Property Portfolio Summary and Review1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Coin Cart Schedule (From 2014 to 2020) Service Hours: 10 A.M

Coin Cart Schedule (From 2014 to 2020) Service hours: 10 a.m. to 7 p.m. (* denotes LCSD mobile library service locations) Date Coin Cart No. 1 Coin Cart No. 2 2014 6 Oct (Mon) to Kwun Tong District Kwun Tong District 12 Oct (Sun) Upper Ngau Tau Kok Estate Piazza Upper Ngau Tau Kok Estate Piazza 13 Oct (Mon) to Yuen Long District Tuen Mun District 19 Oct (Sun) Ching Yuet House, Tin Ching Estate, Tin Yin Tai House, Fu Tai Estate Shui Wai * 20 Oct (Mon) to North District Tai Po District 26 Oct (Sun) Wah Min House, Wah Sum Estate, Kwong Yau House, Kwong Fuk Estate * Fanling * (Service suspended on Tuesday 21 October) 27 Oct (Mon) to Wong Tai Sin District Sham Shui Po District 2 Nov (Sun) Ngan Fung House, Fung Tak Estate, Fu Wong House, Fu Cheong Estate * Diamond Hill * (Service suspended on Friday 31 October) (Service suspended on Saturday 1 November) 3 Nov (Mon) to Eastern District Wan Chai District 9 Nov (Sun) Oi Yuk House, Oi Tung Estate, Shau Kei Lay-by outside Causeway Centre, Harbour Wan * Drive (Service suspended on Thursday 6 (opposite to Sun Hung Kai Centre) November) 10 Nov (Mon) to Kwai Tsing District Islands District 16 Nov (Sun) Ching Wai House, Cheung Ching Estate, Ying Yat House, Yat Tung Estate, Tung Tsing Yi * Chung * (Service suspended on Monday 10 November and Wednesday 12 November) 17 Nov (Mon) to Kwun Tong District Sai Kung District 23 Nov (Sun) Tsui Ying House, Tak Chak House, Tsui Ping (South) Estate * Hau Tak Estate, Tseung Kwan O * (Service suspended on Tuesday 18 November) 24 Nov (Mon) to Sha Tin District Tsuen Wan -

Standard Chartered Bank (Hong Kong)

Consumption Voucher Scheme Locations with drop-box for collection of paper registration forms Standard Chartered Bank (Hong Kong) Number Location Bank Branch Branch Address 1 HK Shek Tong Tsui Branch Shops 8-12, G/F, Dragonfair Garden, 455-485 Queen's Road West, Shek Tong Tsui, Hong Kong 2 HK 188 Des Voeux Road Shop No. 7 on G/F, whole of 1/F - 3/F Branch Golden Centre, 188 Des Voeux Road Central, Hong Kong 3 HK Central Branch G/F, 1/F, 2/F and 27/F, Two Chinachem Central, 26 Des Voeux Road Central, Hong Kong 4 HK Des Voeux Road Branch Shop G1, G/F & 1/F, Standard Chartered Bank Building, 4-4A Des Voeux Road Central, Central, Hong Kong 5 HK Exchange Square Branch The Forum, Exchange Square, 8 Connaught Place, Central, Hong Kong 6 HK Admiralty Branch Shop C, UG/F, Far East Finance Centre, 16 Harcourt Road, Admiralty, Hong Kong 7 HK Queen's Road East Branch G/F & 1/F, Pak Fook Building, 208-212 Queen's Road East, Wanchai, Hong Kong 8 HK Wanchai Southorn Branch Shop C2, G/F & 1/F to 2/F, Lee Wing Building, 156-162 Hennessy Road, Wanchai, Hong Kong 9 HK Wanchai Great Eagle Shops 113-120, 1/F, Great Eagle Centre, 23 Branch Harbour Road, Wanchai, Hong Kong 10 HK Causeway Bay Branch G/F to 2/F, Yee Wah Mansion, 38-40A Yee Wo Street, Causeway Bay, Hong Kong 11 HK Times Square Priority Whole of Third Floor & Sixth Floor, No. 8 Banking Centre Branch Russell Street, Causeway Bay, Hong Kong 12 HK Happy Valley Branch G/F, 16 King Kwong Street, Happy Valley, Hong Kong 13 HK North Point Centre Branch Shop G2, G/F, North Point Centre, 278-288 King's Road, -

