Electrical Products Group Conference Scott Donnelly Chairman & CEO May 17Th, 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bell Helicopter Confidential and Proprietary 1 FORWARD-LOOKING INFORMATION

STATE OF THE BUSINESS MITCH SNYDER President and CEO Bell Helicopter Confidential and Proprietary 1 FORWARD-LOOKING INFORMATION Certain statements in today’s discussion will be forward-looking statements, including those that discuss strategies, goals, outlook or other non-historical matters; or project revenues, income, returns or other financial measures. These forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those contained in the statements, including the risks and uncertainties set forth under our full disclosure located at the end of this presentation and included in our SEC filings. Bell Helicopter Confidential and Proprietary 2 2 TEXTRON: LEADING BRANDED BUSINESSES Bell Helicopter Textron Systems Textron Aviation Industrial Finance 26% 26% 11% 36% 1% Bell Helicopter Weapon and Sensor Cessna Aircraft Specialized Vehicles Textron Financial Systems Beechcraft Tools and Test Unmanned Systems Hawker Jacobsen Marine and Land Kautex Systems TRU Simulations + Training 2015 Revenue $13.4 Billion Bell Helicopter Confidential and Proprietary 3 3 STRATEGIC PRIORITIES Grow our balanced business Differentiate our products and services Become more responsive and cost competitive - globally Exhibit execution excellence Bell Helicopter Confidential and Proprietary 4 4 EXECUTIVE LEADERSHIP TEAM LISA ATHERTON MATTHEW -

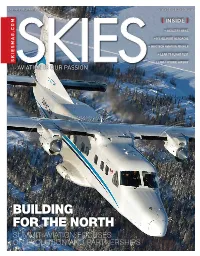

Building for the North Summit Aviation Focuses on Evolution and Partnerships WHEN DEPENDABLE MEANS EVERYTHING

AN mHm PUbLISHING mAGAZINe November/December 2016 [ INSIDE ] • INDUSTRY NEWS • H1 HELIPORT HEADACHE • INNOTECH AVIATION PROFILE • LEAR 75 FLIGHT TEST skiesmag.com • LHM-1 HYBRID AIRSHIP AvIAtIoN IS oUr PassioN BUILDING FOR THE NORTH SUMMIT AVIATION FOCUSES ON EVOLUTION AND PARTNERSHIPS WHEN DEPENDABLE MEANS EVERYTHING Each mission is unique, but all P&WC turboshaft engines have one thing in common: You can depend on them. Designed for outstanding performance, enhanced fl ying experience and competitive operating economics, the PW200 and PT6 engine families are the leaders in helicopter power. With innovative technology that respects the environment and a trusted support network that offers you peace of mind, you can focus on what matters most: A MISSION ACCOMPLISHED WWW.PWC.CA POWERFUL. EFFICIENT. VERSATILE. SOUND LIKE ANYBODY YOU KNOW? You demand continuous improvement in your business, so why not expect it from your business aircraft? Through intelligent design the new PC-12 NG climbs faster, cruises faster, and is even more quiet, comfortable and efficient than its predecessor. If your current aircraft isn’t giving you this kind of value, maybe it’s time for a Pilatus. Stan Kuliavas, Vice President of Sales | [email protected] | 1 844.538.2376 | www.levaero.com November/December 2016 1 Levaero-Full-CSV6I6.indd 1 2016-09-29 1:12 PM November/December 2016 Volume 6, Issue 6 in this issue in the JUmpseat. 06 view from the hill ......08 focal Points ........... 10 Briefing room .......... 12 plane spotting .........30 APS: Upset Training -

