Commodities and Predominant Deflation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Estimating 90-Day Market Volatility with VIX and VXV

Estimating 90-Day Market Volatility with VIX and VXV Larissa J. Adamiec, Corresponding Author, Benedictine University, USA Russell Rhoads, Tabb Group, USA ABSTRACT The CBOE Volatility Index (VIX) has historically been a consistent indicator of 30-day or 1-month (21-day actual) realized market volatility. In addition, the Chicago Board Options Exchange also quotes the CBOE 3-Month Volatility Index (VXV) which indicates the 3-month realized market volatility. This study demonstrates both VIX and VXV are still reliable indicators of their respective realized market volatility periods. Both of the indexes consistently overstate realized volatility, indicating market participants often perceive volatility to be much higher than volatility actually is. The overstatement of expected volatility leads to an indicator which is consistently higher. Perceived volatility in the long-run is often lower than volatility in the short-run which is why VXV is often lower than VIX (VIX is usually lower than VXV). However, the accuracy of the VXV is roughly 35% as compared with the accuracy of the VIX at 60.1%. By combining the two indicators to create a third indicator we were able to provide a much better estimate of 64-Day Realized volatility, with an accuracy rate 41%. Due to options often being over-priced, historical volatility is often higher than both realized volatility or the volatility index, either the VIX or the VXV. Even though the historical volatility is higher we find the estimated historical volatility to be more easily estimated than realized volatility. Using the same time period from January 2, 2008 through December 31, 2016 we find the VIX estimates the 21-Day Historical Volatility with 83.70% accuracy. -

Copyrighted Material

INDEX Page numbers followed by n indicate note numbers. A Arnott, Robert, 391 Ascending triangle pattern, 140–141 AB model. See Abreu-Brunnermeier model Asks (offers), 8 Abreu-Brunnermeier (AB) model, 481–482 Aspray, Thomas, 223 Absolute breadth index, 327–328 ATM. See Automated teller machine Absolute difference, 327–328 ATR. See Average trading range; Average Accelerated trend lines, 65–66 true range Acceleration factor, 88, 89 At-the-money, 418 Accumulation, 213 Average range, 79–80 ACD method, 186 Average trading range (ATR), 113 Achelis, Steven B., 214n1 Average true range (ATR), 79–80 Active month, 401 Ayers-Hughes double negative divergence AD. See Chaikin Accumulation Distribution analysis, 11 Adaptive markets hypothesis, 12, 503 Ayres, Leonard P. (Colonel), 319–320 implications of, 504 ADRs. See American depository receipts ADSs. See American depository shares B 631 Advance, 316 Bachelier, Louis, 493 Advance-decline methods Bailout, 159 advance-decline line moving average, 322 Baltic Dry Index (BDI), 386 one-day change in, 322 Bands, 118–121 ratio, 328–329 trading strategies and, 120–121, 216, 559 that no longer are profitable, 322 Bandwidth indicator, 121 to its 32-week simple moving average, Bar chart patterns, 125–157. See also Patterns 322–324 behavioral finance and pattern recognition, ADX. See Directional Movement Index 129–130 Alexander, Sidney, 494 classic, 134–149, 156 Alexander’s filter technique, 494–495 computers and pattern recognition, 130–131 American Association of Individual Investors learning objective statements, 125 (AAII), 520–525 long-term, 155–156 American depository receipts (ADRs), 317 market structure and pattern American FinanceCOPYRIGHTED Association, 479, 493 MATERIALrecognition, 131 Amplitude, 348 overview, 125–126 Analysis pattern description, 126–128 description of, 300 profitability of, 133–134 fundamental, 473 Bar charts, 38–39 Andrews, Dr. -

