Copertina Action Plan 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Group Q1 2015 Revenues

Q1 15 Results Save Group Venice, May 15th 2015 1 Table of contents Section 1 Group overview Section 2 Appendix 2 SECTION 1 GROUP OVERVIEW 3 Q1 15 Revenues up, +7,1% YoY, EBITDA up, + 19,8% YoY • Q1 2015 Revenues: : revenues increase € million Q1 2015 Q1 2014 YoY % by 7,1% (or +c.€2,0m) thanks to i) increase of aviation revenues (+6,5% YoY Revenues 30,1 28,1 7,1% or +€1,2m) mainly driven by new tariffs and increase in pax, ii) increase of non EBITDA 8,7 7,3 19,8% aviation revenues in line with pax EBIT 4,1 3,5 20,0% increase (+5,4% YoY or +€0,5m) mainly Gross Profit of the period 2,3 2,7 -13,6% driven by parking (+7,2% YoY) and commercial revenues (+5,3% YoY) and iii) increase of other revenues (+22,2% YoY or +€0,4m), which include internal activities linked to investment plan and recharges. • Q1 2015 EBITDA: the margin shows an EBITDA margin EBIT margin increase by +19,8% (or +c€1,4m) driven by revenues and the better absorption of operating costs, which increased about + €0,5m YoY. The costs increase is primarily referred to higher labour costs (+€0,4m) due to strengthening of security and of Treviso airport operating staff. EBITDA on Revenues rises from 25,9% to 29%. 4 Dynamic trend in traffic (1/2) SYSTEM Q1 2015 % YoY Q1 2014 PAX 2.002.197 5,0% 1.906.942 MOV 19.317 2,1% 18.918 MTOW 1.246.731 2,8% 1.213.262 CARGO (tons) 11.220 14,8% 9.775 2011 - 2014 Trends in VCE and VCE Airport 2013-2015 Trends in VCE, TSF and Italy traffic system traffic vs Italy (as of Dec 2014) 5 Dynamic trend in traffic (2/2) In the last 5 years Venice Airport has outperformed the Italian market CAGR +6% vce airport growth (Mpax) 8,2 8,4 8,5 6,85 7,3 2010 2011 2012 2013 2014 Italian Market 139,8 148,8 146,9 144,1 150,5 (Mpax) CAGR +2% 6 Group Q1 2015 EBITDA • Q1 2015 EBITDA: EBITDA increase by 19,8% (or +€1,4m) thanks to i) increase of aviation revenues (+6,5% YoY or +€1,2m) mainly driven by new tariffs and increase in passengers, ii) increase of non aviation revenues (+5,4% YoY or +€0,5m) mainly driven by commercial revenues (+5,3% YoY or + c. -

Attachment F – Participants in the Agreement

Revenue Accounting Manual B16 ATTACHMENT F – PARTICIPANTS IN THE AGREEMENT 1. TABULATION OF PARTICIPANTS 0B 475 BLUE AIR AIRLINE MANAGEMENT SOLUTIONS S.R.L. 1A A79 AMADEUS IT GROUP SA 1B A76 SABRE ASIA PACIFIC PTE. LTD. 1G A73 Travelport International Operations Limited 1S A01 SABRE INC. 2D 54 EASTERN AIRLINES, LLC 2I 156 STAR UP S.A. 2I 681 21 AIR LLC 2J 226 AIR BURKINA 2K 547 AEROLINEAS GALAPAGOS S.A. AEROGAL 2T 212 TIMBIS AIR SERVICES 2V 554 AMTRAK 3B 383 Transportes Interilhas de Cabo Verde, Sociedade Unipessoal, SA 3E 122 MULTI-AERO, INC. DBA AIR CHOICE ONE 3J 535 Jubba Airways Limited 3K 375 JETSTAR ASIA AIRWAYS PTE LTD 3L 049 AIR ARABIA ABDU DHABI 3M 449 SILVER AIRWAYS CORP. 3S 875 CAIRE DBA AIR ANTILLES EXPRESS 3U 876 SICHUAN AIRLINES CO. LTD. 3V 756 TNT AIRWAYS S.A. 3X 435 PREMIER TRANS AIRE INC. 4B 184 BOUTIQUE AIR, INC. 4C 035 AEROVIAS DE INTEGRACION REGIONAL 4L 174 LINEAS AEREAS SURAMERICANAS S.A. 4M 469 LAN ARGENTINA S.A. 4N 287 AIR NORTH CHARTER AND TRAINING LTD. 4O 837 ABC AEROLINEAS S.A. DE C.V. 4S 644 SOLAR CARGO, C.A. 4U 051 GERMANWINGS GMBH 4X 805 MERCURY AIR CARGO, INC. 4Z 749 SA AIRLINK 5C 700 C.A.L. CARGO AIRLINES LTD. 5J 203 CEBU PACIFIC AIR 5N 316 JOINT-STOCK COMPANY NORDAVIA - REGIONAL AIRLINES 5O 558 ASL AIRLINES FRANCE 5T 518 CANADIAN NORTH INC. 5U 911 TRANSPORTES AEREOS GUATEMALTECOS S.A. 5X 406 UPS 5Y 369 ATLAS AIR, INC. 50 Standard Agreement For SIS Participation – B16 5Z 225 CEMAIR (PTY) LTD. -

