Access 22 Access

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Headline in Arial 14 Bold

Press Release from the Atlas Copco Group Atlas Copco wins construction equipment order in Germany Stockholm, Sweden, September 23, 2015: Atlas Copco, a leading provider of sustainable productivity solutions, won a major order in Germany for generators and compressors for usage at construction sites. The order value is MEUR 7.1 (MSEK 68). Boels Rental, a leading European rental business in the construction sector, chose Atlas Copco’s Portable Energy division to deliver about 500 generators and portable compressors. The products will be rented to end-users across Europe, serving Boels Rental’s expansive customer base within the construction industry. The products will be covered for service by Atlas Copco’s Construction Technique Service division. “We are delighted that Boels Rental continues to show great faith in our products and our local organizations,” said Andrew Walker, President of Atlas Copco’s Construction Technique business area. “Partnering with forward-thinking companies such as Boels Rental is paramount to our continued development as a business area, and we look forward to continue helping their construction customers be as productive as possible.” With this order, Boels Rental will receive a full range of the strongest products for the construction market. For example, the Power QAS generators operate with minimum noise, and the portable air compressors are durable, tough and easy to use. Headquartered in Sittard, Netherlands, Boels Rental has more than 340 stores across Europe with primary markets being the Netherlands, Belgium, Luxembourg, Germany, Austria, Czech Republic, Poland, Italy and Slovakia. For more information please contact: Andrew Walker, Business Area President Ola Kinnander, Media Relations Manager Construction Technique +46 8 743 8060 or +46 70 347 2455 +32 3 401 93 29 [email protected] Atlas Copco is a world-leading provider of sustainable productivity solutions. -

2016 Olympic Cycling Media Guide

ROAD TRACK BMX MOUNTAIN BIKE AUGUST 6 - 10 AUGUST 11 - 16 AUGUST 17 - 19 AUGUST 20 - 21 2016 USA CYCLING OLYMPIC MEDIA GUIDE USA CYCLING ROAD EVENTS About the Road Race All riders start together and must complete a course of 241.5km (men) or 141km (women). The first rider to cross the finish line wins. About the Time Trial In a race against the clock, riders leave the start ramp individually, at intervals of 90 seconds, and complete a course of 54.5km (men) or 29.8km (women). The rider who records the fastest time claims gold. Team USA Olympic Road Schedule (all times local) Saturday, August 6 9:30 a.m. - 3:57 p.m. Men’s road race Fort Copacabana Sunday, August 7 12:15 - 4:21 p.m. Women’s road race Fort Copacabana Wednesday, August 10 8:30 - 9:46 a.m. Women’s individual time trial Pontal 10:00 a.m. - 1:00 p.m. Men’s individual time trial Pontal BACK TO THE TOP 2 2016 USA CYCLING OLYMPIC MEDIA GUIDE USA CYCLING ROAD 2016 OLYMPIC WOMEN’S TEAM BIOS POINTS OF INTEREST/PERSONAL Competed as a swimmer at Whtiman College Three-time collegiate national champion Works as a yoga instructor off the bike Serves on the City of Boulder’s Environmental Advisory Board OLYMPIC/WORLD CHAMPIONSHIP RESULTS 2014 UCI Road World Championships, Ponferrada, Spain — DNF road race 2013 UCI Road World Championships, Toscana, MARA ABBOTT Italy — 13th road race Discipline: Road 2007 UCI Road World Championships, Stuttgart, Germany — 45th road race Date of birth: 11/14/1985 Height: 5’5” CAREER HIGHLIGHTS Weight: 115 lbs Two-time Giro D’Italia Internazionale Femminile Education: Whitman College winner — 2013 & 2010 Birthplace: Boulder, Colo. -

