Maquetación 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Read an Extract

PAVEL IS A GEORDIE Pavel Srnicek Will Scott Contents 1 Pavel’s return 2 Kenny Conflict 3 Budgie crap, crap salad and crap in the bath 4 Dodgy keeper and Kevin who? 5 Got the t-shirt 6 Hooper challenge 7 Cole’s goals gone 8 Second best 9 From Tyne to Wear? 10 Pavel is a bairn 11 Stop or I’ll shoot! 12 Magpie to Owl 13 Italian job 14 Pompey, Portugal and blowing bubbles 15 Country calls 16 Testimonial 17 Slippery slope 18 Best Newcastle team 19 Best international team 20 The Naked Chef 21 Epilogue FOREWORD Spending the first ten years of my football career away from St James’ Park didn’t mean I wasn’t aware of what was going on at my home town club. As a Geordie and a Newcastle United supporter, I always kept a keen interest on what was happening on Tyneside in the early stages of my career at Southampton and Blackburn. Although it was common for clubs to sign foreign players in the early 1990s, the market wasn’t saturated the way it is now, but it was certainly unusual for teams to invest in foreign goalkeepers. And Pavel’s arrival on Tyneside certainly caused a stir. He turned up on the club’s doorstep when it was struggling at the wrong end of the old Second Division. It must have been a baptism of fire for the young Czech goalkeeper. Not only did he have to adapt to a new style of football he had to settle in to a new town and culture. -

Download the App Now

The magazine of the League Managers Association Issue 10: Winter 2011 £7.50 “Having a strong spirit is essential” M ART IN O ’ N EI LL Ossie Ardiles WHAT DO Aidy Boothroyd LEADERS DO? The big question... Herbert Chapman asked and answered Terry Connor Roy Keane SECOND IN Matt Lorenzo COMMAND Mark McGhee The assistant Gary Speed manager’s role revealed BOXING CLEVER Team The changing face of the TV rights market Issue 10 spirited : Winter 2011 Martin O’Neill on learning from Clough, the art of team building and the challenges ahead SPONSORED BY We’ve created an oil SO STRONG WE HAD TO ENGINEER THE TESTS TO PROVE IT. ENGINEERED WITH Today’s engines work harder, run hotter and operate under higher pressures, to demand maximum performance in these conditions you need a strong oil. That’s why we engineered Castrol EDGE, with new Fluid Strength Technology™. Proven in testing to minimise metal to metal contact, maximising engine performance and always ready to adapt wherever your drive takes you. Find out more at castroledge.com Recent economic and political events in Europe’s autumn THE have highlighted the dangers of reckless over-spending, poor debt management and short-sighted, short-term MANAGERS’ leadership. The macro-economic solutions being worked on in Europe’s major capitals have micro-economic lessons VOICE in them. Short-term fixes do not bring about long-term solutions, stability and prosperity. “We hope 2012 The LMA’s Annual Management Conference held in October at the magnificent Emirates stadium, brought will not see a repeat football and business together for a day of discussion and debate on the subject of leadership. -

Zo Wint Oranje De Halve Finale Gratis Epub, Ebook

ZO WINT ORANJE DE HALVE FINALE GRATIS Auteur: J.H. van Melle Aantal pagina's: 64 pagina's Verschijningsdatum: none Uitgever: Baeckens Books Nederland B.V.||9789081052719 EAN: nl Taal: Link: Download hier WK historie van het Nederlands elftal Het is echter in een enkel geval mogelijk dat door omstandigheden de bezorging vertraagd is. Bezorgopties We bieden verschillende opties aan voor het bezorgen of ophalen van je bestelling. Welke opties voor jouw bestelling beschikbaar zijn, zie je bij het afronden van de bestelling. Ga naar zoeken Ga naar hoofdinhoud Door drukte bij de bezorgdiensten kan de bezorging van je pakketje langer duren. Taal: Nederlands. Auteur: J. Uitgever: Baeckens Books Nederland B. Betrokkenen Auteur J. Overige kenmerken Gewicht g Verpakking breedte mm Verpakking hoogte 8 mm Verpakking lengte mm. Toon meer Toon minder. Reviews Schrijf een review. Aantal reviews: 2. Breda, Nederland 2 mei Vond je dit een nuttige review? Nieuwegein 29 september Bindwijze: Paperback. Alleen tweedehands. Verkoop door Lutoban books 9. In winkelwagen Op verlanglijstje. Bestellen en betalen via bol. Anderen bekeken ook. Het format van het toernooi riep voortdurende verwarring op in de afgelopen anderhalf jaar. De voorrondewedstrijden in vier verschillende divisies, met promotie- en degradatieregelingen, wildcards en play-offs voor het EK; het was zo onnavolgbaar, dat het satirische programma Zondag met Lubach er vorig jaar nog een hilarisch item aan wijdde. Tekst gaat door na de video. Bij verlies speelt het om de derde en vierde plaats in opnieuw Guimarães. De vier deelnemende landen bereiden zich voor volgens hetzelfde plechtige protocol dat je op alle moderne eindtoernooien ziet. -

