~ Mothercare- U S Agency for International Development -·"9--·

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Habitat Ltd, Furniture and Household Goods Manufacturer and Retailer: Records, Ca

V&A Archive of Art and Design Habitat Ltd, furniture and household goods manufacturer and retailer: records, ca. 1960 – 2000 1 Table of Contents Introduction and summary description ................................................................ Page 4 Context .......................................................................................................... Page 4 Scope and content ....................................................................................... Page 4 Provenance ................................................................................................... Page 5 Access ......................................................................................................... Page 5 Related material .......................................................................................... Page 5 Detailed catalogue ................................................................................ Page 6 Corporate records .............................................................................................. Page 6 Offer for sale by tender, 1981 ................................................................................................ Page 6 Annual Reports and Accounts, 1965-1986 ............................................................................. Page 6 Marketing and public relations records ............................................................. Page 7 Advertising records, 1966-1996 ............................................................................................ -

Annual Report and Accounts 2018Mothercare Plc Annual Report 2018 Annual Report and Accounts

mothercare plc annual report 2018 and accounts 2018 Annual report and accounts Contents Our brands Overview Mothercare 2 At a glance and financial highlights Our aim is to meet the needs of mothers-to-be, babies and children up to pre-school age. Our clothing & Strategic report footwear product includes ranges for babies, pre-school children and maternity wear and has a growing selection 3 Chairman’s statement of branded product. Home & travel includes pushchairs, 4 Business model car seats, furniture, bedding, feeding and bathing 5 Chief executive’s review equipment. Toys is mainly for babies and complements 11 KPIs – measuring our performance our ELC ranges. 12 Enterprise risk management 15 Principal risks and uncertainties STORES 18 Financial review UK – in town: 38 27 Corporate responsibility UK – out of town: 96 International partners: 932 Governance 36 Board of directors 37 Executive committee 38 Corporate governance Early Learning Centre 44 Audit and risk committee 49 Nomination committee Our aim is to provide children up to pre-school age 50 Directors’ report with toys that nurture and encourage learning through 53 Directors’ remuneration report play. Whilst the ranges are mainly own brand and are 57 Annual report on remuneration designed and sourced through our facilities in Hong Kong, we selectively bring in branded product that enhances Financial statements our ranges. 80 Directors’ responsibilities statement STORES 81 Independent auditor’s report UK – in town: 3 90 Consolidated income statement UK – inserts: 115 91 Consolidated -

The Case for Firing Prosecutor General Viktor Shokin

October 9, 2015, Vol. 2, Issue 3 Obstruction Of Justice The case for fi ring Prosecutor General Viktor Shokin Special coverage pages 4-15 Editors’ Note Contents This seventh issue of the Legal Quarterly is devoted to three themes – or three Ps: prosecu- 4 Interview: tors, privatization, procurement. These are key areas for Ukraine’s future. Lawmaker Yegor Sobolev explains why he is leading drive In the fi rst one, prosecutors, all is not well. More than 110 lawmakers led by Yegor Sobolev to dump Shokin are calling on President Petro Poroshenko to fi re Prosecutor General Viktor Shokin. Not only has Shokin failed to prosecute high-level crime in Ukraine, but critics call him the chief ob- 7 Selective justice, lack of due structionist to justice and accuse him of tolerating corruption within his ranks. “They want process still alive in Ukraine to spearhead corruption, not fi ght it,” Sobolev said of Shokin’s team. The top prosecutor has Opinion: never agreed to be interviewed by the Kyiv Post. 10 US ambassador says prosecutors As for the second one, privatization, this refers to the 3,000 state-owned enterprises that sabotaging fi ght against continue to bleed money – more than $5 billion alone last year – through mismanagement corruption in Ukraine and corruption. But large-scale privatization is not likely to happen soon, at least until a new law on privatization is passed by parliament. The aim is to have public, transparent, compet- 12 Interview: itive tenders – not just televised ones. The law, reformers say, needs to prevent current state Shabunin says Poroshenko directors from looting companies that are sold and ensure both state and investor rights. -

