Portfolio Performance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Code Security Description ARI Arrium Ltd AWC Alumina Ltd AWE AWE

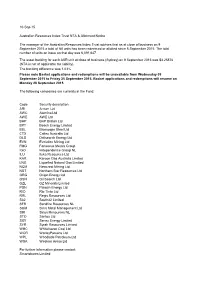

10-Sep-15 Australian Resources Index Trust NTA & Allotment Notice The manager of the Australian Resources Index Trust advises that as at close of business on 9 September 2015 a total of Nil units has been redeemed or allotted since 8 September 2015. The total number of units on issue on that day was 6,091,647. The asset backing for each ASR unit at close of business (Sydney) on 9 September 2015 was $3.25876 (NTA is net of applicable tax liability). The tracking difference was 1.03% Please note Basket applications and redemptions will be unavailable from Wednesday 09 September 2015 to Friday 25 September 2015. Basket applications and redemptions will resume on Monday 28 September 2015. The following companies are currently in the Fund: Code Security description ARI Arrium Ltd AWC Alumina Ltd AWE AWE Ltd BHP BHP Billiton Ltd BPT Beach Energy Limited BSL Bluescope Steel Ltd CTX Caltex Australia Ltd DLS Drillsearch Energy Ltd EVN Evolution Mining Ltd FMG Fortescue Metals Group IGO Independence Group NL ILU Iluka Resources Ltd KAR Karoon Gas Australia Limited LNG Liquefied Natural Gas Limited NCM Newcrest Mining Ltd NST Northern Star Resources Ltd ORG Origin Energy Ltd OSH Oil Search Ltd OZL OZ Minerals Limited PDN Paladin Energy Ltd. RIO Rio Tinto Ltd RRL Regis Resources Ltd S32 South32 Limited SFR Sandfire Resources NL SGM Sims Metal Management Ltd SIR Sirius Resources NL STO Santos Ltd SXY Senex Energy Limited SYR Syrah Resources Limited WHC Whitehaven Coal Ltd WOR WorleyParsons Ltd WPL Woodside Petroleum Ltd WSA Western Areas Ltd For further information please contact: Smartshares Limited 0800 80 87 80 [email protected]. -

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

17 Jan 2017 2012 Full Year Results 1.36 MB

O I L S E A R C H L I M I T E D (Incorporated in Papua New Guinea) ARBN – 055 079 868 RESULTS FOR THE YEAR ENDED 31 DECEMBER 2012 26 February 2013 (ASX: OSH; ADR: OISHY) HIGHLIGHTS • 2012 net profit after tax (NPAT) including significant items was US$175.8 million. Excluding significant items, underlying NPAT was US$153.0 million. • Total oil and gas production in 2012 was 6.38 mmboe, within the Company’s guidance range despite several shutdowns during the year. • Sales volumes for the year were 6.13 mmboe, 8% down on 2011. • The average realised oil price was US$113.97/bbl compared to US$116.09/bbl in 2011. • Total revenue from operations was similar to 2011, at US$724.6 million. • Liquidity remains strong, with US$488.3 million in cash (including JV balances) and an undrawn revolving facility of US$500 million at year end. • A 2012 final dividend of two US cents per share was announced, taking the 2012 full year dividend to four US cents per share, consistent with 2011. • A strong reserves and resource base has been confirmed, with proven and probable reserves increasing, fully replacing production. 2C contingent resources increased by 77.4 mmboe, or 24%, to 395.1 mmboe, underscoring the resource base to underpin further gas commercialisation. Commenting on the 2012 results, Oil Search Managing Director, Peter Botten, said: “Oil Search delivered a solid set of operational and financial results in 2012 and the Company’s growth strategy remains firmly on track, with significant progress made on the PNG LNG Project, gas expansion in PNG and exploration activities in the Middle East. -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

