Uscc 2016 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Competitiveness Analysis of China's Main Coastal Ports

2019 International Conference on Economic Development and Management Science (EDMS 2019) Competitiveness analysis of China's main coastal ports Yu Zhua, * School of Economics and Management, Nanjing University of Science and Technology, Nanjing 210000, China; [email protected] *Corresponding author Keywords: China coastal ports above a certain size, competitive power analysis, factor analysis, cluster analysis Abstract: As a big trading power, China's main mode of transportation of international trade goods is sea transportation. Ports play an important role in China's economic development. Therefore, improving the competitiveness of coastal ports is an urgent problem facing the society at present. This paper selects 12 relevant indexes to establish a relatively comprehensive evaluation index system, and uses factor analysis and cluster analysis to evaluate and rank the competitiveness of China's 30 major coastal ports. 1. Introduction Port is the gathering point and hub of water and land transportation, the distribution center of import and export of industrial and agricultural products and foreign trade products, and the important node of logistics. With the continuous innovation of transportation mode and the rapid development of science and technology, ports play an increasingly important role in driving the economy, with increasingly rich functions and more important status and role. Meanwhile, the competition among ports is also increasingly fierce. In recent years, with the rapid development of China's economy and the promotion of "the Belt and Road Initiative", China's coastal ports have also been greatly developed. China has more than 18,000 kilometers of coastline, with superior natural conditions. With the introduction of the policy of reformation and opening, the human conditions are also excellent. -

Post Event Report

presents 9th Asian Investment Summit Building better portfolios 21-22 May 2014, Ritz-Carlton, Hong Kong Post Event Report 310 delegates representing 190 companies across 18 countries www.AsianInvestmentSummit.com Thank You to our sponsors & partners AIWEEK Marquee Sponsors Co-Sponsors Associate Sponsors Workshop Sponsor Supporting Organisations alternative assets. intelligent data. Tech Handset Provider Education Partner Analytics Partner ® Media Partners Offical Broadcast Partner 1 www.AsianInvestmentSummit.com Delegate Breakdown 310 delegates representing 190 companies across 18 countries Breakdown by Organisation Institutional Investors 46% Haymarket Financial Media delegate attendee data is Asset Managemer 19% independently verified by the BPA Consultant 8% Fund Distributor / Private Wealth Management 5% Media & Publishing 4% Commercial Bank 4% Index / Trading Platform Provider 3% Association 2% Other 9% Breakdown of Institutional Investors Insurance 31% Endowment / Foundation 27% Corporation 13% Pension Fund 13% Family Office 8% Breakdown by Country Sovereign Wealth Fund 6% PE Funds of Funds 1% Mulitlateral Finance Hong Kong 82% Institution 1% ASEAN 10% North Asia 5% Australia 1% Europe 1% North America 1% Breakdown by Job Function Investment 34% Finance / Treasury 20% Marketing and Investor Relations 19% Other 11% CEO / Managing Director 7% Fund Selection / Distribution 7% Strategist / Economist 2% 2 www.AsianInvestmentSummit.com Participating Companies Haymarket Financial Media delegate attendee data is independently verified by the BPA 310 institutonal investors, asset managers, corporates, bankers and advisors attended the Forum. Attending companies included: ACE Life Insurance CFA Institute Board of Governors ACMI China Automation Group Limited Ageas China BOCOM Insurance Co., Ltd. Ageas Hong Kong China Construction Bank Head Office Ageas Insurance Company (Asia) Limited China Life Insurance AIA Chinese YMCA of Hong Kong AIA Group CIC AIA International Limited CIC International (HK) AIA Pension and Trustee Co. -

