CK Group: the Makings of One Big, Happy Family

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MKS/EQD/07/21 日期 Date: 01/02/2021

編號 Ref. No.: MKS/EQD/07/21 日期 Date: 01/02/2021 香港聯合交易所有限公司 (香港交易及結算所有限公司全資附屬公司) THE STOCK EXCHANGE OF HONG KONG LIMITED (A wholly-owned subsidiary of Hong Kong Exchanges and Clearing Limited) 通告 CIRCULAR Subject: Introduction of New Stock Option Class on Kuaishou Technology Enquiry: Mr. Wallace Chan (Tel: 2211-6139 E-mail: [email protected]) The Stock Exchange of Hong Kong Limited (the “Exchange”) is pleased to announce that stock option class on Kuaishou Technology (“KST”) will commence trading on Friday, 5 February 2021 (“Commencement Date”), subject to the successful listing of KST: Expiry Months Contract Min. No. of Trading Underlying Stock HKATS Tier Available Size Fluctuation Board Tariff (Stock Code) Code Level on the (shares) (HK$) Lots (HK$) Commence ment Date Feb 21, Mar 21, Apr 21, Kuaishou Technology May 21, KST 500 $0.01 5 1 $3 (1024) Jun 21, Sep 21 & Dec 21 The list of stock option classes available for trading is set forth in Attachment I. For details of the contract specifications, please refer to Appendix B of the Operational Trading Procedures for Options Trading Exchange Participants (“Options Contract Specifications”). Strike Price In order to offer more choices for investors, 28 strikes above and below HK$115 (which is the offer price of the underlying stock) will be available for trading on the Commencement Date (see Attachment II). New strike prices subsequent to the Commencement Date will be introduced according to the Operational Trading Procedures for Options Trading Exchange Participants. 2 Position Limit The position limit for KST options contracts will be 50,000 open contracts in any one market direction for all expiry months combined. -

Riverside Energy Park Design and Access Statement

Riverside Energy Park Design and Access Statement VOLUME NUMBER: PLANNING INSPECTORATE REFERENCE NUMBER: EN010093 DOCUMENT REFERENCE: 07 7. 3 November 2018 Revision 0 APFP Regulation 5(2)(q) Planning Act 2008 | Infrastructure Planning (Applications: Prescribed Forms and Procedure) Regulations 2009 Riverside Energy Park Design and Access Statement - Document Reference 7.3 Harry’s Yard, 176-178 Newhall St, Birmingham, B3 1SJ T: +44 (0)121 454 4171 E:[email protected] Riverside Energy Park Design and Access Statement - Document Reference 7.3 Contents Summary 3.4 Site Analysis 3.4.1 REP Site 1.0 Introduction 3.4.2 Sun Path Analysis 1.1 Introduction 3.4.3 Access 1.1.1 Cory Riverside Energy Holdings Limited 3.4.4 Site Opportunities and Constraints 1.1.2 Riverside Resource Recovery Facility 1.2 Purpose of the Design and Access Statement 4.0 Design Process 4.1 Overview of the Design Process to date 2.0 The Proposed Development 4.2 Good Design Principles 2.1 Overview 2.2 Key Components of the Proposed Development 5.0 Illustrative Masterplan 2.2.1 The Energy Recovery Facility 5.1 Introduction 2.2.2 Anaerobic Digestion Facility 5.2 Illustrative Masterplan Proposals 2.2.3 Solar Photovoltaic Panels 5.2.1 Illustrative Masterplan Proposal 1 - North to South - Stack South 2.2.4 Battery Storage 5.2.2 Illustrative Masterplan Proposal 2 - North to South - Stack North 2.2.5 Other Elements 5.2.3 Illustrative Masterplan Proposal 3 - East to West - Stack West 3.0 Site Overview 5.2.4 Illustrative Masterplan Proposal 4 - East to West - Stack East -

