Stv Ink News and Views Download

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PHASE IA ARCHAEOLOGICAL SURVEY REPORT Laguardia Airport Central Terminal Building Redevelopment

PHASE IA ARCHAEOLOGICAL SURVEY REPORT LaGuardia Airport Central Terminal Building Redevelopment Queens Borough New York City Prepared for Port Authority of New York & New Jersey Port Authority of NY & NJ 225 Park Avenue South New York, NY 10003 Prepared by Frank G. Mikolic, Principal Investigator John W. Lawrence, Principal Investigator Brian M. Albright, GIS Specialist/Field Director AECOM 516 East State St. Trenton, New Jersey 08609 June 2013 PHASE IA ARCHAEOLOGICAL SURVEY REPORT LaGuardia Airport Central Terminal Building Redevelopment Queens Borough New York City Prepared for Port Authority of New York & New Jersey 225 Park Avenue South New York, NY 10003 Prepared by Frank G. Mikolic, Principal Investigator John W. Lawrence, Principal Investigator Brian M. Albright, GIS Specialist/Field Director AECOM 516 East State Street Trenton, NJ 08609 June 2013 Management Summary SHPO PROJECT REVIEW NUMBER: 12PR05127 INVOLVED STATE AND FEDERAL AGENCIES: FAA Port Authority of New York and New Jersey PHASE OF SURVEY: IA, Literature Search and Sensitivity Assessment LOCATION INFORMATION: Location: New York City Minor Civil Division: Queens Borough County: Queens County SURVEY AREA: Length: 1.2 mi (2 km) Width: width varies depending on location Number of Acres Surveyed: 159 ac (64 ha) USGS 7.5 MINUTE QUADRANGLE MAP: Central Park, Flushing SENSITIVITY ASSESSMENT: Prehistoric (high, medium, low): Sensitivity Area 1 (Moderate to High), 2 (High), 3 (Low) and 4 (Moderate). Historic (high, medium, low): Sensitivity Area 1 (Moderate to High), 2 (Low), -

Scotland's Digital Media Company

Annual Report and Accounts 2010 Annual Report and Accounts Scotland’s digital media company 2010 STV Group plc STV Group plc In producing this report we have chosen production Pacific Quay methods which aim to minimise the impact on our Glasgow G51 1PQ environment. The papers chosen – Revive 50:50 Gloss and Revive 100 Uncoated contain 50% and 100% recycled Tel: 0141 300 3000 fibre respectively and are certified in accordance with the www.stv.tv FSC (Forest stewardship Council). Both the paper mill and printer involved in this production are environmentally Company Registration Number SC203873 accredited with ISO 14001. Directors’ Report Business Review 02 Highlights of 2010 04 Chairman’s Statement 06 A conversation with Rob Woodward by journalist and media commentator Ray Snoddy 09 Chief Executive’s Review – Scotland’s Digital Media Company 10 – Broadcasting 14 – Content 18 – Ventures 22 KPIs 2010-2012 24 Performance Review 27 Principal Risks and Uncertainties 29 Corporate Social Responsibility Corporate Governance 34 Board of Directors 36 Corporate Governance Report 44 Remuneration Committee Report Accounts 56 STV Group plc Consolidated Financial Statements – Independent Auditors’ Report 58 Consolidated Income Statement 58 Consolidated Statement of Comprehensive Income 59 Consolidated Balance Sheet 60 Consolidated Statement of Changes in Equity 61 Consolidated Statement of Cash Flows 62 Notes to the Financial Statements 90 STV Group plc Company Financial Statements – Independent Auditors’ Report 92 Company Balance Sheet 93 Statement -

