France Retail Foods 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Décision N° 16-DCC-210 Du 9 Décembre 2016 Relative À La Prise

RÉPUBLIQUE FRANÇAISE Décision n° 16-DCC-210 du 9 décembre 2016 relative à la prise de contrôle conjoint d’un fonds de commerce exploité par la société ATAC par la société Worksea et ITM Entreprises L’Autorité de la concurrence, Vu le dossier de notification adressé complet au service des concentrations le 9 novembre 2016, relatif à la prise de contrôle conjoint d’un fonds de commerce exploité par la société ATAC par la société Worksea et ITM Entreprises, formalisée par une lettre d’intention en date du 22 juillet 2016 ; Vu le livre IV du code de commerce relatif à la liberté des prix et de la concurrence, et notamment ses articles L. 430-1 à L. 430-7 ; Adopte la décision suivante : I. Les entreprises concernées et l’opération 1. ITM Entreprises, société contrôlée à 100 % par la société civile des Mousquetaires, elle-même détenue par 1 330 personnes physiques dits « adhérents associés », conduit et anime le réseau de commerçants indépendants connu sous le nom de « Groupement des Mousquetaires ». En sa qualité de franchiseur, la société ITM Entreprises a comme activité principale l’animation d’un réseau de points de vente, alimentaires et non alimentaires, exploités par des commerçants indépendants sous les enseignes suivantes : Intermarché, Ecomarché, Netto, Restaumarché, Bricomarché, Roady et Vêti. Cette gestion s’effectue notamment au travers de la signature et du suivi de contrats d’enseigne avec les sociétés exploitant ces points de vente. ITM Entreprises met également à la disposition de ses franchisés divers services de prospection, de conseil, de formation, etc. Enfin, ITM Entreprises offre aux franchisés la possibilité de bénéficier de conditions d’approvisionnement avantageuses auprès de ses filiales nationales et régionales mais également de fournisseurs référencés extérieurs au « Groupement des Mousquetaires ». -

Supermarkets in India: Struggles Over the Organization of Agricultural Markets and Food Supply Chains

\\jciprod01\productn\M\MIA\68-1\MIA109.txt unknown Seq: 1 12-NOV-13 14:58 Supermarkets in India: Struggles over the Organization of Agricultural Markets and Food Supply Chains AMY J. COHEN* This article analyzes the conflicts and distributional effects of efforts to restructure food supply chains in India. Specifically, it examines how large retail corporations are presently attempting to transform how fresh produce is produced and distributed in the “new” India—and efforts by policymakers, farmers, and traders to resist these changes. It explores these conflicts in West Bengal, a state that has been especially hostile to supermarket chains. Via an ethnographic study of small pro- ducers, traders, corporate leaders, and policymakers in the state, the article illustrates what food systems, and the legal and extralegal rules that govern them, reveal about the organization of markets and the increasingly large-scale concentration of private capital taking place in India and elsewhere in the developing world. INTRODUCTION .............................................................. 20 R I. ON THE RISE OF SUPERMARKETS IN THE WEST ............................ 24 R II. INDIA AND THE GLOBAL SPREAD OF SUPERMARKETS ....................... 29 R III. LAND, LAW, AND AGRICULTURAL MARKETS IN WEST BENGAL .............. 40 R A. Land Reform, Finance Capital, and Agricultural Marketing Law ........ 40 R B. Siliguri Regulated Market ......................................... 47 R C. Kolay Market ................................................... 53 R D. -

Décision N° 18-DCC-65 Du 27 Avril 2018 Relative À La Prise De Contrôle

RÉPUBLIQUE FRANÇAISE Décision n° 18-DCC-65 du 27 avril 2018 relative à la prise de contrôle exclusif des sociétés Zormat, Les Chênes et Puech Eco par la société Carrefour Supermarchés France L’Autorité de la concurrence, Vu le dossier de notification adressé complet au service des concentrations le 15 mars 2018, relatif à la prise de contrôle exclusif des sociétés Zormat, Les Chênes et Puech Eco par la société Carrefour Supermarchés France, et formalisée par un protocole de cession en date du 1er février 2018 ; Vu le livre IV du code de commerce relatif à la liberté des prix et de la concurrence, et notamment ses articles L. 430-1 à L. 430-7 ; Vu les engagements présentés les 15 mars et 18 avril 2018 par la partie notifiante ; Vu les éléments complémentaires transmis par la partie notifiante au cours de l’instruction ; Adopte la décision suivante : I. Les entreprises concernées et l’opération 1. La société Carrefour Supermarchés France SAS (ci-après « CSF ») est une filiale à 100 % du groupe Carrefour, lequel est actif dans le secteur du commerce de détail à dominante alimentaire, ainsi que dans la distribution en gros à dominante alimentaire. En France, le groupe Carrefour exploite des hypermarchés, supermarchés, commerces de proximité, cash and carry, sous les enseignes Carrefour, Carrefour Market, Carrefour City, Carrefour Contact, Carrefour Express, Carrefour Montagne, Huit à 8, Marché Plus, Proxi et Promocash. Le groupe Carrefour dispose par ailleurs d’une activité de drive et exploite plusieurs sites marchands sur internet : www.carrefour.fr, www.ooshop.carrefour.fr et www.rueducommerce.fr. -

