Longleaf Partners Quarterly Summary Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MKS/EQD/07/21 日期 Date: 01/02/2021

編號 Ref. No.: MKS/EQD/07/21 日期 Date: 01/02/2021 香港聯合交易所有限公司 (香港交易及結算所有限公司全資附屬公司) THE STOCK EXCHANGE OF HONG KONG LIMITED (A wholly-owned subsidiary of Hong Kong Exchanges and Clearing Limited) 通告 CIRCULAR Subject: Introduction of New Stock Option Class on Kuaishou Technology Enquiry: Mr. Wallace Chan (Tel: 2211-6139 E-mail: [email protected]) The Stock Exchange of Hong Kong Limited (the “Exchange”) is pleased to announce that stock option class on Kuaishou Technology (“KST”) will commence trading on Friday, 5 February 2021 (“Commencement Date”), subject to the successful listing of KST: Expiry Months Contract Min. No. of Trading Underlying Stock HKATS Tier Available Size Fluctuation Board Tariff (Stock Code) Code Level on the (shares) (HK$) Lots (HK$) Commence ment Date Feb 21, Mar 21, Apr 21, Kuaishou Technology May 21, KST 500 $0.01 5 1 $3 (1024) Jun 21, Sep 21 & Dec 21 The list of stock option classes available for trading is set forth in Attachment I. For details of the contract specifications, please refer to Appendix B of the Operational Trading Procedures for Options Trading Exchange Participants (“Options Contract Specifications”). Strike Price In order to offer more choices for investors, 28 strikes above and below HK$115 (which is the offer price of the underlying stock) will be available for trading on the Commencement Date (see Attachment II). New strike prices subsequent to the Commencement Date will be introduced according to the Operational Trading Procedures for Options Trading Exchange Participants. 2 Position Limit The position limit for KST options contracts will be 50,000 open contracts in any one market direction for all expiry months combined. -

INTERIM REPORT 2020 CK INFRASTRUCTURE HOLDINGS LIMITED 長江基建集團有限公司 放眼環球 GLOBAL 基建世界 INFRASTRUCTURE 二零二零年度中期報告 PLAYER 二零二零年度中期報告 Interim Report 2020

INTERIM REPORT 2020 CK INFRASTRUCTURE HOLDINGS LIMITED 長江基建集團有限公司 放眼環球 GLOBAL 基建世界 INFRASTRUCTURE 二零二零年度中期報告 PLAYER 二零二零年度中期報告 Interim Report 2020 (於百慕達註冊成立之有限公司) (股份代號:1038) Stock Code: 1038 CKI_IR2020_Cover_7.7mm_AW.indd 1 10/8/2020 16:31 A Leading Player in CKI the Global Infrastructure Arena CKI 環球基建業界翹楚 CKI is a global infrastructure company that aims to make 長江基建是一家國際性基建集團,透過於世界 the world a better place through a variety of infrastructure 各地的基建投資,致力締造更美好的世界。 investments and developments in different parts of the world. The Group has diversified investments in Energy Infrastructure, 長江基建的多元化業務包括:能源基建、 Transportation Infrastructure, Water Infrastructure, 交通基建、水處理基建、廢物管理、轉廢為能、 Waste Management, Waste-to-energy, Household Infrastructure 屋宇服務基建及基建有關業務。集團的投資及 and Infrastructure Related Businesses. Its investments and 營運範圍遍及香港、中國內地、英國、歐洲大陸、 operations span Hong Kong, Mainland China, the United Kingdom, Continental Europe, Australia, New Zealand and 澳洲、新西蘭及加拿大。 Canada. THE HALF YEAR AT A GLANCE 半年業績概覽 Profit attributable Earnings Interim dividend 股東應佔溢利 每股溢利 每股中期股息 to shareholders per share per share (百萬港元) (港元) (港元) (HK$ million) (HK$) (HK$) 2,860 1.14 0.68 2,860 1.14 0.68 CKI_IR2020_Cover_7.7mm_AW.indd 2 10/8/2020 16:32 CONTENTS 2 Corporate Information and Key Dates 4 Chairman’s Letter 10 Financial Review 12 Directors’ Biographical Information 20 Consolidated Income Statement 21 Consolidated Statement of Comprehensive Income 22 Consolidated Statement of Financial Position 23 Consolidated Statement of Changes in Equity 25 Condensed Consolidated -

