MSCI Malaysia ESG Leaders Index (USD) (GROSS)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PPB GROUP (PEP MK, PEPT.KL) 11 Dec 2020

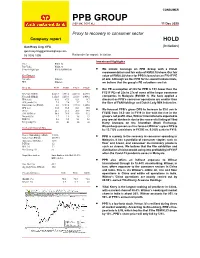

CONSUMER PPB GROUP (PEP MK, PEPT.KL) 11 Dec 2020 Proxy to recovery in consumer sector Company report HOLD Gan Huey Ling, CFA (Initiation) [email protected] 03 2036 2305 Rationale for report: Initiation Investment Highlights Price RM18.74 Fair Value RM20.30 52-week High/Low RM19.96/RM15.00 We initiate coverage on PPB Group with a HOLD recommendation and fair value of RM20.30/share. Our fair Key Changes value of RM20.30/share for PPB is based on an FY21F PE Fair value Initiation of 22x. Although we like PPB for its sound fundamentals, EPS Initiation we believe that the group’s PE valuations are fair. YE to Dec FY19 FY20E FY21F FY22F Our PE assumption of 22x for PPB is 15% lower than the Revenue (RMmil) 4,683.8 3,952.6 4,492.0 4,691.0 FY21F PEs of 25x to 27x of some of the larger consumer Net profit (RMmil) 1,152.6 1,239.8 1,310.8 1,404.1 companies in Malaysia (Exhibit 1). We have applied a EPS (sen) 81.0 87.1 92.1 98.7 discount as PPB’s consumer operations are smaller than EPS growth (%) 7.2 7.6 5.7 7.1 the likes of F&N Holdings and Dutch Lady Milk Industries. Consensus net (RMmil) 0.0 1,152.0 1,291.0 1,345.0 DPS (sen) 31.0 33.0 34.0 35.0 PE (x) 23.1 21.5 20.3 19.0 We forecast PPB’s gross DPS to increase to 33.0 sen in EV/EBITDA (x) 58.8 78.9 55.8 51.2 FY20E from 31.0 sen in FY19 in line with the rise in the Div yield (%) 1.7 1.8 1.8 1.9 group’s net profit. -

Simplified Consolidated Statements of Financial Position

SIMPLIFIED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION Expansion Consistency THE VALUE PROPOSITION STORY OF PPB GROUP is about how PPB Group’s heritage of values and culture translate to growth, Growth consistency and care. The enduring passion of everyone within the Group has helped build a strong customer base and supportive stakeholders. Today, we are equally proud and humbled to tell the story of PPB Group’s value proposition. Quality Passion Care The Corporation 001 OUR PRODUCTS, OUR VALUE PROPOSITION. CONTENTS THE CORPORATION 008 Chairman’s Statement 016 Group Financial Highlights THE 017 Simplified Consolidated Statements FINANCIALS Of Financial Position 018 Directors’ Profiles 054 5-Year Group Financial Statistics 022 Group Corporate Structure 056 Segmental Analysis 024 Corporate Information 057 Share Performance 025 PPB’s Corporate Events And Investor Relations Activities 058 Additional Financial Information 026 Financial Calendar 059 Directors’ Responsibility 027 Corporate Governance Statement Statement 036 Audit Committee Report 060 Directors’ Report 039 Statement On Risk Management And Internal Control 041 Corporate Sustainability Statement 050 Additional Compliance Information THE FINANCIAL STATEMENTS 066 Consolidated Income Statement 067 Consolidated Statement Of Comprehensive Income 068 Consolidated Statement Of Financial Position THE 070 Consolidated Statement Of Changes In Equity PROPERTIES & SHAREHOLDINGS 072 Consolidated Statement Of Cash Flows 074 Income Statement 164 Properties Owned By PPB And Its Subsidiaries 074 -

Malaysian Invited Companies Company Name Country Robecosam Industry AMMB Holdings Bhd Malaysia BNK Banks Astro Malaysia Holdings

