Appropriation Accounts 2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 Annual Report

2019 ANNUAL REPORT Credit Union Invocation LORD, make me an instrument of Thy peace; where there is hatred, let me sow love; where there is injury, pardon; where there is doubt, faith; where there is despair, hope; where there is darkness, light; where there is sadness, joy. O DIVINE MASTER, grant that I may not so much seek to be consoled as to console; to be understood as to understand; to be loved as to love; for it is in giving that we receive, it is in pardoning that we are pardoned, and it is in dying that we are born to eternal life. CONTENTS 1 Agenda . 2 General Information . 3 Chairman’s Report . 4 CEO’s Report . 6 Directors’ Responsibilities Statement . 9 Board Oversight Committee Report . 10 Independent Auditors’ Report to the Members of Croí Laighean Credit Union Limited . 11 Audit & Finance Committee Report . 14 Risk & Compliance Committee Report . 15 Community Committee Report . 16 Nominations Committee Report . 20 Directors’ Report . 21 Income and Expenditure Account . 23 Balance Sheet . 24 Statement of Changes in Reserves . 25 Statement of Cash Flows . 26 Notes to the Financial Statements . 27 Schedules to the Income and Expenditure Account . 43 Model Standing Orders . 44 Members Draw Report . 45 Annual Report 2019 2 AGENDA Notice is hereby given that the AGM of Croí Laighean Credit Union will take place on Wednesday, December 11th, 2019 at 7pm, in MU Barnhall Rugby Football Club, Parsonstown, Leixlip, Co . Kildare, W23 V56N . The agenda for the AGM is as follows: ▪ Acceptance by the Board of Directors of the authorised -

JANUARY 2018 the Newsletter of Waterford Sports Partnership

‘Everyone Active’ ISSUE 40 JANUARY 2018 the newsletter of Waterford Sports Partnership IN THIS ISSUE ARTICLE PAGE Operation Transformation 2018 1 Meet the WSP Team 2 SCHOOL PROGRAMME UPDATE Balance Bile Teacher Training 3 Sports Hall Athletics Training 3 Orienteering Teacher Training Day 3 River Rowers 4 Programmes & Opportunities for Schools 4 Waterford Walks OLDER ADULTS UPDATE Walk for Life Beat the Street 5 Walk for Life 2018 5 Fun Circuit Training for over 50’s 5 New! Fun Circuits - Stradbally & Tramore 5 New! Try Sailing - Dungarvan 5 KICKSTART YOUR 2018! Go For Life Inter-County Games 6 Mid Century Movers 6 Cycle Training 7 Equipment & Demonstrations 7 Swimming for Beginners 7 Leisure Centre Opportunities 7 Bowling Opportunities 7 Join us for the 2018 Pitch & Putt Opportunities 7 CLUB DEVELOPMENT Sports Capital Grants 2017 8 Operation Transformation Walks WSP - the next five years 2018 to 2022 8 WSP Club Development Seminar Series 9 Child Welfare & Protection Training 9 along the stunning Waterford Greenway TRAINING, EVENTS & PROGRAMMES Men on the Move 2017 10 Let’s Run 10 Walk to Run 11 The Sport Ireland National Network of Local Sports Partnerships has Pedal Safely 11 Desk to 5km 11 Beat the Street 12 teamed up with Operation Transformation once again this year to Buggy Buddies 13 Women on the Move 13 promote healthy living in 2018. Waterford Sports Partnership 2018 CALENDAR OF TRAINING is organising three walks as follows . & EVENTS 14 - 15 Beat the Street Photos 15 DISABILITY SPORT UPDATE Fishing for People with Sight Loss -