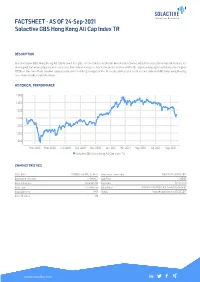

FACTSHEET - AS of 24-Sep-2021 Solactive GBS Hong Kong All Cap Index TR

FACTSHEET - AS OF 24-Sep-2021 Solactive GBS Hong Kong All Cap Index TR DESCRIPTION The Solactive GBS Hong Kong All Cap Index TR is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the all cap covering approximately the largest 100% of the free-float market capitalization in the Hong Kong market. It is calculated as a total return index in HKD andweightedby free-float market capitalization. HISTORICAL PERFORMANCE 1,500 1,400 1,300 1,200 1,100 1,000 900 Mar-2020 May-2020 Jul-2020 Sep-2020 Nov-2020 Jan-2021 Mar-2021 May-2021 Jul-2021 Sep-2021 Solactive GBS Hong Kong All Cap Index TR CHARACTERISTICS ISIN / WKN DE000SLA4JY6 / SLA4JY Base Value / Base Date 1000 Points / 08.05.2017 Bloomberg / Reuters / .SHKACT Last Price 1220.68 Index Calculator Solactive AG Dividends Reinvested Index Type Total Return Calculation 8:00 am to 10:30 pm (CET), every 15 seconds Index Currency HKD History Available daily back to 08.05.2017 Index Members 173 FACTSHEET - AS OF 24-Sep-2021 Solactive GBS Hong Kong All Cap Index TR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -8.02% -13.44% -12.28% 10.53% -5.61% 2.91% Performance (p.a.) - - - - - 1.75% Volatility (p.a.) 19.86% 18.30% 16.27% 17.51% 18.41% 21.63% High 1344.72 1404.68 1460.66 1473.97 1473.97 1473.97 Low 1214.90 1214.90 1214.90 1099.92 1214.90 879.57 Sharpe Ratio -3.21 -2.42 -1.43 0.61 -0.41 0.08 Max. -

UBS AG (Incorporated with Limited Liability in Switzerland) Acting Through Its London Branch

16 November 2020 Hong Kong Exchanges and Clearing Limited (“HKEX”), The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. This document, for which we accept full responsibility, includes particulars given in compliance with the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (the “Rules”) for the purpose of giving information with regard to us. We, having made all reasonable enquiries, confirm that to the best of our knowledge and belief the information contained in this document is accurate and complete in all material respects and not misleading or deceptive, and there are no other matters the omission of which would make any statement herein or this document misleading. This document is for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for the Warrants. The Warrants are complex products. Investors should exercise caution in relation to them. Investors are warned that the price of the Warrants may fall in value as rapidly as it may rise and holders may sustain a total loss of their investment. Prospective purchasers should therefore ensure that they understand the nature of the Warrants and carefully study the risk factors set out in the Base Listing Document (as defined below) and this document and, where necessary, seek professional advice, before they invest in the Warrants. -

