SHELL's PLAN to SELL ANOTHER REFINERY, THIS TIME in LOUISIANA's REFINERY ROW July 21, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sweet and Dirty a Collaboration of Sweet Brenda and Dirty Red Band Bios

Sweet and Dirty A collaboration of Sweet Brenda and Dirty Red Band Bios When Dirty Red – Eric McDaniel – leader of modern day powerhouse band, Dirty Red and the Soul Shakers invited legendary Oklahoma Blues Singer, Sweet Brenda – Bren Severson – on stage the first time to sit in with the band, a lightning bolt of electricity melded them together and shot their sound and energy into an unsuspecting blues audience that soaked it up like fireball whiskey on freaky Saturday night. From that moment this energetic collaboration has caused quite a stirring in the blues scene. Both musicians have made a name for themselves across the blues nation with experience and expertise that speaks for itself. When all of that is combined with the background and expertise of the rest of the band, a stage full of all-stars is born. Besides the giant personalities of Dirty Red and Sweet Brenda, the scary tight rhythm section of Cliff the “Iron Man” Belcher and Forrest Worrell, both of Watermelon Slim and the Workers fame, and the lonesome but ripping tasty blues guitar of Big Robb Hibbard, former lead for Miss Blues and the Blue Notes, put the icing on the cake. Add to all of that, the fact that Dirty Red and Sweet Brenda both write all the songs with soulful and pertinent lyrics written for all people, and a jolting beat that never stops, the dance floor is full and crazy, the room is packed with a punch of energy and the blues appetite is wildly satisfied. Sweet and Dirty is a collaboration of blues monsters bragging over 130 years of performance altogether culminating into this fabulous high- energy show. -

Steve Cropper | Primary Wave Music

STEVE CROPPER facebook.com/stevecropper twitter.com/officialcropper Image not found or type unknown youtube.com/channel/UCQk6gXkhbUNnhgXHaARGskg playitsteve.com en.wikipedia.org/wiki/Steve_Cropper open.spotify.com/artist/1gLCO8HDtmhp1eWmGcPl8S If Yankee Stadium is “the house that Babe Ruth built,” Stax Records is “the house that Booker T, and the MG’s built.” Integral to that potent combination is MG rhythm guitarist extraordinaire Steve Cropper. As a guitarist, A & R man, engineer, producer, songwriting partner of Otis Redding, Eddie Floyd and a dozen others and founding member of both Booker T. and the MG’s and The Mar-Keys, Cropper was literally involved in virtually every record issued by Stax from the fall of 1961 through year end 1970.Such credits assure Cropper of an honored place in the soul music hall of fame. As co-writer of (Sittin’ On) The Dock Of The Bay, Knock On Wood and In The Midnight Hour, Cropper is in line for immortality. Born on October 21, 1941 on a farm near Dora, Missouri, Steve Cropper moved with his family to Memphis at the age of nine. In Missouri he had been exposed to a wealth of country music and little else. In his adopted home, his thirsty ears amply drank of the fountain of Gospel, R & B and nascent Rock and Roll that thundered over the airwaves of both black and white Memphis radio. Bit by the music bug, Cropper acquired his first mail order guitar at the age of 14. Personal guitar heroes included Tal Farlow, Chuck Berry, Jimmy Reed, Chet Atkins, Lowman Pauling of the Five Royales and Billy Butler of the Bill Doggett band. -