Allianz Se Allianz Finance Ii B.V. Allianz

2nd Supplement pursuant to Art. 16(1) of Directive 2003/71/EC, as amended (the "Prospectus Directive") and Art. 13 (1) of the Luxembourg Act (the "Luxembourg Act") relating to prospectuses for securities (loi relative aux prospectus pour valeurs mobilières) dated 12 August 2016 (the "Supplement") to the Base Prospectus dated 2 May 2016, as supplemented by the 1st Supplement dated 24 May 2016 (the "Prospectus") with respect to ALLIANZ SE (incorporated as a European Company (Societas Europaea – SE) in Munich, Germany) ALLIANZ FINANCE II B.V. (incorporated with limited liability in Amsterdam, The Netherlands) ALLIANZ FINANCE III B.V. (incorporated with limited liability in Amsterdam, The Netherlands) € 25,000,000,000 Debt Issuance Programme guaranteed by ALLIANZ SE This Supplement has been approved by the Commission de Surveillance du Secteur Financier (the "CSSF") of the Grand Duchy of Luxembourg in its capacity as competent authority (the "Competent Authority") under the Luxembourg Act for the purposes of the Prospectus Directive. The Issuer may request the CSSF in its capacity as competent authority under the Luxemburg Act to provide competent authorities in host Member States within the European Economic Area with a certificate of approval attesting that the Supplement has been drawn up in accordance with the Luxembourg Act which implements the Prospectus Directive into Luxembourg law ("Notification"). Right to withdraw In accordance with Article 13 paragraph 2 of the Luxembourg Act, investors who have already agreed to purchase or subscribe for the securities before the Supplement is published have the right, exercisable within two working days after the publication of this Supplement, to withdraw their acceptances, provided that the new factor arose before the final closing of the offer to the public and the delivery of the securities. -

In Pueblo's Wake

IN PUEBLO’S WAKE: FLAWED LEADERSHIP AND THE ROLE OF JUCHE IN THE CAPTURE OF THE USS PUEBLO by JAMES A. DUERMEYER Presented to the Faculty of the Graduate School of The University of Texas at Arlington in Partial Fulfillment of the Requirements for the Degree of MASTER OF ARTS IN U.S. HISTORY THE UNIVERSITY OF TEXAS AT ARLINGTON December 2016 Copyright © by James Duermeyer 2016 All Rights Reserved Acknowledgements My sincere thanks to my professor and friend, Dr. Joyce Goldberg, who has guided me in my search for the detailed and obscure facts that make a thesis more interesting to read and scholarly in content. Her advice has helped me to dig just a bit deeper than my original ideas and produce a more professional paper. Thank you, Dr. Goldberg. I also wish to thank my wife, Janet, for her patience, her editing, and sage advice. She has always been extremely supportive in my quest for the masters degree and was my source of encouragement through three years of study. Thank you, Janet. October 21, 2016 ii Abstract IN PUEBLO’S WAKE: FLAWED LEADERSHIP AND THE ROLE OF JUCHE IN THE CAPTURE OF THE USS PUEBLO James Duermeyer, MA, U.S. History The University of Texas at Arlington, 2016 Supervising Professor: Joyce Goldberg On January 23, 1968, North Korea attacked and seized an American Navy spy ship, the USS Pueblo. In the process, one American sailor was mortally wounded and another ten crew members were injured, including the ship’s commanding officer. The crew was held for eleven months in a North Korea prison. -

Journal of Current Chinese Affairs

3/2006 Data Supplement PR China Hong Kong SAR Macau SAR Taiwan CHINA aktuell Journal of Current Chinese Affairs Data Supplement People’s Republic of China, Hong Kong SAR, Macau SAR, Taiwan ISSN 0943-7533 All information given here is derived from generally accessible sources. Publisher/Distributor: Institute of Asian Affairs Rothenbaumchaussee 32 20148 Hamburg Germany Phone: (0 40) 42 88 74-0 Fax:(040)4107945 Contributors: Uwe Kotzel Dr. Liu Jen-Kai Christine Reinking Dr. Günter Schucher Dr. Margot Schüller Contents The Main National Leadership of the PRC LIU JEN-KAI 3 The Main Provincial Leadership of the PRC LIU JEN-KAI 22 Data on Changes in PRC Main Leadership LIU JEN-KAI 27 PRC Agreements with Foreign Countries LIU JEN-KAI 30 PRC Laws and Regulations LIU JEN-KAI 34 Hong Kong SAR Political Data LIU JEN-KAI 36 Macau SAR Political Data LIU JEN-KAI 39 Taiwan Political Data LIU JEN-KAI 41 Bibliography of Articles on the PRC, Hong Kong SAR, Macau SAR, and on Taiwan UWE KOTZEL / LIU JEN-KAI / CHRISTINE REINKING / GÜNTER SCHUCHER 43 CHINA aktuell Data Supplement - 3 - 3/2006 Dep.Dir.: CHINESE COMMUNIST Li Jianhua 03/07 PARTY Li Zhiyong 05/07 The Main National Ouyang Song 05/08 Shen Yueyue (f) CCa 03/01 Leadership of the Sun Xiaoqun 00/08 Wang Dongming 02/10 CCP CC General Secretary Zhang Bolin (exec.) 98/03 PRC Hu Jintao 02/11 Zhao Hongzhu (exec.) 00/10 Zhao Zongnai 00/10 Liu Jen-Kai POLITBURO Sec.-Gen.: Li Zhiyong 01/03 Standing Committee Members Propaganda (Publicity) Department Hu Jintao 92/10 Dir.: Liu Yunshan PBm CCSm 02/10 Huang Ju 02/11 -