Ladies Tour of Norway 2018 Uci World Tour

LADIES TOUR OF NORWAY 2018 UCI WORLD TOUR * Norges første World Tour-ritt på sykkel * Hele verdenseliten på start * Live på TV2 hovedkanalen LADIES TOUR OF NORWAY 2018 Dato: 16.-19.august 2018 Etapper: 4 etapper, tempo evt lagtempo torsdag og fellesstart fredag-søndag TV: Live TV2 hovedkanalen, ca 2 timer hver dag fredag-søndag Status: Ladies World Tour (høyeste nivå) Deltakere: De 20 beste lagene i verden får automatisk innbydelse Sted: Østfold, etapper skal være klare i overgangen januar/februar Historikk: Ladies Tour of Norway har på rekordtid nådd syklingens høyeste nivå, nemlig World Tour (WWT). Det er samme nivå som for eksemel Tour de France, Giro d’Italia og Paris-Roubaix blant herrenes ritt. LToN ble dermed Nordens første etapperitt for damer som fikk denne statusen. Det er det første damerittet noen gang på dette nivået i Norge. Hit kommer hele verdenseliten, akkurat som i 2017. Med denne statusen kommer også LToN inn blant de rittene i verden som får betydelig mer oppmerksomhet på TV. Arrangøren har allerede gjort en avtale med TV2 hovedkanalen om direktesending i Norge også i 2018. Nytt i 2018 blir at LToN kommer til å inngå i en helg der TV2 satser på en sykkelhelg med både LToN og Arctic Race of Norway samme dager. Rittet vil også bli vist internasjonalt. I 2017 hadde LToN distribusjon til hele verden enten via inter - nett live eller liniær TV. Dette kommer vi til å videreføre i 2018.Damesykling er på vei oppover og holder på å bli en TV-idrett på lik linje med herrenes proffsykling. -