The Link Real Estate Investment Trust (‘‘The Link REIT’’) Dated 14 November 2005

This announcement is for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for securities. The Securities and Futures Commission of Hong Kong, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Terms in this announcement shall have the same meaning as those defined in the offering circular of The Link Real Estate Investment Trust (‘‘The Link REIT’’) dated 14 November 2005. The Link Real Estate Investment Trust (a Hong Kong unit trust authorised under section 104 of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong)) (stock code: 823) PUBLICATION OF ALLOCATION RESULTS Allocation results, which will include the Hong Kong Identity Card numbers, passport numbers or Hong Kong business registration numbers of successful applicants (where applicable) and the number of the Hong Kong Public Offering Units successfully applied for, will be made available through a variety of channels: The Link REIT’s Hong Kong 183 3838 Between 8: 00 a.m. and 12 Public Offering hotline midnight from 24 November 2005 to 28 November 2005 Hong Kong Stock Exchange www.hkex.com.hk From 24 November 2005 website Special allocation results All branches of Hongkong Post Opening -

Branch List English

Telephone Name of Branch Address Fax No. No. Central District Branch 2A Des Voeux Road Central, Hong Kong 2160 8888 2545 0950 Des Voeux Road West Branch 111-119 Des Voeux Road West, Hong Kong 2546 1134 2549 5068 Shek Tong Tsui Branch 534 Queen's Road West, Shek Tong Tsui, Hong Kong 2819 7277 2855 0240 Happy Valley Branch 11 King Kwong Street, Happy Valley, Hong Kong 2838 6668 2573 3662 Connaught Road Central Branch 13-14 Connaught Road Central, Hong Kong 2841 0410 2525 8756 409 Hennessy Road Branch 409-415 Hennessy Road, Wan Chai, Hong Kong 2835 6118 2591 6168 Sheung Wan Branch 252 Des Voeux Road Central, Hong Kong 2541 1601 2545 4896 Wan Chai (China Overseas Building) Branch 139 Hennessy Road, Wan Chai, Hong Kong 2529 0866 2866 1550 Johnston Road Branch 152-158 Johnston Road, Wan Chai, Hong Kong 2574 8257 2838 4039 Gilman Street Branch 136 Des Voeux Road Central, Hong Kong 2135 1123 2544 8013 Wyndham Street Branch 1-3 Wyndham Street, Central, Hong Kong 2843 2888 2521 1339 Queen’s Road Central Branch 81-83 Queen’s Road Central, Hong Kong 2588 1288 2598 1081 First Street Branch 55A First Street, Sai Ying Pun, Hong Kong 2517 3399 2517 3366 United Centre Branch Shop 1021, United Centre, 95 Queensway, Hong Kong 2861 1889 2861 0828 Shun Tak Centre Branch Shop 225, 2/F, Shun Tak Centre, 200 Connaught Road Central, Hong Kong 2291 6081 2291 6306 Causeway Bay Branch 18 Percival Street, Causeway Bay, Hong Kong 2572 4273 2573 1233 Bank of China Tower Branch 1 Garden Road, Hong Kong 2826 6888 2804 6370 Harbour Road Branch Shop 4, G/F, Causeway Centre, -

