Retail a Trusted Partner We Understand The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Property Portfolio 30 June 2020 About Stockland We Have a Long and Proud History of Creating Places That Meet the Needs of Our Customers and Communities

Stockland Stockland PropertyPortfolio PropertyPortfolio Property Portfolio 30 June 2020 30 June 2020 30 June 2020 For personal use only stockland.com.au About Stockland We have a long and proud history of creating places that meet the needs of our customers and communities. OUR STORY When Stockland was founded in 1952, Ervin Graf had a vision “to not merely achieve growth and profits, but to make a worthwhile contribution to the development of our cities and great country”. Pursuing that vision has seen Stockland grow to become one of Australia’s largest diversified property groups. We develop and manage retail town centres, logistics, workplace properties, residential communities and retirement living villages. With the benefit of our diverse property skills, we connect different types of properties in shared locations, to create places that inspire people to gather, to share and to live life. We recognise our responsibilities to the environment and are a leader in sustainable business practices. For over 65 years, we have worked hard to grow our portfolio of assets and projects. We have a long and proud history of creating places that meet the needs of our customers and communities. OUR PROPERTY PORTFOLIO Stockland is one of Australia’s leading diversified property groups. We’re active in retail, logistics, workplace properties, residential communities and retirement living villages. This portfolio identifies all of our properties across Australia. More information on Stockland’s activities For personal use only and an online version of the portfolio data is available at www.stockland.com.au Image: Green Hills, NSW Property Portfolio Commercial Property .................................................................................................................................................................................................................................................................. -

2015 Annual Results 19 August 2015 Agenda

2015 Annual Results 19 August 2015 Agenda • Merger update and strategic focus Angus McNaughton • Financial results Richard Jamieson Angus McNaughton Richard Jamieson • Portfolio performance Chief Executive Officer CFO and EGM Investments Stuart Macrae • Development update Jonathan Timms • FY16 focus and guidance Stuart Macrae Jonathan Timms Angus McNaughton EGM Leasing EGM Development 2 Merger update and strategic focus Angus McNaughton Cranbourne Park, VIC Merger benefits on track with a strong platform for growth • Strategic focus remains unchanged • Operational cost synergies on track • Over 60% of operational cost savings1 already locked in • Merger financing savings achieved1 with over $100m lower cost • Weighted average cost of debt reduced to 4.2% • Integration is on program • Key operational teams finalised and team co-locations underway • Solid FY15 performance • Statutory net profit of $675.1m • Underlying earnings up 6.2%2 • Development pipeline increased to $3.1b and current projects on or ahead of plan The Myer Centre Brisbane, QLD 1. On a run-rate or annualised basis. 2. On an aggregate basis. 4 Strategic focus remains unchanged Retail real estate • We will own, manage and develop Australian retail assets across the spectrum • Portfolio composition will evolve as developments occur and asset recycling continues Operational excellence • High performance intensive asset management approach • Continuous improvement of systems and processes • Strongly committed to responsible investment and sustainability • Development of a fully -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

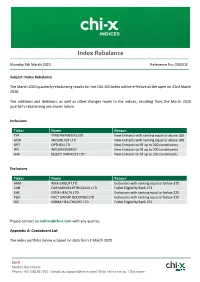

Index Rebalance

Index Rebalance Monday 9th March 2020 Reference No: 0002/20 Subject: Index Rebalance The March 2020 quarterly rebalancing results for the CXA 200 Index will be effective at the open on 23rd March 2020. The additions and deletions, as well as other changes made to the indices, resulting from the March 2020 quarterly rebalancing are shown below. Inclusions Ticker Name Reason TYR TYRO PAYMENTS LTD New Entrants with ranking equal or above 180 MSB MESOBLAST LTD New Entrants with ranking equal or above 180 OPT OPTHEA LTD New Entrants to fill up to 200 constituents IFN INFIGEN ENERGY New Entrants to fill up to 200 constituents SHV SELECT HARVESTS LTD New Entrants to fill up to 200 constituents Exclusions Ticker Name Reason AMA AMA GROUP LTD Exclusions with ranking equal or below 220 CVN CARNARVON PETROLEUM LTD Failed Eligibility Rank 273 EHE ESTIA HEALTH LTD Exclusions with ranking equal or below 220 PGH PACT GROUP HOLDINGS LTD Exclusions with ranking equal or below 220 SIG SIGMA HEALTHCARE LTD Failed Eligibility Rank 252 Please contact [email protected] with any queries. Appendix A: Constituent List The index portfolio below is based on data from 2 March 2020. Chi-X Market Operations Phone: +61 2 8078 1701 | Email: [email protected]| Web: chi-x.com.au | Disclaimer Newly added constituents are in BOLD. Chi-X indices (CXA 200 Index) Ticker Name CBA COMMONWEALTH BANK OF AUSTRAL CSL CSL LTD BHP BHP GROUP LTD WBC WESTPAC BANKING CORP NAB NATIONAL AUSTRALIA BANK LTD ANZ AUST AND NZ BANKING GROUP WOW WOOLWORTHS GROUP LTD MQG MACQUARIE GROUP -

