2020 Des Endúr Prospectus Fi

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bridge Department, Norwegian Public Road Administration

CHALLENGEING STRAIT CROSSINGS IN NORWAY Tore Ljunggren, Head of Bridge Department, Norwegian Public Road Administration Introduction The Norwegian coast consists of fjords that cut deep into the mountains, straits and islands. The population on the coast has traditionally travelled by boat, but the need for better communication has radically changed this in recent years. A large number of impressive road, tunnel and bridge projects have either recently been opened or are in the process of being planned. In spite of that, it is still not easy to travel in Norway and long distances with narrow roads and ferries in between give our industry a disadvantage compared with other European countries. Most of the population lives in the southeast of Norway and in this area the road network is fairly well Here in Scandinavia we like to think that the Vikings had some positive influence on the countries they visited, and we know that the cultures they met made some impression on them. It is a fact that some of these crossings resulted in lasting relations and permanent settlements. We can therefore boast of a long tradition in strait crossings. We are also in process of establishing a tradition in symposia on the subject, and I would like to take this opportunity to look back upon what we have achieved in Norway… I believe that it is important to exchange information between Norway and the Baltic States and I am very pleased to have the opportunity to chair my experience with you. On the picture, a typical Viking boat. 1. Ferries I would like to challenge you, bridge and tunnel engineers, with the statement that the first strait crossings of any magnitude had to be made on some floating element. -

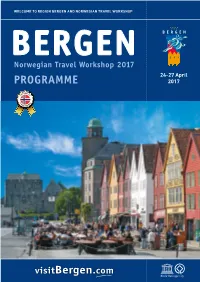

Programme 2017

WELCOME TO REGION BERGEN AND NORWEGIAN TRAVEL WORKSHOP BERGEN Norwegian Travel Workshop 2017 24-27 April PROGRAMME 2017 visitBergen.com PLAN & BOOK: visitBergen.com 3 INDEX Norwegian Travel Workshop 2017 2 WELCOME 4 Programme for Norwegian Travel Workshop 4 Saturday 22 April .................................................................................................................................................... 10:00 & 14.00 Fjord cruise Bergen – Mostraumen (3 hours) 4–5 Sunday 23 April ....................................................................................................................................................... 10:00 & 14.00 Fjord cruise Bergen – Mostraumen (3 hours) 18:00 – 23:00 Unique Seafood experience with a boat trip and dinner at Cornelius Seafood Restaurant Monday 24 April ...................................................................................................................................................... 10:00 – 16:00 Suppliers decorate stands at Grieghallen (Dovregubbens hall) 12:00 – 14:00 Bergen Panorama tour by bus 12:00 – 15:00 Bergen Coast Adventure – where the history of fi sheries comes alive 10:00 + 14:00 Fjord cruise Bergen – Mostraumen (3h) 13:30 – 16:00 Site inspection of the new hotels in Bergen city centre and by the airport 17:30 – 19:00 Seminar for suppliers at Grieghallen (Peer Gynt Salen) 6 17:45 – 19:00 Welcome Drink for buyers at KODE – Art Museums of Bergen 19:30 – 20:00 Opening Ceremony at Grieghallen 20:00 Welcome party at Grieghallen (foyer 2nd fl oor) Tuesday -