EXPAND to OPPOSE CHINA . More on P10 AP PHOTO AP PHOTO

12 YEARS A-CHANGIN’ Double Down! ADVERTISING HERE Kowie Geldenhuys Paulo Coutinho www.macaudailytimes.com.mo +853 287 160 81 FOUNDER & PUBLISHER EDITOR-IN-CHIEF THURSDAY T. 27º/ 35º Air Quality Good MOP 8.00 3335 “ THE TIMES THEY ARE A-CHANGIN’ ” N.º 18 Jul 2019 HKD 10.00 HKZMB: THOSE TALLER THAN GAMING CHIPS HIGHER AN AIR MACAU FLIGHT EN-ROUTE 1.2M NEED NOT APPLY FOR TO MACAU FROM TOKYO WAS CHILD DISCOUNT, EVEN IF AFTER SHAMING OF FORCED TO RETURN DUE TO AN UNDER 12 ONLINE CASINOS ENGINE PROBLEM P5 P3 P5 Cinema When Wu Ke-xi was looking for a frightening plotline for her latest film, she didn’t need to look further than her own industry. The Taiwanese actress and screenwriter’s latest HONG KONG PROTESTS movie, “Nina Wu,” is the story of an actress who is abused and psychologically P8,11 scarred by a man in power. EXPAND TO OPPOSE CHINA . More on p10 AP PHOTO AP PHOTO Hong Kong Thousands of senior citizens, including a popular actress, marched yesterday in a show of support for youths at the forefront of monthlong protests against a contentious extradition bill in the semi-autonomous Chinese territory. AP PHOTO South Korea The United States will “do what it can” to help resolve festering trade and political disputes between South Korea and Japan, David Stilwell, the top U.S. diplomat for East Asian affairs, said yesterday after a series of meetings with Seoul officials. Cambodia Almost seven dozen shipping containers sitting in a Cambodian seaport that were found to be filled with plastic waste came from the United States and Canada, the Southeast Asian country’s Environment Ministry said yesterday. -

The Hongkong and Shanghai Banking Corporation Branch Location

The Hongkong and Shanghai Banking Corporation Bank Branch Address 1. Causeway Bay Branch Basement 1 and Shop G08, G/F, Causeway Bay Plaza 2, 463-483 Lockhart Road, Causeway Bay, Hong Kong 2. Happy Valley Branch G/F, Sun & Moon Building, 45 Sing Woo Road, Happy Valley, Hong Kong 3. Hopewell Centre Branch Shop 2A, 2/F, Hopewell Centre, 183 Queen's Road East, Wan Chai, Hong Kong 4. Park Lane Branch Shops 1.09 - 1.10, 1/F, Style House, Park Lane Hotel, 310 Gloucester Road, Causeway Bay, Hong Kong 5. Sun Hung Kai Centre Shops 115-117 & 127-133, 1/F, Sun Hung Kai Centre, Branch 30 Harbour Road, Wan Chai, Hong Kong 6. Central Branch Basement, 29 Queen's Road Central, Central, Hong Kong 7. Exchange Square Branch Shop 102, 1/F, Exchange Square Podium, Central, Hong Kong 8. Hay Wah Building Hay Wah Building, 71-85 Hennessy Road, Wan Chai, Branch Hong Kong 9. Hong Kong Office Level 3, 1 Queen's Road Central, Central, Hong Kong 10. Chai Wan Branch Shop No. 1-11, Block B, G/F, Walton Estate, Chai Wan, Hong Kong 11. Cityplaza Branch Unit 065, Cityplaza I, Taikoo Shing, Quarry Bay, Hong Kong 12. Electric Road Branch Shop A2, Block A, Sea View Estate, Watson Road, North Point, Hong Kong 13. Island Place Branch Shop 131 - 132, Island Place, 500 King's Road, North Point, Hong Kong 14. North Point Branch G/F, Winner House, 306-316 King's Road, North Point, Hong Kong 15. Quarry Bay Branch* G/F- 1/F, 971 King's Road, Quarry Bay, Hong Kong 16. -