Regulamento (Ue) N

11.2.2012 PT Jornal Oficial da União Europeia L 39/1 II (Atos não legislativos) REGULAMENTOS o REGULAMENTO (UE) N. 100/2012 DA COMISSÃO de 3 de fevereiro de 2012 o que altera o Regulamento (CE) n. 748/2009, relativo à lista de operadores de aeronaves que realizaram uma das atividades de aviação enumeradas no anexo I da Diretiva 2003/87/CE em ou após 1 de janeiro de 2006, inclusive, com indicação do Estado-Membro responsável em relação a cada operador de aeronave, tendo igualmente em conta a expansão do regime de comércio de licenças de emissão da União aos países EEE-EFTA (Texto relevante para efeitos do EEE) A COMISSÃO EUROPEIA, 2003/87/CE e é independente da inclusão na lista de operadores de aeronaves estabelecida pela Comissão por o o força do artigo 18. -A, n. 3, da diretiva. Tendo em conta o Tratado sobre o Funcionamento da União Europeia, (5) A Diretiva 2008/101/CE foi incorporada no Acordo so bre o Espaço Económico Europeu pela Decisão o Tendo em conta a Diretiva 2003/87/CE do Parlamento Europeu n. 6/2011 do Comité Misto do EEE, de 1 de abril de e do Conselho, de 13 de Outubro de 2003, relativa à criação de 2011, que altera o anexo XX (Ambiente) do Acordo um regime de comércio de licenças de emissão de gases com EEE ( 4). efeito de estufa na Comunidade e que altera a Diretiva 96/61/CE o o do Conselho ( 1), nomeadamente o artigo 18. -A, n. 3, alínea a), (6) A extensão das disposições do regime de comércio de licenças de emissão da União, no setor da aviação, aos Considerando o seguinte: países EEE-EFTA implica que os critérios fixados nos o o termos do artigo 18. -

Unione Degli Industriali E Delle Imprese

Evento - 15/05/2014 The next challenges for the airline industry How to face the economic crisis with a focus on passenger rights' protection - Appuntamento alle ore 9.00 presso LUISS Business School - Viale Pola 12, Roma - Aula Magna Mario Arcelli 9.00 Registration/ Arrival of participants 9.30 – 10.00 Welcome and Introductions 10.00 – 11.15 Panel I – Airline industry crisis, the role of regulators Mr. Giacomo Aiello, Chief of Cabinet, Italian Ministry of Transport, Rome Mr. Alessio Quaranta, General Director, Italian Civil Aviation Authority, Rome Mr. Massimo Garbini, Sole Director of the Italian Air Traffic Controller, Rome* Mr. Giovanni Pitruzzella, President, Antitrust Authority, Rome* Mr. Andrea Camanzi, Commissioner, Authority Public Procurement, Turin* Regulators will discuss openly about their respective role and the challenges in the era of air industry crisis 11.15 – 11.45 Coffee break 11.45 – 13.00 Panel II – Consequences of airline insolvency and remedies Prof. Laura Pierallini, LUISS University and Studio Pierallini, Rome Prof. Pablo Mendes de Leon, Director, IIASL, University of Leiden, Leiden Mr. Mark Bisset, Partner, Clyde & Co LLP, London Mr. David Kendrick, Head, Airline Licensing & Consumer Issues, UK Civil Aviation Authority, London A focus on issues involving: aircraft repossession, recovery of credits and granting of temporary air carrier licenses 13.00 – 14.30 Light lunch 14.30 – 15.45 Panel III – Prospected revision of regulation 261/2004 Mr. Jean-Louis Colson, European Commission, DG MOVE, Head of Unit Passengers’ Rights, Brussels Mr. Nikolai Ehlers, Partner, Ehlers, Ehlers & Partners, Munich Mr. Alan Meneghetti, Partner, Locke Lord LLP, London Ms. Sorana Pop, Vice president Team Aviation Solution, Bucharest Mr. -

