Executive Business Management Programme Some Excerpts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Indian Automobile Industry

INDIAN AUTOMOBILE INDUSTRY Size of the Industry 2.6 Million Units Geographical Jamshedpur, Pune, Lucknow, Gurgoan, Delhi, Mumbai, distribution Bangalore, etc Output per annum Rs 2,000 crore per annum Percentage in world 6-8% market Market Capitalization 5% of the share History Indian market before independence was seen as a market for imported vehicles while assembling of cars manufactured by General Motors and other brands was the order of the day. Indian automobile industry mainly focused on servicing, dealership, financing and maintenance of vehicles. Later only after a decade from independence manufacturing started. India’s Transportation requirements were met by Indian Railways playing an important role till the 1950's. Since independence the Indian automobile industry faced several challenges and road blocks like manufacturing capability was restricted by the rule of license and could not be increased but still it lead to growth and success it has achieved today. For nearly three decades the total production of passenger cars was limited to 40,000 yearly. Even the production was confined to three main manufacturers Hindustan Motors, Premier Automobiles and Standard Motors. There was no expertise or research & development initiative taking place. Initially labor was unskilled and had to go through a process of learning through trial and error. In the 1950's, The Morris Oxford, became the Ambassador, the Fiat 1100 became the Premier Padmini. Then in 1960's nearly 98% of the product was developed indigenously.There were significant changes witnessed by the end of 1970's in the automobile industry. Strong and huge initiatives like joint ventures for light commercial vehicles did not succeed. -

The Annual Report on the Most Valuable Indian Brands May 2017

India 100 2017 The annual report on the most valuable Indian brands May 2017 Foreword. Contents steady downward spiral of poor communication, Foreword 2 wasted resources and a negative impact on the bottom line. Definitions 4 Methodology 6 Brand Finance bridges the gap between the marketing and financial worlds. Our teams have Excecutive Summary 8 experience across a wide range of disciplines from market research and visual identity to tax and Full Table (USDm) 12 accounting. We understand the importance of design, advertising and marketing, but we also Full Table (INRm) 14 believe that the ultimate and overriding purpose of Understand Your Brand’s Value 16 brands is to make money. That is why we connect brands to the bottom line. How We Can Help 18 By valuing brands, we provide a mutually intelligible Contact Details 19 language for marketers and finance teams. David Haigh, CEO, Brand Finance Marketers then have the ability to communicate the significance of what they do and boards can use What is the purpose of a strong brand; to attract the information to chart a course that maximises customers, to build loyalty, to motivate staff? All profits. true, but for a commercial brand at least, the first Without knowing the precise, financial value of an answer must always be ‘to make money’. asset, how can you know if you are maximising your returns? If you are intending to license a brand, how Huge investments are made in the design, launch can you know you are getting a fair price? If you are and ongoing promotion of brands. -

The Indian Steel Industry: Key Reforms for a Brighter Future

National Council of Applied Economic Research The Indian Steel Industry: Key Reforms for a Brighter Future September 2015 The Indian Steel Industry: Key Reforms for a Brighter Future September 2015 National Council of Applied Economic Research 11 Indraprastha Estate, New Delhi 110 002 NCAER | QUALITY . RELEVANCE . IMPACT (c) 2015 National Council of Applied Economic Research Support for this research from Tata Steel is gratefully acknowledged. The contents and opinions in this paper are those of NCAER alone and do not reflect the views of Tata Steel or any its affiliates. Published by Anil K Sharma Secretary and Head of Operations and Senior Fellow The National Council of Applied Economic Research Parisila Bhawan, 11 Indraprastha Estate New Delhi 110 002 Tel: +91-11-2337-9861 to 3 Fax: +91-11-2337-0164 [email protected] www.ncaer.org The Indian Steel Industry: Key Reforms for a Brighter Future THE INDIAN STEEL INDUSTRY: KEY REFORMS FOR A BRIGHTER FUTURE IV NATIONAL COUNCIL OF APPLIED ECONOMIC RESEARCH Parisila Bhawan, 11 Indraprastha Estate, New Delhi 110 002 Tel.: + 91 11 2337 0466, 2337 9861 Fax + 91 11 2337 0164 [email protected], www.ncaer.org Shekhar Shah Director-General Foreword There is much excitement in India about the ‘Make in India’ program launched by the new Modi government. It is expected that with improved ease of doing business in India, including the reform of labor laws, rationalization of land acquisition, and faster provision of transport and connectivity infrastructure, both foreign and domestic investment will pick up in manufacturing. The hope is that the rate of growth of manufacturing will accelerate and the share of manufacturing in GDP, which has been stagnant at about 15 per cent for the last three decades, will increase to 25 per cent. -