Annual Report 2014

DOWNLOAD ANNUAL REPORT 2014 ENTER ANNUAL REPORT 2014 HOME DOWNLOAD 2014 highlights Our vision Our values Our six strategies Chairman and Managing Director’s review Senior executive team Sustain and optimise our oil and gas assets Commercialise gas in PNG TRANSFORMATION Pursue high-value exploration opportunities COMPLETE Contribute to a stable operating environment The US$19 billion PNG LNG Project came onstream in 2014 and has transformed Oil Search into a r Enhance organisational capability gas producer with a long-term LNG revenue stream. It has also established an excellent platform for LNG expansion in PNG. With Optimise capital management 2014 reserves and resources Oil Search is well placed to continue to deliver top quartile returns to shareholders, even in a lower oil and gas price environment. License interests PL AY Corporate governance Financial report contents Directors’ report Financial statements Shareholder Information Ten-year summary Glossary Corporate directory NEXT HOME CONTENTS DOWNLOAD 2014 HIGHLIGHTS 992 992 992 992 992 992 19.27 19.27 19.27 19.27 19.27 19.27 1,877 1,877 1,877 1,877 1,877 1,877 14 14 14 14 14 14 1,861 1,861 1,861 1,861 1,861 1,861 353 353 353 353 353 353 2.64 2.64 2.64 2.64 2.64 2.64 1,673 1,673 1,673 1,673 1,673 1,673 2.47 2.47 2.47 2.47 2.47 2.47 404 404 404 404 404 404 1,610 1,610 1,610 1,610 1,610 1,610 1,568 1,568 1,568 1,568 1,568 1,568 1,568 1,568 1,568 1,568 1,568 1,568 4 cents 1,560 1,560 1,560 1,560 1,560 1,560 special 1,363 1,363 1,363 1,363 1,363 1,363 1.97 1.97 1.97 1.97 1.97 1.97 oil -

Stoxx® Australia 150 Index

STOXX® AUSTRALIA 150 INDEX Components1 Company Supersector Country Weight (%) Commonwealth Bank of Australia Banks Australia 8.37 CSL Ltd. Health Care Australia 7.46 BHP GROUP LTD. Basic Resources Australia 7.23 National Australia Bank Ltd. Banks Australia 4.37 Westpac Banking Corp. Banks Australia 4.09 Australia & New Zealand Bankin Banks Australia 3.75 Wesfarmers Ltd. Retail Australia 3.30 WOOLWORTHS GROUP Personal Care, Drug & Grocery Australia 2.87 Macquarie Group Ltd. Financial Services Australia 2.84 Rio Tinto Ltd. Basic Resources Australia 2.48 Fortescue Metals Group Ltd. Basic Resources Australia 2.27 Transurban Group Industrial Goods & Services Australia 2.20 Telstra Corp. Ltd. Telecommunications Australia 2.05 Goodman Group Real Estate Australia 1.77 AFTERPAY Industrial Goods & Services Australia 1.54 Coles Group Personal Care, Drug & Grocery Australia 1.39 Woodside Petroleum Ltd. Energy Australia 1.28 Newcrest Mining Ltd. Basic Resources Australia 1.27 Aristocrat Leisure Ltd. Travel & Leisure Australia 1.11 XERO Technology Australia 1.00 SYDNEY AIRPORT Industrial Goods & Services Australia 0.93 Brambles Ltd. Industrial Goods & Services Australia 0.91 Sonic Healthcare Ltd. Health Care Australia 0.90 ASX Ltd. Financial Services Australia 0.82 SCENTRE GROUP Real Estate Australia 0.80 Cochlear Ltd. Health Care Australia 0.74 QBE Insurance Group Ltd. Insurance Australia 0.73 SUNCORP GROUP LTD. Insurance Australia 0.71 South32 Australia Basic Resources Australia 0.71 Santos Ltd. Energy Australia 0.68 Ramsay Health Care Ltd. Health Care Australia 0.66 Insurance Australia Group Ltd. Insurance Australia 0.65 Mirvac Group Real Estate Australia 0.60 DEXUS Real Estate Australia 0.59 SEEK Ltd. -

