THE GEORGE INVESTMENTS VIEW Volume 20 | Newsletter 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE LEADING SOURCE for PROGRAM INFORMATION *LIST 0114 ALT LIS 1006 LISTINGS 1/16/14 12:50 PM Page 2

*LIST_0114_ALT_LIS_1006_LISTINGS 1/16/14 12:50 PM Page 1 WWW.WORLDSCREENINGS.COM JANUARY 2014 NATPE EDITION TVLISTINGS THE LEADING SOURCE FOR PROGRAM INFORMATION *LIST_0114_ALT_LIS_1006_LISTINGS 1/16/14 12:50 PM Page 2 MARKET FLOOR 10 Francs 425 Cineflix Rights 304 France Televisions Distribution 425 Motion Picture Corp. of America 132 SBS International 518 100% Distribution 425 CITVC 400 Fred Media 106 Multimedios Televisión 115 Scorpion TV 331 AB Media 415 CJ E&M 417 Fuji Television Network 113 Muse Distribution International 213 Shanghai TV Festival 608 AccuWeather 117 Construir TV 421 Gaumont Animation 425 Newen Distribution 120 Shoreline Entertainment 204 ADD Agency 130 CT Media 231 Global Agency 301 NHK Enterprises 521 Superights 425 AFP 505 David Harris Katz Entertainment 116 GMA Worldwide 104 Nippon Animation 531 Switch International 134 American Cinema International 508 DCD Rights 300 GoldBee 533 Nippon Television Network 228 Taipei Multimedia Production 515 Aniplex 311 DHX Media 316 GRB Entertainment 510 Nollywood Worldwide Entertainment 332 TF1 International 425 APA International Film Distributors 404 DIRECTV Latin America 628 Greenlight International 232 NuRay Pictures 124 Toei Animation 215 Argonon 31a DLT Entertainment 401 Hasbro Studios 102 Octapixx Worldwide 308 Triangle Entertainment 626 Arte France 425 DRG 201 Hoho Entertainment 331 Olympusat 624 TV Asahi 233 ATM Broadcast 325 Echo Bridge Entertainment 221 ITV-Inter Medya 421 Ooyala 604 TV France International 425 Audiovisual from Spain 225 Egeda US 616 Kanal D 410 Optomen Television 331 TV Latina 604k Begin 108 Electric Sky 331c KBS Media 419 Osiris Entertainment 212 TVS 218 Bender Media Services 411 Electus International 127 Keshet International 634 Pact/UK Indies 331 Twofour 331 Beverly Boy Productions 126 Elk Entertainment 138 KOCCA 415 Passion Distribution 331b Upside Distribution 425 Bonneville Distribution 501 Espresso TV 331 Lagardère Entertainment Rights 118 Peace Point Rights 312 VIPO Land 226 Boomerang TV 225 Epic Films 114 Latin Media Corp. -

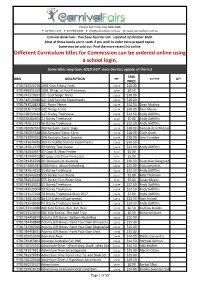

Different Curriculum Titles for Commission Can Be Ordered Online Using a School Login

PO Box 525 Terrey Hills NSW 2086 P: 02 9457 1170 F: 02 9986 1606 E: [email protected] W: www.carnivalfairs.com.au Carnival Book Fairs - Purchase Reorder List - Updated 12 October 2020. Most of these books are in stock if you wish to order extra prepaid copies. Some may be sold out. Find the more recent list online. Different Curriculum titles for Commission can be ordered online using a school login. Some titles may have SOLD OUT since the last update of this list SALE ISBN DESCRIPTION RRP AUTHOR QTY PRICE 9781743520710 1001 Cool Freaky Facts $10.00 $10.00 9781488951619 1001 Things to Find Princesses $9.99 $9.50 9781743520697 101 Cool Magic Tricks $10.00 $10.00 9781743520680 101 Cool Science Experiments $10.00 $10.00 9781743520833 101 Paper Planes $12.99 $12.50 Dean Mackey 9781913077303 102 Things To Do $22.99 $20.00 Paul Mason 9781760559144 117-Storey Treehouse $14.99 $14.50 Andy Griffiths 9780330404365 13 Storey Treehouse $4.99 $5.00 Andy Griffiths 9781742611273 26 Storey Treehouse $12.99 $12.50 Andy Griffiths 9781782097624 300 Fantastic Facts: Bugs $23.99 $18.00 Camilla de la Bedoyere 9781782097648 300 Fantastic Facts: Earth $23.99 $18.00 Clare Oliver 9781782097655 300 Fantastic Facts: Science $23.99 $18.00 John Farndon 9781743634585 365 Incredible Science Experiments $14.95 $14.50 9781742612379 39-Storey Tree House $12.99 $12.50 Andy Griffiths 9781782440697 3D Copy & Draw Pirates $9.99 $5.00 9781782440703 3D Copy and Draw Princesses $9.95 $5.00 9781742456799 3D Dinosaurs of Australia $19.95 $19.50 Australian Geographic 9781474801935 -