Effectiveness of In-Season Manager Changes in English Premier League Football

Effectiveness of in-season manager changes in English Premier League football Lucas M. Besters*, Jan C. van Ours** and Martin A. van Tuijl*** May 9, 2016 Abstract We analyze the performance effects of in-season manager changes in English Premier League (EPL) football during the seasons 2000/01 – 2014/15. We find that some managerial changes are successful, while others are counterproductive. On average, performance does not improve following a managerial replacement. The successfulness of managerial turnover depends on specific highly unpredictable circumstances, as we illustrate through case-studies. JEL-codes: J44, L83 Keywords: Professional football, manager, change, performance *Department of Economics, CentER, Tilburg University, The Netherlands; [email protected] **Department of Economics, CentER, Tilburg University, The Netherlands; Department of Economics, University of Melbourne, Parkville, Australia; IZA and CEPR; [email protected] ***Department of Economics, Tilburg University, The Netherlands, [email protected] 1 1. Introduction Football is very popular worldwide. In Europe and Latin-America, football has entertained crowds for more than one century. In other continents, interest has increased in the past decades. Top players now move to the football leagues of Australia, Japan and the United States, and, more recently, also to the league of the People’s Republic of China. Both clubs and national associations employ top-class managers from all around the globe to coach their squads. Furthermore, top clubs have an enormous global fan base. The great interest in football is not restricted to fans seeking entertainment. Professional sports, in general, and professional football, in particular, have proven to be a fruitful soil for scientific research. -

Download the App Now

THE MAGAZINE OF THE LEAGUE MANAGERS ASSOCIATION ISSUE 40 | £7.50 VALUES, DISCIPLINE, SELF-BELIEF PHIL NEVILLE, ENGLAND WOMEN’S MANAGER EXCELLENCE THROUGH INSIGHT FROM THE EDITOR As this edition hits desks and doormats, the FIFA Women’s The League Managers Association, St. George’s Park, National Football World Cup 2019 will be well underway, with Phil Neville’s Centre, Newborough Road, Needwood, Lionesses aiming not only to top their third-place finish in Burton upon Trent, DE13 9PD The views and opinions expressed 2015, but to come away victorious. by contributors are their own and not necessarily those of the League Having won the SheBelieves Cup earlier this year, the side go to France Managers Association, its members, emboldened and ready to work their socks off, but Neville knows first hand officers or employees. Reproduction there needs to be something to counter the intense pressure of tournament in whole or in part without written football. “They need to breathe, to enjoy the experience and create memories permission is strictly prohibited. that will last a lifetime,” he says. www.leaguemanagers.com Neville leads his players with understanding and empathy, but as we discover in our cover feature, he has high expectations in terms of professionalism and work ethic and never dons kid gloves. “Very early on, I explained my vision and Editor Alice Hoey values to the players,” he says. “For six-to-eight months we reinforced our [email protected] core messages every day, the standards we expected, the intensity we wanted in training, our winning mentality.” Editor for LMA Sue McKellar [email protected] Of course, a winning mindset is about more than self-belief and discipline. -