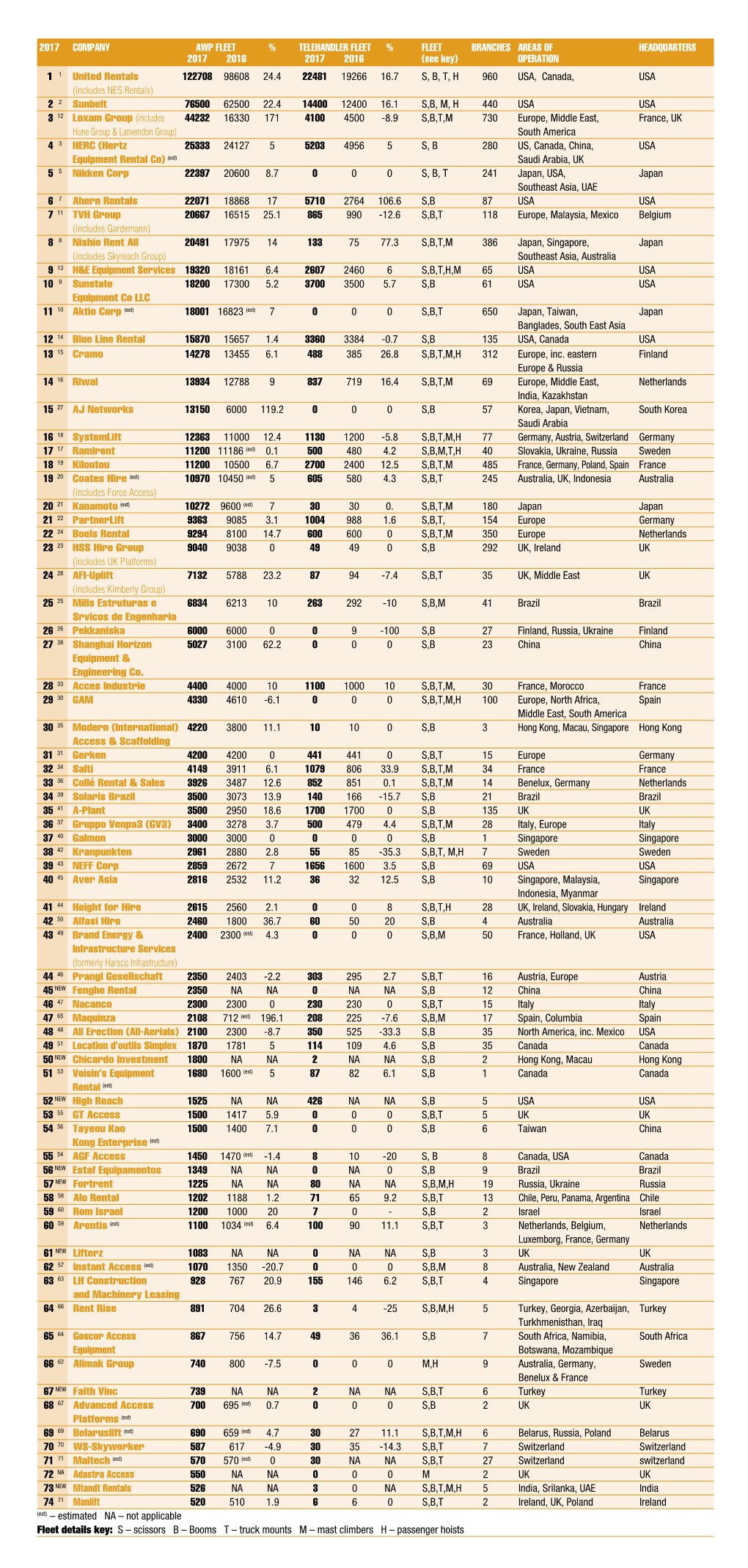

The World's Largest Access Equipment Rental Companies

Volume Twenty Four I Issue Five I August-September 2017 A KHL Group publication I www.khl.com/ai The world’s largest access equipment rental companies Official magazine of IPAF INTERVIEWS: CHINA | APEX ASIA PREVIEW | ONSITE IN INDIA | SCISSORS Access 08-09 2017 Cover.indd 1 21/08/2017 09:09:00 SJ85AJ LAUNCH READY! CLASS LEADING 85’ (25.91 m) PLATFORM HEIGHT DUAL CAPACITY RATING OF 750/500LBS (227/340 kg) 34’ (10.36 m) UP AND OVER CLEARANCE Launching the newest addition to its growing boom lineup, the SJ85AJ Articulating Boom fills out Skyjack’s offering in the core 40’, 60’ and 80’ boom classes. Like all Skyjack booms, the new SJ85AJ is engineered with simple reliability in mind. FOR MORE INFORMATION VISIT WWW.SKYJACK.COM IRN MAR 2017 indd 1 2017-01-30 10:08 AM Untitled-1 1 22/08/2017 08:19:46 commentFROM THE EDITOR Volume 24 ■ Issue 5 August-September 2017 STAFF LIST Changing gears Editor Euan Youdale e-mail: [email protected] t has been a year of change in the world of access and, as I write, we Staff Writers are still well within the third quarter, meaning there is still plenty Many Chinese Lindsey Anderson, Alex Dahm, I of time for more major industry news to develop. Steve Ducker, Sandy Guthrie, In this issue of AI we have the access50 listing of the world’s manufacturers Mike Hayes, Joe Malone, “ biggest rental companies, ranked by fl eet size, which very much refl ects Cristián Peters, D.Ann Shiffl er Consultant these changes. -

