0609160550Annual-Report-2016.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kalahandi Forest Division Reserved Forests Name of Range Name Of

Kalahandi Forest Division Reserved Forests Name of range Name of Blocks Area in Hectares Govt. notification Madanpur –Rampur Tapranga 6839 Urladani 10737 Benaguda 5087 Sunamukhi 2399 Dengen 496 Jerka 1006 Turchi 246 Sadel”A” 282 Sadel “B” 320 Satami 1873 Telen 2630 Lumersingha 119 Bhatel 37 Sripali 46 Biswanathpur Champadeipur 67 Jhimri 1419 Raul 655 Bori 1448 Patraguda 179 Dhepaguda 464 Sargiguda 767 Kidding 688 Samjhola 893 Niyamgiri 2007 Porgel 1762 Dulma 565 Nachiniguda 1154 Jalkrida 1775 Machul 967 Benbhata 1657 Pahadpadar 1670 Kesinga Nangalguda 1474 Kamel 176 Karladanger 375 Madakhola’A’ 659 Kerbandi 1108 Bazargarh 7911 Kadalighati 1655 Narla 1293 Bhawanipatna Dhangada-Dhangidi 250 Kanamanjure 1932 Sinang 1178 Kutrukhai 315 Bhalu 60 Pordhar 704 Jugsaipatna 2084 Nehela 3956 Karlapat 7077 Alma 1404 Madakhol ‘B’ 645 Brahmani 5768 Dhanupanchan 740 Junagarh Ghana 3094 Kelia 232 Jalabandha ‘A’ 40 Jalabandha ‘B’ 28 Jalabandha ‘C’ 76 Pariagarh 810 Panigaon 508 Kandul 95 Barjan 355 Jharbandha 317 Sahajkhol 12521 Raktaboden 180 Talc hirka 140 Bhalujore 48 Balagaon 64 Dulkibandha 47 Ninaguda 71 Singhari 5887 Udayagiri 1197 Jerka 2754 Kegaon Daka 343 Kumkot 5000 Chura ‘A’ 7732 Chura ‘B’ 2333 Gujia 339 Lini 139 Ghatual 275 Adabori 921 Bisbhurni 212 Nageswar 3154 Thuamul-Rampur Thakuranipadar 83 Goyalkhoj 234 Kuspari 131 Khakes 74 Ampadar 94 Sulbadi 11 Baghmari 26 Arkhapedi 66 Kucharighati 33 Uperchikra 69 Ranipadar 62 Benakhamar 450 Kadokhaman 78 Bijaghati 38 Proposed reserved forest Name of the Range Name of the blocks Area in Hectors Notification with date I .Bhawanipatna Sagada 1069 Khandual 450.73 46268/R dt.02.06.75 Jugsaipatna Extn. -

Impact of COVID-19 Lockdown on Migrant Labourers from Kalahandi, Odisha

Impact of COVID-19 Lockdown on Migrant Labourers from Kalahandi, Odisha With wages in the agricultural sector ranging from a mere ₹100 to ₹120 and irregular employment, migration for work Ajaya Behera Ajaya is a major coping strategy for the youth Context conducted a rapid assessment following up a robust The lockdown by the Government of India that came random sample of migrant workers from Thuamul Rampur into effect on March 25, 2020 to arrest the spread of to understand the initial impact of the lockdown on migrant the COVID-19 pandemic suddenly exposed the plight labourers from Kalahandi whose remittances play a pivotal of internal migrant labourers to mainstream India. The role in the local economy. This report summarises the key migrant labourers in India’s urban centres and their families, findings from the assessment. irrespective of whether they were at the destination or staying behind in the villages, were devastated by the Migration from Thuamul Rampur sudden lockdown. India witnessed the largest exodus ever With wages in the agricultural sector ranging from a after the partition and several miserable deaths en route. mere ₹100 to ₹120 and infrequent availability of work, the Migration has been a key survival strategy for millions of youngsters in Thuamul Rampur do not have many options rural poor from the Indian state of Odisha, with a poverty left other than migrating for work. A lot of them also migrate ratio of 32.6 per centin 2011.1 for short periods to cope with the financial shocks. Overall, The districts of Kalahandi, Balangir and Koraput, commonly one in every three households in Thuamul Rampur reported referred to as the KBK districts, which are among the most a history of labour migration in the past ten years. -