HUB Store List ▪ Victoria ▪ Queensland ▪ Western Australia ▪ Northern Territory New South Wales

▪ New South Wales ▪ Australian Capital Territory HUB store list ▪ Victoria ▪ Queensland ▪ Western Australia ▪ Northern Territory New South Wales Balmain Baulkham Hills Campbelltown Chatswood 279 Darling Street, Kiosk 10 Stockland Baulkham Hills, Shop L50 Campbelltown Mall, 340 Victoria Avenue, Balmain NSW 2041 Baulkham Hills NSW 2153 Campbelltown NSW 2170 Chatswood NSW 206 02 9555 8866 02 9688 6936 02 4626 2250 02 9884 8880 Mon-Sun: 8am-6pm Mon-Sun: 8am-7pm Mon-Sun: 8am-6:00pm Mon-Sun: 8am-8pm Thurs: 8am-9pm Thurs: 8am-9pm Thurs: 8am-9pm Bankstown Blacktown Castle Hill Chifley Plaza Kiosk KI113 Bankstown Centre, Shop 3033 Westpoint Shopping Shop 210A Castle Towers, Shop L1, F8/Chifley Plaza Bankstown NSW 2200 Centre, Blacktown NSW 2148 Castle Hill NSW 2154 Chifley Square, Sydney NSW 2000 02 9793 9688 02 9676 3260 02 9680 9886 02 9222 9618 Mon-Sun: 8am-6pm Mon-Sun: 8am-6:00pm Mon-Sun: 8am-7pm Mon-Fri: 9:30am-5pm Thurs: 8am-9pm Thurs: 8am-9pm Thurs: 8am-9pm Bass Hill Brookvale Casula Cranebrook Shop 19A Bass Hill Plaza, Kiosk 25K04 Warringah Mall Shop 30 Casula Mall, Shop 2 Cranebrook Village, Bass Hill NSW 2197 Brookvale NSW 2100 1 Ingham Drive, Casula NSW 2170 Cranebrook NSW 2749 02 9793 9688 02 9907 3077 02 9822 7543 02 9037 7066 Mon-Sun: 8am-6:30pm Mon-Sun: 8am-6pm Mon-Sun: 8am-8pm Mon-Sun: 9am-7pm Thurs: 8am-9pm Thurs: 8am-9pm Thurs: 8am-9pm Thurs: 9am-9pm Sun: 10am-6pm Bateau Bay Cabramatta Central Shop 107 Bateau Bay Square, 23/ 101-103 John Street, Shop 2 815-825 George Street Bateau Bay NSW 2261 Cabramatta NSW 2166 Haymarket NSW 2000 02 4334 7755 02 9728 9600 02 9281 1258 Mon-Sun: 8am-6:00pm Mon-Sun: 8am-7:30pm Mon-Fri: 8am-10pm Thurs: 8am-9pm Sat-Sun: 8am-9:30pm Trading hours may vary during public holiday, please contact individual stores for details. -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

