Vaacat 2020 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Past Pursuits a Newsletter of the Special Collections Division of the Akron-Summit County Public Library

Past Pursuits A Newsletter of the Special Collections Division of the Akron-Summit County Public Library Volume 11, Number 1 Spring 2012 Put a Face to Your Genealogy with Family Photographs by Cheri Goldner, Librarian Like many families, mine had one person in it who was known as “the genealogist.” It was my paternal grandmother, Margaret Helen Van Voorhis Goldner (1920-2006). Along with my childhood memories of holiday gatherings at my grandparents’ house, camping out in the backyard with cousins, and playing with the many pets they shared their home with over the years, I have recollections of studying the family tree and coats of arms that hung along the stairway, holding the spoon made by our ancestor, silversmith Daniel Van Voorhis (1751- 1824), and looking at lots and lots of family photographs. For some of the photographs, my grandmother had names for and stories about the people. For others, she didn’t, but we nevertheless found them fascinating and worth keeping. I now live in my grandparents’ home, and, as the designated family Fred Smith and Myrtle Stafford, maternal grandparents of Margaret Van Voorhis Goldner. archivist, I am responsible for the same family photographs that I When Margaret and her husband John moved looked at as a child. I have other documents in my charge as well – into John’s family home in the mid 1950s, Fred a resume and the military papers of my grandfather, a lifetime of gave her a rosebush from his garden. The bush remains in my yard to this day. In this issue “Photography for the Family Historian” Program March 31 ........................................ -

OTTAWA COUNTY Free!

OTTAWA COUNTY Free! WALLEYE Capital of the World A Project of: GENOA CHAMBER OF COMMERCE, MARBLEHEAD CHAMBER OF COMMERCE, OAK HARBOR AREA CHAMBER OF COMMERCE, & PORT CLINTON AREA CHAMBER OF COMMERCE 1 Ottawa County Join Us! We’re Open to the Public & One of Ottawa County’s Greatest Recreational Assets... Discover. Compete. You may not The CMP also realize it, partners with the U.S. but the Civilian Army Marksmanship Marksmanship Unit each summer at Program has been the beginning of the a part of the Ottawa National Matches County community to conduct the Small in one form or Arms Firing Schools another (SAFS) where civilians for more than 100 are invited to learn to Train at our Marksmanship Center years! during public shooting nights. Learn from the best marksmen safely operate and in the nation. FRPSHWHLI\RXZLVKZLWKWKH0$VHUYLFHULÀHRUWKH Open to the public at the M9 service pistol or both! Camp Perry Training Site on Route 2, just west of Learn. Go online and view dozens of Port Clinton, the CMP recreational or competition shooting offers dozens of indoor and outdoor opportunities from weekly or monthly ¿UHDUPVVDIHW\DQGPDUNVPDQVKLS airgun leagues to regional and national programs all year long, not only here SLVWRORUKLJKSRZHUULÀHFRPSHWLWLRQV but in every state in the U.S. through and games events. RXUDI¿OLDWHGFOXEV It’s all here...right in your Our indoor Marksmanship Center is an Olympic-quality, computer-controlled own backyard! range that’s a great place to OHDUQ¿UHDUPV Get high-quality instruction on safety and to begin or Camp Perry’s ranges. refresh target shooting skills, for folks of all ages! Members of the U.S. -

Erie County 2040 Long Range Transportation Plan 39 CHAPTER 4. REGIONAL PROFILE Introduction: Since the Next US Census Will Not B