Malaysian invited companies Company_Name Country RobecoSAM_Industry AMMB Holdings Bhd Malaysia BNK Banks Astro Malaysia Holdings Bhd Malaysia PUB Media Axiata Group Bhd Malaysia TLS Telecommunication Services Batu Kawan Bhd Malaysia CHM Chemicals British American Tobacco Malaysia Bhd Malaysia TOB Tobacco Bumi Armada Bhd Malaysia OIE Energy Equipment & Services CIMB Group Holdings Bhd Malaysia BNK Banks Dialog Group Bhd Malaysia CON Construction & Engineering Digi.com Bhd Malaysia TLS Telecommunication Services Felda Global Ventures Holdings Bhd Malaysia FOA Food Products Gamuda Bhd Malaysia CON Construction & Engineering Genting Bhd Malaysia CNO Casinos & Gaming Genting Malaysia Bhd Malaysia CNO Casinos & Gaming Hong Leong Bank Bhd Malaysia BNK Banks Hong Leong Financial Group Bhd Malaysia BNK Banks IHH Healthcare Bhd Malaysia HEA Health Care Providers & Services IJM Corp Bhd Malaysia CON Construction & Engineering IOI Corp Bhd Malaysia FOA Food Products IOI Properties Group Bhd Malaysia REA Real Estate Kuala Lumpur Kepong Bhd Malaysia FOA Food Products Lafarge Malaysia Bhd Malaysia COM Construction Materials Malayan Banking Bhd Malaysia BNK Banks Malaysia Airports Holdings Bhd Malaysia TRA Transportation and Transportation Infrastructure Maxis Bhd Malaysia TLS Telecommunication Services MISC Bhd Malaysia TRA Transportation and Transportation Infrastructure Nestle Malaysia Bhd Malaysia FOA Food Products Petronas Chemicals Group Bhd Malaysia CHM Chemicals Petronas Dagangan BHD Malaysia OIX Oil & Gas Petronas Gas BHD Malaysia GAS Gas Utilities -

Financial Hegemony, Diversification Strategies and the Firm Value of Top 30 FTSE Companies in Malaysia

Asian Social Science; Vol. 12, No. 3; 2016 ISSN 1911-2017 E-ISSN 1911-2025 Published by Canadian Center of Science and Education Financial Hegemony, Diversification Strategies and the Firm Value of Top 30 FTSE Companies in Malaysia Wan Sallha Yusoff1, Mohd Fairuz Md. Salleh2, Azlina Ahmad2 & Norida Basnan2 1 School of Business Innovation and Technopreneurship, Universiti Malaysia Perlis, Malaysia 2 School of Accounting, Faculty of Economics and Management, Universiti Kebangsaan Malaysia, Malaysia Correspondence: Wan Sallha Yusoff, School of Business Innovation and Technopreneurship, Universiti Malaysia Perlis, Malaysia. E-mail: [email protected] Received: August 8, 2015 Accepted: January 18, 2016 Online Published: February 23, 2016 doi:10.5539/ass.v12n3p14 URL: http://dx.doi.org/10.5539/ass.v12n3p14 Abstract This study investigates the relationships between financial hegemony groups, global diversification strategies and firm value of the Malaysia’s 30 largest companies listed in FTSE Bursa Malaysia Index Series during 2009 to 2012 period. We chose Malaysia as an ideal setting because the findings contribute to the phenomenon of the diversification–performance relationship in the Southeast Asian countries. We apply hegemony stability theory to explain the importance of financial hegemony groups in deciding international locations for operations. By using panel data analysis, we find that financial hegemony groups are significantly important in international location decisions. Results reveal that the stability of financial hegemony in BRICS and G7 groups enhances the financial value of the Malaysia’s 30 largest companies, whereas the stability of financial hegemony in ASEAN groups is able to enhance the non-financial value of the firms. -

Corporate Earnings Improved in 2Q

Headline Corporate earnings improved in 2Q MediaTitle The Malaysian Reserve Date 03 Sep 2021 Language English Circulation 12,000 Readership 36,000 Section Companies Page No 10 ArticleSize 399 cm² Journalist S BIRRUNTHA PR Value RM 12,569 Corporate earnings improved in 2Q Expectations of a more robust commented the FBM KLCI component stocks delivered a set of 2Q21 results that recovery in the coming quarters had yet to show meaningful improvement could be on hold sequentially. He views this as due to the reintroduc- by S BIRRUNTHA tion of various pandemic restrictions against a backdrop of surging Covid-19 THE corporate sector's second-quarter infections which weighed on corporate (2Q) financial results reporting season financial performance. appears to be healthier in terms of face According to Ng, six FBM KLCI compo- value, with the number of companies nent stocks, namely, CIMB Group Holdings meeting and/or exceeding expectations Bhd (lower operating expenditure), Sime trumping those that missed, Public Invest- Darby Group Bhd (stronger vehicle and ment Bank Bhd (Publiclnvest) stated results heavy equipment sales), Sime Darby Plan- from the banking, plantation and consu- tation Bhd (higher crude palm oil prices), mer sectors exceeded expectations. IHH Healthcare Bhd (Covid-19-related "A closer look into the results will reveal patients and effective cost-saving initia- some extremes. Be it a function of over- •S^SL, * tives), Petronas Chemicals Group Bhd pessimism or under-estimation, results (higher product prices) and Tenaga Nasional -

