The Magnificent Seven

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BLOCK by BLOCK a Comparative Analysis of the Leading Distributed Ledgers

BLOCK BY BLOCK A Comparative Analysis of the Leading Distributed Ledgers Table of Contents EXECUTIVE SUMMARY 3 PRELIMINARY MATTERS 4 A NOTE ON METHODOLOGY 4 THE EVOLUTION OF DISTRIBUTED LEDGERS 5 SEC. 1 : TECHNICAL STRUCTURE & FEATURE SET 7 PUBLIC OR PRIVATE? 7 PERMISSIONED OR PERMISSIONLESS? 8 CONSENSUS MECHANISM 9 LANGUAGES SUPPORTED 10 TRANSACTION RATES 11 SMART CONTRACTS 12 ADDITIONAL FEATURES 13 SEC. 2 : BUSINESS CONSIDERATIONS 14 PROJECT GOVERNANCE 14 LICENSING 16 THIRD PARTY SUPPORT 16 DEVELOPER SUPPORT 17 PUBLISHER SUPPORT 18 BLOCKCHAIN AS A SERVICE (BAAS) PROVIDERS 19 PARTNERSHIPS 21 ASSOCIATED COSTS 22 PRICING 22 COST PER TRANSACTION 23 ENERGY CONSUMPTION 24 SEC. 3 : HEALTH INDICATORS 25 DEVELOPMENT ACTIVITY 25 MINDSHARE 27 PROJECT SITE POPULARITY 28 SEARCH ENGINE QUERY VOLUME 29 FINANCIAL STRENGTH INDICATORS 30 MARKET CAP 30 24 HOUR TRADING VOLUME 31 VENTURE CAPITAL AND INVESTORS 32 NODES ONLINE 33 WEISS CRYPTOCURRENCY RANKINGS 34 SIGNIFICANT DEPLOYMENTS 35 CONCLUSIONS 36 PUBLIC LEDGERS 37 PRIVATE LEDGERS 37 PROJECTS TO WATCH 40 APPENDIX A. PROJECT LINKS 42 MERCY CORPS 2 EXECUTIVE SUMMARY Purpose This report compares nine distributed ledger platforms on nearly 30 metrics What’s Included related to the capabilities and the health of each project. The analysis looks at a broad range of indicators -- both direct and indirect -- with the goal of Bitcoin synthesizing trends and patterns that define the market leaders. Corda Ethereum Audience Hyperledger Fabric Multichain This paper is intended for readers already familiar with distributed ledger NEO technologies and will prove most useful to those that are currently evaluating NXT platforms in order to make a decision where to build or deploy applications. -

Blockchain & Cryptocurrency Regulation

Blockchain & Cryptocurrency Regulation Third Edition Contributing Editor: Josias N. Dewey Global Legal Insights Blockchain & Cryptocurrency Regulation 2021, Third Edition Contributing Editor: Josias N. Dewey Published by Global Legal Group GLOBAL LEGAL INSIGHTS – BLOCKCHAIN & CRYPTOCURRENCY REGULATION 2021, THIRD EDITION Contributing Editor Josias N. Dewey, Holland & Knight LLP Head of Production Suzie Levy Senior Editor Sam Friend Sub Editor Megan Hylton Consulting Group Publisher Rory Smith Chief Media Officer Fraser Allan We are extremely grateful for all contributions to this edition. Special thanks are reserved for Josias N. Dewey of Holland & Knight LLP for all of his assistance. Published by Global Legal Group Ltd. 59 Tanner Street, London SE1 3PL, United Kingdom Tel: +44 207 367 0720 / URL: www.glgroup.co.uk Copyright © 2020 Global Legal Group Ltd. All rights reserved No photocopying ISBN 978-1-83918-077-4 ISSN 2631-2999 This publication is for general information purposes only. It does not purport to provide comprehensive full legal or other advice. Global Legal Group Ltd. and the contributors accept no responsibility for losses that may arise from reliance upon information contained in this publication. This publication is intended to give an indication of legal issues upon which you may need advice. Full legal advice should be taken from a qualified professional when dealing with specific situations. The information contained herein is accurate as of the date of publication. Printed and bound by TJ International, Trecerus Industrial Estate, Padstow, Cornwall, PL28 8RW October 2020 PREFACE nother year has passed and virtual currency and other blockchain-based digital assets continue to attract the attention of policymakers across the globe. -

