Download Full Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tank Information System Map of Madhugiri Taluk, Tumakuru District. Μ 1:88,300

Tank Information System Map of Madhugiri Taluk, Tumakuru District. µ 1:88,300 KA18040042 KA18040233 KA18040043 KA18040260 KA18040044 Bidarakere KA18040221 KA18040234 Ammanahalli KA18040236 Shravanagundi KA18040187Satthigenahalli KA18040154 KA18040187 KA18040154 KA18040053 KA18040223Benakanahalli KA18040235 KA18040223 KA18040052 NallekamanahalliBedatthur KA18040052 R.Gollahalli Reddyhalli Thadi Legend KA18040258 KA18040271 S.Appenahalli Thondote KA18040238 KA18040251 Malagondanahalli KA18040036 KA18040172 Nagalapura KA18040237 Pulamachi KA18040020 KA18040185 KA18040160 Drainage Midigeshi Vitalapura Kasapura KA18040135 J.I.Thummalahalli Chowlahalli Doddadalavata KA18040195 KA18040141 KA18040153 Adavihalli KA18040136 Hanumanthapura KA18040281 KA18040239 District Road KA18040239 KA18040104 Brahmadevarahalli Kavalu Hale Itakalote KA18040137 KA18040037 KA18040049 KA18040009 KA18040181 KA18040121 KanthanahalliKA18040092 KA18040093 KA18040183 Gondhi National Highway K.G.Srinivasapura Itakadhibbanahalli Chikkadalavata Katthirajanahalli KA18040072 Chikkanayakanapalya Obalapura Channenahalli KA18040118 KA18040071 Hosa Itakalote KA18040105 KA18040279 State Highway KA18040130 KA18040189 Janakalote KA18040279 Katthirajanahalli Neerakallu KA18040189 KA18040274 KA18040021 KA18040140 KA18040188 Gollahalli Shyanaganahalli Brahmadevarahalli KA18040073 Byadarahalli K.G.Varadanahalli KA18040013 Hosahalli Veerachannenahalli J.I.Garani Kasinayakanahalli Taluk Boundary Sadarahalli Muddenahalli KA18040142Devagondanahalli KA18040232 Yaramallanahalli Polenahalli -

THE KARNATAKA SHOPS and COMMERCIAL ESTABLISHMENTS ACT, 1961 ARRANGEMENT of SECTIONS Sections : CHAPTER I

THE KARNATAKA SHOPS AND COMMERCIAL ESTABLISHMENTS ACT, 1961 ARRANGEMENT OF SECTIONS Sections : CHAPTER I PRELIMINARY 1. Short title, extent, commencement and application. 2. Definitions. 3. Exemptions. CHAPTER II REGISTRATION OF ESTABLISHMENTS 4. Registration of Establishments. 5. Change to be communicated to Inspector. 6. Closing of establishment to be communicated to Inspector. 6A. Issue of appointment orders. CHAPTER III HOURS OF WORK 7. Daily and weekly hours. 8. Extra wages for overtime work. 9. Interval for rest. 10. Spread over. 11. Opening and closing hours. 12. Weekly holidays. 13. Selling outside establishment prohibited after closing hours. CHAPTER IV ANNUAL LEAVE WITH WAGES 14. Application of chapter. 15. Annual leave with wages. 16. Wages during leave period. 17. Payment of advance in certain cases. GUNDU DATA BANK KARNATAKA LAW 2002 18. Mode of recovery of unpaid wages. 19. Power to make rules. 20. Power to exempt establishments. CHAPTER V WAGES AND COMPENSATION 21. Application of the Payment of Wages Act. 22. Application of the Workmens Compensation Act. 23. Omitted. CHAPTER VI EMPLOYMENT OF CHILDREN AND WOMEN 24. Prohibition of employment of children. 25. Prohibition of employment of women and young persons during night. CHAPTER VII ENFORCEMENT AND INSPECTION 26. Inspectors. 27. Powers and duties of Inspectors. 28. Inspectors to be public servants. 29. Employer to produce registers, records, etc., for inspection. CHAPTER VIII OFFENCES, PENALTIES AND PROCEDURE 30. Penalties. 31. Procedure. 32. Limitation of prosecutions. 33. Penalty for obstructing Inspectors, etc. CHAPTER IX MISCELLANEOUS 34. Maintenance of registers and records and display of notices. 35. Saving of certain rights and privileges. 36. -