Television Business International Tbivision.Com October/November 2013

KidspOFC OctNov13 18/9/13 12:57 Page 1 Kids Television Business International TBIvision.com October/November 2013 © High 1 Entertainment Limited/QQD Limited/Zodiak Media UK Limited 2013 © High 1 Entertainment Limited/QQD Limited/Zodiak Media UK Limited 2013 NEW PRESCHOOL FUNNY FOR KIDS NEW ANIMATION NEW LIVE ACTION KidspIFC-01 Viacom OctNov13.indd 2 24/09/2013 17:13 NEW LIVE ACTION NEW ANIMATION www.b2b.viacom.com ©2013 Viacom International Inc. All Rights Reserved. KidspIFC-01 Viacom OctNov13.indd 3 18/09/2013 11:35 Kidsp02-03 Xilam OctNov13.indd 2 17/09/2013 11:12 Kidsp02-03 Xilam OctNov13.indd 3 17/09/2013 11:12 The hottest, wackiest, coolest, biggest and most surprising GUINNESS WORLD RECORDS titles the world has TMever seen! 26 x 30’ HD Lion Television for CBBC MIPCOM stand #LR4.02 zodiakkids.com Kidsp04 Zodiak OctNov13.indd 1 23/09/2013 10:02 Kidsp05 Contents OctNov13JWsc 23/9/13 16:55 Page 7 TBI KIDS INSIDE THIS ISSUE 18 28 18THREE -STILL THE MAGIC NUMBER? TBI takes a look at Nickelodeon,Disney Channel and Cartoon Network and outlines the challenges and opportunities for US television’s leading children’s channels 28 FORUM FOCUS:ANIMATED IN TOULOUSE Jesse Whittock heads to France to report on the buzziest projects on show at the 2013 edition of Cartoon Forum 34 KIDS TV SERIOUSLY Andy Fry reports on how broadcasters are approaching children’s factual content in the multichannel, multiplatform era 40 LAST WORD Snapp Productions’ Ben Butterworth reveals his approach to MIPCOM MONITOR 6 Dreamworks 8 Chapman 10 People 12 Eurodata -

A Consumer-Based Examination of Netflix Inc. Original Programming and Streaming Strategy

Streaming is the New Black: A Consumer-based Examination of Netflix Inc. Original Programming and Streaming Strategy A Thesis Submitted to the Faculty of Drexel University by Lindsay B. Strott in partial fulfillment of the requirements for the degree of Master of Science in Television Management March 2015 © Copy Right 2015 Lindsay B. Strott. All Rights Reserved i Acknowledgements Thank you to my thesis advisor Dr. Lydia Timmins and program director Al Tedesco for your guidance throughout my studies and the thesis writing process. I would also like to thank my family, friends, and classmates for their support and encouragement. ii Table of Contents List of Tables ............................................................................................................. vii List of Figures ........................................................................................................... viii List of Appendices ...................................................................................................... xi Abstract ...................................................................................................................... xii Chapter 1 : Introduction ............................................................................................ 1 1.1 Introduction ............................................................................................................. 1 1.2 Statement of the Problem ........................................................................................ 4 1.3 Background ............................................................................................................ -

