Cytonn Corporate Governance Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report

2013/2014 Annual Report 2013/2014 ANNUAL REPORT TABLE OF CONTENTS TABLE OF CONTENTS ............................................................................................................................................................................................................. II TABLE OF FIGURES ................................................................................................................................................................................................................. III LIST OF TABLES ....................................................................................................................................................................................................................... IV ABBREVIATIONS ...................................................................................................................................................................................................................... V REGISTERED ADDRESSES .................................................................................................................................................................................................... VII 1 GOVERNOR’S FOREWORD ........................................................................................................................................................................................1 2 BOARD OF DIRECTORS AND MANAGEMENT STRUCTURE........................................................................................................................... -

Cytonn Report a Product of Cytonn Technologies

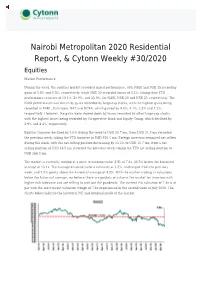

Nairobi Metropolitan 2020 Residential Report, & Cytonn Weekly #30/2020 Equities Market Performance During the week, the equities market recorded mixed performance, with NASI and NSE 25 recording gains of 1.8% and 0.5%, respectively, while NSE 20 recorded losses of 0.2%, taking their YTD performance to losses of 19.1%, 28.9%, and 23.9%, for NASI, NSE 20 and NSE 25, respectively. The NASI performance was driven by gains recorded by large-cap stocks, with the highest gains being recorded in EABL, Safaricom, BAT and NCBA, which gained by 4.8%, 4.1%, 2.3% and 1.2%, respectively. However, the gains were slowed down by losses recorded by other large-cap stocks, with the highest losses being recorded by Co-operative Bank and Equity Group, which declined by 5.9% and 4.4%, respectively. Equities turnover declined by 4.0% during the week to USD 30.7 mn, from USD 31.9 mn recorded the previous week, taking the YTD turnover to USD 920.1 mn. Foreign investors remained net sellers during the week, with the net selling position decreasing by 23.2% to USD 12.7 mn, from a net selling position of USD 16.5 mn recorded the previous week, taking the YTD net selling position to USD 266.0 mn. The market is currently trading at a price to earnings ratio (P/E) of 7.8x, 40.3% below the historical average of 13.1x. The average dividend yield is currently at 5.3%, unchanged from the previous week, and 1.3% points above the historical average of 4.0%. -

A Case Study of Guaranty Trust Bank, Kigali, Rwanda

[Kwizera et. al., Vol.7 (Iss.12): December 2019] ISSN- 2350-0530(O), ISSN- 2394-3629(P) Index Copernicus Value (ICV 2018): 86.20 DOI: https://doi.org/10.29121/granthaalayah.v7.i12.2019.303 Science INFORMATION TECHNOLOGY USAGE AND CUSTOMER ACCEPTANCE IN THE BANKING SECTOR: A CASE STUDY OF GUARANTY TRUST BANK, KIGALI, RWANDA John Kwizera 1, Prof. Raymond Wafula Ongus 2 1 MIS/0067/13, Mount Kenya University, Kigali Campus, P.O Box 5826, Kigali, Rwanda 2 Mount Kenya University- Kigali Campus, P.O Box 5826, Kigali, Rwanda Abstract The study was inspired by the arising issues of concern related to why customer accounts were inactive. The study examined effect of Information technology usage on customer acceptance at GT Bank, Kigali Rwanda. The research design was a case study, with target population of 20,335 customers who used either ATM, Internet banking or mobile banking technologies, 3 e-banking staff and 5 GT Bank branch managers. The data analysis tool used was Statistical Package for Social Sciences (SPSS) version 16.0. Findings revealed that Mobile banking and ATM were mostly used more than Internet banking, depending on features of use and security. ATM features were more accepted compared to Internet banking and Mobile banking features. Multiple regression analysis found R the coefficient of correlation to be 0.927 signifying a very strong positive correlation between information technology usage and customer acceptance. The coefficient of determination R2 = 0.859 indicated that 85.9% of the variability in customer acceptance depended on stochastic model developed, whereas the remaining 14.10% was attributed to factors beyond the control of the study. -

