August 19, 2021 Alpha Daily Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

September 02, 2021 Alpha Daily Summary

September 02, 2021 Alpha Daily Summary Volume Value Trades # Symbols Advancers Vol Decliners Vol Unchanged # Advancers # Decliners # Unchanged traded Vol 66,763,283 $990,070,451 118,491 1,756 39,065,389 22,396,492 5,301,402 813 774 169 52-Week New High/Low YTD Volume YTD Value YTD Trades 176 / 27 16,015,503,475 $176,363,357,632 23,440,752 Most Actively Traded TSX Stocks on Alpha Symbol Stock Name Volume Value Trades Close High Low BTE Baytex Energy Corp. 1,304,766 $3,001,411 659 $2.32 $2.35 $2.18 ATH Athabasca Oil Corp J 1,280,950 $991,177 166 $0.80 $0.81 $0.73 HND BetaProNatGas Lev Br 1,106,296 $3,232,188 341 $2.95 $2.99 $2.85 FCU Fission Uranium J 1,102,000 $727,515 205 $0.69 $0.70 $0.63 NCU Nevada Copper Corp J 1,048,000 $93,120 50 $0.09 $0.09 $0.09 ETX Etrion Corporation J 804,470 $39,976 48 $0.06 $0.06 $0.04 HUT Hut 8 Mining Corp J 751,443 $8,534,232 1,188 $11.19 $11.92 $10.63 BBD.B Bombardier Cl B SV 631,227 $1,208,729 660 $1.92 $1.94 $1.88 BB BlackBerry Limited 583,869 $8,359,948 1,182 $14.13 $14.90 $13.91 DML Denison Mines Corp 582,036 $1,007,919 287 $1.74 $1.78 $1.66 CVE Cenovus Energy Inc. 581,168 $6,390,204 1,165 $11.11 $11.17 $10.61 NXE NexGen Energy Ltd. -

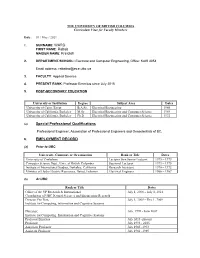

CV Master Form

THE UNIVERSITY OF BRITISH COLUMBIA Curriculum Vitae for Faculty Members Date: 01 / May / 2021 1. SURNAME: WARD FIRST NAME: Rabab MAIDEN NAME: Kreidieh 2. DEPARTMENT/SCHOOL: Electrical and Computer Engineering, Office: KAIS 4054 Email address: [email protected] 3. FACULTY: Applied Science 4. PRESENT RANK: Professor Emeritus since July 2015 5. POST-SECONDARY EDUCATION University or Institution Degree Subject Area Dates University of Cairo, Egypt B.A.Sc. Electrical Engineering 1966 University of California, Berkeley M.Sc. Electrical Engineering and Computer Science 1969 University of California, Berkeley Ph.D. Electrical Engineering and Computer Science 1972 (a) Special Professional Qualifications Professional Engineer, Association of Professional Engineers and Geoscientists of BC. 6. EMPLOYMENT RECORD (a) Prior to UBC University, Company or Organization Rank or Title Dates University of Zimbabwe Lecturer then Senior Lecturer 1975 – 1979 Computer Science Dept., Univ. of British Columbia Sessional Lecturer 1973 – 1975 Institute of International Studies, Berkeley, California Research Assistant 1970 – 1972 Ministry of Hydro Electric Resources, Beirut, Lebanon Electrical Engineer 1966 – 1967 (b) At UBC Rank or Title Dates Office of the VP Research & International July 1, 2008 – July 1, 2014 Coordinator of UBC Natural Sciences and Engineering Research Director Pro Tem, July 1, 2009 – Dec 1, 2009 Institute for Computing, information and Cognitive Systems Director, July, 1996 - June 2007 Institute for Computing, Information and Cognitive Systems Professor Emeritus July 2015 -present Professor July 1993 - 2015 Associate Professor July 1985 -1993 Assistant Professor July 1981 -1985 Page 2/57 Rank or Title Dates Lecturer July 1980 - June 1981 Sessional Lecturer Sept 1979 – June 1980 7. AWARDS AND DISTINCTIONS Distinctions IEEE Director (Division 1X) 2020-present IEEE Director-Elect, (Division 1X) 2019 President of IEEE Signal Processing Society, 2016-2017. -

