Brand Finance Germany 50 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FACTSHEET - AS of 28-Sep-2021 Solactive Mittelstand & Midcap Deutschland Index (TRN)

FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) DESCRIPTION The Index reflects the net total return performance of 70 medium/smaller capitalisation companies incorporated in Germany. Weights are based on free float market capitalisation and are increased if significant holdings in a company can be attributed to currentmgmtor company founders. HISTORICAL PERFORMANCE 350 300 250 200 150 100 50 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive Mittelstand & MidCap Deutschland Index (TRN) CHARACTERISTICS ISIN / WKN DE000SLA1MN9 / SLA1MN Base Value / Base Date 100 Points / 19.09.2008 Bloomberg / Reuters MTTLSTRN Index / .MTTLSTRN Last Price 342.52 Index Calculator Solactive AG Dividends Included (Performance Index) Index Type Equity Calculation 08:00am to 06:00pm (CET), every 15 seconds Index Currency EUR History Available daily back to 19.09.2008 Index Members 70 FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -3.69% 3.12% 7.26% 27.72% 12.73% 242.52% Performance (p.a.) - - - - - 9.91% Volatility (p.a.) 13.05% 12.12% 12.48% 13.60% 12.90% 21.43% High 357.49 357.49 357.49 357.49 357.49 357.49 Low 342.52 329.86 315.93 251.01 305.77 52.12 Sharpe Ratio -2.77 1.14 1.27 2.11 1.40 0.49 Max. Drawdown -4.19% -4.19% -4.19% -9.62% -5.56% -47.88% VaR 95 \ 99 -21.5% \ -35.8% -34.5% \ -64.0% CVaR 95 \ 99 -31.5% \ -46.8% -53.5% \ -89.0% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES EUR 100.0% DE -

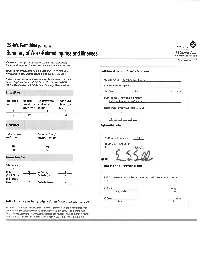

Thyssenkrupp Elevator Corporation Making Sure You've Added the Entries from Every Page of the Log

OSHA's Form 300A (Rev. 01/2004) Year 2017 U.S. Department of Labor Summary of Work-Related Injuries and Illnesses Occupational Safety and Health Administration Form approved OMB no. 1218-0176 All establishments covered by Part 1904 must complete this Summary page, even if no injuries or illnesses occurred during the year. Remember to review the Log to verify that the entries are complete Using the Log, count the individual entries you made for each category. Then write the totals below, Establishment information ThyssenKrupp Elevator Corporation making sure you've added the entries from every page of the log. If you had no cases write "0." Employees former employees, and their representatives have the right to review the OSHA Form 300 in Your establishment name ThyssenKrupp Elevator Corporation its entirety. They also have limited access to the OSHA Form 301 or its equivalent. See 29 CFR 1904.35, in OSHA's Recordkeeping rule, for further details on the access provisions for these forms. Street 5701 Pine Island Road Suite 390 Number of Cases City Tamarac State FL Zip 33321 Industry description (e.g., Manufacture of motor truck trailers) Total number of Total number of Total number of cases Total number of Elevator installation, conversion, repair & maintenance deaths cases with days with job transfer or other recordable away from work restriction cases Standard Industrial Classification (SIC), if known (e.g., SIC 3715) 0 53 51 29 1 7 9 6 (G) (H) (I) (J) 2 3 8 2 9 0 Number of Days Employment information Total number of days Total number of days of away from work job transfer or restriction Annual average number of employees 7944 Total hours worked by all employees last 2242 3003 year 15,889,281 (K) (L) Injury and Illness Types Sign here Total number of… Knowingly falsifying this document may result in a fine. -

Thyssenkrupp AG As a Whole We Must Materials and Industrials – Two New and We Will Continue to Follow This Path