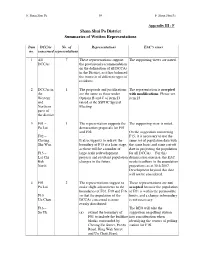

Sham Shui Po District Summaries of Written Representations

F. Sham Shui Po - 59 - F. Sham Shui Po Appendix III - F Sham Shui Po District Summaries of Written Representations Item DCCAs No. of Representations EAC’s views no. concerned representations 1 All 7 These representations support The supporting views are noted. DCCAs the provisional recommendation on the delineation of all DCCAs in the District, as it has balanced the interests of different types of residents. 2 DCCAs in 1 The proposals and justifications The representation is accepted the are the same as those under with modifications . Please see Western Options B and C of item 23 item 23. and raised at the SSPDC Special Northern Meeting. parts of the district 3 F01 – 1 The representation supports the The supporting view is noted. Po Lai demarcation proposals for F01 and F02. On the suggestion concerning F02 – F15, it is necessary to use the Cheung It also suggests to redraw the same set of population data with Sha Wan boundary of F15 at a later stage, the same basis and same cut-off as there will be a number of date in projecting the population F15 – large scale redevelopment for all DCCAs. For this Lai Chi projects and resultant population demarcation exercise, the EAC Kok changes in the future. needs to adhere to the population North projections as at 30.6.2007. Development beyond this date will not be considered. 4 F01 – 2 The representations suggest to These representations are not Po Lai make slight adjustments to the accepted because the population boundaries of F01, F10 and F16 of F01 is within the permissible F10 – so that the population of the limits, and a change in boundary Un Chau DCCAs concerned is more is not necessary. -

Annual Report

Contents Delivering Value 2 Ten-Year Financial Summary 4 Chairman’s Statement 6 Financial Highlights 9 Management Discussion and Analysis Review of Operations 10 Financial Review 38 Credit Analysis 46 Corporate Governance Corporate Governance 53 Directors and Offi cers 66 Directors’ Report 68 Sustainable Development 75 Auditor’s Report and Accounts Independent Auditor’s Report 83 Consolidated Profi t and Loss Account 84 Consolidated Balance Sheet 85 Company Balance Sheet 86 Consolidated Cash Flow Statement 87 Consolidated Statement of Changes in Equity 88 Notes to the Accounts 89 Principal Accounting Policies 141 Principal Subsidiary, Jointly Controlled and Associated Companies and Investments 151 Supplementary Information Cathay Pacifi c Airways Limited – Abridged Financial Statements 160 Schedule of Principal Group Properties 163 Group Structure Chart 174 Glossary 176 Financial Calendar and Information for Investors 177 2007 Annual Report 1 Delivering Value Swire Pacifi c is one of the leading companies in Hong Kong with fi ve operating divisions: Property, Aviation, Beverages, Marine Services and Trading & Industrial. The Group’s operations are predominantly in Greater China where the name Swire or 太古 has been established for over 130 years. Swire Pacifi c is deeply committed to Hong Kong where our subsidiaries, jointly controlled and associated companies employ over 43,000 staff. Globally we employ over 70,000 staff. We are committed to ensuring that our The Group’s total net assets employed Excluding the impact of the sale affairs are conducted with high ethical increased by HK$32.2 billion during of the Group’s interest in Shekou standards which is a key component 2007 to HK$159.2 billion at the year- Container Terminals during the year, of our long-term success. -