Poverty and Economic Change in Kalahandi, Orissa: the Unfinished Agenda and New Challenges Sunil Kumar Mishra * Abstract

Poverty and Economic Change in Kalahandi, Orissa: The Unfinished Agenda and New Challenges Sunil Kumar Mishra * Abstract Poverty rips the very social fabric of a society. Its victims are apparently divested of some universally accepted human quality of life. This paper analyses the incidence of poverty in the backward district of Kalahandi, Orissa. It focuses on the economic structure and socio-economic conditions of the people to identify the probable reasons for chronic poverty in the district. The paper argues that to reap the benefits of large deposits of raw material and human resources, development of the non-agricultural sector through proper planning is a prerequisite. Collectivity among the members of the co-operative societies and other decentralized institutions would help in harnessing the benefits. The possibilities of such collective actions for rural development are explored. Introduction Poverty in Kalahandi1 is paradoxical in nature. The district is rich in natural resources like forests and minerals, and has a large labour force. The landholding size is larger than the average size of landholdings in Punjab; it receives more rain than Punjab, and the cropped area in the district is the highest in Orissa (Mahapatra et al. 2001). Yet, people here are trapped in a vicious circle of poverty. Kalahandi is well known for its backwardness, hunger, starvation deaths and all other social maladies. The district came into prominence in the national and international developmental discourse in the 1980s when the people of the lower strata faced serious economic and social deprivation and were driven to eat inedible roots and grasses. Kalahandi has a high concentration of Scheduled Caste (SC) and Scheduled Tribe (ST) populations. -

~~1Q OOR':JQ;Q~Q~Tt Iqa QI.Q1il~1900~,QI£1~QI

'ti. ,~."" OFFICE 01; TIlE D VISIONAL 'OREST OFFICER, RAY'AGlilll DWL.qON, Rl\YAG;u).t\ < ~~1Q OOR':JQ;Q~Q~tt IQa QI.Q1il~1900~,QI£1~QI (FAX:06956-224556, "-Ph: 06856-222056,225056 Evmail: dfn rgcla@Yahoo_-com) G~:o~rS~-99~S3~,~~g:o~rS~-9990S~, 9~80S~ I o. '1 51 I-lF(Misc) 1263/2015. Dated, Rayagada tfc 12. th February, 2015. To The Deputy Director of Mines, Koraput Circle, Koraput. Sub:- Regarding DLC Report of Baphilimali Mining Lease area for Bauxite over an area of 1388.74 hectare in Rayagada and Kalahandi district of Mls Utkal Alumina International Ltd. X-Sub: Joint verification of DLCforest land in Mining Lease area of Mls Utkal Alumina International Ltd. over an area of 1388.74 hectare. Ref:- This office letter no. 6737 dated 17.12.2013 and This office letter No. 1014 dated 19.02.2014. Sir, In inviting a kind reference to the above cited letters on the captioned subject it is to inform you thar you have been intimated in this office letter no. 6737 dated 17.12.2013 under reference regarding involvement of DLC forest land in Karanja Kupakhal, Paika Kupakhal and Dhuturapas village under Kashipur Tahasil in the above said mining lease area granted to Mjs Utkal Alumina International Ltd. Perusal of land schedule of mining lease area of Mjs UAIL, it indicates the existence of 153.11 Acres equivalent to 61.962 hectare in Karanja Kupakhal village, 303.89 Acres equivalent to 122.981 hectare in Paika Kupakhal village and 119.60 Acres equivalent to 48.400 hectare in Dhuturapas village of DLC Forest Land inside the mining lease area of Mjs UAIL. -