Annual Report 2017/2018 thyssenkrupp at a glance ORDER INTAKE THYSSENKRUPP IN FIGURES (Group without Steel Americas) in € million 2017 / 2018 Change in % Order intake € million 42,754 0 Sales € million 42,745 3 Adjusted EBIT € million 1,551 – 10 Net income € million 60 – 78 Earnings per share € 0.01 – 96 42,754 Free cash flow before M & A € million – 134 84 Net financial debt 1 € million 2,364 21 tkVA 1 € million – 217 67 Market capitalization € million 13,534 – 13 Order intake in 2017/2018 at high prior-year level Dividend per share € 0.15 2) – 1 Full Group 2 Proposal to the Annual General Meeting ~ € 4 2 .7 billion 6 regional HQs 78 countries sales generated by thyssenkrupp in fiscal 2017 / 2018 ~ 1,900 locations BUSINESS AREAS Components Elevator Industrial 161,096 Technology Technology Solutions employees work every day to ensure thyssenkrupp Materials Steel can implement unique projects. Services Europe 1 (as at September 30, 2018) 1 Discontinued operation The more specific the targets, the better the performance. So let’s talk specifics. From thyssenkrupp in transition Guido Kerkhoff, Donatus Kaufmann and Oliver Burkhard have been out and about a lot in recent weeks. Around the world they been talking with employees, answering questions, and explaining the separation of thyssenkrupp and the next steps. Here they talk about current developments in the company – and why “best for both” also means the best for our shareholders. I.2 thyssenkrupp annual report 2017 / 2018 Magazine to thyssenkrupp on the rise. Looking back, last fiscal year was very business – and addressed the challenges. -

German Companies

30 32 33 31 GERMAN 3 29 2 COMPANIES IN ARKANSAS 4 1 55 PARENT 26 COMPANY CITY COMPANY NAICS WEBSITE 18 Thyssenkrupp ThyssenKrupp 9 Alexander 238290 www.thyssenkruppelevator.com 49 17 Elevator Corporation AG 25 Lanxess www.lanxess.com 10 Lanxess Corporation Little Rock Deutschland 326299 555 www.rch.lanxess.com 28 GmbH Siemens Industry, 7 67 22 11 Little Rock Siemens AG 335313 www.energy.siemens.com Inc. 8 Mahle Engine 12 40 24 12 Components USA, Russellville MAHLE GmbH 336310 www.us.mahle.com 23 Inc. Helm Fertilizer 13 Helena Helm AG 424910 www.helmag.com Helena Terminal Inc. 40 Peter Greven 11 14 Norac Additives, LLC Helena 325199 www.noracadditives.com 10 GmbH & Co. KG United Initiators 9 18 15 United Initiators, Inc. Helena 325199 www.united-initiators.com 13 GmbH & Co. KG American 16 Rheinmetall Camden Rheinmetall AG 332993 www.rheinmetall-defence.com 15 530 Munitions, Inc. Evonik Industries 17 Evonik Cyro LLC Osceola 325211 http://corporate.evonik.com 34 AG MKT Metall-und 167 18 Mkt Fastening, LLC Lonoke Kunststoff- 332722 www.mktfastening.com technik GmbH Hanson Aggregates HeidelbergCeme www.lehighhanson.com 21 19 Ashdown 221321 LLC nt AG www.heidelbergcement.com 20 Linde Gas LLC Lewisville Linde AG 325120 www.lindeus.com 19 30 SAF-HOLLAND www.safholland.us 65 21 SAF-Holland, Inc. Dumas 336350 16 GmbH www.safholland.com BASF - Soybean 22 Marion BASF SE 541715 https://agriculture.basf.com Breeding Station 20 23 BASF Corporation West Memphis BASF SE 325199 www.basf.com Kloeckner Metals 27 5 24 Marion Klöckner & Co. -

Growing Together Annual Report

8$& THYSSENKRUPPJ>OII;DAHKFF9ECF79J COMPACT ? I Annual Report On November 21, 2005, the Alfried Krupp von Bohlen und Halbach Foundation purchased 15,339,893 treasury shares of ThyssenKrupp ag – equating to 2.98% of the capital stock – from the Company at the market price of €17.44. As a 2004 2005 result of this transaction and the issue of employee shares in and , 2004_2005 ThyssenKrupp ag has sold all the treasury stock purchased from ific Holding ag in May 2003. addition to disposition of unappropriated profit dispositionofunappropriated addition to THEJ> ;GROUP=HEKF?D<?=KH IN FIGURES;I Due to this event, the following data have changed compared with(&& )%(the&& situation* (&&*%(&&+ at the 9^Wd][ 2003/2004 2004/2005 Change balance sheet date and the time the financial statements were drawn up: 9edj_dk_d]ef[hWj_edie\j^[=hekf Continuing operations of the Group EhZ[h_djWa[ c_bb_edÐ ).".() *("+&. )",.+ Order intakeThe Alfried Krupp von Bohlen und Halbach Foundation million as € the largest38,823 stockholder42,508 now 3,685 IWb[i c_bb_edÐ )-")&) *("&,* *"-,' Salesholds 23.58% of the voting rights in ThyssenKrupp millionag (previously € 37,303 20.6%). 42,064 4,761 ;8?J:7 c_bb_edÐ )"&), )"*+( *', EBITDA million € 3,036 3,452 416 ;8?J ;VXihVcY[^\jgZh# c_bb_edÐ '",.) ("&&' )'. EBIT The free float is reduced from 79.4% to 76.4% million € 1,683 2,001 318 <gdl^c\id\Zi]Zg ;8J_dYec[\hecYedj_dk_d]eÆi]nhhZc`gjeeXdbeVXiÇf[hWj_ediX[\eh[jWn[i XdciV^chVaai]ZcjbWZgh[dg EBT (income from continuing operations before taxes WdZc_deh_jo_dj[h[ij i]Z'%%)T'%%*[^hXVanZVg#>[^iÈhcdi]ZgZ!ndjXVcYdlcadVYc_bb_edÐ -