And the Band Played on Pdf

And the band played on pdf Continue Music fans were sad to learn that Tom Petty passed away at the age of 66 on Monday night. The musician became famous for his successful career as a solo artist, but worked with several bands, including The Heartbreakers. Who the Heartbreakers were Tom Petty showed they were more than a band. They were the longest-running group Petty had worked with, playing together since 1976. Since then, Petty has released more than a dozen albums, either in collaboration with The Heartbreakers or prominently. Together, the band is recognizable for some of Petty's favorite hits, including Mary Jane's Last Dance and American Girl. The introduction to American Girl has probably stuck in your head since the first time you heard it, but for some reason, you just never get tired of it. You have Tom Petty and the Heartbreakers to thank for that. Petty also collaborated with the following bands: Mudcrutch (1970-1975), the supergroup The Traveling Willburys (1988-1990). On Petty's solo albums, The Heartbreakers served as studio musicians, and were additionally supported by Petty's collaborator stable. This stable famously included musicians like Jeff Lynne and George Harrison, who were also two of the petty bandmates in Willburys Travel. Petty recorded with Bob Dylan, Stevie Nicks and countless other industry icons, but The Heartbreakers were his constant. According to Petty's official website, the 2017 Heartbreakers included Campbell, Trench, bassist Ron Blair, rhythm guitarist Scott Thurston and percussionist Steve Ferrone. Ferrone joined in 1994 after drummer Stan Lynch left to work on other projects. -

Steve Ferrone MIDI Groove Library Manual.Pdf

Steve Ferrone MIDI Groove Library Welcome and thank you for purchasing the Platinum Samples Steve Ferrone MIDI Groove Library. This groove library is available in multiple formats: BFD2, BFD Eco, BFD Eco DV, Toontrack EZDrummer & Superior Drummer, Addictive Drums, Cakewalk Session Drummer and General MIDI. Please download the version(s) you will be using. BFD2, BFD Eco & BFD Eco DV Installation: Windows XP or later The BFD library download is provided as a single compressed (zipped) archive. The archive is named Steve_Ferrone_BFD.zip 1. In order to access the installer, right-click the downloaded archive package and select “Extract All...” to unarchive. Find the installer named Steve Ferrone Groove Library Installer WIN.exe and double click it to run it. 2. A splash screen appears, followed by a welcome page. Read the on-screen instructions and click Next to begin the installation. 3. Read the license conditions and check the tick box to agree. If you leave the tick box unchecked, you will not be able to continue with the installation. Click Next to proceed. 4. Specify any folder on a suitable hard disk in which to install the groove library data. Note: If installing on Windows Vista®, the current BFD Eco and BFD2 data paths may not be listed. In this case you must browse to the required data path manually. The drop-down menu contains all current BFD Eco, BFD Eco DV or BFD2 data paths. Select one of these or click Browse to navigate to and select a new location. If you select a new location, it is added to BFD Eco’s and/or BFD2’s and BFD Eco DV’s list of data paths automatically. -

Wildflowers E-Edition

Crawling Back to You A critical and personal breakdown of Tom Petty’s masterpiece, “Wildflowers” by Nick Tavares Static and Feedback editor Static and Feedback | www.staticandfeedback.com | September, 2012 1 September, 2012 Static and Feedback www.staticandfeedback.com ooking at the spine of the CD, it’s would resume, the music would begin, and clear that the color has mutated a I’d lie with my head on my pillow and my L bit through the years, trapped in hands over my stomach, eyes closed. sunbeams by windows and faded from it’s Sometimes, I’d be more alert and reading brown paper bag origins to a pale bluish the liner notes tucked away in the CD’s grey. The CD case itself is in excellent booklet in an effort to take in as much shape save for a few scratches, spared the information about this seemingly magic art cracks and malfunctioning hinges so many form as possible. other jewel boxes have suffered through The first time I listened to Wildflowers, I drops, moves and general carelessness. All was in high school, in bed, laying out in all, the disc holds up rather well. straight, reading along with the lyrics, More often than not, however, it sits inspecting the credits, the thanks and the on the shelf, tucked below a greatest hits photographs included with this Tom Petty collection and above a later album. Thanks solo record. One hour, two minutes and 41 to technology, the more frequent method seconds later, I felt an overwhelming rush, a of play is the simple mp3, broadcasting out warmth that covered my entire body from of a speaker the size of the head of a head to toe and reached back within my pencil’s eraser mounted above the skull to fill my insides. -

