OC-2016OH.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2009 MSSU Volleyball Whatês Inside

2009 MSSU Volleyball 2009 Schedule DATE OPPONENT LOCATION TIME Missouri Southern Invitational (Aug. 28-29, Joplin, Mo.) WhatÊs Inside August 28 Midwestern State Joplin 4 pm Missouri Southern State University August 28 Missouri S&T Joplin 7 pm This is Missouri Southern ...........................................2-3 August 29 Southeastern Okla. St. Joplin 10 am Missouri Southern Administration ................................4 August 29 Harding Joplin 4 pm Missouri Southern Athletics Administration ................5 September 5 @ Arkansas Fort Smith Fort Smith, Ark 2 pm @ UCO Broncho/Fairfield Inn Invitational (Sept. 11-12, Edmond, Okla.) Missouri Southern Athletic Support Staff .....................6 September 11 vs. Arkansas Fort Smith Edmond, Okla. 9 am Missouri Southern Coaches & Staff ..............................7 September 11 @ Central Oklahoma Edmond, Okla. 3:30 pm Strength & Conditioning .............................................8-9 September 12 vs. St. Edwards Edmond, Okla. 9:30 am Missouri Southern Athletics ..........................................10 September 12 vs. Southeastern Oklahoma St. Edmond, Okla 6 pm September 16 Nebraska-Omaha* Joplin 5 pm 2009 Volleyball September 18 @ Central Missouri* Warrensburg, Mo. 7 pm Robert Ellis Young Gymnasium ...................................11 September 25 @ Truman* Kirksville, Mo. 7 pm Head Coach Chris Willis ...............................................12 September 26 @ Missouri Western* St. Joseph, Mo. 2 pm @ Pittsburg State Invitational (Oct. 2-3) Assistant Coach Ryan Meek -

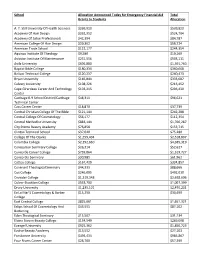

School Allocation Announced Today for Emergency Financial Aid Grants to Students Total Allocation A. T. Still University of Heal

School Allocation Announced Today for Emergency Financial Aid Total Grants to Students Allocation A. T. Still University Of Health Sciences $269,910 $539,820 Academy Of Hair Design $262,352 $524,704 Academy Of Salon Professionals $42,394 $84,787 American College Of Hair Design $29,362 $58,724 American Trade School $122,177 $244,354 Aquinas Institute Of Theology $9,580 $19,160 Aviation Institute Of Maintenance $251,556 $503,111 Avila University $695,880 $1,391,760 Baptist Bible College $180,334 $360,668 Bolivar Technical College $120,237 $240,473 Bryan University $166,844 $333,687 Calvary University $108,226 $216,452 Cape Girardeau Career And Technology $103,215 $206,430 Center Carthage R-9 School District/Carthage $48,311 $96,621 Technical Center Cass Career Center $18,870 $37,739 Central Christian College Of The Bible $121,144 $242,288 Central College Of Cosmetology $56,177 $112,354 Central Methodist University $883,144 $1,766,287 City Pointe Beauty Academy $76,858 $153,715 Clinton Technical School $37,640 $75,280 College Of The Ozarks $1,259,404 $2,518,807 Columbia College $2,192,660 $4,385,319 Conception Seminary College $26,314 $52,627 Concorde Career College $759,864 $1,519,727 Concordia Seminary $30,981 $61,962 Cottey College $167,429 $334,857 Covenant Theological Seminary $44,333 $88,666 Cox College $246,005 $492,010 Crowder College $1,319,348 $2,638,696 Culver-Stockton College $533,700 $1,067,399 Drury University $1,235,101 $2,470,201 Ea La Mar'S Cosmetology & Barber $15,250 $30,499 College East Central College $825,661 $1,651,321 -