Cable-Stayed Bridge Connected to a Chained Floating Bridge – a Case Study

Cable-stayed bridge connected to a chained floating bridge – A case study Anna Tranell Civil Engineering, masters level 2017 Luleå University of Technology Department of Civil, Environmental and Natural Resources Engineering Author: Anna Tranell Title: “Cable-stayed bridge connected to a chained floating bridge – A case study” Department of Civil, Environmental and Natural resources engineering Luleå University of Technology Titel: “Snedkabelbro sammankopplad med en kedjeflytbro – en fallstudie” Instititutionen Samhällsbyggnad och Naturresurser Luleå Tekniska Universitet [email protected] [email protected] Cable-stayed bridge connected to a chained floating bridge – A case study [email protected] Preface/Abstract/Sammanfattning Preface My work with this thesis started in October 2013 and I finalized it in April 2017. Over the years I took the time to mature the ideas, resulting in a more advanced and comprehensive study than initially planned. Although the thesis has continued longer than usual, the estimated 20 weeks for a master thesis has not been extensively exceeded. I consider the subject and the analytical work of this thesis of great personal interest. With all things of great interest to individuals it’s always a balance in when to stop improving and analyzing, resulting in vast amounts of data. In this report I have tried to select the most important and scientific results of my study. Working with my thesis has had the added benefit in that I’ve learnt about the construction, design and global behavior of cable-stayed bridges. I have also learnt about creating and optimizing analytical models with finite-elements in the software SOFiSTiK. -

Shipbreaking Bulletin of Information and Analysis on Ship Demolition # 57, from July 1, to September 30, 2019

Shipbreaking Bulletin of information and analysis on ship demolition # 57, from July 1, to September 30, 2019 November 27, 2019 Shipbreaking kills Shahidul Islam Mandal, 30, Rasel Matbor, 25, Nantu Hussain, 24, Chhobidul Haque, 30, Yousuf, 45, Aminul Islam, 50, Tushar Chakma, 27, Robiul Islam, 21, Masudul Islam, 22, Saiful Islam, 23. Bangladesh, Chattogram ex Chittagong Shipbreaking is a party In front of the Crystal Gold wreck, Parki Beach, Bangladesh (p 65). Content Bloody Summer 2 Ferry/passenger ship 23 Oil tanker 50 The Royal Navy anticipes Brexit 4 Livestock carrier 25 Chemical tanker 58 The Rio Tagus slow-speed death 5 Fishing ship 25 Gas tanker 60 Enlargement of the European list 7 General cargo carrier 26 Bulker 63 Europe-Africa: the on-going traffic 8 Container ship 37 Limestone carrier 71 Cameroon: 45 ships flying a flag of 9 Car carrier 43 Aggregate carrier 71 convenience or flying a pirate flag? Reefer 44 Cement 72 Trade Winds Ship Recycling Forum 18 Seismic research vessel 46 Dredger 72 - conclusion Drilling ship 46 Ro Ro 74 The wrecked ships did not survive 20 Offshore supply vessel 47 The END: Just Noran 75 3 rd quarter overview: the crash 21 Diving support vessel 51 Sources 78 Robin des Bois - 1 - Shipbreaking # 57 – November 2019 Bloody summer The summer of 2019 marked a respite for end-of-life ships. For shipbreaking workers it was bloody. Four European countries, Cyprus, France, Greece and the Netherlands, would deserve to be sued on different levels as shipowners, flag States or port States for having sold or let ships leave to substandard yards. -

Nordhordland Biosphere Reserve Coastal Landscape of Western Norway

PILOT Pilot study about Nordhordland as a UNESCO Biosphere Reserve Nordhordland Biosphere Reserve Coastal Landscape of Western Norway Pilot study: "Nordhordland Biosphere Reserve - Coastal Landscape of Western Norway» Published by: Nordhordland IKS Knarvik, January 2015 Steering committee: Knut Moe (Leader) Modalen municipality Gudrun Mathiesen, Hordaland County Dirk Kohlmann, Office of the County Governor of Hordaland Andreas Steigen, University of Bergen Jan Nordø, Naturvernforbundet in Nordhordland Wenche Teigland, BKK Karstein Totland, Masfjorden municipality Rune Heradsveit, Nordhordland Utviklingsselskap IKS Working group: Kari Evensen Natland (project leader) Nordhordland Utviklingsselskap IKS Kjersti Isdal (adviser), Nordhordland Utviklingsselskap IKS Peter Emil Kaland (academic coordinator), University of Bergen Arne Abrahamsen (communications adviser), Nor.PR Front page illustration: In a Biosphere Reserve it is important to preserve local heritage, as part of developing a sustainable local community. Photo from Keipane Kystlag, their STREIF event in Kvalvika, Sæbø, 2012. Photo: Hans Kristian Dolmen. The project is supported by: 2 PILOT Pilot study about Nordhordland as a UNESCO Biosphere Reserve Nordhordland Biosphere Reserve Coastal Landscape of Western Norway ______________________________ ___________________________ Knut Moe Jon Askeland Chairman of the Biosphere Project Chairman, Regional Counsel Major, Modalen municipality Major, Øygarden municipality ______________________________ ___________________________ Per Lerøy -