EQUITY RESEARCH Cibcwminc

EQUITY RESEARCH CIBCWMInc. CIBCWMInc. April 28, 2021 Industry Update Canadian Research Review And Common Stock Universe The Canadian Research Review compiles the ratings, price targets and estimates for all companies under our coverage. Our Research analysts offer their three main sector takeaways and provide their current top picks. All figures in Canadian dollars unless otherwise stated. For required regulatory disclosures please refer to "Important Disclosures" beginning on page 42. Canadian Research Review And Common Stock Universe - April 28, 2021 In This Issue Company Ratings ...............................................................................................................3 Economics – Avery Shenfeld and Katherine Judge ............................................................6 Analyst Coverage Bryce Adams .....................................................................................................................12 Robert Bek ........................................................................................................................14 Jacob Bout ........................................................................................................................16 Robert Catellier .................................................................................................................18 Kevin Chiang .....................................................................................................................19 Cosmos Chiu ....................................................................................................................21 -

OSC Bulletin, Volume 44, Issue 33

The Ontario Securities Commission OSC Bulletin August 19, 2021 Volume 44, Issue 33 (2021), 44 OSCB The Ontario Securities Commission administers the Securities Act of Ontario (R.S.O. 1990, c. S.5) and the Commodity Futures Act of Ontario (R.S.O. 1990, c. C.20) The Ontario Securities Commission Published under the authority of the Commission by: Cadillac Fairview Tower Thomson Reuters 22nd Floor, Box 55 One Corporate Plaza 20 Queen Street West 2075 Kennedy Road Toronto, Ontario Toronto, Ontario M5H 3S8 M1T 3V4 416-593-8314 or Toll Free 1-877-785-1555 416-609-3800 or 1-800-387-5164 Contact Centre – Inquiries, Complaints: Fax: 416-593-8122 TTY: 1-866-827-1295 Office of the Secretary: Fax: 416-593-2318 42869967 The OSC Bulletin is published weekly by Thomson Reuters Canada, under the authority of the Ontario Securities Commission. Thomson Reuters Canada offers every issue of the Bulletin, from 1994 onwards, fully searchable on SecuritiesSource™, Canada’s pre-eminent web-based securities resource. SecuritiesSource™ also features comprehensive securities legislation, expert analysis, precedents and a weekly Newsletter. For more information on SecuritiesSource™, as well as ordering information, please go to: https://www.westlawnextcanada.com/westlaw-products/securitiessource/ or call Thomson Reuters Canada Customer Support at 1-416-609-3800 (Toronto & International) or 1-800-387-5164 (Toll Free Canada & U.S.). Claims from bona fide subscribers for missing issues will be honoured by Thomson Reuters Canada up to one month from publication date. Space is available in the Ontario Securities Commission Bulletin for advertisements. The publisher will accept advertising aimed at the securities industry or financial community in Canada. -

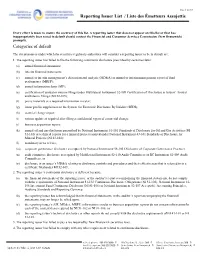

Reporting Issuer List / Liste Des Émetteurs Assujettis Categories Of

Page 1 of 163 Reporting Issuer List / Liste des Émetteurs Assujettis Every effort is made to ensure the accuracy of this list. A reporting issuer that does not appear on this list or that has inappropriately been noted in default should contact the Financial and Consumer Services Commission (New Brunswick) promptly. Categories of default The circumstances under which the securities regulatory authorities will consider a reporting issuer to be in default are: 1. The reporting issuer has failed to file the following continuous disclosure prescribed by securities laws: (a) annual financial statements; (b) interim financial statements; (c) annual or interim management’s discussion and analysis (MD&A) or annual or interim management report of fund performance (MRFP); (d) annual information form (AIF); (e) certification of annual or interim filings under Multilateral Instrument 52-109 Certification of Disclosure in Issuers’ Annual and Interim Filings (MI 52-109); (f) proxy materials or a required information circular; (g) issuer profile supplement on the System for Electronic Disclosure By Insiders (SEDI); (h) material change report; (i) written update as required after filing a confidential report of a material change; (j) business acquisition report; (k) annual oil and gas disclosure prescribed by National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities (NI 51-101) or technical reports for a mineral project required under National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101); (l) mandatory news release; (m) corporate governance disclosure as required by National Instrument 58-101 Disclosure of Corporate Governance Practices; (n) audit committee disclosure as required by Multilateral Instrument 52-110 Audit Committees or BC Instrument 52-509 Audit Committees; or (o) disclosure in an issuer’s MD&A relating to disclosure controls and procedures and their effectiveness that is referred to in a certificate filed under MI 52-109. -

