OIES Annual Report – 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Redalyc.COORDINATOR's NOTE

UNISCI Discussion Papers ISSN: 1696-2206 [email protected] Universidad Complutense de Madrid España Alaminos, María-Ángeles COORDINATOR'S NOTE UNISCI Discussion Papers, núm. 33, octubre-, 2013, pp. 9-11 Universidad Complutense de Madrid Madrid, España Available in: http://www.redalyc.org/articulo.oa?id=76728723002 How to cite Complete issue Scientific Information System More information about this article Network of Scientific Journals from Latin America, the Caribbean, Spain and Portugal Journal's homepage in redalyc.org Non-profit academic project, developed under the open access initiative UNISCI Discussion Papers, Nº 33 (Octubre / October 2013) ISSN 1696-2206 NOTA DE LA COORDINADORA / COORDINATOR´S NOTE María-Ángeles Alaminos 1 UCM / UNISCI The current crises in Sudan and South Sudan highlight the need for discussion and reflection on the key issues surrounding South Sudan’s secession from the North. This collection of articles considers those crises emerging between and within the Sudans and seeks to understand both Sudanese and South Sudanese internal dynamics and the way they relate to the external influence of major powers. The history of Sudan, formerly the biggest African country and often considered “a microcosm of Africa”, has been characterized by inequality between the center and the peripheries and by protracted internal conflicts that have shaped the country since its independence from British and Egyptian rule in 1956. The Comprehensive Peace Agreement (CPA), which was signed in 2005 between the Government of Sudan and the Sudan People’s Liberation Movement/Army (SPLM/A), brought an end to the second civil war in Sudan and granted the people of Southern Sudan the right to self-determination through a referendum. -

Annual Report

annual report How to find ASIC Business Centres Newcastle http://www.asic.gov.au Incorporation, document Telephone 02 4929 4555 lodgement, searches & fees Facsimile 02 4929 1759 Infoline Adelaide Perth Information for consumers and Telephone 08 8202 8500 Telephone 08 9261 4200 complaints about financial services Facsimile 08 8202 8510 Facsimile 08 9261 4210 and products (except lending), Brisbane Sydney investors’ rights, companies, Telephone 07 3867 4900 Telephone 02 9911 2500 company directors, auditors & Facsimile 07 3867 4930 Facsimile 02 9911 2550 liquidators, company administration, Canberra Townsville policy & procedures Telephone 02 6250 3850 Telephone 07 4721 3885 1300 300 630 Facsimile 02 6250 3888 Facsimile 07 4721 3803 Darwin National Offices Telephone 08 8943 0950 Information Processing Centre Facsimile 08 8943 0960 Company annual returns, penalty Policy and coordination notices, deregistration and rein- Melbourne Geelong statement Sydney Telephone 03 5229 2966 Facsimile 03 5229 2940 Traralgon,VIC Regional Offices Gold Coast Telephone 03 5177 3700 Telephone 07 5528 1960 Corporate regulation and Facsimile 03 5177 3999 Facsimile 07 5528 1968 investigations Hobart Australian Capital Territory Telephone 03 6235 6850 New South Wales Facsimile 03 6235 6860 Northern Territory Melbourne Queensland Telephone 03 9280 3500 South Australia Facsimile 03 9280 3550 Tasmania Victoria Western Australia until 30 June 1998 the Australian Securities Commission Contents Highlights 1 ASIC at a glance 2 1997-98 summary of results 3 Key results -

Global Energy 2012 Conference & Exhibition

GLOBAL 12 ENERGY 20 29/30/31 OCTOBER 2012 HOTEL PRESIDENT WILSON Global Energy Geneva 2012 Where the oil & gas trade meets...with key participation of Cargill, Gunvor, Lundin, Lukoil, Mercuria, Socar, Trafigura To register: www.globalenergygeneva.com GLOBAL 12 ENERGY 20 GLOBAL ENERGY 2012 CONFERENCE & EXHIBITION 29/30/31 October 2012, Hotel President Wilson, Geneva T: +41 (0) 22 321 74 80 | F: +41 (0) 22 321 74 82 | E: [email protected] | www.globalenergygeneva.com About Global Energy 2012 The oil and gas trade is critical to the global economy and the effect of energy prices and trade is more profound than for any other traded commodity. Global Energy is a trade show, conference and exhibition unique to Geneva. Global Energy 2012 is being held on October 29/30/31 at the prestigious Hotel President Wilson in the heart of Geneva. The event brings together energy traders, banks, policymakers, delivering important keynote speeches and panel debates. Global Energy 2012 takes place during an important week in the Geneva commodities trade calendar. It will be attended by a “who’s who” in oil and gas in Switzerland and abroad. Who will attend Global Energy 2012? Major international oil & gas trading firms Traders from small and medium-sized firms throughout the globe Leaders in the Swiss energy trade community Upstream oil and gas majors – interested in the global S&D of oil and gas Oil and gas investors, including family offices and private banks Trade financiers specialising in oil and gas Professional firms: lawyers, advisory/management -