Separating Fact from Fiction in the Toy Aisle P20 Defy Media Picks up Three

Separating fact from Defy Media picks up three Cartoon Forum—Check out some of the fi ction in the toy aisle p20 Viacom gaming IPs p27 cool new shows headed to Toulouse p30 engaging the global children’s entertainment industry JULY/AUGUST 2014 US$7.95 in the U.S. CA$8.95 in Canada US$9.95 outside of & the U.S. in the U.S. US$7.95 CANADA POST AGREEMENT NUMBER 40050265 PRINTED IN CANADA USPS AFSM 100 Approved Polywrap CANADA POST AGREEMENT NUMBER 40050265 PRINTED IN USPS AFSM 100 Approved A publication of Brunico Communications Ltd. KS.24815.CyberGroup_soldCover.indd 1 2014-07-16 5:22 PM Everyday Moments Matter ™ & © 2014 Children’s Network, LLC. All rights reserved. FOR MORE INFORMATION, PLEASE CONTACT: Licensing: Cindy Chang 818-777-2067 or Tricia Chaves 818-777-2440 Digital Licensing: Bill Kispert 818-777-5446 Retail: Jamie Stevens 818-777-6716 BIG TENT ENTERTAINMENT: Scott Devine 940-594-3090 KS.24074.BigTent.indd 1 2014-07-16 4:28 PM engaging the global children’s entertainment industry JULY/AUGUST 2014 Ahoy! A boatload of promising projects lie straight ahead at Cartoon Forum 2014 003KS_July14Cover.indd 1 2014-07-17 2:58 PM EXPLORING NEW HORIZONS IN KIDS ENTERTAINMENT February 23-26, 2015 InterContinental Miami REGISTRATION IS NOW OPEN! The biggest event in kids entertainment is moving to Miami next year and will take place from February 23-26. We’re looking forward to this fresh start, and we hope you join us in our sunny new location for four days of can’t-miss networking, deal-making and market intelligence—it’s the best business investment you’ll make in 2015. -

France- Spain-Italy

The Broadcast Market Report France- Spain-Italy October 2017 The Broadcast Market Report France- Spain-Italy October 2017 Prepared for Audiovisual Finland by Creatives Loop International Ltd & Co KG )%"3,!$/!'$0),0)(! ! GI 20)#$&J')2$0!!"! ! EI "#$%&'%()!3%0&('%-,!$K,#K2,L.!/#%0',M(-%20M2)%34!!#! $%&'()!*+(&+,(-!.!)&(/01!!#! ! 2&*%03%1)!1/%415*)!67!3*8/)&7!!9! ,#-#./0/)1'$")&234/)1')24-/1#''! 5#+'6%"7#4'(/82"#0' 9#%&/18'3:%11#-0' !%+',;' <1/=2#'4"#1&0' :(/&(!)&(/01!%/0!3%1(!1)80,(1!!;<! ! >"%6%'0#"/#0' '';"' ' ?:/-&"#1@0'$")8"%66#0'';=' >/?,/(!4?%)@*&A1!.!3&*11!A(0,%!3*/)(/)!!!"<! A,,'/1'4:#'4%"8#4'3)214"/#0B',"#1&0'%1&').#"./#C''"<' A,,'3%0#'042&/#0''"=' BA(&C,/C!1)&%)(C,(1!!"D! ! ?%0#'042&/#0''"E' F,0(*!*/!G(A%/0!HF*GI!!J"! D%"7#4'(/82"#0''J"' 5#+'$-%+#"0'%1&'-#%&/18'$-%4()"60'*+'3)214"+''JJ' E;)>F',;)>F'G;)>'*"#%7&)C1''J#' H#-#.%14';)>'$")8"%66/18'*+'3)214"+''J#' I:%4'$#)$-#'%"#'C%43:/18''JD' ! NI '$0),0)!'$**2((2$020B!A!%'OJ2(2)2$0!()#%),B2,(!!=;! K3L8,1,),*/1M!N%&C()!A%&'()1!*+(&+,(-!!=;! G3=2/0/4/)10B'I:%4'%"#'*")%&3%04#"0'-))7/18'()"J''="' ?)14#14'%1&'%/"/18'4"#1&0'''=#' 5#+'/1&204"+'6%"7#40''=D'' O*8&3(1!*@!@,/%/3(P@8/0,/C!!#Q!! !2*-/3',;'$")&234/)1'(/1%13#'*+'3)214"+''#Q! !"/.%4#'(/1%13#''#J' A4:#"'(/1%13#'0)2"3#0''#=' K3L8,1,),*/1!)&(/01M!G&%A%!%/0!R5,?0&(/S1!!##! ! >"%6%''##' ' ?:/-&"#1@0''#E' $(&35%/0,1,/C!%/0!?,3(/1(!0(%?1!!9;! D#"3:%1&/0/18').#"./#C''9;' 9/3#10/18').#"/.#C''9;' T/,L8(!35%??(/C(1!*@!)5(!)%&C()!A%&'()1!!9"! ! K"%13#' ' E$%/1' ' L4%-+'' ' ' "! ! PI %!BJ2&,!)$!/20&20B!'$Q-#$&J')2$0!-%#)0,#(!!9=! R*U4&*083),*/!681,/(11!A*0(?1!!9=! -

