2019 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Proxy Statement

DESTINATION XL GROUP, INC. Notice of Annual Meeting of Stockholders to be held on August 12, 2020 Notice is hereby given that the 2020 Annual Meeting of Stockholders of Destination XL Group, Inc. (the “Company”) will be held at the corporate offices of the Company, 555 Turnpike Street, Canton, Massachusetts 02021 at 11:30 A.M., local time, on Wednesday, August 12, 2020 for the following purposes: 1. To elect six directors to serve until the next Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified. 2. To approve, on an advisory basis, named executive officer compensation. 3. To approve an amendment to the Company’s Restated Certificate of Incorporation, as amended to effect a reverse stock split of the Company’s issued and outstanding common stock at a ratio of not less than 1-for-2 and not more than 1-for-15, such ratio, and the implementation and timing of such reverse stock split, to be determined in the sole discretion of the Company’s Board of Directors. 4. To approve amendments to our 2016 Incentive Compensation Plan to increase the total number of shares of common stock authorized for issuance under the plan by 1,740,000 shares. 5. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending January 30, 2021. 6. To transact such other business as may properly come before the meeting or any adjournment thereof. These proposals are more fully described in the Proxy Statement following this Notice. -

ARMADO LIBRO2 FINAL CORREGIDO.Indd

AARMADO_LIBRO2_FINALRMADO_LIBRO2_FINAL CORREGIDO.inddCORREGIDO.indd 1 002/09/20102/09/2010 111:39:001:39:00 aa.m..m. TÍTULOS DE LA SERIE RED MERCOSUR 1. El Boom de Inversión Extranjera Directa en el Mercosur 2. Coordinación de Políticas Macroeconómicas en el Mercosur 3. Sobre el Beneficio de la Integración Plena en el Mercosur 4. El desafío de integrarse para crecer: Balance y perspectivas del Mercosur en su primera década 5. Hacia una política comercial común del Mercosur 6. Fundamentos para la cooperación macroeconómica en el Mercosur 7. El desarrollo industrial del Mercosur 8. 15 años de Mercosur 9. Mercosur: Integración y profundización de los mercados financieros 10. La industria automotriz en el Mercosur 11. Crecimiento económico, instituciones, política comercial y defensa de la competencia en el Mercosur 12. Asimetrías en el Mercosur: ¿Impedimento para el crecimiento? 13. Diagnóstico de Crecimiento para el Mercosur: La Dimensión Regional y la Competitividad 14. Ganancias Potenciales en el Comercio de Servicios en el Mercosur: Telecomunicaciones y Bancos 15. La Industria de Biocombustibles en el Mercosur 16. Espacio Fiscal para el Crecimiento en el Mercosur 17. La exportación de servicios en América Latina: Los casos de Argentina, Brasil y México 18. Los impactos de la crisis internacional en América Latina: ¿Hay margen para el diseño de políticas regionales? 19. La inserción de América Latina en las cadenas globales de valor AARMADO_LIBRO2_FINALRMADO_LIBRO2_FINAL CORREGIDO.inddCORREGIDO.indd 2 002/09/20102/09/2010 111:39:011:39:01 aa.m..m. SERIE RED MERCOSUR LA INSERCIÓN DE AMÉRICA LATINA EN LAS CADENAS GLOBALES DE VALOR AARMADO_LIBRO2_FINALRMADO_LIBRO2_FINAL CORREGIDO.inddCORREGIDO.indd 3 002/09/20102/09/2010 111:39:021:39:02 aa.m..m. -