Brief Industrial Profile of Kalahandi District

Contents S. No. Topic Page No. 1. General Characteristics of the District 3 1.1 Location & Geographical Area 3 1.2 Topography 3 1.3 Availability of Minerals. 4 1.4 Forest 5 1.5 Administrative set up 5 2. District at a glance 6 2.1 Existing Status of Industrial Area in the District of Kalahandi 9 3. Industrial Scenario Of Kalahandi 10 3.1 Industry at a Glance 9 3.2 Year Wise Trend Of Units Registered 11 3.3 Details Of Existing Micro & Small Enterprises & Artisan Units In The 10 District 3.4 Large Scale Industries / Public Sector undertakings 11 3.5 Major Exportable Item 12 3.6 Growth Trend 12 3.7 Vendorisation / Ancillarisation of the Industry 12 3.8 Medium Scale Enterprises 12 3.8.1 List of the units in Kalahandi & near by Area 11 3.8.2 Major Exportable Item 12 3.9 Service Enterprises 12 3.9.1 Potentials areas for service industry 13 3.10 Potential for new MSMEs 13 4. Existing Clusters of Micro & Small Enterprise 14 4.1 Detail Of Major Clusters 14 4.1.1 Manufacturing Sector 14 4.1.2 Service Sector 14 4.2 Details of Identified cluster 14 5. General issues raised by industry association during the course of 14 meeting 6 Steps to set up MSMEs 15 2 Brief Industrial Profile of Kalahandi District 1. General Characteristics of the District The present district of Kalahandi was in ancient times a part of South Kosala. It was a princely state. After independence of the country, merger of princely states took place on 1st January, 1948. -

District Irrigation Plan of Kalahandi District, Odisha

District Irrigation Plan of Kalahandi, Odisha DISTRICT IRRIGATION PLAN OF KALAHANDI DISTRICT, ODISHA i District Irrigation Plan of Kalahandi, Odisha Prepared by: District Level Implementation Committee (DLIC), Kalahandi, Odisha Technical Support by: ICAR-Indian Institute of Soil and Water Conservation (IISWC), Research Centre, Sunabeda, Post Box-12, Koraput, Odisha Phone: 06853-220125; Fax: 06853-220124 E-mail: [email protected] For more information please contact: Collector & District Magistrate Bhawanipatna :766001 District : Kalahandi Phone : 06670-230201 Fax : 06670-230303 Email : [email protected] ii District Irrigation Plan of Kalahandi, Odisha FOREWORD Kalahandi district is the seventh largest district in the state and has spread about 7920 sq. kms area. The district is comes under the KBK region which is considered as the underdeveloped region of India. The SC/ST population of the district is around 46.31% of the total district population. More than 90% of the inhabitants are rural based and depends on agriculture for their livelihood. But the literacy rate of the Kalahandi districts is about 59.62% which is quite higher than the neighboring districts. The district receives good amount of rainfall which ranges from 1111 to 2712 mm. The Net Sown Area (NSA) of the districts is 31.72% to the total geographical area(TGA) of the district and area under irrigation is 66.21 % of the NSA. Though the larger area of the district is under irrigation, un-equal development of irrigation facility led to inequality between the blocks interns overall development. The district has good forest cover of about 49.22% of the TGA of the district. -