Seeding & Pools Results

2013 NCCAA DII Women’s Volleyball Championship Host: Lincoln Christian University November 14-16, 2013 Location: Lincoln, Illinois Seeding & Pools Pool A 1) Kentucky Christian University 4) Manhattan Christian College 5) Cairn University 8) Ozark Christian College 9) Providence University College Pool B 2) Clearwater Christian College 3) Lincoln Christian University 6) Maranatha Baptist University 7) Arlington Baptist College 10) West Coast Baptist College Results 11/14/13 Match 1 Manhattan Christian College def. Ozark Christian College 3-0 Match 2 Lincoln Christian University def. Arlington Baptist College 3-0 Match 3 Kentucky Christian University def. Providence University College 3-0 Match 4 Clearwater Christian College def. West Coast Baptist College 3-0 Match 5 Manhattan Christian College def. Cairn University 3-0 Match 6 Lincoln Christian University def. Maranatha Baptist Bible College 3-0 Match 7 Ozark Christian College def. Providence University College 3-1 Match 8 Arlington Baptist College def. West Coast Baptist College 3-0 Match 9 Kentucky Christian University def. Cairn University 3-2 Match 10 Clearwater Christian College def. Maranatha Baptist Bible College 3-1 11/15/13 Match 11 Clearwater Christian College def. Arlington Baptist College 3-0 Match 12 Ozark Christian College def. Kentucky Christian College 2-3 Match 13 Lincoln Christian University def. West Coast Baptist College 3-0 Match 14 Manhattan Christian College def. Providence University College 3-1 Match 15 Maranatha Baptist Bible College def. Arlington Baptist College 3-0 Match 16 Ozark Christian College def. Cairn University 3-2 Match 17 Lincoln Christian University def. Clearwater Christian College 3-1 Match 18 Manhattan Christian College def. -

School Deadline Washington University of St

Priority FAFSA School Deadline Washington University of St. Louis 1-Feb College of the Ozarks 15-Feb Westminster College 15-Feb Columbia College 1-Mar Cottey College 1-Mar Culver-Stockton College 1-Mar East Central College 1-Mar Evangel University 1-Mar Missouri University of Science and Technology 1-Mar Missouri Western State University 1-Mar Rockhurst University 1-Mar Saint Louis University 1-Mar Southeast Missouri State University 1-Mar Stephens College 1-Mar University of Central Missouri 1-Mar University of Missouri 1-Mar University of Missouri- Kansas City 1-Mar University of Missouri- St. Louis 1-Mar Webster University 1-Mar To be sure, call the Student Financial Services (SFS) Office at 573-592-1793 to confirm your deadline for processing. William Woods University 1-Mar William Jewell College 10-Mar Drury University 15-Mar Lindenwood University 15-Mar Park University 15-Mar Southwest Baptist University 15-Mar Missouri State University - West Plains 31-Mar St. Louis College of Pharmacy 31-Mar Avila University 1-Apr Baptist Bible College 1-Apr Calvary Bible College 1-Apr Central Bible College 1-Apr Central Christian College of the Bible 1-Apr Crowder College 1-Apr Fontbonne University 1-Apr Gateway College of Evangelism 1-Apr Hannibal-LaGrange College 1-Apr Harris-Stowe State University 1-Apr Jefferson College 1-Apr Lincoln University 1-Apr Logan College of Chiropractic 1-Apr Maryville University 1-Apr Messenger College 1-Apr Metropolitan Community College 1-Apr Mineral Area College 1-Apr Missouri Baptist University 1-Apr Missouri Southern State University 1-Apr Missouri State University 1-Apr Missouri Valley College 1-Apr Moberly Area Community College 1-Apr North Central Missouri College 1-Apr Northwest Missouri State University 1-Apr Ozark Christian College 1-Apr Ozarks Technical Community College 1-Apr Ranken Technical College 1-Apr Rolla Technical Institute/Center 1-Apr Saint Louis Christian College 1-Apr St. -

Joplin, Missouri, Regional Disaster and Economic Recovery and Resiliency Strategy