2010 League Presentations Dates for Your Diary GAA Email GAA Season

th Nuachtlitir Coiste Chontae Chorcaí: Vol. 2 No. 26, December 14 2010 Dates for Your 2010 League Presentations GAA Email Diary The presentation of cheques to the successful teams in Just a reminder: 16th December: Cork this year's RedFM Senior Hurling League took recently in where clubs have a GAA Clubs’ Draw, the RedFM Studios. In all, €11,000 was presented to change of secretary, Mitchelstown seven clubs - the top six, Midleton, Erin's Own, Sars, please ensure the th Killeagh, Na Piarsaigh and Glen Rovers, plus new secretary gets 20 December: Presentation of Bishopstown who completed their full league access to the GAA Munster Council programme and were thus entered into a draw for Email address. For Grants, time and €1000. County Chairman Jerry O'Sullivan and PRO any queries, contact venue tbc Gerard Lane both expressed their gratitude to Fiona [email protected] Darcy (CEO) and all at RedFM for their generous sponsorship of this competition. GAA Season 2011 Ticket 2011 Competitions The 2011 GAA The draws for the Season Ticket is now 2011 Evening Echo County Chairman Jerry O’Sullivan presents Midleton with their County on sale at a base price winners’ cheque. Also included are Fiona Darcy, Red FM CEO, and Pat of €75 (Juveniles Horgan, SHL Chairman. Championships €10). Rounds 1 and 2 were Cheques were also presented to the winners and made at Convention The Season Ticket th Scheme offers huge runners-up of all the other leagues at a recent function on December 12 – savings to fans, and is in Rochestown Park Hotel, where a total €29,725 was click here to view the available for either distributed between thirteen clubs. -

Directory 2015

WHAT WE DO: o Organise Summer Camps for children o Organise fun activity days for school children o Train coaches & leaders to help improve in your sports o Set up new clubs to give you a wider choice of sport o Provide information on all types of sport and activity o Help develop community facilities e.g. playgrounds o Develop & maintain playgrounds for children in Co. Laois Ann Marie Maher Catherine Murphy Sport & Leisure Officer Clerical Officer Nicole Dunphy James Kelly & Andrew Kavanagh FAI Officer GAA Games Administration Officers Stephen Gore Gordon Matthews Padraig Mahon CCRO Leinster Rugby CCRO Leinster Rugby CCRO Leinster Rugby WHERE TO FIND US: Áras an Chontae, Portlaoise, Co. Laois. Tel: 057 867 4364 Emaail: [email protected] Laois County Council do not accept responsibility for any errors & omissions contained in this directory. Coaching Monday to Friday at PORTARLINGTON TENNIS CLUB 6th - 10th July ABBEYLEIX TENNIS CLUB 13th - 17th July MOUNTMELLICK TENNIS CLUB: IRISHTOWN 20th - 24th July PORTLAOISE COLLEGE M/Rath Rd 27th - 31st July Duration: one week in July at each venue above Lesson Times: 10am - 11.30am (5 - 9yrs) | 12 noon - 2.00pm (10 - 14yrs) Fee: €25 per week - €5 discount for each additional family members Racquets and balls provided Laois County Council welcome participation of children with special needs and/or disabilities. Enquiries & Bookings to: Sport Section, Laois County Council, Áras an Chontae, Portlaoise Phone: 057 8674363 or Email: [email protected] REGISTRATION FORM Parks Tennis adheres to the Code of Ethics and Good Practice for Children in Sport. Please complete the details below including a signature by a parent or guardian and bring it to your nearest tennis court for registration with the fee for the programme. -

LAOIS COUNTY COUNCIL LIBRARY SERVICES Laois County Council Have Libraries in the Folowing Locations