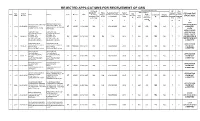

REJECTED LIST.Xlsx

REJECTED APPLICATIONS FOR RECRUITMENT OF GRS Educational Qualification PHYSICAL ME HSC DISABILITY ( Photo Residentail Proof( Year of Intermediate/+2 passed Passed Appl. Date of 10th/ REASON FOR Sl No Name Address Caste Gender DOB Certificate Submitte He/She must belong Passing HSC Marks Computer(Y/ If Higher with Odia with Odia Sl.No Receipt Matric(Y/ Total submitted Y/N & d(Y/N) to Kalahandi) Exam secured N) Qualification Language Language REJECTION percentage N) Marks without 4th (Y/N) (Y/N) optional 1 2 3 4 5 6 7 8 9 10 11 12 13 10TH KESI MAJHI S/O- RAJA KESI MAJHI AT- JAMULI PO- CERTIFICATE NOT ,MAJHI AT- JAMULI PO- 1 2169 MOHANGIRI VIA- 26.04.2021 MOHANGIRI VIA- M.RAMPUR ST MALE 31.12.1999 NO Y KALAHANDI 2016 Y 600 250 YES NO Y Y SUBMIITED. M.RAMPUR PIN- 766102 PIN- 766103 GIVEN UNDERTAKING GOPINATH NAIK GOPINATH NAIK APPLICATION S/O-INDRAMANI NAIK S/O-INDRAMANI NAIK FORM , CASTE AT-PABLI, PO- AT-PABLI, PO- 2 1458 22.04.21 BADKARLAKOT BADKARLAKOT NA MALE 10.10.1993 NA NA NA 2012 Y 600 348 YES NO Y Y AND RESIDENCE VIA-JAIPATNA, DIST- VIA-JAIPATNA, DIST- CERTIFICATE NOT KALAHANDI, ODISHA KALAHANDI, ODISHA SUBMITTED PIN-766018, MOB- PIN-766018, MOB-6381221741 SUBHASMITA NAIK SUBHASMITA NAIK APPLICATION D/O-SANTOST KU NAYAK D/O-SANTOST KU NAYAK 3 656 13.04.21 AT/PO-NARLA AT/PO-NARLA OBC FEMALE 03.07.2000 NO Y KALAHANDI 2015 Y 600 327 YES BA Y Y FORM NOT PIN-766100, MOB-766100 PIN-766100, MOB-766100 SUBMITTED AMULYA MAJHI AMULYA MAJHI S/O-HARU MAJHI S/O-HARU MAJHI APPLICATION AT-GODRAMASKA,PO- AT-GODRAMASKA,PO- 4 740 13.04.21 BIRIKOT -

Water Proposal

Proposal for developing Gravity fed pipe water supply system in four villages of Thuamul Rampur, Kalahandi Contents: Pages 1. Chapter-1 Introduction (about the Organisation) 1- 5 2. Chapter-2 Proposal 5-15 3. Chapter – 3 Budget (Financial proposal) 16-19 0 Chapter-1 INTRODUCTION ABOUT ANTODAYA 1 Name of the organization: ANTODAYA 2. Address and telephone: ANTODAYA , AT/PO-Kaniguma, Via-Thuamul Rampur, Dist: Kalahandi Contact Address: Dillip Kumar Das, Chairman, ANTODAYA, Bahadur Bagicha Para PO: BHAWANIPATNA – 766 001, Kalahandi, Orissa, India Tel: 91+6670 – 232038, 234012 E Mail: [email protected] Web site: www.antodaya-kalahandi.org .in 3. Registration Number - Kld/409-17/1989-90 , Under Societies Registration Act of 1860 (Registered in the year 1989) Date of Establishment: 9 th June 1989 4. FCRA Registration Number - 104950020 under FCRA Regulation Act of 1976. (Registered in the year 1991) 5. Aims and Objectives of ANTODAYA : VISION: ANTODAYA’s vision is to realize a society where there is no hunger, fear, injustice (arising out of the culture of silence) and diseases. MISSION: ANTODAYA believes that its vision can be realized through Group Action, which leads to: Emergence of strong Village Level Organizations Critical analysis of situation. Having access to development opportunities where they exist and asserting for it where they don’t. Encouraging the marginalized sections for their greater involvement in a development process, which is sustainable, socially acceptable, economically viable and technically feasible Collaboration/building partnership with like-minded institutions, groups and individuals. GOAL (AIM): To ensure people’s participation for sustainable development. Brief history of ANTODAYA : (Organisation Profile) ANTODAYA has been dwelling in one of the most vulnerable and drought prone Districts of Orissa, India namely Kalahandi since its inception in 1989. -