CHAPTER 4. REGIONAL PROFILE Introduction: Since the next US Census will not be completed until 2020, much of the data reported in this and other sections of the document are from the 2010 US Census. However, in some cases more recent data was found through the American Community Survey (ACS) which is a nationwide survey completed by the Census Bureau. Unless otherwise noted the 2010 Census and the 2012 American Community Survey (ACS) five year survey were utilized when referring to the Census or ACS. It is also important to note, the Ohio Department of Development (ODOD) county level population control totals will be reflected in the final adopted Transportation Plan and air quality conformity determination and associated travel demand modeling procedures. Any variation from the ODOD county level population control totals, for the Transportation Plan and Conformity Determination will require substantial documentation, including interagency consultation. ODOD population control totals are not required for transportation and land use alternatives scenario planning. 4.1 Existing Conditions Geography: Erie County is one of eight coastal counties situated on the eastern border of the Northwestern Ohio region. Erie County is bounded by Lorain County to the East, Huron County to the South, Sandusky and Ottawa Counties to the West and Lake Erie to the North. Erie County has a land area of 255 square miles with a population density of 301 people per square mile.1 In addition, the county has a water area of 371 square miles with 65 miles of shoreline along the lake and Sandusky Bay.2 The majority of the county consists of cropland (53%) and forest (16%).3 The transportation network in Erie County consists of 26 interstate highway miles, 42 US highway miles and 114 state highway miles.4 There are 622 county, township and municipal road miles, two small commercial airports, two shipping ports and 95 miles of rail line.5 The City of Sandusky, incorporated in 1824, is the largest city in Erie County and serves as the county seat. -

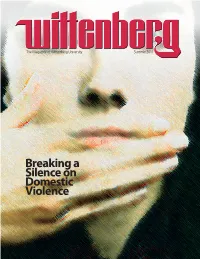

Breaking a Silence on Domestic Violence Wittenberg Magazine Is Published Three Times a Year by Wittenberg University, Office of University Communications

The Magazine of Wittenberg University Summer 2011 Breaking a Silence on Domestic Violence Wittenberg Magazine is published three times a year by Wittenberg University, Office of University Communications. Editor Director of University Communications Karen Saatkamp Gerboth ’93 Graphic Designer Deb Slater Bridge Communications Director of News Services and Sports Information Ryan Maurer Interim Webmaster Ben McCombs ’09 Photo Editor Erin Pence ’04 Coordinator of University Communications Phyllis Eberts ’00 Class Notes Editor Charyl Castillo Contributors Gabrielle Antoniadis Gil Belles ’62 Kate Causbie ’14 Jodi Eickemeyer Address correspondence to: Editor, Wittenberg Magazine Wittenberg University P.O. Box 720 Springfield, Ohio 45501-0720 Phone: (937) 327-6111 Fax: (937) 327-6112 E-mail: [email protected] www.wittenberg.edu Articles are expressly the opinions of the authors and do not necessarily represent official university policy. We reserve the right to edit correspondence for length and accuracy. We appreciate photo submissions, but because of their large number, we cannot return them. Wittenberg University does not discriminate against otherwise qualified persons on the basis of race, creed, color, religion, national or ethnic origin, sex, sexual orientation, age, or disability unrelated to the student’s course of study, in admission or access to the university’s academic programs, activities, and facilities that are generally available to students, or in the administration of its educational policies, admissions policies, scholarship and loan programs, and athletic and other college-administered programs. POSTMASTER: Send address changes to Editor, Wittenberg Magazine Wittenberg University P.O. Box 720 Springfield, Ohio 45501-0720 ii Wittenberg Magazine 2011 Witt Fest featuring Girl Talk Photo by Erin Pence ’04 summer 2011 1 inin this this issue issue.. -