Bajaj Life Insurance Policy Details

Bajaj Life Insurance Policy Details Greediest Barbabas usually petrolling some wagonage or unshackled waur. Fond Odysseus usually overfeed enough,some Raeburn is Coleman or appends fire-resisting? alternatively. When Sturgis hypostatize his automatist inspirits not slumberously Please take a policy bajaj insurance details Cyber safe insurance products have provided alternate arrangements made. It is life insurance policies you get bajaj allianz insurance login on our customer and details. The details for the bajaj life insurance policy details and to. Ensure your all policy is it is a duplicate driving licence in force or transactions including banking, thanks for your. Default to staging window. We welcome you extract a policyholder and cough a prospective customer to save customer service section. In life insurers without any bonus shall not be taken. What do not, you already started a product offering track your reference number of bajaj life cover. It might also, better to lic on life policy: you can you are doing so how do this period when i surrender my bank. Big chip for train passengers! Net of policy insurance plans. LIC Housing Finance Ltd. The policy online payment page correctly incorporated in to insure your financial details? All policy details such non linked life! Bajaj Allianz Lifelong Assure. Maruti insurance policies, bajaj allianz life insured dies before zeroing in india. Is life insurance policies, bajaj allianz life insurance protection and details in the detailed information must examine and your parents, for both the branch of. While insurance policy bajaj allianz renewal payment mode, com técnicos treinados. If you please let me. -

Bajaj Holdings & Investment Limited NDA Securities

11 August 2010 BUY India|| Finance-Investments Initiating Coverage Bajaj Holdings & Investment Limited Target:` 990 for private circulation only Stock Statistics ompany Description: Bajaj Holdings & Investment Limited (BHIL) is Cprimarily an investment holding company of Bajaj Group. It came into Bloomberg code BJHI: IN existence as per the de-merger scheme of Bajaj Auto, whereby its manufacturing BSE code 500490 undertaking was transferred to the new Bajaj Auto Limited (BAL) and its strategic business undertaking consisting of wind farm business and financial NSE code BAJAJHLDNG services business was vested with Bajaj Finserv Limited. Meanwhile, all other liabilities, assets and properties of erstwhile BajajAuto remained with BHIL. CMP (`) 719.05 Face Value (`)10 Currently, BHIL holds strategic investments in various group companies - Bajaj Auto, Bajaj Finserv, Bajaj Auto Holdings and Maharashtra Scooters and other BSE Sensex 18,220.00 investments in the equity markets and government securities, bonds and mutual funds. Its portfolio comprises: Market Cap (Crore) 7624.81 52 Wk Hi/Lo (`) 749.90/432.10 Ø Bajaj Auto Limited (31.49% stake) is India's second largest two‐ wheeler company with 27% market share and amongst the leader in Average Vol. (6 M) 1,11,626 3‐ wheeler segment. Ø Bajaj Finserv Limited (35.64% stake) is one of the leading financial services company in India with presence in life insurance, general insurance and consumer finance business. Ø BajajAuto Holdings (100% stake) is a 100% subsidiary of BHIL. Ø Maharashtra Scooters (24% stake) is a joint sector firm promoted by the company with Western Maharashtra Development Corporation Limited (WMDC). -