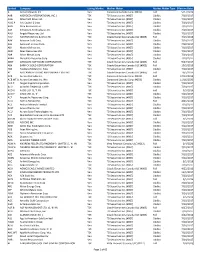

Reporting Issuers Listing

Reporting Issuers Listing Current Date as of November 3, 2020 Issuer Name Start Date 35137 @rgentum Canadian Equity Portfolio 29-Apr-1998 35164 @rgentum Canadian Performance Portfolio 29-Apr-1998 38641 @rgentum Discovery Portfolio 5-May-1999 35159 @rgentum Income Porfolio 29-Apr-1998 35166 @rgentum International Master Portfolio 29-Apr-1998 35161 @rgentum Short Term Asset Portfolio 29-Apr-1998 40224 @rgentum U.S. Market Neutral Portfolio 9-May-2000 35165 @rgentum U.S. Master Portfolio 29-Apr-1998 42037 01 Communique Laboratory Inc. 31-Mar-2000 81806 1320659 Alberta Ltd. 11-Jul-2007 71911 1608557 Ontario Inc. 30-Apr-2004 104328 1832 AM Investment Grade Canadian Corporate Bond Pool 23-Jan-2020 102153 1832 AM U.S. $ Investment Grade U.S. Corporate Bond Pool 11-Oct-2018 101948 1911 Gold Corporation 20-Jul-2018 83757 1933 Industries Inc. 24-Apr-2008 89177 2242749 Ontario Limited 1-Jan-2011 41946 3040915 Nova Scotia Limited 30-Dec-1962 41570 360networks Inc. (T) 19-Apr-2000 39287 407 International Inc. 21-Jul-1999 71916 4504020 Canada Inc. 28-May-2004 103155 48North Cannabis Corp. 26-Mar-2019 77259 *49 North Resources Inc. 3-Oct-2005 82873 5N Plus Inc. 13-Dec-2007 30112 9342-8530 Quebec Inc. (formerly DiagnoCure Inc.) 14-Nov-1996 48257 A&W Revenue Royalties Income Fund 11-Feb-2002 84813 Abacus Mining & Exploration Corporation 18-Dec-2009 10860 Abbey Exploration Inc. (CT) 10-Sep-1987 14-Feb-1993 9490 Aberdeen Asia-Pacific Income Investment Company Limited 30-May-1986 8538 ABI Biotechnology Inc. (CT) 15-Nov-1984 10-Feb-1993 33333 Aboriginal Global Investment Fund (CT) 6-Jan-1998 17-Jan-2002 41606 *Absolute Software Corporation 17-Mar-2000 43076 Acadian Core International Equity Fund 28-Sep-2000 87081 Acadian Timber Corp. -

FINANCIAL STATEMENTS | March 31, 2021

MACKENZIE CANADIAN EQUITY INDEX ETF ANNUAL AUDITED FINANCIAL STATEMENTS | March 31, 2021 MANAGEMENT REPORT Management’s Responsibility for Financial Reporting The accompanying financial statements have been prepared by Mackenzie Financial Corporation, as Manager of Mackenzie Canadian Equity Index ETF (the “ETF”). The Manager is responsible for the integrity, objectivity and reliability of the data presented. This responsibility includes selecting appropriate accounting principles and making judgments and estimates consistent with International Financial Reporting Standards. The Manager is also responsible for the development of internal controls over the financial reporting process, which are designed to provide reasonable assurance that relevant and reliable financial information is produced. The Board of Directors (the “Board”) of Mackenzie Financial Corporation is responsible for reviewing and approving the financial statements and overseeing the Manager’s performance of its financial reporting responsibilities. The Board is assisted in discharging this responsibility by an Audit Committee, which reviews the financial statements and recommends them for approval by the Board. The Audit Committee also meets regularly with the Manager, internal auditors and external auditors to discuss internal controls over the financial reporting process, auditing matters and financial reporting issues. Deloitte LLP is the external auditor of the ETF. It is appointed by the Board. The external auditor has audited the financial statements in accordance -

Reporting Issuers in Good Standing in Newfoundland and Labrador (As of 7:37Am NST September 27, 2021)