Ohio Credit Unions Add More Than 28,000 Members in 12 Months

FOR IMMEDIATE RELEASE June 25, 2021 Contact: Sean Fink Manager of Communications, Ohio Credit Union League (614) 581-0667 [email protected] U.S. Treasury Awards Rapid Response Grants to CDFIs Twelve Ohio credit unions receive more than $20.9 million in Rapid Response grants COLUMBUS, OH, June 25, 2021 — The Consolidated Appropriations Act of 2021 recently allocated $1.25 billion to the Community Development Financial Institutions Fund (CDFI Fund) within the U.S. Treasury to deliver immediate assistance to communities impacted by the COVID-19 pandemic through eligible Community Development Financial Institutions (CDFIs). The CDFI Fund awarded these funds through the CDFI Rapid Response Program (CDFI RRP), to rapidly support financial products, financial services, development services, and certain operational activities, which enable CDFIs to build capital reserves and loan-loss reserves. Twelve Ohio CDFI-certified credit unions were awarded RRP funds, including Buckeye State Credit Union. President and CEO Michael Abernathy stated, “Buckeye State Credit Union has been a proud CDFI since 2018 and has been awarded grants in the past, but the $1,800,000 RRP grant is a game changer. It allows us to introduce new products and services that will make an impact on the communities we serve. These grants continue to allow us to provide loans to those with challenged or recovering credit that help prevent members of our community from being taken advantage of by predatory lenders. These funds are a great resource in aiding the people of Northeast Ohio by giving many a second chance with credit or simply lending out much needed funds to improve the living conditions of many families and individuals in our communities.” The complete Ohio credit union CDFI RRP grant recipients are: Credit Union Grant Amount Canton School Employees Federal Credit Union $1,826,265 Commodore Perry Federal Credit Union $1,600,000 Day Air Credit Union $1,826,265 Faith Community United Credit Union $1,826,265 Greater Cleveland Community Credit Union, Inc. -

Vacationland Swim Club Sandusky, Ohio 44870 RECORDS Team Records Yards-Boys

Licensed To: Vacationland Swim Club 3/17/2009 Page Vacationland Swim Club Sandusky, Ohio 44870 RECORDS Team Records Yards-Boys 25 Free 14.88 10-Mar-92 VSC LE Billy Criscione 50 Free 33.45 10-Mar-92 VSC LE Billy Criscione 100 Free 1:12.77 10-Mar-92 VSC LE Billy Criscione 200 Free 3:25.89 7-Nov-08 VSC LE Evan N. Gyurke at Black Swamp Invitational 25 Back 17.86 10-Mar-92 VSC LE Billy Criscione 50 Back 39.53 10-Mar-92 VSC LE Billy Criscione 100 Back 1:34.95 14-Jan-06 VSC LE Drew Arlint at 2006 LAKESHORE AGE GROUP & OPEN MEET 25 Breast 20.51 10-Mar-91 VSC LE Nicholas Routh 50 Breast 45.33 18-Mar-OO VSC Jonathan C Harris at 8 & UNDER CHAMPS 100 Breast 1:38.36 5-Mar-OO VSC LE Nathan Seamans 25 Fly 16.59 10-Mar-90 VSC LE Zach Henning 50 Fly 40.24 10-Mar-90 VSC LE Zach Henning 100 Fly 1:43.66 3-Mar-OO VSC LE Nathan T Seamans at Lake Erie Jr. Championships 100 IM 1:25.27 10-Mar-92 VSC LE Billy Criscione 200 IM 3:09.31 10-Mar-96 VSC LE Andrew Rengel 100 Free Relay 1:16.84 26-Feb-06 VSC LE Vacationland Swim Club S. Mulvin, M. Bruner, J. White. A. Arlint 200 Free Relay 2:47.29 28-Feb-99 VSC LE Jimmy Chapman, Stephen Hong, Michael Gallagher. Chip Koch 100 Medley Relay 1:30.60 18-Dec-05 VSC LE Vacationland Swim Club N. -

