Update on the Proposed Acquisition of the Target Company Which Holds Ixm

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Geneva, Switzerland September 16, 2020 #Commoditiestradingforum

Geneva, Switzerland #CommoditiesTradingForum www.gtreview.com/CTF September 16, 2020 OVERVIEW Once registered, log-in to GTR Connect to network with fellow delegates, download event materials and more. Building on the success of 2019’s inaugural Geneva event and reflecting increased collaboration and partnership with the Swiss Trading & Shipping Association (STSA), GTR is delighted to announce that its newly expanded Commodities Trading As the world’s leading trade, commodity and export Forum will be taking place at the Intercontinental finance publisher and event organiser,GTR offers sponsors and advertisers unrivalled exposure and Hotel Geneva on September 16, 2020. profiling among their peer and client groups.GTR can offer various appealing options that would strategically Co-hosted and held in partnership with both the STSA and PwC, and effectively help raise the profile of the partner, and reflecting on Switzerland’s role as one for the world’s leading and offer a highly effective platform with which to hubs for commodities from oil and gas to metals and agribusiness showcase its capabilities and mission. products, the conference will provide a comprehensive overview of the global commodities and commodity finance markets. With an extensive mix of industry experts and practitioners set to attend, including corporates and traders, banks, funds Sponsorship opportunities and alternative financiers, insurers and brokers, law firms and Peter Gubbins technology experts, this event will provide an unrivalled forum for Co-founder & CEO networking -

Annual Information Form (“AIF”) Means Dundee Precious Metals Inc

Annual Date: March 28, 2019 Information Form 2018 For the Year Ended December 31, 2018 Table of Contents GENERAL INFORMATION ................................................................................................................ 3 GENERAL DEVELOPMENT OF THE BUSINESS .................................................................................. 4 DESCRIPTION OF THE BUSINESS ..................................................................................................... 5 RISK FACTORS ................................................................................................................................ 13 MINING PROPERTIES ..................................................................................................................... 24 CHELOPECH MINE, CHELOPECH, BULGARIA .......................................................................................... 24 KRUMOVGRAD GOLD PROJECT, KRUMOVGRAD, BULGARIA ..................................................................... 36 SMELTER OPERATIONS ................................................................................................................. 48 EXPLORATION ASSETS ................................................................................................................... 51 SERBIA ......................................................................................................................................... 51 CANADA ...................................................................................................................................... -

Delivering the World's Largest Trade Finance Gathering... Digitally

Delivering the world’s largest trade finance gathering... digitally www.gtreview.com/gtrasia Post-event media kit #GTRAsia INTRODUCTION & CONTACTS GTR Asia 2020, the region’s largest trade finance gathering, took place virtually on September 8-11. Welcoming over 1,300 trade finance representatives over 4 days, this virtual event offered the chance to hear the latest developments from experts on THE most pertinent issues affecting the trade, commodity, treasury and fintech communities. Utilising a mixture of live-streamed and pre- “Great and easy to use platform. recorded content, and fostering a new way of Whilst nothing can replace an in-person conference, you have networking via GTR’s dedicated virtual event done a great job at keeping the industry conversation going.” platform, GTR Asia 2020 Virtual offered a Christoph Woermann, CMO Corporate Bank, Deutsche Bank truly international perspective and a chance to connect with global and local decision makers from around the world. Sponsorship opportunities Speaking opportunities Marketing & media opportunities Ed Virtue Jeff Ando Elisabeth Spry Join the conversation at #GTRAsia Director, Global Sales Director, Content Marketing Manager [email protected] [email protected] [email protected] +44 (0)20 8772 3008 +44 (0)20 8772 3015 +44 (0)20 8772 3006 2 | #GTRAsia www.gtreview.com/gtrasia STATISTICS Social media statistics Attendees by sector in 2020 Company size breakdown in 2020 Corporates & traders 12 % % 9 6 10 15 3 3 SME % Mid 60 75% 1.5 million impressions 12 Banks & financiers 2 -

