May 11, 2020 the Honorable Gene L. Dodaro

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

August 10, 2021 the Honorable Nancy Pelosi the Honorable Steny

August 10, 2021 The Honorable Nancy Pelosi The Honorable Steny Hoyer Speaker Majority Leader U.S. House of Representatives U.S. House of Representatives Washington, D.C. 20515 Washington, D.C. 20515 Dear Speaker Pelosi and Leader Hoyer, As we advance legislation to rebuild and renew America’s infrastructure, we encourage you to continue your commitment to combating the climate crisis by including critical clean energy, energy efficiency, and clean transportation tax incentives in the upcoming infrastructure package. These incentives will play a critical role in America’s economic recovery, alleviate some of the pollution impacts that have been borne by disadvantaged communities, and help the country build back better and cleaner. The clean energy sector was projected to add 175,000 jobs in 2020 but the COVID-19 pandemic upended the industry and roughly 300,000 clean energy workers were still out of work in the beginning of 2021.1 Clean energy, energy efficiency, and clean transportation tax incentives are an important part of bringing these workers back. It is critical that these policies support strong labor standards and domestic manufacturing. The importance of clean energy tax policy is made even more apparent and urgent with record- high temperatures in the Pacific Northwest, unprecedented drought across the West, and the impacts of tropical storms felt up and down the East Coast. We ask that the infrastructure package prioritize inclusion of a stable, predictable, and long-term tax platform that: Provides long-term extensions and expansions to the Production Tax Credit and Investment Tax Credit to meet President Biden’s goal of a carbon pollution-free power sector by 2035; Extends and modernizes tax incentives for commercial and residential energy efficiency improvements and residential electrification; Extends and modifies incentives for clean transportation options and alternative fuel infrastructure; and Supports domestic clean energy, energy efficiency, and clean transportation manufacturing. -

1 April 2, 2020 the Honorable Nancy Pelosi Speaker, U.S. House Of

April 2, 2020 The Honorable Nancy Pelosi Speaker, U.S. House of Representatives H-232, United States Capitol Washington, DC 20515 Dear Speaker Pelosi: We are grateful for your tireless work to address the needs of all Americans struggling during the COVID-19 pandemic, and for your understanding of the tremendous burdens that have been borne by localities as they work to respond to this crisis and keep their populations safe. However, we are concerned that the COVID-19 relief packages considered thus far have not provided direct funding to stabilize smaller counties, cities, and towns—specifically, those with populations under 500,000. As such, we urge you to include direct stabilization funding to such localities in the next COVID-19 response bill, or to lower the threshold for direct funding through the Coronavirus Relief Fund to localities with smaller populations. Many of us represent districts containing no or few localities with populations above 500,000. Like their larger neighbors, though, these smaller counties, cities, and towns have faced enormous costs while responding to the COVID-19 pandemic. These costs include deploying timely public service announcements to keep Americans informed, rapidly activating emergency operations, readying employees for telework to keep services running, and more. This work is essential to keeping our constituents safe and mitigating the spread of the coronavirus as effectively as possible. We fear that, without targeted stabilization funding, smaller localities will be unable to continue providing these critical services to our constituents at the rate they are currently. We applaud you for including a $200 billion Coronavirus Relief Fund as part of H.R. -