2011-Dshb-Kalahandi.Pdf

GOVERNMENT OF ODISHA DISTRICT STATISTICAL HANDBOOK KALAHANDI 2011 DISTRICT PLANNING AND MONITORING UNIT KALAHANDI ( Price : Rs.25.00 ) CONTENTS Table No. SUBJECT PAGE ( 1 ) ( 2 ) ( 3 ) Socio-Economic Profile : Kalahandi … 1 Administrative set up … 4 I POSITION OF DISTRICT IN THE STATE 1.01 Geographical Area … 5 District wise Population with Rural & Urban and their proportion of 1.02 … 6 Odisha. District-wise SC & ST Population with percentage to total population of 1.03 … 8 Odisha. 1.04 Population by Sex, Density & Growth rate … 10 1.05 District wise sex ratio among all category, SC & ST by residence of Odisha. … 11 1.06 District wise Literacy rate, 2011 Census … 12 Child population in the age Group 0-6 in different district of Odisha. 1.07 … 13 II AREA AND POPULATION Geographical Area, Households and Number of Census Villages in different 2.01 … 14 Blocks and ULBs of the District. 2.02 Classification of workers (Main+ Marginal) … 15 2.03 Total workers and work participation by residence … 17 III CLIMATE 3.01 Month wise Actual Rainfall in different Rain gauge Stations in the District. … 18 3.02 Month wise Temperature and Relative Humidity of the district. … 20 IV AGRICULTURE 4.01 Block wise Land Utilisation pattern of the district. … 21 Season wise Estimated Area, Yield rate and Production of Paddy in 4.02 … 23 different Blocks and ULBs of the district. Estimated Area, Yield rate and Production of different Major crops in the 4.03 … 25 district. 4.04 Source- wise Irrigation Potential Created in different Blocks of the district … 26 Achievement of Pani Panchayat programme of different Blocks of the 4.05 … 27 district 4.06 Consumption of Chemical Fertiliser in different Blocks of the district. -

Kalahandi Family Planning Plan 2011 12

DRAFT 2011 -12 District Family Planning Plan District: KALAHANDI District Family Welfare Bureau Zilla Swasthya Samiti KALAHANDI DISTRICT FAMILY PLANNING PLAN 2011 -12 1 KALAHANDI DISTRICT FAMILY PLANNING PLAN 2011-12 2 KALAHANDI DISTRICT FAMILY PLANNING PLAN 2011-12 3 Table of Contents Chapter Topics Chapter – 1 Background Chapter – 2 Situational Analyses a. Contraceptive Use b. Service Delivery c. Quality Assurance Mechanism d. Logistic and Supply System e. Human Resource Development f. Communication Activities g. Private Sector Partnership h. Monitoring and Evaluation Chapter – 3 District Priorities as per the situations with respect to the State mandate. Chapter – 4 Family Planning Plan for the year 2011-12 a. Service Delivery b. Human Resource Development & Training c. Logistics and supply chain with requirement & distribution plan d. Communication Activities e. Private Sector Partnership f. Monitoring and Evaluation g. Any other (Innovations, Dist/Block/Sector specific) IEC, new plans etc. Chapter – 5 Resource Requirements KALAHANDI DISTRICT FAMILY PLANNING PLAN 2011-12 4 Executive Summary – Kalahandi district is situated in the southwestern portion of Orissa. Geographically this district lies between 19º 8’ N 20º 25’ N latitudes and 82 0 32 ’ E and 83 0 47’ E longitudes with geographical area of 7920 sq Km. The population of the Kalahandi district as per the 2011 census is 157305; the sex ratio is 1003 per one thousand male. It has 13 blocks, 273 Grampanchayats, 2236 Rev villages (including 137 uninhabited villages), 13 Tahsils, and 2 Subdivisions. It has 4 towns Bhawanipatna Municipality, Junagarh & Kesinga NAC and Dharamgarh. Out of 13 blocks two are Tribal blocks1-Biswanathpur 2.Thuamulrampur. -

