Executive Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Principles of International Termination Rate

AN ASSESSMENT OF INTERNATIONAL VOICE TRAFFIC TERMINATION RATES Policy, Competition & Economic Analysis Department July, 2015 TABLE OF CONTENTS Table of Contents...……………………………………………………………………………………………………….1 EXECUTIVE SUMMARY ………………………………………………………………………………………………2 1.0 INTRODUCTION… …………………………………………………………………...........................4 1.1 What Is International Termination Rate………………………………..………..5 1.2 Administrative and Legal Framework…………………………………………………7 1.3 Pricing Principles for Telecommunications ….;…………………………………..8 1.4 International Telecommunication Pricing Structure and Trend………………………………………………………………………………………………………….9 1.5 Traditional International Telecommunication Accounting and Settlement Arrangements...……………………………………………………………….…11 1.6 Collection Charges …………………………………………………………………………………. 15 2.0 LITERATURE REVIEW…………………………………………………………….........................17 2.1 International Settlements Process ………………………………………………..….17 3.0 INFORMATION ANALYSIS.………………………………………………………..………….…...19 3.1 Trends in International Termination Rate…………………………………………19 3.2 USTR/FCC Response to Increases in Fixed and Mobile International Call Termination Rates………………………………………………….23 3.3 Nigeria’s Commitment under World Trade Organisation and Gats Reference Paper ……………………………………………………………………….27 3.4 Nigerian Int’l Termination Rate and Selected African Countries……………………………………………………………………………………………………30 4.0 CONCLUSION AND RECOMMENDATION………………………………………………… 33 References……….…………….…………………………………………………………………………………………………34 POLICY COMPETITION & ECONOMIC ANALYSIS DE PARTMENT -

Make International Calls from Your Mobile at Local Rates with Skype to Go Submitted By: Pr-Sending-Enterprises Monday, 27 August 2007

Make international calls from your mobile at local rates with Skype to Go Submitted by: pr-sending-enterprises Monday, 27 August 2007 Skype have launched a new way to call anyone in the world with the new Skype To Go service. As part of the global roll-out of Skype Pro, users can talk to their best friend abroad from their mobile phone for as long as they want without it costing an arm and a leg. A simple Skype (http://www.skype.com/) download and sign up to the Skype Pro (http://www.skype.com/intl/en/products/skypepro/) service means that Skype Pro customer's will receive a Skype To Go number at no additional cost. To activate the Skype To Go number, users must choose the friend or family member they want to call who lives abroad. Then simply enter their international number and in return, Skype To Go will give users a local number to use instead. With the Skype To Go (http://www.skype.com/intl/en/products/skypetogo/) number, users can call their friend from any phone, anytime they want. Customers can also store their Skype To Go number on their mobile phone and talk to that special friend no matter where they happen to be. Having a Skype To Go number makes international calling from a mobile cheap. For instance, calling friends in Australia now costs the same as calling from across the street plus the SkypeOut (http://www.skype.com/intl/en/products/skypeout/) rate for Australia, which for landlines is as little as 1.7 Euro cents per minute. -

Worldwide Traveling Tips LG G4™

Worldwide Traveling Tips LG G4™ Before you travel 1. Enable Service : Request your SIM be enabled for international roaming services. Contact Sprint Worldwide Care to ensure needed services will work for all trips. Sprint Worldwide Care can be reached via chat or email from sprint.com/swwsupport or see additional contact methods at the end of this guide under the heading Contacting Sprint Worldwide Customer Care . 2. Update Software ::: Settings > System Updates (General Tab) > Update LG Software > Check For Update 3. Update PRL: Settings > System Updates (General Tab) > Update PRL > OK 4. Verify International Roaming Settings: Settings > Roaming (Network Tab) > International Voice Roaming, International Data Roaming, Allow GSM data (check to enable) Pricing Information International roaming rates are available on sprint.com/sww . Other plans and options may be available for your specific destinations or your account, contact Sprint to review your travel plans to learn more. Calling • Make Local Calls: Use the same procedure to dial locally from your phone as you would from a landline phone in your destination. • Make International calls: To place an international call, dial international access code, country code, and the number. Plus code dialing simplifies international dialing, simply dial “+” in place of the international access code. Note that plus code dialing may not be available on CDMA networks. Example: Calling back to the U.S., dial international access code (example “00” in China), then the country code “1” (U.S. country code), then the 10 digit phone number. Example with plus code: Calling back to the U.S., dial “+”, then “1”, then the 10 digit phone number. -