Terme Euganee Conference Hall

How to join us in TERME EUGANEE/Montegrotto Terme Hotel Augustus - Terme Euganee Conference Hall Viale Stazione 150 - 35136 Montegrotto Terme (Padova), Italy Tel +39 049 793 200 - Fax +39 049 793518 E-mail: [email protected] http://www.hotelaugustus.com/english/pages/hotel_augustus.php The HOTEL AUGUSTUS stands on a low hill at walking distance (100 m) from the Rail Station: “Terme Euganee” in Montegrotto Terme. We suggest that you arrives in Terme Euganee (Padua, Italy) the late morning/afternoon of Wednesday April 13, 2016 to Hotel AUGUSTUS (see PROGRAM), spending evening and nights in the Hotel. Dinner is included in the “Registration & 3-Days Full-Board Package”. The next day, Thursday April 14 will be spent to follow the Sessions of the First Padua Muscle Day in the “Terme Euganee Conference Hall” of Hotel AUGUSTUS (see PROGRAM). The day after, Friday April 15, 2016, please, be ready at 8.00 a.m. to be transferred by a complementary Bus to “Villa dei Vescovi”, Luvigliano di Torreglia, an historical Villa Veneta, where the Meeting will start at 9.00 a.m. with the Opening Ceremony and the Lecture of the Interdepartmental Research Center of Myology (CIR-Myo). In the afternoon, the Sessions of the Workshop Interreg IVa “Mobility in elderly” will be held in the Villa dei Vescovi up to 7.00 p.m. when a complimentary Bus will take all us to Terme Euganee for the dinner at Hotel Augustus. The Conference will continue Saturday April 16 in the Hotel AUGUSTUS “Terme Euganee Conference Hall” with the Sessions of the Workshop “Functional Rejuvenation in Aging”, and “ES in Neuromuscular Disorders”. -

DHL and Leipzig Now Lead ATM Stats 3 European Airline Operations in April According to Eurocontrol

Issue 56 Monday 20 April 2020 www.anker-report.com Contents C-19 wipes out 95% of April air traffic; 1 C-19 wipes out 95% of April air traffic; DHL and Leipzig now lead movements statistics in Europe. DHL and Leipzig now lead ATM stats 3 European airline operations in April according to Eurocontrol. The coronavirus pandemic has managed in the space of a According to the airline’s website, Avinor has temporarily month to reduce European air passenger travel from roughly its closed nine Norwegian airports to commercial traffic and 4 Alitalia rescued (yet again) by Italian normal level (at the beginning of March) to being virtually non- Widerøe has identified alternatives for all of them, with bus government; most international existent (at the end of March). Aircraft movement figures from transport provided to get the passengers to their required routes from Rome face intense Eurocontrol show the rapid decrease in operations during the destination. competition; dominant at Milan LIN. month. By the end of the month, flights were down around Ryanair still connecting Ireland and the UK 5 Round-up of over 300 new routes 90%, but many of those still operating were either pure cargo flights (from the likes of DHL and FedEx), or all-cargo flights Ryanair’s current operating network comprises 13 routes from from over 60 airlines that were being operated by scheduled airlines. Ireland, eight of which are to the UK (from Dublin to supposed to have launched during Birmingham, Bristol, Edinburgh, Glasgow, London LGW, London the last five weeks involving Leipzig/Halle is now Europe’s busiest airport STN and Manchester as well as Cork to London STN). -