Reporting Issuers in Good Standing in Newfoundland and Labrador (As of 7:37am NST September 27, 2021) 01 Communique Laboratory Inc. 1285081 Ontario 1608557 Ontario Inc. 1832 AM Canadian All Cap Equity Pool (formerly Scotia Private Canadian All Cap Equity Pool) 1832 AM Emerging Markets Equity Pool (formerly Scotia Emerging Markets Equity Fund) 1832 AM Fundamental Canadian Equity Pool (formerly Scotia Private Fundamental Canadian Equity Pool) 1832 AM Global Credit Pool (formerly Scotia Private Global Credit Pool) 1832 AM International Growth Equity Pool (formerly Scotia Private International Growth Equity Pool) 1832 AM Investment Grade Canadian Corporate Bond Pool 1832 AM U.S. $ Investment Grade U.S. Corporate Bond Pool (formerly 1832 AM Investment Grade U.S. Corporate Bond Pool) 1911 Gold Corporation 20/20 Group 1990 Limited Partnership 20/20 Group 1992 Limited Partnership 2242749 Ontario Limited (formerly Armtec Infrastructure Inc.) 2737469 Canada Inc. (formerly, CanWest Global Communications Corp.) 360networks inc. 3iQ CoinShares Bitcoin ETF (formerly, 3iQ Bitcoin ETF) 3iQ CoinShares Ether ETF (formerly, 3iQ Ether ETF) 407 International Inc. 4141377 Canada Inc. 4504020 Canada Inc. (formerly Railpower Technologies Corp.) 48North Cannabis Corp. 49 North 2007 Resource Flow‐Through Limited Partnership 49 North 2008 Resource Flow‐Through Limited Partnership 49 North 2009 Resource Flow‐Through Limited Partnership 4Front Ventures Corp. 5N Plus Inc. 9342‐8530 Québec Inc. (formerly DiagnoCure Inc.) AAER Inc. Abacus Mining & Exploration Corporation Abaxx Technologies Inc. ABC Technologies Holdings Inc. Pg. 1 of 220 Reporting Issuers in Good Standing in Newfoundland and Labrador (As of 7:37am NST September 27, 2021) Aberdeen Asia‐Pacific Income Investment Company Limited Absolute Software Corporation Acadian Core International Equity Fund Acadian Timber Corp. -

Name Country Continent Number of Scores Date of First Score Recorded Date of Last Score Recorded Eurasia Energy Ltd Anguilla

Gradement's coverage as of 2021-08-08 07:40:54.383776768 UTC name country continent number_of_scores date_of_first_score_recorded date_of_last_score_recorded Eurasia Energy Ltd Anguilla North America 752 2006-12-31 2021-07-22 Kidoz Inc Anguilla North America 1336 2007-12-31 2021-07-15 Banco Bbva Argentina SA Argentina South America 1333 2007-12-31 2021-07-20 Banco Santander Rio SA Argentina South America 1313 2001-12-31 2021-07-20 Bioceres Crop Solutions Corp Argentina South America 873 2013-01-01 2021-08-04 Despegar.com Corp Argentina South America 1048 2013-01-01 2021-08-04 Grupo Supervielle SA -ADR Argentina South America 1314 2011-12-31 2021-08-05 Loma Negra Compania Indl Argntna SA-ADR Argentina South America 420 2013-01-01 2021-08-04 Mercadolibre Inc Argentina South America 2813 2007-12-31 2021-08-04 Patagonia Gold Corp Argentina South America 1319 2007-12-31 2021-07-15 1300 Smiles Limited Australia Australia 1282 2008-06-30 2021-07-22 1414 Degrees Ltd Australia Australia 439 2013-01-01 2021-07-22 1st Group Ltd Australia Australia 922 2011-06-30 2021-07-22 29Metals Ltd Australia Australia 33 2013-01-01 2021-07-22 333D Ltd Australia Australia 1314 2007-06-30 2021-07-22 360 Capital Enhanced Income Fund Australia Australia 1276 2007-06-30 2021-07-22 360 Capital Group Ltd Australia Australia 1417 2007-06-30 2021-07-22 360 Capital REIT Australia Australia 805 2013-01-01 2021-07-22 3D Metalforge Ltd Australia Australia 31 2013-01-01 2021-07-22 3D Oil Limited Australia Australia 1319 2007-06-30 2021-07-22 3D Resources Limited Australia -

