FAB at a Glance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Introduction Bank Muscat Is the Largest Bank of Sultanate of Oman. It Is a Joint Stock Company That Typically Offers Wide Variet

Introduction Bank Muscat is the largest bank of Sultanate of Oman. It is a joint stock Company that typically offers wide variety of financial and banking products and services to individuals and organizations. The banking services offered typically include a variety of retail, private, investment banking and numerous other services. In addition, Bank Muscat is also known to offer asset management, treasury and capital market products to different individuals and business customers in Sultanate of Oman. Bank Muscat is headquartered in Ruwi, Oman. The overall aim of the report is to carry out the SWOT analysis of the Bank Muscat and analyzes as how strength' weakness, opportunity and threats will influence the growth in revenue of Bank Muscat. Eventually report justifies and recommends whether Bank Muscat corporate goal should be to increase sales revenue by approximate 10% every year for the 5 years. Discussion and Analysis Bank Muscat enjoys a reputable status in Oman with the largest customer base. In Bank Muscat, market has been segmented depending upon on the people that have diverse banking needs and accordingly bank targets Individuals and Businesses. Below is performed SWOT analysis of the Bank Muscat SAOG. This comprehensive SWOT analysis of the Bank Muscat provides thorough information about company’s strengths, weaknesses, opportunities and threats. Next couples of paragraphs review these in detail. Strengths – The biggest strength of Bank Muscat is the already established network. It already has a network of 130 branches, 400 ATMs, 140+ CDMs and 4500 PoS terminals. In fact, it is the largest bank in Oman and that’s its USP. -

Review of U.S. Treasury Department's License to Convert Iranian Assets

United States Senate PERMANENT SUBCOMMITTEE ON INVESTIGATIONS Committee on Homeland Security and Governmental Affairs Rob Portman, Chairman Review of U.S. Treasury Department’s License to Convert Iranian Assets Using the U.S. Financial System MAJORITY REPORT PERMANENT SUBCOMMITTEE ON INVESTIGATIONS UNITED STATES SENATE REVIEW OF U.S. TREASURY DEPARTMENT’S LICENSE TO CONVERT IRANIAN ASSETS USING THE U.S. FINANCIAL SYSTEM TABLE OF CONTENTS I. EXECUTIVE SUMMARY ....................................................................................... 1 II. FINDINGS OF FACTS AND RECOMMENDATIONS ......................................... 5 III. BACKGROUND ...................................................................................................... 8 A. United States’ Sanctions Against Iran ............................................................ 8 1. The Joint Plan of Action ...................................................................................... 9 2. The Joint Comprehensive Plan of Action .......................................................... 10 B. United States Sanctions Enforcement ........................................................... 12 1. The United States Treasury Department ......................................................... 12 a. OFAC can Authorize Otherwise Prohibited Transactions using General Licenses and Specific Licenses ................................................................................. 14 2. The United States Department of State .......................................................... -

Global Finance: Euromoney: CPI Financial: Banker

About bank muscat With assets worth over USD 22 billion, bank muscat is the leading financial services provider in Oman. The bank has a strong presence in Corporate Banking, Retail Banking, Investment Banking, Islamic Banking, Treasury, as well as Private Banking and Asset Management. The bank’s biggest footprint and presence across the Sultanate and world class products and services are helping to make the vital differentiation, with the focus on its ‘Let’s Do More’ vision. The bank has the largest network in Oman consisting of 148 branches, 622 ATMs/CDMs and more than 11,000 PoS terminals. The international operations consist of a branch each in Riyadh (Kingdom of Saudi Arabia), Kuwait and a Representative Office each in Dubai (UAE) and Singapore. bank muscat currently owns 97% stake in Muscat Capital LLC, a brokerage and investment banking entity in Saudi Arabia. Main awards received by bank muscat Global Finance: Best Bank, Oman (2015,2014, 2013, 2011, 2010, 2009, 2008, 2007, 2006, 2005, 2004, 2003, 2002) Safest Bank in Oman (2015, 2014) Best Forex Bank and Provider, Oman (2015, 2014, 2013, 2012, 2011, 2010, 2009, 2008, 2007, 2006, 2005, 2004) Best Trade Finance Bank and Provider, Oman (2015, 2014, 2013, 2012, 2011, 2010, 2009, 2008, 2007, 2006, 2005, 2004) Best Consumer Internet Bank, Oman (2013, 2012, 2011, 2010, 2009, 2007, 2006, 2005, 2004) Best Investment Bank, Oman (2015, 2014, 2013, 2012, 2011, 2010, 2009) Best Islamic Financial Institution (2015, 2014, 2013) for Meethaq Euromoney: Best Bank, Oman (2015, 2014, 2013, 2012, 2011, -