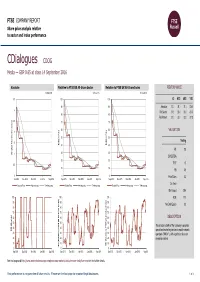

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 14 September 2016 CDialogues CDOG Media — GBP 0.65 at close 14 September 2016 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-Sep-2016 14-Sep-2016 14-Sep-2016 3.5 100 100 1D WTD MTD YTD 90 90 Absolute 31.3 31.3 31.3 -23.5 3 Rel.Sector 31.5 33.0 33.2 -24.0 80 80 Rel.Market 31.2 33.3 33.2 -27.8 2.5 70 70 60 60 VALUATION 2 (local currency) (local 50 50 Trailing 1.5 Relative Price 40 Relative Price 40 PE 2.8 30 30 Absolute Price Price Absolute 1 EV/EBITDA - 20 20 0.5 PCF 1.0 10 10 PB 0.5 0 0 0 Price/Sales 0.3 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Div Yield - Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout 29.4 100 100 100 ROE 17.7 90 90 90 Net Debt/Equity 0.0 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The principal activity of the Company is provides 40 40 40 RSI (Absolute) RSI specialised marketing services to mobile network 30 30 30 operators ("MNOs" ), with a particular focus on 20 20 20 emerging markets. -

Q1 2016 New York Office Outlook

Office Outlook New York | Q1 2016 Vacancy moves higher as large blocks are added to the market • The Manhattan office market showed signs of caution in the first quarter of 2016 as vacancy moved higher and renewal activity increased. • While there have been concerns about slower expansion in the tech sector—as a result of a potential pullback in venture capital—the TAMI sector remained strong in Midtown South. • Investment sales activity slowed in the first quarter of the year after a strong 2015 with 120 sales totaling $12.3 billion, down nearly 20 percent year-over-year. JLL • Office Outlook • New York • Q1 2016 2 New York overview The Manhattan office market showed signs of caution in the first comprised the majority of leasing activity. McGraw Hill Financial Inc. quarter of 2016 as vacancy moved higher and renewal activity—rather renewed at 55 Water Street in Lower Manhattan for 900,027 square feet than relocations and expansions—captured the bulk of top in the largest lease of the quarter. Salesforce.com subleased 202,678 transactions. Manhattan Class A vacancy rose as several large blocks square feet at 1095 Avenue of the Americas in a transaction that were returned to the market. The vacancy rate for Midtown Class A included a provision to replace MetLife’s name atop the building with its space increased to 11.6 percent, up from 10.4 percent at year-end own, in full view of highly-trafficked Bryant Park. In Midtown South, 2015. Average asking rents were also higher as a result of newer and Facebook continued its massive expansion in a 200,668-square-foot higher quality product becoming available. -

Emergency Response Incidents

Emergency Response Incidents Incident Type Location Borough Utility-Water Main 136-17 72 Avenue Queens Structural-Sidewalk Collapse 927 Broadway Manhattan Utility-Other Manhattan Administration-Other Seagirt Blvd & Beach 9 Street Queens Law Enforcement-Other Brooklyn Utility-Water Main 2-17 54 Avenue Queens Fire-2nd Alarm 238 East 24 Street Manhattan Utility-Water Main 7th Avenue & West 27 Street Manhattan Fire-10-76 (Commercial High Rise Fire) 130 East 57 Street Manhattan Structural-Crane Brooklyn Fire-2nd Alarm 24 Charles Street Manhattan Fire-3rd Alarm 581 3 ave new york Structural-Collapse 55 Thompson St Manhattan Utility-Other Hylan Blvd & Arbutus Avenue Staten Island Fire-2nd Alarm 53-09 Beach Channel Drive Far Rockaway Fire-1st Alarm 151 West 100 Street Manhattan Fire-2nd Alarm 1747 West 6 Street Brooklyn Structural-Crane Brooklyn Structural-Crane 225 Park Avenue South Manhattan Utility-Gas Low Pressure Noble Avenue & Watson Avenue Bronx Page 1 of 478 09/30/2021 Emergency Response Incidents Creation Date Closed Date Latitude Longitude 01/16/2017 01:13:38 PM 40.71400364095638 -73.82998933154158 10/29/2016 12:13:31 PM 40.71442154062271 -74.00607638041981 11/22/2016 08:53:17 AM 11/14/2016 03:53:54 PM 40.71400364095638 -73.82998933154158 10/29/2016 05:35:28 PM 12/02/2016 04:40:13 PM 40.71400364095638 -73.82998933154158 11/25/2016 04:06:09 AM 40.71442154062271 -74.00607638041981 12/03/2016 04:17:30 AM 40.71442154062271 -74.00607638041981 11/26/2016 05:45:43 AM 11/18/2016 01:12:51 PM 12/14/2016 10:26:17 PM 40.71442154062271 -74.00607638041981 -