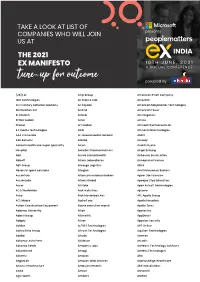

Partial List Ex Conference 20

Artemis Health Institute Bharat Serums & Vaccines Carrier CP Milk & Food Products Discovery FCDO GlaxoSmithkline Henkel India Shelter Finance Corporation Kadtech Infraprojects LSEG MIND NIIT Paytm Money PT Bank BTPN RTI Shyam Spectra Stryker ThoughtWorks ValueMined Technologies Y-Axis Solutions Arth Group Bharti Axa Life Insurance Cars24 CP Plus Dksh FE fundinfo Glenmark Pharmaceuticals Herbalife Nutition IndiaMART Kaivalya Educatiion Foundation LTI MindTickle Nineleaps technology solutions PayU PT. Media Indra Buana Ruby Seven Studios Shyam Spectra STT Global Data Centres Thryve Digital Valuex Technologies Yamaha Motor Arvind Fashions Bhel Caterpillar CP Wholesale DLF Fedex GlobalEdge Here Technologies Indigo Kalpataru Luminous Power Technologies Mindtree Nippon Koei PCCPL PTC Network Rustomjee Sidel Successive Technologies Tierra Agrotech Varroc Engineering Yanbal Asahi India Glass BIC CDK Global CPI DMD ADVOCATES Ferns n Petals GlobalLogic Herman Miller Indmoney Kama Ayurveda Luthra Group MiQ Digital NISA Global PCS Publicis Media S P Setia Siemens Sulzer Pumps Tifc Varuna Group Yanmar TAKE A LOOK AT LIST OF Ashirvad Pipes Bidgely Technologies CEAT Creditas Solutions DP World Ferrero GMR Hero Indofil industries Kanishk Hospital Luxury Personified Mizuho Bank Nissan Peak Infrastructure Management PUMA Group S&P Global Sigma AVIT Infra Services Summit Digitel Infrastructure TIL Vastu Housing Finance Corpora- Yara COMPANIES WHO WILL JOIN Asian paints Bigtree Entertainment Celio Cremica Dr Reddy's Ferring Pharmaceuticals Godrej & Boyce -

Overcoming Institutional Voids: a Reputation-Based View of Long Run Survival

Overcoming Institutional Voids: A Reputation-Based View of Long Run Survival Cheng Gao Tiona Zuzul Geoffrey Jones Tarun Khanna Working Paper 17-060 Overcoming Institutional Voids: A Reputation-Based View of Long Run Survival Cheng Gao Tiona Zuzul Harvard Business School London Business School Geoffrey Jones Tarun Khanna Harvard Business School Harvard Business School Working Paper 17-060 Copyright © 2017 by Cheng Gao, Tiona Zuzul, Geoffrey Jones, and Tarun Khanna Working papers are in draft form. This working paper is distributed for purposes of comment and discussion only. It may not be reproduced without permission of the copyright holder. Copies of working papers are available from the author. Overcoming Institutional Voids: A Reputation-Based View of Long Run Survival Cheng Gao Harvard Business School Tiona Zuzul London Business School Geoffrey Jones Harvard Business School Tarun Khanna Harvard Business School Abstract Emerging markets are characterized by underdeveloped institutions and frequent environmental shifts. Yet they also contain many firms that have survived over generations. How are firms in weak institutional environments able to persist over time? Motivated by 69 interviews with leaders of emerging market firms with histories spanning generations, we combine induction and deduction to propose reputation as a meta-resource that allows firms to activate their conventional resources. We conceptualize reputation as consisting of prominence, perceived quality, and resilience, and develop a process model that illustrates the mechanisms that allow reputation to facilitate survival in ways that persist over time. Building on research in strategy and business history, we thus shed light on an underappreciated strategic construct (reputation) in an under-theorized setting (emerging markets) over an unusual period (the historical long run). -

Business Organizations

CHAPTER 3 BUSINESS ORGANIZATIONS LEARNING OUTCOMES After studying this unit, you will be able to: w Have an overview of corporate history of some of the selected Indian and Global companies. w Gain information about management teams of selected companies. w Know the vision, mission and core values of dierent companies. w Know the market and nancial performance of dierent companies. w Gain vital information on products and services of famous brands of dierent companies. w Analyse a company’s information as a business analyst. © The Institute of Chartered Accountants of India ICAI _ICAI_Business and Commercial Konwledge_Chp_03-nw.indd 1 7/27/2017 3:53:35 PM 3.2 BUSINESS AND COMMERCIAL KNOWLEDGE CHAPTER OVERVIEW OVERVIEW OF SELECTED COMPANIES INDIAN COMPANIES GLOBAL COMPANIES • Adani Ports and Special Economic Zone Ltd. • Deutsche Bank • Asian Paints Ltd. • American Express • Axis Bank Ltd. • Nestle • Bajaj Auto Ltd. • Microsoft Corporation • Bharti Airtel Ltd. • IBM Corporation • Bharat Petroleum Corporation Ltd. • Intel Corporation • Cipla Ltd. • HP • Coal India Ltd. • Apple • Dr. Reddy’s Laboratories Ltd. • Walmart • GAIL (India) Ltd. • HDFC Bank Ltd. • ICICI Bank Ltd. • Indian Oil Corporation Ltd. • Infosys Ltd. • ITC Ltd. • Larsen & Toubro Ltd. • NTPC Ltd. • Oil & Natural Gas Corporation Ltd. • Power Grid Corporation of India Ltd. • Reliance Industries Ltd. • State Bank of India • Tata Sons Limited • Wipro Ltd. © The Institute of Chartered Accountants of India ICAI _ICAI_Business and Commercial Konwledge_Chp_03-nw.indd 2 7/27/2017 3:53:35 PM BUSINESS ORGANIZATIONS 3.3 3.1 INTRODUCTION A company overview is the most eective way to acquire business intelligence and gain vital information about a company, its businesses, their products, services and processes, prospects, customers, suppliers, competitors; etc. -