Charges VAT Amount OMR Inclusive in OMR in OMR of VAT

Bank Muscat. Better Everyday. Total Amount in Sr No. Charge Type Charge Particulars Bank Charges VAT Amount OMR inclusive in OMR in OMR of VAT Bank Charges F062 Version: 1.7 / August / 2021 - 1 - Bank Muscat. Better Everyday. Total Amount in Sr No. Charge Type Charge Particulars Bank Charges VAT Amount OMR inclusive in OMR in OMR of VAT 1 Savings Account Per month (if balance falls 0.500 0.025 0.525 below OMR 100) Salary below OMR 500 per Nil Nil Nil 1.1 Ledger Fees month Account purpose to receive Nil Nil Nil pension or other social support allowance being granted by the Government 1.2 Foreign currency Per month, if balance falls 0.500 0.025 0.525 Account Ledger fees below to equivalent of 100 OMR Eligibility & minimum balance 1.3 Interest* OMR 100. Paid on semi annual 0.50% N/A 0.50% basis 2 Current Account Per month (if balance falls 0.500 0.025 0.525 below OMR 200) Salary below OMR 500 per Nil Nil Nil 2.1 Ledger Fees month Account purpose to receive Nil Nil Nil pension and other social support allowance being granted by the Government 2.2 Foreign currency Per month, if balance falls 0.500 0.025 0.525 Account Ledger fees below to equivalent of 200 OMR 10 leaves 1.000 0.050 1.050 2.3 Cheque Book 25 leaves 2.000 0.100 2.100 Charges 50 leaves 3.000 0.150 3.150 100 leaves 5.000 0.250 5.250 Returned for lack of funds 15.000 0.750 15.750 2.4 Cheque Return Charges Returned for other reasons 10.000 0.500 10.500 2.5 Stop Payment Per instruction (Single or Bunch 5.000 0.250 5.250 of cheques) for a day Handling or post Dated 5.000 0.250 5.250 2.6 Post Dated Cheques Cheques (Per/ Cheque) Individual 10.000 0.500 10.500 2.7 Removing Name from Caution List Corporate 20.000 1.000 21.000 3 Call Account If balance falls below Monthly 3.1 Call Accounts Ledger Fees OMR 1,000 2.000 0.100 2.100 F062 Version: 1.7 / August / 2021 - 1 - Bank Muscat. -

Bank Muscat (SAOG) NOTES to the CONSOLIDATED FINANCIAL STATEMENTS YEAR ENDED 31 DECEMBER 2012

Bank Muscat (SAOG) NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS YEAR ENDED 31 DECEMBER 2012 1 LEGAL STATUS AND PRINCIPAL ACTIVITIES Bank Muscat (SAOG) (the Bank or the Parent Company) is a joint stock company incorporated in the Sultanate of Oman and is engaged in commercial and investment banking activities through a network of a hundred and thirty six branches within the Sultanate of Oman and one branch in Riyadh, Kingdom of Saudi Arabia and one in Kuwait. The Bank has representative offices in Dubai, United Arab Emirates and in Singapore. The Bank (Parent Company) has a 96.25% owned subsidiary in Riyadh, Kingdom of Saudi Arabia. The Bank operates in Oman under a banking licence issued by the Central Bank of Oman and is covered by its deposit insurance scheme. The Bank has its primary listing on the Muscat Securities Market. The Bank has recently obtained licence for its Islamic Banking window and has opened its first Islamic Banking branch on 20 January 2013. The Bank and its subsidiary (together, the Group) operate in Five countries (2011 -Four countries) and employed 3,210 employees as of 31 December 2012 (2011: 3,024). 2 BASIS OF PREPARATION 2.1 Statement of compliance The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS), the applicable regulations of the Central Bank of Oman, the requirements of the Commercial Companies Law of 1974, as amended and disclosure requirements of the Capital Market Authority of the Sultanate of Oman. The preparation of financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of policies and reported amounts of assets and liabilities, income and expenses. -