Sustainability Report 2018 2 Sustainability Report 2018 Cory Riverside Energy

SUSTAINABILITY REPORT 2018 2 SUSTAINABILITY REPORT 2018 CORY RIVERSIDE ENERGY CONTENTS Report highlights 3 About Cory Riverside Energy 5 Chair’s statement 10 CEO’s statement 11 Scope of the report 12 Governance and Materiality 14 Our sustainable business strategy 17 Our sustainability performance 21 Making london a more sustainable city 22 Our sustainability performance against priority areas 30 Our performance scorecard and future plans 40 Appendix 49 Report highlights In 2018, we established our sustainable business strategy to help drive performance across our business in line with five key priority areas aimed at: • supporting London’s circular economy by processing recyclable waste, enabling resource recovery from non-recyclable residual waste, and creating by-products for use in construction; • reducing the level of waste sent to landfill and exported abroad; and • partnering to increase awareness of recycling, the circular economy and the role of the River Thames for freight transportation. 4 SUSTAINABILITY REPORT 2018 CORY RIVERSIDE ENERGY REPORT HIGHLIGHTS Our sustainable business strategy seeks to improve BUSINESS INTEGRITY our operations to support London’s aims of becoming We have instigated a health and safety culture change programme a sustainable city, and support the nine United to reduce the incidents and accidents we have in our operations. Nations Sustainable Development Goals that we have We have increased awareness and understanding of modern identified as having the greatest ability to impact. We slavery and anti-bribery and corruption amongst employees and invite you to explore our 2018 sustainability report for our suppliers, through enhanced policies and procedures. a greater insight into Cory’s key priorities, which are At our energy from waste facility, we have remained fully compliant summarised below. -

INTERIM REPORT 2020 CK INFRASTRUCTURE HOLDINGS LIMITED 長江基建集團有限公司 放眼環球 GLOBAL 基建世界 INFRASTRUCTURE 二零二零年度中期報告 PLAYER 二零二零年度中期報告 Interim Report 2020

INTERIM REPORT 2020 CK INFRASTRUCTURE HOLDINGS LIMITED 長江基建集團有限公司 放眼環球 GLOBAL 基建世界 INFRASTRUCTURE 二零二零年度中期報告 PLAYER 二零二零年度中期報告 Interim Report 2020 (於百慕達註冊成立之有限公司) (股份代號:1038) Stock Code: 1038 CKI_IR2020_Cover_7.7mm_AW.indd 1 10/8/2020 16:31 A Leading Player in CKI the Global Infrastructure Arena CKI 環球基建業界翹楚 CKI is a global infrastructure company that aims to make 長江基建是一家國際性基建集團,透過於世界 the world a better place through a variety of infrastructure 各地的基建投資,致力締造更美好的世界。 investments and developments in different parts of the world. The Group has diversified investments in Energy Infrastructure, 長江基建的多元化業務包括:能源基建、 Transportation Infrastructure, Water Infrastructure, 交通基建、水處理基建、廢物管理、轉廢為能、 Waste Management, Waste-to-energy, Household Infrastructure 屋宇服務基建及基建有關業務。集團的投資及 and Infrastructure Related Businesses. Its investments and 營運範圍遍及香港、中國內地、英國、歐洲大陸、 operations span Hong Kong, Mainland China, the United Kingdom, Continental Europe, Australia, New Zealand and 澳洲、新西蘭及加拿大。 Canada. THE HALF YEAR AT A GLANCE 半年業績概覽 Profit attributable Earnings Interim dividend 股東應佔溢利 每股溢利 每股中期股息 to shareholders per share per share (百萬港元) (港元) (港元) (HK$ million) (HK$) (HK$) 2,860 1.14 0.68 2,860 1.14 0.68 CKI_IR2020_Cover_7.7mm_AW.indd 2 10/8/2020 16:32 CONTENTS 2 Corporate Information and Key Dates 4 Chairman’s Letter 10 Financial Review 12 Directors’ Biographical Information 20 Consolidated Income Statement 21 Consolidated Statement of Comprehensive Income 22 Consolidated Statement of Financial Position 23 Consolidated Statement of Changes in Equity 25 Condensed Consolidated -