sports, leisure & play WHAT WE DO: • Organise summer activities for children • Organise fun activity days for school children • Train coaches and leaders to help improve in your sports • Set up new clubs to give you a wider choice of sport • Provide information on all types of sport and activity • Help develop community facilities e.g. playgrounds • Develop and maintain playgrounds for children in Co. Laois Ann Marie Maher Catherine Murphy Pamela Holmes Bredin Sport & Leisure Officer Clerical Officer Laois Water Safety Nicole Dunphy James Kelly Andrew Kavanagh FAI Officer GAA Games Admin Officer GAA Games Admin Officer Stephen Gore Paul Brady Padraig Mahon CCRO Leinster Rugby CCRO Leinster Rugby CCRO Leinster Rugby WHERE TO FIND US: Áras an Chontae, Portlaoise, Co. Laois. Tel: 057 866 4058 Email: [email protected] Laois County Council do not accept responsibility for any errors and/or omissions contained in this directory. Laois Parks Tennis Camps COaCHing MOnDay TO FriDay aT: abbeyleix Tennis Club 3rd - 7th July Mountmellick: irishtown 17th - 21st July Duration: one Portarlington: Tennis Club 10th – 14th July week in July at Portlaoise College: M/rath rd 24th – 28th July each venue listed LESSOn TiMES: 10am - 11.30am (5 - 9yrs) 12 noon - 2.00pm (10 - 16yrs) FEE: €30 per week - €5 discount for each additional family members racquets and balls provided Enquiries & Bookings to: Sport & Leisure Section, Laois County Council, Áras an Chontae, Portlaoise. Phone: 057 866 4058 or Email: [email protected] Laois County Council welcome participation of children with special needs and/or disabilities. REGISTRATION FORM Parks Tennis adheres to the Code of Ethics and Good Practice for Children in Sport. -

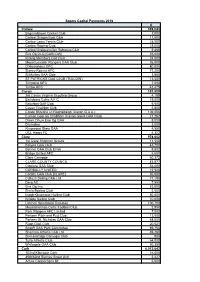

Grid Export Data

Sports Capital Payments 2018 € Carlow 389,043 Bagenalstown Cricket Club 7,000 Carlow Dragon Boat Club 11,500 Carlow Lawn Tennis Club 28,500 Carlow Rowing Club 18,000 Carlow/Graiguecullen Subaqua Club 9,468 Éire Óg CLG [CARLOW] 35,000 Killerig Members Golf Club 24,500 Mount Leinster Rangers GAA Club 36,000 O'Hanrahans GFC 80,000 Slaney Rovers AFC 71,250 St Mullins GAA Club 3,850 ST PATRICKS GAA CLUB (TULLOW) 13,500 Tinryland GFC 7,000 Tullow RFC 43,475 Cavan 183,809 3rd Cavan Virginia Scouting Group 4,189 Bailieboro Celtic A.F.C 19,000 Belturbet Golf Club 5,500 Cavan Triathlon Club 2,800 Coiste Bhreifne Uí Raghaillaigh (Cavan G.A.A.) 109,686 Cuman Gael an Chabhain (Cavan Gaels GAA Club) 21,262 Droim Dhuin Eire Og GAA 9,000 Drumalee 3,500 Kingscourt Stars GAA 4,550 UCL Harps FC 4,322 Clare 978,602 1st Clare Shannon Scouts 11,500 Ballyea GAA Club 43,700 Banner GAA Club Ennis 9,602 Bridge United AFC 5,500 Clare Camogie 60,372 CLARE COUNTY COUNCIL 83,877 Clonlara GAA Club 54,000 CORBALLY UNITED 12,500 Corofin GAA Club [CLARE] 50,000 Cullaun Sailing Club Ltd 77,180 Derg AC 7,990 Eire Og Inis 53,000 Ennis Boxing Club 2,500 Inagh Kilnamona Hurling Club 50,000 Killaloe Sailing Club 10,000 Lahinch Sportsfield Comittee 100,700 Mountshannon Celtic Football Club 2,850 Park Rangers AFC Limited 7,000 Parteen Pitch and Putt Club 13,500 Parteen St. Nicholas GAA Club 68,000 Ruan GAA Club 20,621 Scariff GAA Park Committee 99,750 Shannon Athletic Club Ltd 39,260 Sixmilebridge Camogie Club 850 Tulla Athletic Club 64,000 Whitegate GAA Club 30,350 Cork 6,013,642 -