Boels Look & Feel Template

Pierre Boels – Boels Rental PIERRE BOELS | CEO Boels Rental THE COMPANY | WHERE IT ALL STARTED FOUNDED IN 1977, FAMILY-OWNED GENERALIST EQUIPMENT RENTAL COMPANY IN EUROPE Amstenrade (NL), 1977 THE COMPANY | OVER 40 YEARS OF EXPERIENCE A PASSION FOR SOLUTIONS, PROVIDING TAILOR-MADE ANSWERS FOR EVERY RENTAL NEED Acquisition of 4 specialist First international Introduction of the Opening of the businesses expansion to Belgium Boels DIY concept 100th Boels depot 1981 1991 1992 1994 2004 2007 2016 2017 1977 1996 2018 Start of Boels Party First depot in Germany Expansion to Austria Acquisition of Supply UK and Container rental Pierre Boels Jr. and opening of 400th becomes CEO depot THE COMPANY | RENTAL IS LOCAL BUSINESS OVER 400 COMPANY-OWNED BRANCHES GOING ABROAD | OPPORTUNITIES & CHALLENGES OPPORTUNITIES CHALLENGES ▪ New markets ▪ Communications ▪ Diversification ▪ Physical Distance ▪ Competitive advantage ▪ Unfamiliar cultures ▪ Foreign investment opportunities ▪ Foreign legislation and regulations ▪ Access to talent ▪ Currency rates ▪ Political Risks ▪ Marketing ▪ HR THE COMPANY | FACTS & FIGURES EUROPE’S NO. 5 RENTAL BUSINESS €600 374 Generalist depots 4.000+ Employees Annual Turnover million €850 42 Specialist locations 110.000+ Customers Fleet value million 2.500 DIY Shop-in-Shops 18 Countries 35% EBITDA THE COMPANY | A CONTINUOUS FOCUS ON GROWTH EUROPE’S NO. 5 RENTAL BUSINESS 500 100% 450 90% In millions € 400 80% 350 70% 300 60% 250 50% 200 40% 150 30% 100 20% 50 10% 0 0% 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Revenue EBITDA Investments Incl. Acquisitions EBITDA Margin FROM GENERALIST TO SPECIALIST | ACQUISITIONS ACCELERATION IN SPECIALIST ACQUISITIONS General Rental Specialist Rental Market Baurent Germany 2012 Loca-System Belgium Racor Benelux Yellow Rental Netherlands 2015 M.R. -

Boels Account Number Application Form

BOELS ACCOUNT NUMBER APPLICATION FORM Only forms filled in completely will be processed. Company details Company name Trade name (if different) Business address Postcode and city Invoice address (if different) Postcode and city E-mail address for invoicing Company telephone number Mobile telephone number Fax number Company description Chamber of Commerce number E-mail VAT number Applicant’s name Initials Surname Mr / Ms/Mrs Identity document number Please enclose a copy of your registration with the Chamber of Commerce (not older than 3 months) and a copy of your stationery (invalidated if necessary).. Signature I declare that I have completed the form truthfully and am authorised to do so. I agree to the General Terms and Conditions of Rental and Delivery that apply at Boels Rental (enclosed). You can also read these on www.boels.nl. Any other terms and conditions are explicitly excluded. A standard damage waiver scheme to prevent any unforeseen costs being payable by the client and fire and theft cover apply to all rented items that qualify (this does not apply to rental companies). You will find the current terms and conditions on the back of your rental agreement(s) and at www.boels.com. The current scheme is enclosed with this form for your information.. Name Signature Date and place Boels Verhuur B.V. Tel. 046-7502035 Rabobank 10.27.81.796 Afd. debiteuren Fax 046-4592141 IBAN NL40 RABO 0102781796 Dr. Nolenslaan 140 [email protected] BIC Code RABONL2U 6136 GV Sittard www.boels.nl KVK 14039581 Postbus 666 BTW NL008439965B01 6130 AR Sittard ARTICLE 1: GENERAL PROVISIONS objects deviate from the Contract and/or the Information provided by Boels to such an Article 9: Prices 1.1 In these General Lease Terms and Conditions, the capitalised terms listed below and extent that the Other Party cannot reasonably be obliged to comply. -