Study of Small Schools in Karnataka. Final Report.Pdf

Study of Small Schools in Karnataka – Final Draft Report Study of SMALL SCHOOLS IN KARNATAKA FFiinnaall RReeppoorrtt Submitted to: O/o State Project Director, Sarva Shiksha Abhiyan, Karnataka 15th September 2010 Catalyst Management Services Pvt. Ltd. #19, 1st Main, 1st Cross, Ashwathnagar RMV 2nd Stage, Bangalore – 560 094, India SSA Mission, Karnataka CMS, Bangalore Ph.: +91 (080) 23419616 Fax: +91 (080) 23417714 Email: raghu@cms -india.org: [email protected]; Website: http://www.catalysts.org Study of Small Schools in Karnataka – Final Draft Report Acknowledgement We thank Smt. Sandhya Venugopal Sharma,IAS, State Project Director, SSA Karnataka, Mr.Kulkarni, Director (Programmes), Mr.Hanumantharayappa - Joint Director (Quality), Mr. Bailanjaneya, Programme Officer, Prof. A. S Seetharamu, Consultant and all the staff of SSA at the head quarters for their whole hearted support extended for successfully completing the study on time. We also acknowledge Mr. R. G Nadadur, IAS, Secretary (Primary& Secondary Education), Mr.Shashidhar, IAS, Commissioner of Public Instruction and Mr. Sanjeev Kumar, IAS, Secretary (Planning) for their support and encouragement provided during the presentation on the final report. We thank all the field level functionaries specifically the BEOs, BRCs and the CRCs who despite their busy schedule could able to support the field staff in getting information from the schools. We are grateful to all the teachers of the small schools visited without whose cooperation we could not have completed this study on time. We thank the SDMC members and parents who despite their daily activities were able to spend time with our field team and provide useful feedback about their schools. -

Multidisciplinary Research

ISSN (Online) : 2455 - 3662 SJIF Impact Factor :5.148 EPRA International Journal of Multidisciplinary Research Monthly Peer Reviewed & Indexed International Online Journal Volume: 4 Issue:12 December 2018 Published By : EPRA Journals CC License Volume: 4 | Issue: 12 | December 2018 SJIF Impact Factor: 5.148 ISSN (Online): 2455-3662 EPRA International Journal of Multidisciplinary Research (IJMR) MAHANADAPRABHUS OF MADHUGIRI AND THEIR CONTRIBUTIONS-AN ANALYSIS ABSTRACT There were more than 70 feudal states in Medieval Shivaraju Karnataka. Among them Madhugiri was an important one. It included many part of Madhugiri, Assistant Professor of History, Koratagere and Pavagada. The Nadaprabhus of this Govt. First Grade College, territory were very powerful in the days of Koratagere, Tumkur District, Vijayanagara. Today Madhugiri is a Taluk Head Karnataka-572129 Quarter in Tumkur District. Immadi Chikkappa Gowda had built a strong fort at Madhugiri and made it as a new capital. The Mahanadaprabhus contribution in the field of Administration, Religion, Literature, Art and Architecture is of immense value. Mahanadaprbhus were hereditary rulers. They were Veerashaivas. They built good number of Veerashaiva Mathas and Shaiva Temples. They also built some Vaishnava Temples at Madhugiri. There were poets under the patronage of Mahanada Prabhus. Mummadi Chikkabhupala was also a poet. He wrote many books. They built a number of temples, forts and mansions. KEYWORDS: Vijayanagara, Maregowda, Medieval Karnataka, Jayamangali valley INTRODUCTION Veerashaiva Mathas and Shaiva Temples. They also There were more than 70 feudal states in built some Vaishnava Temples at Madhugiri. There Medieval Karnataka. Among them Madhugiri was an were poets under the patronage of Mahanada important one. -