Lie Bans Nine U:S. Workers

■■'J- ; . Jil/ \ \ ./ ", . 1. ■ ■•■; ■f ■ V#; : / I ‘ / THURSDAV. DECEMBER 4, 19S2 . The W wthcr i |a g e t w e n t y -p o u r • iianrhPBtfr StoPtiing l^pralii AYerage Daily Net Press Ran rerechut of U. •. Weather ■w aoo . ^ For the Week Eaded I Nov. SS, ISBt 'recently at a linen ahower given by K iln tonight, Satnrdajf morning. Jean Garlinghouse Mias Patricia Wllaon at the home Partly cloudy Saturday., attemeoB. About Town o f‘her mother, Mrs. John Wilson, 10,812 Minimum tonight 40. Has m ien Shower on Woodland atreet. '-Member of the Audit The decorations used were pink ~ Bnreoa of Clrcnlatlona, Manche$ter-^A City of Village ^Charm t il* Looml* School Press Club, and white streamers and the bride- Windsor. InsdvertenUy omitted the elect opened her gift/whlle-Seated of two Manchester boys at- Miss Jean A. Garlinghou.se of 895 Center street, who will be mar under s watering can decorated MANCHESTER, CONN., FRIDAY., DECEMBER 5, 1952 tending the school In the story ried to Charles Baldwin of Tor with the same colors. A buffet wMch appeared In last night's Is- rence. Calif., on Dec. 27 at St. Brid Itincheon was served by the host Boa of The Herald. The two are get's ChurCh. was guest of honor ess. Jtoiii C. Reed, a senior, and Thomas Milton Reed, a sophomore, sons of Mr. and Mra. Harold M. Reed of 5 ? South Mahi-streefe-----^.... ‘ The Manchester Garden Club WiU hold .lU anrtusl Christmas, puty Mofitey nif^ht At 9 ociock | 6» the RcAbins Room of Center ^ Church house. -

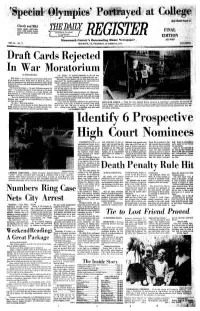

Identify 6 Prospective High Court Nominees WASHINGTON (AP) - a Nent Assignment in This Re- California State Appeals Court Nixon

Cloudy and Mild Mostly cloudy, mild today. THEDAILY Clear, mild tonight; Sunny, pleasant tomorrow and Satur- FINAL day. EDITION Monmouth County's Outstanding Home X«?wspa|»c*r 32 PAGES VOL. 94 NO. 77 BED BANK, IS J. THURSDAY, OCTOBEK M,1971 Draft Cards Rejected In War Moratorium By DOBIS KULMAN "Mr. Dilapo?" he inquired pleasantly as the two men 1 shook hands, "I'm Larry Erickson. I've wanted to meet you." RED BANK — Two young men turned in their draft cards "When you go home tonight, why not think about why you're at the Selective Service Board office on Broad St., here, as doing this?" Mr, prkkson .suggested to the board staff as he* part of 3 Moratorium Day observance yesterday while a group and Mr. Gurniak left to rejoin the demonstrators. of about 150 anti-war, anti-draft demonstrators picketed on the Mr. Erickson also, turned in the draft card of Bic Kcssler, sidewalk below. formerly of Fair Haven, which he said Mr. Kcssler had given The chant of the pickets - "no more Victnams, no more At- him for that purpose. He said Mr. Kessler is believed en route , ticas" -~ was audible through the closed windows of the board here from Boulder, Colo. offices as Lawrence D. Erickson, 22, of Long Branch, arid The draft board wasn't taken by surprise, Mr. Dilapo said. Greg Gurniak, 21, of Red Bank, dropped their draft cards on He said he had read nowspaper reports quoting Mr. Erick- the desk of Joan Dixon, a board secretary, son as saying he would return his own draft card and would j "There are demonstrators outside against the draft," Mr. -

Low-Cost Trademark Filers

Low-cost trademark filers Below are USPTO trademarks filed by representatives that have sparked concern from legal experts. Entities: Trademark Axis, Trademark Falcon, Trademark Funnel, Trademark Regal, Trademark Terminal, USPTO Trademarks. Data from USPTO database; taken from 16 Februrary 2021. Filings based on entity representative email used on initial new application. Read full WTR article for more details. TRADEMARK AXIS Trademark term Serial Number Filing Date Applicant/owner Name Current Status BALANCE & THRIVE 90372389 10/12/2020 Lynette Hoyle Filed O G 90387584 16/12/2020 Nasir Best Filed TRIPLE THREAT FITNESS 90399848 21/12/2020 Damon Grant Filed BIANCHI IVELLISSE 90402841 22/12/2020 Sandra Correa Filed BIANCHI IVELLISSE 90411628 24/12/2020 Sandra Correa Filed THE REAL ESTATE EMPRESS 90411603 24/12/2020 Lateefah Pruitt Filed QUIT YAPPIN DUCKS FLAPPIN 90420015 28/12/2020 Edward Cullum Filed BEAUTY BY TAYLOR 90420042 28/12/2020 Taylor Garcia Filed MIA ISLA BELLA 90424948 29/12/2020 Michael & Sylvia Hibbert Filed LXL LXO 90444994 01/01/2021 Raymond Sumner Filed WE WANT YOUR BODY 90445140 01/01/2021 Mike Abenante Filed ZEN MONK 90444731 01/01/2021 Nirmit Agarwala Filed F.I.E.N.D DESIGNER 90444979 01/01/2021 Keyona Payne Filed MARGGIESTORE 90445004 01/01/2021 Margaret Ogunlana Filed USML BAG N TAG 90445054 01/01/2021 Frank Gonzales Filed MAS4JI 90445072 01/01/2021 Dennis Robert Filed THE MASTER ARPEGGIO SYSTEM FOR JAZZ IMPROVISATION 90445089 01/01/2021 Dennis Robert Filed FREQUENCY COLLECTION 90445164 01/01/2021 Deonna Winstondickey Filed MAKADET HEALTH+ 90445206 01/01/2021 Marie Therese Affissong Filed BABES N PUFFS INC 90449062 05/01/2021 Levala Muhammad Filed DACT 90450235 06/01/2021 Innovatio Statistics, Inc. -