Team Checklist I Have the Complete Set 1975/76 Monty Gum Footballers 1976

Nigel's Webspace - English Football Cards 1965/66 to 1979/80 Team checklist I have the complete set 1975/76 Monty Gum Footballers 1976 Coventry City John McLaughlan Robert (Bobby) Lee Ken McNaught Malcolm Munro Coventry City Jim Pearson Dennis Rofe Jim Brogan Neil Robinson Steve Sims Willie Carr David Smallman David Tomlin Les Cartwright George Telfer Mark Wallington Chris Cattlin Joe Waters Mick Coop Ipswich Town Keith Weller John Craven Ipswich Town Steve Whitworth David Cross Kevin Beattie Alan Woollett Alan Dugdale George Burley Frank Worthington Alan Green Ian Collard Steve Yates Peter Hindley Paul Cooper James (Jimmy) Holmes Eric Gates Manchester United Tom Hutchison Allan Hunter Martin Buchan Brian King David Johnson Steve Coppell Larry Lloyd Mick Lambert Gerry Daly Graham Oakey Mick Mills Alex Forsyth Derby County Roger Osborne Jimmy Greenhoff John Peddelty Gordon Hill Derby County Brian Talbot Jim Holton Geoff Bourne Trevor Whymark Stewart Houston Roger Davies Clive Woods Tommy Jackson Archie Gemmill Steve James Charlie George Leeds United Lou Macari Kevin Hector Leeds United David McCreery Leighton James Billy Bremner Jimmy Nicholl Francis Lee Trevor Cherry Stuart Pearson Roy McFarland Allan Clarke Alex Stepney Graham Moseley Eddie Gray Anthony (Tony) Young Henry Newton Frank Gray David Nish David Harvey Middlesbrough Barry Powell Norman Hunter Middlesbrough Bruce Rioch Joe Jordan David Armstrong Rod Thomas - 3 Peter Lorimer Stuart Boam Colin Todd Paul Madeley Peter Brine Everton Duncan McKenzie Terry Cooper Gordon McQueen John Craggs Everton Paul Reaney Alan Foggon John Connolly Terry Yorath John Hickton Terry Darracott Willie Maddren Dai Davies Leicester City David Mills Martin Dobson Leicester City Robert (Bobby) Murdoch David Jones Brian Alderson Graeme Souness Roger Kenyon Steve Earle Frank Spraggon Bob Latchford Chris Garland David Lawson Len Glover Newcastle United Mick Lyons Steve Kember Newcastle United This checklist is to be provided only by Nigel's Webspace - http://cards.littleoak.com.au/. -

Advanced Information

Title information Sheffield United Greatest Games The Blades’ Fifty Finest Matches By Matt Anson Key features • Expertly chosen matches from across 126 years of Sheffield United’s history • Atmospherically presented, drawing on contemporary newspaper reports, club history books and the author’s personal memories • Each featured match includes line-ups, contextual background and overviews of star performers • Written by Matt Anson, who has followed the Blades home and away for 35 years • Photo section including action images and photographs to tie in with the text • Publicity campaign planned including radio, newspapers, websites and magazines Description Sheffield United Greatest Games offers every Blade a terrace ticket back in time. Described in atmospheric and evocative detail, here are 50 of the club’s most thrilling and glorious games of all. Founded in 1889, Sheffield United were soon among the football elite, winning the league championship and FA Cup (twice) within their first two decades. After adding another two pre-war cup wins, the second half of the 20th century saw a sad decline, with the club dropping to the fourth tier before clawing its way back to the top flight and then yo-yoing between the top three divisions in the new century. Here are tales that bring to life the exploits of the club’s greatest ever players, including Bill ‘Fatty’ Foulke, Ernest Needham, Harry Johnson, Jimmy Hagan, Tony Currie and Brian Deane – as well as managers such as John Harris, Dave Bassett and Neil Warnock. There’s action in all four divisions, unforgettable cup and play-off exploits and great derby days, from the first ever victory to the memorable 4-2 win at Hillsborough in 2017. -

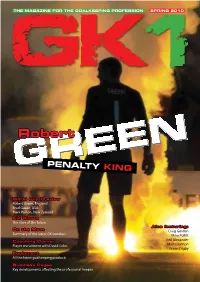

GK1 - FINAL (4).Indd 1 22/04/2010 20:16:02

THE MAGAZINE FOR THE GOALKEEPING PROFESSION SPRING 2010 Robert PENALTY KING World Cup Preview Robert Green, England Brad Guzan, USA Mark Paston, New Zealand Kid Gloves The stars of the future Also featuring: On the Move Craig Gordon Summary of the latest GK transfers Mike Pollitt Coaching Corner Neil Alexander Player recruitment with David Coles Matt Glennon Fraser Digby Equipment All the latest goalkeeping products Business Pages Key developments affecting the professional ‘keeper GK1 - FINAL (4).indd 1 22/04/2010 20:16:02 BPI_Ad_FullPageA4_v2 6/2/10 16:26 Page 1 Welcome to The magazine exclusively for the professional goalkeeping community. goalkeeper, with coaching features, With the greatest footballing show on Editor’s note equipment updates, legal and financial earth a matter of months away we speak issues affecting the professional player, a to Brad Guzan and Robert Green about the Andy Evans / Editor-in-Chief of GK1 and Director of World In Motion ltd summary of the key transfers and features potentially decisive art of saving penalties, stand out covering the uniqueness of the goalkeeper and hear the remarkable story of how one to a football team. We focus not only on the penalty save, by former Bradford City stopper from the crowd stars of today such as Robert Green and Mark Paston, secured the All Whites of New Craig Gordon, but look to the emerging Zealand a historic place in South Africa. talent (see ‘kid gloves’), the lower leagues is a magazine for the goalkeeping and equally to life once the gloves are hung profession. We actively encourage your up (featuring Fraser Digby). -