Thyssenkrupp Annual Report 2014/2015 Thyssenkrupp in Figures

Annual Report 2014 / 2015 C2 thyssenkrupp annual report 2014/2015 thyssenkrupp in figures thyssenkrupp in figures thyssenkrupp in figures 1) Full Group Continuing operations 2013/2014 2014/2015 Change in % 2013/2014 2014/2015 Change in % Order intake million € 41,376 41,318 (58) 0 41,376 41,318 (58) 0 Net sales million € 41,212 42,778 1,566 4 41,212 42,778 1,566 4 EBITDA million € 2,330 2,445 115 5 2,145 2,456 311 14 EBIT 2) million € 1,145 1,050 (95) (8) 959 1,061 102 11 EBIT margin 2) % 2.8 2.5 (0.3) — 2.3 2.5 0.2 — Adjusted EBIT 2) million € 1,329 1,676 347 26 1,329 1,676 347 26 Adjusted EBIT margin 2) % 3.2 3.9 0.7 — 3.2 3.9 0.7 — EBT million € 429 485 56 13 243 496 253 104 Net income/(loss) / Income/(loss) (net of tax) million € 195 268 73 37 9 279 270 ++ attributable to thyssenkrupp AG's shareholders million € 212 309 97 46 26 320 294 ++ Basic earnings per share € 0.38 0.55 0.17 45 0.05 0.57 0.52 ++ Operating cashflow million € 903 1,300 397 44 903 1,311 408 45 Cashflow for investments million € (1,260) (1,235) 25 2 (1,260) (1,235) 25 2 Free cashflow before divestments million € (357) 65 422 ++ (357) 76 433 ++ Cashflow from divestments million € 1,054 597 (457) (43) 1,054 597 (457) (43) Free cashflow million € 697 662 (35) (5) 697 673 (24) (3) Net financial debt (September 30) million € 3,677 3,414 (263) (7) Total equity (September 30) million € 3,199 3,307 108 3 Gearing (September 30) % 114.9 103.2 (11.7) — ROCE % 7.2 6.5 (0.7) — thyssenkrupp Value Added million € (282) (399) (117) (41) Dividend per share € 0.11 0.15 3) — — Dividend payout million € 62 85 3) — — Employees (September 30) 162,372 154,906 (7,466) (5) 1) Prior-year figures have been adjusted due to the adoption of IFRS 11 (cf. -

Thyssenkrupp AG

Debt Issuance Programme Prospectus 22 January 2021 This document constitutes the base prospectus for the purpose of article 8(1) of Regulation (EU) No 2017/1129 of the European Parliament and of the Council of 14 June 2017 as amended or superseded (the "Prospectus Regulation"), of thyssenkrupp AG in respect of non-equity securities within the meaning of article 2 (c) of the Prospectus Regulation ("Debt Issuance Programme Prospectus" or the "Prospectus"). thyssenkrupp AG (Duisburg and Essen, Federal Republic of Germany) € 10,000,000,000 Debt Issuance Programme (the "Programme") Application has been made to the Luxembourg Stock Exchange to list notes to be issued under the Programme (the "Notes") on the official list of the Luxembourg Stock Exchange and to admit Notes to trading on the Regulated Market "Bourse de Luxembourg". The Luxembourg Stock Exchange's regulated market (the "Regulated Market") is a regulated market for the purposes of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments, as amended ("MiFiD II"). Notes issued under the Programme may not be listed at all. This Prospectus has been approved by the Commission de Surveillance du Secteur Financier of the Grand Duchy of Luxembourg (the "CSSF") in its capacity as competent authority under the Prospectus Regulation and the Luxembourg law of 16 July 2019 relating to prospectuses for securities, as amended (Loi relative aux prospectus pour valeurs mobilières - "Luxembourg Prospectus Law") and provided to the competent authorities in the Federal Republic of Germany, The Netherlands and the Republic of Austria with a certificate of approval attesting that this Prospectus has been drawn up in accordance with the Prospectus Regulation (each a "Notification"). -