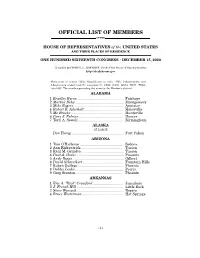

Official List of Members

OFFICIAL LIST OF MEMBERS OF THE HOUSE OF REPRESENTATIVES of the UNITED STATES AND THEIR PLACES OF RESIDENCE ONE HUNDRED SIXTEENTH CONGRESS • DECEMBER 15, 2020 Compiled by CHERYL L. JOHNSON, Clerk of the House of Representatives http://clerk.house.gov Democrats in roman (233); Republicans in italic (195); Independents and Libertarians underlined (2); vacancies (5) CA08, CA50, GA14, NC11, TX04; total 435. The number preceding the name is the Member's district. ALABAMA 1 Bradley Byrne .............................................. Fairhope 2 Martha Roby ................................................ Montgomery 3 Mike Rogers ................................................. Anniston 4 Robert B. Aderholt ....................................... Haleyville 5 Mo Brooks .................................................... Huntsville 6 Gary J. Palmer ............................................ Hoover 7 Terri A. Sewell ............................................. Birmingham ALASKA AT LARGE Don Young .................................................... Fort Yukon ARIZONA 1 Tom O'Halleran ........................................... Sedona 2 Ann Kirkpatrick .......................................... Tucson 3 Raúl M. Grijalva .......................................... Tucson 4 Paul A. Gosar ............................................... Prescott 5 Andy Biggs ................................................... Gilbert 6 David Schweikert ........................................ Fountain Hills 7 Ruben Gallego ............................................ -

House Organic Caucus Members

HOUSE ORGANIC CAUCUS The House Organic Caucus is a bipartisan group of Representatives that supports organic farmers, ranchers, processors, distributors, retailers, and consumers. The Caucus informs Members of Congress about organic agriculture policy and opportunities to advance the sector. By joining the Caucus, you can play a pivotal role in rural development while voicing your community’s desires to advance organic agriculture in your district and across the country. WHY JOIN THE CAUCUS? Organic, a $55-billion-per-year industry, is the fastest-growing sector in U.S. agriculture. Growing consumer demand for organic offers a lucrative market for small, medium, and large-scale farms. Organic agriculture creates jobs in rural America. Currently, there are over 28,000 certified organic operations in the U.S. Organic agriculture provides healthy options for consumers. WHAT DOES THE EDUCATE MEMBERS AND THEIR STAFF ON: CAUCUS DO? Keeps Members Organic farming methods What “organic” really means informed about Organic programs at USDA opportunities to Issues facing the growing support organic. organic industry TO JOIN THE HOUSE ORGANIC CAUCUS, CONTACT: Kris Pratt ([email protected]) in Congressman Peter DeFazio’s office Ben Hutterer ([email protected]) in Congressman Ron Kind’s office Travis Martinez ([email protected]) in Congressman Dan Newhouse’s office Janie Costa ([email protected]) in Congressman Rodney Davis’s office Katie Bergh ([email protected]) in Congresswoman Chellie Pingree’s office 4 4 4 N . C a p i t o l S t . N W , S u i t e 4 4 5 A , W a s h i n g t o n D . -

Congress of the United States Washington D.C

Congress of the United States Washington D.C. 20515 April 29, 2020 The Honorable Nancy Pelosi The Honorable Kevin McCarthy Speaker of the House Minority Leader United States House of Representatives United States House of Representatives H-232, U.S. Capitol H-204, U.S. Capitol Washington, D.C. 20515 Washington, D.C. 20515 Dear Speaker Pelosi and Leader McCarthy: As Congress continues to work on economic relief legislation in response to the COVID-19 pandemic, we ask that you address the challenges faced by the U.S. scientific research workforce during this crisis. While COVID-19 related-research is now in overdrive, most other research has been slowed down or stopped due to pandemic-induced closures of campuses and laboratories. We are deeply concerned that the people who comprise the research workforce – graduate students, postdocs, principal investigators, and technical support staff – are at risk. While Federal rules have allowed researchers to continue to receive their salaries from federal grant funding, their work has been stopped due to shuttered laboratories and facilities and many researchers are currently unable to make progress on their grants. Additionally, researchers will need supplemental funding to support an additional four months’ salary, as many campuses will remain shuttered until the fall, at the earliest. Many core research facilities – typically funded by user fees – sit idle. Still, others have incurred significant costs for shutting down their labs, donating the personal protective equipment (PPE) to frontline health care workers, and cancelling planned experiments. Congress must act to preserve our current scientific workforce and ensure that the U.S. -