Women's Development in Guangdong; Unequal Opportunities and Limited Development in a Market Economy

City University of New York (CUNY) CUNY Academic Works Dissertations and Theses City College of New York 2012 Women's Development in Guangdong; Unequal Opportunities and Limited Development in a Market Economy Ying Hua Yue CUNY City College How does access to this work benefit ou?y Let us know! More information about this work at: https://academicworks.cuny.edu/cc_etds_theses/169 Discover additional works at: https://academicworks.cuny.edu This work is made publicly available by the City University of New York (CUNY). Contact: [email protected] Running head: WOMEN’S DEVELOPMENT IN GUANGDONG 1 Women’s Development in Guangdong: Unequal Opportunities and Limited Development in a Market Economy Yinghua Yue The City College of New York In Partial Fulfillment of the Requirements for the Degree of Master of Arts in Sociology Fall 2012 WOMEN’ S DEVELOPMENT IN GUANGDONG 2 ABSTRACT In the context of China’s three-decade market-oriented economic reform, in which economic development has long been prioritized, women’s development, as one of the social undertakings peripheral to economic development, has relatively lagged behind. This research is an attempt to unfold the current situation of women’s development within such context by studying the case of Guangdong -- the province as forerunner of China’s economic reform and opening-up -- drawing on current primary resources. First, this study reveals mixed results for women’s development in Guangdong: achievements have been made in education, employment and political participation in terms of “rates” and “numbers,” and small “breakthroughs” have taken place in legislation and women’s awareness of their equal rights and interests; however, limitations and challenges, like disparities between different women groups in addition to gender disparity, continue to exist. -

Hebdomadario De La Política Taiwanesa

HEBDOMADARIO DE LA POLÍTICA TAIWANESA Nº 13/2013 * Semana del 25 de Noviembre al 1 de Diciembre [email protected] 1) Informe 2) Observaciones de contexto 3) Datos relevantes 4) Nombres relevantes 1. Informe El anuncio de China continental del establecimiento de una Zona de Identificación de Defensa Aérea en el Mar de China Oriental, que incluye en su perímetro a las deshabitadas Diaoyutai, también provocó revuelo en Taiwán. Taipei, que calificó la decisión de “lamentable”, reunió a su Consejo de Seguridad Nacional y estableció contacto con EEUU y Japón, significando que ni sus reclamos de soberanía ni la leve superposición de esta nueva zona con la propia de la República de China motivarían cambios en la delimitación de su propia área. Por su parte, Beijing hizo saber que la citada zona concuerda “con los intereses de ambos lados del Estrecho”. A la pregunta de si Taiwán la aceptaría o no, el gobierno no ha respondido de manera definitiva pero 1 las aerolíneas han empezado a entregar sus planes de vuelo a China continental (al igual que Singapur o Filipinas y, unos días después, Corea del Sur y EEUU, por el momento) argumentando razones de seguridad. Taipei, señaló que la decisión, que en ningún caso fue objeto de consulta previa, no es favorable para el positivo desarrollo de las relaciones a través del Estrecho y así se lo hará saber al continente “a través de los canales adecuados”. La oposición acusó al gobierno de respuesta “muy débil” ante tal violación de la soberanía taiwanesa. Los diputados del PDP y la UST ocuparon el estrado de la presidencia del Yuan legislativo para protestar, exigiendo medidas enérgicas. -