The George-Anne Student Media

Georgia Southern University Digital Commons@Georgia Southern The George-Anne Student Media 2-18-1992 The George-Anne Georgia Southern University Follow this and additional works at: https://digitalcommons.georgiasouthern.edu/george-anne Part of the Higher Education Commons Recommended Citation Georgia Southern University, "The George-Anne" (1992). The George-Anne. 1262. https://digitalcommons.georgiasouthern.edu/george-anne/1262 This newspaper is brought to you for free and open access by the Student Media at Digital Commons@Georgia Southern. It has been accepted for inclusion in The George-Anne by an authorized administrator of Digital Commons@Georgia Southern. For more information, please contact [email protected]. Students, faculty and staff are all urged to Hoop Eagles secure TAAC title donate blood at the Red Cross blood drive to be Blood held Thursday, Feb. 20 from noon to 6 p.m. This drive is sponsored by Delta Tau Delta, and is co- with win over SE Louisiana sponsored by SGA and Resident Life. See Story, Page 5 Drive: ^H The A BLUE EDITION Liked By Many, Action Ads — 8 Comics 9 Cussed By Some, Announcements 2 Features 3 Baseball 6 Police Beat 2 ...Read By Them All W Basketball 5 Opinions 4 Tuesday, February 18,1992 George-Anne Vol. 64 No. 32 •a 912/681-5246 Celebrating 65 years as Georgia Southerns Official Student Newspaper Georgia Southern University • Statesboro, GA 30460 NEWS BRIEFS University of Georgia sets winter enrollment record ATHENS, Ga. (AP)-A total Computer virus invading GSU By Ken Ward of 27,432 students enrolled for Ultimately, Slow destroys all Staff Writer A computer virus is the equivalent of a winter quarter classes at the the information stored in a University of Georgia, settinga Picture this: It's around drive-by shooting. -

Weighing 18 Oz., with a King Size Double Nylon Zipper and Sea Gull In

Weighing 18 oz., with a king size designs, colors and sizes are also fur- POWERED by an engine, the John double nylon zipper and sea gull in- nished. Deere Weed Eater * Trimmer cuts signia, the bags are available in effectively under fences and other navy, black, terra cotta, chocolate, places with ease. Its flexible line has mushroom, suede, natural and a head spinning about 3,750 rpm. It yellow with natural web trim. also presents less danger from shat- tering bottles or objects thrown from the grass. Circle 711 on free information card COMPACT yet strong, Bock Industries' new utility trailer doubles up for varied uses around home, farm and commercial needs. With a 1,000 pound load capacity, it has a tilting bed and hinged tail- gate, and meets Department of Transportation standards. Circle 708 on free information card Circle 714 on free information card TURF AND SAND shots are SOLID DOORS and sides and a simplified with the carbine tipped, special locking mechanism give the three sided golf spike, Trebler, by Secur-n-vent locker added strength. Sandvik, Inc. Besides offering better Marketed and created by the De lateral stability, the Trebler lessens Bourgh Manufacturing Co., the spike lift, twist and drag marks. It locker permits cross ventilization for will be replaced should it break, Circle 712 on free information card its contents while hampering theft. wear out or be lost. LIGHTWEIGHT and stylish, the Classic Canvas Nine is the top-of- the-line bag from Mac Hunter. Nine pounds, made of durable canvas and trimmed in leather, the bag has a high density inner lining that pro- tects grips and preserves the shape without stays and ribs. -