The IFSO Global Registry 5Th IFSO Global Registry Report 2019

The IFSO Global Registry 5th IFSO Global Registry Report 2019 Prepared by Almino Ramos MD MSc PhD FACS FASMBS Lilian Kow BMBS PhD FRACS Wendy Brown MBBS PhD FACS FRACS Richard Welbourn MD FRCS John Dixon PhD FRACGP FRCP Edin Robin Kinsman BSc PhD Peter Walton MA MB BChir MBA FRCP IFSO & Dendrite Clinical Systems The International Federation for the Surgery of Obesity and Metabolic Disorders Fifth IFSO Global Registry Report 2019 Prepared by Almino Ramos MD MSc PhD FACS FASMBS Lilian Kow BMBS PhD FRACS Wendy Brown MBBS PhD FACS FRACS Richard Welbourn MD FRCS John Dixon PhD FRACGP FRCP Edin Robin Kinsman BSc PhD Peter Walton MA MB BChir MBA FRCP IFSO & Dendrite Clinical Systems The International Federation for the Surgery of Obesity and Metabolic Disorders operates the IFSO Global Registry in partnership with Dendrite Clinical Systems Limited. IFSO gratefully acknowledge the assistance of Dendrite Clinical Systems for: • building, maintaining & hosting the web registry • data analysis and • publishing this report Dendrite Clinical Systems Ltd maintains the following United Kingdom and GDPR-compliant Information Governance and Data Security Certificates: • Registration with the UK Government Information Commissioner’s Office (ICO) • NHS Data Security & Protection Toolkit (ODS code 8HJ38) • Cyber Essentials Plus (Registration number QGCE 1448) • G-Cloud 11 (Framework reference RM1557.11) This document is proprietary information that is protected by copyright. All rights reserved. No part of this document may be photocopied, stored in a retrieval system, transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the permission of the publishers and without prior written consent from IFSO and Dendrite Clinical Systems Limited. -

How to Fix Ukraine's Broken Legal System

June 26, 2015, Vol. 2, Issue 2 How To Fix Ukraine’s Broken Legal System Editors’ Note Contents If it ain't broke, don't fi x it. But if it is broke, as Ukraine's criminal justice system is, how to 4 Is it time to scrap Ukraine’s fi x it? Does society start from scratch or simply focus on a few areas at a time? These are legal system and start over with the questions that Ukrainians are still wrestling with, nearly 24 years after the collapse of the another nation’s system? Soviet Union The U.S.S.R.'s half-life is proving to be way too long, and the legal system pro- 6 Armine Sahakyan: Judicial reform vides one of the best examples of how much damage was infl icted during those 70 years. is still a pipe dream in former Basic legal concepts are either not appreciated or in force here. Soviet Union Probable cause – It still feels like a society where police can take people away in the dead of night on any pretext. 8 Soviet social guarantees for Presumption of innocence until proven guilty – Suspects can be subject to damning pre-tri- employees scare investors, often backfi re al publicity. Putting defendants in courtroom cages announces to the world: This is a guilty person. Lengthy pre-trial detention assumes guilt and ruins lives. 10 Anders Aslund: How to reform Plea bargains – These come in handy in getting lower-level suspects to turn state's evidence prosecutors and judicial system against top-level suspects, in murders and in fi nancial crimes, and also in ensuring justice is done without lengthy and costly trials. -

Design Index: the Impact of Design on Stock Market Performance Report to December 2004