List of Phone Numbers Tumkur District

LIST OF PHONE NUMBERS TUMKUR DISTRICT Designation Name Sri/Smt STD Office Residence Mobile 2272480 D.C Sri R.K.Raju, IAS 0816 2272410 98807-00711 2278312 F Sri K.B Anjanappa KGS 2272898 94808-77000 CEO ZP (I/c) 0816 2272897 2274161 F 94493-06183 PA - Harish 2272451 94480-61330 S.P T.R.Suresh, IPS., 0816 2272461 2278000 F 94808-02901 ADC V. Doddappa, KAS., 0816 2261744 2211534 94489-76154 SLAO Muniswamy, KAS., 0816 2276042 99007-35360 SLAO NH48 Malleshaiah 08132 222210 77606-29095 Angadi - NH48 Kunigal 95380-09080 2278718 OA to DC Yashoda 0816 - 94482-48688 2260714 Mun. Tah Tabassum Zahera 0816 2254638 - 97408-22663 AD, Statist Gayathri 0816 2278718 - 99640-11153 94480-66770 Eln. Tah. Rudrappa G 0816 2272928 - 91415-54446 Assistant Commissioners Tumkur Rohini Sindhuri Dasari, IAS 0816 2278493 2278288 282323 Madhugiri Dipti Dilip Mehendale, IAS 08137 282340 95353-70670 282018 F Tiptur Shilpa M, KAS 08134 251085 251106 99456-16006 Tahsildars Tumkur B. Ahobalaiah 0816 2278496 98807-75222 Kunigal S.R.Krishnaiah 08132 220239 220202 99642-04776 Gubbi H.Gnanesh 08131 222234 222274 98452-68668 282324 Madhugiri Nagarajashetty 08137 282466 99457-61965 282125 F Sira Nagahanumaiah 08135 275243 275373 94496-55684 232153 Koratagere B. Anjaneya Shetty 08138 232836 97312-29999 232253 F Pavagada Prasanna Kumar 08136 244246 244337 99009-97120 A.B. Vijayakumar 97414-97315 Tiptur 08134 251039 252683 Satyanarayan - Manager 94486-60310 C.N.Hally Umesh Chandra 08133 267242 267268 94804-08363 Turuvekere Shobha T R 08139 287325 287202 94491-82125 KSWAN (Dist Consultant) Afroz : 93792-29749 Dist. Consultant E-Procurement : Sridhar : 98444-38275 - 2 - Executive Officers, Taluk Panchayath Designation Name Sri/Smt STD Office Residence Mobile Tumkur Virupaksha 0816 2277503 - 94808-77100 220238 Kunigal Ravikumar 08132 - 94800-17818 220929 F 222237 Gubbi Revanna 08131 - 94808-77110 222784 F 282330 Madhugiri Shivaramegowda 08137 - 93433-20318 283880 F 276412 Sira T. -

Chemistry Ground Water Analysis in the Surrounding Areas of Madhugiri

Research Paper Volume : 4 | Issue : 9 | Sept 2015 • ISSN No 2277 - 8179 Chemistry Ground Water Analysis in the Surrounding KEYWORDS : Madhugiri Taluk, Rural areas, Areas of Madhugiri Taluk, Tumkur District, Ground Water, Drinking water. Karnataka, India. Department of Chemistry, B M S College for Women, Basavanagudi, Bangalore, Nanda N Karnataka, India. Puneeth Kumar Department of Chemistry, Sambhram Institute of Technology, Bangalore, Karnataka, India. ABSTRACT Water is essential natural resource, basic amenity and universal solvent used for sustaining life and environment which we have always thought to be available in abundance and free gift of nature. Groundwater forms a major source of drinking water in urban as well as natural areas. The quality of ground water of any area is of great importance for human be- ing and irrigation. Current emphasis is not only how abundant water is, but also on whether its quality status is good enough to sustain its various uses. However, people in certain rural areas are not at all aware of the major problems are being faced due to the presence of excess fluoride, arsenic and nitrate in groundwater. Fluoride is present in water and it is necessary for human health, excessive ingestion of fluoride results into a disease called fluorosis. The objective of the present study to carry out the physico-chemical analysis like colour, pH, turbidity, total hardness, total dissolved solids, chloride, fluoride, sulphates, and nitrates of ground water samples collected from different villages in madhugiri taluk. It has been taken up to evaluate its suitability for portable purpose. In some samples, fluoride concentration was exceeding the permissible limit and in some samples concentration was lower than permissible limit. -