2019 Annual Report FORGING a STRONGER NEWCREST

2019 Annual Report FORGING A STRONGER NEWCREST The success of FY19 reflects the enormous amount of effort applied by our people towards delivering on our commitments and our potential. SANDEEP BISWAS MANAGING DIRECTOR AND CHIEF EXECUTIVE OFFICER To be the Miner of Choice. To be the Miner of Choice for VISION our people, shareholders, host OUR communities, partners and suppliers. To safely deliver superior returns to our stakeholders from finding, developing and MISSION operating gold/copper mines. OUR NEWCREST 2019 ANNUAL REPORT 1 CONTENTS FORGING A STRONGER NEWCREST Forging a stronger Newcrest 2 Asset overview 4 Key Achievements for FY19 6 Safety & Sustainability 12 People 13 Releasing orebody potential 14 NEWCREST’S VALUE PROPOSITION Long reserve life 16 Delivering on commitments 16 Low cost production 16 Organic growth options 17 Financially robust 18 Exploration & technical capability 19 OUR COMPANY Chairman’s Report 8 Managing Director’s Review 10 The Board 20 Mineral Resources & Ore Reserves 24 Corporate Governance Statement 32 Directors’ Report 34 Financial Report 89 Corporate Directory 149 Coarse ore stockpile at Cadia, New South Wales, Australia FORGING A STRONGER NEWCREST The health and safety of our people 2 Forging a stronger is of primary importance at Newcrest. Newcrest Our clear focus remains on eliminating To achieve Newcrest’s full potential FORGING A STRONGER FORGING A STRONGER NEWCREST fatalities and life-changing injuries from for our stakeholders, our company our business, while striving to make strategy focuses on five key pillars, continual progress on reducing all injuries each with associated aspirations. and health impacts. We believe that a strong and enduring commitment to the health and safety of our workforce best reflects our values and underpins and sustains optimal business performance. -

Promises, Pathways & Performance

Promises, pathways & performance Climate change disclosure in the ASX200 August 2021 About ACSI Established in 2001, ACSI exists to provide a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 36 Australian and international asset owners and institutional investors. Collectively, they manage over $1 trillion in assets and own on average 10% of every ASX200 company. 36 Australian & international investors Our members believe that ESG risks and opportunities have a material impact on investment outcomes. As fiduciary investors, they have a responsibility to act to enhance the long- term value of the savings entrusted to them. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. ACSI staff undertake a year-round program of Leading voice on ESG issues research, engagement, advocacy and voting and advocacy advice. These activities provide a solid basis for our members to exercise their ownership rights. ACSI members own around 10% of every ASX200 company Climate reporting in ASX200 companies: August 2021 2 Table of contents Introduction .................................................................................................................................................... 4 Key findings .................................................................................................................................................... 5 Net zero emissions -

Selector High Conviction Equity Fund Monthly Report – November 2018

Selector High Conviction Equity Fund Monthly report – November 2018 Market insights Cumulative returns since inception Australian markets sold off further during November, with the All Ordinaries Accumulation Index closing down 2.2%. Major European markets fell by a 600% similar magnitude, while indices in the U.S. and Asia staged modest recoveries. The energy sector was hardest hit during November as Brent crude fell more 500% than 20% to US$59 per barrel. Fears of an oil glut have taken hold as the global dominance of US crude oil production, led by booming shale oil output, have 400% emerged. In June 2018, America accounted for 13% of global crude oil, nearly 2x that produced in June 2008. As America nears the status of net exporter, 300% investment banks have laid heavy bets against the price of oil. The Australian economy has shown no real signs of slowing despite the recent 200% weakness in equity and property markets. In their statement on monetary policy, the RBA outlined expectations for GDP growth of 3.5% over 2018 and 100% 2019 and for inflation to remain both low and stable. Should these conditions hold, the RBA expects the unemployment rate to trend down from its current 0% level of 5.0% to 4.75% by 2020. The latest economic growth data would suggest these views now sit on the optimistic side -100% The RBA also commented on developments overseas, highlighting that growth 2004 2006 2008 2010 2012 2014 2016 2018 in advanced economies has been exceeding growth in productive capacity. SHCEF Returns Benchmark Returns This has seen some small pockets of inflationary pressure emerge.