April 30, 2021 the Honorable Chellie Pingree the Honorable David

April 30, 2021 The Honorable Chellie Pingree The Honorable David Joyce Chairwoman Ranking Member House Appropriations Subcommittee on House Appropriations Subcommittee on Interior, Environment and Interior, Environment and Related Agencies Related Agencies 2007 Rayburn House Office Building 1036 Longworth House Office Building Washington, D.C. 20515 Washington, D.C. 20515 Dear Chairwoman Pingree and Ranking Member Joyce: As you craft the Fiscal Year 2022 Interior, Environment, and Related Agencies Appropriations bill, we respectfully request robust funding for the National Trails system overall, and continued funding for NPS system operation of the Washington-Rochambeau Revolutionary Route National Historic Trail. The Washington-Rochambeau Revolutionary Route National Historic Trail (WARO) was created to commemorate the American-French march from New England to victory at Yorktown, a march that included one-quarter Black and Indigenous soldiers in the Continental Army. The 680-mile Trail goes through a dozen minority-majority “Founding Cities” and is the most urban trail in the National Trails system within the National Park Service (NPS). The Trail celebrates not only our independence, but also the vital alliance with our nation’s first ally, France and the important, but little appreciated role of Black and Indigenous people in the fight for American independence. Additional federal resources are critical to tell this story. The Trail was Congressionally designated in 2009, and for ten years had only one half-time staff member. In 2019, one full-time Trail Administrator was hired to cover the 680-mile trail. With more than 500 Revolutionary locations in the trail corridor, five high potential route segments, and 115 high potential historic sites, additional staff are essential, particularly as the nation prepares for the upcoming America 250 Commemoration. -

Hearing National Defense Authorization Act For

i [H.A.S.C. No. 112–106] HEARING ON NATIONAL DEFENSE AUTHORIZATION ACT FOR FISCAL YEAR 2013 AND OVERSIGHT OF PREVIOUSLY AUTHORIZED PROGRAMS BEFORE THE COMMITTEE ON ARMED SERVICES HOUSE OF REPRESENTATIVES ONE HUNDRED TWELFTH CONGRESS SECOND SESSION FULL COMMITTEE HEARING ON BUDGET REQUESTS FROM U.S. EUROPEAN COMMAND AND U.S. AFRICA COMMAND HEARING HELD FEBRUARY 29, 2012 U.S. GOVERNMENT PRINTING OFFICE 73–432 WASHINGTON : 2012 For sale by the Superintendent of Documents, U.S. Government Printing Office, http://bookstore.gpo.gov. For more information, contact the GPO Customer Contact Center, U.S. Government Printing Office. Phone 202–512–1800, or 866–512–1800 (toll-free). E-mail, [email protected]. HOUSE COMMITTEE ON ARMED SERVICES ONE HUNDRED TWELFTH CONGRESS HOWARD P. ‘‘BUCK’’ MCKEON, California, Chairman ROSCOE G. BARTLETT, Maryland ADAM SMITH, Washington MAC THORNBERRY, Texas SILVESTRE REYES, Texas WALTER B. JONES, North Carolina LORETTA SANCHEZ, California W. TODD AKIN, Missouri MIKE MCINTYRE, North Carolina J. RANDY FORBES, Virginia ROBERT A. BRADY, Pennsylvania JEFF MILLER, Florida ROBERT ANDREWS, New Jersey JOE WILSON, South Carolina SUSAN A. DAVIS, California FRANK A. LOBIONDO, New Jersey JAMES R. LANGEVIN, Rhode Island MICHAEL TURNER, Ohio RICK LARSEN, Washington JOHN KLINE, Minnesota JIM COOPER, Tennessee MIKE ROGERS, Alabama MADELEINE Z. BORDALLO, Guam TRENT FRANKS, Arizona JOE COURTNEY, Connecticut BILL SHUSTER, Pennsylvania DAVE LOEBSACK, Iowa K. MICHAEL CONAWAY, Texas NIKI TSONGAS, Massachusetts DOUG LAMBORN, Colorado CHELLIE PINGREE, Maine ROB WITTMAN, Virginia LARRY KISSELL, North Carolina DUNCAN HUNTER, California MARTIN HEINRICH, New Mexico JOHN C. FLEMING, M.D., Louisiana BILL OWENS, New York MIKE COFFMAN, Colorado JOHN R. -