Police Aviation News SPECIAL EDITION

Police Aviation News SPECIAL EDITION ©Police Aviation Research SPECIAL EDITION JULY 2012 PAR Police Aviation News July 2012 2 PAN—Police Aviation News is published monthly by POLICE AVIATION RESEARCH, 7 Wind- mill Close, Honey Lane, Waltham Abbey, Essex EN9 3BQ UK. Contacts: Main: +44 1992 714162 Cell: +44 7778 296650 Skype: BrynElliott E-mail: [email protected] SHOWS JULY 2012 FARNBOROUGH AIR SHOW Farnborough, Hampshire, UK 9-10 July 2012 Farnborough, one of the major shows in the aerospace calendar and yet in the main one not too kind to the Airborne Emergency Service sector of business. The large size and im- personal nature of Farnborough and its ilk are the main spur for the niche air events – not always shows – including PAvCon, NBAA and Heli-Expo. Visitors are drawn to see displays covering nearly 3,500 square meters from hundreds of international companies housed under cover in a number of vast halls and chalets con- structed at great expense – others being left to the vagaries of the weather without cover or in their own tents and caravans. And this year the vagaries were decidedly nasty as Britain endured the worst summer in living memory. The poor weather clearly affected visitor num- bers early in the week. As the browned grass testifies, Farnborough 2010 was a far drier affair than this year. © Aviation-images.com via FI2012 Front Cover Image: The Bell 525 Relentless has ‘Oil Industry’ written all over it and it may never feature as an emergency services aircraft. That said it has features that could one day appear more widely—including the pilots seats. -

HAI PUBLICATIONS Convention News

DAY 3 January 30, 2020 HAI PUBLICATIONS Convention News « The crowds at Heli-Expo 2020 made a beeline for the exhibit hall where visitors could spend the day learning about the latest technology in the fascinating helicopter industry. This Sikosrky Firehawk and its crew were center stage for aficianados of seriously functional heavy-metal machinery. MARIANO ROSALES Firefighting Step-by-step to urban air mobility Erickson adopting Matrix tech › page 2 by Nicolas Zart People The Urban Air Mobility (UAM) concept Aircraft Systems Integration Office. Speak- ecosystem for the new aircraft to operate in needs to reach beyond the goal of serving ing at Helicopter Association Internation- and to win public acceptance for UAM. Meet MD’s maverick urban areas, with new electric vertical take- al’s (HAI) UAM Forum in Anaheim, Merkle Accordingly, the FAA official told forum leader › page 4 off and landing (eVTOL) aircraft—whether said the development of regulation and attendees that eVTOL operations will manned or unmanned—ready to serve wher- unmanned traffic management (UTM) will likely start with smaller aircraft flying short ever they are needed, according to Jay Merkle, have to happen through incremental steps hops before more complex operations with Helicopters executive director of FAA’s Unmanned as part of a wider effort to build a complete larger aircraft are possible. On December Guimbal’s G2 gets new 31, Merkle’s team issued a notice of pro - posed rulemaking for new requirements for avionics › page 6 remote identification of unmanned aircraft. This is widely viewed as an important step Tiltrotors Noise a critical issue for in establishing a regulatory framework that could support autonomous eVTOL opera- What is it like to fly the tions and the industry has until March 2 AW609 sim? › page 20 public acceptance of eVTOLs to respond. -