Brief Industrial Profile of Chickballapur District

GOVERNMENT OF INDIA MINISTRY OF MSME Brief Industrial Profile of Chickballapur District MSME-Development Institute (Ministry of MSME, Govt. of India,) Phone 91 080 23151581,82,83 Fax: 91 080 23144506 e-mail:[email protected] Web- www.msmedibangalore.gov.in/ CHICKABALLAPURA DISTRICT MAP WITH TALUKS 2 FOREWARD The Micro, Small and, Medium Enterprises, Development Institute (earlier called SISI), under Ministry of MSME, Govt. of India, Bangalore is one of the prime organizations in Karnataka, engaged in the promotion and development of Industries in the Micro, Small and Medium Enterprises. As a part of the promotional and developmental activities, the Institute conducts studies on the Status and performance of Micro, Small and Medium Enterprises in the State. The District profile is one such report compiled and updated under District Industry Development Plan of the Institute assigned by Office of the Development Commissioner (SSI), New Delhi. This report contains the present status of economy, geographical information, statistical data relating to MSME’s in each district, salient features of the progress of the different sectors of the each district of Karnataka and performance of industries particularly in Micro, Small and Medium industries. I am happy to appreciate the efforts put in by all the offices and staff in this institute especially S/Shri. B.N.Sudhakar, Deputy Director,Sri. P.V.Raghavendra, Asst.Director (ISS), Sri.K.Channabasavaiah and Smt. D.T.Vijayalakshmi. Asst.Director (Stat) in collecting the latest information available form different departments of Government of Karnataka and in bringing out this Industrial Profile report. I would also like to thank all Joint Directors of District Industry Centres, Senior Officers of Statistics Division of Govt. -

Language Handbook, Tumkur

MYSORE CENSUS 1951 LANGUAGE HANDBOOK TUMKUR DISTRICT J. B. MALLARAU>HY A Published for the Government of India by the Manager of Publications and Printed at the Government Press, Bangalore by the Director of Printing in Myson~ 19~~ TABLE OF CONTENTS INTRODUCTORY LANGUAGE PATTERN OF TUMKUR DISTRICT III STATEMENT SHOWING DIFl!'ERENCES BETWEEN THE ORIGINAL AND PRESENT SORTINGS IV TABLES Madhugiri Taluk 1 Koratagere Taluk 9 Sira Taluk 15 Pavagada Taluk 21 FACING PAGE LANGUAGE MAPS Tumkur District III Madhugiri Taluk 1 Koratagere Taluk ,9 Sira Taluk 15 Pavagada Taluk 21 INtRODUCTORY Towards the end of August 1953, the Government of Mysore asked me to undertake tbe extmction of figures relating to Scheduled Castes and S,0heduled Tribes, for submission of circle wise statements to the Delimitation Commission. Just when the work was about to be taken on hand accordingly, the Prime Minister happened to announce in Parliament that a High Power Commission was shortly to be appointed to go into the question of reorganisation of States. Since this meant that sooner or later there would be a demand for village wise language data, at least in respect of bilingual areas· in the State, I sought the permission of the Deputy Regis trar General to extract the language figures simultaneously with the extraction of figures for Scheduled Castes and Scheduled Tribes. rrhe Deputy Registrar Genera.!, India, readily fell in with my view but suggested that the extraction of villagewise language data, be confined only to taluks lying' on either side of a lingui8tic dividing line.' Accordingly, figures ,\'ere extracted for the villages of the following 13 clearly bilingual taluks :-- BANGALOltE DISTRICT TUMKUR DISTRICT KOLAIt DIS~RIC~' CHITALDRUG DIS'rRW'l' Hoskote Pavagada MaIm Challakere Devanhalli Koratagere Kolllr Anekal Madhugiri Goribidnur DodballapUI' Chikballapur Sidlllghatta With villagewise language data cmnpiled for the above taluks, I thought I had anticipated all pos8ible demands. -