Why Food Waste Is Becoming a Revolution? Putting the Bin out of Business Could Be Good for Business November 2017

Why food waste is becoming a revolution? Putting the bin out of business could be good for business November 2017 This article was written by Léonore Perrin from “We are Phenix” a successful French social company born in 2014 who helps businesses to turn waste into wealth by unleashing the potential of surplus products. L’Institut du Commerce asked “We are Phenix” to explain to the ECR Community the current waste initiatives’ landscape in France. Since 2017, l’Institut du Commerce embodies the Efficient Consumer Response in France. The association supports its members (manufacturers, retailers and service providers) to work together to better fulfill the consumers’ needs. More precisely, it provides them with the perfect framework to build collectively tomorrow’s businesses thanks to a better understanding of the deep changes occurring for the shopper, the supply chain and the retail (data, environment, technology…). There is an urge to eradicate waste in our societies. The circular economy is a basic yet revolutionary approach that could transform tomorrow’s production and consumption. L’Institut du Commerce is proud to announce the launch in December 2017 of a new working group entitled « Circular Economy: How can retail have a positive impact »? Each year, an estimated 1.3 billion tons of food is lost or wasted globally. That’s over a third of the world’s food production which is thrown away, somewhere between farm to fork. In the European Union it is estimated that 11% of food losses and waste occurs at the production level, while 17% at the distribution level. From food banks to food aid organizations, food redistribution is not a new thing. -

“Continuing to Innovate for the Future of Retail” Contents Contents

2018 ANNUAL REPORT “CONTINUING TO INNOVATE FOR THE FUTURE OF RETAIL” CONTENTS CONTENTS INTERVIEW WITH “WHAT’S THE PURPOSE JEAN-CHARLES HIGHLIGHTS KEY FIGURES NAOURI PAGE 6 PAGE 12 OF AN ANNUAL REPORT?” PAGE 2 POWERFUL STRATEGIC A RESPONSIBLE GOVERNANCE BRANDS ALLIANCES APPROACH t’s a question that comes up often, in them an enticing shopping experience, PAGE 14 PAGE 20 PAGE 30 PAGE 38 all large companies. and making their lives easier with I With 12,000 stores that open their helpful services and innovative digital doors every morning – under such solutions. banners as Vival, Franprix, Naturalia, To infuse some of that energy into our Éxito, Assaí and Devoto – and hundreds annual report, we interviewed around of transformation projects to be sixty men and women who work in a very INTERNATIONAL INNOVATION AUGMENTED A MORE PRESENCE CULTURE STORES AGILE MODEL implemented in an ever shorter time to wide range of positions within the market, the Casino Group views the company, from store greeter to Executive PAGE 48 PAGE 58 PAGE 68 PAGE 78 annual report as an invaluable Committee member. “What does Casino opportunity to take a step back from the represent for you?”, “How is your job frenetic race against the clock that evolving?” and “What are today’s trends represents the daily routine in the retail in terms of customer expectations?”. sector. The result is this annual report, which BANNERS AND SOCIETAL FINANCIAL Casino has more than 220,000 service- provides an overview of the Casino SUBSIDIARIES PERFORMANCE PERFORMANCE oriented employees who are fully Group and shares the beliefs and committed to providing our customers enthusiasm of a small sample of the PAGE 86 PAGE 108 PAGE 122 with safe, high-quality products, offering people behind its success. -

