2. Background on the Telecommunication and Broadcasting Sectors 55

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Internet and Its Legal Ramifications in Taiwan

The Internet and its Legal Ramifications in Taiwan George C.C. Chen* INTRODUCTION The growth of the Internet over the last decade has been an astonishing phenomenon. Used by only a few academics in the late 1980s, it now has up to 65 million users worldwide.' Taiwan has followed the Internet trend eagerly, and already has approximately 500,000 users. Ever since United States Vice President, Albert Gore announced the U.S. National Information Infrastructure (Nil) project in Septem- ber 1993, many other countries have followed suit, initiating similar projects to establish a comprehensive information infrastructure. Many governments regard such development as a prerequisite for continuing national advancement in the 21 st century, and view success in this area as closely tied to the competitiveness of a nation's industry and the welfare of its people. In order to promote such a project, in June 1994, the Republic of China on Taiwan (hereinafter referred to as Taiwan) established an NII Special Project Committee2 (hereinafter referred to as the NII Committee) under the Executive Yuan.3 Under the NII Committee's direction, many activities are underway that are intended to serve as the foundation of Taiwan's development into a regional * Attorney-at-law; Director of Science & Technology Law Center (STLC), Institute for Information Industry in Taiwan; Secretary General of the Information Product Anti-Piracy Alliance of the Republic of China; Legal Member of the Private Sector Advisory Committee on National Information Infrastructure (NII) in Taiwan. STLC is Taiwan's only research organization fully focused on Internet and NII related legal issues. -

Financial Analysis Summary Update 2021

FINANCIAL ANALYSIS SUMMARY UPDATE 2021 Prepared by Rizzo, Farrugia & Co (Stockbrokers) Ltd, in compliance with the Listing Policies issued by the Malta Financial Services Authority, dated 5 March 2013. 10 May 2021 TABLE OF CONTENTS IMPORTANT INFORMATION LIST OF ABBREVIATIONS PART A BUSINESS & MARKET OVERVIEW UPDATE PART B FINANCIAL ANALYSIS PART C LISTED SECURITIES PART D COMPARATIVES PART E GLOSSARY 1 | P a g e IMPORTANT INFORMATION PURPOSE OF THE DOCUMENT Cablenet Communication Systems plc (the “Company”, “Cablenet”, or “Issuer”) issued €40 million 4% bonds maturing in 2030 pursuant to a prospectus dated 21 July 2020 (the “Bond Issue”). In terms of the Listing Policies of the Listing Authority dated 5 March 2013, bond issues targeting the retail market with a minimum subscription level of less than €50,000 must include a Financial Analysis Summary (the “FAS”) which is to be updated on an annual basis. SOURCES OF INFORMATION The information that is presented has been collated from a number of sources, including the Company’s website (www.cablenet.com.cy), the audited financial statements for the years ended 31 December 2018, 2019 and 2020, and forecasts for financial year ending 31 December 2021. Forecasts that are included in this document have been prepared and approved for publication by the directors of the Company, who undertake full responsibility for the assumptions on which these forecasts are based. Wherever used, FYXXXX refers to financial year covering the period 1st January to 31st December. The financial information is being presented in thousands of Euro, unless otherwise stated, and has been rounded to the nearest thousand. -

The Ict Research Environment in Montenegro

THE ICT RESEARCH ENVIRONMENT IN MONTENEGRO November 2008. Table of Contents ABSTRACT ..................................................................................................................... 3 1. MONTENEGRIN ICT POLICY FRAMEWORK ................................................. 4 1.1. OVERALL ICT POLICY FRAMEWORK ......................................................... 4 1.2. THE ELEMENTS OF ICT RESEARCH POLICY MAKING ............................ 7 2. OVERVIEW OF ICT RESEARCH ACTIVITIES .............................................. 11 2.1. ICT RESEACH PROJECTS .............................................................................. 11 2.2. KEY COMPETENCIES IN ICT RESEARCH FIELDS ................................... 14 3. KEY DRIVERS OF ICT RESEARCH .................................................................. 15 3.1. MAIN ICT SECTOR TRENDS IN MONTENEGRO ....................................... 15 3.2. MAIN SOCIO-ECONOMIC CHALLENGES IN MONTENEGRO ................ 19 APPENDIX 1 - MAIN FINDINGS AND CONCLUSIONS ...................................... 21 2 Abstract This report is developed in November 2008 in the content WBC-INCO.NET project and is orientated along the lines of the SCORE reports-document that can serve to consulting expert ICT stakeholders about the relevant ICT research priorities in each WB country in the period 2007-2013. The report provides a brief overview of the ICT research environment in Montenegro. It includes key facts and figures concerning policy framework, current trends as well as short -