Design Index: The Impact of Design on Stock Market Performance Report to December 2004 July 2005 Contents Foreword page 03 Executive summary page 05 Findings page 06 1.1 Introduction page 06 1.2 General overview page 06 1.3 Key points from 2004 page 08 Sector Performance page 10 2.1 The importance of retail and banking page 10 2.2 Retail page 10 2.3 Banking page 11 2.4 What lies behind the outperformance? page 12 Charts and tables Chart 1: Ten-year performance 1995-2004 page 06 Table 1: Performance relative to FTSE indices page 07 Table 2: Highs and lows of performance page 08 Chart 2: Recovery performance – 31 March 2003 to 31 December 2004 page 09 Chart 3: Retail performance – 29 November 2003 to 29 December 2004 page 10 Chart 4: Banking Performance – 29 November 2003 to 29 December 2004 page 11 Appendices page 13 Appendix 1: Index constituents page 14 - Design Index page 14 - Emerging Index page 15 Appendix 2: FTSE ‘ground rules’ page 16 Appendix 3: Original selection criteria page 17 Appendix 4: Retail and banking sectors page 20 02 Foreword Good design is good business. We’ve said it for years, and now we have the proof to back that belief – proof that can’t be ignored by anyone who cares about the long-term health of UK plc. This report shows clearly that businesses which invest in design out-perform their peers. We’ve tracked the share prices of the biggest hitters in corporate Britain and the evidence is unequivocal: Design-led companies have produced dramatically better share-price performance for their investors, not just for a few weeks or months but consistently over a solid decade. -

Schedule One Appendix

MOTHERCARE PLC (incorporated and registered in England and Wales with registered number 01950509) APPENDIX TO SCHEDULE ONE ANNOUNCEMENT FURTHER INFORMATION RELATING TO MOTHERCARE PLC IN CONNECTION WITH THE PROPOSED ADMISSION OF ITS ORDINARY SHARES TO TRADING ON AIM This Appendix has been prepared in accordance with the requirements of Rule 2 of, and Schedule One (including the Supplement to Schedule One for a quoted applicant) to, the AIM Rules that, for a quoted applicant, all information that is equivalent to that required for an 'admission document' which is not currently public shall be made public. Information which is public includes, without limitation, all information available in respect of the Company accessed at the London Stock Exchange (available at www.londonstockexchange.com), all information available in respect of the Company on the FCA's National Storage Mechanism (available at https://data.fca.org.uk/#/nsm/nationalstoragemechanism), all information available in respect of the Company at the website of Companies House at www.beta.companieshouse.gov.uk/, all information available on the Company's website (www.mothercareplc.com) and the contents of this Appendix (together comprising the “Company’s Public Record”). Definitions used in this Appendix are set out on pages 3 – 5. AIM AIM is a market designed primarily for emerging or smaller companies to which a higher investment risk tends to be attached than to larger or more established companies. AIM securities are not admitted to the Official List of the FCA. A prospective investor should be aware of the risks of investing in such companies and should make the decision to invest only after careful consideration and, if appropriate, consultation with an independent financial adviser. -

E-Commerce in MENA Report

E-commerce in MENA Opportunity beyond the hype Disclaimer This report was published by Google and Bain & Company for information purposes only. To the extent permitted by law, we do not represent or warrant that this report is reliable, accurate, complete. Accordingly, this report is made available for use “as is,” and any use thereof will be undertaken solely at your own risk. We reserve the right, in our sole discretion, to cease publishing this report at any time, and we do not give or enter into any conditions, warranties or other terms with regard to this report. In particular, no condition, warranty or other term is given or entered into to the effect that this report will be of satisfactory quality, noninfringement or that the report will be fit for any particular purpose. This work is based on secondary market research, analysis of financial information available or provided to Bain & Company and a range of interviews with industry participants. Bain & Company has not independently verified any such information provided or available to Bain and makes no representation or warranty, express or implied, that such information is accurate or complete. Projected market and financial information, analyses and conclusions contained herein are based on the information described above and on Bain & Company’s judgment, and should not be construed as definitive forecasts or guarantees of future performance or results. The information and analysis herein do not constitute advice of any kind, are not intended to be used for investment purposes, and neither Bain & Company nor any of its subsidiaries or their respective officers, directors, shareholders, employees or agents accept any responsibility or liability with respect to the use of or reliance on any information or analysis contained in this document. -