Acquisition Announcement

ACQUISITION ANNOUNCEMENT See Small. Think Big. NEWS RELEASE Toronto, July 12, 2020 Triple Flag Announces US$550 million Gold and Silver Stream on CMOC’s Northparkes Mine Triple Flag Precious Metals Corp. (“TFPM”) is pleased to announce that its wholly-owned subsidiary, Triple Flag Mining Finance Bermuda Ltd. (“Triple Flag Bermuda” and collectively with TFPM, “Triple Flag”) has entered into a stream agreement with certain subsidiaries of China Molybdenum Co., Ltd. (collectively, “CMOC”), to receive gold and silver deliveries determined by reference to production from the Northparkes copper-gold mine located in New South Wales, Australia. Northparkes is operated by CMOC on behalf of the Northparkes Joint Venture, an unincorporated joint venture between CMOC (80%), SC Mineral Resources Pty Ltd. (6.7%) and Sumitomo Metal Mining Oceania Pty Limited (13.3%) (the latter two collectively, “Sumitomo”) . Triple Flag Bermuda will make an upfront cash payment of US$550 million and on-going payments equal to 10% of the spot gold price and spot silver price at the time of delivery for gold and silver equal to 54.0% of the gold and 80.0% of the silver produced at Northparkes (the “Stream”). “Northparkes will be a new cornerstone asset, with robust cash flows over a very long mine life in a top-tier mining jurisdiction. This is a globally recognized mine with an excellent track record of safety, operations, reserve replacement and community involvement further bolstering and diversifying our portfolio,” commented Shaun Usmar, Founder and CEO of Triple Flag. “Mining at Northparkes commenced in 1993 with a Reserve of 68Mt; 25 years later the mine has created significant value for its owners and their local stakeholders, and stands with a Reserve of 133Mt, a Resource of 483Mt and a long future ahead of it. -

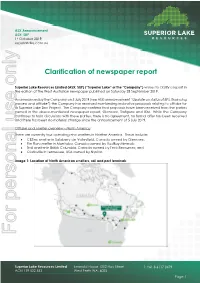

For Personal Use Only Use Personal For

ASX Announcement ASX: SUP 1st October 2019 superiorlake.com.au Clarification of newspaper report Superior Lake Resources Limited (ASX: SUP) (“Superior Lake” or the “Company”) wishes to clarify a report in the edition of The West Australian newspaper published on Saturday 28 September 2019. As announced by the Company on 5 July 2019 (see ASX announcement “Update on status of BFS, financing process and offtake”) the Company has received non-binding indicative proposals relating to offtake for its Superior Lake Zinc Project. The Company confirms that proposals have been received from the parties named in the above-mentioned newspaper report, Glencore, Trafigura and IXM. While the Company continues to hold discussions with these parties, there is no agreement, no formal offer has been received and there has been no material change since the announcement of 5 July 2019. Offtake and smelter overview – North America There are currently four operating zinc smelters in Norther America. These include: CEZinc smelter in Salaberry-de-Valleyfield, Canada owned by Glencore; Flin Flon smelter in Manitoba, Canada owned by HudBay Minerals; Trail smelter in British Columbia, Canada owned by Teck Resources; and Clarksville in Tennessee, USA owned by Nyrstar. Image 1: Location of North American smelters, rail and port terminals For personal use only Superior Lake Resources Limited Emerald House 1202 Hay Street T: +61 8 6117 0479 ACN 139 522 553 West Perth WA, 6005 Page 1 The majority of supply for these smelters is provided by North American zinc operations. Leading independent commodity expert, CRU, recently highlighted that North American zinc in concentrate production has been almost flat since the end of 2014, rising only 1.9% over the period to 1.76 Mt in 2018. -

This Document Is Important and Requires Your Immediate Attention Financial Report and Budget Report Proposed Distribution Of

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt about this circular or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in China Molybdenum Co., Ltd.*, you should at once hand this circular to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this circular, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss however arising from or in reliance upon the whole or any part of the contents of this circular. (Stock Code: 03993) FINANCIAL REPORT AND BUDGET REPORT PROPOSED DISTRIBUTION OF FINAL DIVIDEND PROPOSED SUBSCRIPTIONS OF STRUCTURED DEPOSIT WITH INTERNAL IDLE FUNDS PROPOSED PURCHASE OF WEALTH MANAGEMENT PRODUCTS WITH INTERNAL IDLE FUNDS PROPOSED PROVISION OF FINANCIAL GUARANTEE TO WHOLLY-OWNED SUBSIDIARIES PROPOSED GENERAL MANDATE FOR ISSUE OF SHARES PROPOSED GENERAL MANDATE FOR REPURCHASE OF H SHARES VERY SUBSTANTIAL ACQUISITION OF THE TARGET COMPANY WHICH HOLDS IXM AND NOTICE OF THE ANNUAL GENERAL MEETING NOTICE OF THE 2019 SECOND CLASS MEETING OF H SHAREHOLDERS A letter from the Board is set out on pages 1 to 44 of this circular. Notice convening the AGM to be held at the International Conference Room of Mudu-Lee Royal International Hotel at No. -