Joplin, Missouri, Regional Disaster and Economic Recovery and Resiliency Strategy In response to May 22, 2011 Disasters: Jasper, Newton, and McDonald Counties This report was funded by the Economic Development Administration and compiled with material and support from multiple public and private agencies and organizations to provide the most comprehensive collection of information about current progress and future projects of the region’s recovery and resiliency. Submitted to the Economic Development Administration, September 30, 2014 Report prepared by Tony Robyn, Assistant Director of Planning, Development and Neighborhood Services, City of Joplin, Missouri with technical support from Nathan Jurey, Community Planner, Harry S. Truman Coordinating Council, Carl Junction, Missouri. EDA 05.79.05171-01—Joplin Regional Disaster and Economic Recovery and Resiliency Strategy This report was prepared under an Economic Development Administration (EDA) Investment Award from the U.S. Department of Commerce Economic Development Administration. This publication was compiled and prepared by the City of Joplin and the Harry S. Truman Coordinating Council (HSTCC) EDA grant funded recovery coordinators. The statement, findings, conclusions, and recommendations do not necessarily reflect the views of the U.S. Department of Commerce (USDOC) Economic Development Administration (EDA). Prepared by Tony Robyn, Assistant Director of Planning, Development and Neighborhood Services, City of Joplin, Missouri and Nathan Jurey, Community Planner, Harry S. Truman Coordinating Council, Carl Junction, Missouri. Cover Photo: Known locally as “The Volunteer House”, this home came to represent a touchstone for the thousands of volunteers that came to provide comfort and help Joplin remove debris and rebuild the city. Many volunteers left encouraging messages. -

Secondary Credit

Festus High School Human Services Career Cluster Suggested Individual Career and Academic Plan http://festus.k12.mo.us SUGGESTED COURSE OF HIGH SCHOOL STUDY Minimum Graduation Requirements It is suggested that students consider dual credit, articulation, or advanced placement opportunities for postsecondary credit. Required Courses/ Area Technical School of Jefferson Additional Learning Opportunities Grade English Math Science Social Studies Elective Options College School Based: Career Research Cooperative Education ELA I Algebra I Physical World History PEI Internship 9 or or Science Lifetime Health Job Shadowing Advanced ELA I Geometry/ Fine Arts Service Learning Project Advanced Geometry Foreign Language I Other: __________________________ Community Based: Mentorship Volunteer ELA II Geometry/ Biology US History PE II Part-time Employment 10 or Advanced Geometry Foreign Language II Other: Advanced ELA II or Public Speaking __________________________ Algebra II/ Advanced Algebra II Assessments/Certifications: Technical Skills Attainment (TSA) Other __________________________ Algebra II/ Early Childhood and Elementary Placement Assessment: ELA III Advanced Algebra II General US Government Personal Finance Secondary 11 or or Chem Foreign Language III Education I ACCUPLACER Advanced ELA III College Algebra Food Preparation ACT AP Statistics Nutrition Now PSAT General Psychology SAT ASVAB Other: __________________________ ELA IV College Algebra Anatomy and AP US History Child Development I Early Childhood and Elementary -

2010-2012 Undergraduate Catalog

UNDERGRADUATE CATALOG Table of Contents EDUCATIONAL FOUNDATIONS . 3 MISSION . 3 CAMPUS RESOURCES AND OPPORTUNITIES . 7 Student Admissions Policy and Requirements 14 Student Charges and Payment Information 20 Academic Information 29 Majors & Minors 74 Undergraduate Teacher Education Program (UTEP) 91 Organizational Leadership 121 Undergraduate Course Listings 136 COLLEGE PERSONNEL . 210 CORRESPONDENCE DIRECTORY . 230 2010 - 2012 ACADEMIC CATALOG | 1 A CHRISTIAN COLLEGE OF THE LIBERAL ARTS AND SCIENCES About the Catalog This Catalog contains information about Greenville College that is current at the time it is printed It is a guide for students who enter the College for the first time during the 2010-2011 or 2011- 2012 academic years It should help them in their planning across their years at Greenville College Students should regularly consult the Catalog as they prepare to register for courses and as they choose and plan how they will complete their degree requirements The provisions and requirements stated in the Greenville College Catalog do not constitute a contract between the student and Greenville College Programs occasionally change, courses are added or deleted from the curriculum, and policies are altered Students who interrupt their education by a period of more than four years who then return to Greenville College must comply with the provisions and requirements in place upon their return If professional certification requirements change during the time students are absent from the College, they must meet the requirements in -