Summer Mustang

igi6 S u m m e r M u s t a n g 2 0 0 5 c: A 1 1 F C' N F c') L Y T f: c: n N 1 c: s r a r i: u n 1 v f r s 1 t y .t WEEKEND WEATHER PETTY! Men’s basketball Reviews of Toni Petty, preview for the S a tu rd a y 7 0 /5 r Toby Keith and KC" 2005-06 season and the Sunshine S u n d a y Band at the Fair 72/51° J- y ' IN ARTS S i ENTERTAINMENT, 5 IN SPORTS. S Volume LXIX, Number 8 August 11 - August 17, 2005 Mustangdaily^calpoly.edu Cal Pok student dies after Bishop Peak kill Jennifer Gongaware fell about .SO feet and landed in a reached by the firefighters. He was Ml ! DMIY remote area bordered by poison then placed on a stretcher and lift oak, brush and rocks, according to ed into a (’HP helicopter, which An unidentifica C'al I'oly student the Tribune. flew him to a nearby ambulance. died late Tuesday after falling frt>in He fell from the ledge around He was pronounced dead short a ledge while hiking on Mishop (>:4.S p.m. ly after p.m. at Sierra Vista Peak. Firefighters from San Luis Ifegional Medical Center. The name of the student will not (Obispo and CIDF/C'ounty Fire This is the third death resulting be released by the Sheriff’s reached the man after .^0 minutes. from a fall from Ihshop IVak over ('oroner’s otTiee until the student's “The base to the top is a very the last five years. -

On Tom Petty's

SUMMER 2017 // ISSUE 4 Production Crew Joins the Trip Down Memory Lane on Tom Petty’s 40th Anniversary Tour Tour Link Magazine 1 2 Tour Link Magazine Britannia Row Productions Goes Global with Clair Global Following a successful strategic alliance which About Clair Global: has been in place since the beginning of the year, Britannia Row Productions recently announced Building on over 50 years of experience, Clair its acquisition by Clair Global, Inc. Global continues to boldly advance the entertain- ment experience in the touring, festival, broad- Clair Global has a long-established history and is cast, and corporate markets. Our clients are ex- one of the most respected entertainment industry traordinary. We strive every day, at any hour, to suppliers with serval international operations. exceed their expectations. Our employees’ crea- tivity, talents, problem-solving skills and commit- Britannia Row Productions is one of the leading ment to service set us apart. Our passion is to UK audio companies with links throughout the provide our clients with solutions that meet their world. “Both companies see this as the perfect needs in audio, communications, backline, and way to expand and strengthen their worldwide data services. client base, allowing them to offer consistent ser- vice in all major territories,” said Britannia Row www.clairglobal.com Directors Bryan Grant and Mike Lowe in a joint statement. “The synergies we’ve experienced with the entire Britannia Row team have been over- whelmingly positive. Culturally and profes- sionally, we are on the same page. We are excited to bring this new level of global sup- port to our clients and better serve their pas- sions to advance this industry.” Troy Clair, President/CEO, Clair Global. -

Still Won T Back Down Tom Petty Rocks Against the Clock Story and Photos by Randy Falsetta

issue 57 layout 7/25/08 10:41 AM Page 36 Still Won t Back Down Tom Petty Rocks Against The Clock Story and photos by Randy Falsetta Exploiting an enviable cata- While celebrating just over three logue of three and four-chord time- decades of work, the always mellow less masterpieces, Tom Petty and yet artistically brilliant singer-song- the Heartbreakers performed to a writer confesses he would be lost nearly sold-out show at the Palace without the Heartbreakers. From the of Auburn Hills in Auburn Hills, documentary “Running Down A Michigan. Armed with his traditional Dream,” Petty states, “There’s some- Rickenbacker guitar run through a thing special about this group of peo- row of Vox Super Beatle amps, Petty ple. I treasure it now because one had fans easily chiming in on his link in the chain gone can make it all iconic repertoire of classic hits, go away”. Evidence of their close including “Free Fallin’”, “American Girl”, “You Wreck Me” , “Mary bond was witnessed in their leader’s heart-felt introduction of his Jane’s Last Dance” and “Refugee”. fellow band mates to a grateful audience. The energy present in the building was a refreshing change in Petty, now 57, appeared confident and, at times, carefree as he atmosphere following the Detroit Pistons’ devastating season-end- glided across the stage with arms flailing outward resembling a ing loss to the Boston Celtics the night before. Not only a plane taking flight. Founding lead guitarist Mike Campbell, sporting spectacle for the ears, but surprisingly for the eyes as well, some unique guitars himself, supplied all the great accompanying thanks to a well-designed light show that caught even long- melody lines and solos while Benmont Tench, also an original time fans off guard. -