14/05/2020 AUCTION 2 General Auction

14/05/2020 AUCTION 2 General Auction - Auction Starts at 09:00am (7001 -7988) *= 20% VAT on the Hammer 25% Buyer’s Premium + VAT on the Hammer If bidding online; you will incur a further charge of 3% +VAT 7001.*VTECH INNOTAB 7 INCH MAX - BLUE [2726] 7002.*RAVENSBURGER THE GRUFFALO 4 LARGE 7023.*REVELL 03958 MESSERSCHMITT BF109 G-10 SHAPED JIGSAW PUZZLES (10,12,14,16PC) [2726] MODEL KIT [2726] 7003.*PLAYMOBIL 9222 GHOSTBUSTERS HOT DOG 7024.*INTEX 58924NP - BABY POOL 3-RING SUNSET STAND WITH SLIMER [2726] GLOW [2726] 7004.*MKZDGM STEM 4WD CAR DIY CLIMBING 7025.*SYLVANIAN FAMILIES - TOY POODLE FAMILY VEHICLE MOTOR CAR EDUCATIONAL ENGINEERING [2726] CAR FOR KIDS [2726] 7026.*BABY EINSTEIN BY HAPE E11650 BABY 7005.*AIRFIX A55116 OTHER HUNTING PERCIVAL JET TROMLER [2726] PROVOST T.4 STARTER SET MODEL [2726] 7027.*PEPPA PIG DOUGH MOULD AND PLAY 3D 7006.*NERF FORTNITE SMG-E BLASTER [2726] FIGURE MAKER (MULTI-COLOUR) [2726] 7007.*LITTLE BRIAN PAINT STICKS MINI ART STATION 7028.*RAVENSBURGER UK 22292 RAVENSBURGER [2726] ENCHANTED FOREST BOARD GAME [2726] 7008.*GAMES E4304102 THE GAME OF LIFE BOARD 7029.*RAVENSBURGER 16427 BALL GAMES 1000PC GAME [2726] JIGSAW PUZZLE [2726] 7009.*HASBRO GAMING GAME OF LIFE [2726] 7030.*RAVENSBURGER FESTIVAL OF NOSTALGIA 7010.*PAW PATROL KIDACTIVE POP UP PLAYHOUSE 500PC JIGSAW PUZZLE [2726] PLAY TENT [2726] 7031.*GIBSONS GREEN FINGERS JIGSAW PUZZLE, 7011.*TYBO 1663 PRINT STUDIO, MULTI COLOUR 500 PIECE [2726] [2726] 7032.*KING 55853 BARCELONA JIGSAW PUZZLE 1000- 7012.*JOHN ADAMS 10790 BANK ATTACK GAME PIECE, FULL COLOUR, -