Bell Helicopter – Delivering Value to the Market

HELICOPTER INVESTOR Glenn Isbell, SVP of Customer Support and Services, Bell Helicopter Textron Inc. Bell Helicopter – Delivering Value to the Market HELICOPTER INVESTOR Expanding Globally to Meet Customer Needs • Footprint expansion • New Sales offices in Prague, Singapore, Shanghai, Tokyo and Mexico City • New Training offerings in Valencia and Singapore with more planned in 2016/17 • Over 100 Global Customer Service Facilities HELICOPTER INVESTOR Investing In Products and Services • Three new products and three upgraded products. • Bell 525 Relentless • Bell 407GXP • Bell 505 Jet Ranger X • Bell 412EPI • Bell V-280 Valor • Bell 429WLG • Expanding our global support and services. • Investing to maintain #1 global support • ProPilot Magazine - 21 years in a row as #1 • AIN Publications – 9 years in a row as #1 • Vertical Magazine – Ranked #1 • Growing our global training. HELICOPTER INVESTOR Changing the Game: Bell 525 Relentless • The first Commercial Fly-By-Wire helicopter: • Will change the industry like the A320 & Boeing 777 did for the airline market. • First flight completed July 1st • Best in class range, payload, cabin and operating costs. • More than 65 LOIs to date. HELICOPTER INVESTOR Reenergizing the Market: Bell 505 Jet Ranger X • First fully integrated glass cockpit in the 5-seat class. • Modern design and cockpit will drive high residual values. • Replacement opportunity for over 2,700 Bell aircraft. • Additional opportunities for over 3,500 competitor replacements • Over 350 LOIs signed to date. • Price tag around $1M (2014 USD). HELICOPTER INVESTOR Outpacing the Competition Bell 407GXP Bell 429 Bell 412EPI • Modern, integrated glass avionics • Modern, integrated glass avionics with • Modern, integrated glass avionics with featuring Garmin synthetic vision. -

2019 Annual Report

2019 ANNUAL REPORT ANNUAL REPORT 2 019 ANNUAL REPORT Textron’s Diverse Product Portfolio Textron is known around the world for its powerful brands of aircraft, defense and industrial products that provide customers with groundbreaking technologies, innovative solutions and first-class service. TEXTRON AVIATION BELL INDUSTRIAL TEXTRON SYSTEMS Citation Longitude® Bell V-280 Valor Tracker Off Road 800SX Ship-to-Shore Connector (SSC) Aerosonde® Small Unmanned Citation Latitude® Bell-Boeing MV-22 Osprey Arctic Cat RIOT 8000 Aircraft System Beechcraft AT-6 Wolverine Bell 360 Invictus E-Z-GO® RXV® ELiTETM RIPSAW® M5 LycomingTM iE2 Integrated Beechcraft® King Air® 350i Bell 525 Relentless Jacobsen TR330 Electronic Engine TRU Simulaton + Training Cessna SkyCourierTM Bell 429 Global Ranger Kautex Fuel Tank Full Flight Simulator Common Unmanned Surface DenaliTM Bell 505 Jet Ranger X Textron GSE TUGTM ALPHA 4 Vehicle (CUSV®) Textron’s Global Network of Businesses TEXTRON AVIATION Textron Aviation is home to the Beechcraft®, Cessna® and Hawker® aircraft brands and continues to be a leader in general aviation through two principal lines of business: aircraft and aftermarket. Aircraft includes sales of business jet, turboprop and piston aircraft, as well as special mission and military aircraft. Aftermarket includes commercial parts sales, maintenance, inspection and repair services. BELL Bell is a leading supplier of helicopters and related spare parts and services. Bell is the pioneer of the revolutionary tiltrotor aircraft. Globally recognized for world-class customer service, innovation and superior quality, Bell’s global workforce serves customers flying Bell aircraft in more than 130 countries. INDUSTRIAL Our Industrial segment offers two main product lines: fuel systems and functional components produced by Kautex; and specialized vehicles such as golf cars, recreational and utility vehicles, aviation ground support equipment and professional mowers, manufactured by Textron Specialized Vehicles businesses. -