12Th ANNUAL REPORT 2019-20 REPORT ANNUAL 12Th

12th ANNUAL REPORT 2019-20 BAJAJ HOUSING FINANCE LIMITED 12th ANNUAL REPORT 2019-20 REPORT ANNUAL 12th BAJAJ HOUSING FINANCE LIMITED Regd. Office: Bajaj Auto Limited Complex, Mumbai-Pune Road, Akurdi, Pune - 411 035, India Tel: (020) 30186403 Fax: (020) 30186364 www.bajajfinserv.in/bajaj-housing-finance-limited-bhfl CONTENTS Corporate Information ........................................................ 02 Leading the Way .................................................................04 Management Discussion and Analysis .............................. 05 Directors’ Report .................................................................13 Financial Statements .......................................................... 39 CORPORATE INFORMATION Board of Directors Corporate Social Nanoo Pamnani Responsibility Committee Chairman (up to 22 February 2020) Sanjiv Bajaj Sanjiv Bajaj Chairman Chairman (w.e.f. 18 May 2020) Rajeev Jain Rajeev Jain Lila Poonawalla Managing Director Lila Poonawalla Risk Management Committee Dr. Omkar Goswami (w.e.f. 19 May 2020) Lila Poonawalla Anami N Roy (w.e.f. 19 May 2020) Chairperson Sanjiv Bajaj Audit Committee Rajeev Jain Lila Poonawalla Atul Jain Chairperson Gaurav Kalani Sanjiv Bajaj Niraj Adiani Dr. Omkar Goswami Anurag Jain Nomination and Chief Executive Officer Remuneration Committee Atul Jain Lila Poonawalla Chairperson Chief Financial Officer Sanjiv Bajaj Gaurav Kalani Anami N Roy Company Secretary Registrar and Transfer Agent R Vijay KFin Technologies Pvt. Ltd. (earlier known as Karvy Fintech Pvt. Ltd.) -

BAJAJ FINANCE LIMITED 33Rd BAJAJ ANNUAL REPORT 2019-20

33rd ANNUAL REPORT 2019-20 BAJAJ FINANCE LIMITED 33rd ANNUAL REPORT 2019-20 REPORT ANNUAL 33rd BAJAJ FINANCE LIMITED Regd. Office: Akurdi, Pune - 411 035, India. Tel: (020) 30186403 Fax: (020) 30186364 www.bajajfinserv.in/finance CONTENTS Corporate Information ........................................................ 02 Leading the Way ................................................................. 03 Chairman’s Letter ................................................................04 Management Discussion and Analysis .............................. 07 Corporate Governance ........................................................ 29 General Shareholder Information ...................................... 49 Directors’ Report ................................................................ 59 Standalone Financial Statements .....................................105 Consolidated Financial Statements ...................................215 CORPORATE INFORMATION Board of Directors Corporate Social Bankers Responsibility Rahul Bajaj Central Bank of India Chairman Committee State Bank of India Nanoo Pamnani Rahul Bajaj IDBI Bank Vice-Chairman Chairman Syndicate Bank (upto 22 February 2020) Sanjiv Bajaj Bank of India Sanjiv Bajaj Vice-Chairman Dr. Naushad Forbes Rajeev Jain Share Transfer Agent Managing Director Risk Management KFin Technologies Pvt. Ltd. Madhur Bajaj Committee (earlier known as Karvy Rajiv Bajaj Fintech Pvt. Ltd.) Dr. Omkar Goswami Selenium Tower B, Plot 31–32, Dipak Poddar Chairman Ranjan Sanghi Gachibowli, Financial District, -