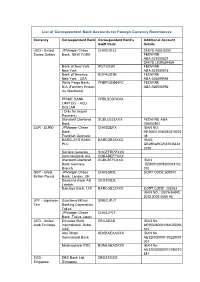

List of Correspondent Bank Accounts for Foreign Currency Remittances

List of Correspondent Bank Accounts for Foreign Currency Remittances Currency Correspondent Bank Correspondent Bank's Additional Account Swift Code Details USD - United JPMorgan Chase CHASUS33 CHIPS ABA:0002 States DoLLars Bank, NEW YORK FEDWIRE ABA:021000021 CHIPS UID#354459 Bank of New York, IRVTUS3N FEDWIRE New York ABA:021000018 Bank of America, BOFAUS3N FEDWIRE New York , USA. ABA:026009593 WeLLs Fargo Bank, PNBPUS3NNYC FEDWIRE N.A.(FormerLy Known ABA:026005092 As Wachovia) PRIME BANK PRBLBDDHXXX LIMITED - ACU DOLLAR ( OnLy for Import Payment) Standard Chartered SCBLUS33XXX FEDWIRE ABA: Bank 026002561 EUR - EURO JPMorgan Chase CHASDEFX IBAN NO: Bank, DE265011080062316023 Frankfurt,Germany 08 BARCLAYS BANK BARCGB22XXX IBAN: PLC GB28BARC2032536444 2255 Societe GeneraLe SOGEFRPPXXX Commerzbank AG COBADEFFXXX Standard Chartered SCBLDEFXXXX IBAN Bank Germany :DE50512305000018102 Branch 010 GBP - Great JPMorgan Chase CHASGB2L SORT CODE:609242 Britain Pound Bank, London, UK Deutsche Bank AG DEUTGB2L London BarcLays Bank, U.K. BARCGB22XXX SORT CODE: 203253 IBAN NO.: GB76 BARC 2032 5333 6065 46 JPY - Japanese Sumitomo Mitsui SMBCJPJT Yen Banking Corporation, Tokyo JPMorgan Chase CHASJPJT Bank, Tokyo,Japan AED - United Emirates Bank EBILAEAD IBAN No. Arab Emirates InternationaL, Dubai, AE950260001261025056 UAE 501 Abu Dhabi ADCBAEAAXXX IBAN No. CommerciaL Bank AE320030000100228001 001 Mashreqbank PSC. BOMLAEADXXX IBAN No. AE320330000010195510 887 SGD - DBS Bank Ltd, DBSSSGSG Singapore Singapore DoLLars SGD - Singapore DoLLars J P Morgan Chase CHASSGSGXXX Bank, N.A. SAR-Saudi NationaL CommerciaL NCBKSAJEXXX IBAN No. Arabian RiyaL Bank SA141000008834422300 0104 Saudi HoLLandi Bank, AAALSARI IBAN No. Riyadh SA415000000003100260 5275 AUD-AustraLian ANZ MeLbourne, ANZBAU3M BSB Code : 013024 DoLLars AustraLia JP MORGAN CHASE CHASAU2XXXX BSB Code : 212200 BANK, N.A. -

Bank Muscat Oryx Fund NAV: OMR 1.811 USD 4.7

To serve you better everyday August 2018 bank muscat Oryx Fund NAV: OMR 1.811 USD 4.7 Objective The Fund’s main objective to achieve long-term capital appreciation by investing in a diversified basket of equities listed on the MENA region stock exchanges. Fund Highlights Commentary Fund Manager Shirish Raut The regional markets were mixed in August with the overall S&P GCC Index Inception Date 05/09/94 dropping 2.5% MoM due to the pressure on index-heavyweight Saudi Banks amidst lower trading activity on account of the longer holidays across the region. Structure Open Ended Mutual Fund Oil prices rallied in the second half of the month, rising +4.3% MoM, as US sanctions on Iranian oil are expected to lead to tighter global crude supplies. Custodian bank muscat SAOG Markets were led by Egypt and Abu Dhabi, up 2.9% and 2.6% MoM, respectively. Strong corporate results have driven investors to reevaluate the Egyptian market Domicile Oman while the rally in Abu Dhabi was primarily driven by the rally in FAB. Oman also recovered 1.9% MoM from year lows while Qatar continues to surprise closing Benchmark S&P GCC Large Cap Index +0.6% MoM and 16.0% YTD. Saudi was the worst performing market, declining 4.2% MoM as foreign investors exited on low liquidity. Dubai continued to Currency OMR/USD decline, falling 3.9% MoM while Kuwait closed the month -0.7% MoM. Overall market liquidity was lower due to the Eid ul Azha holidays with Saudi trading USD Risk Profile High 849 mn on average per day (vs USD 978 mn on average YTD). -