The World's Most Active Machinery Professionals on Social - June 2021

The World's Most Active Machinery Professionals on Social - June 2021 Industry at a glance: Why should you care? So, where does your company rank? Position Company Name LinkedIn URL Location Employees on LinkedIn No. Employees Shared (Last 30 Days) % Shared (Last 30 Days) 1 LoxamHune https://www.linkedin.com/company/loxamhune/Spain 384 90) 23.44% 2 Kalmar https://www.linkedin.com/company/kalmar/Finland 1,360 316) 23.24% 3 RUBI https://www.linkedin.com/company/rubi-group/Spain 242 54) 22.31% 4 GAM https://www.linkedin.com/company/gam-soluciones/Spain 568 122) 21.48% 5 Weber Maschinenbau https://www.linkedin.com/company/weber-maschinenbau/Germany 248 53) 21.37% 6 UNOX https://www.linkedin.com/company/unox-spa/Italy 341 72) 21.11% 7 Rational https://www.linkedin.com/company/rational-ag/Germany 1107 228) 20.60% 8 Körber https://www.linkedin.com/company/k%C3%B6rber/Germany 1,493 298) 19.96% 9 Herrmann Ultraschall https://www.linkedin.com/company/herrmann-ultraschall/Germany 225 42) 18.67% 10 item https://www.linkedin.com/company/item-industrietechnik-gmbh/Germany 257 47) 18.29% 11 GF Machining https://www.linkedin.com/company/gf-machining-solutions/Switzerland 608 108) 17.76% 12 Collé https://www.linkedin.com/company/colle-official/Netherlands 252 43) 17.06% 13 Combilift https://www.linkedin.com/company/combilift-ltd/Ireland 254 43) 16.93% 14 Robatech https://www.linkedin.com/company/robatech/Switzerland 261 44) 16.86% 15 Selwood https://www.linkedin.com/company/selwood-ltd/United Kingdom 323 54) 16.72% 16 Boels Rental https://www.linkedin.com/company/boels-rental/Netherlands -

Boels Rental

CASE STUDY: Boels Rental BOELS HEAD OF AP IS EXCITED TO “AUTOMATE, AUTOMATE, AUTOMATE” THE FUTURE LOOKS BRIGHT FOR BOELS RENTAL NOW THAT THEY’RE FULLY EMBRACING INVOICE AUTOMATION WITH BASWARE – SO MUCH SO THAT IT IS HELPING GIVE THEIR HEAD OF AP EUROPE A LOT OF ENTHUSIASM. “I can’t wait to go to work half years ago, which is when Rob tomorrow to automate, automate, joined their team. CUSTOMER: automate,” says Rob van der Hagen, Head of Accounts Payable Boels Rental decided to move to (AP) Europe at Boels Rental. Basware’s cloud solution because they knew Basware was the right It wasn’t always this way, but partner for automating incoming INDUSTRY: invoices in a diverse range of now that Boels have started Machinery and equipment to automate their processes formats: XML invoices, machine- readable PDF, or e-invoices. They successfully, they believe they can LOCATION: move from 5% to 20% automation also wanted to be able to use in just a year. In an organisation templates for non-PO invoices and Europe with a highly complex system for payment plans for recurring costs pre-booking invoices, this sort of such as rent, electricity, gas etc. BASWARE SOLUTION: progress impressive. Boels knew that Basware was • Basware e-Invoice sending MOVING FROM already helping them increase and receiving • Basware PDF e-Invoice BASWARE’S ON-PREMISE employee productivity (from 69-81 invoices per day) and receiving SOLUTION TO THEIR wanted to use Basware’s analytics • Basware Scan & Capture CLOUD OFFERING solution to give them a better • Basware AP Automation Boels Rental has been using view of the bottlenecks within • Basware AP Analytics Basware for many years and their organisation, as well as moved away from their on-premise look to outsource their scanning solution towards the cloud-based to Basware’s Scan & Capture SaaS offering nearly three and a services. -