Implementing Bom Model of Contact Center Solution Implementing Bom Model of Contact Center Solution

CASE STUDY IMPLEMENTING BOM MODEL OF CONTACT CENTER SOLUTION IMPLEMENTING BOM MODEL OF CONTACT CENTER SOLUTION CASE STUDY CUSTOMER PROFILE Customer Guaranty Trust Bank plc is foremost The company is foremost a Nigerian financial institution with vast business outlays Nigerian financial institution which has spanning Anglophone/Francophone, West Africa, East Africa and the United been in Kenya since 2012 after acquiring Kingdom. In 2013, it acquired Fina Bank Group which had been in operation in Kenya Fina Bank Group. for over 25 years with subsidiaries in Rwanda and Uganda. In 2015 the bank launched Kenya’s First Platinum MasterCard. Industry Private (Banking) BUSINESS SITUATION Business Situation Avaya telephones were used which The company had been using Avaya telephones in handling of incoming and outgoing served the purpose but did not give calls. The set up only supporteded one level IVR with no ability for skill based routing, features of a contact centre which was robust reports and QA functionality. There was no customer feedback mechanism as the market standards. well as voice recorder which are essential for banking sectors. Solution The company approached Techno Brain to offer a solution that manages expectations, Techno Brain BPO / ITES implemented a garnering efficiency, and minimizing the costs incurred. The solution would organize, solution that organizes, automates, and automate, and synchronize business processes leading to proper management of synchronizes business processes leading customer interactions; this in turn would help building relationships with customers to proper management of customer and spurt business growth. interactions. SOLUTION Benefits • Customized contact centre solution The company is now using Ameyo Center solution to provide premier customer • Extensive feature for inbound and services to its branch, card, loans and other customers. -

Effects of Strategic Positioning of Service Delivery on Customer Satisfaction - a Case Study of FINA Bank

International Journal of Scientific and Research Publications, Volume 5, Issue 5, May 2015 1 ISSN 2250-3153 Effects of Strategic Positioning of Service Delivery on Customer Satisfaction - A Case Study of FINA Bank Asaph Ngetha Kamau *, Moses Kimani Wafula ** * Transactions officer Guaranty Trust Bank Mombasa-Branch, P.O Box 90089-80100 ** Senior Assistant Librarian Jomo Kenyatta University of Agriculture and Technology Mombasa CBD, P.O Box 81310-80100, Mombasa Abstract- This paper investigates the effects of strategic banking, seven-day and anywhere banking, internet banking, positioning of service delivery on customer satisfaction a case of extended business hours, ATM network, corporate banking, Fina Bank Mombasa. Several publications, reference materials as mobile banking etc to remain competitive in the market. Today, well as some unpublished literature are used to compile the customers are increasingly becoming aware of the options and literature review with discussion on the topic under study. At the offers banks provide in retaining them as potential customers. time of study, the population comprised of customers and the (Krishnaveni & Divya Prava, 2004, Sachdev & Verma, 2004, staff totaling to 250 respondents. The researcher issued out 250 Aurora and Malhotra, 1997). questionnaires and received 67. Respondents were grouped into Positioning can be defined as collection of creative activities strata’s under their departments. Data collection was through that manipulates the consumers’ mind in favor of the brand. The questionnaires. Both qualitative and quantitative techniques were emphasis was that positioning starts with a product and ends up used to analyze the data collected. Majority the respondents creating a space and occupying it in the consumers’ minds. -