Download the Printable 96-Page 2020 Annual Report

2020 ANNUAL REPORT TEXTRON’S DIVERSE PRODUCT PORTFOLIO Textron is known around the world for its powerful brands of aircraft, defense and industrial products that provide customers with groundbreaking technologies, innovative solutions and first-class service. TEXTRON AVIATION BELL INDUSTRIAL TEXTRON SYSTEMS Citation Longitude® Bell V-280 Valor Tracker Off Road 800SX Ship-to-Shore Connector (SSC) Aerosonde® Small Unmanned Citation Latitude® Bell Boeing MV-22 Osprey Blast-M Arctic Cat Aircraft System Beechcraft® AT-6 Wolverine® Bell 360 Invictus E-Z-GO® RXV® ELiTETM RIPSAW® M5 LycomingTM iE2 Integrated Beechcraft® King Air® 360 Bell 525 Relentless Jacobsen Eclipse 360 Elite Electronic Engine Cessna SkyCourier® Bell 429 Global Ranger Kautex Fuel Tank ATAC’s Mirage F1B Fighter Jet Common Unmanned Surface Beechcraft® King Air® 260 Bell 505 Jet Ranger X Textron GSE TUGTM ALPHA 1 Vehicle (CUSV®) TEXTRON’S GLOBAL NETWORK OF BUSINESSES TEXTRON TEXTRON AVIATION BELL INDUSTRIAL SYSTEMS FINANCE Textron Aviation is home Bell is a leading supplier Our Industrial segment Textron Systems’ Our Finance segment, to the Beechcraft®, of helicopters and offers two main product businesses provide operated by Textron Cessna® and Hawker® related spare parts lines: fuel systems and innovative solutions to Financial Corporation aircraft brands and and services. Bell functional components the defense, aerospace (TFC), is a commercial continues to be a leader is the pioneer of the produced by Kautex; and general aviation finance business that in general aviation revolutionary tiltrotor and specialized vehicles markets. Product lines provides financing through two principal aircraft. Globally such as golf cars, include unmanned solutions for purchasers lines of business: recognized for world- recreational and utility systems, advanced of Textron products, aircraft and aftermarket. -

Police Aviation News August 2016

Police Aviation News August 2016 ©Police Aviation Research Number 244 August 2016 PAR Police Aviation News August 2016 2 PAN—Police Aviation News is published monthly by POLICE AVIATION RESEARCH, 7 Wind- mill Close, Honey Lane, Waltham Abbey, Essex EN9 3BQ UK. Contacts: Main: +44 1992 714162 Cell: +44 7778 296650 Skype: BrynElliott E-mail: [email protected] Police Aviation Research Airborne Law Enforcement Member since 1994—Corporate Member since 2014 SPONSORS Airborne Technologies www.airbornetechnologies.at Avalex www.avalex.com Broadcast Microwave www.bms-inc.com Enterprise Control Systems www.enterprisecontrol.co.uk L3 Wescam www.wescam.com Powervamp www.powervamp.com Trakka Searchlights www.trakkacorp.com Airborne Law Enforcement Association www.alea.org LAW ENFORCEMENT FINLAND BORDER GUARD: Wescam has received an order from the Finnish Border Guard to provide MX™-15 electro-optical and infrared (EO/IR) imaging systems for installation on a number of Airbus H215 twin-engine helicopters. The newly equipped H215s will support a variety of missions across Finland, including maritime border patrol and search and rescue (SAR). HUNGARY RENDORSEG: It is said that Hungarian Police air sup- port have bought a batch of five MD902 Explorer’s from a German police force. The five have been acquired from the Baden-Wurttemberg Police, who are taking delivery of six H145 helicopters from Airbus, and are the first law enforce- ment operator of the type. The five Explorers – the first of which was delivered last month, were originally purchased from 2003 – four new aircraft and one pre-owned from a German operator. It is this latter one – serial 900-0052 – which has been deliv- ered so far and will carry the Hungarian Police registration © FILE of R-900. -