Stoxx® Australia 150 Index

STOXX® AUSTRALIA 150 INDEX Components1 Company Supersector Country Weight (%) Commonwealth Bank of Australia Banks Australia 8.37 CSL Ltd. Health Care Australia 7.46 BHP GROUP LTD. Basic Resources Australia 7.23 National Australia Bank Ltd. Banks Australia 4.37 Westpac Banking Corp. Banks Australia 4.09 Australia & New Zealand Bankin Banks Australia 3.75 Wesfarmers Ltd. Retail Australia 3.30 WOOLWORTHS GROUP Personal Care, Drug & Grocery Australia 2.87 Macquarie Group Ltd. Financial Services Australia 2.84 Rio Tinto Ltd. Basic Resources Australia 2.48 Fortescue Metals Group Ltd. Basic Resources Australia 2.27 Transurban Group Industrial Goods & Services Australia 2.20 Telstra Corp. Ltd. Telecommunications Australia 2.05 Goodman Group Real Estate Australia 1.77 AFTERPAY Industrial Goods & Services Australia 1.54 Coles Group Personal Care, Drug & Grocery Australia 1.39 Woodside Petroleum Ltd. Energy Australia 1.28 Newcrest Mining Ltd. Basic Resources Australia 1.27 Aristocrat Leisure Ltd. Travel & Leisure Australia 1.11 XERO Technology Australia 1.00 SYDNEY AIRPORT Industrial Goods & Services Australia 0.93 Brambles Ltd. Industrial Goods & Services Australia 0.91 Sonic Healthcare Ltd. Health Care Australia 0.90 ASX Ltd. Financial Services Australia 0.82 SCENTRE GROUP Real Estate Australia 0.80 Cochlear Ltd. Health Care Australia 0.74 QBE Insurance Group Ltd. Insurance Australia 0.73 SUNCORP GROUP LTD. Insurance Australia 0.71 South32 Australia Basic Resources Australia 0.71 Santos Ltd. Energy Australia 0.68 Ramsay Health Care Ltd. Health Care Australia 0.66 Insurance Australia Group Ltd. Insurance Australia 0.65 Mirvac Group Real Estate Australia 0.60 DEXUS Real Estate Australia 0.59 SEEK Ltd. -

New South Wales

New South Wales Venue Location Suburb Bar Patron 2 Phillip St Sydney Westfield Kotara Kotara BEERHAUS 24 York St Sydney 108-110 Jonson St Byron Bay El Camino Cantina Manly Wharf Manly 18 Argyle St The Rocks 52 Mitchell Road Alexandria 118 Willoughby Rd Crows Nest ICC Sydney Darling Harbour Fratelli Fresh Entertainment Quarter Moore Park 11 Bridge St Sydney Westfield Sydney Sydney Munich Brauhaus 33 Playfair St The Rocks Rockpool Bar & Grill 66 Hunter St Sydney Rosetta Ristorante 118 Harrington St The Rocks 33 Cross Street Double Bay Sake Restaurant & Bar Manly Wharf Manly 12 Argyle Street The Rocks Spice Temple 10 Bligh St Sydney 108 Campbell Parade Bondi Beach Macarthur Square Shopping Centre Campbelltown Castle Towers Castle Hill Charlestown Square Charlestown Chatswood Central Chatswood Stockland Greenhills East Maitland Manly Wharf Manly Westfield Miranda Miranda The Bavarian Entertainment Quarter Moore Park Westfield Penrith Penrith Rouse Hill Town Centre Rouse Hill Stockland Shellharbour Shellharbour World Square Sydney Westfield Tuggerah Tuggerah Stockland Wetherill Park Wetherill Park Wollongong Central Wollongong The Cut Bar & Grill 16 Argyle St The Rocks Page 1 of 2 12 Shelley Street, Sydney, NSW 2000, Australia. ABN 92 108 952 085. Victoria Venue Location Suburb El Camino Cantina 222 Brunswick St Fitzroy Munich Brauhaus 45 South Wharf Promenade South Wharf Rockpool Bar & Grill Crown Melbourne Southbank Rosetta Trattoria Crown Melbourne Southbank 121 Flinders Lane Melbourne Sake Restaurant & Bar 100 St Kilda Rd Southbank Spice -