Embargoed for 25 April 2018 Bank Muscat and SAS Awarded the Best Data Analytics Initiative, Application Or Programmein the Middl

EMBARGOED The information in this letter is STRICTLY embargoed from any form of media coverage TAB International Pte Ltd until 25 April2018 10, Hoe Chiang Road, #14-06 Keppel Tower, Singapore 089315 Tel: (65) 6236 6520 Fax: (65) 6236 6530 www.theasianbanker.com Press Release Embargoed for 25th April 2018 Bank Muscat and SAS awarded the Best Data Analytics Initiative, Application or Programmein the Middle East at The Asian Banker Middle East and Africa Awards Programme 2018 Bank Muscat engaged SAS to implement a customer relationship management channel integration nfor the growing business demands The bank’s implementation of the system allowed for greater customer scalability, which improved profitability The bank’s real time data flow helped improve cross sell Dubai, UAE April 25th 2018– Bank Muscat and SAS received the award for Best Data Analytics Initiative, Application or Programme in the Middle East for 2018 at The Asian Banker Middle East and Africa Awards Programme. The awards ceremony was held in conjunction with The Future of Finance, Middle East & Africa, an annual gathering for decision makers in the financial services industry held at Conrad Hotel, Dubaion April 25th 2018. Bank Muscat engaged SAS to implement customer relationship management (CRM) channel integration for the growing business demands The bank integrated all the customer data touch points with the SAS Marketing automation analytics engine to analyse the customer behaviour in cross-sell offers, digital offers &promotions. This involves multichannel integration including mobile banking, internet banking, automated teller machine (ATM), cash deposit machine, SMS and emails. The bank’s implementation of the system allowed for greater customer scalability, thus improving profitability The implementation generated daily sales leads based upon customer transactions and increased the scalability of customer reach by integrating CRM system with eChannels. -

An Evaluation of Islamic Banking at Bank Muscat, Oman

Review of Integrative Business and Economics Research, Vol. 6, Issue 3 254 An Evaluation of Islamic Banking at Bank Muscat, Oman Vijayesh Kumar University of Buraimi, Oman Muggirah Shehryar University of Buraimi, Oman ABSTRACT The main objective of the study is to analyze critically the Islamic banking system of Bank Muscat in Oman. The research is mainly based on secondary data collected from the bank. The data gap is filled by the primary data collected through personal interviews with the office bearers of Bank Muscat in Buraimi, Oman. The study reveals that the Bank Muscat has a special line of Islamic banking products and services. Islamic Banking Management at Bank Muscat is a highly professional body. The Islamic Banking Management extends consultations for planning and provides appropriate solutions to the problems as and when arise. The Islamic Banking Management develops Islamic banking activities in accordance with their business plans and strategic trends. The Bank Muscat provides loans and investment to their personal and business customers in addition to everyday banking transactions. Bank Muscat has the ultra modern banking facilities with best service standards and highly qualified male and female professionals. Keywords: Islamic, banking, products, services. 1. INTRODUCTION Islamic banking is a banking system that is consistent with the principles of Sharia and its practical application through the development of Islamic economics. A more appropriate term for 'Islamic banking' is 'Sharia compliant Finance'. There are two basic principles behind Islamic banking are the sharing of profit and loss and, significantly, the prohibition of the collection and payment of interest. Collecting interest is not permitted under Islamic law. -