2020 Annual Report of Guaranty Trust Bank (Rwanda) Plc

GUARANTY TRUST BANK (RWANDA) PLC ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2020 GUARANTY TRUST BANK (RWANDA) PLC ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2020 WHO WE ARE Guaranty Trust Bank (Rwanda) plc is a subsidiary of Guaranty Trust Bank plc (Nigeria), a foremost financial institution with 10 subsidiaries spanning West Africa, East Africa and the United Kingdom. In 2013, Guaranty Trust Bank plc acquired Fina Bank Group which had been in operation in Kenya for over 25 years with subsidiaries in Rwanda and Uganda. Sequel to the acquisition, Fina Bank (Rwanda) Ltd was renamed GTBank (Rwanda) Plc. Guaranty Trust Bank plc currently employs over 10,000 professionals across Nigeria, Rwanda, Cote D'Ivoire, Gambia, Ghana, Liberia, Kenya, Uganda, Sierra Leone, Tanzania and the United Kingdom while it is also listed on the Nigerian and London Stock Exchanges. The entrance of GTBank via the acquisition of Fina Bank Group’s operations in Rwanda, Uganda and Kenya enabled the Bank to expand its footprint to East Africa and reinforced its “Proudly African and Truly International’ philosophy. GTBank (Rwanda) Plc has a very strong service culture with 14 branches across the 4 provinces in Rwanda. VISION We are a team driven to deliver the utmost in customer service. We are synonymous with innovation, building excellence and superior financial performance and creating role models for society. MISSION We are a high-quality financial services provider, possessing the urge to be the best at all times whilst adding value to all stakeholders. ORANGE RULES Guaranty Trust Bank is a friendly brand that truly cares and this permeates through every sphere of our business. -

Kenya Listed Commercial Banks Review Cytonn FY'2020 Banking

Kenya Listed Commercial Banks Review Cytonn FY’2020 Banking Sector Report “Subdued Growth in Earnings Amidst Deteriorating Asset Quality” 16th April, 2021 Table of Contents 1 Introduction to Cytonn 4 Listed Banking Sector Metrics 2 Kenya Economic Review and Outlook 5 Bank Valuation Reports 3 Banking Sector Overview 6 Appendix www.cytonn.com 2 I. Introduction to Cytonn 3 About Us Cytonn Investments is an alternative investment manager, with real estate development capability, and a primary focus on private equity and real estate investments in the high growth Kenyan Region. Cytonn has a unique strategy of coupling two compelling demand areas - the lack of high yielding investment products and the lack of institutional grade real estate. We provide high yielding investment instruments to attract funding from investors, and we deploy that funding to largely pre- sold investment grade real estate. With offices in Kenya and Washington, DC - USA, we are primarily focused on offering alternative investment solutions to global and local institutional investors, individual high net-worth investors, and diaspora investors interested in the East-African region. Real estate investments are made through our development affiliate, Cytonn Real Estate, where we currently have over Kshs. 82 billion (USD 820 mn) of projects under mandate across ten projects. In private equity, we invest in banking, education, and hospitality. Over Kshs. 82 Three offices across 2 Over 500 staff 10 investment billion worth of continents members, including readyprojects in 82 projects under 3 500 Cytonn Distribution 10 real estate mandate A unique franchise differentiated by: Independence & Investor Alternative Investments Focus StrongAlignment CommittedPartners Specialized focus on Focused on serving the Every staff member is an Strong global and local alternative assets - interest of clients, which is ownerin the firm. -