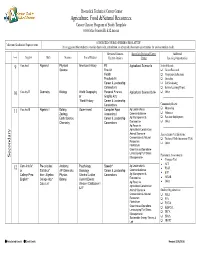

Program of Study Templates

Boonslick Technical Career Center Agriculture, Food & Natural Resources Career Cluster Program of Study Template www.btec.boonville.k12.mo.us SUGGESTED COURSE OF HIGH SCHOOL STUDY Minimum Graduation Requirements It is suggested that students consider dual credit, articulation, or advanced placement opportunities for postsecondary credit. Required Courses, Boonslick Technical Career Additional Grade English Math Science Social Studies Elective Options Center Learning Opportunities 9 Com Arts I Algebra I Physical American History PE Agricultural Science I School-Based: Science Fine Art Career Research Health Cooperative Education Practical Art Internship Career & Leadership Job Shadowing Connections Service Learning Project 10 Com Arts II Geometry Biology World Geography Personal Finance Agricultural Science I& II Other: or Graphic Arts _____________________________ World History Career & Leadership Connections Community Based: 11 Com Arts III Algebra II Botany, Government Computer Apps Ag Leadership & Mentorship Zoology, Accounting I Communications Volunteer Earth Science, Career & Leadership Ag Management & Part-time Employment Chemistry Connections Economics Other: Ag Power I _____________________________ Agricultural Construction Animal Science Assessments/Certifications: Conservation & Natural Technical Skills Attainment (TSA) Resources Other: Floriculture _ ____________________________ Greenhouse Operation Landscaping/Turf Grass Placement Assessments: Secondary Management Compass Test ACT Com Arts IV Pre-calculus Anatomy, -

Table of Contents

TABLE OF CONTENTS From the President . 3 General Information . 4 Student Life . 9 Financial Information . 12 Admissions Information . 21 Academic Policies . 28 Degree Programs . 39 Courses of Instruction . 61 Directory of Personnel . 95 Communication and Visitor Information . 100 2 FROM THE PRESIDENT This may be a divine appointment. Perhaps you’re a prospective student . Maybe you’re a parent, church leader or guidance counselor who will advise prospective students . Whatever your circumstance, your choice to open this catalog may be providential . It may be the start of a whole new life . As a graduate of the college, I can give personal testimony . While I enjoyed my studies at the state university I first attended, my education at Ozark was truly life-changing . The classes I took, the relationships I built, the professors who mentored me—the Lord used each of these to shape me in significant ways . The knowledge, commitments and skills I gained here equipped me for a fruitful life and ministry . Maybe God has the same in store for you . Only you can discern if the Lord is leading you here, so I invite you to give us a careful, prayerful look . Whether you’re preparing for full-time Christian service or simply looking for a stronger biblical foundation for your faith, your experience at Ozark will be marked by: n Excellent Bible teaching. We really believe that “all Scripture is God-breathed and useful for teaching . so that the man of God may be thoroughly equipped for every good work” (2 Tim 3:16-17) . Our curriculum backs our commitment—every graduate takes a strong core of top-notch Bible classes . -