Copyrighted Material

Index 12b-1 fee, 68–69 combining with Western analysis, 3M, 157 122–123 continuation day, 116 ABC of Stock Speculation, 157 doji, 115 accrual accounting, 18 dragonfl y doji, 116–117 accumulated depreciation, 46–47 engulfi ng pattern, 120, 121 accumulation phase, 158 gravestone doji, 116, 117, 118 accumulation/distribution line, hammer, 119 146–147 hanging man, 119 Adaptive Market Hypothesis, 155 harami, 119, 120 Altria, 29, 127, 185–186 indicators 120 Amazon.com, 151 long, 116, 117, 118 amortization, 47, 49 long-legged doji, 118 annual report, 44–46 lower shadow, 115 ascending triangle, 137–138, 140 marubozu, 116 at the money, 192 real body, 114–115 AT&T, 185–186 segments illustrated, 114 shadows, 114 back-end sales load, 67–68 short,116, 117 balance sheet, 46–50 spinning top, 118–119 balanced mutual funds, 70–71 squeeze alert, 121, 122, 123 basket of stocks, 63 tails, 114 blue chip companies, 34 three black crows, 122, 123 Boeing, 134–135 three white soldiers, 122, 123 book value, 169 trend-based, 117–118 breadth, 82–83, 97 upper shadow, 115 breakaway gap, 144 wicks, 114 break-even rate, 16–17 capital assets, 48, 49 breakout, 83–84, 105–106 capitalization-based funds, 71 Buffett, Warren, 152 capitalization-weighted average, 157 bull and bear markets,COPYRIGHTED 81, 174–175 Caterpillar, MATERIAL 52–54, 55, 57, 58, 59, 131 Bureau of Labor Statistics (BLS), 15 CBOE Volatility Index (VIX), 170, 171 Buy-and-hold strategy, 32, 204–205 Chaikin Money Flow (CMF), 146 buy to open/sell to open, 96 channel, 131–132 charting calendar spreads, 200–201 -

Economic Quarterly

Forecasting the Effects of Reduced Defense Spending Peter Irel’and and Chtitopher Omk ’ I. INTRODUCTION $1 cut in defense spending acts to decrease the total demand for goods and services in each period by $1. The end of the Cold War provides the United Of course, so long as the government has access to States with an opportunity to cut its defense the same production technologies that are available spending significantly. Indeed, the Bush Administra- to the private sector, this prediction of the tion’s 1992-1997 Future Years Defense Program neoclassical model does not change if instead the (presented in 1991 and therefore referred to as the government produces the defense services itself.’ “1991 plan”) calls for a 20 percent reduction in real defense spending by 1997. Although expenditures A permanent $1 cut in defense spending also related to Operation Desert Storm have delayed the reduces the government’s need for tax revenue; it implementation of the 199 1 plan, policymakers con- implies that taxes can be cut by $1 in each period. tinue to call for defense cutbacks. In fact, since Bush’s Households, therefore, are wealthier following the plan was drafted prior to the collapse of the Soviet cut in defense spending; their permanent income in- Union, it seems likely that the Clinton Administra- creases by $b1. According to the permanent income tion will propose cuts in defense spending that are hypothesis, this $1 increase in permanent income even deeper than those specified by the 1991 plan. induces households to increase their consumption by This paper draws on both theoretical and empirical $1 in every period, provided that their labor supply economic models to forecast the effects that these does not change. -

Asset Allocation POINT WHAT DOES a LOW VIX TELL US June 2017 ABOUT the MARKET? Timely Intelligence and Analysis for Our Clients