The Redstone Commodity Update 2019: Q2

Welcome to the Redstone Commodity Update 2019: Q2 Q2 has rounded off a good first half year for commodities in general, across the board we are seeing more bullish markets with companies raising their recruitment levels rise in tandem. Energy was by far and away the standout sector producing around half of the total moves tracked. This represents some significant strategic and tactical shifts in the industry as players look to diversify their offerings, which feeds into our ship and bunker segment due to the changes being implemented for bunker players in 2020. Essentially the bunker market is currently acting as a microcosm for the wider oil and gas sectors moving forwards. The apparent easing of trade tensions between China and the US has in no small part added to the gains seen across the commodities markets this quarter. As a general rule the market has continued its forward momentum from last year in spite of the ongoing trade spat, thereby making Trump’s and Xi’s most recent accord very welcome. __________________________________________________________________________________ Noteworthy Energy Talent Moves The back and forth with oil prices has continued this quarter with the average price per barrel maintaining an overall upward trend. US exports continued to rise above previous records as it enjoys OPEC’s continued output reduction measures, as well as the markets need to make up for the shortfalls experienced from the fallout of Iran’s actions in the Middle East and continued political and social unrest in Venezuela. Recruitment wise Energy was the big player this quarter making up the clear majority of moves we tracked. -

Condensed Interim Consolidated Financial Statements

Condensed Interim Consolidated Financial Statements For the three and six months ended June 30, 2020 and 2019 (Unaudited) Aura Minerals Inc. Condensed Consolidated Statements of Income (Loss) For the three and six months ended June 30, 2020 and 2019 Expressed in thousands of United States dollars (Unaudited) For the three For the three For the six For the six Note months ended months ended months ended months ended June 30, 2020 June 30, 2019 June 30, 2020 June 30, 2019 Net revenue 19 $ 60,834 $ 50,374 $ 109,460 $ 86,630 Cost of goods sold 20 42,947 45,563 84,883 80,743 Gross margin 17,887 4,811 24,577 5,887 General and administrative expenses 21 3,075 3,577 7,144 6,215 Care-and-maintenance expenses 22 214 689 650 1,465 Exploration expenses 23 902 1,092 1,740 2,108 Operating income/(loss) 13,696 (547) 15,043 (3,901) Finance costs 24 (2,500) (1,208) (4,222) (2,255) Other gains (losses) 25 (7,109) (2,361) (13,678) (2,201) Income/ (Loss) before income taxes 4,087 (4,116) (2,857) (8,357) Current income tax (expense) 14 (1,176) (439) (2,328) (1,481) Deferred income tax (expense) recovery 14 1,074 641 (8,494) 1,201 Income/(Loss) for the period $ 3,985 $ (3,914) $ (13,679) $ (8,637) Income/(Loss) per share: Basic & Diluted 32 $ 0.92 $ (0.90) $ (3.14) $ (1.98) Diluted 32 $ 0.91 $ (0.90) $ (3.11) $ (1.98) Weighted average number of common shares outstanding: Basic 32 4,353,946 4,353,865 4,353,684 4,352,083 Diluted 32 4,392,996 4,370,834 4,392,734 4,369,052 The accompanying notes form an integral part of these condensed interim consolidated financial statements. -

Great Panther Mining Limited Annual Information Form

GREAT PANTHER MINING LIMITED ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2020 March 11, 2021 Great Panther Mining Limited 1 Annual Information Form for the year ended December 31, 2020 GREAT PANTHER MINING LIMITED (“COMPANY”) ANNUAL INFORMATION FORM CONTENTS CONTENTS ............................................................................................................................................................. 2 1. IMPORTANT INFORMATION ABOUT THIS DOCUMENT ............................................................................. 4 1.A. DATE OF INFORMATION .................................................................................................................................. 4 1.B. NOMENCLATURE ............................................................................................................................................. 4 1.C. FINANCIAL INFORMATION AND REPORTING CURRENCY ................................................................................ 4 1.D. CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS ............................................................ 4 1.E. SCIENTIFIC AND TECHNICAL INFORMATION ................................................................................................. 11 1.F. CANADIAN MINERAL PROPERTY STANDARDS AND RESERVE/ RESOURCE ESTIMATES ................................. 12 1.G. CAUTIONARY NOTES TO U.S. INVESTORS REGARDING RESOURCE AND RESERVE ESTIMATES ..................... 13 1.H. GLOSSARY OF TERMS AND UNITS OF MEASURE .......................................................................................... -