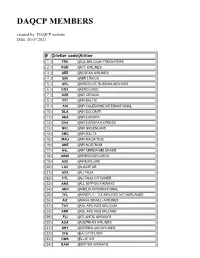

DAQCP MEMBERS Created By: DAQCP Website Date: 20.07.2021

DAQCP MEMBERS created by: DAQCP website Date: 20.07.2021 # 3-letter code Airline 1 FRH ACE BELGIUM FREIGHTERS 2 RUN ACT AIRLINES 3 AEE AEGEAN AIRLINES 4 EIN AER LINGUS 5 AFL AEROFLOT RUSSIAN AIRLINES 6 BOX AEROLOGIC 7 KZR AIR ASTANA 8 BTI AIR BALTIC 9 ACI AIR CALEDONIE INTERNATIONAL 10 DLA AIR DOLOMITI 11 AEA AIR EUROPA 12 OVA AIR EUROPA EXPRESS 13 GRL AIR GREENLAND 14 AMC AIR MALTA 15 MAU AIR MAURITIUS 16 ANE AIR NOSTRUM 17 ASL AIR SERBIA BELGRADE 18 ABW AIRBRIDGECARGO 19 AXE AIREXPLORE 20 LAV ALBASTAR 21 AZA ALITALIA 22 CYL ALITALIA CITYLINER 23 ANA ALL NIPPON AIRWAYS 24 AEH AMELIA INTERNATIONAL 25 TFL ARKEFLY - TUI AIRLINES NETHERLANDS 26 AIZ ARKIA ISRAELI AIRLINES 27 TAY ASL AIRLINES BELGIUM 28 ABR ASL AIRLINES IRELAND 29 FLI ATLANTIC AIRWAYS 30 AUA AUSTRIAN AIRLINES 31 AHY AZERBAIJAN AIRLINES 32 CFE BA CITYFLYER 33 BMS BLUE AIR 34 BAW BRITISH AIRWAYS 35 BEL BRUSSELS AIRLINES 36 GNE BUSINESS AVIATION SERVICES GUERNSEY LTD 37 CLU CARGOLOGICAIR 38 CLX CARGOLUX AIRLINES INTERNATIONAL S.A 39 ICV CARGOLUX ITALIA 40 CEB CEBU PACIFIC 41 BCY CITYJET 42 CFG CONDOR FLUGDIENST GMBH 43 CTN CROATIA AIRLINES 44 CSA CZECH AIRLINES 45 DLH DEUTSCHE LUFTHANSA 46 DHK DHL AIR LTD. 47 EZE EASTERN AIRWAYS 48 EJU EASYJET EUROPE 49 EZS EASYJET SWITZERLAND 50 EZY EASYJET UK 51 EDW EDELWEISS AIR 52 ELY EL AL 53 UAE EMIRATES 54 ETH ETHIOPIAN AIRLINES 55 ETD ETIHAD AIRWAYS 56 MMZ EUROATLANTIC 57 BCS EUROPEAN AIR TRANSPORT 58 EWG EUROWINGS 59 OCN EUROWINGS DISCOVER 60 EWE EUROWINGS EUROPE 61 EVE EVELOP AIRLINES 62 FIN FINNAIR 63 FHY FREEBIRD AIRLINES 64 GJT GETJET AIRLINES 65 GFA GULF AIR 66 OAW HELVETIC AIRWAYS 67 HFY HI FLY 68 HBN HIBERNIAN AIRLINES 69 HOP HOP! 70 IBE IBERIA 71 ICE ICELANDAIR 72 ISR ISRAIR AIRLINES 73 JAL JAPAN AIRLINES CO. -

Vea Un Ejemplo

3 To search aircraft in the registration index, go to page 178 Operator Page Operator Page Operator Page Operator Page 10 Tanker Air Carrier 8 Air Georgian 20 Amapola Flyg 32 Belavia 45 21 Air 8 Air Ghana 20 Amaszonas 32 Bering Air 45 2Excel Aviation 8 Air Greenland 20 Amaszonas Uruguay 32 Berjaya Air 45 748 Air Services 8 Air Guilin 20 AMC 32 Berkut Air 45 9 Air 8 Air Hamburg 21 Amelia 33 Berry Aviation 45 Abu Dhabi Aviation 8 Air Hong Kong 21 American Airlines 33 Bestfly 45 ABX Air 8 Air Horizont 21 American Jet 35 BH Air - Balkan Holidays 46 ACE Belgium Freighters 8 Air Iceland Connect 21 Ameriflight 35 Bhutan Airlines 46 Acropolis Aviation 8 Air India 21 Amerijet International 35 Bid Air Cargo 46 ACT Airlines 8 Air India Express 21 AMS Airlines 35 Biman Bangladesh 46 ADI Aerodynamics 9 Air India Regional 22 ANA Wings 35 Binter Canarias 46 Aegean Airlines 9 Air Inuit 22 AnadoluJet 36 Blue Air 46 Aer Lingus 9 Air KBZ 22 Anda Air 36 Blue Bird Airways 46 AerCaribe 9 Air Kenya 22 Andes Lineas Aereas 36 Blue Bird Aviation 46 Aereo Calafia 9 Air Kiribati 22 Angkasa Pura Logistics 36 Blue Dart Aviation 46 Aero Caribbean 9 Air Leap 22 Animawings 36 Blue Islands 47 Aero Flite 9 Air Libya 22 Apex Air 36 Blue Panorama Airlines 47 Aero K 9 Air Macau 22 Arab Wings 36 Blue Ridge Aero Services 47 Aero Mongolia 10 Air Madagascar 22 ARAMCO 36 Bluebird Nordic 47 Aero Transporte 10 Air Malta 23 Ariana Afghan Airlines 36 Boliviana de Aviacion 47 AeroContractors 10 Air Mandalay 23 Arik Air 36 BRA Braathens Regional 47 Aeroflot 10 Air Marshall Islands 23 -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