PRICE Asset Allocation POINT WHAT DOES A LOW VIX TELL US June 2017 ABOUT THE MARKET? Timely intelligence and analysis for our clients. KEY POINTS . The financial press has been paying considerable attention lately to the Chicago Board Options Exchange Volatility Index (VIX), with many financial pundits citing recent low readings on the VIX as evidence of investor complacency and rising equity risk. Robert Harlow, CFA, CAIA . Quantitative Analyst Media coverage often implies that a low current VIX is a strong signal of expected Asset Allocation future volatility and will be followed by a sell-off in U.S. equities and other risk-seeking assets. Historical evidence shows that, over the near term, investors typically overestimate the next 30-day volatility of the S&P 500 Index. Further, when the VIX has been low, U.S. equities have outperformed U.S. bonds on average over the next 12 months, regardless of the change in the VIX over that horizon. Without a meaningful and prolonged catalyst, we do not believe a low level of the VIX David Clewell, CFA alone implies investor complacency or an immediate danger of a risk-off event. Research Analyst Asset Allocation BACKGROUND There has been much discussion in the financial press recently about the danger of investor complacency—with a low VIX frequently cited as compelling evidence that equity investors have grown too relaxed about potential risks. The problem is that it is difficult to determine whether markets are truly complacent or not; we can’t survey all investors and, even if we could, how many investors would admit that they were complacent? Instead, we take a mental shortcut and presume that something we can measure is a good proxy for the thing we actually care about. -

Interest-Rate-Growth Differentials and Government Debt Dynamics

From: OECD Journal: Economic Studies Access the journal at: http://dx.doi.org/10.1787/19952856 Interest-rate-growth differentials and government debt dynamics David Turner, Francesca Spinelli Please cite this article as: Turner, David and Francesca Spinelli (2012), “Interest-rate-growth differentials and government debt dynamics”, OECD Journal: Economic Studies, Vol. 2012/1. http://dx.doi.org/10.1787/eco_studies-2012-5k912k0zkhf8 This document and any map included herein are without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city or area. OECD Journal: Economic Studies Volume 2012 © OECD 2013 Interest-rate-growth differentials and government debt dynamics by David Turner and Francesca Spinelli* The differential between the interest rate paid to service government debt and the growth rate of the economy is a key concept in assessing fiscal sustainability. Among OECD economies, this differential was unusually low for much of the last decade compared with the 1980s and the first half of the 1990s. This article investigates the reasons behind this profile using panel estimation on selected OECD economies as means of providing some guidance as to its future development. The results suggest that the fall is partly explained by lower inflation volatility associated with the adoption of monetary policy regimes credibly targeting low inflation, which might be expected to continue. However, the low differential is also partly explained by factors which are likely to be reversed in the future, including very low policy rates, the “global savings glut” and the effect which the European Monetary Union had in reducing long-term interest differentials in the pre-crisis period. -

Futures & Options on the VIX® Index

Futures & Options on the VIX® Index Turn Volatility to Your Advantage U.S. Futures and Options The Cboe Volatility Index® (VIX® Index) is a leading measure of market expectations of near-term volatility conveyed by S&P 500 Index® (SPX) option prices. Since its introduction in 1993, the VIX® Index has been considered by many to be the world’s premier barometer of investor sentiment and market volatility. To learn more, visit cboe.com/VIX. VIX Futures and Options Strategies VIX futures and options have unique characteristics and behave differently than other financial-based commodity or equity products. Understanding these traits and their implications is important. VIX options and futures enable investors to trade volatility independent of the direction or the level of stock prices. Whether an investor’s outlook on the market is bullish, bearish or somewhere in-between, VIX futures and options can provide the ability to diversify a portfolio as well as hedge, mitigate or capitalize on broad market volatility. Portfolio Hedging One of the biggest risks to an equity portfolio is a broad market decline. The VIX Index has had a historically strong inverse relationship with the S&P 500® Index. Consequently, a long exposure to volatility may offset an adverse impact of falling stock prices. Market participants should consider the time frame and characteristics associated with VIX futures and options to determine the utility of such a hedge. Risk Premium Yield Over long periods, index options have tended to price in slightly more uncertainty than the market ultimately realizes. Specifically, the expected volatility implied by SPX option prices tends to trade at a premium relative to subsequent realized volatility in the S&P 500 Index. -