Description and Structural Analysis of a Marine Bridge for the Digernessund Crossing

Description and Structural Analysis of a Marine Bridge for the Digernessund crossing Elise Hellvik Marine Technology Submission date: June 2018 Supervisor: Bernt Johan Leira, IMT Norwegian University of Science and Technology Department of Marine Technology NTNU Norwegian University of Science and Technology Department of Marine Technology Master Thesis, Spring 2018 for Master Student Elise Hellvik Description and Structural Analysis of a Marine Bridge for the Digernessundet crossing Beskrivelse og strukturanalyse av et marint brukonsept for kryssing av Digernessundet Marine bridges (i.e. floating bridges, submerged tunnels and more traditional bridge types with floating foundations) are relevant for crossing of very deep and wide lakes or fjord systems. In order to compute the static and dynamic response of these bridges, the joint properties of the entire hydro-elastic system need to be accounted for. The objective of the present project is to outline methods for response analysis and illustrate the calculation procedure for a particular bridge concept. The following subjects are to be addressed as part of this work: 1. Review of existing marine bridges and future plans for such bridges. Similarities and differences between the different bridge types are to be highlighted. Loads acting on such bridges are described together with associated structural models. Methods for both static and dynamic response analysis are elaborated and relevant numerical algorithms are described. 2. A global model of a particular bridge (Submerged tunnel for Digernessundet) is to be established in SESAM. Static response analyses are performed. Sensitivity studies of bending moment and axial forces with respect to current direction and profile are performed. -

Concept Study and Analysis of a Constant Buoyancy System for a Floating Single Column Platform

Concept Study and Analysis of a Constant Buoyancy System for a Floating Single Column Platform Sondre Stang Midtbust Marine Technology Submission date: June 2018 Supervisor: Bernt Johan Leira, IMT Norwegian University of Science and Technology Department of Marine Technology Preface The following document is a Master Thesis in Marine Structures at the Department of Marine Technology at the Norwegian University of Science and Technology (NTNU) in Trondheim. The thesis was written during the spring semester 2018, and the study was carried out in cooperation with the Department of Marine Technology and Professor Bernt J. Leira. The topic of this thesis is to investigate a new concept for a floating single column platform. A system which utilizes compression and expansion of a submerged air volume is proposed as a pos- sible solution for maintaining constant buoyancy. The idea behind the concept has been developed outside the University and presented to staffs at the Department of Geoscience and Petroleum, who forwarded it to the Department of Marine Technology as a suitable master thesis study. A full investigation of all aspects connected to this concept is comprehensive, complex and beyond the workload suitable for a master thesis. Aspects which should be considered ranges from struc- tural engineering and hydrodynamics to control systems and thermodynamics. This thesis aims to present preliminary results and comments which could be used as a starting point for further work suitable for PhD-studies. After finishing a specialization project studying floating bridges during the fall semester 2018, the main focus was shifted towards the new concept study in the master thesis. -

Orthotropic Design Meets Cold Weather Challenges an Overview of Orthotropic Steel Deck Bridges in Cold Regions