Condensed Interim Consolidated Financial Statements

Condensed Interim Consolidated Financial Statements For the three and nine months ended September 30, 2019 and 2018 (Unaudited) Notice to Reader – From Aura Minerals The unaudited condensed interim consolidated financial statements of Aura Minerals Inc. including the accompanying condensed interim consolidated statements of financial position as at September 30, 2019 and December 31, 2018, the condensed interim consolidated statements of income and comprehensive (loss) income for the three and nine months ended September 30, 2019 and 2018 and the condensed interim consolidated statements of cash flows and changes in equity for the nine months ended September 30, 2019 and 2018 are the responsibility of the Company’s management. The unaudited condensed interim consolidated financial statements have been prepared by management and include the selection of appropriate accounting principles, judgements and estimates necessary to prepare the unaudited condensed interim consolidated financial statements in accordance with International Financial Reporting Standards for interim consolidated financial statements. Aura Minerals Inc. Condensed Consolidated Statements of Income (Loss) For the three and nine months ended September 30, 2019 and 2018 Expressed in thousands of United States dollars (Unaudited) For the three For the three For the nine For the nine Note months ended months ended months ended months ended September 30, 2019 September 30, 2018 September 30, 2019 September 30, 2018 Revenue 20 $ 69,919 $ 33,176 $ 156,549 $ 123,537 Cost of goods sold 21 51,422 31,495 132,165 106,638 Gross margin 18,497 1,681 24,384 16,899 General and administrative expenses 22 2,695 3,155 8,910 9,562 Care-and-maintenance expenses 23 439 1,562 1,904 3,452 Exploration expenses 24 852 1,190 2,960 3,455 Operating income (loss) 14,511 (4,226) 10,610 430 Gain on acquisition of Rio Novo Gold Inc. -

First Cobalt Signs Supply Deal with Glencore, Has Tentative Agreement with China Moly As It Sources Metal for New Refinery

First Cobalt signs supply deal with Glencore, has tentative agreement with China Moly as it sources metal for new refinery JEFF LEWIS TORONTO REUTERS PUBLISHED JANUARY 12, 2021 Canada’s First Cobalt Corp said on Tuesday it signed a deal with Glencore and has agreed on a tentative pact with a unit of China Molybdenum Ltd for cobalt supplies from the Democratic Republic of the Congo. The agreements come after First Cobalt last month secured $10 million in government loans and grants to accelerate startup and expansion of North America’s first cobalt refinery in Ontario. The DRC is the world’s top producer of cobalt, a crucial ingredient for the lithium-ion batteries that underpin the fast-growing electric vehicle sector. Toronto-based First Cobalt said it will source cobalt hydroxide at prevailing market prices from Glencore’s Kamoto Copper Co operation for five years starting in the fourth quarter of 2022. The Canadian company also said it aims to complete a definitive contract with China Moly subsidiary IXM SA for cobalt from CMOC’s massive Tenke Fungurume mining operation in the DRC over the same time period. It was not immediately clear how much supply would come from each mine; First Cobalt did not disclose specific figures. The agreements represent 90 per cent of the Canadian plant’s projected capacity, yielding 22,250 tonnes per year of battery-grade cobalt sulphate, the company said. Construction at the $77 million plant, about 600 kilometers from the U.S. border, is slated to start in mid-2021, the company said. -

Redstone Commodity Update Q3 2019

Welcome to the Redstone Commodity Update 2019: Q3 Welcome to the Redstone Commodity Moves Update Q3 2019. This quarter has been a busy one on the recruitment front across all our main commodity classes. This has been at odds with a lot of the economic and industrial data that has hit the market. EMEA once again saw the highest volume of moves, greatly boosted by the recruiting drives from energy focused trading houses, brokerages and producers. Behind the scenes there have been plenty of headlines providing concern for commodity players. However, it does seem that a significant portion of employers are now engaging in a policy of keep calm and carry on. China and the US must be heading toward a deal if only for Trump’s re-election campaign and the need to halt the erosion of Chinese industrial output. The never-ending story that is Brexit and its ever-changing deadline has certainly had the media talking about a lack of investment and growth, however, as a recruitment specialist this does not match what we have witnessed and are happy to show in the following update. Even bombing the world’s largest producer of oil caused little more than a blip, with Saudi Arabia bringing supply back to normal levels miraculously quickly. Moving into Q4 2019 there is a lot to be positive about, with volatility comes opportunity and our wider commodities audience seem to be gearing up to charge into 2020 with an enhanced and well-prepared workforce. We have reached a tipping point in recruitment where candidates no longer outnumber the opportunities available.