Polling Offaly

CONSTITUENCY OF OFFALY NOTICE OF POLLING STATIONS EUROPEAN PARLIAMENT, LOCAL ELECTIONS AND REFERENDUM ON THIRTY-EIGHTH AMENDMENT OF THE CONSTITUTION BILL 2016 To be held on Friday the 24th day of MAY 2019 between the hours of 07.00 a.m. and 10.00 p.m. I, THE UNDERSIGNED, BEING THE EUROPEAN LOCAL RETURNING OFFICER FOR THE CONSTITUENCY OF OFFALY, HEREBY GIVE NOTICE THAT THE POLLING STATIONS LISTED BELOW, FOR THE COUNTY OF OFFALY AND THE DESCRIPTION OF ELECTORS ENTITLED TO VOTE AT EACH STATION IS AS FOLLOWS: VOTERS ENTITLED POLLING POLLING TO VOTE AT EACH POLLING STATION TOWNLANDS AND/OR STREETS STATION DISTRICT PLACE, NUMBERS NO. ON REGISTER Crinkle National School BIRR RURAL (Pt. of): Ballindarra (Riverstown), Ballinree (Fortal), 1 BIRR RURAL Beech Park, Boherboy, Cemetery Road, Clonbrone, Clonoghill 1 - 556 No. 1 Lower, Clonoghill Upper, Coolnagrower, Cribben Terrace, Cypress B.1 Grove, Derrinduff, Ely Place, Grove Street, Hawthorn Drive, Leinster Villas BIRR RURAL (Pt. of): Main Street Crinkle, Millbrook Park, Military 2 Crinkle National School BIRR RURAL 557 - 1097 No. 2 Road, Roscrea Road, School Street, Swag Street, The Rocks. B.1 KILCOLMAN (Pt. of): Ballegan, Ballygaddy, Boheerdeel, Clonkelly, Lisduff, Rathbeg, Southgate. 3 Oxmanstown National BIRR RURAL BIRR RURAL (Pt. of): Ballindown, Ballywillian, Lisheen, Woodfield 1098 - 1191 School, Birr No. 1 or Tullynisk. B.1 4 Civic Offices, Birr No. 1 BIRR URBAN: Brendan Street, Bridge Street, Castle Court, Castle BIRR URBAN Mall, Castle Street, Castle St. Apartments, Chapel Lane, Church 1 - 600 Street, Community Nursing Unit, Connaught Street, Cornmarket B.2 Apartments, Cornmarket Street, Emmet Court, Emmet Square, Emmet Street, High Street, Main Street, Main Street Court, Mill Street, Mineral Water Court, Mount Sally, Oxmantown Mall, Post Office Lane, Rosse Row, St. -

Central Statistics Office, Information Section, Skehard Road, Cork

Published by the Stationery Office, Dublin, Ireland. To be purchased from the: Central Statistics Office, Information Section, Skehard Road, Cork. Government Publications Sales Office, Sun Alliance House, Molesworth Street, Dublin 2, or through any bookseller. Prn 443. Price 15.00. July 2003. © Government of Ireland 2003 Material compiled and presented by Central Statistics Office. Reproduction is authorised, except for commercial purposes, provided the source is acknowledged. ISBN 0-7557-1507-1 3 Table of Contents General Details Page Introduction 5 Coverage of the Census 5 Conduct of the Census 5 Production of Results 5 Publication of Results 6 Maps Percentage change in the population of Electoral Divisions, 1996-2002 8 Population density of Electoral Divisions, 2002 9 Tables Table No. 1 Population of each Province, County and City and actual and percentage change, 1996-2002 13 2 Population of each Province and County as constituted at each census since 1841 14 3 Persons, males and females in the Aggregate Town and Aggregate Rural Areas of each Province, County and City and percentage of population in the Aggregate Town Area, 2002 19 4 Persons, males and females in each Regional Authority Area, showing those in the Aggregate Town and Aggregate Rural Areas and percentage of total population in towns of various sizes, 2002 20 5 Population of Towns ordered by County and size, 1996 and 2002 21 6 Population and area of each Province, County, City, urban area, rural area and Electoral Division, 1996 and 2002 58 7 Persons in each town of 1,500 population and over, distinguishing those within legally defined boundaries and in suburbs or environs, 1996 and 2002 119 8 Persons, males and females in each Constituency, as defined in the Electoral (Amendment) (No. -