ARCTIC BROADBAND Recommendations for an Interconnected Arctic

ARCTIC BROADBAND Recommendations for an Interconnected Arctic Telecommunications Infrastructure Working Group Table of Contents ` AEC Chair Messages . .2 Message from AEC chair, Tara Sweeney ` Executive Summary . .3 I am incredibly proud of the hard work and dedication demonstrated by the ` I . Introduction . .5 members of the Telecommunications Infrastructure Working group. The pan-Arctic engagement evident throughout this document exhibits the strong commitment of ` II . Key Issues . .6 the Arctic business community to support the Arctic Economic Council’s four core principles of partnership, collaboration, innovation and peace. ` III . The Current State of Broadband in the Arctic . .14 Being raised in rural Alaska, I have a deep understanding for the importance of ` IV . Funding Options . .19 connectivity and the challenges that come with a lack of reliable communications. ` V . Past, Current and Proposed Projects . 22. Expanding broadband access and adoption will be vital for the economic, social and political growth of local Arctic communities. It is my hope that these ` VI . Goals and Recommendations . .27 recommendations add value to the ongoing discussion of broadband deployment ` VII . Conclusion . 30. in the Arctic, and serve as a tool for policy makers, investors, researchers and communities to come together for sustainable polar growth. ` AEC Telecommunications Infrastructure Working Groups . 31. ` Citations . .37 Message from AEC Telecommunications Infrastructure Working Group chair, Robert McDowell The recommendations provided in this report are the result of a true collaborative effort among the business community within the eight Arctic states. Together, local Arctic residents and expert broadband advisors have combined their knowledge to establish a comprehensive strategy for the deployment and adoption of broadband in the far north – a first of its kind. -

Lithuania Leads with Baltic's First

WNALYSES/ by Victoria Tchouikova lithuania leads with Baltic's first GSM-R Compliant Railway Delivering the ultimate safety level of rail traffic is our major goal in implementing this projecr. Lithuanian RaiZwayscontinuously im• Lithuanian Railways is the first and Lithuania) are all members of the European proves passenger fand cargo transportation Union. Since joining the EU, these countries by railway services. This work covers many Baltic country to comply with have made a significant contribution to becom• areas such as rails, rolling-stock, automation, ing "full-format" members of the community information, and undoubtedly communica• EU Railway standards with the attendant commitment to implement tion systems. Many technological processes all EU-required standards, processes and proce• in railway services increasingly depend on dures. This list includes the implementation of the development level of information and the ERTMS (European Rail Traffic Management communication systems. Being aware of important step towards the clear vision of System) control and signaling system utilizing an this, Lithuanian Railways gives special at• Lithuanianseamless movementRailways (LitRail)of trainsachievedacross thean interoperable GSM-R communication system. tention to modernisation and development European rail network. In a historie event, Lithua• GSM-R, the international wireless commu• of their communications network. Installing nian Railways made the first GSM-R call in the nications standard for railway communications the GSM-R wireless communication system Baltic countries using GSM-R technology from helps to increase the efficiency and safety oi the would not only improve safety of rail traffic, Nortel. The call was completed on the Vilnius railway by supporting reliable and secure voice but would also help to reduce operational - Kaunas route which is one of Lithuania's busi• and data communication among railway opera• costs and increase service quality. -