Présentation Résultats Annuels

RÉSULTATS ANNUELS 2017 RÉSULTATS8 mars ANNUELS2018 2017 • 8 mars 2018 1 SOMMAIRE 1 Faits marquants 2017 2 Activité des enseignes 3 Résultats 4 Priorités stratégiques et Perspectives Annexes RÉSULTATS ANNUELS 2017 • 8 mars 2018 2 Faits marquants 1 2017 RÉSULTATS ANNUELS 2017 • 8 mars 2018 3 Évènements marquants de 2017 (1/2) Poursuite de la transformation des concepts et nouveaux services Concept Noé Concept Next Franprix Leader Price Prêts Nouveau Cdiscount instantanés concept SM Énergie Alliance autour Carte de crédit Concept du programme Passaí (Assaí) Carulla Fresh de fidélité Market RÉSULTATS ANNUELS 2017 • 8 mars 2018 4 Évènements marquants de 2017 (2/2) Accélération sur le digital et l’omnicanal Partenariat Application exclusif Franprix Scan & Go en France Casino Max, application Corners de fidélité ciblée Cdiscount Application Livraison Monétisation Partenariat Rachat de fidélité à domicile de la data Google Home par Monoprix (GPA) (Éxito) (Monoprix) RÉSULTATS ANNUELS 2017 • 8 mars 2018 5 Faits marquants France Un volume d’affaires total 2017 de 22 Mds€ en progression hors calendaire de + 2,3 %, dont + 1,7 % en alimentaire et + 5,6 % en non-alimentaire (y compris Cdiscount) Bonne dynamique commerciale et excellente rentabilité des enseignes de proximité / qualitatives / à services : Franprix, Monoprix, Supermarchés Casino . Volumes d’affaires respectivement en croissance de + 2,2 %, + 2,7 % et + 1,1 % en 2017 . Forte capacité d’innovation (Mandarine, Noé, Supermarchés Casino, Naturalia Vegan) . Bonne dynamique d’expansion et de franchise : + 60 magasins Monoprix, + 51 magasins Franprix ; premier ralliement en franchise d’un indépendant pour les Supermarchés Casino . 168 magasins bio Naturalia à fin décembre 2017 Poursuite du redressement de Géant : . -

Retail Food Sector Retail Foods France

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 9/13/2012 GAIN Report Number: FR9608 France Retail Foods Retail Food Sector Approved By: Lashonda McLeod Agricultural Attaché Prepared By: Laurent J. Journo Ag Marketing Specialist Report Highlights: In 2011, consumers spent approximately 13 percent of their budget on food and beverage purchases. Approximately 70 percent of household food purchases were made in hyper/supermarkets, and hard discounters. As a result of the economic situation in France, consumers are now paying more attention to prices. This situation is likely to continue in 2012 and 2013. Post: Paris Author Defined: Average exchange rate used in this report, unless otherwise specified: Calendar Year 2009: US Dollar 1 = 0.72 Euros Calendar Year 2010: US Dollar 1 = 0.75 Euros Calendar Year 2011: US Dollar 1 = 0.72 Euros (Source: The Federal Bank of New York and/or the International Monetary Fund) SECTION I. MARKET SUMMARY France’s retail distribution network is diverse and sophisticated. The food retail sector is generally comprised of six types of establishments: hypermarkets, supermarkets, hard discounters, convenience, gourmet centers in department stores, and traditional outlets. (See definition Section C of this report). In 2011, sales within the first five categories represented 75 percent of the country’s retail food market, and traditional outlets, which include neighborhood and specialized food stores, represented 25 percent of the market. In 2011, the overall retail food sales in France were valued at $323.6 billion, a 3 percent increase over 2010, due to price increases. -

Décision N° 14-DCC-11 Du 28 Janvier 2014 Relative À La Prise De Contrôle Par La Société Franprix Leader Price Holding De 4

RÉPUBLIQUE FRANÇAISE Décision n° 14-DCC-11 du 28 janvier 2014 relative à la prise de contrôle par la société Franprix Leader Price Holding de 47 magasins de commerce de détail à dominante alimentaire Le Mutant et de 22 fonds de commerce de boucherie L’Autorité de la concurrence, Vu le dossier de notification adressé complet au service des concentrations le 11 décembre 2013, relatif à la prise de contrôle de 47 magasins de commerce de détail à dominante alimentaire et de 22 fonds de commerce de boucherie par la société Franprix Leader Price Holding (« FLPH »), formalisée par un protocole d’accord conclu le 25 octobre 2013 ; Vu le livre IV du code de commerce relatif à la liberté des prix et de la concurrence, et notamment ses articles L. 430-1 à L. 430-7 ; Vu les engagements présentés le 14 janvier 2014 par la partie notifiante ; Vu les éléments complémentaires transmis par les parties au cours de l’instruction ; Adopte la décision suivante : I. Les entreprises concernées et l’opération 1. La société Franprix Leader Price Holding (ci-après « FPLPH ») est une filiale du groupe Casino Guichard Perrachon (ci-après « Casino »), dont le principal objet est la prise de participation dans des sociétés exploitant des magasins sous les enseignes Franprix et Leader Price. Le groupe Casino, troisième acteur français du secteur de la distribution à dominante alimentaire, gère un parc de plus de 12 000 magasins dans le monde (hypermarchés, supermarchés, magasins de proximité, magasins discompteurs) sous les enseignes notamment Géant Casino, Franprix, Casino Supermarché, Petit Casino, Casino Shop, Casino Shopping, Spar, Vival, Monoprix et Leader Price. -