Corporate Summary

RETAIL PARKS PORTFOLIO 7 August 2008 UK Abbey Retail Park, Newtownabbey, Belfast The scheme is located approximately three miles north of Belfast City Centre in an established retail location adjacent Size: 23,400m² to the Abbey Centre and a new flagship Marks & Spencer No of tenants: 5 store. The scheme is currently let at rents of between Ownership: Hammerson 100% £100/m² and £180/m². Proposals have been prepared for Main tenants: Tesco, B&Q an extension of the scheme to provide six new retail Tenure: Leasehold warehouse units. Planning: Part Open A1, part bulky goods Average rent: £140/m² Battery Retail Park, Birmingham Built in 1990, Battery Retail Park is located four miles to the South West of Birmingham City Centre. The park currently Size: 12,600m² consists of seven units and planning permission has been No of tenants: 7 obtained to build a further 900m² unit, which has been let to Ownership: Hammerson 25%/TIAA-CREF 75% Next. The extension will be completed in September and is Main tenants: B&Q, Currys, Homebase, PC World expected to open in November. Tenure: Leasehold Planning: Open A1 and restaurants Average rent: £285/m² Brent South Shopping Park, London, NW2 Owned by Hammerson and Standard Life, Brent South Shopping Park was constructed in November 2004. The Size: 8,500m² scheme, which is located directly opposite Brent Cross No of tenants: 9 Shopping Centre on the North Circular Road, is fully let. Ownership: Hammerson 41%/Standard Life 59% Main tenants: Arcadia, Borders, Next, TK Maxx, Tenure: Freehold Planning: Mainly open A1 Average rent: £505/m² Central Retail Park, Falkirk The scheme is anchored by a Tesco superstore and incorporates a 3,900m² Cineworld cinema and a 2,335m² Size: 37,200m² Ballantyne’s Health Club. -

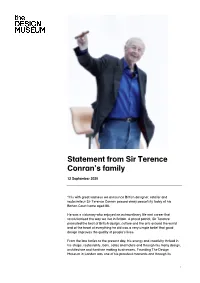

Statement from Sir Terence Conran's Family

Statement from Sir Terence Conran’s family 12 September 2020 "It is with great sadness we announce British designer, retailer and restaurateur Sir Terence Conran passed away peacefully today at his Barton Court home aged 88. He was a visionary who enjoyed an extraordinary life and career that revolutionised the way we live in Britain. A proud patriot, Sir Terence promoted the best of British design, culture and the arts around the world and at the heart of everything he did was a very simple belief that good design improves the quality of people's lives. From the late forties to the present day, his energy and creativity thrived in his shops, restaurants, bars, cafes and hotels and through his many design, architecture and furniture making businesses. Founding The Design Museum in London was one of his proudest moments and through its 1 endeavours he remained a relentless champion of the importance of education to young people in the creative industries. Sir Terence enjoyed a remarkable life to the full and always maintained that his work never felt like a job - everything he did for business he would have done for pleasure. In his private life he was adored by his family and friends and we will miss him dearly. It gives us great comfort to know that many of you will mourn with us but we ask that you celebrate Terence's extraordinary legacy and contribution to the country he loved so dearly." – ENDS – CLICK HERE FOR PRESS IMAGES CLICK HERE FOR BIOGRAPHY CLICK HERE FOR DESIGN TIMELINE Notes to Editor PRESS ENQUIRIES: Matt Riches E: [email protected] M: +44 (0)7812 072 759 Rioco Green, Senior Media & PR Manager, the Design Museum E: [email protected] M: +44 (0)7801 355012 BIOGRAPHY 1931 Born in Kingston upon Thames 1948 Enrolled in Central School of Arts & Crafts 1949 Shared a studio in London’s East End with Eduardo Paolozzi. -