Goalden Times: December, 2011 Edition

GOALDEN TIMES 0 December, 2011 1 GOALDEN TIMES Declaration: The views and opinions expressed in this magazine are those of the authors of the respective articles and do not necessarily reflect the official policy or position of Goalden Times. All the logos and symbols of teams are the respective trademarks of the teams and national federations. The images are the sole property of the owners. However none of the materials published here can fully or partially be used without prior written permission from Goalden Times. If anyone finds any of the contents objectionable for any reasons, do reach out to us at [email protected]. We shall take necessary actions accordingly. Cover Illustration: Neena Majumdar & Srinwantu Dey Logo Design: Avik Kumar Maitra Design and Concepts: Tulika Das Website: www.goaldentimes.org Email: [email protected] Facebook: Goalden Times http://www.facebook.com/pages/GOALden-Times/160385524032953 Twitter: http://twitter.com/#!/goaldentimes December, 2011 GOALDEN TIMES 2 GT December 2011 Team P.S. Special Thanks to Tulika Das for her contribution in the Compile&Publish Process December, 2011 3 GOALDEN TIMES | Edition V | First Whistle …………5 Goalden Times is all set for the New Year Euro 2012 Group Preview …………7 Building up towards EURO 2012 in Poland-Ukraine, we review one group at a time, starting with Group A. Is the easiest group really 'easy'? ‘Glory’ – We, the Hunters …………18 The internet-based football forums treat them as pests. But does a glory hunter really have anything to be ashamed of? Hengul -

Maquetación 1

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Central Archive at the University of Reading Does managerial turnover affect football club share prices? Article Published Version Open Access Bell, A., Brooks, C. and Markham, T. (2013) Does managerial turnover affect football club share prices? Aestimatio, the IEB International Journal of Finance, 7. 02-21. ISSN 2173-0164 Available at http://centaur.reading.ac.uk/32210/ It is advisable to refer to the publisher's version if you intend to cite from the work. Publisher: Instituto de Estudios Bursátiles All outputs in CentAUR are protected by Intellectual Property Rights law, including copyright law. Copyright and IPR is retained by the creators or other copyright holders. Terms and conditions for use of this material are defined in the End User Agreement . www.reading.ac.uk/centaur CentAUR Central Archive at the University of Reading Reading's research outputs online E aestimatio, the ieb international journal of finance , 2013. 7: 02-21 L the ieb international journal of finance C © 2013 aestimatio , I T R A H C Does managerial turnover R A E S Affect Football Club Share Prices? E R Bell, Adrian R. Brooks, Chris Markham, Tom ̈ RECEIVED : 13 JANUARY 2013 ̈ ACCEPTED : 11 MARCH 2013 Abstract This paper analyses the 53 managerial sackings and resignations from 16 stock exchange listed English football clubs during the nine seasons between 2000/01 and 2008/09. The results demonstrate that, on average, a managerial sacking results in a post-announcement day market-adjusted share price rise of 0.3%, whilst a resignation leads to a drop in share price of 1% that continues for a trading month thereafter, cumulating in a negative abnormal return of over 8% from a trading day before the event. -