Uchicago April Overnight

THURSDAY AND FRIDAY OVERVIEW (CONT’D) THURSDAY, APRIL 6 (CONT’D) FRIDAY OVERVIEW UCIE: ENTREPRENEURSHIP LUGGAGE DROP-OFF 8:30 a.m. LIBRARY, LUNCH Jerry Huang, Senior Program Director of Drop off your luggage with our staff, and we’ll UChicago Careers in Entrepreneurship, will ROCKEFELLER – IDA NOYES Boxed lunches will be provided to all guests THIRD FLOOR 12:30 p.m. MEMORIAL 2:00 p.m. take care of it for you during the program. Please HALL 11:30 a.m. between 11:30 a.m. and 2:30 p.m. in the three THEATER, lead a panel of students who have started their CHAPEL retrieve all luggage no later than 2:00 p.m. – WEST LOUNGE, 2:30 p.m. locations available. You may go to any of these OR EAST LOUNGE, own businesses with the help of our Career areas located on the second and third floors of IDA NOYES HALL Advancement office. Ida Noyes Hall. (Thursday only.) SCHEDULE OF EVENTS: FRIDAY, APRIL 7 MODEL CLASS: ASTROPHYSICS MAX P. Richard Kron is a Professor of Astronomy and CINEMA, ECONOMICS INFORMATION SESSION Astrophysics and the College, and is the former IDA NOYES HALL Grace Tsiang, Senior Lecturer and Co-Director of Director of the Yerkes Observatory. STUDENTS MEET OVERNIGHT HOSTS Undergraduate Studies in Economics, will give ROCKEFELLER 9:30 a.m. MEMORIAL All students staying overnight must attend MAX P. CINEMA, 4:15 p.m. an overview of academic resources and research CHAPEL this session. Please note: This session is for IDA NOYES HALL opportunities in our incomparable economics students only. -

The Pueblo Incident

The Pueblo Incident Held hostage for 11 months, this Navy crew was freed two days before Christmas One of Pueblo's crew (left) checks in after crossing the Bridge of No Return at the Korean Demilitarized Zone, on Dec. 23, 1968, following his release by the North Korean government. He is wearing clothing provided by the North Koreans. The Pueblo (AGER-2) and her crew had been captured off Wonsan on January 23, 1968. Note North Korean troops in the background. (Navy) On the afternoon of Jan. 23, 1968, an emergency message reached the aircraft carrier Enterprise from the Navy vessel Pueblo, operating in the Sea of Japan. A North Korean ship, the message reported, was harassing Pueblo and had ordered it to heave to or be fired upon. A second message soon announced that North Korean vessels had surrounded Pueblo, and one was trying to put an armed party aboard the American ship. By then it was clear something was seriously amiss, but Enterprise, which was operating 500 miles south of Wonsan, North Korea, was unsure how to respond. “Number one,” recalled Enterprise commanding officer Kent Lee, “we didn’t know that there was such a ship as Pueblo.…By the time we waited for clarification on the message, and by the time we found out that Pueblo was a U.S. Navy ship…it was too late to launch.” This confusion was replicated elsewhere. Messages had started to flood the nation’s capital as well, but with similar results. Inside the White House Situation Room, watch officer Andrew Denner quickly recognized the gravity of the incident and started making calls but could obtain little information. -

2012 Annual Report

CENTER IN BEIJING 2011 –2012 ANNUAL REPORT 芝加哥大学北京中心 年度报告 7090_3C_BeijingAR_r1.indd 1 9/26/12 11:13 AM ABOUT THE CENTER 中心简介 Established in 2010, the University of Chicago Center in Beijing provides a physical presence that enhances and strengthens the University’s traditionally strong ties to Chinese thought and culture. Building on more than a century of collaboration 芝加哥大学北京中心创办于2010年。中心的成立巩 between scholars from UChicago and China, 固和加强了芝加哥大学与中国思想界和文化界之间 the Center in Beijing enables the University to expand existing activities and form new 由来已久的紧密联系。 alliances and partnerships with universities, medical centers, businesses, policy groups, government agencies, and cultural organiza- 芝大学者与中国同行之间的合作已逾百年。在此基 tions in China. The 23,000-square-foot center 础上创办的北京中心使芝大得以拓展现有活动项 is located in the Haidian District of Beijing, known for its top universities, research 目,与中国高校、企业、医学机构、政策团体、政 academies, and government agencies. 府部门和文化组织结成新的联盟和伙伴关系。芝大 Focusing on three core areas where University 北京中心总面积2100平方米,位于名校云集、科研 of Chicago scholarship and the concerns of 院所林立、政府机构众多的北京市海淀区。 contemporary China intersect—business, economics, and policy; science, medicine, and public health; culture, society, and the 芝大北京中心专注于三大核心领域:商业、经济和 arts—the center capitalizes on a substantial body of work already under way, including 政策;科学、医学和公共卫生;文化、社会和艺 faculty research and programs for students. 术。这些领域是我校学术研究与当代中国热点领域 A base for University of Chicago faculty, 之间存在的交集。中心成立之前,芝大已经在这些 graduate students, and undergraduates 领域开展了不少教师科研和学生项目,这些项目为 working in China, the center houses the University’s East Asian Civilizations Program 中心的发展奠定了基础。 for undergraduate students, an intensive language training program, and the Beijing Social Sciences Program. It supports 作为芝加哥大学教师、研究生和本科生在中国学习 research and study at all levels from each 与工作的基地,芝大北京中心为本科生开设了“东 of the University’s divisions and schools, as well as the College. -