Living in a Virtual World Sky's the Limit for Gola Boom On

JANUARY 2017 £3.50 sportsTRADE LEISURE CYCLING NUTRITION insight FITNESS TECH OUTDOOR sports-insight.co.uk INTERVIEW BADMINTON TECHNOLOGY SKY’S BOOM LIVING IN THE LIMIT ON THE A VIRTUAL FOR GOLA CARDS WORLD P. 13 P. 29 P. 37 Cover.indd 1 16/01/2017 16:51 TM AS USED AT THE 2017 LAKESIDE WORLD CHAMPIONSHIP DANNY NOPPERT LAKESIDE DEBUT 2017 FINALIST VIEW THE FULL 2017 COLLECTION AT WINMAU.COM winmau.com Follow us on @winmau Find us on winmaudarts Subscribe on winmaudartstv 4 Editor: MARK HAYHURST WELCOME Tel: 01206 508618 to this month's Sports Insight Farah signs Email: [email protected] Advertising Manager: three-year deal KEITH MARSHALL Tel: 01206 505947 Fax: 01206 500243. with Nabufit Email: [email protected] Nabufit has signed British Advertising Sales athletics legend Mo Farah 21-23 Phoenix Court, Hawkins Rd, as a brand ambassador in a Colchester, Essex CO2 8JY three-year deal for its online and help motivate and inspire Mo Farah to our team of fitness platform. people to live a more active and international sports stars Group Advertising Farah (pictured) is the most healthy life. and legends. He has shown an Manager: SAM REUBIN successful British track athlete Farah said: “I am very extraordinary commitment to Group Editor: I hope everyone had a great ever after winning the 5k/10k honoured to be part of the his sport and his fans, and that CHARLOTTE SMITH Christmas. double at the Olympic Games in Nabufit line-up of legends and I now includes providing unique Tel: 01206 508615 We look ahead to an London 2012 and again at the cannot wait to start recording content to the Nabufit platform. -

Rental July-August 2013 Book Now! International Rental Conference P20 Interview: Riwal CEO Norty Turner P17 Dan Kaplan: Essential Rental Metrics P46

INTERNATIONAL www.khl.comwww.khl.com NEWS A KHL Group Publication Volume 13 Issue 5 rental July-August 2013 Book now! International Rental Conference p20 Interview: Riwal CEO Norty Turner p17 Dan Kaplan: essential rental metrics p46 Power generation products for rental and Altaaqa Global interview Power on p29 Official magazine of the ERA THE ONLY MAGAZINE COVERING THE GLOBAL EQUIPMENT RENTAL MARKET IRN 07-08 2013 Cover-MP-EDITED.indd 1 15/07/2013 09:24:07 The QAS range. Predictable Power. Atlas Copco brings Predictable Power to the on-site generator and power generation business: peace of mind with solutions that combine low cost of ownership, reliable performance and risk-free operation. Atlas Copco Portable Energy A Company Within the Altas Copco Group www.atlascopco.com Full page.indd 1 15/07/2013 09:25:27 3 COMMENT t NEWS July-August 2013 Volume 13 Issue 5 Editor Editorial Team Murray Pollok e-mail: [email protected] Staff Writers Tel: +44 (0)1505 850 043 businesses focusing Lindsey Anderson, commen Alex Dahm, Lindsay Gale, Sandy Guthrie, Laura most visibly in rental Hatton, Cristián Peters, D.Ann Shiffler, Helen the world report pretty significant Wright, EuanEditorial Youdale Director Paul Marsden Diversification coming ny business needs to diversify - whetherrental businessesgeographically of or by sector - if it is to prosper. A KHL SPECIAL REPORT KHL’s rental THE RENTAL Production Production Team and In recent years this impetus has been seen pportfolio REPORT Circulation Director INTERNATIONAL www.khl.comwww.khl.com Saara Rootes more on industrial customers, or, in other words, anything except general construction. -

VADEMECUM 2017 ASSOCIAZIONE CORRIDORI CICLISTI PROFESSIONISTI ITALIANI Via Piranesi 46, 20137 Milano Tel