Orthotropic Design Meets Cold Weather Challenges An Overview of Orthotropic Steel Deck Bridges in Cold Regions By Alfred R. Mangus, P.E. Transportation Engineer, Civil California Dept. of Transportation (CALTRANS) Sacramento, California Introduction Initially developed by German engineers following World War II, orthotropic bridge design was a creative response to material shortages during the post- war period. Lightweight orthotropic steel bridge decks not only offered excellent structural characteristics, but were also In Norway economical to build (Troitsky 1987). Nordhordland Floating Bridge Moreover, they could be built in cold The Nordhordland Bridge across the climates at any time of the year. Salhus fjord is Norway’s second float- Engineers from around the world utilize ing bridge and the world’s largest float- this practical and economic system for ing bridge (Meaas, Lande, and Vindoy, all types of bridges. While concrete 1994). The bridge was opened for traf- must be at or above 5 degrees Celsius fic in 1994. The total bridge length is to properly cure, it is physically possible Figure 1. Rib designs. 1615 m and consists of a high level to encapsulate and heat the concrete 369 m long cable stayed bridge and a construction process; admittedly, this cover a matrix of rib types, superstruc- 1246 m long floating bridge (Figure 2). adds to construction costs (Mangus ture types and various bridge types. The floating bridge consists of a steel 1988), (Mangus 1991). Russia has developed a mass manu- box girder, which is supported on ten factured panelized orthotropic deck concrete pontoons and connected to Orthotropic steel deck bridges have system and has devised special abutments with transition elements in proven to be durable in cold regions. -

Nordhordland Bridge

Project name: Nordhordland Bridge Project period: 1991-1994 Owner: Statens Vegvesen Region Vest Client: Statens Vegvesen Region Vest In brief: The Nordhordland Bridge is a unique bridge concept, which combines a floating bridge on pontoons with a cable-stayed fixed bridge spanning the sailing channel Unique combination of floating bridge and cable- Project size: Building cost ca.700 MNOK. stayed bridge The Nordhordland Bridge crosses the Salhusfjord at a point where it is around 1300 metres wide and 500 metres deep. The only types of structure that could bridge this span would be a suspension bridge or floating bridge. A floating bridge was chosen as the solution, allowing us to combine our bridge and offshore expertise to achieve a unique solution in a global context. Aas-Jakobsen acted as the lead consultant for both the floating bridge and cable-stayed bridge elements. We worked in partnership with Veritec for the floating bridge deck. As well as delivering the preliminary project, which included the concept design, tender documents and detailed design, Aas- Jakobsen was also very much involved with supervision during the construction period. The Nordhordland Bridge is made up of an end-anchored floating bridge with a total length of 1246 metres, and a cable-stayed bridge with a main span of 172 metres and one pylon. The floating bridge has 12 spans, each with a length of 113 metres, and floats on 10 pontoons made from high-strength lightweight concrete. It is anchored directly to the shore at one end, and at the other end is anchored with the aid of a caisson submerged and set into rock at a depth of around 30 metres. -

Experiences with Thermal Spray Zinc Duplex Coatings on Road Bridges

coatings Article Experiences with Thermal Spray Zinc Duplex Coatings on Road Bridges Ole Øystein Knudsen 1,* , Håkon Matre 2, Cato Dørum 2 and Martin Gagné 3 1 SINTEF, P.O. Box 4760 Torgarden, NO-7465 Trondheim, Norway 2 Norwegian Public Roads Administration, 5008 Bergen, Norway; [email protected] (H.M.); [email protected] (C.D.) 3 Zelixir Inc., Toronto, ON M5A4R4, Canada; [email protected] * Correspondence: [email protected]; Tel.: +47-9823-0420 Received: 12 May 2019; Accepted: 4 June 2019; Published: 8 June 2019 Abstract: Road bridges are typically designed with a 100-year lifetime, so protective coatings with very long durability are desired. Thermal spray zinc (TSZ) duplex coatings have proven to be very durable. The Norwegian Public Roads Administration (NPRA) has specified TSZ duplex coatings for protection of steel bridges since 1965. In this study, the performance of TSZ duplex coatings on 61 steel bridges has been analyzed. Based on corrosivity measurements on five bridges, a corrosivity category was estimated for each bridge in the study. Coating performance was evaluated from pictures taken by the NPRA during routine inspections of the bridges. The results show that very long lifetimes can be achieved with TSZ duplex coatings. There are examples of 50-year old bridges with duplex coatings in good condition. Even in very corrosive environments, more than 40-year old coatings are still in good condition. While there are a few bridges in this study where the coating failed after only about 20 years, the typical coating failures are due to application errors, low paint film thickness and saponification of the paint. -