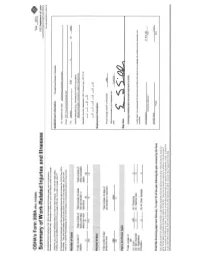

Master Agreement

OSHA's Form 300A (Rev. 01/2004) Year 2017 U.S. Department of Labor Summary of Work-Related Injuries and Illnesses Occupational Safety and Health Administration Form approved OMB no. 1218-0176 All establishments covered by Part 1904 must complete this Summary page, even if no injuries or illnesses occurred during the year. Remember to review the Log to verify that the entries are complete Using the Log, count the individual entries you made for each category. Then write the totals below, Establishment information ThyssenKrupp Elevator Corporation making sure you've added the entries from every page of the log. If you had no cases write "0." Employees former employees, and their representatives have the right to review the OSHA Form 300 in Your establishment name ThyssenKrupp Elevator Corporation its entirety. They also have limited access to the OSHA Form 301 or its equivalent. See 29 CFR 1904.35, in OSHA's Recordkeeping rule, for further details on the access provisions for these forms. Street 5701 Pine Island Road Suite 390 Number of Cases City Tamarac State FL Zip 33321 Industry description (e.g., Manufacture of motor truck trailers) Total number of Total number of Total number of cases Total number of Elevator installation, conversion, repair & maintenance deaths cases with days with job transfer or other recordable away from work restriction cases Standard Industrial Classification (SIC), if known (e.g., SIC 3715) 0 53 51 29 1 7 9 6 (G) (H) (I) (J) 2 3 8 2 9 0 Number of Days Employment information Total number of days Total number of days of away from work job transfer or restriction Annual average number of employees 7944 Total hours worked by all employees last 2242 3003 year 15,889,281 (K) (L) Injury and Illness Types Sign here Total number of… Knowingly falsifying this document may result in a fine. -

Metro Hosts 7Th German Diversity Day of the Rhine

PRESS RELEASE 28 May 2019 METRO HOSTS 7TH GERMAN DIVERSITY DAY 1 - 2 OF THE RHINE-RUHR NETWORK Düsseldorf, 28 May 2019 – “Diversity vs. simple-mindedness – I can do what you can’t do”: this is the motto used by the Diversity Network Rhine-Ruhr for its event organised on the occasion of the 7th German Diversity Day. On this day, around 100 employees and senior managers from 15 participating companies, all of them sig- natories of the Charta der Vielfalt (Diversity Charta), share their ideas about the numerous facets of diversity, discuss and learn from each other. As the host of the event, METRO invites the par- ticipants to the Düsseldorf Campus. “An open and inclusive management style, ideally with a highly diverse team, is not only a basic requirement for good diversity management but also in general for a sound management –especially with regard to our very international workforce”, says Heiko Hutmacher, Chief Human Resources Officer and Labour Director of METRO AG. “It is a great pleasure for us to be the host of the Diversity Network Rhine-Ruhr this year”, continues Hutma- cher. Following the welcome address delivered by the Chief Human Resources Officer the expert and author Janis McDavid will present a keynote speech on the topic “There is no such thing as impossible”. In his function as moti- vational speaker for UNICEF and “YES, YOU CAN” ambassador, he inspires his audience not only by explaining that the boundaries exist only in your mind, but also through his own life story. Another dimension of diversity will then be addressed by Prof. -

Special Materials Supply of High-Grade and Hard-To-Find Metals

Special Materials Supply of high-grade and hard-to-find metals Materials as a Service 2 About thyssenkrupp Aerospace Netherlands Our value proposition for Materials as a Service thyssenkrupp Aerospace Netherlands is a company that’s part of the thyssenkrupp Aerospace Group. It has the expertise and industry leading knowledge to advise and supply our customers with a comprehensive range of high-grade metals. Our value proposition includes a wide range of supply chain and manufacturing services for partners in demanding and industries such as Aerospace, Motorsports, Power Generation, Semiconductors and High Technology. We procure, store and process raw materials to meet our customers’ precise specifications. Given today’s immense competitive pressure on production to be fast, cost effective and of the highest standards, we under- stand the enormous challenges for manufacturing companies in the industries we serve. As their partner, our customers expect us to excel through reliability, best prices, on-time delivery and excellent material quality. thyssenkrupp Aerospace Netherlands is the perfect choice to be your reliable service partner. We have years of experience serving customers around the world. As part of the thyssenkrupp Aerospace group, we are perfectly positioned to be your dedicated and competent partner when it comes to special materials, even in small quantities. Our focus is on creating long-term, stable business relationships. By working closely with our customers, we are able to identify changing demands and needs at an early stage, enabling us to create the best solutions possible. We do not just meet demands – we surpass expectations. That is embedded in our philosophy. -