Bell Unveils Air-Taxi Concept

PUBLICATIONS Vol.50 | No.2 $9.00 FEBRUARY 2019 | ainonline.com The Bell Nexus will initially feature human operation and a hybrid- electric propulsion system powering six ducted fans. Airshows New models on deck for Heli-Expo page 43 Safety U.S. bizjet accidents rise in 2018 page 14 Maintenance Industry looks to build tech pipeline page 51 Industry One Aviation works on bankruptcy page 27 Bell unveils air-taxi concept ATC First digital tower opens by Rob Finfrock in the UK page 12 Highlighting the increasing awareness and challenges in the vertical dimension,” said landing skids, and a modified V tail topped by appeal of vertical takeoff and landing (VTOL) Bell president and CEO Mitch Snyder. “We a short horizontal stabilizer. The flight model solutions outside the traditional domains of believe the design, taken with our strategic will use a hybrid/electric distributed propul- the rotorcraft industry, Bell returned to the approach to build this infrastructure, will sion system feeding six tilting ducted fans, annual Consumer Electronics Show (CES) in lead to the successful deployment of the each powered by individual electric motors. Las Vegas last month with its “full vision” of a Bell Nexus to the world.” The six-fan design is a compromise practical urban air taxi, dubbed the Bell Nexus. The full-scale Nexus display builds upon between quad- and octo-rotor configurations “As space at the ground level becomes the fuselage mockup unveiled at last year’s seen on other urban VTOL designs to provide limited, we must solve transportation CES and features a central wing, integrated continues on page 16 Read Our SPECIAL REPORT Shutdown weighs on bizav Amazing apps by Kerry Lynch It has been less than a decade since the introduction of Apple’s iPad, but the The failure of the White House and Con- withheld, and deliveries delayed, industry device—and those that followed—has gress to reach agreement on border wall groups reported as the shutdown became been embraced by operators, who are funding in late December touched off a the longest in history. -

2016 Annual Report

2016 ANNUAL REPORT 2016 ANNUAL REPORT Textron’s Diverse Product Portfolio Textron is known around the world for its powerful brands of aircraft, defense and industrial products that provide customers with groundbreaking technologies, innovative solutions and first-class service. TEXTRON AVIATION BELL HELICOPTER INDUSTRIAL TEXTRON SYSTEMS Citation Longitude® Bell Boeing V-22 Osprey Jacobsen AR522 Ship to Shore Connector (SSC) Citation Latitude® Bell AH-1Z Greenlee® GorillaTM Press TRU Level D Full Flight Simulator Textron AirLand ScorpionTM Bell 525 RelentlessTM T-1608 Bullwheel Tensioner Lycoming Race Engines Beechcraft® King Air® 350i Bell 505 Jet Ranger XTM E-Z-GO Freedom® TXT® Shadow® M2 Beechcraft T-6 Military Trainer Bell 429WLG Textron Off Road Stampede FuryTM Precision Guided Weapon Cessna® Grand Caravan® EX Bell 407GXP Premier Deicer COMMANDOTM Elite Textron’s Global Network of Businesses TEXTRON AVIATION BELL HELICOPTER INDUSTRIAL TEXTRON SYSTEMS FINANCE Textron Aviation is home Bell Helicopter is one Our Industrial segment Textron Systems’ Our Finance segment, to the Beechcraft®, of the leading suppliers offers three main businesses provide operated by Textron Cessna® and Hawker® of helicopters and product lines: fuel innovative solutions to Financial Corporation aircraft brands, and related spare parts and systems and functional the defense, aerospace (TFC), is a commercial continues to lead services in the world. components produced and general aviation finance business that general aviation through Bell is the pioneer by Kautex; specialized markets. Product lines provides financing two principal lines of the revolutionary vehicles and equipment include unmanned solutions for purchasers of business: aircraft tiltrotor aircraft and manufactured by systems, armored of Textron products, sales and aftermarket. -