Press Release: the Battle of Protocols

Press Release: The Battle of Protocols Omenics cryptocurrency data analytics startup have teamed up with Bitassist, a Cryptoasset research firm, to release a comprehensive report on the performance of popular blockchain protocols Ethereum, Tron, EOS and Tezos. A full version of the Battle of the Protocols PDF Report can be downloaded here: https://omenics.com/blog/the-battle-of-protocols-a-competitive-analysis-on-ethereum-eos-tron-and-tezos And an online PDF is available here: https://view.publitas.com/bitassist/the-battle-of-the-blockchain-protocols/ Summary 1. A brief overview of the report 2. An analysis of the key findings In this report, Bitassist and Omenics collate and contrast key metrics for leading protocols to provide meaningful insights into the current state of competition. The metrics used in this report include the number of transactions per Second (TPS), the decentralization of governance, the number and distribution of nodes, various measures of on-chain activity or economic output and the community sentiment around the platform. As leading protocols compete for the top spot, developers, DApp users and investors eagerly observe the state of competition. This report leverages key blockchain metrics to highlight the respective strengths and weaknesses among Ethereum, EOS, Tron and Tezos. Omenics: Pierre-Alexandre Picard+33643035796, COO [email protected] Bitassist: James Bennett, CEO [email protected]. Key Takeaways from the Report Below are some of the key insights offered by the report indicating the overall performance of blockchain protocols. ● Transactions Per Second (TPS): This is one of the most important performance metrics to gauge the relative strength of the blockchain protocol. -

Exploring the Interconnectedness of Cryptocurrencies Using Correlation Networks

Exploring the Interconnectedness of Cryptocurrencies using Correlation Networks Andrew Burnie UCL Computer Science Doctoral Student at The Alan Turing Institute [email protected] Conference Paper presented at The Cryptocurrency Research Conference 2018, 24 May 2018, Anglia Ruskin University Lord Ashcroft International Business School Centre for Financial Research, Cambridge, UK. Abstract Correlation networks were used to detect characteristics which, although fixed over time, have an important influence on the evolution of prices over time. Potentially important features were identified using the websites and whitepapers of cryptocurrencies with the largest userbases. These were assessed using two datasets to enhance robustness: one with fourteen cryptocurrencies beginning from 9 November 2017, and a subset with nine cryptocurrencies starting 9 September 2016, both ending 6 March 2018. Separately analysing the subset of cryptocurrencies raised the number of data points from 115 to 537, and improved robustness to changes in relationships over time. Excluding USD Tether, the results showed a positive association between different cryptocurrencies that was statistically significant. Robust, strong positive associations were observed for six cryptocurrencies where one was a fork of the other; Bitcoin / Bitcoin Cash was an exception. There was evidence for the existence of a group of cryptocurrencies particularly associated with Cardano, and a separate group correlated with Ethereum. The data was not consistent with a token’s functionality or creation mechanism being the dominant determinants of the evolution of prices over time but did suggest that factors other than speculation contributed to the price. Keywords: Correlation Networks; Interconnectedness; Contagion; Speculation 1 1. Introduction The year 2017 saw the start of a rapid diversification in cryptocurrencies. -

Makoto Yano Chris Dai Kenichi Masuda Yoshio Kishimoto Editors

Economics, Law, and Institutions in Asia Pacific Makoto Yano Chris Dai Kenichi Masuda Yoshio Kishimoto Editors Blockchain and Crypto Currency Building a High Quality Marketplace for Crypto Data Economics, Law, and Institutions in Asia Pacific Series Editor Makoto Yano, Research Institute of Economy, Trade and Industry (RIETI), Tokyo, Japan The Asia Pacific region is expected to steadily enhance its economic and political presence in the world during the twenty-first century. At the same time, many serious economic and political issues remain unresolved in the region. To further academic enquiry and enhance readers’ understanding about this vibrant region, the present series, Economics, Law, and Institutions in Asia Pacific, aims to present cutting-edge research on the Asia Pacific region and its relationship with the rest of the world. For countries in this region to achieve robust economic growth, it is of foremost importance that they improve the quality of their markets, as history shows that healthy economic growth cannot be achieved without high-quality markets. High-quality markets can be established and maintained only under a well-designed set of rules and laws, without which competition will not flourish. Based on these principles, this series places a special focus on economic, business, legal, and institutional issues geared towards the healthy development of Asia Pacific markets. The series considers book proposals for scientific research, either theoretical or empirical, that is related to the theme of improving market quality and has policy implications for the Asia Pacific region. The types of books that will be considered for publication include research monographs as well as relevant proceedings. -

A Conceptual Framework for Digital-Asset Securities: Tokens and Coins As Debt and Equity