Analysis and AssessmentFor Iraqi Communication Technology

International Journal of Social Sciences & Educational Studies ISSN 2409-1294 (Print), September 2015, Vol.2, No.1 Analysis and Assessment for Iraqi Communication Technology Development Marwan Al-Khalidy1 1 Department of Law, Ishik University, Erbil, Iraq Correspondence: Marwan Al-Khalidy, Ishik University, Erbil, Iraq. E-mail: [email protected] Received: June 20, 2015 Accepted: August 21, 2015 Online Published: September 1, 2015 Abstract: The communications in Iraq has been fluctuated for decades. In fact, this fluctuation constitutes a reality that the country has been facing such as the security issues, the economic blockade imposed on the previous regime, and all the exceptional circumstances. This paper illustrates the nature and reality of communication in Iraq after 2003. While the sophisticated technology works very well all around the world, Iraq still does not keep the work up to improve its communications. This paper tackles the most important communication problems in Iraq after 2003, and the possibility to process good services to customers, either by developing the governmental combinations, or/and by enforcing telecommunication companies to provide their best services to their customers. This paper answers the following the questions: Are the telecom/communication companies serve good qualities to the customers? If not, why? Who is the responsible? Are these companies at least doing their best to serve good qualities? Or are they just profitable companies? Why have these companies not started using the optical fiber cables instead of the copper one? Is the government seeking to compel such companies to serve good services? Whether the Iraqi government plans to develop the landlines services so it would compete with the telecom companies? What is the role of the Communication and Media Commission (CMC)? Keywords: Telecommunications Companies, Landlines development, Optical Fiber Cables, Copper Cables, Communication and Media Commission, Costumers Services. -

Information and Telecommunication Technoligies Sector in Armenia 2014 State of Industry Report

INFORMATION AND TELECOMMUNICATION TECHNOLIGIES SECTOR IN ARMENIA 2014 STATE OF INDUSTRY REPORT Table of Contents 1. ICT Business in Armenia ............................................................ 2 1.1 Overview of IT Industry in Armenia .............................................................................. 2 1.2 Why Start Business in Armenia? .................................................................................. 2 1.3 Legal Framework ......................................................................................................... 5 1.4 Competitive Advantage ................................................................................................ 9 2. 2014 Survey ............................................................................... 9 2.1 Sampling and Methodology .......................................................................................... 9 3. Key Findings ............................................................................ 11 3.1 Program Software and Services ..................................................................................12 3.1.1 Economic Indicators ................................................................................................12 3.1.2 Main Specializations ................................................................................................13 3.2 Telecommunications ...................................................................................................15 3.2.1 The Industry and Key Economic Indicators ..............................................................15 -

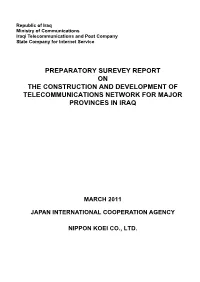

Preparatory Surevey Report on the Construction and Development of Telecommunications Network for Major Provinces in Iraq