Making Energy More – Sustainability Report 2005

beyond petroleum® ABOUT THIS REPORT For BP, ‘sustainability’ means the capacity to 1 Group chief executive’s introduction endure as a group: by renewing assets; creating and delivering 3 Achievements and challenges better products and services that meet the evolving needs 4 Industry in context of society; attracting successive generations of employees; 6 BP at a glance contributing to a sustainable environment; and retaining the trust 8 Energy for tomorrow and support of our customers, shareholders and the communities in which we operate. 10 CHAPTER 1 – RESPOnSIBlE OPERATIOnS Each year we aim to improve our sustainability reporting 12 The way we work to reflect the concerns of our readers more closely and the 16 Dialogue and engagement Making energy more BP Sustainability Report 2005 priorities of the business more clearly. This year, we are giving 18 Safety and operational integrity more emphasis to the business case for activities that benefit 22 Environmental management society and promote environmental sustainability. For the second 30 Our people year, we have used in-depth analysis to define the non-financial issues material to our reporting. We have further developed this 36 BP worldwide ‘materiality’ process by categorizing issues according to the level of public exposure and awareness they have received, and by Making energy more taking into account the source of the interest – for example, the 38 CHAPTER 2 – BP And ClImATE CHAngE Sustainability Report 2005 media, regulatory organizations or engagements with NGOs or 40 Climate change socially responsible investors. 42 BP Alternative Energy This year’s report is entitled ‘Making energy more’ because it 45 Sustainable transportation focuses on improvement – whether to the quality of our products, the way we manage environmental issues or the influence we have on the communities around us. -

Improving Institutional Capacity for Early Warning

IfP-EW Cluster: IMPROVING INSTITUTIONAL CAPACITY FOR EARLY WARNING IMPROVING INSTITUTIONAL CAPACITY FOR EARLY WARNING SYNTHESIS REPORT Terri Beswick January 2012 This initiative is funded by the European Union About IfP-EW The Initiative for Peacebuilding – Early Warning Analysis to Action (IfP-EW) is a consortium led by International Alert and funded by the European Commission. It draws on the expertise of 10 members with offices across the EU and in conflict-affected countries. It aims to develop and harness international knowledge and expertise in the field of conflict prevention and peacebuilding to ensure that all stakeholders, including EU institutions, can access strong, independent, locally derived analysis in order to facilitate better informed and more evidence-based policy and programming decisions. This document has been produced with financial assistance of the EU. The contents of this document are the sole responsibility of IfP-EW/Clingendael and can under no circumstances be regarded as reflecting the position of the EU. To learn more, visit http://www.ifp-ew.eu. About Clingendael Clingendael, the Netherlands Institute of International Relations, is a training and research organisation on international affairs. Within Clingendael, the Conflict Research Unit (CRU) conducts research on the connections between security and development with a special focus on integrated/comprehensive approaches to conflict prevention, stabilisation and reconstruction in fragile and post-conflict states. Specialising in conducting applied, policy-oriented research, linking academic research with policy analyses, the CRU translates theoretical insights into practical tools and policy recommendations for decision-makers in national and multilateral governmental and non-governmental organisations. The CRU was founded in 1996 as a long-term research project for the Netherlands Ministry of Foreign Affairs, focusing on the causes and consequences of violent conflict in developing countries and countries in transition. -

Energy in Wales

House of Commons Welsh Affairs Committee Energy in Wales Third Report of Session 2005–06 Volume I Report, together with formal minutes, Ordered by The House of Commons to be printed 11 July 2006 HC 876-I Published on Thursday 20 July 2006 by authority of the House of Commons London: The Stationery Office Limited £0.00 The Welsh Affairs Committee The Welsh Affairs Committee is appointed by the House of Commons to examine the expenditure, administration, and policy of the Office of the Secretary of State for Wales (including relations with the National Assembly for Wales.) Current membership Dr Hywel Francis MP (Chairman) (Labour, Aberavon) Mr Stephen Crabb MP (Conservative, Preseli Pembrokeshire) David T. C. Davies MP (Conservative, Monmouth) Nia Griffith MP (Labour, Llanelli) Mrs Siân C. James MP (Labour, Swansea East) Mr David Jones MP (Conservative, Clwyd West) Mr Martyn Jones MP (Labour, Clwyd South) Albert Owen MP (Labour, Ynys Môn) Jessica Morden MP (Labour, Newport East) Hywel Williams MP (Plaid Cymru, Caernarfon) Mark Williams MP (Liberal Democrat, Ceredigion) Powers The Committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. These are available on the Internet via www.parliament.uk. Publications The Reports and evidence of the Committee are published by The Stationery Office by Order of the House. All publications of the Committee (including press notices) are on the Internet at www.parliament.uk/parliamentary_committees/welsh_affairs_committee.cfm. A list of Reports of the Committee in the present Parliament is at the back of this volume. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