Maryland Law Review Volume 80 Issue 1 Article 7 A Conceptual Framework for Digital-Asset Securities: Tokens and Coins as Debt and Equity Yuliya Guseva Follow this and additional works at: https://digitalcommons.law.umaryland.edu/mlr Part of the Securities Law Commons Recommended Citation Yuliya Guseva, A Conceptual Framework for Digital-Asset Securities: Tokens and Coins as Debt and Equity, 80 Md. L. Rev. 166 (2021) Available at: https://digitalcommons.law.umaryland.edu/mlr/vol80/iss1/7 This Article is brought to you for free and open access by the Academic Journals at DigitalCommons@UM Carey Law. It has been accepted for inclusion in Maryland Law Review by an authorized editor of DigitalCommons@UM Carey Law. For more information, please contact [email protected]. A CONCEPTUAL FRAMEWORK FOR DIGITAL-ASSET SECURITIES: TOKENS AND COINS AS DEBT AND EQUITY YULIYA GUSEVA* A. INTRODUCTION ......................................................................................167 B. AN OVERVIEW OF TOKENS ....................................................................175 1. Token Taxonomy .....................................................................175 1.1. Native and Non-native Tokens ....................................175 1.2. Functional and Regulatory ClassiFications ..................176 1.3. Fungible and Non-Fungible Tokens ............................177 2. The Two Stages oF Digital Asset Markets ...............................179 3. Howey and Bonds ....................................................................184 -

The Blockchain: Industry Applications and Legal Perspectives

MUMBAI SILICON VALLEY BANGALOR E SINGAPORE MUMBAI BKC NEW DELHI MUNICH N E W Y ORK The Blockchain Industry Applications and Legal Perspectives November 2018 © Copyright 2018 Nishith Desai Associates www.nishithdesai.com The Blockchain Industry Applications and Legal Perspectives November 2018 [email protected] © Nishith Desai Associates 2018 The Blockchain Industry Applications and Legal Perspectives Contents 1. INTRODUCTION 01 2. HOW BLOCKCHAIN TECHNOLOGY WORKS 03 I. Technical Perspective 03 II. Public and Private Blockchains 05 III. Looking Past the Hype 06 3. STATE OF THE ART IN INDUSTRY 08 4. REGULATORY REACTION 20 5. FORECASTING LEGAL ISSUES 25 I. Pseudonymity and Legal Enforcement 25 II. Privacy and Cybersecurity 25 III. Complications Associated with Decentralized Autonomous Organizations (DAOs) 27 IV. Complications Due to Immutability and Irreversability 28 V. Jurisdictional Questions 29 VI. Contract Law Grey Areas 29 VII. Whether Blockchain Tokens are ‘Securities’ 31 VIII. Adaptations of Older Requirements 31 6. PRACTICAL CHALLENGES 33 I. Cybersecurity 33 II. Widespread Adoption 33 III. Necessity 33 IV. Teething Problems 34 V. Privacy 34 VI. Energy Consumption 34 7. CONCLUSION 35 © Nishith Desai Associates 2018 The Blockchain Industry Applications and Legal Perspectives 1. Introduction Most people have heard of Bitcoin, the their businesses, independently and through revolutionary decentralized, trustless payment consortiums such as the Enterprise Ethereum system. But Bitcoin is just one application of Alliance.2 Big name technology and consulting a broader concept known as blockchain firms heavily involved in blockchain projects technology, or simply, ‘the blockchain.’ include Deloitte, Google (DeepMind), IBM, Blockchain technology made Bitcoin achieve KPMG, and Microsoft. a goal that many virtual currencies before The Indian fintech space has seen considerable it could not. -

Profiting from Kitties on Ethereum: Leveraging Blockchain RDF Data

Profiting from Kitties on Ethereum: Leveraging Blockchain RDF Data with SANSA Damien Graux1, Gezim Sejdiu2, Hajira Jabeen2, Jens Lehmann1;2, Danning Sui3, Dominik Muhs3 and Johannes Pfeffer3 1 Fraunhofer IAIS, Germany fdamien.graux,[email protected] 2 Smart Data Analytics, University of Bonn, Germany fsejdiu,jabeen,[email protected] 3 Alethio [email protected] fdanning.sui,[email protected] Abstract. In this poster, we will present attendees how the recent state- of-the-art Semantic Web tool SANSA could be used to tackle blockchain specific challenges. In particular, the poster will focus on the use case of CryptoKitties: a popular Ethereum-based online game where users are able to trade virtual kitty pets in a secure way. 1 Introduction During the recent years, the interest of the research community for blockchain technologies has raised up since the Bitcoin white paper published by Nakamoto [4]. Indeed, several applications either practical or theoretical have been made, for instance with crypto-currencies or with secured exchanges of data. More specifically, several blockchain systems have been designed, each one having their own set of properties, for example Ethereum [6] {further described in Section2{ which provides access to so-called smart-contracts. Recently, Mukhopadhyay et al. surveyed major crypto-currencies in [3]. In parallel to ongoing blockchain development, the research community has focused on the possibilities offered by the Semantic Web such as designing efficient data management systems, dealing with large and distributed knowledge RDF graphs. As a consequence, recently, some studies have started to connect the Semantic Web world with the blockchain one, see for example the study of English et al. -

