A Spoonful of Progress in a Bowl Full of Unhealthy Marketing to Children

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Newsletter Nov 7

BAXTER ELEMENTARY SCHOOL BAXTER BULLETIN SPECIAL EDITION 2991 Baxter Rd, Anchorage, AK 99504, 907-742-1750 November 11, 2019 CALENDAR NOV 12 - PTA Mtg 6pm NOV 13 - Community Flu Shot Clinic 2-5PM Join us for a NO COST fu shot clinic at: NOV 15 - Popcorn Friday NOV 22 - Turkey Shoot 6pm NOV 28 & 29th NO SCHOOL; Thanksgiving Baxter Elementary Holiday Wednesday - Nov 13th DEC 6 - Family Bingo Night DEC 10 - Band & Orch Concert 9:45 am 2:00pm - 5:00pm PTA Mtg 6pm DEC 13 - Popcorn Friday • Open to anyone ages 6 months and older. Roar • No insurance required. DEC 18 - Baxter Choir Concert • Parent or guardian consent required for ages 17 and under. • Contact the school nurse with any questons. DECEMBER 20th - JANUARY 5th NO SCHOOL (Winter Break) Important Numbers: Attendance: [email protected] www.facebook.com/ Attendance: 742-1750, Press 1 BaxterElementaryASD Nurse: 742-1751 Cafeteria: 742-1767 http://baxter.asdk12.org Office: 742-1750 November 2019 Sunday Monday Tuesday Wednesday Thursday Friday Saturday 10 11Veterans 12 PTA MTG 13 FLU SHOT 14 15 POPCORN 16 Day-NO 6PM CLINIC FRIDAY SCHOOL 2-5PM 17 18 19 20 21 22 TURKEY 23 SHOOT 6PM 24 25 26 27 28 29 30 THANKSGIVING THANKSGIVING HOLIDAY HOLIDAY December 2019 Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1 2 3 4 5 6 FAMILY 7 BINGO NIGHT 8 9 10 PTA MTG 11 12 13 POPCORN 14 6PM FRIDAY BAND & ORCH ROAR CONCERT 15 16 17 18 CHOIR 19 20 21 CONCERT NO SCHOOL DECEMBER 20TH - JANUARY 5TH. HAVE A HAPPY WINTER BREAK! FROM THE PRINCIPAL’S DESK AND ASSISTANT PRINCIPAL’S DESK Hello Baxter Families, What an interesting November we are having! This mild, wet weather is definitely not the Alaska we are used to. -

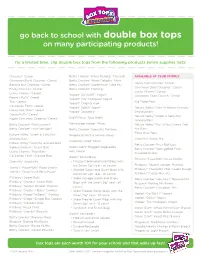

Go Back to School with Double Box Tops on Many Participating Products!

go back to school with double box tops on many participating products! for a limited time, clip double box tops from the following products (while supplies last): Cheerios® Cereal Betty Crocker® Warm Delights® Desserts AVAILABLE AT CLUB STORES: Cinnamon Burst Cheerios® Cereal Betty Crocker® Warm Delights® Minis Honey Nut Cheerios® Cereal Banana Nut Cheerios® Cereal Betty Crocker® SuperMoist® Cake Mix Cinnamon Burst Cheerios® Cereal Fruity Cheerios® Cereal Betty Crocker® Frosting Lucky Charms® Cereal Lucky Charms® Cereal Yoplait® Go-GURT® Yogurt Cinnamon Toast Crunch® Cereal Reese’s Pus® Cereal Yoplait® Trix® Multipack Yogurt Trix® Cereal Kid Triple Pack Yoplait® Original 4-pk Cascadian Farm® Cereal Yoplait® Splitz® Yogurt Nature Valley® Oats ‘N Honey Crunchy Honey Nut Chex® Cereal Yoplait® Smoothie Granola Bars Cocoa Pus® Cereal Nature Valley® Sweet & Salty Nut Apple Cinnamon Cheerios® Cereal Old El Paso® Taco Shells Granola Bars Betty Crocker® Fruit Gushers® Hamburger Helper® Mixes Nature Valley® Fruit & Nut Chewy Trail Betty Crocker® Fruit Roll-Ups® Betty Crocker® Specialty Potatoes Mix Bars Fiber One® Bars Nature Valley® Sweet & Salty Nut Progresso® Rich & Hearty Soups Granola Bars Chex Mix® Snack Mix Suddenly Salad® Mixes Nature Valley® Crunchy Granola Bars Betty Crocker® Fruit Roll-Ups® Golden Graham® Snack Bars Green Giant® Bagged Vegetables Betty Crocker® SpongeBob Fruit- Lucky Charms® Treat Bars with Sauce Flavored Snacks Cascadian Farm® Granola Bars Ziploc® brand Bags : Totino’s® Pizza Rolls® Pizza Snacks Chex Mix® Snack Mix -

Clip Box Tops–Earn Cash for Our School!