The Definitive Who's Who of the Wind Energy Industry

2014 Top 100 Power People 1 100 TOP 100 POWER PEOPLE 2014 The definitive who’s who of the wind energy industry © A Word About Wind, 2014 2014 Top 100 Power People Contents 2 CONTENTS Editorial: Introducing the Top 100 Power People 3 Compiling the top 100: Advisory panel and methodology 4 Profiles: Numbers 100 to 11 6 Q&A: Rory O’Connor, Managing Director, BlackRock 15 Q&A: David Jones, Managing Director, Allianz Capital Partners 19 Q&A: Torben Möger Pedersen, CEO, PensionDanmark 23 Top ten profiles:The most influential people in global wind 25 Top 100 list: The full Top 100 Power People for 2014 28 Next year: Key dates for A Word About Wind in 2015 30 Networking at A Word About Wind Quarterly Drinks © A Word About Wind, 2014 2014 Top 100 Power People Editorial 3 EDITORIAL elcome to our third annual Top from the six last year, but shows there W100 Power People report. is still plenty that wind can do to attract and retain women in senior roles. When we took on the challenge back in 2012 of identifying and assessing the Wind likes to think of itself as a pro- key people working in wind, it was a gressive industry, and in many ways it timely task. The industry was starting to is. But let’s not be blind to the ways in move out of established pockets in Eu- which it continues to operate like many rope, North America and Asia, and into other sectors, with males continuing to by Richard Heap, emerging markets around the world. -

Reuters Institute Digital News Report 2020

Reuters Institute Digital News Report 2020 Reuters Institute Digital News Report 2020 Nic Newman with Richard Fletcher, Anne Schulz, Simge Andı, and Rasmus Kleis Nielsen Supported by Surveyed by © Reuters Institute for the Study of Journalism Reuters Institute for the Study of Journalism / Digital News Report 2020 4 Contents Foreword by Rasmus Kleis Nielsen 5 3.15 Netherlands 76 Methodology 6 3.16 Norway 77 Authorship and Research Acknowledgements 7 3.17 Poland 78 3.18 Portugal 79 SECTION 1 3.19 Romania 80 Executive Summary and Key Findings by Nic Newman 9 3.20 Slovakia 81 3.21 Spain 82 SECTION 2 3.22 Sweden 83 Further Analysis and International Comparison 33 3.23 Switzerland 84 2.1 How and Why People are Paying for Online News 34 3.24 Turkey 85 2.2 The Resurgence and Importance of Email Newsletters 38 AMERICAS 2.3 How Do People Want the Media to Cover Politics? 42 3.25 United States 88 2.4 Global Turmoil in the Neighbourhood: 3.26 Argentina 89 Problems Mount for Regional and Local News 47 3.27 Brazil 90 2.5 How People Access News about Climate Change 52 3.28 Canada 91 3.29 Chile 92 SECTION 3 3.30 Mexico 93 Country and Market Data 59 ASIA PACIFIC EUROPE 3.31 Australia 96 3.01 United Kingdom 62 3.32 Hong Kong 97 3.02 Austria 63 3.33 Japan 98 3.03 Belgium 64 3.34 Malaysia 99 3.04 Bulgaria 65 3.35 Philippines 100 3.05 Croatia 66 3.36 Singapore 101 3.06 Czech Republic 67 3.37 South Korea 102 3.07 Denmark 68 3.38 Taiwan 103 3.08 Finland 69 AFRICA 3.09 France 70 3.39 Kenya 106 3.10 Germany 71 3.40 South Africa 107 3.11 Greece 72 3.12 Hungary 73 SECTION 4 3.13 Ireland 74 References and Selected Publications 109 3.14 Italy 75 4 / 5 Foreword Professor Rasmus Kleis Nielsen Director, Reuters Institute for the Study of Journalism (RISJ) The coronavirus crisis is having a profound impact not just on Our main survey this year covered respondents in 40 markets, our health and our communities, but also on the news media. -