Landfill and Residual Treatment Capacity in the Wider South East of England Including the ➢ East of England ➢ the South East of England ➢ London

Landfill and Residual Treatment Capacity in the Wider South East of England including the ➢ East of England ➢ the South East of England ➢ London for the East of England Waste Technical Advisory Body South East Waste Planning Advisory Group London Waste Planning Forum Final Report May 2021 with Contents 1 Introduction .................................................................................................................................... 1 2 Context ........................................................................................................................................... 2 2.1 Waste arising ........................................................................................................................... 2 2.2 Residual Waste Treatment Facilities ....................................................................................... 3 3 Recycling rates and targets ............................................................................................................ 5 4 Scope of the Report ........................................................................................................................ 5 4.1 Capacity of Waste Management Facilities .............................................................................. 5 4.2 Waste Arisings ......................................................................................................................... 6 4.3 London policy context ............................................................................................................ -

Cory Riverside Energy: a Carbon Case 2 | a Carbon Case CORY RIVERSIDE ENERGY

Cory Riverside Energy: A Carbon Case 2 | A Carbon Case CORY RIVERSIDE ENERGY Carbon Trust Peer Review Cory Riverside Energy: A Carbon Case The Carbon Trust has conducted a peer-review on the report Cory Riverside Energy: A Carbon Case. The scope of this study was to run a comparison between two alternative scenarios for waste management and its goal being to demonstrate which has the lower impact: the conversion of waste into electricity within Cory Riverside Energy’s operations, with waste transport by road and river; and the disposal of the same waste to a UK landfill site with waste transport by road only. This was accepted as suitable for the goal of the study and to be in line with the UK Government 2014 Defra study, Energy from Waste: A Carbon Based Modelling Approach. The main findings of the peer-review were: • The carbon footprint study is based on an appropriate methodology and identifies the key carbon impact categories for Cory Riverside Energy’s own Energy from Waste activities and an alternative scenario of the waste being sent off to Landfill. • The study also supports Cory Riverside Energy’s results regarding the comparative analysis of their own Energy from Waste operations to the alternative scenario of Landfill. 1 March 2017 Carbon Trust Certification Limited 4th Floor Dorset House 27-45 Stamford Street London SE1 9NT www.carbontruststandard.com Registered in England and Wales Number 06547658 Registered at 4th Floor, Dorset House, 27-45 Stamford Street, London SE1 9NT “Cory Riverside Energy’s mission is to provide London with a safe, secure, affordable and sustainable energy supply and to continue to do so into the future.“ 4 | A Carbon Case CORY RIVERSIDE ENERGY Who we are Cory Riverside Energy (‘Cory’) is one of the leading waste management companies in London with 275 employees across a network of sites and facilities. -

Environmental Permit Appendices

Riverside Energy Park Environmental Permit Appendices APPENDIX: SITE CONDITION REPORT B December 2018 Revision 0 Riverside Energy Park Site Condition Report i Riverside Energy Park Site Condition Report Contents 1 Introduction ................................................................................................................................. 1 1.2 Project Description ........................................................................................................ 1 1.3 The Objective ................................................................................................................ 1 2 Desk Study Information .............................................................................................................. 3 2.1 Geology, Hydrogeology & Hydrology ............................................................................ 3 2.2 Pollution History ............................................................................................................. 4 3 Previous Contamination and Site Investigations .................................................................... 9 3.2 Site Investigations ......................................................................................................... 9 3.3 Soil Contamination Monitoring & Results .................................................................... 12 3.4 Groundwater and Surface Water Monitoring & Results .............................................. 34 3.5 Gas Monitoring and results ........................................................................................ -