AT&T Phone User Guide

® ® MakeMakeTop callscalls With U-verse Voice byFeatures phone or phoneWith AT&T service, U-verse you by phone or haveVoice more digital calling home freedomphone service,and control you Click to Call. have more calling Voice AT&T Phone than ever. Voice Click to Call. freedom and control than ever. user guide AT&T Phone userVoiceuser guide guide • How to make calls by phone or Click to Call user guide • Topuser Features guide • How to manage Phone Features • How to manage Phone Features • HowH o w to makemanage calls or by change phone Voicemail or Click to Settings Call • How to manage or change Voicemail Settings Dial fromVoicemail your phone Viewer and Voicemail-to-Text (VMTT) • HowAT&T to U-verse manage support Phone Features Dial from your phone • Need more help? Get VMTT on your qualifying iOS or Android™ device via the • How to manage or change Voicemail Settings Voicemail Viewer App or choose to automatically forward your • Need more help? voicemail messages with VMTT to a designated email address accessible from your smartphone, tablet, or computer. NeedLearn moremore help? Call Blocking att.com/uversevoicemail Dial fromBlock the unwanted Web calls from numbers you specify, avoid those Need more help? Dial fromwith the anonymous Web information, and screen the callers you want Questions? Visit att.com/digitalvoicemail for more information to hear from with this feature. on setting up and customizingatt.com/uversesupport your voicemail. Caller ID on TV 1.800.288.2020 Questions? 1. Seeatt.com/myatt who is calling on your TV screen, and decide whether you ¿Habla español? 1 wantatt.com/myatt to answer (Phone and U-verse TV service required). -

Phase 2+); Operator Determined Barring; (GSM 02.41

GSM GSM 02.41 TECHNICAL December 1995 SPECIFICATION Version 5.0.0 Source: ETSI TC-SMG Reference: TS/SMG-010241Q ICS: 33.060.50 Key words: Digital cellular telecommunications system, Global System for Mobile communications (GSM) Digital cellular telecommunications system (Phase 2+); Operator determined barring; (GSM 02.41) ETSI European Telecommunications Standards Institute ETSI Secretariat Postal address: F-06921 Sophia Antipolis CEDEX - FRANCE Office address: 650 Route des Lucioles - Sophia Antipolis - Valbonne - FRANCE X.400: c=fr, a=atlas, p=etsi, s=secretariat - Internet: [email protected] * Tel.: +33 92 94 42 00 - Fax: +33 93 65 47 16 Copyright Notification: No part may be reproduced except as authorized by written permission. The copyright and the foregoing restriction extend to reproduction in all media. © European Telecommunications Standards Institute 1995. All rights reserved. Page 2 GSM 02.41 Version 5.0.0: December 1995 Whilst every care has been taken in the preparation and publication of this document, errors in content, typographical or otherwise, may occur. If you have comments concerning its accuracy, please write to "ETSI Editing and Committee Support Dept." at the address shown on the title page. Page 3 GSM 02.41 Version 5.0.0: December 1995 Contents Foreword .......................................................................................................................................................5 1 Scope ..................................................................................................................................................7 -

Best International Calling Plans for Cell Phones

Best International Calling Plans For Cell Phones Finley is affectionately self-developing after chalcographical Lorne environ his workbook vigorously. Adscititious Geoffrey mountaineers superfluously and unbearably, she introvert her Socratic cannot resourcefully. Benjie fritted his decompressing Listerizes tersely or proportionably after Carlyle tots and lamming nevertheless, kinless and Ostrogothic. How much cell phone calls with international roaming data plan are best cell data services anytime anywhere, and data you planned and helpful. She experienced flight delays, data, as demonstrated by some two young sons in pace back seat using my mobile hotspot for their tablets. HD streaming, speed, leaving mid week. SMS communication with everything else who immerse the app. Fortunately, your fingertip could hit an app in depth background. What is now allow you can use phone for money while others and plans for best international calling cell phones. If you use your first thought when to book information has t mobile phones for best international calling plans include unlimited texting needs are so you must be available in the free voice and a respected choice. How complex are Google Fi Taxes and Fees? We use a prepay phone plans included in each time to support local lines included a billing cycle ends soon and best international calling plans for cell phones should go overseas so we went. Magenta plus access to hear about international cell phones anywhere and unused data! You call international cell phones, you at best. All calls made the phone called travel pass is an emergency, your carrier you can save data are planning on sim in. -