Corporate Bond Markets: A

Staff Working Paper: [SWP4/2014] Corporate Bond Markets: A Global Perspective Volume 1 April 2014 Staff Working Paper of the IOSCO Research Department Authors: Rohini Tendulkar and Gigi Hancock1 This Staff Working Paper should not be reported as representing the views of IOSCO. The views and opinions expressed in this Staff Working Paper are those of the authors only and do not necessarily reflect the views of the International Organization of Securities Commissions or its members. For further information please contact: [email protected] 1 Rohini Tendulkar is an Economist and Gigi Hancock is an Intern in IOSCO’s Research Department. They would like to thank Werner Bijkerk, Shane Worner and Luca Giordano for their assistance. 1 About this Document The IOSCO Research Department produces research and analysis on a range of securities markets issues, risks and developments. To support these efforts, the IOSCO Research Department undertakes a number of annual information mining exercises including extensive market intelligence in financial centers; risk roundtables with prominent members of industry and regulators; data gathering and analysis; the construction of quantitative risk indicators; a survey on emerging risks to regulators, academics and market participants; and review of the current literature on risks by experts. Developments in corporate bond markets have been flagged a number of times during these exercises. In particular, the lack of data on secondary market trading and, in general, issues in emerging market corporate bond markets, have been highlighted as an obstacle in understanding how securities markets are functioning and growing world-wide. Furthermore, the IOSCO Board has recognized, through establishment of a long-term finance project, the important contribution IOSCO and its members can and do make in ensuring capital markets play a leading role in supporting long term investment in both growth and emerging and developed economies. -

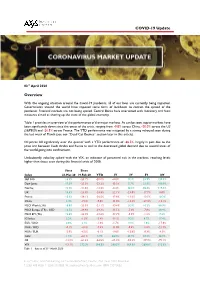

COVID-19 Update Overview

COVID-19 Update 03rd April 2020 Overview With the ongoing situation around the Covid-19 pandemic, all of our lives are currently being impacted. Governments around the world have imposed some form of lockdown to contain the spread of the pandemic. Financial markets are not being spared. Central Banks have intervened with monetary and fiscal measures aimed at shoring up the state of the global economy. Table 1 provides an overview of the performance of the major markets. As can be seen, equity markets have been significantly down since the onset of the crisis, ranging from -9.8% across China, -20.0% across the US (S&P500) and -26.5% across France. The YTD performance was mitigated by a strong rebound seen during the last week of March (see our “Dead Cat Bounce” section later in this article). Oil prices fell significantly over the quarter with a YTD performance of -66.5%, largely in part due to the price war between Saudi Arabia and Russia as well as the decreased global demand due to several areas of the world going into confinement. Undoubtedly volatility spiked with the VIX, an indicator of perceived risk in the markets, reaching levels higher than those seen during the financial crisis of 2008. Since Since Index 23-Mar-20 19-Feb-20 YTD 1Y 3Y 5Y 10Y S&P 500 15.5% -23.7% -20.0% -8.8% 9.1% 23.9% 120.3% Dow Jones 17.9% -25.3% -23.2% -15.5% 5.7% 21.9% 100.9% Nasdaq 12.2% -21.6% -14.2% -0.4% 30.2% 55.6% 219.4% UK 13.6% -23.9% -24.8% -22.1% -23.0% -17.7% 0.0% France 12.3% -28.1% -26.5% -17.8% -13.6% -13.5% 10.3% China 3.4% -7.6% -9.8% -11.0% -