Thomas Hansen Viuff Uncertainty Assessment of Wave- and Current-Induced Global Response of Floating Bridges a Numerical Investig

Doctoral theses at NTNU, 2020:126 Thomas Hansen Viuff Thomas Hansen Viuff Uncertainty assessment of wave- and current-induced global response of floating bridges A numerical investigation ISBN 978-82-326-4600-5 (printed version) ISBN 978-82-326-4601-2 (electronic version) ISSN 1503-8181 Doctoral theses at NTNU, 2020:126 NTNU Faculty of Engineering Norwegian University of Science and Technology Department of MarineTechnology Thomas Hansen Viuff Uncertainty assessment of wave- and current-induced global response of floating bridges A numerical investigation Thesis for the degree of Philosophiae Doctor Trondheim, May 2020 Norwegian University of Science and Technology Faculty of Engineering Department of MarineTechnology NTNU Norwegian University of Science and Technology Thesis for the degree of Philosophiae Doctor Faculty of Engineering Department of MarineTechnology © Thomas Hansen Viuff ISBN 978-82-326-4600-5 (printed version) ISBN 978-82-326-4601-2 (electronic version) ISSN 1503-8181 Doctoral theses at NTNU, 2020:126 Printed by Skipnes Kommunikasjon as Abstract Floating pontoon bridge concepts have proven to be useful for crossing very deep and wide waters where conventional bridge types are not feasible, and different concepts have been built in several locations around the world within the last 70 years. Norway and the United States in particular have contributed to the capabilities of the technology and some of the most impressive floating pontoon bridge structures are currently located in those two countries, i.e. the Hood Canal Bridge in the United States and the Bergsøysund- and Nordhordland Bridges in Norway. Today the Norwegian Public Roads Administration (NPRA) has proposed to establish several fixed links across the many wide and deep fjords in the western part of Norway and floating pontoon bridge concepts are among the proposed solutions. -

Initial Design and Analysis of a Floating Bridge Concept

Initial Design and Analysis of a Floating Bridge Concept Simon Gundegjerde Marine Technology Submission date: June 2017 Supervisor: Bernt Johan Leira, IMT Co-supervisor: Rune Risnes, Risnes Innovation AS Norwegian University of Science and Technology Department of Marine Technology NTNU Norwegian University of Science and Technology Department of Marine Technology Master Thesis, Spring 2017 for Master Student Simon Gundegjerde Initial Design and Analysis of a Floating Bridge Concept Innledende Design og Analyse av et Flytebrokonsept The estimated cost for Coastal Highway Route E39 has increased significantly over the last three years. Some of the cost drivers are linked to the high complexity of the bridge concepts. Rune Risnes in Risnes Innovation AS has come up with an alternative concept called X-bridge. This concept is designed to reduce the cost by utilizing well-known Norwegian marine and technology solutions. The X-bridge concept is designed to reduce cost especially within the fields of heavy lift operations and subsea operations as well as by removing large bridge towers. The following subjects are to be addressed as part of this work: 1. Describe the background for the Coastal Highway Route E39 and give a brief introduction to the concept of floating bridges. Some examples of existing floating bridges are to be included. 2. The relevant theoretical basis is to be outlined and some of the key algorithims utlized by the relevant computer software are to be described. 3. Explain the concept behind the X-bridge. Emphasis should be on the difference relative to ordinary floating bridges. 4. Come up with a suggested design based on the given input given by the designer Rune Risnes.