Ac 2021 61.Pdf

Accounting 7 (2021) 1033–1048 Contents lists available at GrowingScience Accounting homepage: www.GrowingScience.com/ac/ac.html Can investors benefit from corporate social responsibility and portfolio model during the Covid19 pandemic? Ternence T. J. Tana* and Baliira Kalyebarab aFaculty of Business, Economics and Social Development, University of Malaysia Terengganu, Kuala Nerus, Terengganu, Malaysia bDepartment of Accounting and Finance, School of Business, American University of Ras Al Khaimah, United Arab Emirates C H R O N I C L E A B S T R A C T Article history: Since late 2019 and throughout 2020, the global economy has been experiencing difficult times due Received: November 15, 2020 to the outbreak of the lethal Coronavirus (COVID-19). This study looks at the financial impact of Received in revised format: this epidemic on the global economy using Malaysian market index i.e., FTSE Bursa Malaysia KLCI January 28 2021 before and during COVID-19. Measuring the financial impact of this epidemic on the Malaysia Accepted: March 2, 2021 Available online: economy may help policy makers to develop measures to avert similar financial catastrophic impacts March 2, 2021 on the global economy. The study uses Sharpe optimal and naïve diversification model to solve a scenario that factors in the level of corporate social responsibility (CSR) exhibited before and during Keywords: Corporate Social Responsibility the epidemic to measure the financial impact on the stock portfolio. The results show that the Naïve Diversification emergence of COVID-19exacerbated the already weak Malaysian economy. Our findings may help Optimal Portfolio the policy makers in Malaysia to develop and maintain techniques and policies that may mitigate the Sharpe Ratio negative financial impact and handle similar epidemics in the future. -

FTSE Publications

2 FTSE Russell Publications 28 October 2020 FTSE Malaysia Indicative Index Weight Data as at Closing on 27 October 2020 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country AirAsia Group Berhad 0.16 MALAYSIA Hong Leong Bank 1.83 MALAYSIA Press Metal Aluminium Holdings 2.07 MALAYSIA Alliance Bank Malaysia 0.48 MALAYSIA Hong Leong Financial 0.66 MALAYSIA Public Bank BHD 9.5 MALAYSIA AMMB Holdings 1.1 MALAYSIA IHH Healthcare 2.99 MALAYSIA QL Resources 1.31 MALAYSIA Astro Malaysia Holdings 0.22 MALAYSIA IJM 0.87 MALAYSIA RHB Bank 1.3 MALAYSIA Axiata Group Bhd 2.49 MALAYSIA IOI 2.73 MALAYSIA Sime Darby 1.65 MALAYSIA British American Tobacco (Malaysia) 0.27 MALAYSIA IOI Properties Group 0.31 MALAYSIA Sime Darby Plantation 3.39 MALAYSIA CIMB Group Holdings 4.14 MALAYSIA Kuala Lumpur Kepong 2.05 MALAYSIA Sime Darby Property 0.38 MALAYSIA Dialog Group 3.3 MALAYSIA Malayan Banking 8.28 MALAYSIA Telekom Malaysia 0.93 MALAYSIA Digi.com 2.8 MALAYSIA Malaysia Airports 0.74 MALAYSIA Tenaga Nasional 7.53 MALAYSIA FGV Holdings 0.41 MALAYSIA Maxis Bhd 2.65 MALAYSIA Top Glove Corp 8.82 MALAYSIA Fraser & Neave Holdings 0.64 MALAYSIA MISC 1.9 MALAYSIA Westports Holdings 0.8 MALAYSIA Gamuda 1.48 MALAYSIA Nestle (Malaysia) 1.69 MALAYSIA YTL Corp 0.72 MALAYSIA Genting 1.34 MALAYSIA PETRONAS Chemicals Group Bhd 3.28 MALAYSIA Genting Malaysia BHD 1.11 MALAYSIA Petronas Dagangan 1.18 MALAYSIA Hap Seng Consolidated 0.93 MALAYSIA Petronas Gas 1.79 MALAYSIA Hartalega Holdings Bhd 5.25 MALAYSIA PPB Group 2.49 MALAYSIA Source: FTSE Russell 1 of 2 28 October 2020 Data Explanation Weights Weights data is indicative, as values have been rounded up or down to two decimal points. -