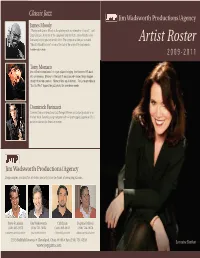

Client Roster 09 10 FINAL

Classic Jazz Jim Wadsworth Productions/Agency James Moody “Playing with James Moody is like playing with a continuation of myself,” said Dizzy Gillespie. A master of the saxophone and the flute, James Moody is like fine wine, he just gets better with time. The composer of the jazz standard Artist Roster “Moody’s Mood For Love” is one of the last of the original Be-bop legends. Available with big bands 2009-2011 Tony Monaco One of the hot new breed of organ players bringing the Hammond B3 back into prominence. Monaco is the kind of musician who makes things happen straight from the count-in. Monaco fires up all burners. Tony’s recent release “East to West” topped the jazz charts for seventeen weeks. Dominick Farinacci Carmine Carusso International Jazz Trumpet Winner and Juliard graduate is on the fast track. Dynamic young trumpeter with six chart-topping Japanese CDs is poised to take on the American market. Jim Wadsworth Productions/Agency Song samples, and bios for all shows and artists can be found at www.jwpjazz.com. Steve Frumkin Jim Wadsworth Cliff Lynn Daphne Wilson (330) 405-9075 (216) 721-5624 (330) 405-0611 (216) 744-0676 [email protected] [email protected] [email protected] [email protected] 2213 Bellfield Avenue • Cleveland, Ohio 44106 • Fax (216) 721-6533 Lorraine Feather www.jwpjazz.com Great American Songbook Classic Jazz Freddy Cole Buster Williams’ “Something More” Tribute to Nat “King” Cole Buster Williams, one of the world’s finest bassists, has put together an all-star, Freddy Cole stirs up memories as he honors the legacy of his brother Nat “King” hard-hitting quartet that is commanding! Buster is joined by several of today’s Cole. -

Band Bios Fin.Xlsx

Misplaced Priorities Bio's PO BOX 1401 La Canada Flintridge, CA 91012 818-371-5311 Full Name: Mandy Boesche Instrument Vocals, slide whistle, weeee whistle Musicians The Beatles, Ella Fitzgerald, George Gershwin, That Inspired You: Cole Porter, Crosby, Stills, Nash and Young, Judy Collins, Peter Paul and Mary Spouse's Name: Roger Child: Kelsey City Where You Live: Eagle Rock (Husband is a professor at Occidental College) Birth Place: Pasadena, CA (Grew up in La Canada) High School Westridge School Occupation Drama Teacher, The Waverly School, Pasadena Other Interests Travel (116 countries and counting…), Zumba, Friends, Family and Rock and Roll. Full Name: Tom Reynolds Instrument Rhythm Guitar Musicians Neil Young, Stevie Ray Von, That Inspired You: Van Morrison, Dixie Chicks Spouse's Name: Meredith Children Brittany, Alexandra, Jim City Where You Live: La Canada Flintridge Birth Place: (Glendale) La Canada Flintridge High School La Canada High School Occupation Integrated Marketing Other Interests Gardening, Travel, Wine and Beer Tasting, Golf Website: www.ReynoldsGroupWeb.com LinkedIn Profile: www.linkedin.com/in/TomBReynolds Full Name: Jeanne Norton Instrument Vocals Musicians Stevie Wonder, Jane Oliver, That Inspired You: Melissa Manchester, Bonnie Rait Spouse's Name: Escott Children Kyle and Evan City Where You Live: Southern California Birth Place: Until 9 yrs - Brooklyn, NY High School Grew up and High School - Houston, TX Occupation Business consultant for a large financial institution Other Interests Travel, golf and games Full -