Market Maker Assignments Ja

Symbol Company Listing Market Market Maker Market Maker Type Effective Date A Armor Minerals Inc. Ven Canaccord Genuity Corp. (#033) Full 5/27/2019 AAB ABERDEEN INTERNATIONAL INC. J TSX TD Securities Inc. (#007) Oddlot 7/10/2017 AAG Aftermath Silver Ltd. Ven TD Securities Inc. (#007) Oddlot 7/10/2017 AAJC.P AAJ Capital 2 Corp. Ven TD Securities Inc. (#007) Oddlot 7/10/2017 AAN Aton Resources Inc. Ven TD Securities Inc. (#007) Oddlot 7/10/2017 AAT ATI Airtest Technologies Inc. Ven TD Securities Inc. (#007) Oddlot 7/10/2017 AAU Angold Resources Ltd Ven TD Securities Inc. (#007) Oddlot 7/10/2017 AAV ADVANTAGE OIL & GAS LTD. TSX Citadel Securities Canada ULC (#005) Full 4/19/2016 AAX Advance Gold Corp. Ven TD Securities Inc. (#007) Oddlot 7/10/2017 AAZ Azincourt Energy Corp. Ven TD Securities Inc. (#007) Oddlot 7/10/2017 ABI Abcourt Mines Inc. Ven TD Securities Inc. (#007) Oddlot 7/10/2017 ABN Aben Resources Ltd. Ven TD Securities Inc. (#007) Oddlot 7/10/2017 ABR Arbor Metals Corp. Ven TD Securities Inc. (#007) Oddlot 7/10/2017 ABRA Abraplata Resource Corp. Ven TD Securities Inc. (#007) Oddlot 7/10/2017 ABST ABSOLUTE SOFTWARE CORPORATION TSX Citadel Securities Canada ULC (#005) Full 9/27/2017 ABX BARRICK GOLD CORPORATION TSX Citadel Securities Canada ULC (#005) Full 10/5/2015 ABZ AsiaBase Metals Inc. New Ven TD Securities Inc. (#007) Oddlot 7/10/2017 AC AIR CANADA VOTING AND VARIABLE VOTING TSX Citadel Securities Canada ULC (#005) Full 10/5/2015 ACB Aurora Cannabis Inc. -

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page Reporting Issuers Default When a reporting issuer is noted in default, standardized codes (a number and, if applicable a letter, described in the legend below) will be appear in the column 'Nature of Default'. Every effort is made to ensure the accuracy of this list. A reporting issuer that does not appear on this list or that has inappropriately been noted in default should contact the Alberta Securities Commission (ASC) promptly. A reporting issuer’s management or insiders may be subject to a Management Cease Trade Order, but that order will NOT be shown on the list. Legend 1. The reporting issuer has failed to file the following continuous disclosure document prescribed by Alberta securities laws: (a) annual financial statements; (b) an interim financial report; (c) an annual or interim management's discussion and analysis (MD&A) or an annual or interim management report of fund performance (MRFP); (d) an annual information form; (AIF); (e) a certification of annual or interim filings under National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-109); (f) proxy materials or a required information circular; (g) an issuer profile supplement on the System for Electronic Disclosure By Insiders (SEDI); (h) a material change report; (i) a written update as required after filing a confidential report of a material change; (j) a business acquisition report; (k) the annual oil and gas disclosure prescribed by National Instrument -

The “Preliminary Prospe

This presentation is dated October 9, 2020. A preliminary base PREP prospectus dated October 7, 2020 (the “preliminary prospectus”) containing important information relating to the securities described in this presentation has been filed with the securities regulatory authorities in each of the provinces and territories of Canada. A copy of the preliminary prospectus, and any amendment, is required to be delivered with this presentation. The preliminary prospectus is still subject to completion. There will not be any sale or any acceptance of an offer to buy the securities until a receipt for the final prospectus has been issued. This presentation does not provide full, true and plain disclosure of all material facts relating to the securities offered. Investors should read the preliminary prospectus, the final base PREP prospectus, the supplemented PREP prospectus and any amendment for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision. DISCLAIMER AND CAUTIONARY NOTES General Capitalized terms used herein that are not otherwise defined have the meanings ascribed to such terms in the preliminary prospectus. This presentation is being provided by BBTV Holdings Inc. (“BBTV Holdings”) regarding the business of BroadbandTV Corp. (“BBTV”), a company which BBTV Holdings intends to acquire, and the Company, as defined below. In this presentation, references to the “Company” means BBTV Holdings and BBTV, collectively. At the time of this presentation, BBTV Holdings has not acquired BBTV and there is no assurance that BBTV Holdings will acquire BBTV. This presentation is qualified in its entirety by reference to, and must be read in conjunction with, the information contained in the preliminary prospectus.