General Post Office 2 Connaught Place, Central Postmaster 2921

Access Officer - Hongkong Post District Venue/Premise/Facility Address Post Title of Access Officer Telephone Number Email Address Fax Number General Post Office 2 Connaught Place, Central Postmaster 2921 2222 [email protected] 2868 0094 G/F, Kennedy Town Community Complex, 12 Rock Kennedy Town Post Office Postmaster 2921 2222 [email protected] 2868 0094 Hill Street, Kennedy Town Shop P116, P1, the Peak Tower, 128 Peak Road, the Peak Post Office Postmaster 2921 2222 [email protected] 2868 0094 Peak Central and Western Sai Ying Pun Post Office 27 Pok Fu Lam Road Postmaster 2921 2222 [email protected] 2868 0094 1/F, Hong Kong Telecom CSL Tower, 322-324 Des Sheung Wan Post Office Postmaster 2921 2222 [email protected] 2868 0094 Voeux Road Central Wyndham Street Post Office G/F, Hoseinee House, 69 Wyndham Street Postmaster 2921 2222 [email protected] 2868 0094 Gloucester Road Post Office 1/F, Revenue Tower, 5 Gloucester Road, Wan Chai Postmaster 2921 2222 [email protected] 2868 0094 Happy Valley Post Office G/F, 14-16 Sing Woo Road, Happy Valley Postmaster 2921 2222 [email protected] 2868 0094 Morrison Hill Post Office G/F, 28 Oi Kwan Road, Wan Chai Postmaster 2921 2222 [email protected] 2868 0094 Wan Chai Wan Chai Post Office 2/F Wu Chung House, 197-213 Queen's Road East Postmaster 2921 2222 [email protected] 2868 0094 Perkins Road Post Office G/F, 5 Perkins Road, Jardine's Lookout Postmaster 2921 2222 [email protected] 2868 0094 Shops 1015-1018, 10/F, Windsor House, 311 Causeway Bay Post Office Postmaster 2921 2222 [email protected] 2868 0094 Gloucester -

The Bank of East Asia Branch Location

The Bank of East Asia Bank Branch Address 1. 133 Wai Yip Street G/F, 133 Wai Yip Street, Kwun Tong 2. Aberdeen 162-164 Aberdeen Main Road, Aberdeen 3. Admiralty Shop 2003-2006, 2/F, United Centre, 95 Queensway, Admiralty, Hong Kong. 4. BEA Harbour View Centre Shop 1, G/F, Bank of East Asia Harbour View Centre, 56 Gloucester Road, Wanchai 5. Bonham Road Shop 1-3, G/F, Ka Fu Building, 19-27 Bonham Road 6. Castle Peak Road Shop 1A, G/F & UG/F, One Madison, 305 Castle Peak Road, Cheung Sha Wan 7. Causeway Bay G/F, Ying Kong Mansion, 2-6 Yee Wo Street, Causeway Bay 8. Causeway Bay The Sharp (This branch was closed after 28 Mar 2021) 9. Chai Wan 345 Chai Wan Road, Chai Wan 10. Cheung Sha Wan Plaza Shop 117 - 119, 1/F, Cheung Sha Wan Plaza, 833 Cheung Sha Wan Road, Cheung Sha Wan 11. East Point City Shop 217B, Level 2, East Point City, 8 Chung Wa Road, Tseung Kwan O 12. Fanling (This branch was closed after August 21, 2021) 13. Festival Walk (This branch was closed after October 10, 2020) 14. Happy Valley 5-7 Sing Woo Road, Happy Valley 15. Hennessy Road G/F, Eastern Commercial Centre, 395-399 Hennessy Road, Wanchai 16. Hoi Yuen Road Unit 1, G/F, Hewlett Centre, 54 Hoi Yuen Road, Kwun Tong 17. Hong Kong Baptist G02, G/F, Jockey Club Academic Community University Centre, 9 Baptist University Road, Kowloon Tong 18. iSQUARE Shop UG01, iSQUARE, 63 Nathan Road, Tsim Sha Tsui Bank Branch Address 19. -