Connacht GAA Tain League 2015(Adult) Dates

Connacht GAA Tain League 2015(Adult) Dates- . Round 1- 31st January 2015 . Round 2- 7th February 2015 . Round 3- 14th February 2015 . Round 4- 28th February 2015 . Round 5- 11th April 2015 . Semi-Finals- 18th April 2015 . Finals- 25th April 2015 Connacht GAA Tain League Groups Division 1 Division 2* 1. Oran Group 1 Group 2 Group 3 2. Abbeyknockmoy 1. Cluainin Iomaint 1. Western Gaels 1. Castlebar Mitchels 3. Tooreen 2. Tourlestrane 2. Westport 2. Tremane 4. Athleague 3. Sylane 3. St Marys Carrick 3. Ml Breathnachs 5. Ballyhaunis 4. St. Dominics 4. Salthill/Knocknacarra 4. Ballinasloe 5. Annaghdown 5. Skehana 5. Longford Slashers 6. Roscommon Gaels 6. Ballinamore Rules & Regulations 1. First Named team has home advantage except in semi-finals and finals of the competition. 2. Referees to be appointed by Connacht GAA however each club is expected to provide a linesman for each fixture. 3. Games to be played on or before the date set. 4. If games are to be changed, it must be on the agreement of both clubs with correspondence sent to [email protected] with the details of the agreed fixture. Any unfulfilled games not played prior to the final round of league fixtures will be declared null and void. 5. Format for deciding League & Round Robin Format- In accordance with Rial 6.20 T.O 2013 Results to be notified to the Connacht GAA Office immediately after the match by the designated home team, (first team listed), via email to [email protected] or by text to 0876290210 Connacht GAA Tain League 2015(Adult) Division 1 Home Team -

![County of Offaly Local Electoral Areas and Municipal Districts Order 2014 2 [62]](https://docslib.b-cdn.net/cover/9576/county-of-offaly-local-electoral-areas-and-municipal-districts-order-2014-2-62-1309576.webp)

County of Offaly Local Electoral Areas and Municipal Districts Order 2014 2 [62]

STATUTORY INSTRUMENTS. S.I. No. 62 of 2014 ———————— COUNTY OF OFFALY LOCAL ELECTORAL AREAS AND MUNICIPAL DISTRICTS ORDER 2014 2 [62] S.I. No. 62 of 2014 COUNTY OF OFFALY LOCAL ELECTORAL AREAS AND MUNICIPAL DISTRICTS ORDER 2014 The Minister for the Environment, Community and Local Government, in exercise of the powers conferred on him by sections 4 and 23 of the Local Government Act 2001 (No. 37 of 2001) and having regard to section 28(1)(d) of the Local Government Reform Act 2014 (No. 1 of 2014) hereby orders as follows: 1. This Order may be cited as the County of Offaly Local Electoral Areas and Municipal Districts Order 2014. 2. (1) The County of Offaly shall be divided into the local electoral areas which are named in the first column of the Schedule to this Order. (2) Each such local electoral area shall consist of the area described in the second column of the Schedule to this Order opposite the name of such local electoral area. (3) The number of members of Offaly County Council to be elected for each such local electoral area shall be the number set out in the third column of the Schedule to this Order opposite the name of that local electoral area. 3. Every reference in the Schedule to this Order to an electoral division shall be construed as referring to such electoral division as existing at the date of this Order and every reference to a former rural district shall be construed as a reference to that district as constituted immediately before the 1st day of October 1925. -