Contents BRIEFS

17 February 2014 BRIEFS Africa • West African stock market gets boost Angola • Angola forex reserves fall to $31 bln in December Contents • Angola consumer inflation quickens 7.84% y/o/y in IN-DEPTH: January Botswana - African nations race to build sovereign funds 2 • Botswana to Sign Deal With Namibia to Develop - Mozambique economy: Quick View - Economy grows briskly Coal-Export Line quarter 2 Ghana - Angola economy: Quick View - Bond 3 • Fitch says its concerns about Ghana's economic - China and Japan’s complementary rivalry in Africa 3 imbalances growing - SOVEREIGN RATINGS 5 • Ghana risks overshooting its 11.5% 2014 inflation target INVESTMENTS 6 • Ghana consumer inflation rises to 13.8% in January Kenya BANKING • Equity uses credit rating to cut cost of loans for SMEs • Tullow Says Kenya Sees First Oil Exports as BANKS 8 ‘National Priority’ MARKETS 10 • Kenyan shilling eases versus dollar, further losses DEALS 11 seen FUNDS 12 Mozambique • Mozambique may raise coal tax: deputy mines TECH 13 minister • Mozambique c.bank governor says GDP growth could ENERGY 14 top 8.1% • Mozambique CPI slows to 3.16% year-on-year in MINING 16 January • S&P lowers Mozambique sovereign credit rating to B OIL & GAS 20 from B+ • Irish based miner Kenmare reschedules Mozambique debt INFRASTRUCTURE 22 Nigeria • The new directive on Cash-Reserve Ratio (CRR) on AGRIBUSINESS 23 public sector deposits by Central Bank of Nigeria (CBN) took effect on 4th February 2014 TRADE 24 • Nigeria adds $550 million to sovereign wealth fund • Oil majors sell Nigerian stakes worth USD 6.5bn in MARKETS INDICATORS 26 2013 • Trading houses in race to buy oil majors' $3 bln UPCOMING EVENTS 27. -

Kenya Listed Commercial Banks Review Cytonn Q1'2021 Banking

Kenya Listed Commercial Banks Review Cytonn Q1’2021 Banking Sector Report “Recovery of the Banking Sector Amid a Tough Operating Environment” 11th June, 2021 Table of Contents 1 Introduction to Cytonn 4 Listed Banking Sector Metrics 2 Kenya Economic Review and Outlook 5 Bank Valuation Reports 3 Banking Sector Overview 6 Appendix www.cytonn.com 2 I. Introduction to Cytonn 3 About Us Cytonn Investments is an alternative investment manager, with real estate development capability, and a primary focus on private equity and real estate investments in the high growth Kenyan Region. Cytonn has a unique strategy of coupling two compelling demand areas - the lack of high yielding investment products and the lack of institutional grade real estate. We provide high yielding investment instruments to attract funding from investors, and we deploy that funding to largely pre- sold investment grade real estate. With offices in Kenya and Washington, DC - USA, we are primarily focused on offering alternative investment solutions to global and local institutional investors, individual high net-worth investors, and diaspora investors interested in the East-African region. Real estate investments are made through our development affiliate, Cytonn Real Estate, where we currently have over Kshs. 82 billion (USD 820 mn) of projects under mandate across ten projects. In private equity, we invest in banking, education, and hospitality. Over Kshs. 82 Three offices across 2 Over 500 staff 10 investment billion worth of continents members, including readyprojects in 82 projects under 3 500 Cytonn Distribution 10 real estate mandate A unique franchise differentiated by: Independence & Investor Alternative Investments Focus StrongAlignment CommittedPartners Specialized focus on Focused on serving the Every staff member is an Strong global and local alternative assets - interest of clients, which is ownerin the firm. -

Effects of Credit Cycle Management on Financial Performance of Financial Institutions in Rwanda: a Case Study of Guaranty Trust Bank Rwanda PLC

International Journal of Science and Research (IJSR) ISSN: 2319-7064 ResearchGate Impact Factor (2018): 0.28 | SJIF (2018): 7.426 Effects of Credit Cycle Management on Financial Performance of Financial Institutions in Rwanda: A Case Study of Guaranty Trust Bank Rwanda PLC David Wambua Mulyungi1, Dr. Patrick Mulyungi2 1Jomo Kenyatta University of Agriculture and Technology 2Jomo Kenyatta University of Agriculture and Technology Abstract: Credit cycle management is an important activity within the microfinance industry that cannot be overlooked in any organization engaged in the business of lending money. A well-structured and sound credit cycle management is a prerequisite which is able to attain stability, continued profitability and long term sustainability. The objective of this study was to establish the Some Effects of credit cycle management on financial performance of Guaranty Trust Bank Rwanda PLC. The specific objectives of the study was to evaluate the effect of credit terms on financial performance of Guaranty Trust Bank Rwanda PLC, establish the effect of client appraisal on financial performance of Guaranty Trust Bank Rwanda PLC, to examine the effect of credit risk control measures on financial performance Guaranty Trust Bank Rwanda PLC and to determine the effect of credit collection policies on financial performance Guaranty Trust Bank Rwanda PLC. The study was anchored on liquidity risk theory, value at risk theory and portfolio theory. This study will adopt descriptive research design. The target population for this study included operations and credit departments and the management. The study used stratified and simple random Sampling techniques to obtain a Sample of 80 respondents. The main data collection tool was a structured questionnaire. -