Treffer Oktober 2019

De Treffer klupblêd fan fuotbalferiening SDS Jiergong 50 nûmer 1 oktober 2019 Redaksje: Adres: tillefoan: Tryntsje Bouma Gabbemastraat 21, 8701EE Boalsert Metsje Huitema Tywert 4, 8731 CL Wommels 0515-333295 Willem Wijnia De Homeie 27, 8731 EC Wommels 0515-331444 Tjerk van der Pol Geins 5, 8731 CR Wommels 06-40614250 Fakatuere Fêste stikjesskriuwers; Aant, Steven, Habtamu en Kees. Ynternetredaksje: Aant Hofstra: [email protected] Willem Wijnia: [email protected] Bestjoer: tillefoan: funksje: Willem Wijnia De Homeie 27, 8731 EC Wommels 0515-331444 Foarsitter Anneke Gaastra Walperterwei 53 8731 CD Wommels 0515-332048 Skriuwer Henk Postma Stapertstrjitte 15, 8731 CA Wommels 06-51679033 Ponghâlder Tjerk van der Pol Geins 5, 8731 CR Wommels 06-40614250 Foarsitter jongerein Syb Overal Streek 30, 8734 GR Easterein 06-33030042 Wedstrydsekretaris Anco Elgersma Roordastrjitte 6, 8771 Nijland 06-39805090 Ledenadministraasje Bauke de Boer A.Joustrastrjitte 10, 8734 GJ Easterein 0515-332555 PR en Reklame Jaap Toering Perk 1, 8731 AJ Wommels 06-10695193 Sen./Technyske saken Marco Groothof Wynserdyk 43, 8734 GE Easterein 06-10562399 Terrein/Skoalleseize Jongereinkommisje: funksje: Tjerk van der Pol Foarsitter Marjo Groothof Algemien lid Lize Schuurmans Algemien lid Lourens van der Pol Algemien lid E-mailadressen: [email protected] => Willem Wijnia [email protected] => Henk Postma [email protected] => Bauke de Boer [email protected] => Syb Overal [email protected] => Anco Elgersma [email protected] => Anneke Gaastra [email protected] => Jaap Toering [email protected] => Tjerk van der Pol [email protected] => Marco Groothof Sponsor- c.q. -

Football Photos FPM01

April 2015 Issue 1 Football Photos FPM01 FPG028 £30 GEORGE GRAHAM 10X8" ARSENAL FPK018 £35 HOWARD KENDALL 6½x8½” EVERTON FPH034 £35 EMLYN HUGHES 6½x8½" LIVERPOOL FPH033 £25 FPA019 £25 GERARD HOULLIER 8x12" LIVERPOOL RON ATKINSON 12X8" MAN UTD FPF021 £60 FPC043 £60 ALEX FERGUSON BRIAN CLOUGH 8X12" MAN UTD SIGNED 6½ x 8½” Why not sign up to our regular Sports themed emails? www.buckinghamcovers.com/family Warren House, Shearway Road, Folkestone, Kent CT19 4BF FPM01 Tel 01303 278137 Fax 01303 279429 Email [email protected] Manchester United FPB002 £50 DAVID BECKHAM FPB036 NICKY BUTT 6X8” .....................................£15 8X12” MAGAZINE FPD019 ALEX DAWSON 10X8” ...............................£15 POSTER FPF009 RIO FERDINAND 5X7” MOUNTED ...............£20 FPG017A £20 HARRY GREGG 8X11” MAGAZINE PAGE FPC032 £25 JACK CROMPTON 12X8 FPF020 £25 ALEX FERGUSON & FPS003 £20 PETER SCHMEICHEL ALEX STEPNEY 8X10” 8X12” FPT012A £15 FPM003 £15 MICKY THOMAS LOU MACARI 8X10” MAN UTD 8X10” OR 8X12” FPJ001 JOEY JONES (LIVERPOOL) & JIMMY GREENHOFF (MAN UNITED) 8X12” .....£20 FPM002 GORDON MCQUEEN 10X8” MAN UTD ..£20 FPD009 £25 FPO005 JOHN O’SHEA 8X10” MAGAZINE PAGE ...£5 TOMMY DOCHERTY FPV007A RUUD VAN NISTELROOY 8X12” 8X10” MAN UNITED PSV EINDHOVEN ..............................£25 West Ham FPB038A TREVOR BROOKING 12X8 WEST HAM . £20 FPM042A ALVIN MARTIN 8X10” WEST HAM ...... £10 FPC033 ALAN CURBISHLEY 8X10 WEST HAM ... £10 FPN014A MARK NOBLE 8X12” WEST HAM ......... £15 FPD003 JULIAN DICKS 8X10” WEST HAM ........ £15 FPP006 GEOFF PIKE 8X10” WEST HAM ........... £10 FPD012 GUY DEMEL 8X12” WEST HAM UTD..... £15 FPP009 GEORGE PARRIS 8X10” WEST HAM .. £7.50 FPD015 MOHAMMED DIAME 8X12” WEST HAM £10 FPP012 PHIL PARKES 8X10” WEST HAM ........