Union Calendar No. 104

1 Union Calendar No. 104 113TH CONGRESS " ! REPORT 1st Session HOUSE OF REPRESENTATIVES 113–143 R E P O R T ON THE REVISED SUBALLOCATION OF BUDGET ALLOCATIONS FOR FISCAL YEAR 2014 SUBMITTED BY MR. ROGERS, CHAIRMAN, COMMITTEE ON APPROPRIATIONS JULY 8, 2013.—Committed to the Committee of the Whole House on the State of the Union and ordered to be printed U.S. GOVERNMENT PRINTING OFFICE 29–006 WASHINGTON : 2013 SBDV 2014–2 VerDate Mar 15 2010 06:05 Jul 09, 2013 Jkt 029006 PO 00000 Frm 00001 Fmt 4012 Sfmt 4012 E:\HR\OC\HR143.XXX HR143 rfrederick on DSK6VPTVN1PROD with HEARING E:\Seals\Congress.#13 COMMITTEE ON APPROPRIATIONS HAROLD ROGERS, Kentucky, Chairman C. W. BILL YOUNG, Florida 1 NITA M. LOWEY, New York FRANK R. WOLF, Virginia MARCY KAPTUR, Ohio JACK KINGSTON, Georgia PETER J. VISCLOSKY, Indiana RODNEY P. FRELINGHUYSEN, New Jersey JOSE´ E. SERRANO, New York TOM LATHAM, Iowa ROSA L. DELAURO, Connecticut ROBERT B. ADERHOLT, Alabama JAMES P. MORAN, Virginia KAY GRANGER, Texas ED PASTOR, Arizona MICHAEL K. SIMPSON, Idaho DAVID E. PRICE, North Carolina JOHN ABNEY CULBERSON, Texas LUCILLE ROYBAL-ALLARD, California ANDER CRENSHAW, Florida SAM FARR, California JOHN R. CARTER, Texas CHAKA FATTAH, Pennsylvania RODNEY ALEXANDER, Louisiana SANFORD D. BISHOP, JR., Georgia KEN CALVERT, California BARBARA LEE, California JO BONNER, Alabama ADAM B. SCHIFF, California TOM COLE, Oklahoma MICHAEL M. HONDA, California MARIO DIAZ-BALART, Florida BETTY MCCOLLUM, Minnesota CHARLES W. DENT, Pennsylvania TIM RYAN, Ohio TOM GRAVES, Georgia DEBBIE WASSERMAN SCHULTZ, Florida KEVIN YODER, Kansas HENRY CUELLAR, Texas STEVE WOMACK, Arkansas CHELLIE PINGREE, Maine ALAN NUNNELEE, Mississippi MIKE QUIGLEY, Illinois JEFF FORTENBERRY, Nebraska WILLIAM L. -