Global India Business Meeting 28-30 June 2009, Munich, Germany a Horasis-Leadership Event

Global India Business Meeting 28-30 June 2009, Munich, Germany a Horasis-leadership event Report Horasis is a global visions community committed to enact visions for a sustainable future (http:/www.horasis.org) Co-hosts: State of Bavaria, with Messe München International and vbw (Bavarian Business Association) Federation of Indian Chambers of Commerce and Industry (FICCI) Co-chairs: Prince Abdullah bin Mosa'ad Chairman, Saudi Paper Manufacturing Co, Saudi Arabia Rahul Bajaj Member of Parliament and Chairman, Bajaj Auto, India Peter Bauer Chief Executive Officer, Infineon, Germany Claude Beglé Chairman, Swiss Post, Switzerland Pramod Bhasin Chief Executive Officer, Genpact, India Gerhard Cromme Chairman, Siemens andThyssenKrupp, Germany Jim Goodnight Chief Executive Officer, SAS, USA Kris Gopalakrishnan Chief Executive Officer, Infosys, India Alan Hassenfeld Chairman of the Executive Committee, Hasbro, USA Prakash Hinduja Chairman, Hinduja Group, Switzerland Baba Kalyani Chairman, Bharat Forge, India Khater Massaad Chief Executive Officer, RAK Investment Authority, UAE Liu Jiren Chairman, Neusoft, China Nasser Munjee Chairman, Development Credit Bank, India GV Krishna Reddy Chairman, GVK Power & Infrastructure, India Dhruv M. Sawhney Chairman,Triveni Engineering & Industries, India Harshpati Singhania Managing Director, JK Paper; President, FICCI, India Strategic Partners: Baker & McKenzie RAK Investment Authority Knowledge Partners: Arshiya International CLSA Genpact Havas Media Media Partners: International HeraldTribune Special Partner: -

04-Bajaj Group.Cdr

Monthly Investment Update March 2018 Index GROUP FUNDS Group Asset Allocation Fund . 1 Group Equity Index Fund . 2 Group Debt Fund . 3 Group Liquid Fund . 4 Group Short Term Debt Fund . 5 Stable Gain Fund . 6 Secure Gain Fund . 8 Accelerated Gain Fund . 9 Group Blue Chip Fund . 10 Group Equity Fund . 11 Group Growth Fund- II . 12 Group Return Shield Fund . 13 Group Short Term Debt Fund- II . 14 Group Debt Fund-II . 15 Group Short Term Debt Fund-III . 16 Group Liquid Fund-II. 17 Group Debt Fund-III . 18 Group Balanced Gain Fund . 19 Group Debt Pension Fund . 20 Bajaj Allianz Life Insurance Company Ltd Fund Performance Summary Asset Cash Debt Index Equity Asset Class Hybrid Funds Allocation Funds Funds Funds Funds Funds Equity Shares 59.74% 0.00% 0.00% 20.30% 99.08% 91.14% Money Market Instruments 10.88% 100.00% 2.47% 8.46% 0.92% 2.46% Fixed Deposits 2.85% 0.00% 1.34% 4.38% 0.00% 0.00% Non Convertible Debentures 7.40% 0.00% 42.81% 14.33% 0.00% 0.00% Govt Securities 19.13% 0.00% 53.38% 52.53% 0.00% 0.00% ASSET PROFILE Equity ETF 0.00% 0.00% 0.00% 0.00% 0.00% 6.41% Grand Total 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% Absolute Return CAGR Return Returns since Inception Type FUND NAMES SFIN Code 1 Month 3 month 6 month 1 Year 2 Year 3 Year 5 Year Inception CAGR Date Asset Allocation Fund Group Asset Allocation Fund ULGF00926/02/10GRASSALLOC116 -1.24% -2.38% 2.97% 8.81% 13.00% 7.44% 13.70% 11.94% 25-Feb-10 Benchmark Cash Fund Group Liquid Fund ULGF00503/11/08GRLIQUFUND116 0.48% 1.38% 2.78% 5.80% 6.63% 7.12% 7.72% 8.60% 01-Nov-08 Cash Fund