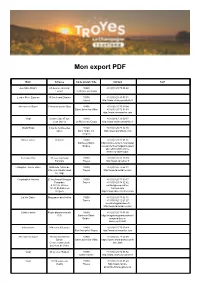

Mon Export PDF

Mon export PDF Nom Adresse Code postal / Ville Contact Tarif Aux Mille Affair's 67 Avenue Général 10440 +33 (0)3 25 75 08 62 Leclerc La Rivière-de-Corps Leader Price Express 30 Boulevard Danton 10000 +33 (0)3 25 80 03 31 Troyes http://www.casino-proximite.fr Intermarché Super 23 boulevard de Dijon 10800 +33 (0)3 25 75 39 94 Saint-Julien-les-Villas +33 (0)3 25 72 93 33 http://www.intermarche.com Vival Centre Cial, 47 rue 10440 +33 (0)9 67 33 60 17 Jean Jaurès La Rivière-de-Corps http://www.casino-proximite.fr Grand Frais 3 rue de l'entrée des 10120 +33 (0)3 25 78 32 35 antes Saint-André-les- http://www.grandfrais.com Vergers Brico Leclerc RD 619 10600 +33 (0)3 25 72 51 51 Barberey-Saint- http://www.e-leclerc.com/st-par Sulpice res-aux-tertres/magasins-speci alises/brico/info--brico- barberey-saint-sulpic Carrefour City 37, rue Raymond 10000 +33 (0)3 25 81 10 79 Poincaré Troyes http://www.carrefour.fr L'Angélus - La vie claire Halles de l'Hôtel de 10000 +33 (0)3 25 73 62 11 Ville, rue Claude Huez Troyes http://www.lavieclaire.com/ 1er étage Coopérative Hermès 23 boulevard Georges 10000 +33 (0)3 25 73 39 17 Pompidou Troyes +33 (0)3 25 78 32 82 & 127 av. Wilson contact@cooperative- 10120 St André les hermes.com Vergers http://cooperative-hermes.com La Vie Claire Mezzanine des Halles 10000 +33 (0)3 25 73 62 11 Troyes +33 (0)9 62 12 21 27 [email protected] http://www.lavieclaire.com/ Géant Casino Route départementale 10600 +33 (0)3 25 71 54 00 619 Barberey-Saint- http://magasins.geantcasino.fr/ Sulpice magasin/troyes- barberey/CG201 Intermarché -

FRENCH MARKET PRESENTATION for : FEVIA from : Sophie Delcroix – Elise Deroo – Green Seed France Date : 19Th June, 2014

FRENCH MARKET PRESENTATION For : FEVIA From : Sophie Delcroix – Elise Deroo – Green Seed France Date : 19th June, 2014 FEVIA 1 I. GREEN SEED GROUP : WHO WE ARE II. MARKET BACKGROUND AND CONSUMER TRENDS III. THE FRENCH RETAIL SECTOR IV. KEY RETAILERS PROFILES V. FOODSERVICE VI. KEY LEARNINGS VII. CASE STUDIES FEVIA 2 Green Seed Group Having 25 years of experience, the Green Seed Group is a unique international network of 11 offices in Europe, North America and Australia, specializing in the food & beverage sector OUR MISSION Advise both French and foreign food and beverage companies or marketing boards, on how to develop a sustainable and profitable position abroad Green Seed France help you to develop your activity in France using our in-depth knowledge of the local food and beverage market and our established contacts within the trade FEVIA 3 A growing and unique international network Germany (+ A, CH) The Netherlands Scandinavia U.S.A./Canada Great Britain Belgium France Portugal Spain Italy 11 offices covering 18 countries Australasia FEVIA 4 The Green Seed model Over the last decade, one of the most important trends in the French food & drink trade has been for retailers to deal with their suppliers on a direct line. Green Seed France has developed its business model around this trend. We act as business facilitators ensuring that every step of the process is managed with maximum efficiency. From first market visit, to launch as well as the ongoing relationship that follows. We offer a highly cost-effective solution of “flexible local sales and marketing management support” aimed at adding value. -