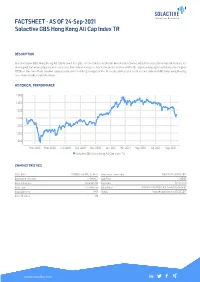

FACTSHEET - AS of 24-Sep-2021 Solactive GBS Hong Kong All Cap Index TR

FACTSHEET - AS OF 24-Sep-2021 Solactive GBS Hong Kong All Cap Index TR DESCRIPTION The Solactive GBS Hong Kong All Cap Index TR is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the all cap covering approximately the largest 100% of the free-float market capitalization in the Hong Kong market. It is calculated as a total return index in HKD andweightedby free-float market capitalization. HISTORICAL PERFORMANCE 1,500 1,400 1,300 1,200 1,100 1,000 900 Mar-2020 May-2020 Jul-2020 Sep-2020 Nov-2020 Jan-2021 Mar-2021 May-2021 Jul-2021 Sep-2021 Solactive GBS Hong Kong All Cap Index TR CHARACTERISTICS ISIN / WKN DE000SLA4JY6 / SLA4JY Base Value / Base Date 1000 Points / 08.05.2017 Bloomberg / Reuters / .SHKACT Last Price 1220.68 Index Calculator Solactive AG Dividends Reinvested Index Type Total Return Calculation 8:00 am to 10:30 pm (CET), every 15 seconds Index Currency HKD History Available daily back to 08.05.2017 Index Members 173 FACTSHEET - AS OF 24-Sep-2021 Solactive GBS Hong Kong All Cap Index TR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -8.02% -13.44% -12.28% 10.53% -5.61% 2.91% Performance (p.a.) - - - - - 1.75% Volatility (p.a.) 19.86% 18.30% 16.27% 17.51% 18.41% 21.63% High 1344.72 1404.68 1460.66 1473.97 1473.97 1473.97 Low 1214.90 1214.90 1214.90 1099.92 1214.90 879.57 Sharpe Ratio -3.21 -2.42 -1.43 0.61 -0.41 0.08 Max. -

UBS AG (Incorporated with Limited Liability in Switzerland) Acting Through Its London Branch

16 November 2020 Hong Kong Exchanges and Clearing Limited (“HKEX”), The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. This document, for which we accept full responsibility, includes particulars given in compliance with the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (the “Rules”) for the purpose of giving information with regard to us. We, having made all reasonable enquiries, confirm that to the best of our knowledge and belief the information contained in this document is accurate and complete in all material respects and not misleading or deceptive, and there are no other matters the omission of which would make any statement herein or this document misleading. This document is for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for the Warrants. The Warrants are complex products. Investors should exercise caution in relation to them. Investors are warned that the price of the Warrants may fall in value as rapidly as it may rise and holders may sustain a total loss of their investment. Prospective purchasers should therefore ensure that they understand the nature of the Warrants and carefully study the risk factors set out in the Base Listing Document (as defined below) and this document and, where necessary, seek professional advice, before they invest in the Warrants. -

