Thyssenkrupp Ag

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

Important Notice the Depository Trust Company

Important Notice The Depository Trust Company B #: 12945-20 Date: February 10, 2020 To: All Participants Category: Dividends | International From: Global Tax Services Attention: Managing Partner/Officer, Cashier, Dividend Mgr., Tax Mgr. BNY Mellon | ADRs | Qualified Dividends for Tax Year 2019 Subject: Bank of New York Mellon Corporation (“BNYM”), as depositary for these issues listed below has reviewed and determined if they met the criteria for reduced U.S. tax rate as “qualified dividends” for tax year 2019. The Depository Trust Company received the attached correspondence containing Tax Information. If applicable, please consult your tax advisor to ensure proper treatment of these events. Non-Confidential DTCC Public (White) 2019 DIVIDEND CERTIFICATION CUSIP DR Name Country Exchange Qualified 000304105 AAC TECHNOLOGIES HLDGS INC CAYMAN ISLANDS OTC N 000380105 ABCAM PLC UNITED KINGDOM OTC Y 001201102 AGL ENERGY LTD AUSTRALIA OTC Y 001317205 AIA GROUP LTD HONG KONG OTC N 002482107 A2A SPA ITALY OTC Y 003381100 ABERTIS INFRAESTRUCTURAS S A SPAIN OTC Y 003725306 ABOITIZ EQUITY VENTURES INC PHILIPPINES OTC Y 003730108 ABOITIZ PWR CORP PHILIPPINES OTC Y 004563102 ACKERMANS & VAN HAAREN BELGIUM OTC Y 004845202 ACOM CO. JAPAN OTC Y 006754204 ADECCO GROUP AG SWITZERLAND OTC Y 007192107 ADMIRAL GROUP UNITED KINGDOM OTC Y 007627102 AEON CO LTD JAPAN OTC Y 008712200 AIDA ENGR LTD JAPAN OTC Y 009126202 AIR LIQUIDE FRANCE OTC Y 009279100 AIRBUS SE NETHERLANDS OTC Y 009707100 AJINOMOTO INC JAPAN OTC Y 015096209 ALEXANDRIA MINERAL - REG. S EGYPT None N 015393101 ALFA LAVAL AB SWEDEN SWEDEN OTC Y 021090204 ALPS ELEC LTD JAPAN OTC Y 021244207 ALSTOM FRANCE OTC Y 022205108 ALUMINA LTD AUSTRALIA OTC Y 022631204 AMADA HLDGS CO LTD JAPAN OTC Y 023511207 AMER GROUP HOLDING - REG. -

CCP Instruments As of 2003 03 27 Engl

First introduction sequence of CCP instruments as of March 27, 2003 CCP Instruments DAX Block Crossing DAX (Xetra XXL) + corresponding instruments 1 DE0008232125 LHA LUFTHANSA AG VNA O.N. 1 BC0008232125 BCLHA LUFTHANSA AG VNA O.N. 2 DE0007172009 SCH SCHERING AG O.N. 2 BC0007172009 BCSCH SCHERING AG O.N. CCP Instruments MDAX + corresponding instruments Block Crossing MDAX (Xetra XXL) 1 DE0002457561 HEIJ HEIDELBERGCEMENT O.N. NST 2 DE0005072102 BZL BERU AG O.N. 1 BC0005072102 BCBZL BERU AG 3 DE0005085906 AWD AWD HOLDING AG O.N. 2 BC0005085906 BCAWD AWD HOLDING AG O.N. 4 DE0005200000 BEI BEIERSDORF AG O.N. 3 BC0005200000 BCBEI BEIERSDORF AG O.N. 5 DE0005245500 BOS HUGO BOSS AG ST O.N. 6 DE0005245534 BOS3 HUGO BOSS AG VZO O.N. 4 BC0005245534 BBOS3 HUGO BOSS AG VZO O.N. 7 DE0005278006 BUD BUDERUS AG O.N. 5 BC0005278006 BCBUD BUDERUS AG O.N. 8 DE0005408116 ARL AAREAL BANK AG 6 BC0005408116 BCARL AAREAL BANK AG 9 DE0005408884 LEO LEONI AG NA O.N. 7 BC0005408884 BCLEO LEONI AG 10 DE0005421903 DGX DEGUSSA AG O.N. 8 BC0005421903 BCDGX DEGUSSA AG O.N. 11 DE0005439004 CON CONTINENTAL AG O.N. 9 BC0005439004 BCCON CONTINENTAL AG O.N. 12 DE0005471601 TNH TECHEM O.N. 10 BC0005471601 BCTNH TECHEM O.N. 13 DE0005591002 DYK DYCKERHOFF ST O.N. 14 DE0005591036 DYK3 DYCKERHOFF VZO O.N. 11 BC0005591036 BDYK3 DYCKERHOFF VZO O.N. 15 DE0005753008 CZZ CELANESE AG O.N. 12 BC0005753008 BCCZZ CELANESE AG O.N. 16 DE0005773303 FRA FRAPORT AG FFM.AIRPORT 13 BC0005773303 BCFRA FRAPORT AG 17 DE0005785604 FRE FRESENIUS AG O.N. -