Carrefour Group, Building RELATIONSHIPS a L R EPO RT

2007 ANNUAL REPORT CARREFOUR GROUP, BUILDIng RELATIONSHIPS RT EPO R L A U ANN Carrefour SA with capital of 1,762,256,790 euros 2007 RCS Nanterre 652 014 051 www.groupecarrefour.com N°1 in Europe 30 countries N°2 worldwide OTHERS PUBLICATIONS: RAPPORT DÉVELOPPEMENT DURABLE 2007 102.442 billion euros in sales carrEFOUR carrEFOUR incl. tax under GROUP GROUP Group banners 16,899,020 sq.m sales area BUILDING FInancIAL RESPOnsIBLE REPORT RELATIONSHIPS 2007 490,042 employees 2007 Sustainability Report 2007 Financial Report stores More than 3 billion cash 14,991 transactions per year YOU CAN FIND THE LATEST CARREFOUR GROUP NEWS AND THE INTERACTIVE ANNUAL REPORT AT WWW.GROUPECARREFOUR.COM Design, copywriting and production: Translation: Photocredits: Carrefour Photo Library, Lionel Barbe, Christophe Gay/Skyzone, Nicolas Landemard, Gilles Leimdorfer/Rapho, Jean-Erick Pasquier/Rapho, Michel Labelle, all rights reserved - p. 2-3: Getty Images/Bruno Morandi - p. 4-5: Getty Images/ Hans Neleman - p. 6-7: Getty Images/Lonely Planet Images/Krzysztof Dydynski - p. 8-9: Getty Images/Daly & Newton - p. 16: Getty Images/Shannon Fagan - p. 24: Getty Images/Daly & Newton - p. 32: Getty Images/Frank Herholdt - p. 36: Corbis/Beathan - p. 38: Getty Images/fStop - p. 39: Getty Images/Darryl Estrine - p. 40: Corbis/Jose Luis Pelaez - p. 41: Getty Images/Somos/Veer - p. 42: Getty Images/Floresco Images - p. 45: Getty Images/Dimitri Vervitsiotis. CARREFOUR / ATACADAO / CARREFOUR EXPRESS / CARREFOUR BAIRRO / CARREFOUR CITY / CARREFOUR MARKET / 5 MINUT CARREFOUR / Paper: the Carrefour group is committed to the responsible management of its paper sourcing. The paper used for this document is certified PEFC (Programme for the Endorsement of Forest Certification schemes). -

Country Retail Scene Report

SPAIN COUNTRY RETAIL SCENE REPORT December 2012 KANTAR RETAIL 24 – 28 Bloomsbury Way, London WC1A 2PX, UK / Tel. +44 (0)207 031 0272 / www.KantarRetail.com INFORMATION / INSIGHT / STRATEGY / EXECUTION © Kantar Retail 2012 245 First Street 24 – 28 Bloomsbury Way T +44 (0) 207 0310272 Suite 1000 London, WC1A 2PX F +44 (0) 207 0310270 Cambridge, MA 02142 UK [email protected] USA www.kantarretail.com Index I. Key Themes .......................................................................................................... 2 II. Socio – Economic Background .............................................................................. 3 III. Key Players in the Grocery Retail Sector ............................................................ 11 IV. Grocery Retail Channels ..................................................................................... 19 V. Conclusion ........................................................................................................... 24 © 2012 KANTAR RETAIL | 2012 Spain Retail Scene | www.kantarretail.com 1 245 First Street 24 – 28 Bloomsbury Way T +44 (0) 207 0310272 Suite 1000 London, WC1A 2PX F +44 (0) 207 0310270 Cambridge, MA 02142 UK [email protected] USA www.kantarretail.com I. Key Themes National players are capturing growth and increasing concentration in Spain Despite the economic turmoil in Spain, leading Spanish grocery retailers are expected to see their growth accelerate in the coming years, led by retailers such as Mercadona and Dia, both growing at over 5% per year. Mercadona is by far the largest Spanish grocery retailer in terms of sales and has successfully adapted its strategy to the economic crisis that Spain is facing. Its impressive business model has enabled it to retain shopper loyalty and support robust physical expansion and the retailer is looking to further strengthen its domination of the supermarket channel and the grocery market overall. Due to the strong growth of two of the top five grocery retailers in Spain the dominance of a few major players will increase.