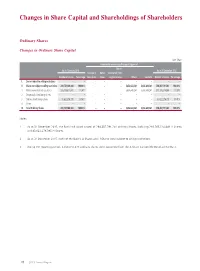

Changes in Share Capital and Shareholdings of Shareholders

Changes in Share Capital and Shareholdings of Shareholders Ordinary Shares Changes in Ordinary Share Capital Unit: Share Increase/decrease during the reporting period Shares As at 1 January 2015 As at 31 December 2015 Issuance of Bonus transferred from Number of shares Percentage new shares shares surplus reserve Others Sub-total Number of shares Percentage I. Shares subject to selling restrictions – – – – – – – – – II. Shares not subject to selling restrictions 288,731,148,000 100.00% – – – 5,656,643,241 5,656,643,241 294,387,791,241 100.00% 1. RMB-denominated ordinary shares 205,108,871,605 71.04% – – – 5,656,643,241 5,656,643,241 210,765,514,846 71.59% 2. Domestically listed foreign shares – – – – – – – – – 3. Overseas listed foreign shares 83,622,276,395 28.96% – – – – – 83,622,276,395 28.41% 4. Others – – – – – – – – – III. Total Ordinary Shares 288,731,148,000 100.00% – – – 5,656,643,241 5,656,643,241 294,387,791,241 100.00% Notes: 1 As at 31 December 2015, the Bank had issued a total of 294,387,791,241 ordinary shares, including 210,765,514,846 A Shares and 83,622,276,395 H Shares. 2 As at 31 December 2015, none of the Bank’s A Shares and H Shares were subject to selling restrictions. 3 During the reporting period, 5,656,643,241 ordinary shares were converted from the A-Share Convertible Bonds of the Bank. 79 2015 Annual Report Changes in Share Capital and Shareholdings of Shareholders Number of Ordinary Shareholders and Shareholdings Number of ordinary shareholders as at 31 December 2015: 963,786 (including 761,073 A-Share Holders and 202,713 H-Share Holders) Number of ordinary shareholders as at the end of the last month before the disclosure of this report: 992,136 (including 789,535 A-Share Holders and 202,601 H-Share Holders) Top ten ordinary shareholders as at 31 December 2015: Unit: Share Number of Changes shares held as Percentage Number of Number of during at the end of of total shares subject shares Type of the reporting the reporting ordinary to selling pledged ordinary No. -

Mizuho China Business Express Economic Journal (No

July 19, 2016 Mizuho Bank (China), Ltd. Corporate Banking Coordination Division ―The macroeconomy― Mizuho China Business Express Economic Journal (No. 58) Summary China’s real GDP (gross domestic product) grew by 6.7% y-o-y in April–June, the same level as January–March. June’s economic indicators were mixed, with some up slightly and some down slightly on May. If moves to eliminate overcapacity and other structural reforms accelerate from the 2H onwards, this will place more downward pressure on the economy. The question is whether China will be able to promote structural reform while maintaining jobs and growth. 1. June’s economic indicators deteriorated slightly on the whole ・ Growth hit +6.7% in April–June too ・ Investment fell slightly ・ Retail sales of consumer goods accelerated slightly ・ Property prices continued to grow at a slower pace in first-tier cities ・ Exports and imports both fell ・ The CPI growth rate slowed, mainly due to stable vegetable prices ・ There was a net increase in new loans, with total social financing also increasing 2. Movement on the employment and earnings environment and to eliminate overcapacity ・ ‘China faces challenges in maintaining household income growth’ (National Bureau of Statistics) ・ ‘Strict penalties will be applied for failure to reach targets for eliminating overcapacity’ (National Development and Reform Commission) - 1 - 1. June’s economic indicators deteriorated slightly on the whole ・Growth hit +6.7% in April–June too On July 15, the National Bureau of Statistics announced that China’s real GDP (gross domestic product) had grown by 6.7% on the same period last year (all figures from here on refer to ‘same-period previous-year’ growth unless otherwise specified) in both January–June and April–June1.