In Fund Base Currency

As of Date: 12/31/18 Fund: Manulife Global Fund Asia Small Cap Fund SECURITY DESCRIPTION MARKET VALUE + ACCRUED PERCENT INTEREST (IN FUND BASE ASSETS CURRENCY) ADITYA BIRLA FASHION AND RET 1,487,135.75 0.70 AEON THANA SINSAP THA-FOREIG 2,039,115.48 0.96 AEROSPACE INDUSTRIAL DEVELOP 2,957,435.66 1.39 AFREECATV CO LTD 1,868,869.33 0.88 ALKEM LABORATORIES LTD 3,350,033.07 1.57 AMMB HOLDINGS BHD 2,844,918.57 1.34 APOLLO HOSPITALS ENTERPRISE 1,682,894.02 0.79 APPEN LTD 1,780,077.26 0.84 AU SMALL FINANCE BANK LTD 3,212,188.82 1.51 BANGKOK CHAIN HOSPITAL-FOREG 2,299,840.29 1.08 BEACH ENERGY LTD 2,482,882.59 1.17 BEIGENE LTD-ADR 2,222,139.18 1.04 BIZLINK HOLDING INC 3,570,940.56 1.68 BUKIT ASAM TBK PT 2,751,491.66 1.29 CATHAY REAL ESTATE DEVELOPME 2,751,992.71 1.29 CHINA EVERBRIGHT GREENTECH L 2,130,008.24 1.00 CHINA METAL RECYCLING - - CHINA TRADITIONAL CHINESE ME 1,616,808.55 0.76 CHINASOFT INTERNATIONAL LTD 2,002,299.04 0.94 CIPUTRA DEVELOPMENT TBK PT 3,244,642.56 1.52 CITY UNION BANK LTD 1,483,156.68 0.70 COLGATE PALMOLIVE (INDIA) 3,408,958.63 1.60 COM2US CORP 1,249,535.76 0.59 COSTA GROUP HOLDINGS LTD 1,838,741.24 0.86 COWAY CO LTD 2,662,034.86 1.25 CTCI CORP 1,662,634.61 0.78 DAH SING FINANCIAL HOLDINGS 2,609,871.83 1.23 DAXIN MATERIALS CORP 1,068,061.29 0.50 E-MART INC 3,093,569.64 1.45 ECLAT TEXTILE COMPANY LTD 2,502,130.98 1.17 EGIS TECHNOLOGY INC 4,414,061.23 2.07 EXIDE INDUSTRIES LTD 3,274,063.84 1.54 FAR EASTONE TELECOMM CO LTD 5,431,044.02 2.55 FILA KOREA LTD 3,516,865.03 1.65 GENEXINE CO LTD 1,581,089.80 0.74 GLOBALWAFERS CO LTD -

Templeton Foreign Fund Fact Sheet

International Templeton Foreign Fund June 30, 2021 Fund Fact Sheet | Share Class: Advisor Fund Description Performance The fund seeks long-term capital growth by investing Growth of a $10,000 Investment (from 10/05/1982-06/30/2021) at least 80% of its net assets in foreign securities, that $387,500 Templeton Foreign Fund are predominantly equity securities of companies - Advisor Class: located outside of the U.S., including developing $310,000 $364,460 markets. $232,500 Fund Overview $155,000 Total Net Assets [All Share Classes] $3,790 million $77,500 Fund Inception Date 10/5/1982 $0 Dividend Frequency Annually in December 10/82 06/92 02/02 10/11 06/21 Number of Issuers 71 Share Class Information Total Returns % (as of 6/30/2021) NASDAQ CUMULATIVE AVERAGE ANNUAL Share Class CUSIP Symbol Since Inception Advisor 880 196 506 TFFAX Share Class YTD 1 Yr 3 Yrs 5 Yrs 10 Yrs Inception Date A 880 196 209 TEMFX Advisor 10.84 35.92 3.25 6.84 3.65 9.73 10/5/1982 C 880 196 407 TEFTX Calendar Year Total Returns % R 880 196 803 TEFRX R6 880 196 878 FTFGX Share Class 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 Advisor -0.35 12.96 -15.00 17.57 11.99 -6.93 -10.55 27.32 18.89 -12.57 Fund Management 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 Years with Years of Advisor 8.87 50.18 -45.98 17.56 20.14 10.94 18.37 30.87 -8.42 -7.68 Firm Experience Christopher James Peel, 13 13 Performance data represents past performance, which does not guarantee future results. -