Spartan Daily Building Results San Jose State College in Block Closing Vc:'

Nabel K. anis, California State, UI Sacramento 9, Criaifnia. Building Results Spartan Daily San Jose State College In Block Closing vc:'. SAN JOSE, CALIFORNIA, THURSDAY, NOVEMBER 8, 1951. No. 32 Eighth street was closed he- land patement. according to Ped I tt teen San Antonio anti San For- I Stovall, superintendent of con- nando streets 1/0/int' Danforth Fellowship Foundation .Cenior .1driser I yesterday morning strut:tam for Barret and Hilp !so Barret and Hilp contractors First. before the trees can be .i can continue to clear t he area , out doun the pours. lines on the ; where the new college Engineer- I Street must be d itrfed.e 41 a : ing building will be locate d. ! later dat e lamer lines u ill be I - ' The L-shaped Engineering build- , tywrmanentl renamed tr this ag will extend to the center of S.' section. Mr. `.14o all said. :ighth street. Seeonii. el, telephone etimPalW Three problems confront the must di ,'rt a ti-leplame cable contractors before their firm can from the area so that woik can .arnpletely clear the area of trees I begin. Third, a six-inch high pressure I gas line must he shifted before any digging can begin on Fiehth Reoionales Frat !street. Byron Bollineer, college I superintendent le I .iii I, ii e es , eel fmnfab Op ells !gberolii.i,ttdess,,hs,:idpluyittisj., lis Nioni,. ,tric1 company will . 't 1 a K an 1 line so that it will Ir..... loop areund tit- . The first meeting of the Western PFart, ' confer. : lion area. He added that tile hoe Regional Inter-Fraternity cot'.' officially was opened this !will he moved t S S'''''"it `1'''''t at a later date. -

The Herpetological Journal

Volume 3, Number 2 April 1993 ISSN 0268-0130 THE HERPETOLOGICAL JOURNAL Published by Indexed in THE BRITISH HERPETOLOGICAL SOCIETY Current Contents The Herpetological Journal is published quarterly by the British Herpetological Society and is issued free to members. Applications to purchase copies and/or for details of membership should be made to,the Hon. Secretary, British Herpetological Society, The Zoological Society of London, Regent's Park, London NWI 4RY, U.K. Instructions to authors are printed inside the back cover. All contributions should be addressed to the Editor (address below), Editor: Richard A. Griffiths, The Durrell Institute of Conservation and Ecology, The University of Kent, Canterbury CT2 7NX, UK Assistant Editor: Margaret M. Bray, Department of Biological Sciences, Wye College (University of London), Nr. Ashford, Kent, TN25 SAH, UK Editorial Board: Pim Arntzen (Leicester) Donald Broadley (Zimpabwe) John Cooper (Tanzania) John Davenport (Millport) Tim Halliday (Milton Keynes) Michael Klemens (New York) Colin McCarthy (London) Andrew Milner (London) Henk Strijbosch (Nijmegen) Richard Tinsley (London) . �-��. · �·.. "' · .. · · �. .. <·-'��; �\·:·� · . : BRITISH - ?�. HERPETOLOGICAL SOCIETY Copyright It is a fundamental condition that submitted manuscripts have not been published and will not be simultaneously submitted or published elsewhere. By submitting a manuscript, the authors agree that the copyright for their article is transferred to the publisher if and when the article is accepted for publication. The copyright covers the exclusive rights to reproduce and distribute the article, including reprints and photographic reproductions. Permission for any such activities must be sought in advance from the Editor. ADVERTISEMENTS The Herpetological Journal accepts advertisements subject to approval of contents by theEditor, to whom enquiries should be addressed. -