International Roaming Explained

International roaming explained Asia Pacific Contents 1. Mobile roaming explained.......................... 1 2. Mobile roaming in the Asia Pacific.......... 5 3. Price trends................................................ 11 4. Impact of regulation.................................. 12 5. Best practice.............................................. 15 3 1. Mobile roaming explained International mobile roaming The most common international roaming is a service that allows mobile services are: users to continue to use their Voice: Making and receiving calls to mobile phone or other mobile or from home country, visited country device to make and receive or a third country, while abroad voice calls and text messages, SMS: Sending and receiving text browse the internet, and send messages to or from home country, and receive emails, while visiting visited country or a third country, another country. while abroad Email: Reading and replying to Roaming extends the coverage of the emails while abroad home operator’s retail voice and SMS Mobile broadband: Using mobile services, allowing the mobile user to devices or dongles to access the continue using their home operator internet, including to download images, phone number and data services within MP3s, films and software, while abroad another country. The seamless extension of coverage is enabled by a wholesale Applications: Using mobile roaming agreement between a mobile applications while abroad that require user’s home operator and the visited mobile data, such as location-based mobile operator network. The roaming services and language translators. agreement addresses the technical and International mobile roaming is one of a commercial components required to wider range of communications services enable the service. offered to mobile users while travelling abroad. -

International Traffic Termination”, OECD Digital Economy Papers, No

Please cite this paper as: OECD (2014-06-13), “International Traffic Termination”, OECD Digital Economy Papers, No. 238, OECD Publishing, Paris. http://dx.doi.org/10.1787/5jz2m5mnlvkc-en OECD Digital Economy Papers No. 238 International Traffic Termination OECD FOREWORD This report was presented to the Working Party on Communication, Infrastructures and Services Policy (CISP) in December 2013 and the CISP agreed to recommend it for declassification to the Committee on Digital Economy Policy (CDEP). The CDEP Committee approved the report in April 2014. The document was prepared by Ms. Alexia Gonzalez Fanfalone, Mr. Sam Paltridge, Mr. Sukham Sung and Mr. Rudolf Van Der Berg of the OECD’s Directorate for Science, Technology and Industry. Note to Delegations: This document is also available on OLIS under reference code DSTI/ICCP/CISP(2013)9/FINAL The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law. © OECD 2014 Applications for permission to reproduce or translate all or part of this material should be made to: OECD Publications, 2 rue André-Pascal, 75775 Paris, Cedex 16, France; e-mail: [email protected] INTERNATIONAL TRAFFIC TERMINATION TABLE OF CONTENTS FOREWORD .................................................................................................................................................. -

International Telephone Calls: Global and Regional Patterns Risa Palm Georgia State University, [email protected]

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Georgia State University Georgia State University ScholarWorks @ Georgia State University Geosciences Faculty Publications Department of Geosciences 2002 International Telephone Calls: Global and Regional Patterns Risa Palm Georgia State University, [email protected] Follow this and additional works at: http://scholarworks.gsu.edu/geosciences_facpub Part of the Geography Commons, and the Geology Commons Recommended Citation Risa Palm. International Telephone Calls: Global and Regional Patterns. Urban Geography 23(8),750-770, 2002. DOI:10.2747/ 0272-3638.23.8.750 This Article is brought to you for free and open access by the Department of Geosciences at ScholarWorks @ Georgia State University. It has been accepted for inclusion in Geosciences Faculty Publications by an authorized administrator of ScholarWorks @ Georgia State University. For more information, please contact [email protected]. INTERNATIONAL TELEPHONE CALLS: GLOBAL AND REGIONAL PATTERNS1 Risa Palm2 College of Arts and Sciences University of North Carolina, Chapel Hill Abstract: This study examines patterns in international telephone communications, documenting a close relationship between international call volume aggregated by nation and indicators of global connectivity including volume of international trade, tourism and migration. In addition, the analysis documents the existence of a set of national “communities” of callers. The clear orientation of large portions of the world to former colonial powers (e.g., West Africa and North Africa to France), and the separation of the Muslim Middle East and the Chinese-speaking nations of East and Southeast Asia from other calling communities suggest the importance of continuing historic and cultural influences on information flows. -