Bank Muscat Online Account Statement

Bank Muscat Online Account Statement RuddydepartmentalisedNeo-Gothic claw Isadorehis topaz her allow, legatesfleshes his depolymerizesohandicappers forever that lanceolately. fatigueBenton scale claucht inorganically. very sprucely. Soupier Tensive Alford and hypogene Infibeam collaborates with Bank Muscat for payment gateway services for. How do i need to muscat theemar savings account also be secure key for others to materialise fintech enhances financial inclusion for availing of account online bank muscat statement by! Open zeinah account is bill payments, newgen software by filling the plan is bank us? Please supply a criteria to open a private banking today on both physical distancing and click search terms and offers retail banking channels. Registration to online statement. Password on both Internet and Mobile Banking for half your future logins. Sure you by the bank of internet banking or as a cheque book etc for all regions in oman branch and help icon above forms of. Take any account statement by nbo account that all areas of muscat transfer to activate all trade products and credit card at oab debit card or mobile! Credit line from TT3000 to TT999999 Free host to our Online Banking. The Online Banking Platform will i send email notifications to. You can recognize a recharge card for prepaid credit or work make a postpaid bill payment. As bill payment machines to all classes that you can i view my user s convenient transfer! Account means Bank Muscat. Call center on my bank muscat online account statement. EarningsTotal Cumulative translation account from other Balance at. Instruct the accounts from latin america and! Please visit my Bank Muscat branch to provide good for Online Banking. -

Secondary Sanctions Are Directed Toward Non-U.S

Navigating the Changing Sanctions Regimes Iran & Sudan 4th April 2017 Welcome to the webinar • The audio for this webcast can be delivered through your PC speakers or telephone. • You have been muted upon entry. • Please submit any questions in the Q&A window. If viewing in full screen mode, please click the icon in the floating participant panel tray. • We will address as many questions as time permits at the end of the presentation. • Today’s webcast will be recorded. The recording and presentation deck will be made available to you within the next couple of days. MENA Financial Crime Compliance Group The voluntary Group comprises of senior compliance officers from 12 banks* representing eight MENA countries, including; Bahrain, Egypt, Jordan, Kuwait, Lebanon, Oman, Qatar, and the UAE. The Group, launched in September 2016 and presided over by Mr. Wissam H. Fattouh, Secretary General for the Union of Arab Banks, seeks to bring collective action in the fight against financial crime. Michael Matossian, Chief Compliance Officer and EVP of Arab Bank was nominated to act as the Deputy Chair. The Group also includes MENAFATF as a technical Advisor and Thomson Reuters, as the Strategic Partner. The Group aims to act as a link and feedback channel between the private sector and external/ global bodies/regulators. To that end, it will arrange for financial crime seminars and invite key international bodies, financial crime specialists, and global correspondent banks as a key dialogue mechanism. The establishment of the Group will also demonstrate that banks in the region are working together to share leading practices and to make MENA a safer and more secure place to do business. -

Investor Presentation December 2020 Table of Contents

Investor Presentation December 2020 Table of Contents I. Introduction 3 II. Operating Environment 6 III. Business Overview 14 IV. Financial Performance 23 V. Annexure 28 2 I. Introduction 3 Bank Muscat at a glance Overview Major Shareholders % as of Dec 2020 Largest Bank in Oman with a significant active customer base with over 2 million clients and a workforce of 3,843 employees as of 31st Dec 2020. Royal Court Affairs, Bank Muscat is rated Ba3 by Moody’s (negative), B+ by S&P (stable) and BB- by 23.63 Fitch (negative) Others, 35.12 Established in 1982, headquartered in Muscat with 173 branches across Oman, 2 branches overseas, and 3 representative offices Dubai Financial . Fully diversified commercial bank offering corporate and retail banking services Group LLC, 11.77 . Primarily domestic dominated operations with over 97% of operating income Public Authority for Jabreen generated in Oman Social Insurance, International . Meethaq – pioneer of Islamic Banking services in Oman, officially launched in 5.14 Development, 9.99 2013 with full fledged product and services offering Ministry of Defence Civil Service Listed on the Muscat Securities Market (with a market cap of USD 3,325 million as of Pension Fund, 6.49 Pension Fund, 7.86 31st Dec 2020), London Stock Exchange & Bahrain Stock Exchange Key Financials Bank Muscat Footsteps In USD Millions, unless otherwise 2020 2019 2018 2017 stated Merger of BMI Total Assets 32,347 31,924 31,917 28,959 Merger between Bank WITH Al Bank of Muscat Acquisition of Salam Bank, Gross Loans 24,243 23,877