Legislativeagenda

Opportunity & JAustlicel for legislative agenda CONGRESSWOMAN ANNIE KUSTER NEW HAMPSHIRE'S SECOND DISTRICT table of contents EDUCATIONAL CRIMINAL JUSTICE AND OPPORTUNITIES FOR POLICE REFORMS ALL AMERICANS 4 HR 7120, HR 1636 15 PACT ACT 5 HR 4141, HR 3496 16 REBUILD AMERICA'S SCHOOLS ACT, GET LEAD OUT OF SCHOOLS ACT, END CORPORAL PUNISHMENT IN SCHOOLS ACT ADDRESSING HEALTH DISPARITIES SUPPORTING 6 HEALTH ENTERPRISE ZONE ACT INDIGENOUS PEOPLE 7 HR 1897, HR 4995 17 HR 3977, HR 1351 8 HR 6141, HR 6142, HR 7104 18 HR 1694 9 ANTI LUNCH SHAMING ACT PRO TECTING FAIR ELECTIONS AND EQUAL ECONOMIC ACCESS TO THE POLLS EMPOWERMENT FOR ALL AMERICANS 19 HR 4 10 HR 6699 20 HR 1, NATIVE AMERICAN VOTING 11 HR 7, HR 5599 RIGHTS ACT 12 THE ACCESSIBLE, AFFORDABLE 21 HR 51 INTERNET FOR ALL ACT, H.CON RES. RECOGNIZING HISTORY & 100 COMMEMORATING AMERICANS ENVIRONMENTAL JUSTICE FOR COMMUNITIES OF 22 HR 7232 COLOR RESOURCES 13 HR 1315, HR 4007 PG. 23 14 HR 7024 Opportunity & Justice for all agenda Dear Friend, The United States of America has a long and painful history of racial inequality and injustice that touches on nearly every aspect of our society. From health disparities that result in lower life expectancy and higher risk of chronic illness, to lack of access to affordable housing and a criminal justice system that disproportionately incarcerates people of color and low-income Americans, inequality is pervasive throughout ourcountry and we must act without delay to right these wrongs. While our country currently engages in a national dialogue around police brutality and reforms that will keep all our communities safe, it is imperative that Congress takes action to advance policies that promote economic opportunity for communities of color, enact reforms that strengthen our public education system, expand access to homeownership and put a stop to the voter suppression tactics that make it more difficult for Black and Latino Americans to vote. -

State Delegations

STATE DELEGATIONS Number before names designates Congressional district. Senate Republicans in roman; Senate Democrats in italic; Senate Independents in SMALL CAPS; House Democrats in roman; House Republicans in italic; House Libertarians in SMALL CAPS; Resident Commissioner and Delegates in boldface. ALABAMA SENATORS 3. Mike Rogers Richard C. Shelby 4. Robert B. Aderholt Doug Jones 5. Mo Brooks REPRESENTATIVES 6. Gary J. Palmer [Democrat 1, Republicans 6] 7. Terri A. Sewell 1. Bradley Byrne 2. Martha Roby ALASKA SENATORS REPRESENTATIVE Lisa Murkowski [Republican 1] Dan Sullivan At Large – Don Young ARIZONA SENATORS 3. Rau´l M. Grijalva Kyrsten Sinema 4. Paul A. Gosar Martha McSally 5. Andy Biggs REPRESENTATIVES 6. David Schweikert [Democrats 5, Republicans 4] 7. Ruben Gallego 1. Tom O’Halleran 8. Debbie Lesko 2. Ann Kirkpatrick 9. Greg Stanton ARKANSAS SENATORS REPRESENTATIVES John Boozman [Republicans 4] Tom Cotton 1. Eric A. ‘‘Rick’’ Crawford 2. J. French Hill 3. Steve Womack 4. Bruce Westerman CALIFORNIA SENATORS 1. Doug LaMalfa Dianne Feinstein 2. Jared Huffman Kamala D. Harris 3. John Garamendi 4. Tom McClintock REPRESENTATIVES 5. Mike Thompson [Democrats 45, Republicans 7, 6. Doris O. Matsui Vacant 1] 7. Ami Bera 309 310 Congressional Directory 8. Paul Cook 31. Pete Aguilar 9. Jerry McNerney 32. Grace F. Napolitano 10. Josh Harder 33. Ted Lieu 11. Mark DeSaulnier 34. Jimmy Gomez 12. Nancy Pelosi 35. Norma J. Torres 13. Barbara Lee 36. Raul Ruiz 14. Jackie Speier 37. Karen Bass 15. Eric Swalwell 38. Linda T. Sa´nchez 16. Jim Costa 39. Gilbert Ray Cisneros, Jr. 17. Ro Khanna 40. Lucille Roybal-Allard 18. -