Brand Finance Germany 50 2017

Germany 50 2017 The annual report on the most valuable German brands May 2017 Foreword. Contents steady downward spiral of poor communication, Foreword 2 wasted resources and a negative impact on the bottom line. Definitions 4 Methodology 6 Brand Finance bridges the gap between the marketing and financial worlds. Our teams have Executive Summary 8 experience across a wide range of disciplines from market research and visual identity to tax and Full Table (EURm) 12 accounting. We understand the importance of design, advertising and marketing, but we also Full Table (USDm) 13 believe that the ultimate and overriding purpose of Understand Your Brand’s Value 14 brands is to make money. That is why we connect brands to the bottom line. How We Can Help 16 By valuing brands, we provide a mutually intelligible Contact Details 17 language for marketers and finance teams. David Haigh, CEO, Brand Finance Marketers then have the ability to communicate the significance of what they do and boards can use What is the purpose of a strong brand; to attract the information to chart a course that maximises customers, to build loyalty, to motivate staff? All profits. true, but for a commercial brand at least, the first Without knowing the precise, financial value of an answer must always be ‘to make money’. asset, how can you know if you are maximising your returns? If you are intending to license a brand, how Huge investments are made in the design, launch can you know you are getting a fair price? If you are and ongoing promotion of brands. -

Press Release HOCHTIEF Subsidiary CIMIC Enters Sale Agreement With

CORPORATE HEADQUARTERS CORPORATE COMMUNICATIONS Press Release Contact: Dr. Bernd Pütter HOCHTIEF subsidiary CIMIC enters sale Alfredstraße 236 agreement with Elliott for 50% of Thiess 45133 Essen, Germany Tel.: +49 201 824-2610 • Valuing Thiess at AUD 4.3 billion (100% enterprise value) Fax: +49 201 824-2585 • Realizing cash proceeds of AUD 1.7 billion to AUD 1.9 billion [email protected] to CIMIC Page 1 of 3 10/19/2020 CIMIC Group, in which HOCHTIEF holds a 77.4% stake, today announced that it has entered into an agreement with funds advised by Elliott Advisors (UK) Ltd (“Elliott”) regarding the acquisition by Elliott of a 50% equity interest in Thiess, the world’s largest mining services provider. Elliott is one of the oldest fund managers of its kind under continuous operation and manages more than USD 40 billion in assets, including equity positions in private and listed companies, in Australia and globally. Thiess delivers open cut and underground mining in Australia, Asia, Africa and the Americas, providing services to 25 projects across a range of commodities. It has a diverse fleet of plant and equipment of more than 2,200 assets, a team of around 14,000 employees and generates annual revenues in excess of AUD 4.1 billion. Thiess is included in CIMIC’s Mining and Mineral Processing segment with CIMIC company Sedgman, a leading provider of minerals processing and associated infrastructure solutions to the global resources industry. CIMIC will retain 100% of Sedgman, generating AUD 400 million of annualized revenues with normalized profit before tax margins of around 10%. -