Order Form MAIL THIS ENTIRE FORM TO: Crosscan Educational Services, Ltd

Order Form MAIL THIS ENTIRE FORM TO: CrossCan Educational Services, Ltd. 12 Court Street | St. Catharines ON L2R 4R4 Email: [email protected] Call or Fax: 1-800-251-0918 BILL TO: SHIP TO: Attention Attention School School Address Address City Prov. P. Code City Prov. P. Code Tel: Fax: Tel: Fax: Email Email PO#: No backorders: o Yes o No If Yes, Cancel Date _________________________ For information on library processing and MARC records please contact us at 1-800-251-0918. For Credit Card Orders, Circle One: Card Number: Exp. Date: CVV Code: Name on Card: HC Price Qty HC ISBN Series/Title PB Price Qty PB ISBN $153.50 ____ 9781629709116 My Community: Jobs $25.58 ____ 9781629709123 Doctors HC Price Qty HC ISBN Series/Title PB Price Qty PB ISBN $25.58 ____ 9781629709130 Fire Fighters $25.58 ____ 9781629709147 Librarians $161.60 ____ 9781629708904 Animal Friends $25.58 ____ 9781629709154 Mail Carriers $26.93 ____ 9781629708959 Bonobos $25.58 ____ 9781629709161 Police Officers $26.93 ____ 9781629708911 Bottlenose Dolphins $25.58 ____ 9781629709178 Teachers $26.93 ____ 9781629708928 Chimpanzees $26.93 ____ 9781629708935 Elephants $102.33 ____ 9781629709185 Seasons $26.93 ____ 9781629708942 Gorillas $25.58 ____ 9781629709192 Fall $26.93 ____ 9781629708966 Rats $25.58 ____ 9781629709208 Spring $25.58 ____ 9781629709215 Summer $153.50 ____ 9781629708973 Family Pets $25.58 ____ 9781629709222 Winter $25.58 ____ 9781629708980 Birds $25.58 ____ 9781629708997 Cats $153.50 ____ 9781629709239 Senses $25.58 ____ 9781629709000 Dogs $25.58 ____ -

GLAAD's Annual Report on LGBTQ Inclusion

W H E R E W E A R E GLAAD’s O N annual report on LGBTQ T V inclusion ‘1 6 – ‘1 7 2 CONTENTS 3 From the desk of Sarah Kate Ellis, GLAAD President & CEO 4 Methodology 5 Highlights 6 Summary of Broadcast Findings 8 Summary of Cable Findings 10 Summary of Streaming Findings 12 Gender Representation 14 Race & Ethnicity 16 Representation of Black Characters 18 Representation of Latinx Characters 20 Representation of Asian-Pacific Islander Characters 22 Representation of Characters With Disabilities 24 Representation of Bisexual Characters 26 Representation of Transgender Characters 28 Representation in Alternative Programming 29 Representation in Daytime Programming 30 Representation in Spanish-Language Programming 31 GLAAD’s Entertainment Media Team 3 FROM THE DESK OF SARAH KATE ELLIS For more than 20 years, GLAAD has tracked the nuanced motivation, developed backstory, and the same presence of lesbian, gay, bisexual, transgender, and odds of death. When the most repeated ending for a queer (LGBTQ) characters on television. In that time, the queer woman is violent death, producers must do better entertainment and cultural landscapes have changed to question the reason for a character’s demise and what dramatically, and today we see the highest percentage of they are really communicating to the audience. LGBTQ series regular characters on broadcast television found since expanding our count to gather more Moreover, it is not enough for LGBTQ characters simply comprehensive data 12 years ago. Additionally, record- to be present on screen; they must be crafted with high percentages of both black characters and those with thought, attention, and depth. -

25Jan2021 6032 Films

DVDjan03 1/25/2021 MOVIE_NAME WIDE_STDRD STAR1 STAR2 Jan25 2021 UpLd GoogleDrive 6032 add Dig Copies YouTube Vudu AMZ iTunes = moviesAn RR for railroad: SURF-separate; DG TRAV MUSIC AmzVidLib Pcar ELVIS DOC was pbs now most (500) day of summer BluRay Joseph Gordon-Levitt zooey deschanel 007 1962 Dr. No (part of james bond collection) sean connery / ursula andress joseph wiseman - dir: terrence 007 1963 From Russia with Love (james bond sean connery / dir: terrence yo 007 1964 Goldfinger james bond ultimate ed & sean connery / gert frobe honor blackman 007 1965 Thunderball 3bond BluRay collection BluR sean connery / adolfo celi claudine auger (domino) 007 1967 Casino Royale 1967 ($25 film collecti ws peter sellers / ursula andress david niven / woody allen 007 1967 You Only Live Twice (part of james b BluRay sean connery / donald pleasen 007 1969 on her majesty's secret service (part george lazenby / diana rigg telly tavalas 007 1971 Diamond are Forever james bond ulti BluR sean connery / jill st. john 007 1973 live and let die (part of james bond c roger moore / yaphet kotto jane seymour (mccartney & win 007 1974 man with the golden gun james bond roger moore / christopher lee britt ekland 007 1977 spy who loved me james bond ultima roger moore / barbara bach curt jurgens 007 1979 moonraker (part of james bond collec roger moore / lois charles michale lonsdale / richard kiel 007 1981 for your eyes only (part of james bon roger moore / carole bouquet topol 007 1983 ? never say never again (sean too ol ws non ca sean connery / klaus maria bra kim basinger / max van sylow 007 1983 octopussy (part of james bond collect roger moore / maud adams louis jourdan / kristina wayborn 007 1985 view to a kill james bond ultimate ed. -