Social Impact Insight Report December 2020

Vicinity Centres Social Impact Insight Report December 2020 Corporate Citizenship - LBG Australia & New Zealand Annual Company Benchmarking Report 2020 2020 Social Impact Insight Report Thank you for participating in the LBG benchmarking for 2020. The LBG methodology allows a company to form a reliable and holistic view of its community investment, from what is contributed, what happens and what changes as a result. LBG is the globally recognised methodology used by hundreds of the world’s leading companies to articulate and measure the positive impact they have in the world. The LBG Framework currently underpins the Community & Philanthropy question in the DJSI questionnaire, is reflected in the GRI standard and is recognised by the UN Global Compact as evidence for a company’s social impact narrative to stakeholders. LBG acts as a; • management tool, • a private benchmark, • and a network of professionals This report is designed to provide you with valuable benchmarking insights for program improvements. We encourage all members to arrange to meet with us to discuss the report in more detail and highlight the opportunities it demonstrates. The infographic page of this report acts as a summary of your results for you to use when sharing your results internally as well as a source of pointers where you could evolve your current program. The seismic events of 2020 such as Covid-19 and the Black Lives Matter movement have accelerated stakeholder expectations for companies to play a leading role in creating a more inclusive and robust society. The ‘S’ in ESG has become even more important. The fact that LBG is transforming in 2021 to provide a holistic management model is timely. -

Macquarie Centre Will Be the Second Largest Retail Shopping Centre in Sydney Upon Completion

The $440 Million Macquarie Centre will be the second largest retail shopping centre in Sydney upon completion. This fabulous development will provide one of the finest shopping destinations with approximately 130 extra retail stores and a new fresh food market. AMP Capital is a leading investment speciality Asian food stores, approximately house with over $142 billion in funds under 130 new specialty stores, two new substations management. AMP Capital Shopping Centres and a further 1,050 car spaces. AMP Capital is a specialised team of experts, combining has built out through Macquarie Centre’s world-class experience and specialist capabilities car parks for the expansion. Use is made of in the management of some of Australia’s and natural stone, timber, and sky light to create New Zealand’s most successful retail centres. atmosphere in the redevelopment. Columns AMP Capital Shopping Centres was established in the style of a “European colonnade in 1971 and has a portfolio of 26 centres across streetscape” punctuate the newer parts of Australia and New Zealand generating over A$6 the centre. The skylight is 7m high in order to billion in annual sales. Macquarie Centre forms create a sense of arrival. part of the AMP Capital Shopping Centres’ $2.8 billion development pipeline. The extension will place Macquarie Centre as the largest suburban shopping centre in New AMP Capital Shopping Centres commenced South Wales and one of the top ten centres the $440 million the Macquarie Centre by size in Australia. Macquarie Centre will redevelopment in November 2012. Macquarie open in two stages, the first staged opened Cetre is situated between Herring, Waterloo on 17 July, with a major launch of the entire and Talevera Roads in the suburb of Macquarie centre to take place in October, 2014. -

Sydney Impact Report Retail 2017

Sydney Impact Report Retail Market First Half 2017 INSIDE THIS ISSUE: HIGHLIGHTS Retail Statistics 2 In seasonally adjusted terms, New South Wales retail market performed the strongest over the Online Retail 2 month, with an increase of 1.3% in total turnover to $8,436 million. Snapshot into Sydney Food Services Sector 3 Online Retail Sales Index released by the National Bank of Australia indicates a strong performance in online sales over the month of May, with a seasonally adjusted month-on-month increase of 1.3%. Investment Activity 4 As of May 2017, New South Wales’ Café, restaurant and catering services turnover stands at a seasonally adjusted $713.3 million, signifying a growth of 5.19% when compared to twelve months Development Activity 7 prior. Economic Fundamentals 9 A significant amount of retail development is expected to be completed by 2017. This includes the extensions of Emerton Village Shopping Centre, Glenrose Shopping Centre, Narellan Town Centre About Preston Rowe Paterson 12 and Market Place Leichhardt. Construction of Ingleburn Village Shopping Centre is also expected to be completed by 2017. Contact Us 14 Phone: +61 2 9292 7400 1 Fax: +61 2 9292 7404 Address: Level 14, 347 Kent Street Sydney NSW 2000 Email: [email protected] Follow us: Visit www.prpsydney.com.au to follow us © Copyright Preston Rowe Paterson NSW Pty Limited 9,000 4.0 Source: ABS/Preston Rowe Paterson Research 3.5 3.0 Retail Statistics 8,500 2.5 2.0 1.5 8,000 1.0 Over the month to May 2017, retail turnover in Australia increased by a 0.5 0.0 7,500 seasonally adjusted 0.6%, following a rise of 1.0% over the month to April -0.5 Retail Turnover $ million Turnover Retail -1.0 7,000 -1.5 (%) Change PercentageMonthly 2017.