Press Release

Press Release thyssenkrupp Elevator 03.05.2017 Page 1/2 Major order from Azerbaijan: thyssenkrupp will supply super high escalators in capital city Baku thyssenkrupp has won tenders for 25 escalators, including the highest units ever produced in Germany, with 48.7m rise. The escalators increase capacity of the metro stations by 30% and ensure efficient passenger flow of the almost 222 million commuters per year. Order is a strong confirmation of new distributors’ network strategy. thyssenkrupp Elevator celebrates its latest success in urban mobility: the company has won the public tenders of Baku Metro to supply 25 escalators within the next three years. The double-digit million contract includes eight high-rise escalators for Sahil and Khatai stations, as well as 17 escalators for a new metro station. With a huge 48.7m traveling height, the four escalators for Khatai station will be the highest units ever produced by thyssenkrupp Elevator. Mr. Andreas Schierenbeck, CEO of thyssenkrupp Elevator, commented: “In supplying our advanced mobility solutions to Baku Metro, thyssenkrupp Elevator can increase the metro stations’ capacity by as much as 30% and ensure efficient passenger flow of around 222 million commuters each and every year. This is a significant improvement, and we are proud to provide this support as Baku continues its journey to become an efficient and future-proof city.” thyssenkrupp Elevator has an excellent reputation for innovation and transformation in the urban mobility industry. The new high quality products and services in Baku will revolutionize the ability of the metro stations to cope with increasing passenger numbers, and bring the city in line with the modern-day transport demands of its 2.15 million people. -

18Th German Corporate Conference

18th German Corporate Conference Programme Frankfurt, 21 – 23 January 2019 More than 170 companies confirmed their participation Tue 1&1 Drillisch AG* Mon, Tue Covestro AG Mon Hamburger Hafen und Logistik AG Wed Munich Re* Mon Ströer SE & Co. KGaA Wed Aareal Bank AG Wed CropEnergies AG Wed Hannover Rück SE Tue Mutares AG Tue Südzucker AG* Mon-Wed adidas Group* Mon CTS EVENTIM AG & Co. KG aA* Wed Hapag-Lloyd Aktiengesellschaft Tue NEMETSCHEK SE Tue Symrise AG Wed Adler Modemärkte AG Wed Delivery Hero SE Wed Hawesko Holding AG* Tue Nordex SE Mon TAG Immobilien AG Mon ADLER Real Estate AG* Wed Deutsche Börse AG Mon HeidelbergCement AG Mon, Wed NORMA Group SE Wed TAKKT AG Wed AGRANA Beteiligungs-AG* Tue Deutsche EuroShop AG* Mon Heidelberger Druckmaschinen AG Tue OSRAM Licht AG Wed Talanx AG* Wed AIXTRON SE* Tue, Wed Deutsche Lufthansa AG Tue HELLA KGaA Hueck & Co.* Tue PALFINGER AG Tue Tele Columbus AG* Wed Allianz SE* Wed Deutsche Pfandbriefbank AG Tue HOCHTIEF Aktiengesellschaft* Mon PATRIZIA Immobilien AG Tue Telefónica Deutschland Holding AG Tue alstria office REIT-AG* Mon Deutsche Telekom AG* Tue, Wed Hugo Boss AG Mon Pfeiffer Vacuum Technology AG* Tue thyssenkrupp AG* Wed ANDRITZ AG* Mon, Tue Deutsche Wohnen SE Tue IMMOFINANZ AG Tue PORR AG Tue TLG IMMOBILIEN AG Tue Aroundtown S.A. Mon Deutz AG Mon innogy SE* Tue Porsche Automobil Holding SE* Wed TOM TAILOR Holding SE* Mon AT&S AG Mon, Tue Dialog Semiconductor plc Mon Instone Real Estate Group AG Tue, Wed ProCredit Holding AG & Co. KGaA Tue, Wed TUI Group Tue Aurubis AG Wed Drägerwerk AG & Co.