October 23, 2020 the Honorable Alex M. Azar II Secretary US Department

October 23, 2020 The Honorable Alex M. Azar II Secretary U.S. Department of Health and Human Services 200 Independence Avenue, SW Washington, DC 20201 Dear Secretary Azar: We write today concerning the politicization of the search for a coronavirus disease of 2019 (COVID-19) vaccine. We know a safe, effective, and trusted COVID-19 vaccine will be a critical tool to contain this pandemic. To ensure its success, the American people must be able to have confidence that science, not politics, is driving all COVID-19 vaccine authorization or approval decisions. Unfortunately, due to the Trump Administration’s actions undermining science throughout the COVID-19 pandemic response, including the pursuit of vaccines, we are compelled to urge you to allow the U.S. Food and Drug Administration (FDA) to do its job and to protect the scientific integrity of the COVID-19 vaccine approval process. We appreciate FDA career staff’s stewardship of the COVID-19 vaccine process to date. We are further encouraged by FDA’s issuance of additional guidance on October 6 on the Emergency Use Authorization (EUA) process for COVID-19 vaccines.1 This guidance comes at a crucial time in which clarity and transparency regarding the vaccine approval process is imperative to assure the American people that an authorized COVID-19 vaccine will be safe. The manufacturers pursuing COVID-19 vaccine candidates have committed to putting forward a vaccine only after it has been thoroughly vetted. In September, nine companies joined in an unprecedented pledge that potential vaccines for COVID-19 will be developed “in accordance with high ethical standards and sound scientific principles.”2 Further, the four companies with vaccine candidates currently in phase 3 clinical trials have released their trial protocols, an important step towards transparency. -

NAR Federal Political Coordinators 115Th Congress (By Alphabetical Order )

NAR Federal Political Coordinators 115th Congress (by alphabetical order ) First Name Last Name State District Legislator Name Laurel Abbott CA 24 Rep. Salud Carbajal William Aceto NC 5 Rep. Virginia Foxx Bob Adamson VA 8 Rep. Don Beyer Tina Africk NV 3 Rep. Jacky Rosen Kimberly Allard-Moccia MA 8 Rep. Stephen Lynch Steven A. (Andy) Alloway NE 2 Rep. Don Bacon Sonia Anaya IL 4 Rep. Luis Gutierrez Ennis Antoine GA 13 Rep. David Scott Stephen Antoni RI 2 Rep. James Langevin Evelyn Arnold CA 43 Rep. Maxine Waters Ryan Arnt MI 6 Rep. Fred Upton Steve Babbitt NY 25 Rep. Louise Slaughter Lou Baldwin NC S1 Sen. Richard Burr Robin Banas OH 8 Rep. Warren Davidson Carole Baras MO 2 Rep. Ann Wagner Deborah Barber OH 13 Rep. Tim Ryan Josue Barrios CA 38 Rep. Linda Sanchez Jack Barry PA 1 Rep. Robert Brady Mike Basile MT S2 Sen. Steve Daines Bradley Bennett OH 15 Rep. Steve Stivers Johnny Bennett TX 33 Rep. Marc Veasey Landis Benson WY S2 Sen. John Barrasso Barbara Berry ME 1 Rep. Chellie Pingree Cynthia Birge FL 2 Rep. Neal Dunn Bill Boatman GA S1 Sen. David Perdue Shadrick Bogany TX 9 Rep. Al Green Bradley Boland VA 10 Rep. Barbara Comstock Linda Bonarelli Lugo NY 3 Rep. Steve Israel Charles Bonfiglio FL 23 Rep. Debbie Wasserman Schultz Eugenia Bonilla NJ 1 Rep. Donald Norcross Carlton Boujai MD 6 Rep. John Delaney Bonnie Boyd OH 14 Rep. David Joyce Ron Branch GA 8 Rep. Austin Scott Clayton Brants TX 12 Rep. Kay Granger Ryan Brashear GA 12 Rep.