Redstone Commodity Update Q3

Welcome to the Redstone Commodity Update 2020: Q3 Welcome to the Redstone Commodity Moves Update Q3 2020, another quarter in a year that has been strongly defined by the pandemic. Overall recruitment levels across the board are still down, although we have seen some pockets of hiring intent. There appears to be a general acknowledgement across all market segments that growth must still be encouraged and planned for, this has taken the form in some quite senior / structural moves. The types of hires witnessed tend to pre-empt more mid-junior levels hires within the same companies in following quarters, which leaves us predicting a stronger than expected finish to Q4 2020 and start to Q1 2021 than we had previously planned for coming out of Q2. The highest volume of moves tracked fell to the energy markets, notably, within power and gas and not within the traditional oil focused roles, overall, we are starting to see greater progress towards carbon neutrality targets. Banks such as ABN, BNP and SocGen have all reduced / pulled out providing commodity trade finance, we can expect competition for the acquiring of finance lines to heat up in the coming months until either new lenders step into the market or more traditional lenders swallow up much of the market. We must also be aware of the potential impact of the US elections on global trade as countries such as Great Britain and China (amongst others) await the outcome of the impending election. Many national trade strategies and corporate investment strategies will hinge on this result in a way that no previous election has. -

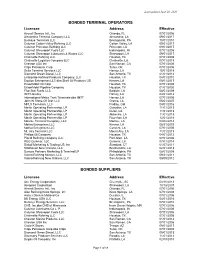

Bonded Terminal Operators

Last updated June 26, 2020 BONDED TERMINAL OPERATORS Licensee Address Effective Aircraft Service Intl., Inc Orlando, FL 07/01/2006 Alexandria Terminal Company LLC Alexandria, LA 09/01/2017 Buckeye Terminals LLC Breinigsville, PA 10/01/2010 Calumet Cotton Valley Refining LLC Cotton Valley, LA 09/01/2017 Calumet Princeton Refining LLC Princeton, LA 09/01/2017 Calumet Shreveport Fuels LLC Indianapolis, IN 07/01/2006 Calumet Shreveport Lubricants & Waxes LLC Shreveport, LA 09/01/2017 Chalmette Refining LLC Houston, TX 07/01/2006 Chalmette Logistics Company LLC Chalmette, LA 07/01/2018 Chevron USA Inc San Ramon, CA 07/01/2006 Citgo Petroleum Corp Tulsa, OK 07/01/2006 Delta Terminal Services LLC Harvey, LA 10/01/2018 Diamond Green Diesel, LLC San Antonio, TX 01/01/2014 Enterprise Refined Products Company, LLC Houston, TX 04/01/2010 Equilon Enterprises LLC dba Shell Oil Products US Kenner, LA 05/01/2017 ExxonMobil Oil Corp Houston, TX 07/01/2006 ExxonMobil Pipeline Company Houston, TX 01/01/2020 Five Star Fuels, LLC Baldwin, LA 08/01/2009 IMTT-Gretna Harvey, LA 04/01/2012 International-Matex Tank Terminals dba IMTT Harvey, LA 07/01/2006 John W Stone Oil Dist, LLC Gretna, LA 05/01/2007 MPLX Terminals, LLC Findlay, OH 04/01/2016 Martin Operating Partnership, LP Gueydan, LA 11/01/2013 Martin Operating Partnership, LP Dulac, LA 11/01/2013 Martin Operating Partnership, LP Abbeville, LA 11/01/2013 Martin Operating Partnership, LP Fourchon, LA 12/01/2016 Monroe Terminal Company, LLC Monroe, LA 04/08/2014 Motiva Enterprises LLC Kenner, LA 08/21/2009 Motiva Enterprises LLC Convent, LA 07/01/2006 Mt. -

Powershift Transmissions, Type Ecomat (1), for Buses, Trucks, and Special Vehicles List of Lubricants TE-ML 14

Commercial Vehicle Technology Powershift transmissions, type Ecomat (1), for buses, trucks, and special vehicles List of lubricants TE-ML 14 Table of contents Page 1. Approved lubricant classes ................................................................................................................................................................ 1 Table 1: Oil and filter change intervals for Ecomat transmissions in buses: ..........................................................................................2 Table 2: Oil and filter change intervals for Ecomat transmissions in trucks, off-road equipment and special vehicles:.........................2 2. Explanation of footnotes and comments ............................................................................................................................................3 3. Lubricant classes and approved trade products ................................................................................................................................4 1. Approved lubricant classes Product groups Lubricant classes for service fills Ecomat (Oil sump temperatures below 100°C) (3) 14A / 14B / 14C / 14E HP500, HP590, HP600 Automatic Transmission Fluids (ATF) HP502C, HP552C, HP592C, HP602C, Refer to the following pages for approved commercial products HP504C, HP554C, and oil change intervals HP594C, HP604C Particularly recommended: Ecomat HL (Oil sump temperatures below 100°C) (3) ZF-Ecofluid A Life (14E) (2) HP900, HP902 Ecomat (Oil sump temperatures below 105°C) (4) HP502C,