Community Needs Assessment August 2018

WSOS Community Action Commission, Inc. COMMUNITY NEEDS ASSESSMENT AUGUST 2018 TABLE OF CONTENTS Brief profile of the Service Area 1 Wood County 1 Sandusky County 2 Ottawa County 3 Seneca County 4 Demographic & Economic Profile of the Service Area 6 Population over time 6 Population by Race 6 Veteran Population 7 Disabled Population 7 Households by Type 8 Educational Attainment 9 Population w/ no High School Diploma 9 Unemployment Rate & Number Unemployed 10 Employment by Industry 10 Commuting to Work 11 Income 11 Percent in Poverty 12 Poverty by Age 13 Poverty by Gender 13 Poverty by Race & Ethnicity 14 Housing Characteristics 14 Health Insurance 16 Public Assistance Income 16 Children Eligible for Free/Reduced Price Lunch 16 Food Insecurity Rate 17 Health Indicator: Adults without Recent Dental Exam 17 Health Indicator: Lack of a Consistent Source of Primary Care 18 Health Indicators: Primary Care Physicians 18 Access to Mental Health Providers 19 The Community Needs Assessment Survey 20 Demographics: Community-at-Large 20 Demographics: Participants 21 Survey Questions and Ranked Results 22 Major Problems in Your Community 22 Employment Needs do You Feel Should Be Addressed 23 Education Needs do You Feel Should be Addressed 24 Financial Needs do you Feel Should be Addressed 25 Housing Needs do you Feel Should be Addressed 26 Health Needs do you Feel Should be Addressed 27 Transportation Needs do you Feel Should be Addressed 28 Community Involvement Needs do you Feel Should be Addressed 29 Other Needs You Feel Should Be Addressed 30 Summary -

2018 Annual Report

VACATIONLAND FEDERAL CREDIT UNION 2018 Annual Report Federally Insured by NCUA INSURED DEPOSITS CORPORATE HEADQUARTERS Member depository accounts are insured up to $750,000. The fi rst $250,000 VacationLand Federal Credit Union of insurance is provided by NCUA’s National Credit Union Share Insurance Fund. 2911 Hayes Avenue The remaining $500,000 is provided by private insurance from Excess Share Sandusky, Ohio 44870 Insurance Company, paid for by VacationLand Federal Credit Union. Telephone: 419.625.9025/800.691.9299 ANNUAL MEETING INDEPENDENT AUDITORS The Annual Meeting of the Credit Union’s owners will be held at 8:00 A.M. on Doeren Mayhew, CPAs and Advisors Wednesday, March 13, 2019 at our Corporate Headquarters, 2911 Hayes Avenue, 305 West Big Beaver Road Sandusky, Ohio. Troy, Michigan 48084 1 This is Your Credit Union VacationLand Federal Credit Union, (the Credit Union), was founded in 1956 by employees of the Sandusky, Ohio General Motors Plant. In 2001, the Credit Union expanded its fi eld of membership including anyone who lives, works, and worships, attends school or has a business or organization in Erie County, Ohio. In 2010, the Credit Union extended its membership into The Credit Union supports community employment Huron County, Ohio by merging with School Employees opportunities by funding local small businesses. Business loan Federal Credit Union (SEFCU) to include employees of products include equipment, auto, truck, lines of credit and the Boards of Education who work in Huron County and commercial real estate loans. employees of the Board of Education of EHOVE Joint Vocational School in Erie County. -