CCB Brochure 2017-Dec

CLARINS CLARINS Founder CLARINS CLARINS CLARINS CLARINS CLARINS CLARINS CLARINS CLARINS CLARINS CLARINS CLARINS CLARINS For more than 60 years, CLARINS products have had a lasting impact on the history of beauty with many revolutionary products. Pioneering innovations, CLARINS formulas are constantly reinvented to become best sellers. 第8代 賦活雙精華 第7代 Body Fit CLARINS CLARINS CLARINS CLARINS CLARINS CLARINS At the heart of CLARINS expertise is a cocktail of the most eective plant extracts. Using the power of science, our researchers extract the most potent beauty benefits from plants to achieve optimal product results. Today CLARINS uses more than 250 natural plant extracts whilst actively protecting biodiversity. CLARINS CLARINS CLARINS CLARINS CLARINS CLARINS CLARINS CLARINS 全球首間概念店 World’s First Retail Concept Store 以開放式設計的全球首間概念店座落又一城。全新面貌採用了大創意 新穎的體驗構思 - (1)CLARINS獨家概念 Open Spa、Skin Beauty Express、 Travel Zone;(2)CLARINS獨有產品 Iconic Tower、Exclusivities、 Wrapping Corner;以及(3)CLARINS獨特體驗 Cocoon Area、Love Wall、 Recycling,讓顧客可在無拘無束的環境下隨心挑選及試用產品,享受 一個It’s all about you的品味購物之旅。 Proudly located in Festival Walk, in Hong Kong, CLARINS’ first open design concept store has been given a faceli to provide customers with a wide array of innovative experiences, including (1) CLARINS’ unique concepts of Open Spa, Skin Beauty Express and Travel Zone; (2) CLARINS’ signature products displayed on Iconic Tower, Exclusivities, Wrapping Corner; and (3) CLARINS’ distinctive experience oered in Cocoon Area, Love Wall and Recycling Area. Customers are welcome to pick and sample their favorite products in a relaxing environment and indulge in an exquisite shopping experience that is “all about you”. CLARINS CLARINS Commitment: to make life more beautiful CLARINS CLARINS CLARINS At CLARINS, we believe in beauty that respects the planet, our stakeholders and future generations. -

Office Address of the Labour Relations Division

If you wish to make enquiries or complaints or lodge claims on matters related to the Employment Ordinance, the Minimum Wage Ordinance or contracts of employment with the Labour Department, please approach, according to your place of work, the nearby branch office of the Labour Relations Division for assistance. Office address Areas covered Labour Relations Division (Hong Kong East) (Eastern side of Arsenal Street), HK Arts Centre, Wan Chai, Causeway Bay, 12/F, 14 Taikoo Wan Road, Taikoo Shing, Happy Valley, Tin Hau, Fortress Hill, North Point, Taikoo Place, Quarry Bay, Hong Kong. Shau Ki Wan, Chai Wan, Tai Tam, Stanley, Repulse Bay, Chung Hum Kok, South Bay, Deep Water Bay (east), Shek O and Po Toi Island. Labour Relations Division (Hong Kong West) (Western side of Arsenal Street including Police Headquarters), HK Academy 3/F, Western Magistracy Building, of Performing Arts, Fenwick Pier, Admiralty, Central District, Sheung Wan, 2A Pok Fu Lam Road, The Peak, Sai Ying Pun, Kennedy Town, Cyberport, Residence Bel-air, Hong Kong. Aberdeen, Wong Chuk Hang, Deep Water Bay (west), Peng Chau, Cheung Chau, Lamma Island, Shek Kwu Chau, Hei Ling Chau, Siu A Chau, Tai A Chau, Tung Lung Chau, Discovery Bay and Mui Wo of Lantau Island. Labour Relations Division (Kowloon East) To Kwa Wan, Ma Tau Wai, Hung Hom, Ho Man Tin, Kowloon City, UGF, Trade and Industry Tower, Kowloon Tong (eastern side of Waterloo Road), Wang Tau Hom, San Po 3 Concorde Road, Kowloon. Kong, Wong Tai Sin, Tsz Wan Shan, Diamond Hill, Choi Hung Estate, Ngau Chi Wan and Kowloon Bay (including Telford Gardens and Richland Gardens).