Emilia Romagna Golf

Top Destination in Italy for Golf, Art & Gastronomy Top Destination in Italy for Golf, Art & Gastronomy Its Etruscan, Celtic, Roman, Lombard and Byzantine origins make this Region unique and multi-faceted. Bologna, Ferrara, Ravenna and all the art cities of the Region are renowned cultural destinations, where you can feel their history in the halls of ancient palaces and in the old walls that define the geometrical shape of the cities. Emilia Romagna is also sea and fun, indeed! With more than 100 Km of sandy beaches with a wide range of hotels, restaurants, discos, cinemas, theatres, and theme and water parks. This is the Riviera of Italy. Thanks to the Regional 20 spas and wellness centres - from the hills surrounding Parma to the beaches of Rimini and Riccione – Emilia-Romagna is an ideal place for relaxing and wellness. Nature lovers will find two National Parks, 13 Regional Parks, 13 Natural Reserves, and many State Reserves. The Apennines, during the winter season, offers ski lovers more than 250 Km of slopes from Piacenza to the Romagna area. In the summer season you can discover this area by walking, by mountain biking, by canoeing and kayaking. Along the 14 Food and Wine Trails and Routes, food lovers can find more than a thousand suggested stops like farms, wine cellars, cheese and ham producers and traditional workshops. All along the ancient Via Emilia, the fans of motors can discover the supercar industry widely known as Motor Valley. Among the famous companies are Ferrari, Lamborghini, Maserati and Ducati. But above all Emilia Romagna is also golf, plenty of top quality golf, on the days and at the times you prefer, thanks to 23 magnificent Championship courses situated close to one another and ready to welcome you 365 days a year. -

Diapositiva 1

Numbers Italian Airport Industry Association - ATI SHORT PROFILES OF AIR TECH ITALY COMPANIES Welcome to the Italian Airport Industry Association Air Tech Italy (ATI) is the leading Trade Association representing Italian companies specialized in supplying products, technologies and services for airports and air-traffic control. We are the first hub for international clients looking for top-quality Italian companies. We have divided the companies into six main segments AIR TRAFFIC MANAGEMENT AIRFIELD CONSTRUCTION & SERVICES ENGINEERING & CONSULTANCY IT TERMINAL Main Segment: IT Numbers 17+ 14 YEARS OF EXPERIENCE PRODUCT PORTFOLIO 46 8 AIRPORTS SERVED SALES AND TECHNICAL WORLDWIDE SUPPORT CENTRES Products & Services Top Airports served • A-DCS Departure control system • Milan Malpensa MXP • A-WBS Weight and balance system • Milan Linate LIN • A-CUBE Multi CUTE Client • Gaborone GBE • A-MDS Message Distribution System • Teheran IKA • A-ODB Airport Operational Database • Istanbul IST • A-SCHED Flight Schedule • Verona Catullo VRN IT Solutions Provider for Airports, Airlines and Ground • A-FIDS Flight information display system • Rome Fiumicino FCO Handlers A-ICE provides value-added IT solutions and • A-MIS Multimedia information system • Tel Aviv TLV integrated applications to Airport, Airlines and Ground • A-SCP Security check point • A-HDB Handling database • Bangkok BKK Handlers, with specific experience in the implementa- • A-CAB Contract and billing • Bari BRI tion and support of mission critical systems. • BRS Baggage Reconciliation System A-ICE relies on its strong relationship with the Air • A-VMS Vehicles Maintenance System Transport community, addressing and anticipating the • CLOS Cooperative Logistics Optimization System needs as they evolve. Company associated with Via dei Castelli Romani, 59, 00071 – Pomezia (RM) ITALY Tel.