Q2 Most Held Crypto

Distribution 06 July Smaller cryptoassets in demand as eToro investors seek diversification - Cardano overtakes bitcoin to be the most held crypto on eToro in Q2 - Dogecoin rockets in popularity, becoming the fifth most held - Tron the biggest mover with 163% increase from Q1, and 1242% YoY Retail investors are increasingly confident in the potential of cryptoassets, despite this quarter’s market correction, with new eToro data revealing increases in the numbers of crytoassets being held during the last quarter (Q2). Perhaps surprisingly, Cardano’s ADA leapfrogged bitcoin to become the most held in the second quarter of 2021, seeing a 51% increase on the previous quarter. Bitcoin, which led the cryptoasset bull run at the start of the year, remained popular – seeing a 42% increase in demand, however, it was eclipsed by ADA and slipped from first to second place. Simon Peters, crypto market analyst at eToro commented: “During Q2, Cardano provided a clearer roadmap for its upcoming Alonzo hardfork – currently in a testing phase. If successful, it will bring smart contract functionality by allowing the writing and deployment of smart contracts for the first time on the Cardano blockchain. This upgrade will be significant as it will enable developers to build projects on the network, helping Cardano to position itself as a real ‘competitor’ to the likes of Ethereum. The price of ADA climbed 15% over the last quarter, suggesting investor optimism around the Alonzo hard fork and Cardano’s ability to challenge Ethereum long-term.” Ethereum, which has seen a 220% price rise so far this year, also gained in popularity, seeing a 79% increase in investors holding the asset. -

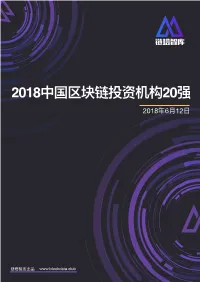

2018中国区块链投资机构20强 2018年6⽉12⽇

2018中国区块链投资机构20强 2018年6⽉12⽇ 链塔智库出品 www.blockdata.club 前⾔ 近年来,中国区块链⾏业的快速发展逐渐获得投资机构关注,中国区块链⾏业投资年增速已连续多年超 过100%。专注于区块链⾏业的投资机构正在⻜速成⻓,在区块链产业积极布局,构建⾃⼰的版图,⽽ 持开放态度的传统投资机构也在跑步⼊局。 链塔智库对活跃于区块链领域的120家投资机构及其所投项⽬进⾏分析,从区块链⾏业投资影响⼒、投 资标的数量、投资⾦额总量等⽅⾯选取了⼆⼗家表现最好的投资机构重点研究,形成结论如下: 从投资项⽬分类来看,这些投资机构普遍看好区块链平台类的公司。 从投资标的地域来看,这些投资机构更多的投资于海外项⽬。 从国内项⽬⻆度来看,北京地区项⽬占⽐最⾼。 从投资轮次来看,⼤部分投资发⽣在天使轮及A轮,反映⾏业仍处于早期阶段。 www.blockdata.club ⽬录 PART.1 2018中国区块链投资机构20强 榜单 PART.2 2018中国区块链投资机构20强 榜单分析 PART.3 影响⼒、投资数⽬、投资⾦额 细分榜单 PART.4 2018中国区块链投资机构版图 www.blockdata.club PART.1 2018中国区块链投资机构20强榜单 链塔智库基于链塔数据库数据,辅以整理超过120余家活跃于区块链领域的投资机构及所投项⽬,从 各家机构在投资影响⼒、投资项⽬数量、投资总额、回报情况、退出情况等维度进⾏评分(单项评价 最⾼10分),评选出2018中国区块链投资机构20强。 区块链投资机构评分维度模型 投资⾦额 重点项⽬影响⼒ 投资影响⼒ 背书能⼒ 媒体影响⼒ 退出情况 总投资数⽬ 投资数⽬ 所投项⽬已发Token数 回报情况 链塔智库研究绘制 www.blockdata.club www.blockdata.club 1 38.1% 21.1%95% 2018中国区块链 79.5% 投资机构 TOP 20 70.2% 名次 47.5% 机构名称 创始⼈ 总评价 影响⼒评分 数量评分 ⾦额评分 1 分布式资本 沈波 9.1 9 10 9 2 硬币资本 李笑来 9.0 10 9 8 3 连接资本 林嘉鹏 8.7 7 10 7 4 15.8% Dfund 赵东 8.1 7 6 9 5 54.1% IDG资本 熊晓鸽 7.7 9 4 9 6 泛城资本 陈伟星 7.5 9 5 6 7 真格基⾦ 徐⼩平 7.4 7 5 7 8 节点资本 杜均 7.1 6 10 7 9 丹华资本 张⾸晟 6.8 8 6 5 10 维京资本 张宇⽂ 6.5 8 5 5 11 了得资本 易理华 6.4 8 6 4 12 FBG Capital 周硕基 6.3 6 6 8 13 千⽅基⾦ 张银海 6.2 8 6 5 14 红杉资本中国 沈南鹏 6.1 10 4 5 15 创世资本 朱怀阳、孙泽宇 6.0 6 6 6 16 Pre Angel 王利杰 5.9 6 8 5 17 蛮⼦基⾦ 薛蛮⼦ 5.8 8 5 3 18 隆领资本 蔡⽂胜 5.5 7 5 3 19 ⼋维资本 傅哲⻜、阮宇博 5.2 6 5 5 20 BlockVC 徐英凯 5.1 6 5 4 数据来源:链塔数据库及公开信息整理 www.blockdata.club www.blockdata.club 2 PART.2 2018中国区块链投资机构20强榜单分析 2.1 区块链平台项目最受欢迎,占比44% 链塔智库根据收录的投资机构20强所投项⽬以及公开信息,对投资项⽬所属⾏业进⾏分类。 20强投资机构投资项⽬⾏业分布 其他 2% 社交 6% ⽣活 8% ⾦融 29% ⽂娱 11% 区块链平台 44% -