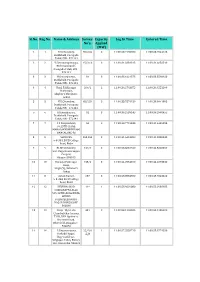

Sl.No. Reg.No. Name & Address Survey No's. Capacity Applied (MW

Sl.No. Reg.No. Name & Address Survey Capacity Log In Time Entered Time No's. Applied (MW) 1 1 H.V.Chowdary, 65/2,84 3 11:00:23.7195700 11:00:23.7544125 Doddahalli, Pavagada Taluk, PIN - 572141 2 2 Y.Satyanarayanappa, 15/2,16 3 11:00:31.3381315 11:00:31.6656510 Bheemunikunte, Pavagada Taluk, PIN - 572141 3 3 H.Ramanjaneya, 81 3 11:00:33.1021575 11:00:33.5590920 Doddahalli, Pavagada Taluk, PIN - 572141 4 4 Hanji Fakkirappa 209/2 2 11:00:36.2763875 11:00:36.4551190 Mariyappa, Shigli(V), Shirahatti, Gadag 5 5 H.V.Chowdary, 65/2,84 3 11:00:38.7876150 11:00:39.0641995 Doddahalli, Pavagada Taluk, PIN - 572141 6 6 H.Ramanjaneya, 81 3 11:00:39.2539145 11:00:39.2998455 Doddahalli, Pavagada Taluk, PIN - 572141 7 7 C S Nanjundaiah, 56 2 11:00:40.7716345 11:00:41.4406295 #6,15TH CROSS, MAHALAKHSMIPURAM, BANGALORE-86 8 8 SRINIVAS, 263,264 3 11:00:41.6413280 11:00:41.8300445 9-8-384, B.V.B College Road, Bidar 9 9 BLDE University, 139/1 3 11:00:23.8031920 11:00:42.5020350 Smt. Bagaramma Sajjan Campus, Bijapur-586103 10 10 Basappa Fakirappa 155/2 3 11:00:44.2554010 11:00:44.2873530 Hanji, Shigli (V), Shirahatti Gadag 11 11 Ashok Kumar, 287 3 11:00:48.8584860 11:00:48.9543420 9-8-384, B.V.B College Road, Bidar 12 12 DEVUBAI W/O 11* 1 11:00:53.9029080 11:00:55.2938185 SHARANAPPA ALLE, 549 12TH CROSS IDEAL HOMES RAJARAJESHWARI NAGAR BANGALORE 560098 13 13 Girija W/o Late 481 2 11:00:58.1295585 11:00:58.1285600 ChandraSekar kamma, T105, DNA Opulence, Borewell Road, Whitefield, Bangalore - 560066 14 14 P.Satyanarayana, 22/*/A 1 11:00:57.2558710 11:00:58.8774350 Seshadri Nagar, ¤ltĔ Bagewadi Post, Siriguppa Taluq, Bellary Dist, Karnataka-583121 Sl.No. -

Bhoosamrudhi: Improving Rural Livelihoods Through Innovative Scaling-Up of Science-Led Participatory Research for Development Contents 1

Project Completion Report 2013-17 Bhoosamrudhi: Improving Rural Livelihoods through Innovative Scaling-up of Science-led Participatory Research for Development Contents 1. Title of the project: Bhoosamrudhi: Improving Rural Livelihoods through Innovative Scaling-up of Science-led Participatory Research for Development ............................................................................ 1 2. Districts, area and beneficiary details: ................................................................................................ 1 3. Implementing departments and other collaborating institutions ...................................................... 1 4. Date of commencement of the project: 2012-13 ............................................................................... 2 5. Date of completion of the project: 2016-17 ....................................................................................... 2 6. Objectives of the project ..................................................................................................................... 2 7. Impact of the new/innovative technologies developed by CGIAR institutes on yield and famers’ incomes ................................................................................................................................................... 1 8. Capacity building details/ workforce trained under the project ........................................................ 1 9. Detailed project report ...................................................................................................................... -