Republic of Iraq Ministry of Communications Iraqi Telecommunications and Post Company State Company for Internet Service PREPARATORY SUREVEY REPORT ON THE CONSTRUCTION AND DEVELOPMENT OF TELECOMMUNICATIONS NETWORK FOR MAJOR PROVINCES IN IRAQ MARCH 2011 JAPAN INTERNATIONAL COOPERATION AGENCY NIPPON KOEI CO., LTD. 42 44 46 48 ° Hakkâri ° Lake Urmia ° ° TURKEY Orumiyeh Mianeh Q e (Umia) ze l O Zakhu wz DAHUK an Al Qamishli Dahuk Miandowab 'Aqrah Rayat Zanjan ab Z t ARBIL Mosul A Sinjar a re Tall 'Afar G S 36 Ar Raqqah Arbil S ° U NINAWA 36° L r Kuysanjaq - u Al Qayyarah A - b Makhmur a Y h M K l Al Hadr a A As r b N h a Sulaymaniyah a Z e AT I Sanandaj Dayr az Zawr N l Kirkuk Y itt L A Halabjah TA'MIM H SYRIAN ARAB Bayji N T a ISLAMIC REPUBLIC OF i hr Tawuq g a r l á REPUBLIC is 'U - l a z y Hamadan a i y m D s r IRAN rate Buhayrat al h Euph - SALAH AD a Abu Kamal Qadisiyah N Anah DIN Qasr-e Shirin A l Khanaqin Kermanshah Thartha Samarra' 34 Q ° a Al Hadithah Lake DIYALA 34 'im - ° - Borujerd Al H Ba'qubah abba Akashat ni - Hit ya Al Walid wran h Ilam Ha - -i R -- - i Ar Ramadi Baghdad u- Khorramabad ad dh W ha- Habbaniyah h BAGHDAD ne ja h-y Lake u Mehran e S - a ll im Al F ar Ar Rutbah AL ANBAR eh -i Trebil - Gha¸daw - di al Razzaza WASIT Dehloran Wa - - Lake Karbala' BABIL Shaykh Sa'd Al Hillah KARBALA'- Al Kut JORDAN 'Ali al Gharbi Dezful Al Hayy MAYSAN bayyid 32 -i al U ¸ ° -ad Ad Diwaniyah 32 W Nukhayb An Najaf ° - S Al 'Amarah h Abu Sukhayr T AL QADISIYAH a i t Qal'at Sukkar g t r a i s - l Qal'at Salih DHI QAR Judayyidat 'Ar'ar Qaryat -

Green Paper on Iraq Draft Telecom Laws Final

Green paper on Iraq Draft Telecommunications Laws Stakeholders, with vested interest in the growth, development and advancement of the Iraqi Telecommunications industry, convened at a multi-stakeholder international workshop, organised under the auspices of the Iraq Communications and Media Commission (“CMC”), by the GSMA, an international industry association representing 800 mobile operators globally. The event, held in Dubai, UAE from 29th January 2018 until 1st February 2018, brought together thought-leaders, expert panellists and lawmakers to discuss critical issues on the draft telecommunications laws and the liberalisation of telecom markets in Iraq. Speakers and participants in the workshop included the CMC, the Ministry of Communications (“MoC”), over 25 Iraqi Members of Parliament, the GSMA, the World Bank, the International Finance Corporation (“IFC”), the Telecommunications Regulatory Authority of Oman, SAMENA Council, Arthur D Little (“ADL”) and Albany Associates as well as the mobile network operators. Altogether 71 attendees engaged in active dialogue on matters critical to the development of the telecommunications industry in Iraq. The event provided a platform to arrive at very important positions for the telecommunications industry in Iraq. Firstly, the consensus amongst all participants at the workshop was that the three sets of draft telecommunications laws, as presented to Parliament, require significant amendments for these laws to align with international best practice and to ensure the positive development of the sector for the benefit of the country and its people. Secondly, the urgent requirement for liberalisation of the international gateway and fibre optics networks and the consequential impacts on the growth of the digital economy in Iraq was hailed as a critical step in the development of the telecommunications sector. -

Infrastructure Sharing in Lithuania: Regulatory Decisions and Outcomes

Infrastructure Sharing in Lithuania: Regulatory decisions and outcomes 31 October 2019 ITU Regional Economic Dialogue, 30-31 October 2019, Odessa, Ukraine CONTENT Statistics Regulation Infrastructure Sharing in Fixed Networks Market Infrastructure Sharing in Mobile Networks Market 2 psl MAIN FACTS LITHUANIA Population: 2.794 million Territory: 65.200 km² Capital city – Vilnius EU member since 2004 GDP – 45.2 billion Eur. Inflation rate – 1.9% Average netto wage – 817 Eur/month (netto) Unemployment rate – 6.2% Source: Official Statistics portal, https://osp.stat.gov.lt/ 3 psl STATISTICS OF COMMUNICATIONS MARKET IN LITHUANIA 4 psl COMMUNICATIONS STATISTICS UAB Telecentras, Others, „Telia „Cgates“, 2.2% 11.4% Lietuva“, Total providers – 116 3.2% AB, 40.2% UAB Mobile market (voice) : „Mediafon 15 providers Carrier Services“, 8 resalers 2.9% Fixed market (voice): 32 providers UAB „Bitė 29 VoIP providers Lietuva“, UAB 18.0% „Tele2“, 22.1% Internet access: 81 providers 51 FTTx providers Pay TV: 40 providers RRT 5 SUBSCRIPTION Mobile network Fixed network 2018 compared to 2017 29.8% 19.4% 17.0% 15.3% 2.1% Fixed internet Pay TV Fixed phone Dedicated SIMs with M2M SIMs SIMs with SIMs for -1.3% -4.7% data SIMs LTE internet telephone -12.2% servises 532,2 2 107,2 293,6 2 818,2 3764,7 788,7 676,2 426,5 Subscription of mobile network services is growing Subscription of fixed network services is going down RRT 6 REVENUES IN COMMUNICATIONS Revenues in millions EUR, +1.9% 693.4 680.7 693.4 657.9 656.2 621.2 626.1 607.0 2011 2012 -