In Fund Base Currency

As of Date: 12/31/18 Fund: Manulife Global Fund Asia Small Cap Fund SECURITY DESCRIPTION MARKET VALUE + ACCRUED PERCENT INTEREST (IN FUND BASE ASSETS CURRENCY) ADITYA BIRLA FASHION AND RET 1,487,135.75 0.70 AEON THANA SINSAP THA-FOREIG 2,039,115.48 0.96 AEROSPACE INDUSTRIAL DEVELOP 2,957,435.66 1.39 AFREECATV CO LTD 1,868,869.33 0.88 ALKEM LABORATORIES LTD 3,350,033.07 1.57 AMMB HOLDINGS BHD 2,844,918.57 1.34 APOLLO HOSPITALS ENTERPRISE 1,682,894.02 0.79 APPEN LTD 1,780,077.26 0.84 AU SMALL FINANCE BANK LTD 3,212,188.82 1.51 BANGKOK CHAIN HOSPITAL-FOREG 2,299,840.29 1.08 BEACH ENERGY LTD 2,482,882.59 1.17 BEIGENE LTD-ADR 2,222,139.18 1.04 BIZLINK HOLDING INC 3,570,940.56 1.68 BUKIT ASAM TBK PT 2,751,491.66 1.29 CATHAY REAL ESTATE DEVELOPME 2,751,992.71 1.29 CHINA EVERBRIGHT GREENTECH L 2,130,008.24 1.00 CHINA METAL RECYCLING - - CHINA TRADITIONAL CHINESE ME 1,616,808.55 0.76 CHINASOFT INTERNATIONAL LTD 2,002,299.04 0.94 CIPUTRA DEVELOPMENT TBK PT 3,244,642.56 1.52 CITY UNION BANK LTD 1,483,156.68 0.70 COLGATE PALMOLIVE (INDIA) 3,408,958.63 1.60 COM2US CORP 1,249,535.76 0.59 COSTA GROUP HOLDINGS LTD 1,838,741.24 0.86 COWAY CO LTD 2,662,034.86 1.25 CTCI CORP 1,662,634.61 0.78 DAH SING FINANCIAL HOLDINGS 2,609,871.83 1.23 DAXIN MATERIALS CORP 1,068,061.29 0.50 E-MART INC 3,093,569.64 1.45 ECLAT TEXTILE COMPANY LTD 2,502,130.98 1.17 EGIS TECHNOLOGY INC 4,414,061.23 2.07 EXIDE INDUSTRIES LTD 3,274,063.84 1.54 FAR EASTONE TELECOMM CO LTD 5,431,044.02 2.55 FILA KOREA LTD 3,516,865.03 1.65 GENEXINE CO LTD 1,581,089.80 0.74 GLOBALWAFERS CO LTD -

Cory Riverside Energy

Riverside Energy Park Statement of Reasons VOLUME NUMBER: PLANNING INSPECTORATE REFERENCE NUMBER: EN010093 DOCUMENT REFERENCE: 04 4.1 November 2018 Revision 0 APFP Regulation 5(2)(h) Planning Act 2008 | Infrastructure Planning (Applications: Prescribed Forms and Procedure) Regulations 2009 Statement of Reasons Riverside Energy Park Contents 1 Summary ........................................................................................................... 1 2 Introduction ...................................................................................................... 3 3 Project Description .......................................................................................... 5 3.1 Introduction ........................................................................................... 5 3.2 REP ....................................................................................................... 5 3.3 Electrical Connection ............................................................................ 6 4 Description of the Order Land ........................................................................ 7 4.1 Introduction ........................................................................................... 7 4.2 Location ................................................................................................ 7 4.3 REP site and Main Temporary Construction Compound - Existing Land Use ........................................................................................................ 7 4.4 Electrical Connection -

Other Reports Template

Environmental Impact Assessment Report, Volume 2: Appendices Riverside Optimisation Project Appendix B.4 Note on Public Health and Evidence Riverside Optimisation Project Note on Public Health and Evidence On behalf of Riverside Resource Recovery Limited Project Ref: 50407 | Rev: 1.0 | Date: April 2021 Registered Office: Buckingham Court Kingsmead Business Park, London Road, High Wycombe, Buckinghamshire, HP11 1JU Office Address: Link House, 78 Cowcross Street, London, United Kingdom, EC1M 6EJ T: +44 (0) 20 7492 5700 E: [email protected] Riverside Optimisation Project Public Health and Evidence Contents 1 Introduction ............................................................................................................................... 1 1.2 Purpose of this Report ................................................................................................... 1 2 Energy Recovery Facilities and Health .................................................................................. 3 2.1 Public Health England Statement .................................................................................. 3 2.2 Public Health England (PHE) Research ........................................................................ 3 3 Ultrafine Particulates................................................................................................................ 6 3.1 Monitoring of Particulates .............................................................................................. 6 3.2 Emissions of Ultrafine Particulates from