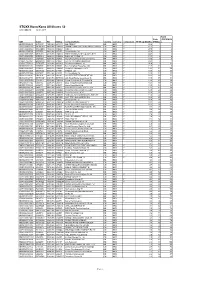

STOXX Hong Kong All Shares 50 Last Updated: 02.01.2018

STOXX Hong Kong All Shares 50 Last Updated: 02.01.2018 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 85.6 1 1 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 65.7 2 2 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 47.5 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 47.2 4 3 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 44.6 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.1 6 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 29.6 7 8 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 29.1 8 7 KYG2177B1014 BYZQ077 1113.HK HK50CI CK Asset Holdings Ltd HK HKD Y 26.9 9 12 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 21.8 10 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 19.5 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 19.0 12 13 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.9 13 11 HK0027032686 6465874 0027.HK 646587 GALAXY ENTERTAINMENT GP. HK HKD Y 18.0 14 15 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 17.0 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 15.6 16 16 HK2388011192 6536112 2388.HK 653611 BOC Hong Kong (Holdings) Ltd. -

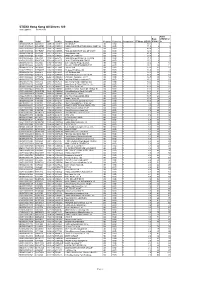

STOXX Hong Kong All Shares 180 Last Updated: 03.04.2018

STOXX Hong Kong All Shares 180 Last Updated: 03.04.2018 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 83.1 1 1 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 71.5 2 2 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 49.4 3 3 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 42.9 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 41.6 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 33.3 6 7 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 31.0 7 6 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 27.1 8 8 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.2 9 10 HK0027032686 6465874 0027.HK 646587 GALAXY ENTERTAINMENT GP. HK HKD Y 20.1 10 11 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 19.0 11 12 KYG2177B1014 BYZQ077 1113.HK HK50CI CK Asset Holdings Ltd HK HKD Y 18.8 12 9 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 18.2 14 15 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 16.7 15 14 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.1 16 16 HK2388011192 6536112 2388.HK 653611 BOC Hong Kong (Holdings) Ltd. -

Hong Kong Warns: Li Ka-Shing Sells the Center in US$5.15Bn Record Deal to Trim His HK’S Assets

Find our latest analyses and trade ideas on bsic.it Hong Kong warns: Li Ka-shing sells The Center in US$5.15bn record deal to trim his HK’s assets CK Asset Holdings Ltd (1113:HK) – market cap as of 05/11/2017: HK$246.07bn Introduction On November 1, 2017, CK Asset Holdings announced an agreement to sell the skyscraper located in Central (Hong Kong) known as “The Center” to C.H.M.T. Peaceful Development Asia Property for a total transaction value of HK$40,2bn ($5.15bn). The sale of The Center, a 73-storey building in Hong Kong’s bustling Central district, is tracked by numerous analysts as the world’s biggest ever single property sale. Although Hong Kong housing prices are close to their peak and economically “unsustainable”, Chinese firms have been aggressively expanding in Hong Kong property along with many internationally-projected investors. Indeed, the deal comes after Mainland developer LVGEM (China) Real Estate Investment’s statement in mid- October, which said that it would buy an office tower for HK$9bn to strengthen its presence in Hong Kong property. About CK Asset Holdings Ltd. CK Asset Holdings Limited - formerly known as Cheung Kong Property Holdings Limited - is a leading and influential real estate investment company owned by Li Ka-Shing, Hong Kong’s wealthiest businessman. The company - which operates mainly as a property developer in Hong Kong, the Mainland China, Singapore, and the UK - is headquartered and listed in Hong Kong. Its activities include residential, commercial, and industrial property development and investment; hotel and serviced suite operation; and property and project management services. -

Case M.9566 - CK ASSET / CK HUTCHISON / ALBERTA / NORTHUMBRIAN WATER / NORTHUMBRIAN SERVICES / WEST GAS / WESTERN GAS / UK RAIL / DUTCH ENVIRO