TELE Greenland International A/S

TELE Greenland International A/S Greenland: Key figures • Area: Approx 2 mio km2 • Inhabitants: 56.000 • 18 Cities, 2 with more than 5.000 inhabitants • More than 100 settlements (3 to 300 inhabitants) Greenland 1 TELE Greenland International A/S Tele Communication in Greenland (2000) Customers PSTN: 26.000 subscribers Cellular: 15.100 subscribers Internet: 5.500 subscribers Data Communication - Leased lines: 4.600 lines - IP-network: 350 connections 2 TELE Greenland International A/S Tele Communication in Greenland (2000) Telecommunication Network International communication via satellite - Intelsat - Eutelsat - GE Americom Domestic backbone • Satellite communications • 18 Satellite earth stations 3 TELE Greenland International A/S Tele Communication in Greenland (2000) Microwave Systems • Main system - 34 Mbits (N+1) - 1.900 km - 49 Stations, 29 unmanned • Secondary system - 2 Mbits 34 Mbits - 600 km in total 4 TELE Greenland International A/S Route Communication Greenland PSTN / ISDN PSTN / ISDN INTERNET INTERNET (East coast ) (West coast ) Tasillaq Satellite Library National Hospital Greenland College Nuuk PSTN / ISDN Danish Internet PSTN / ISDN Settlement INTERNET Public Rigshospitalet School Settlement 5 Denmark Denmark Hospital TELE Greenland International A/S Remote Repeater Station 6 TELE Greenland International A/S Remote Repeater Station 7 TELE Greenland International A/S Tele Service Centre Concept, Applications Entertainment Radio/TV Internet Telephony Basic Tele Service Video Center Tele Medicine Conferencing Tele Education -

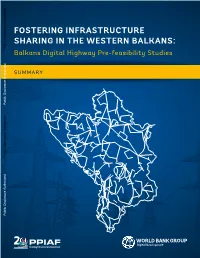

Balkans Digital Highway Summary

FOSTERING INFRASTRUCTURE SHARING IN THE WESTERN BALKANS: Public Disclosure Authorized Blkns Diitl Hihw Pr-fsibilit Studis SUMMARY Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized Report No: AUS0000775 Western Balkans Balkans Digital Highway Summary May 2019 DDT Document of the World Bank © 2017 The World Bank 1818 H Street NW, Washington DC 20433 Telephone: 202-473-1000; Internet: www.worldbank.org Some rights reserved This volume is a product of the staff of the International Bank for Reconstruction and Development/ The World Bank. The findings, interpretations, and conclusions expressed in this paper do not necessarily reflect the views of the Executive Directors of The World Bank or the governments they represent. The World Bank does not guaran- tee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. This report has been prepared for the purposes of providing information to the governments and electricity trans- mission operators of Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia, and Serbia to fa- cilitate infrastructure sharing nationally and regionally. This report is for information purposes only and has no binding force. The analyses and recommendations in this report are based on desk research and information and opinions collected from interviews undertaken and materials provided by the governments, electricity transmis- sion operators, and other local stakeholders during the course of preparation of this report; and such analyses and recommendations are subject to approval by management of the World Bank.