DTZ Ukraine Retail in the Regions

DTZ Ukraine 2013 DTZ Ukraine Retail in the Regions Established London, 1784 Established Kyiv, 1994 Kyiv Population 2 844 000 inhabitants Major existing multi-tenant retail centres in Kyiv Major pipeline multi-tenant retail centres in Kyiv Project Delivery Size (sq m) Project Delivery Size (sq m) 1. Dream Town 2009 / 2011 (in phases) 90 860 15. Respublika 2014 139 000 2. Ocean Plaza* 2012 72 200 16. Lavina Mall 2015 115 000 3. Sky Mall* 2007 / 2010 66 000 17. Retroville 2015 82 700 (in phases) 18. KyivMall 2015-2016 75 400 4. Gulliver 2013 45 500 19. Kvadrat Vyrlytsa 2015-2016 75 000 5. Marmelade 2013 40 000 20. Manhattan Mall 2015-2016 69 200 6. Karavan Megastore 2004 / 2005/ 2008 37 700 (in phases) 21. Blockbuster Mall 2014-2015 66 370 7. Bilshovyk 2007 / 2008 36 200 22. Petrivka Mall 2015-2016 61 800 8. Promenada Centre 2004 / 2007 30 000 23. Hartz 2015-2016 57 000 9. RayON 2012 23 000 24. River Mall 2015 49 070 10. Domosfera* 2009 21 600 25. Retail and leisure centre 2015 / 2016 48 000 on Zdolbunivska Str. (in phases) 11. Magellan 2004 21 000 26. Lukyanivka Mall 2015-2016 45 000 12. Ukrayina 2003 (reconstruction) 20 800 Department Store 27. Happy Mall 2014-2015 42 500 13. Globus 2002 / 2003 (in phases) 18 600 28. Prospekt 2014 40 390 14. Manufaktura outlet village 2013 18 200 29. Art Mall 2013 36 750 * extension planned 30. Atmosphere 2014 30 000 31. TSUM 2015 (reconstruction) 22 500 Supply & Demand Rents Total modern retail stock in the city amounted to During the period from October 2011 to around 1,280,000 sq m (GLA) in late October 2013, or October 2013 inclusive, average monthly rents in 449 sq m (GLA) per 1,000 inhabitants. -

The Impact of Design on Corporate Performance

The Impact of Design on Stock Market Performance An Analysis of UK Quoted Companies 1994-2003 February 2004 © Design Council February 2004 Contents 1 Foreword 1 2 Main Findings 2 2.1 Overview 2 2.2 Performance Commentary 3 3 Methodology 6 3.1 General Approach 6 3.2 Award and Nomination Schemes 6 3.3 Other Selection Issues 9 3.4 Index Calculation 10 Charts and Tables Chart 1: Performance over ten years 1994-2003 2 Table 1: Portfolio performance against market indices 3 Table 2: Highs and lows of portfolio performance 4 Table 3: Award and nomination schemes 7 Table 4: The standard design categories 8 Table 5: Number of companies included with the portfolios 9 Appendices Appendix 1: Earlier Studies of the Influence of Design on Share 12 Price Performance Appendix 2: Portfolio Companies 14 Design Portfolio 14 Emerging Portfolio 15 Appendix 3: Portfolio Performance, Large Format Charts 16 Chart 1: Full Period Performance 1994-2003 17 Chart 2: Bull Market Performance - 27 March 1995 to 27 March 2000 18 Chart 3: Bear Market Performance - 27 March 2000 to 31 March 2003 19 Chart 4: Recovery Performance - 31 March 2003 to 29 December 2003 20 © Design Council February 2004 1 Foreword Design is a critical component of business performance. We’ve heard designers, commentators and companies say it. But, to date, the evidence for the link between shareholder return and investment in design has been scarce and anecdotal. Companies the world over spend billions every year on design, from product development and packaging to web design and branding.