"On the Edge: New Concert Sound Directions for Tom Petty and The

INSTALLATION | CONCERT | THEATER | CORPORATE AV | WORSHIP | CLUB | RECORDING THE JOURNAL FOR LIVE EVENT TECHNOLOGY PROFESSIONALS OctoberJuly 2009 2014 | www.prosoundweb.com | www.prosoundweb.com | $10 | $10 INTERNATIONAL ON THE EDGE Robert Scovill breaks in a new system PLUS: TRENDS IN DIGITAL CONSOLES CONTROLLING MICROPHONE LEAKAGE THOUGHTS ON SYSTEM OPTIMIZATION :: Tom Petty and the Heartbreakers :: On The EDGE ����� New concert sound directions for ����� Tom Petty and The Heartbreakers. by Keith Clark PHOTO: ALAN NEWMAN here’s leading edge, and there’s bleeding edge. The dif- unique vocal timbre fits perfectly within ficulty is striving for the first while avoiding the second, often a a tapestry created by Mike Campbell very fine line, and one that was straddled with great success by the (lead guitar), Benmont Tench (key- sound team in deploying a new main system for Tom Petty and The boards), Ron Blair (bass), Scott Thur- Heartbreakers on the Hypnotic Eye concert tour of North America, ston (guitar, keys, multi instruments), Twhich wraps up in mid-October with dates at the Forum in Los Angeles. and Steve Ferrone (drums). The tour visited a variety of venues, including sheds, arenas, the Gorge and Red Hypnotic Eye marks front of house Rocks amphitheaters and even venerable Fenway Park in Boston, and as usual with engineer Robert Scovill’s 20th year TP & HB, enjoyed great success in packing the house in whatever form it happened with TP & HB, first taking the helm to be. The music is largely straight-up classic rock ‘n’ roll, sometimes with interesting for the Wildflowers tour in 1994. This deviations, always served up by a cohesive, talented group in garage band style. -

Tom Petty Sample Page.Vp

G DEBUT PEAK WKS O ARTIST L DATE POS CHR D Album Title Label & Number PETTY, Tom, And The Heartbreakers 1980s: #25 / 1990s: #25 / All-Time: #79 Born on 10/20/1950 in Gainesville, Florida. Died of a heart attack on 10/2/2017 (age 66). Rock singer/songwriter/guitarist. Formed The Heartbreakers in Los Angeles, California: Mike Campbell (guitar; born on 2/1/1950), Benmont Tench (keyboards; born on 9/7/1953), Ron Blair (bass; born on 9/16/1948) and Stan Lynch (drums; born on 5/21/1955). Howie Epstein (born on 7/21/1955; died of a drug overdose on 2/23/2003, age 47) replaced Blair in 1982; Blair returned in 2002, replacing Epstein. Steve Ferrone replaced Lynch in 1995. Scott Thurston (of The Motels) joined as tour guitarist in 1991 and eventually became a permanent member of the band. Petty appeared in the movies FM, Made In Heaven and The Postman and also voiced the character of Elroy “Lucky” Kleinschmidt on the animated TV series King Of The Hill. Member of the Traveling Wilburys. Tom Petty & The Heartbreakers were the subject of the 2007 documentary film Runnin’ Down A Dream, directed by Peter Bogdanovich. One of America’s favorite rock bands of the past five decades; they had wrapped up a 40th Anniversary concert tour shortly before Petty’s sudden death. Also see Mudcrutch. AWARDS: R&R Hall of Fame: 2002 Billboard Century: 2005 9/24/77+ 55 42 G 1 Tom Petty & The Heartbreakers................................................................................................................................. Shelter 52006 6/10/78 23 24 G 2 You’re Gonna Get It! ..................................................................................................................................................