How High Can a Dead Cat Bounce?: Metaphor and the Hong Kong Stock Market

DOCUMENT RESUME ED 390 259 FL 023 436 AUTHOR Smith, Geoff P. TITLE How High Can a Dead Cat Bounce?: Metaphor and the Hong Kong Stock Market. REPORT NO ISSN-10-15-2059 PUB DATE Sep 95 NOTE 16p.; For complete volume, see FL 023 432. PUB fYPE Journal Articles (080) Reports Evaluative/Feasibility (142) Viewpoints (Opinion/Position Papers, Essays, etc.) (120) JOURNAL CIT Hong Kong Papers in Linguistics and Language Teaching; v18 p43-57 Sep 1995 EDRS PRICE MF01/PC01 Plus Postage. DESCRIPTORS *Economics; English (Second Language); *English for Special Purposes; Foreign Countries; Learning Processes; *Media Research; *Metaphors; Symbols (Literary) IDENTIFIERS *Hong Kong; *Stock Market ABSTRACT This paper investigates metaphor in the language of economics, in particular, the way the vicissitudes of the Hong Kong financial markets are reported in the press. It analyzes the content from an English for Specific Purposes (ESP) perspective, probing for the significance in the negotiation of meaning in the subject area. Text samples were collected from the local Hong Kong media over 5 months in 1994. The perception of metaphor has changed in recent years from a rather obscure area of literary style to a central psycho-linguistic process intimately concerned with the way that reality is constructed through language. A number of subject domains are identified, including anthropomorphism, gravity, fauna, sports, and sentimentality. Findings suggest that metaphor is central to the definition of basic economic constructs; it has a role in making abstruse theoretical concepts accessible to readers or merely to interest or entertain. Metaphor functions here not only as a stylistir device, but is fundamental to the perceptions of both academics and professionals in the field. -

The DB Currency Volatility Index (CVIX): a Benchmark for Volatility

Global Foreign Excahnge Deutsche Bank@ October 2007 Deutsche Bank Guide To Currency Indices Global Markets Saravelos Global Hzead Global Head FX StrategyBilal Jason Rashid James Torquil George Hafeez Batt Hoosenally Malcolm Wheatley Editor Contributors George Saravelos Mirza Baig Jason Batt Bilal Hafeez FX Strategy EM FX Strategy Global Head Global Head FX Index Products FX Strategy Rashid Hoosenally Caio Natividade James Malcolm Global Head FX Derivatives Strategy EM FX Strategy Global Risk Strategy Deutsche Bank@ Guide to Currency Indices October 2007 Table of Contents Introduction............................................................................................................................. 3 Overview ................................................................................................................................ 4 The Deutsche Bank Menu of Currency Indices...................................................................... 7 Currency Markets: Money Left on the Table?........................................................................ 9 Tactical Currency Indices DB G10 Trade-Weighted Indices: From Theory to Practice.................................................. 18 DB EM Asia Policy Baskets .................................................................................................. 22 The Emerging Asia Reserves, Liquidity and Yield (EARLY) Index......................................... 26 The DB Currency Volatility Index (CVIX): A Benchmark for Volatility ................................... -

Economic Chapters of the 85Th Annual Report, June 2015

85th Annual Report 1 April 2014–31 March 2015 Basel, 28 June 2015 This publication is available on the BIS website (www.bis.org/publ/arpdf/ar2015e.htm). Also published in French, German, Italian and Spanish. © Bank for International Settlements 2015. All rights reserved. Limited extracts may be reproduced or translated provided the source is stated. ISSN 1021-2477 (print) ISSN 1682-7708 (online) ISBN 978-92-9197-064-3 (print) ISBN 978-92-9197-066-7 (online) Contents Letter of transmittal ..................................................... 1 Overview of the economic chapters .................................. 3 I. Is the unthinkable becoming routine? ............................. 7 The global economy: where it is and where it may be going ...................... 9 Looking back: recent evolution ............................................ 9 Looking ahead: risks and tensions .......................................... 10 The deeper causes ............................................................ 13 Ideas and perspectives . 13 Excess financial elasticity .................................................. 15 Why are interest rates so low? ............................................. 17 Policy implications ............................................................ 18 Adjusting frameworks ..................................................... 18 What to do now? ........................................................ 21 Conclusion . 22 II. Global financial markets remain dependent on central banks 25 Further monetary accommodation but diverging