Central Electricity Regulatory Commission New Delhi

CENTRAL ELECTRICITY REGULATORY COMMISSION NEW DELHI Petition No. 403/TT/2014 Coram: Shri A.K. Singhal, Member Shri A.S. Bakshi, Member Shri M.K. Iyer, Member Date of Hearing : 26.02.2015 Date of Order : 19.07.2016 In the matter of: Approval of transmission tariff for Gooty-Madhugiri 400 kV D/C line along with the associated bays and establishment of new 400/220 kV Sub-station at Madhugiri with 2x500 MVA transformers (COD: 1.12.2015) under “Transmission System associated with System Strengthening-XIII in Southern Regional Grid” from COD to 31.3.2019, under Regulation 86 of Central Electricity Regulatory Commission (Conduct of Business) Regulations, 1999 and Central Electricity Regulatory Commission (Terms and Conditions of Tariff) Regulations, 2014. And in the matter of: Power Grid Corporation of India Limited, "Saudamini", Plot No.2, Sector-29, Gurgaon -122 001 …….Petitioner Vs 1. Karnataka Power Transmission Corporation Limited (KPTCL), Kaveri Bhawan, Bangalore-560 009 2. Transmission Corporation of Andhra Pradesh Limited (APTRANSCO), Vidyut Soudha, Hyderabad-500 082 3. Kerala State Electricity Board (KSEB), Vaidyuthi Bhavanam, Pattom, Thiruvananthapuram-695 004 4. Tamilnadu Generation and Distribution Corporation Limited NPKRR Maaligai, 800, Anna Salai, Chennai-600 002 5. Electricity Department, Government of Goa, Vidyuti Bhawan, Panaji, Goa 403 001 Page 1 of 43 Order in Petition No. 403/TT/2014 6. Electricity Department, Government of Pondicherry, Pondicherry-605 001 7. Eastern Power Distribution Company of Andhra Pradesh Limited (APEPDCL), APEPDCL, P&T Colony, Seethmmadhara, Vishakhapatnam, Andhra Pradesh 8. Southern Power Distribution Company of Andhra Pradesh Limited (APSPDCL), Srinivasasa Kalyana Mandapam Backside, Tiruchanoor Road, Kesavayana Gunta, Tirupati-517 501, Chittoor District, Andhra Pradesh 9. -

LIST of DDPI`S ,BEO`S & RTE NODAL OFFICERS

RTE Contact Numbers LIST OF DDPI`s ,BEO`s & RTE NODAL OFFICERS Sl. Designation Dist/Block Name Land Line Mobile No 1 DDPI Bangalore South 080-26701189 080-26705692 Nodal Officer Raghavendra 080-26701189 9844226672 Case worker Venkatesh babu 080-26701189 8970009606 Toll Free number 1800-425-11005 BEO South -1 080-26608530 (Shankarapuram) Nodal officer Ramakrishnappa 080-26608530 9480417802 Case worker Bhujendra 080-26608530 9164375551 BEO South- 2 080-22872738 (Tulasithota) Nodal officer Venkatesh.BRP 080-22872737 8951563295 Case worker Anilkumar.FDA 8892268443 BEO South- 3 9480695027 (Gurappanapalya) Nodal officer Gowri.V.Bhat 9448738032 Case worker Srikanth.S 9591381263 BEO South -4 080-25614686 (K.R.puram) Nodal officer Satish 9886560900 Case worker Vijayakumar 9741981740 BEO Anekal 080-27859296 080-7829293 Nodal Oficer Gavirangaiah. Eco 9448515052 Case Worker Umesh 9611985552 2 DDPI Bangalore North Manjunath.H.B 080-22215312 Nodal officer Jayasimha 9448999466 Case worker Manjappa Toll Free number 1800-425-11002 BEO North- 1 080-23421719 (Rajajjinagar) . Nodal officer Gopalakrishna 9902399666 9845631587 Case worker Nagaraj .F.D.A 9900545775 BEO North- 2 080-23354483 (Gandhinagar) Nodal officer Gopalakrishna 9902399666 Case worker Santhosh 9632011844 BEO North- 3 080-25308815 (Shivajjinagar) Nodal officer Boregowda 080-25308815 9742137558 Case worker Imran 080-25308815 9343830277 BEO North -4 080-28567449 (Yelahanka) Nodal officer Jagadesh 080-28567449 9590011955 Case worker Rudramuni 080-28567449 9738777634 1 RTE Contact Numbers S.