Europe 500 2021 Ranking Accounting for 14% of That the Continent’S Rapid the Total Brand Value (€237.7 Billion)

Europe 500 2021The annual report on the most valuable and strongest European brands June 2021 Contents. About Brand Finance 4 Get in Touch 4 Brandirectory.com 6 Brand Finance Group 6 Foreword 8 Executive Summary 10 Sector Reputation Analysis 18 Brand Finance Europe 500 (EUR m) 20 Brand Spotlights 30 Enedis 32 Interview with Catherine Lescure, Communications and CSR Director Orange 34 Interview with Béatrice Mandine, Executive Director of Communication, Brand and Engagement Porsche 36 Interview with Robert Ader, CMO of Dr. Ing. h.c. F. Porsche AG Bankinter 38 Interview with Yolanda Sanz Rey, Director of Image and Brand Management Meliá 40 Interview with André P. Gerondeau, Chief Operating Officer Global Soft Power Index 42 Germany 46 Interview with European Entrepreneurs France 48 Italy 50 Interview with Parmigiano Reggiano Spain 52 Interview with España Global Ireland 54 Ukraine 56 Interview with the Ukrainian Institute Methodology 58 Definitions 60 Brand Valuation Methodology 61 Brand Strength 62 Brand Equity Research Database 63 Our Services 64 Consulting Services 66 Brand Evaluation Services 67 Communications Services 68 Brand Finance Network 71 © 2021 All rights reserved. Brand Finance Plc. Brand Finance Europe 500 June 2021 3 About Brand Finance. Request your own Brand Finance is the world's leading brand valuation consultancy. We bridge the gap between marketing and finance Brand Value Report Brand Finance was set up in 1996 with the aim of 'bridging the gap between marketing and finance'. For 25 years, we have helped companies and organisations of all types to A Brand Value Report provides a connect their brands to the bottom line. -

FACTSHEET - AS of 28-Sep-2021 Solactive Mittelstand & Midcap Deutschland Index (TRN)

FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) DESCRIPTION The Index reflects the net total return performance of 70 medium/smaller capitalisation companies incorporated in Germany. Weights are based on free float market capitalisation and are increased if significant holdings in a company can be attributed to currentmgmtor company founders. HISTORICAL PERFORMANCE 350 300 250 200 150 100 50 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive Mittelstand & MidCap Deutschland Index (TRN) CHARACTERISTICS ISIN / WKN DE000SLA1MN9 / SLA1MN Base Value / Base Date 100 Points / 19.09.2008 Bloomberg / Reuters MTTLSTRN Index / .MTTLSTRN Last Price 342.52 Index Calculator Solactive AG Dividends Included (Performance Index) Index Type Equity Calculation 08:00am to 06:00pm (CET), every 15 seconds Index Currency EUR History Available daily back to 19.09.2008 Index Members 70 FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -3.69% 3.12% 7.26% 27.72% 12.73% 242.52% Performance (p.a.) - - - - - 9.91% Volatility (p.a.) 13.05% 12.12% 12.48% 13.60% 12.90% 21.43% High 357.49 357.49 357.49 357.49 357.49 357.49 Low 342.52 329.86 315.93 251.01 305.77 52.12 Sharpe Ratio -2.77 1.14 1.27 2.11 1.40 0.49 Max. Drawdown -4.19% -4.19% -4.19% -9.62% -5.56% -47.88% VaR 95 \ 99 -21.5% \ -35.8% -34.5% \ -64.0% CVaR 95 \ 99 -31.5% \ -46.8% -53.5% \ -89.0% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES EUR 100.0% DE -

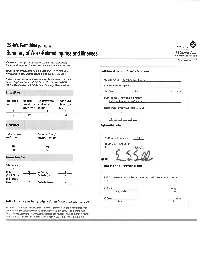

Thyssenkrupp Elevator Corporation Making Sure You've Added the Entries from Every Page of the Log