Agriculture, Food & Natural Resources

Knob Noster High School Human Services Career Cluster Program of Study Template www.hs.knobnoster.k12.mo.us Minimum Graduation Requirements SUGGESTED COURSE OF HIGH SCHOOL STUDY 26 Credits It is suggested that students consider dual credit, articulation, or advanced placement opportunities for postsecondary credit. Required Courses, Elective Warrensburg Area Career Additional Grade English (4) Math (3) Science (3) Social Studies (3) Options Center Learning Opportunities 9 English I Algebra I Biology 19 Century History PE School-Based: Class of 2016 Health Career Research Cooperative Education Western Civilization Fine Arts [1] before graduation Internship 2017 and beyond Job Shadowing Practical Arts [1] before Service Learning Project graduation Other: _____________________________ 10 English II Geometry Physical Science American History I Community Based: Or 2017 & beyond PE [1] before graduation Volunteer Chemistry Part-time Employment Other: _____________________________ Assessments/Certifications: Technical Skills Attainment (TSA) Other: _ ____________________________ 11 English III Algebra II Advance Chemistry 20 Century History Personal Finance before Placement Assessments: Or Anatomy/Physio Class of 2016 graduation Compass Test *Composition I/II Earth Science Aspire Secondary Advance Biology American History ACT Principles of II PSAT Technology 2017 & beyond SAT Physics Government ASVAB 2017 & beyond Other: _____________________________ Student Organizations: 12 English IV College Algebra Advance Chemistry Government FCCLA Or And -

Admissions & Enrollment for Missouri Colleges

Admissions & Enrollment for Missouri Colleges Capella University - PHD Capella University - Masters Kaplan University - Online Gonzaga University - Online Allied College - Arnold - Saint Ann American InterContinental University - Military Online American InterContinental University Online Argosy University Online The Art Institute Online ATI Career Training - Online Baker College Online Berkeley College Bowling Green State University Brooks Institute of Photography Capella University - Bachelors Cardinal Stritch University Central Michigan University Chamberlain College of Nursing Cleveland Institute of Electronics Colorado Technical University - North Kansas City Colorado Technical University - Online DeVry University - Kansas City - Kansas City South - St. Louis West Dominican University - Online Drexel University - Online eCornell Certificates Onlin Everest College - Springfield - St. Louis Everest College Online Everest University Online Fielding Graduate University Florida Tech University - Graduate Florida Tech University - Undergraduate George Washington University - Paralegal Globe University - Online Golden Gate University - Cybercampus High-Tech Institute Hodges University Hope International University Online Indiana State University International Academy of Design & Technology Online Italian Culinary Academy Ivy Bridge College of Tiffin University Jones International University Online Keller Graduate School of Management Kent State University Liberty University Lincoln College - Online Loyola University New Orleans Massage -

2020-2021 Catalog Volume XLI, Number 1

2020-2021 Catalog Volume XLI, Number 1 Welcome to the Adventure In a world of unprecedented change and immense challenges, the unchanging mission of AGTS is to help revitalize the Church and evangelize the world. We seek to accomplish this by helping students to become servant leaders who follow the example of Jesus, and who develop the necessary knowledge and skills—along with a God-given passion that defies every obstacle to accomplish his will. Above all, we strive to understand and experience the work of God’s Spirit in empowering our lives individually and corporately. This catalog serves as a roadmap for your journey toward these goals. Table of Contents 3 The Faculty at AGTS 15 Academic Degree Programs 40 Doctor of Ministry 50 Doctor of Applied Intercultural Studies 61 Doctor of Philosophy in Intercultural Studies 74 Doctor of Philosophy in Biblical Interpretation and Theology 85 AGTS Profile 91 Admission Information 96 Course Descriptions 118 Financial Information 130 Academic Policies and Procedures 139 Student Life and Services 143 Administration at AGTS 146 Adjunct Faculty 149 Resident Academic Calendar 2020-2023 150 Map to AGTS 151 Index Statement This publication is certified as true and correct in content and policy as of the date of publication. The Seminary does reserve the right to make changes of any nature in programs, finances, calendar or academic schedules whenever these changes are deemed necessary or desirable, including changes in course content, class rescheduling and the cancellation of scheduled classes or other academic activities. Changes in college work-study and student loan programs or policies with which AGTS must comply are at the discretion of federal and state governments.