Celebrating 101 Years

GAA Performance Analysis Seminar 4th February 2013 18:00 – 22:00 Mardyke Arena, University College Cork, Ireland Target Audience The Seminar aims to attract all key coaches/personnel involved in GAA clubs at all levels. The Seminar will highlight the significance of performance analysis within the game and the benefits it can bring to both teams and players. Proposed Program 18:00 – 18:30 Registration & Tea’s and Coffee’s 18:30 – 18:45 Opening/Welcome Address Overview of our facilities/services 18:45 – 19:45 Session 1: How Video Analysis is used to improve performance in both a Hurling & Football context? o Case Study: Going through all areas of analysis and highlighting the statistical report that is prepared and how this is used to improve performance. Speaker: Len Browne, Head of Performance Analysis, Mardyke Arena Speaker: Sean O’Donnell, Cork Senior Hurling Analyst 25 Minute Presentations & 10 Minutes Q& A 19:45 – 20:30 Session 2: The Benefits of Performance Analysis within a Team Environment: Coaches/Players Perspective 1. Billy Morgan, UCC Sigerson Head Coach & Ex Cork Senior Football Manager 2. Brian Cuthbert, Bishopstown G.A.A Head Coach/Cork Senior Football Selector 3. Ger Cunningham, UCC Fresher’s Hurling Head Coach & Ex Cork Senior Hurler 4. Noel Furlong, Carrigtwohill GAA Player 10 Minutes Presentations & 5 Minutes Q&A 1 GAA Performance Analysis Seminar 4th February 2013 18:00 – 22:00 Mardyke Arena, University College Cork, Ireland 20:30 – 21:30 Session 3: Active Recovery for Players: Demonstration on Hydrotherapy, Anti- Gravity Treadmills & Fitness Testing 20:30 – 20:50 Group A: Demo on Hydrotherapy Pool Group B: Demo on Anti-Gravity Treadmills Group C: Fitness Testing – Indoor Track 20:50 – 21:10 Group A: Demo on Anti-Gravity Treadmills Group B: Fitness Testing – Indoor Track Group C: Demo on Hydrotherapy Pool 21:10 – 21:30 Group A: Fitness Testing – Indoor Track Group B: Demo on Hydrotherapy Pool Group C: Demo on Anti-Gravity Treadmills 21:30 – 22:00 General Questions & Answers Session 2 . -

2007 Sports Capital Programme Allocations

2007 Sports Capital Programme Allocations County Organisation Amount Allocated Carlow Askea Karate CLub €3,000 Carlow Ballinkillen Hurling Club €80,000 Carlow Carlow Gymnastics Club €10,750 Carlow Carlow Martial Arts Sanctuary €10,000 Carlow Carlow Town Hurling Club €50,000 Carlow County Carlow Football Club €70,000 Carlow Éire Óg CLG [CARLOW] €90,000 Carlow Myshall GAA Club €100,000 Carlow New Oak Boys Football Club €40,000 Carlow OLD LEIGHLIN GFC €100,000 Carlow Palatine GAA Club €80,000 Carlow ST PATRICKS GAA CLUB (TULLOW) €70,000 Cavan Active Virginians €3,500 Cavan Bailieborough Shamrocks GAA €100,000 Cavan Ballyjamesduff Soccer Club €60,000 Cavan Ballymachugh G.F.C. €140,000 Cavan Belturbet Row Boat Club €6,000 Cavan Butlersbridge Gaelic Football Club €100,000 Cavan Castlerahan Community Development Ltd €60,000 Cavan Cootehill Celtic GAA €90,000 Cavan Cootehill Harps AFC €90,000 Cavan Cornafean GFC €50,000 Cavan County Cavan Rugby Football Club €150,000 Cavan Drumalee €18,000 Cavan Drumlane Community Partnership Ltd €9,000 Cavan Drumlane GAA Club €12,000 Cavan Drumlin Equestrian €65,000 Cavan kill community development €40,000 Cavan Killeshandra Leaguers GFC €75,000 Cavan Kingscourt Harps AFC €50,000 Cavan Knockbride G F C €100,000 Cavan Lavey GAA Club €70,000 Cavan Loch Gowna G.A.A. Club €100,000 Cavan Mullahoran GFC €60,000 Cavan Ramor United GFc & Ramor Community Sports Park €130,000 Cavan Templeport Saint Aidans GAA Club €50,000 Clare Aughinish Diving Club €20,000 Clare Bodyke GAA Club €35,000 Clare CLARE COUNTY COUNCIL €130,000 Clare Clarecastle GAA Club €30,000 Clare Clonlara Leisure Athletic and Sports Centre €100,000 Clare Clooney Quin GAA Club €60,000 Clare Cooraclare GAA Club €90,000 Clare CORBALLY UNITED €10,000 Clare Corofin GAA Club [CLARE] €35,000 Clare County Clare Agricultural Show Society Limited €90,000 Clare Cratloe Tennis Club €20,000 Clare Crusheen G.A.A.