OSHA's Form 300A (Rev. 01/2004) Year 2017 U.S. Department of Labor Summary of Work-Related Injuries and Illnesses Occupational Safety and Health Administration Form approved OMB no. 1218-0176 All establishments covered by Part 1904 must complete this Summary page, even if no injuries or illnesses occurred during the year. Remember to review the Log to verify that the entries are complete Using the Log, count the individual entries you made for each category. Then write the totals below, Establishment information ThyssenKrupp Elevator Corporation making sure you've added the entries from every page of the log. If you had no cases write "0." Employees former employees, and their representatives have the right to review the OSHA Form 300 in Your establishment name ThyssenKrupp Elevator Corporation its entirety. They also have limited access to the OSHA Form 301 or its equivalent. See 29 CFR 1904.35, in OSHA's Recordkeeping rule, for further details on the access provisions for these forms. Street 5701 Pine Island Road Suite 390 Number of Cases City Tamarac State FL Zip 33321 Industry description (e.g., Manufacture of motor truck trailers) Total number of Total number of Total number of cases Total number of Elevator installation, conversion, repair & maintenance deaths cases with days with job transfer or other recordable away from work restriction cases Standard Industrial Classification (SIC), if known (e.g., SIC 3715) 0 53 51 29 1 7 9 6 (G) (H) (I) (J) 2 3 8 2 9 0 Number of Days Employment information Total number of days Total number of days of away from work job transfer or restriction Annual average number of employees 7944 Total hours worked by all employees last 2242 3003 year 15,889,281 (K) (L) Injury and Illness Types Sign here Total number of… Knowingly falsifying this document may result in a fine. -

The Annual Report on the World's Most Valuable Brands March 2010

Brand Finance® Global 500 The annual report on the world’s most valuable brands March 2010 David Haigh, Chief Executive, Brand Finance plc “Brands are the most valuable intangible assets in business today. They drive demand, motivate staff, secure business partners and reassure financial markets. Leading edge organisations recognise the need to understand brand equity and brand value when making strategic decisions” David Haigh, CEO, Brand Finance plc © Brand Finance plc 2010 Foreword Since it was released in 2007, the Brand Finance® Global 500 has been the most comprehensive table of published brands values. Each brand is awarded a Brand Rating: a benchmarking study of the strength, risk and future potential of a brand relative to its competitor set and a Brand Value: a summary measure of the financial strength of the brand. In contrast to last year’s dismal performance in which the total brand value of the 500 most valuable brands dropped by a staggering US$707 billion, the top 500 brands have shown tangible signs of recovery, growing by 27% in terms of total brand value. This improved performance is largely caused by the resurgence within the banking sector and the steady growth in the telecommunications sector. It is worth also noting that those brands that focus on providing value-oriented goods or services have fared well during the recession. Bearing this in mind, I am delighted to announce that for the second year running, Walmart is the most valuable brand in the world growing in brand value by 2% to US$41.4 billion. Within the Global 500, we continue to see the rise of emerging market brands. -

The Sustainability Yearbook 2020

The Sustainability Yearbook 2020 Perceiving risks, measuring impact, and disclosing results – critical steps for propelling corporate sustainability into the future The Sustainability Yearbook 2020 January 2020 S&P Global and RobecoSAM AG yearbook.robecosam.com Now a Part of 2 The Sustainability Yearbook 2020 2019 Annual Corporate Sustainability Assessment 61 4,710 Industries Companies assessed* *As of November 30th 2019 227,316 2,657,822 Documents uploaded Data points collected The Sustainability Yearbook 2020 3 Foreword Dear Reader, There’s no question the theme of sustainability is increasingly on the minds of investors, business leaders and policy makers. It’s moved to the top of the agenda at The World Economic Forum. Sustainable investing assets are growing. And you see more CEOs and corporate policy experts advocating long-term thinking. Virtually everywhere I go there are discussions about the role asset owners and the world’s largest businesses have in society, and how we all should be measuring their performance in that context. Just a few years ago these topics didn’t really resonate beyond Scandinavia, parts of Asia and segments of the investment community. Now they’re pervasive. The rising prominence of environmental, social and governance, or ESG, issues and the market demand for greater insights about these matters make this Sustainability Yearbook more important than ever. This Yearbook stands out for another reason. It’s the first one published by S&P Global. 4 The Sustainability Yearbook 2020 We’re incredibly proud to have acquired We thank everyone who participates in RobecoSAM’s ESG Ratings and the CSA for their continued partnership. -