Clip Box Tops–earn cash for our school! Earn cash for our school every time you shop for groceries. Clip Box Tops from hundreds of your favorite products.* Each Box Top is worth 10¢ to our school—and that adds up fast! CEREAL Disney’s® Mickey Mouse Clubhouse Berry Crunch Caribou Coee® Bars Ziploc® Brand Twist ‘n Loc® Containers Cheerios ® Disney’s® Princess Fairytale Flakes Chex Mix® Snack Mix Ziploc® Brand Big Bags Apple Cinnamon Cheerios ® Curves™ Cereal & Bars Chex Mix® for Kids Ziploc® Brand Expandable Bottom Bags Honey Nut Cheerios ® Pop•Secret® Microwave Popcorn Ziploc® Brand Treat Bags Frosted Cheerios ® REFRIGERATED/DAIRY Nature Valley® Crunchy Granola Bars Saran™ Premium Wrap MultiGrain Cheerios ® Pillsbury® Grands! ® Biscuits Nature Valley® Chewy Trail Mix Bars Saran™ Cling Plus® Wrap Team Cheerios ® Pillsbury® Grands! ® Sweet Rolls Nature Valley® Chewy Granola Bars with Yogurt Berry Burst Cheerios ® Pillsbury® Crescent Rolls Nature Valley® Sweet & Salty Nut Granola Bars PAPER PRODUCTS Fruity Cheerios ® Pillsbury® Cookie Dough Nature Valley® Healthy Heart Chewy Granola Bars COTTONELLE® Bath Tissue Yogurt Burst Cheerios® Pillsbury® Flaky Cinnamon Twists Cascadian Farm® Granola Bars COTTONELLE® Bath Tissue with Aloe & E Cheerios Crunch™ Pillsbury® Ready To Bake! ™ Cookies Curves® Snack Bars COTTONELLE® Bath Tissue Ultra Wheaties ® Pillsbury® Sweet Rolls Mini Fruit Roll-Ups® Fruit Flavored Snacks COTTONELLE FRESH® Flushable Moist Wipes Rice Chex ® Pillsbury® Simply Bake® Bars Fruit Roll-Ups® Crazy Pix™ Fruit Flavored Snacks COTTONELLE® -

Kellogg Company 2012 Annual Report

® Kellogg Company 2012 Annual Report ™ Pringles Rice Krispies Kashi Cheez-It Club Frosted Mini Wheats Mother’s Krave Keebler Corn Pops Pop Tarts Special K Town House Eggo Carr’s Frosted Flakes All-Bran Fudge Stripes Crunchy Nut Chips Deluxe Fiber Plus Be Natural Mini Max Zucaritas Froot Loops Tresor MorningStar Farms Sultana Bran Pop Tarts Corn Flakes Raisin Bran Apple Jacks Gardenburger Famous Amos Pringles Rice Krispies Kashi Cheez-It Club Frosted Mini Wheats Mother’s Krave Keebler Corn Pops Pop Tarts Special K Town House Eggo Carr’s Frosted Flakes All-Bran Fudge Stripes Crunchy Nut Chips Deluxe Fiber Plus Be Natural Mini Max Zucaritas Froot Loops Tresor MorningStar Farms Sultana Bran Pop Tarts Corn Flakes Raisin Bran Apple JacksCONTENTS Gardenburger Famous Amos Pringles Rice Letter to Shareowners 01 KrispiesOur Strategy Kashi Cheez-It03 Club Frosted Mini Wheats Pringles 04 Our People 06 Mother’sOur Innovations Krave Keebler11 Corn Pops Pop Tarts Financial Highlights 12 Our Brands 14 SpecialLeadership K Town House15 Eggo Carr’s Frosted Flakes Financials/Form 10-K All-BranBrands and Trademarks Fudge Stripes01 Crunchy Nut Chips Deluxe Selected Financial Data 14 FiberManagement’s Plus Discussion Be & Analysis Natural 15 Mini Max Zucaritas Froot Financial Statements 30 Notes to Financial Statements 35 LoopsShareowner Tresor Information MorningStar Farms Sultana Bran Pop Tarts Corn Flakes Raisin Bran Apple Jacks Gardenburger Famous Amos Pringles Rice Krispies Kashi Cheez-It Club Frosted Mini Wheats Mother’s Krave Keebler Corn Pops Pop Tarts Special K Town House Eggo Carr’s Frosted Flakes All-Bran Fudge Stripes Crunchy Nut Chips Deluxe Fiber Plus2 Be NaturalKellogg Company 2012 Annual Mini Report MaxMOVING FORWARD. -