Tron: Decentralize The

D I G I T A L - A S S E T R E S E A R C H & R I S K M A N A G E M E N T www.paribusgroup.io TRON: R E L E A S E D A T E : M A Y 2 0 1 9 version: 1.0 DECENTRALIZE THE WEB A Paribus Group Report MONERO: SECURE-PRIVATE- UNTRACEABLE DISCLAIMER Trading on any market carries a high level of risk, and may not be suitable for everyone. Past performance is not indicative of future results. Before getting involved in investing or trading, you should carefully consider your personal venture objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial deposit and therefore you should not risk funds that you cannot afford to lose. You should be aware of all the risks associated with trading any market, and seek advice from an independent financial advisor if you have any doubts. THE MEMBERS OF PARIBUS GROUP ARE NOT REGISTERED FINANCIAL ADVISORS OR LEGAL COUNCILORS. The information contained in this publication does not constitute legal or financial advice or a solicitation to buy or sell any asset contract or securities of any type and is to be regarded for educational or entertainment purposes only. Paribus Group will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Our analysis is based on publicly available information. -

Cryptocurrencies and Monetary Policy

Policy Contribution Issue n˚10 | June 2018 Cryptocurrencies and monetary policy Grégory Claeys, Maria Demertzis and Konstantinos Efstathiou Executive summary This Policy Contribution tries to answer two main questions: can cryptocurrencies Grégory claeys (gregory. acquire the role of money? And what are the implications for central banks and monetary [email protected]) is a policy? Research Fellow at Bruegel. Money is a social institution that serves as a unit of account, a medium of exchange and a store of value. With the emergence of decentralised ledger technology (DLT), cryptocur- Maria Demertzis (maria. rencies represent a new form of money: privately issued, digital and enabling peer-to-peer [email protected]) is transactions. Deputy Director of Bruegel. Historically, currencies fulfil their main functions successfully when their value is stable and their user network sufficiently large. So far, cryptocurrencies are arguably falling Konstantinos short against these criteria. They resemble speculative assets rather than money. Primarily Efstathiou (konstantinos. this is because of their inherent volatility, which is the by-product of their inelastic supply, [email protected]) and which limits their widespread use as a medium of exchange. is an Affiliate Fellow at Bruegel. Cryptocurrency protocols could theoretically evolve to limit their volatility and cor- rect their current deficiencies. If successful, this could lead to an increase in their popularity as an alternative to official currencies. A successful alternative to official currencies could put This policy contribution was pressure on those who manage official currencies to provide better policies. prepared for the Committee on Economic and Monetary But the widespread substitution of central bank currency for cryptocurrencies would Affairs of the European effectively create parallel currencies.