General Meeting the Annual 2018

1 Agenda p. 02 2 Chairman’s M essage p. 03 DOCUMENTATION 3 Text and Presentation of 2018 the Resolutions p. 04 Wednesday 11 April 4 Report of the Board 1:30 pm of Directors p. 11 Hotel Okura Amsterdam Ferdinand Bolstraat 333 5 Useful Information p. 79 1072 LH Amsterdam The Netherlands The Annual General Meeting 02 Agenda Agenda 1 Opening and general introductory statements 2 Presentation by the Chairman and the Chief Executive Offi cer, including report by the Board of Directors in respect of the: 1. Corporate governance statement 2. Report on the business and fi nancial results of 2017 3. Application of the remuneration policy in 2017 4. Policy on dividend 3 Discussion of all Agenda items 4 Vote on the resolutions in respect of the: 1. Adoption of the audited accounts for the fi nancial year 2017 2. Approval of the result allocation and distribution 3. Release from liability of the Non-Executive Members of the Board of Directors 4. Release from liability of the Executive Member of the Board of Directors 5. Renewal of the appointment of Ernst & Young Accountants LLP as auditor for the fi nancial year 2018 6. Renewal of the appointment of Ms. María Amparo Moraleda Martínez as a Non-Executive Member of the Board of Directors for a term of three years 7. Appointment of Mr. Victor Chu as a Non-Executive Member of the Board of Directors for a term of three years in replacement of Sir John Parker whose mandate expires 8. Appointment of Mr. Jean-Pierre Clamadieu as a Non-Executive Member of the Board of Directors for a term of three years in replacement of Mr. -

FACTSHEET - AS of 27-Sep-2021 Deutschland Ethik 30 Aktienindex

FACTSHEET - AS OF 27-Sep-2021 Deutschland Ethik 30 Aktienindex HISTORICAL PERFORMANCE 300 250 200 150 100 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Deutschland Ethik 30 Aktienindex CHARACTERISTICS ISIN / WKN DE000SLA8ET8 / SLA8ET Base Value / Base Date 100 Points / 31.12.2013 Bloomberg / Reuters DETHIP30 Index / .DETHIP30 Last Price 290.19 Index Calculator Solactive AG Dividends Not included (Price index) Index Type Equity Calculation 08:00am to 06:00pm (CET), every 15 seconds Index Currency EUR History Available daily back to 31.12.2013 Index Members 30 FACTSHEET - AS OF 27-Sep-2021 Deutschland Ethik 30 Aktienindex STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -2.05% -0.50% 4.31% 18.22% 8.80% 54.20% Performance (p.a.) - - - - - 5.75% Volatility (p.a.) 12.00% 11.76% 11.67% 14.61% 12.36% 18.47% High 296.27 298.82 298.82 298.82 298.82 298.82 Low 282.92 282.92 278.19 225.13 261.73 158.75 Sharpe Ratio -1.81 -0.12 0.81 1.30 1.02 0.34 Max. Drawdown -4.51% -5.32% -5.32% -11.56% -5.32% -41.72% VaR 95 \ 99 -23.1% \ -40.4% -28.6% \ -53.0% CVaR 95 \ 99 -36.1% \ -61.6% -45.3% \ -74.2% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES EUR 100.0% DE 100.0% TOP COMPONENTS AS OF 27-Sep-2021 Company Ticker Country Currency Index Weight (%) SAP SE SAP GY Equity DE EUR 9.88% SIEMENS AG SIE GY Equity DE EUR 9.79% ALLIANZ SE ALV GY Equity DE EUR 8.98% DEUTSCHE POST AG DPW GY Equity DE EUR 7.74% ADIDAS AG ADS GY Equity DE EUR 6.21% LEG IMMOBILIEN SE LEG GY Equity DE EUR 6.03% TELEFONICA DEUTSCHLAND HOLDING AG O2D GY Equity DE EUR