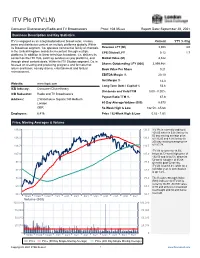

ITV Plc (ITV:LN)

ITV Plc (ITV:LN) Consumer Discretionary/Radio and TV Broadcasters Price: 108.05 GBX Report Date: September 28, 2021 Business Description and Key Statistics ITV is engaged as an integrated producer broadcaster, creates, Current YTY % Chg owns and distributes content on multiple platforms globally. Within its Broadcast segment, Co. operates commercial family of channels Revenue LFY (M) 3,308 3.0 in the United Kingdom and delivers content through multiple EPS Diluted LFY 0.12 1.7 platforms. In addition to linear television broadcast, Co. delivers its content on the ITV Hub, catch up services on pay platforms, and Market Value (M) 4,322 through direct content deals. Within its ITV Studios segment, Co. is focused on creating and producing programs and formats that Shares Outstanding LFY (000) 3,999,984 return and travel, namely drama, entertainment and factual Book Value Per Share 0.21 entertainment. EBITDA Margin % 20.10 Net Margin % 14.3 Website: www.itvplc.com Long-Term Debt / Capital % 53.6 ICB Industry: Consumer Discretionary Dividends and Yield TTM 0.00 - 0.00% ICB Subsector: Radio and TV Broadcasters Payout Ratio TTM % 67.8 Address: 2 Waterhouse Square;140 Holborn London 60-Day Average Volume (000) 8,573 GBR 52-Week High & Low 132.50 - 65.68 Employees: 6,416 Price / 52-Week High & Low 0.82 - 1.65 Price, Moving Averages & Volume 136.0 136.0 ITV Plc is currently trading at 108.05 which is 6.0% below its 50 day moving average price 126.3 126.3 of 115.00 and 8.3% below its 200 day moving average price 116.7 116.7 of 117.78. -

Cteea/S5/20/C19/C015

CTEEA/S5/20/C19/C015 CULTURE, TOURISM, EUROPE AND EXTERNAL AFFAIRS COMMITTEE CALL FOR VIEWS ON THE IMPACT OF COVID-19 ON SCOTLAND’S CULTURE AND TOURISM SECTORS SUBMISSION FROM STV GROUP PLC STV Group plc (“STV”) is pleased to take this opportunity to respond to the Culture, Tourism, Europe And External Affairs Committee inquiry on the impact of Covid-19. STV holds the Channel 3 licences for central and north Scotland, broadcasting both the network schedule of drama, entertainment and events alongside regional content which is primarily news and current affairs. We reach over 85% of the population in our regions every month and our STV News at Six programme is Scotland’s most watched bulletin. STV is also Scotland’s largest commercial producer of television programmes in a range of genres including drama (The Victim and Elizabeth is Missing) - and entertainment (Catchphrase), working with all the major UK networks. In digital, the STV Player has enjoyed significant growth over the past year, with availability on more platforms and an increasing range of new content and channels in addition to our 30 day catchup service. STV is a proud commercial partner for Scottish business including many SMEs. Our Growth Fund initiative enables many businesses to access television advertising for the first time. We have committed £20m to the Growth Fund and worked with nearly 200 businesses already. We are pleased to attach below two documents for the Committee as they examine the impact of Covid-19. Both are forward looking as we consider the challenge of doing business post-lockdown. -