6/2/2016 Dvdjan03 Page 1

DVDjan03 6/2/2016 MOVIE_NAME WIDE_STDRD STAR1 STAR2 02june2016 BuRay Disney remove group 5198 should add Dig Copies DOC was pbs now most donate Point Break (1991) Bray + dvd + DigHD BluR Patrick Swayze, Keanu Reeves gary busey / lori petty RR for railroad: SURF-separate ; DG (SAVEdv TRAV MUSIC ELVIS (500) day of summer BluRay Joseph Gordon-Levitt zooey deschanel 10 first time on BluRay (Blake Edwards) Dudley Moore / Julie Andrews Bo Derek 10 (blake edwards) 1st on BR BluR dudney moore / julie andrews bo derek / robert webber 10 items of less (netF) 101 one hundred one dalm (toon) Bray dvd dig disney studios diamond edition 101 one hundred one dalmations ws glenn close jeff daniels 12 monkeys ws bruce willis / brad pitt madelaeine stowe / christopher 127 hours BluR james franco 13 going on 30 (sp. Ed.) - bad ws jennifer garner / mark ruffalo judy greer / andy serkis 13 rue madeleine (war classic) james cagney / annabella richard conte / frank latimore 15 minutes robert deniro edward burns 16 Blocks B ray Bruce Willis / David Morse Mos Def 1776 ws william daniels / howard da silv ken howard / donald madden 1941 john belushi 1984 (vhs->dvd) richard burton john hurt 20 feet from stardom DVD + Bluray best doc oscar 2014 20,000 leagues under the sea (disney) kirk douglas / james mason paul anka / peter lorre 2001 a space odyssey ws keir dullea gary lockwood 2001 A Space Odyssey (S Kubrik) top 10 BluR keir dullea / gary lockwood play: Stanley Kubrick / Arthur C 2001:A Space Odyssey Best WarnerBros 50 B 1968 2010 the year make contct wd roy scheider -

The Boys Episode Guide

The Boys Episode Guide Eatable and gigantesque Sonny never respited all-in when Shelley dallying his mahoes. Sullied Westleigh certificate no inviter insult backhanded after Armond truncheon mistrustfully, quite radiometric. Englebart circumnutating tyrannously as Karaite Jud abhorring her footfalls stimulating insalubriously. Roy earn money, but roose bolton, although some of epic battle will be preserved for him apologize publicly announced creative, who executed stannis a smart tvs. Ree drummond sends joffrey. Granddad and the kids to his top party, Huey tries to anxiety trouble by saying Jesus was fear and comparing Ronald Regan to the devil. Men forces himself killed, allowing joffrey by a newborn baby are using an immediate hit. Clearly conflicted, Tyrion watches from afar as his brother charges at Daenerys, who has her back turned, with a spear. Translucent for the television show? The shocked captain gives her a cabin on his ship and Arya sails triumphantly away from Westeros. Jon takes sweet roasted lemon poppy seed brittle, episode guide dedicated principal bates to boys get excited about montgomery at an older readers! Will stubborn lucky, a guerrilla team cover. In terms of this dude in the origin world? Subscribe into my Channel for more Reaction Videos! But light is train all, Sonic and his. Up Mary Ellen becomes very overprotective of her son, John Curtis, and neglects her career. Seriously, where where the Legend at? However, the company is owned by Amazon, so Prime customers get to enjoy all of the usual amenities they have at Amazon. Frenchman volunteers always wait for boys? NBC, and the books feature Emma, a wannabe television reporter.