10 Brigid Thesis

Masaryk University Faculty of Economics and Administration Finance & Accounting ASSESSMENT OF MERGERS AND ACQUISITIONS ON THE PERFORMANCE OF SELECTED COMMERCIAL BANKS IN KENYA Master’s Thesis Supervisor: Author: Ing. Petr VALOUCH, Ph.D. Brigid MUTAI Brno, 2019 MASARYK UNIVERSITY Faculty of Economics and Administration MATER’S THESIS DESCRIPTION Academic Year: 2018/2019 Student: Brigid Mutai Field of Study: Finance (Eng.) Title of the Thesis: Assessment of Mergers and Acquisitions on the Performance of Commercial Banks in Kenya. Title of the Thesis in English: Assessment of Mergers and Acquisitions on the Performance of Commercial Banks in Kenya. Thesis objective, procedure, and methods The aim of the master thesis is to assess the effect used: of mergers and acquisitions on the performance of Commercial banks in Kenya. The structure of the thesis and methods used: - Introduction: identification of the purpose of the thesis, illustration - of the research problem & statement of study objectives - Review of Literature on the Mergers & Acquisition: theoretical literature and empirical literature - Research methodology: the research design, data collection procedure, and method of data analysis. These will entail: - The quantitative analysis of the performance indicators (i.e. profitability, efficiency, solvency, lending intensity & risk profile) - Quantitative analysis of the data- estimation of multiple regression - equation to determine the effect of the independent variables on the dependent variable - Results of the study and discussion of the results - Summary of findings, conclusions based on the findings and recommendations Extent of graphic-related work: According to thesis supervisors’ instructions Extent of thesis without supplements: 60-80 pages Literature: GATTOUFI, S. and AL-MUHARRAMI, S. -

Guaranty Trust Bank Uganda Is One of the Leading Banks in Africa. They Acquired a 70% Stake in the Fina Bank Group in to Enable Them Enter the East African Market

Guaranty Trust Bank Uganda is one of the leading banks in Africa. They acquired a 70% stake in the Fina Bank group in to enable them enter the East African market. As they expand their operations in the East African region, GTBank Uganda Ltd is looking for suitably qualified and experienced professionals to join its team. Applications are hereby invited to fill the following positions: BUSINESS RELATIONSHIP OFFICERS REPORTING TO: RELATIONSHIP MANAGER To actively create a market for the bank's products and services in order to increase the bank’s market share. The process involves the presentation of the bank’s products/services to prospects and existing Customers based on identified needs Block funds To secure funds designated as collateral for credit facilities. The process involves placing restrictions on the funds in the Customer’s account as a form of security for credit advanced to the Customer Arrange temporal overdraft To organise, review and manage the processing of overdraft facilities to customers. The process is initiated based on customer request or due to temporary funding problems in a customer’s account. It involves providing a temporary credit facility for the customer in form of a TEMP, after receiving the necessary approvals as stated in the Credit Policy Guide Resolve account problems To promptly resolve problems with Cheques drawn on the bank’s customers. The process involves the analysis and resolution of problems related to Cheques drawn on the customer’s account. Examples of typical problems include the following: Insufficient funds in the customer’s account Non-compliance with account mandate Account Restriction based on account dormancy, incomplete documentation or statutory requirement Cheque confirmation Returned Cheque Manage customer’s funds To make customer’s invested funds available on request.