ESG Ratings of Plcs Assessed by FTSE Russell# in Accordance with FTSE Russell ESG Ratings Methodology

ESG Ratings of PLCs assessed by FTSE Russell# in accordance with FTSE Russell ESG Ratings Methodology Definition Top 25% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Top 26-50% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Top 51%- 75% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Bottom 25% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Stock Company Name Sector F4GBM ESG Grading Code (sorted By Alphabetical) Index Band 6599 AEON CO. (M) BHD CONSUMER PRODUCTS & SERVICES ** 5139 AEON CREDIT SERVICE (M) BHD FINANCIAL SERVICES Yes *** 7078 AHMAD ZAKI RESOURCES BHD CONSTRUCTION *** 5099 AIRASIA GROUP BERHAD CONSUMER PRODUCTS & SERVICES *** 5238 AIRASIA X BERHAD CONSUMER PRODUCTS & SERVICES ** 2658 AJINOMOTO (M) BHD CONSUMER PRODUCTS & SERVICES Yes *** 2488 ALLIANCE BANK MALAYSIA BERHAD FINANCIAL SERVICES Yes *** 5293 AME ELITE CONSORTIUM BERHAD CONSTRUCTION * 1015 AMMB HOLDINGS BHD FINANCIAL SERVICES Yes **** 6556 ANN JOO RESOURCES BHD INDUSTRIAL PRODUCTS & SERVICES * 6399 ASTRO MALAYSIA HOLDINGS BERHAD TELECOMMUNICATIONS & MEDIA Yes **** 6888 AXIATA GROUP BERHAD TELECOMMUNICATIONS & MEDIA Yes *** 5106 AXIS REITS REAL ESTATE INVESTMENT TRUSTS ** 3395 BERJAYA CORPORATION BHD INDUSTRIAL PRODUCTS & SERVICES ** 1562 BERJAYA SPORTS TOTO BHD CONSUMER PRODUCTS & SERVICES ** 5248 BERMAZ AUTO BERHAD CONSUMER PRODUCTS & SERVICES Yes **** 2771 BOUSTEAD HOLDINGS BHD INDUSTRIAL PRODUCTS & SERVICES ** 4162 BRITISH AMERICAN -

TA Securities Monday, December 19, 2016 FBMKLCI: 1, 637.79 a Member of the TA Group

TA Securities Monday, December 19, 2016 FBMKLCI: 1, 637.79 A Member of the TA Group MENARA TA ONE, 22 JALAN P. RAMLEE, 50250 KUALA LUMPUR, MALAYSIA TEL: +603-20721277 / FAX: +603-20325048 WWeeeekkllyy SSttrraatteeggyy Market View, News In Brief: Corporate , Economy , a n d Share Buybacks THIS REPORT IS STRICTLY FOR INTERNAL CIRCULATION ONLY* Kaladher Govindan Tel: +603-2167 9609 [email protected] www.taonline.com.my Market View Modest Year-end Window Dressing Could be on the Cards The local benchmark FTSE Bursa Malaysia Kuala Lumpur Composite Index (FBM KLCI) stayed range bound last week, after earlier gains evaporated as the US Federal Reserve raised interest rates by 25 basis points as expected, for the second time in nearly a decade. However, the Fed guided for three rate hikes next year instead of two as earlier expected, forcing a weaker ringgit as foreign selling persisted to dampen local sentiment. Week-on-week, the FBM KLCI eased 3.63 points, or 0.22 percent to 1,637.79, with gains on Petronas Dagangan (+30sen), Hap Seng Consolidated (+21sen) and Public Bank (+18sen) overshadowed by losses on BAT (-RM1.54), Petronas Gas (-48sen), Hong Leong Financial Group (-40sen) and PPB Group (-22sen). Average daily traded volume and value last week mildly improved to 1.32 billion shares and RM1.66 billion, compared to the 1.12 billion shares and RM1.45 billion the previous week. So, as widely expected, the US interest rate went up by 25 basis points last week but the market was taken aback by the US Federal Reserve’s more hawkish stance now. -