Annual Report 2018-19

ANNUAL REPORT 2018-19 Development Agency for Poor & Tribal Awakening, DAPTA Bhawanipatna, Kalahandi. DAPTA (Development Agency for Poor & Tribal Awakening) Near Old Cinema hall Po: Bhawanipatna Dist: Kalahandi. Phone-06670-234147 [email protected] Or 0 | P a g e [email protected] Foreward I am very glad to present the Annual report of 2018-2019 in which year the organization has completed its 28th eventful journey, DAPTA is a development support organization has diversified its role in sustainable development of down trodden people, marginal community with a special focus to the development of women , children and tribal people of Kalahandi and other tribal areas of Odisha. Since its inception DAPTA is working on five numbers of issues like women empowerment, Agriculture and livelihood, Health care, Education & child right and Humanitarian supports. Witnessing ground reality, we are working with some other network partners. DAPTA usually work for the people with community participation, community involvement and community led evaluation process to lead a sustainable change. This Year DAPTA has covered a large number of women and children mostly in its all project.This year we have added Childline Project , Project on Millet Promotion and Project on Solar power. On behalf of DAPTA, I express my deep gratitude to all our donors like The Hunger Project ,Central Social Welfare Board, State Social Welfare Board, AWO International , Madhyam Foundation , NRLM,NABARD, TATA TRUSTS, OSACS,BNI, WCD Dept. , Smile Foundation India , Millet Mission, Agriculture Department, Wassan India Barefoot College and other donor partners. Moreover, we are grateful to different Govt. Depts.like DCPO unit, CWC unit, DSWO unit , DLSA, NHM unit , Labour Dept. -

Labour Migration from Remote Rural Odisha Thuamul Rampur Block, Kalahandi Labour Migration from Remote Rural Odisha Thuamul Rampur Block, Kalahandi

Labour Migration from Remote Rural Odisha Thuamul Rampur Block, Kalahandi Labour Migration from Remote Rural Odisha Thuamul Rampur Block, Kalahandi November 2020 Design & Layout Bijoy Jacob | [email protected] Images Ajaya Behera, Gram Vikas Gram Vikas Plot No. 72/B, Forest Park, Bhubaneswar, Odisha, India-751009 +91-674-2596366 gramvikas.org [email protected] Centre for Migration and Inclusive Development PMC.XX/1229, Near Town Hall, Perumbavoor, Kerala, India-683542 +91-484-2595256 cmid.org.in [email protected] Please refer to the online version for data accuracy. Labour Migration from Remote Rural Odisha Profiling Labour Migration from Thuamul Rampur Block, Kalahandi 䜀爀愀洀 嘀椀欀愀猀 Foreword The opportunities for secure and sustainable livelihoods in the villages of Odisha are limited by a variety of resource constraints. The North-Eastern Ghats and Western Undulating Lands agro-climatic zone regions, where most of Gram Vikas’ work is focused, are characterised by a mixture of moist and deciduous forests and rain-fed agricultural economy. Gram Vikas has been working with the village communities in Odisha since 1979, helping to build a sustainable and dignified quality of life. The high dependence on scarce and low-quality land and dwindling forest resources cannot sustain a dignified quality of life. Changes in monsoon patterns, over-exploitation of available land, and limited access to irrigation have resulted in widespread food and nutrition insecurity in the area. Industrial activity in the region is largely mining and provides little in terms of employment opportunities, while adversely impacting the natural environment. Non-agricultural wage labour is hard to come by, except through public employment generation schemes.