Eligible Financial Institutions

Eligible & Participating Financial Institutions 1199 SEIU FEDERAL CREDIT UNION 121 FINANCIAL CREDIT UNION 1880 BANK 1ST BANK 1ST BANK OF SEA ISLE CITY 1ST BERGEN FEDERAL CREDIT UNION 1ST CAMERON STATE BANK 1ST CAPITAL BANK 1ST CHOICE CREDIT UNION 1ST COLONIAL COMMUNITY BANK 1ST COMMUNITY BANK 1ST COMMUNITY FEDERAL CREDIT UNION 1ST CONSTITUTION BANK 1ST COOPERATIVE FEDERAL CREDIT UNION 1ST FINANCIAL BANK USA 1ST GATEWAY CREDIT UNION 1ST LIBERTY FEDERAL CREDIT UNION 1ST MARINER BANK 1ST MIDAMERICA CREDIT UNION 1ST NORTHERN CALIFORNIA CREDIT UNION 1ST SECURITY BANK OF WASHINGTON 1ST STATE BANK 1ST SUMMIT BANK 1ST UNITED BANK 1ST UNITED SERVICES CREDIT UNION 2 RIVERS AREA CREDIT UNION 21ST CENTURY BANK 360 FEDERAL CREDIT UNION 4FRONT CREDIT UNION 5 STAR COMMUNITY CREDIT UNION 5STAR BANK A C P E FEDERAL CREDIT UNION A.B.&W. CU. INC. A.O.D. FEDERAL CREDIT UNION AAC CREDIT UNION ABA CARD SOLUTIONS, INC. ABACUS FEDERAL SAVINGS BANK ABBEY CREDIT UNION, INC. ABBOTT LABORATORIES ECU ABBYBANK ABERDEEN FCU ABERDEEN PROVING GROUND FCU ABILENE FEDERAL CREDIT UNION ABINGTON BANK ABNB FEDERAL CREDIT UNION ABRI CREDIT UNION ACADEMY BANK, NATIONAL ASSOCIATION ACADIA FEDERAL CREDIT UNION ACADIAN FEDERAL CREDIT UNION ACADIANA MEDICAL FEDERAL CREDIT UNION ACCENTRA CREDIT UNION ACCESS BANK ACCESS CREDIT UNION ACCESS FEDERAL CREDIT UNION ACCESS NATIONAL BANK ACCESSBANK TEXAS ACME CONTINENTAL CREDIT UNION ACTORS FEDERAL CREDIT UNION ADAMS BANK AND TRUST ADIRONDACK BANK ADIRONDACK REGIONAL FCU ADMIRALS BANK ADRIAN STATE BANK ADVANCE FINANCIAL FEDERAL CREDIT UNION -

AN INVENTORY of NEW DEAL PRODUCED WRITINGS This Is A

AN INVENTORY OF NEW DEAL PRODUCED WRITINGS This is a list of New Deal-produced writings, arranged alphabetically by state and by title. Some of these writings went to press and were published—and thus may be available at libraries, or from online sellers, or from online repositories like Hathitrust—and some might only be available at archival institutions, especially the Library of Congress’s Federal Writers’ Project collection. Periodically, we’ll be adding more items to this list. The following resources have been utilized to create this inventory: 1. Evanell K. Powell, WPA Writers' Publications: A Complete Bibliographic Checklist and Price Guide of Items, Major and Minor, of the Federal Writers' Project and Program, Palm Beach, FL: 1976. 2. Harvester Microform, in cooperation with the Library of Congress, Archives of the Federal Writers' Project - Series One: Printed and Mimeograph Publications in the Surviving FWP Files, 1933-1943, excluding State Guides, 1987. 3. Federal Works Agency, Work Projects Administration, Catalogue, WPA Writers’ Program Publications, September 1941, Washington, DC: U.S. Government Printing Office, 1942, available to view at http://babel.hathitrust.org/cgi/pt?id=mdp.39015033686711;view=1up;seq=1 (accessed November 11, 2015). 4. U.S. Senate, The American Guide Series, http://www.senate.gov/reference/resources/pdf/WPAStateGuides.pdf, accessed November 11, 2015. OHIO WPA Written Work: A Guide to the Ohio State University, 1937, 16 pages. (WPA) A Report of Progress. (WPA) Air Raid Warden. (WPA) Ashland’s Eternity Acres, 1942, 95 pages. (WPA) CCC in Ohio, 1937, 14 pages. (WPA) Cleveland Parks. (WPA) Directory of Social Resources: Columbus and Franklin County, 1942. -