ED380971.Pdf

DOCUMENT RESUME ED 380 971 EC 303 845 AUTHOR Carter, Susanne TITLE Interventions. Organizing Systems To Support Competent Social Behavior in Children and Youth. INSTITUTION Western Regional Resource Center, Eugene, OR. SPONS AGENCY Office of Special Education and Rehabilitative Services (ED), Washington, DC. PUB DATE Nov 94 CONTRACT H028-A30003 NOTE 348p. PUB TYPE Guides Non-Classroom Use (055) EDRS PRICE MFO1 /PC14 Plus Postage. DESCRIPTORS Behavior Change; *Behavior Disorders; Behavior Problems; *Classroom Techniques; *Educational Strategies; Elementary Secondary Education; *Emotional Disturbances; *Intervention; Program Effectiveness ABSTRACT This guide describes classroom and school interventions intended to meet the needs of students with emotional/behavioral disabilities and those at risk for developing these disabilities. The first section presents "Classroom Interventions," a compilation of 77 interventions which may be used in regular or self-contained classrooms. A brief description and source of further information are given for each intervention. Among the interventions described are the following: acceptance, active listening, aerobic exercise, anger management, art therapy, assertiveness training, behavior contracts, bibliotherapy, chaining, "Circle of Friends," classroom discipline plans, cooperative learning strategies, differential reinforcement of incompatible behaviors, direct instruction, discipline with dignity, early childhood interventions, functional analysis, home notes, mentoring, play therapy, prereferral intervention, -

Azul Y Oro Las Múltiples Vidas Sociales De Una Camiseta De Fútbol*

Azul y oro Las múltiples vidas sociales de una camiseta de fútbol* CLAUDIO E. BENZECRY** Introducción La relación entre un objeto y sus usos ha sido una relación esqui- * Traducción: Daniela Lucena. va para los estudios sobre cultura, identidad y práctica. A veces ** Profesor asistente, Departamento de los objetos son presentados como indicadores de las identidades Sociología, University of Connecticut. (Bray, 1997), otras veces como signos de distinción y los premios El autor desea agradecer a Harvey Molotch, Anthony King, Mike a ganar en la batalla por la apropiación del producto social Featherstone, y Daniel Sazbón los múl- (Bourdieu, 1984; Veblen, 1935); son utilizados como el puente tiples y sutiles comentarios a diversos que comunica e integra las relaciones sociales (Redfield, 1941; borradores de este trabajo. Este artícu- lo no existiría si no fuera por la insis- Molotch, 2003; Gell, 1998), o como las piezas centrales en un tencia y la generosidad de Eduardo proceso ritual destinado a sujetar y a fijar significado en un mun- Archetti en un café de Buenos Aires do social siempre cambiante (Douglas y Isherwood, 1979). En durante el invierno del 2003. determinado momento la mayoría de estos debates estructuraron la discusión por medio de la distinción entre el valor que un obje- to adquiere en su uso y el valor que adquiere cuando es intercambiado. En los debates contemporáneos, la dicotomía se expresa habitualmente mediante la distinción entre mercantilización y autenticidad, afirmando de ese modo que la globalización y la comercialización socavan las pretensiones de autenticidad. Este trabajo analiza los diferentes circuitos de fabricación, produc- ción y consumo de un objeto especifico, la camiseta de un equipo de fútbol argentino –Boca Juniors–, con el fin de mostrar no solo las diversas lógicas que estructuran sus usos sino también afirmar que en algunas ocasiones las fuerzas globales, generalmente percibidas como un agente disolvente, cimientan nuevas formas de identidad que son consideradas auténticas. -

University Microfilms International 300 N

INFORMATION TO USERS This reproduction was made from a copy of a document sent to us for microfilming. While the most advanced technology has been used to photograph and reproduce this document, the quality of the reproduction is heavily dependent upon the quality of the material submitted. The following explanation of techniques is provided to help clarify markings or notations which may appear on this reproduction. 1.The sign or “target” for pages apparently lacking from the document photographed is “Missing Page(s)”. If it was possible to obtain the missing page(s) or section, they are spliced into the film along with adjacent pages. This may have necessitated cutting through an image and duplicating adjacent pages to assure complete continuity. 2. When an image on the film is obliterated with a round black mark, it is an indication of either blurred copy because of movement during exposure, duplicate copy, or copyrighted materials that should not have been filmed. For blurred pages, a good image of the page can be found in the adjacent frame. If copyrighted materials were deleted, a target note will appear listing the pages in the adjacent frame. 3. When a map, drawing or chart, etc., is part of the material being photographed, a definite method of “sectioning” the material has been followed. It is customary to begin filming at the upper left hand comer of a large sheet and to continue from left to right in equal sections with small overlaps. If necessary, sectioning is continued again—beginning below the first row and continuing on until complete.