Ppb-Investor-Update-2018-2Qtr.Pdf

INVESTOR UPDATE QUARTERLY REPORT • 30 JUNE 2018 FROM THE DESK OF THE CHAIRMAN Dear Shareholders, We are pleased to report that PPB Group Berhad’s (“PPB”) pre-tax profit increased by 14% to RM546 million in 1H2018. The increase was mainly due to higher contribution by our 18.5% associate, Wilmar International Limited and higher profits fromGrains & Agribusiness and Environmental Engineering & Utilities segments. Group revenue increased by 7% to RM2.23 billion in 1H2018 due to higher contribution from the Grains & Agribusiness and Environmental Engineering & Utilities segments. Profit for the period was higher at RM507 million compared with RM443 million in 1H2017. Accordingly, PPB recorded earnings per share of 34.7 sen for 1H2018 compared with 30.3 sen for 1H2017. INTERIM DIVIDEND The Board of Directors has declared an interim dividend of 8 sen per share for the financial year ending 31 December 2018, payable on 4 October 2018 to shareholders whose names appear in the Record of Depositors on 18 September 2018. REVIEW OF OPERATIONS The results of PPB’s business operations for 1H2018 are summarised as follows :- • Grains & Agribusiness segment’s revenue for 1H2018 increased by 6% to RM1.54 billion mainly attributable to higher sales volume from all flour mills. Segment profit increased by 30% to RM73 million mainly due to lower raw material costs and improved product margins from the feed division. • Consumer Products segment revenue for 1H2018 was RM333 million, down 3% from 1H2017 mainly due to lower sales of in-house products. Segment profit decreased by 46% to RM10 million for 1H2018 mainly due to the one- time gain in 1H2017 of RM8.0 million on sale of land and building, and weaker performance by the bakery division. -

Ppb Group Berhad Investor Handbook 2005 Contents

PPB GROUP BERHAD INVESTOR HANDBOOK 2005 CONTENTS 4 introduction 36 edible oils refining 5 corporate profile 38 engineering services 6 mission statement 40 environmental engineering, 7 corporate history waste management & utilities 9 corporate objectives 42 flour milling 10 corporate structure 44 glove manufacturing 12 board of directors 46 livestock farming 17 group management team 48 oil palm plantations 21 activities 50 packaging 22 amusement centre operations 52 property development 24 animal feed milling 54 sugar refining 26 chemicals manufacturing 56 group financial highlights 28 cinema operations 58 5-year group statistics 30 commodity trading 60 financial performance 32 consumer products distribution 62 movements in share capital 34 contract manufacturing 64 dividend record 65 investor relations schedule for 2006 ACTIVITIES 22 55 INTRODUCTION As part of PPB’s investor relations programme, we are publishing our fifth Investor Handbook to keep shareholders and the investing public informed of PPB Group’s diversified activities. The Investor Handbook is updated yearly and distributed with the Annual Report. We trust it will serve as a convenient reference guide for the reader to better understand PPB, to interpret its results and to appraise its future growth and direction. Through this better understanding, both the corporation and its shareholders are able to work together to build and grow PPB to enable it to provide increasing returns to its shareholders. PPB Group is constantly seeking to expand its core businesses and to invest in businesses which are synergistic to its existing operations in order to maintain its competitive edge in the market and to provide sustainable shareholder value growth. -

Growth & Sustainability

PPB GROUP BERHAD www.ppbgroup.com PPB GROUP BERHAD (8167-W) 17th Floor Wisma Jerneh 38 Jalan Sultan Ismail 50250 Kuala Lumpur Malaysia T +603 2117 0888 F +603 2117 0999 GROWTH & SUSTAINABILITY ANNUAL REPORT ANNUAL REPORT 2010 2010 The theme of ‘Growth and Sustainability’ reflects PPB Group’s vision and expansionary approaches in delivering quality products and services to customers as well as delivering optimum investment returns to shareholders and stakeholders. CONSUMER PRODUCTS THE FINANCIALS 5-Year Group Financial Statistics 46 THE CORPORATION Segmental Analysis 48 Share Performance Chart 49 Chairman’s Statement 08 Additional Financial Information 50 Group Financial Highlights 14 Directors’ Responsibility Statement 51 Simplified Consolidated Statements Of Financial Position 15 Directors’ Report 52 Directors’ Profiles 16 Financial Statements 59 Corporate Structure 20 Consolidated Income Statement 60 Corporate Information 22 Consolidated Statement Of Comprehensive Income 61 Group’s Corporate Events In 2010 23 Consolidated Statement Of Financial Position 62 Financial Calendar 24 Consolidated Statement Of Changes In Equity 64 Corporate Governance Statement 25 Consolidated Statement of Cash Flows 66 Audit Committee Report 32 Income Statement 69 Statement On Internal Control 35 Statement Of Comprehensive Income 69 Corporate Social Responsibility Statement 37 Statement Of Financial Position 70 Additional Compliance Information 42 Statement Of Changes In Equity 71 Statement Of Cash Flows 72 Notes To The Financial Statements 74 Supplementary