VADEMECUM 2017 ASSOCIAZIONE CORRIDORI CICLISTI PROFESSIONISTI ITALIANI Via Piranesi 46, 20137 Milano Tel. +39 02 66 71 24 51 - Fax +39 02 67 07 59 98 [email protected] - www.accpi.it 1 DESIGN AND COMMUNICATION VENICE - TAIPEI - DUBAI - LOS ANGELES IDEE SEMPRE FRESCHE jonnymole.com ELISA LONGO BORGINI Bronzo Olimpiadi Rio 2016 -Gara in Linea ELIA VIVIANI Oro Olimpiadi Rio 2016 - Omnium 2 3 INDICE IL SALUTO DEL PRESIDENTE ACCPI 06 CONSIGLIO DIRETTIVO ACCPI 07 ISTITUZIONI NAZIONALI ED INTERNAZIONALI 08 C.P.A. 10 CICLISTI PROFESSIONISTI ITALIANI 18 CALENDARIO GARE 30 PRO TEAM 2017 86 PROFESSIONAL 2017 96 CONTINENTAL 2017 110 TEAM FEMMINILI UCI 2017 120 ENTI ORGANIZZATORI 144 STATUTO ACCPI 154 ELENCO INSERZIONISTI 159 VINCENZO NIBALI Vincitore Giro d’Italia 2016 4 CONSIGLIO DIRETTIVO ACCPI ACCPI Cristian Salvato PRESIDENTE ASSOCIAZIONE CORRIDORI CICLISTI PROFESSIONISTI ITALIANI Carissimi, Cristian Filippo Alessandra Amedeo Elisa Marco Aurelio Elia sono ormai 8 anni che faccio parte del Direttivo Accpi e negli ultimi 4 ho avuto l’onere e l’onore di ricoprire il ruolo di Salvato Pozzato Cappellotto Colombo Longo Borghini Fontana Viviani vostro presidente. A fine anno si completerà il mio mandato, per questo colgo l’occasione per un bilancio di quello che PRESIDENTE VICEPRESIDENTE VICEPRESIDENTE PRESIDENTE DELEGATO DELEGATO DELEGATO è stato fatto con il vostro appoggio e contributo. (NON IN ATTIVITÀ) ONORARIO DONNE FUORISTRADA PISTA Innanzitutto volevo ringraziare tutta la nostra squadra, Alessandra, Giulia, Amedeo (il nostro grande saggio), Alberto, Alessandro, Andrea, Diego, Ivan e soprattutto Stella e Simone che dai nostri uffici rappresentano l’anima dell’associazione, sempre pronti e disponibili in ogni momento dell’anno. -

Rentalawards

www.khl.com/rentalawards 2020 SHORTLISTED COMPANIES & WINNERS Awards co-organised by E UROPEAN INTERNATIONAL R ENTAL A SSOCIATION rental NEWS BEST PRACTICE THIS YEAR’S International Rental News magazine and the European Rental JUDGES Association have been jointly organising the European Rental Awards for more than a decade and over that period we have Vincent Albasini, CEO, often been asked about the shortlisted companies. How were they Avesco Rent selected, and what did they do that was special? Pierre Boels, President, o help answer these questions, we have created Finally, we thank all the companies who submitted more European Rental Association this special European Rental Awards Supplement, than 80 entries this year, which was one of the best T providing details of the companies that were responses we have ever had. & CEO, Boels Rental shortlisted in all six categories. It is unfortunate that we could not celebrate the awards The winners were announced during the online rental in person this year, but our online event was still a great awards event on 30 June and are highlighted in this opportunity to celebrate some of the successes of the Jaap Fluit, General Manager, supplement. A video recording of the online event is industry over the past year. Bredenoord available to view at khl.com >CLICK HERE< Wishing you all good health. One of the key aims of the rental awards is to share best practice and to recognise excellence in our industry. Karel Huijser, General By providing more details about what each shortlisted Manager & Vice President, company has done over the past 12-18 months, we hope that the supplement will act as a resource for the industry EMEA, JLG Industries and as a reference point as it continues to develop.