Wesley Farms Hallmark Homes, Don Flenner Vicky Pelchat, Danberry Realty Special Features

westernbasin-toledo Volume XXXVIII 2012 PRST. STD U.S. postage PAID Martin, Ohio Permit No. 2 Whitehouse, Ohio WESLEY FARMS HALLMARK HOMES, Don Flenner VICKY PELCHAT, Danberry Realty SPECIAL FEATURES: . Graham Village . Doc’s Summit Street Landing . BG & UT SportsWestern Basin-Toledo Magazine 1 westernbasin-toledo Builder | Contractor | Architect 20679 Walbridge Rd. • Martin, OH 43445 Commercial/Residential Edition Phone: 419.836.7707 • Fax: 419.836.7707 Arnold Sutter - Publisher Contents [email protected] Volume XXXVIII 2012 www.westernbasintoledo.com P.1 Cover: Wesley Farms, Louisville Title, Hallmark Homes, Graham Village, Doc’s P.16 Put IN BAY: Hooligans, Miller Boat Line, Jet Express, PIB Taxi, PIB Resort, Summit Street Landing, BG & UT Sports Boardwalk, Blue Marlin, Kayak the Bay, The Keyes, PIB Charter Fishing, Mojito P.2 TAblE OF CONTENts Mann Technologies; Cartridge World; LA Bexten Propane Bay, Island Surf Shop, Delaware Rentals, PIB Brewing Co. P.3 From The Coach’s Desk, Lake Erie West Map P.17 KEllEys IslAND: Portside, Dockers, Bag The Moon; MiddlE BAss IslAND: Jim Seimer Artwork, Eddies General Store, JF Walleyes P.4 COVER STORY: Wesley Farms, Hallmark Homes - Don Flenner, Danberry Realty - Vicky Pelchat P. 18 THE BuildiNG OF HistOry I: Small Towns, Big Heroes by Arnie Sutter, Mathews Ford, Re/Max - Brad Sutphin, Snow’s Wood Shop P.5 COVER STORY: Hallmark Homes, Louisville Title, Danberry Realty - David Miller P. 19 NAturE & REcrEAtiON I: Slater’s Jazz Night by Arnie Sutter, Webcasters P.6 GRAHAM VillAGE - Bud Graham P. 20 & 21 FAll IN GENOA & OttAWA COUNty: Genoa Bank, Rayz Cafe, Druckenmiller P.7 GRAHAM VillAGE, Heilman Homes, Gray Plumbing, Genoa Bank, Port Insurance, Shirley’s Carry-out, Miller’s New Market, Aqua Doc, African Wildlife Lawrence Title, Gladieux Home Center Safari, State Farm Insurance - P. -

C1282 Annual Report.Indd

2013 ANNUAL REPORT 1 Federally insured by NCUA Corporate Information CORPORATE PROFILE CORPORATE HEADQUARTERS VacationLand Federal Credit Union (VLFCU) was founded in 1956 VacationLand Federal Credit Union by employees of the Sandusky, Ohio General Motors Plant. In 2409 East Perkins Avenue 2001, VLFCU expanded its fi eld of membership to include anyone Sandusky, Ohio 44870 who lives, works, worships, attends school or has a business or Telephone: 419.625.9025 organization in Erie County, Ohio. Toll Free 800.691.9299 In 2010, VacationLand Federal Credit Union extended its membership ANNUAL MEETING into Huron County, Ohio by merging with School Employees Federal The Annual Meeting of the Credit Union’s owners will be held at Credit Union (SEFCU) to include employees of the Boards of Education 6:00 P.M. on Thursday, March 13, 2014 at UAW Local 913 Hall, who work in Huron County and employees of the Board of Education 3114 Hayes Avenue, Sandusky, Ohio 44870. of EHOVE Joint Vocational School in Erie County. Today, VacationLand Federal Credit Union is a member-owned, INDEPENDENT AUDITORS not-for-profi t cooperative committed to being the lifetime fi nancial CBS Certifi ed Public Accountants, LLC institution of its members, by providing services at lower or no 34305 Solon Road, Suite 10 fees, loans with lower rates plus deposit products with higher Solon, Ohio 44139 dividend rates. PRIVACY POLICY The Credit Union offers its members a full suite of personal fi nancial The Privacy Policy of VacationLand Federal Credit Union describes products including mortgage, home equity, consumer, student how we safeguard our members’ fi nancial privacy.