The Bloom Is on the Roses

20100426-NEWS--0001-NAT-CCI-CN_-- 4/23/2010 7:53 PM Page 1 INSIDE IT’S HAMMERED TOP STORIES TIME Journal v. Times: Story NY’s last great Page 3 Editorial newspaper war ® Page 10 PAGE 2 With prices down and confidence up, VOL. XXVI, NO. 17 WWW.CRAINSNEWYORK.COM APRIL 26-MAY 2, 2010 PRICE: $3.00 condo buyers pull out their wallets PAGE 2 The bloom is on the Roses Not bad for an 82-year-old, Adam Rose painted a picture of a Fabled real estate family getting tapped third-generation-led firm that is company that has come a surpris- for toughest property-management jobs known primarily as a residential de- ingly long way from its roots as a veloper. builder and owner of upscale apart- 1,230-unit project.That move came In a brutal real estate market, ment houses. BY AMANDA FUNG just weeks after Rose was brought in some of New York’s fabled real es- Today, Rose Associates derives as a consultant—and likely future tate families are surviving and some the bulk of its revenues from a broad just a month after Harlem’s River- manager—for another distressed are floundering, but few are blos- menu of offerings. It provides con- A tale of 2 eateries: ton Houses apartment complex was residential property, the vast soming like the Roses.In one of the sulting for other developers—in- taken over, owners officially tapped Stuyvesant Town/Peter Cooper Vil- few interviews they’ve granted,first cluding overseeing distressed prop- similar starts, very Rose Associates to manage the lage complex in lower Manhattan. -

Katherine Ryan Writer / Performer

Katherine Ryan Writer / Performer Originally from Canada, now UK based, and star of Netflix’s KATHERINE RYAN: IN TROUBLE and Comedy Central’s ROAST BATTLE and YOUR FACE OR MINE, Katherine is a writer, performer and stand-up comedian who is dominating the television and live comedy scenes – both in the UK and abroad. Britain and Canada’s first and only woman to have a worldwide Netflix special, Katherine Ryan will bring her acclaimed, total sell-out 2017/18 nation-wide tour show GLITTER ROOM to the Garrick Theatre in London’s West End. Buy tickets here. Katherine recently became the first woman to host Channel Four's 8 OUT OF CATS DOES COUNTDOWN, taking the host chair for a special episode to commemorate women’s suffrage in the UK that will air later this year. She was only the second British-based comedian (after Jimmy Carr) to have a Netflix Original Comedy Special released globally and remains the only woman from both Britain and Canada. KATHERINE RYAN: IN TROUBLE was filmed at the Hammersmith Eventim Apollo and was released to 190 countries in February 2017. Watch it here. Katherine performed a set on TBS’ THE CONAN O’BRIEN SHOW in the US to publicize the special. In July 2018, Katherine will return to her native Canada to host the 8-part series THE STAND-UP SHOW WITH KATHERINE RYAN for Canada’s The Comedy Network / Bell Media. Performances will be taped over six records at the prestigious Just For Laughs Festival Comedy Festival in Montreal, a festival of which Katherine is a veteran. -