EUROPEAN COMMISSION DG Competition Case M.9566 - CK ASSET / CK HUTCHISON / ALBERTA / NORTHUMBRIAN WATER / NORTHUMBRIAN SERVICES / WEST GAS / WESTERN GAS / UK RAIL / DUTCH ENVIRO Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 18/10/2019 In electronic form on the EUR-Lex website under document number 32019M9566 EUROPEAN COMMISSION Brussels, 18.10.2019 C(2019) 7602 final PUBLIC VERSION To the notifying parties Subject: Case M.9566 – CK ASSET / CK HUTCHISON / ALBERTA / NORTHUMBRIAN WATER / NORTHUMBRIAN SERVICES / WEST GAS / WESTERN GAS / UK RAIL / DUTCH ENVIRO Commission decision pursuant to Article 6(1)(b) of Council Regulation (EC) No 139/20041 and Article 57 of the Agreement on the European Economic Area2 Dear Sir or Madam, 1. On 26 September 2019, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertakings CK Asset Holdings Limited (“CKA”, Hong Kong) and CK Hutchison Holdings Limited (“CKHH”, Hong Kong) acquire within the meaning of Article 3(1)(b) and 3(4) of the Merger Regulation joint control of the whole of 1822604 Alberta Ltd (Canada), Northumbrian Water Group Limited (UK), Northumbrian Services Limited (UK), West Gas Networks Limited (UK), Western Gas Networks Limited (UK), UK Rails S.à r.l. (UK), and Dutch Enviro Energy Holdings B.V. (the Netherlands), all controlled by CKHH, by way of contract or any other means.3 2. The business activities of the undertakings concerned are: For CKA: property development and investment, hotel and serviced suite operation, property and project management, investment in infrastructure and utility asset operation and aircraft leasing. -

Annual Report 2020 (PDF)

Stock Code: 1038 GLOBAL INFRASTRUCTURE PLAYER Annual Report 2020 CKI is a global infrastructure company that aims to make the world a better place through a variety of infrastructure investments and developments in different parts of the world. The Group has diversified investments in Energy Infrastructure, Transportation CKI Infrastructure, Water Infrastructure, A Leading Player Waste Management, Waste-to- in the Global energy, Household Infrastructure and Infrastructure Arena Infrastructure Related Businesses. Its investments and operations span Hong Kong, Mainland China, the United Kingdom, Continental Europe, Australia, New Zealand, Canada and the United States. CONTENTS 005 Ten-year Financial Summary 006 Chairman’s Letter 012 Group Managing Director’s Report 019 Long Term Development Strategy 020 Business Review 022 Investment in Power Assets 024 Infrastructure Investments in United Kingdom 030 Infrastructure Investments in Australia 038 Infrastructure Investments in New Zealand 041 Infrastructure Investments in Continental Europe 043 Infrastructure Investments in Canada 046 Infrastructure Investments in Hong Kong and Mainland China 048 Financial Review 050 Board and Key Personnel 065 Report of the Directors 077 Independent Auditor’s Report 083 Consolidated Income Statement 084 Consolidated Statement of Comprehensive Income 085 Consolidated Statement of Financial Position 086 Consolidated Statement of Changes in Equity 087 Consolidated Statement of Cash Flows 088 Notes to the Consolidated Financial Statements 141 Principal Subsidiaries -

The “Stock Exchange”

6 Jul 2021 Hong Kong Exchanges and Clearing Limited (“HKEX”), The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. This document, for which we accept full responsibility, includes particulars given in compliance with the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (the “Rules”) for the purpose of giving information with regard to us. We, having made all reasonable enquiries, confirm that to the best of our knowledge and belief the information contained in this document is accurate and complete in all material respects and not misleading or deceptive, and there are no other matters the omission of which would make any statement herein or this document misleading. This document is for information purposes only and does not constitute an offer, an advertisement or invitation to the public to subscribe for or to acquire the Warrants. The Warrants are complex products. You should exercise caution in relation to them. Investors are warned that the price of the Warrants may fall in value as rapidly as it may rise and holders may sustain a total loss of their investment. Prospective purchasers should therefore ensure that they understand the nature of the Warrants and carefully study the risk factors set out in the Base Listing Document (as defined below) and this document and, where necessary, seek professional advice, before they invest in the Warrants.