) and Toowoomba (R). Population at June 2019: Key findings Non-resident population ....................................... 4,040 Key findings of this report include: Resident population ........................................