Transforming ITV ITV Plc Report and Accounts 2010 117

ITV plc ITV 2010 accounts and Report ITV plc The London Television Centre Upper Ground London SE1 9LT www.itv.com investors: www.itvplc.com Transforming ITV ITV plc Report and accounts 2010 117 Financial record 2010 2009 2008 2007 2006 ITV today Broadcasting & Online ITV Studios £m £m £m £m £m ITV is the largest commercial ITV content is funded by advertising and ITV Studios comprises ITV’s UK production Results Revenue 2,064 1,879 2,029 2,082 2,181 television network in the UK. sponsorship revenues as well as viewer operations, ITV’s international production competitions and voting. ITV1 is the largest companies and ITV Studios Global Earnings before interest, tax and amortisation (EBITA) before exceptional items 408 202 211 311 375 It operates a family of channels commercial channel in the UK. It attracts Entertainment. Amortisation of intangible assets (63) (59) (66) (56) (56) including ITV1, and delivers the largest audience of any UK commercial ITV Studios produces programming for Impairment of intangible assets – – (2,695) (28) (20) broadcaster and has the greatest share of content across multiple platforms ITV’s own channels and for other UK and Share of profits or (losses) of joint ventures and associated undertakings (3) (7) (15) 2 8 the UK television advertising market at via itv.com and ITV Player. international broadcasters. 45.1%. ITV’s digital channels continue to Investment income – – 1 1 3 ITV Studios produces and sells grow their audiences and most recently A wide range of programme genres are Exceptional items 19 (20) (108) (9) 4 programmes and formats in saw the launch of high definition (HD) produced, including: drama, soaps, Profit/(loss) before interest and tax 361 116 (2,672) 221 314 the UK and worldwide. -

Manhattan Office Market

Manhattan Offi ce Market 1 ST QUARTER 2016 REPORT A NEWS RECAP AND MARKET SNAPSHOT Pictured: 915 Broadway Looking Ahead Finance Department’s Tentative Assessment Roll Takes High Retail Rents into Account Consumers are not the only ones attracted by the luxury offerings along the city’s prime 5th Avenue retail corridor between 48th and 59th Streets where activity has raised retail rents. The city’s Department of Finance is getting in on the action, prompting the agency to increase tax assessments on some of the high-profi le properties. A tentative tax roll released last month for the 2016-2017 tax year brings the total market value of New York City’s real estate to over $1 trillion — reportedly for the fi rst time. The overall taxable assessed values for the city would increase 8.10%. Brooklyn’s assessed values accounted for the sharpest rise of 9.83% from FY 2015/2016, followed by Manhattan’s 8.47% increase. Although some properties along the 5th Avenue corridor had a reduction in valuations the properties were primarily offi ce, not retail according to a reported analysis of the tentative tax roll details. Building owners have the opportunity to appeal the increase; but an unexpected rise in market value — and hence real estate taxes, will negatively impact the building’s bottom line and value. Typically tenants incur the burden of most of the tax increases from the time the lease is signed, and the landlord pays the taxes that existed before the signing; but in some cases the tenant increase in capped, leaving the burden of the additional expense on the landlord. -

Revenue and Profit Growth As ITV Strategy Begins to Deliver

Revenue and profit growth as ITV strategy begins to deliver External revenues up 4% at £2,140m (2010: £2,064m) driven by non-advertising revenues Total non-NAR revenues up £93m or 11% to £922m (2010: £829m), mainly due to revenue growth from UK and international studios businesses ITV Family NAR up 1% - outperforming the TV advertising market ITV Family SOV up 1% with strong performance by digital channels up 10% EBITA before exceptional items up 13% to £462m (2010: £408m) Adjusted PBT up 24% to £398m (2010: £321m) Adjusted EPS up 23% at 7.9p (2010: 6.4p) Cost savings of £20m delivered – funding investments aligned to the Transformation Plan – with a further £20m identified for 2012 Positive net cash position of £45m (2010: net debt of £188m), with profit to cash conversion again over 100% Continued improvement in the efficiency of the balance sheet with £339m of bonds bought back in 2011 The Board has proposed a final dividend of 1.2p to give a total dividend for 2011 of 1.6p We expect ITV Family NAR to be down 2% in Q1 and April broadly flat. While we remain cautious on the outlook for advertising, we expect to outperform the market over the full year. Adam Crozier, CEO of ITV, said: “We’re now almost two years into our five-year Transformation Plan and our continued growth in revenue and profit - at a time when the advertising market is broadly flat - demonstrates that we’re performing in line with our strategic priorities. The increase in non-advertising revenues of £93m, driven by our studios and online businesses, is clear evidence of progress in rebalancing the Company and our ability to grow new revenue streams.