Heli-Expo Preview Paganini Q&A Elbit's Vision Bell 525 Update

February 2013 Serving the Worldwide Helicopter Industry rotorandwing.com Heli-Expo Preview Paganini Q&A Elbit’s Vision Bell 525 Update AdvancesAW189 Vq"ugtxg"cpf"rtqvgev Ewv"etkog"cpf"rtqvgev"vjg"rwdnke"ykvj"vjg"oquv"cfxcpegf"rncvhqtou" cxckncdng0" CiwuvcYguvncpfÔu"rtqfwev"tcpig"gpcdngu"{qw"vq"oggv"vjg"uvtkpigpv" tgswktgogpvu"qh"vygpv{/Þtuv"egpvwt{""rqnkekpi0" Tqvqtetchv"Þvvgf"ykvj"oqfgtp."ewvvkpi/gfig"gswkrogpv"cpf"àgzkdng" kpvgtkqtu."hceknkvcvg"tcrkf"cpf"tgurqpukxg"tqng"ejcpigu"vq"oggv"Hqteg" pggfu0 NGCFKPI"VJG"HWVWTG ciwuvcyguvncpf0eqo Tqvqt(Ykpi"OFUR"NG"""3 43134134"""37<56 EDITORIAL Andrew Parker Editor-in-Chief, [email protected] Ernie Stephens Editor-at-Large, [email protected] Andrew Drwiega Military Editor, [email protected] Claudio Agostini Latin America Bureau Chief Contributing Writers: Chris Baur; Lee Benson; Shannon Bower; Igor Bozinovski; Keith Brown; Tony Capozzi; Keith Cianfrani; Steve Colby; Frank Colucci; Dan Deutermann; Ian Frain; Pat Gray; Emma Kelly; Frank Lombardi; Elena Malova; Vicki McConnell; Robert Moorman; Douglas Nelms; Mark Robins; Dale Smith; Terry Terrell; Todd Vorenkamp; Richard Whittle. ADVERTISING/BUSINESS Jennifer Schwartz Senior Vice President and Group Publisher, [email protected] Randy Jones Publisher, 1-972-713-9612, [email protected] Eastern United States & Canada Carol Mata, 1-512-607-6361, [email protected] International Sales, Europe/Pac Rim/Asia James McAuley +34 952 118 018, [email protected] DESIGN/PRODUCTION Gretchen Saval Graphic Designer Tony Campana Production Manager, 1-301-354-1689 [email protected] David Hurwitz Web/E-letter Production Manager, 1-301-354-1459 [email protected] AUDIENCE DEVELOPMENT George Severine Fulfillment Manager, [email protected] Customer Service/Back Issues 1-847-559-7314 [email protected] LIST SALES Statlistics Jen Felling ,1-203-778-8700, [email protected] REPRINTS Wright’s Media, 1-877-652-5295 [email protected] ACCESS INTELLIGENCE, LLC Donald A. -

The Civil Market Continues to Slow, but Oems Look to the Future

and a ceiling of 11,000 feet. Power will operations training or limited amphibious come from a Fadec Turbomeca Arrius use. The base price for the Robinson R66 2R (rated at 450 to 550 shp), and Turbine Marine is $875,000. Garmin will provide the G1000H glass- NEW Scott’s-Bell 47, Model 47GT-6 panel avionics. The 505 also features a fully flat-floor cabin and rear clamshell Scott’s acquired the Model 47 type cer- loading doors for cargo or medevac. Bell tificate from Bell in 2009 and announced is adapting proven drivetrain elements its intention to put the iconic ship back from the 206L4 LongRanger to contain into new production with a Rolls-Royce costs. The 505 will be certified initially RR300 engine in 2013. It took delivery of ROTORCRSPECIALA REPORTFT Enstrom 480B-G by Transport Canada, and production its first test engine last year and expects to models will then be built at a new Bell make deliveries of the new, $820,000 Model facility in Lafayette, La. 47-GT6 next year at an eventual produc- A price has not yet been set, but Bell tion rate of two per month. The GT6 will be CEO John Garrison told AIN last year based on the 47G-3B-2A widebody design that hitting near a $1 million price was (3,200-pound max gross weight with exter- viewed as critical to the 505’s market suc- nal load, 1,400-pound internal useful load, cess and achieving that number hinged and external load 1,650 pounds). It features on Bell’s success in applying cost pres- a host of modern upgrades beyond the sure on its suppliers.