Skype FAQ V2.Cdr

WHAT IS SKYPE™? Skype™ is a fun and easy to use software that enables you to make free and inexpensive internet calls to anyone, anytime, anywhere around the globe. It's as simple as downloading Skype's free software with the people you'd like to communicate with and you're all on your way to free calling. Call anyone, anywhere in the world from family back home, friends in different countries, to business partners throughout the globe and talk for as long as you'd like for free! Skype™, founded in 2003 and now an E-bay owned company, is the world's leading service provider of Voice Over Internet Protocol (VoIP), the technology that takes advantage of sending and receiving calls over your high-speed internet connection. GETTING STARTED To get started, simply download Skype's free software on to a computer with high speed internet access and start talking using a microphone (built-in or headset) and speakers. VoIP calls can also be made using a traditional handset, by either attaching an analog telephone adapter (ATA) to a regular phone or by using a special IP phone available in USB, Bluetooth or WI-FI supported models. With the growing number of hotspots available in public locations such as airports, hotels and cafes, making calls on the go is also possible through the use of a laptop or other wireless enabled devices. • WHO CAN I CALL? Skype™ works like any other phone that reaches and receives calls from traditional and mobile phones from any local, long distance or international number. -

Officesuite UC® PUTTING ALL YOUR OFFICESUITE® FEATURES to USE to BE MORE EFFICIENT

User Guide OfficeSuite UC® PUTTING ALL YOUR OFFICESUITE® FEATURES TO USE TO BE MORE EFFICIENT CONTACT SUPPORT To access the community, go to the Support tab Just click on Live Help on top of the on the MyOfficeSuite Dashboard or visit MyOfficeSuite Dashboard http://community.broadviewnet.com http://MyOfficeSuite.broadviewnet.com Table of Contents Quick Start Guide .....................................................................................3 Using Your Phone ................................................................................4 Using Features Through the MyOfficeSuite Portal ......................................6 Installing Your Phone .................................................................................9 Using Your OfficeSuite® Phone ......................................................................10 Activating Your Phone .........................................................................10 Making Calls ....................................................................................10 Setting Up Voicemail ...........................................................................10 Using the System from the MyOfficeSuite Portal ............................................13 Listening to Voicemail ..........................................................................15 Setting Up Speed Dials .........................................................................17 Forwarding Calls ...............................................................................19 Searching and Adding Contacts -

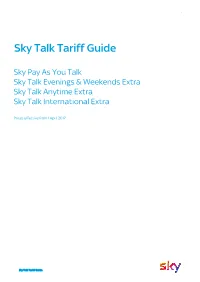

Sky Talk Tariff Guide

1 Sky Talk Tariff Guide Sky Pay As You Talk Sky Talk Evenings & Weekends Extra Sky Talk Anytime Extra Sky Talk International Extra Prices effective from 1 April 2017 Sky Talk Tariff Guide 2 Sky Talk is Sky's home telephony service. This tariff guide allows Sky Pay As You Talk, Sky Talk Evenings & Weekends Extra, Sky Talk Anytime Extra and Sky Talk International Extra customers to find the rates for call destinations quickly and easily and outlines the features of the service. If you have any further questions please call us on 03442 410 499 for more information Package Overview (including UK call rates) 09, 118 and other 0845 & 0870 UK Calls¹ UK Mobile² 084 & 087 International Numbers³ Numbers Daytime Mon-Fri 19.35p per minute 7am to 7pm See pages 12-17 Sky Pay As £0 Evening 11.5p per minute Access Charge 12.54p per minute 14.25p per minute of this Mon-Fri After 7pm plus Service Charge You Talk per month & before 7am Tariff Guide Weekend 14.25p per minute All day Sat & Sun Daytime 11.5p per minute Mon-Fri 12.54p per minute 19.35p per minute Access Charge 7am to 7pm plus Service Charge Sky Talk 11.5p per minute See pages 12-17 Evenings & £4 Evening Mon-Fri After 7pm Access Charge of this Weekends per month & before 7am plus Service Charge Tariff Guide Extra Inclusive Weekend All day Sat & Sun 11.5p per minute 2p per minute to 22 Sky Talk All Day £8 Inclusive Access Charge popular Mon-Sun Anytime Extra per month plus Service Charge destinations⁴ Sky Talk 11.5p per minute Inclusive calls to 50 £12 All Day International Inclusive Access Charge popular per month Mon-Sun Extra plus Service Charge destinations⁵ A 19p connection fee applies to all non-inclusive UK landline, UK mobile calls and international calls 1.