2011-04-03 Po

JOBS THAT PAY WELL, LOO* m o n e y : NO DEGREE REQUIRED lns.de. S A V jN G ' SEE CLASSIFIEDS-SECTION C KATIE COURIC'S THIS WEEK MORE LIFE LESSONS DDA TO RENT ADDED PARKING-A 3 THAN $150 WORTH INSIDE SUNDAY April 3.2011 PLYMOUTH The Observer & Eccentric Newspapers Volume 124 Number 66 O bserver $1.00 hometownlife ffil com a G a n n e t t c o m p a n y PIPELINE Plymouth-Canton Emmy hopeful "SportScience," the popu students top state lar television series featur ing Wayne State University Professor of Biomedical on MEAP scores Engineering Cynthia Birof Plymouth, was nominated for two awards at the 32nd BYBRADKADRICH Last year, the state shifted annual Sports Emmys, sched OBSERVER STAFF WRITER the test to only fourth- and uled for Monday, May 2, at the seventh-graders, rather Frederick P. Rose Hall, home The Michigan Department than grades 3-8, then didn’t of Jazz at Lincoln Center, in of Education released the release the 2009-10 results. New York City. fall 2010 MEAP scores Statewide, fewer than half The "SportScience” team Thursday, and Plymouth- the students passed the new is nominated for Outstanding Canton Community Schools writing test. Graphic Design and Out students were the same place In Plymouth-Canton, standing they’ve been for years. scores for fourth-graders New App Well above state averages. were up four points from two roaches, Plymouth-Canton students years ago (the last year from Sports performed in the testing which results were available); Program largely as they have the last scores for seventh-graders PHOTOS BY BILL BRESLER | STAFF PHOTOGRAPHER ming, Short several years, with gains and dropped significantly. -

1 Whole Grain Trix Cereal Whole Grain Cinnamon Grahams 100% Fruit Juice 2 Strawberry Nutrigrain Cereal Bar Scooby Doo Whole

1 2 3 Whole Grain Trix Cereal Strawberry NutriGrain Whole Grain Bagel Cereal Bar Whole Grain Cinnamon Light Cream Cheese or Grahams Scooby Doo Whole Grain String Cheese Grahams Sticks 100% Fruit Juice Cherry Craisins 100% Fruit Juice Raisins 6 7 8 9 10 Rice Chex Whole Grain Cinnamon Whole Grain Trix Cereal Golden Grahams Whole Grain Smart Choice Toast Crunch Cereal Cereal Bar Banana Muffin Honey Sunflower Seeds Whole Grain Cinnamon Whole Grain Grahams Honey Sunflower Seeds Giant Goldfish Grahams Raisins Honey Grahams 100% Fruit Juice 100% Apple Juice Unsweetened Applesauce 100% Tangerine Juice Raisins Raisins Unsweetened Applesauce 13 14 15 16 17 Whole Grain Trix Cereal Team Cheerios Cereal Bar Frosted Mini– Wheats Whole Grain Golden Whole Grain Grahams Cereal Apple Muffin Top Whole Grain Cinnamon Whole Grain Whole Grain Cheez– Its Grahams Cinnamon Graham Crackers Whole Grain Maple Oat Cinnamon Grahams Cereal Bar Sliced Apples Raisins Sliced Apple Unsweetened Applesauce Raisins 100% Fruit Juice 100% Orange Tangerine 100% Fruit Juice Raisins Juice 100% Apple Juice 19 20 21 22 23 Multigrain Cheerios Whole Grain Cinnamon Whole Grain Trix Cereal Golden Grahams Cinnamon Toast Crunch Toast Crunch Cereal Cereal Bar Cereal Bar Whole Grain Cheddar Whole Grain Cinnamon Goldfish Whole Grain Cinnamon Grahams Honey Sunflower Seeds Salted Sunflower Seeds Grahams 100% Fruit Juice 100% Fruit Juice 100% Apple Juice 100% Orange Tangerine 100% Apple Juice Juice 26 27 28 29 30 Rice Chex Whole Grain Cinnamon Strawberry NutriGrain Whole Grain Bagel Whole Grain Smart Choice Toast Crunch Cereal Cereal Bar Banana Muffin Honey Sunflower Seeds Light Cream Cheese or Whole Grain Scooby Doo Whole Grain String Cheese Giant Goldfish Grahams Raisins Honey Grahams Grahams Sticks Cherry Craisin Unsweetened Applesauce 100% Tangerine Juice Raisins 100% Fruit Juice Raisins Raisins Unsweetened Applesauce . -

Determining Supply Chain Variability at General Mills

Determining Supply Chain Variability at General Mills L to R: Frederick Zhou, Christine England, Teresa Viola, Rajat Bhatia, and Carol German With roots going back to 1856, founded in 1928 and headquartered in Golden Valley, Minnesota, a Minneapolis suburb, General Mills, Inc. is a multinational manufacturer and marketer of branded consumer foods and other packaged goods sold through retail stores in more than 100 countries. The company, which reported 2017 revenue of $15.6 billion, operates approximately 79 food production facilities in a more than The General Mills Tauber team was tasked with a dozen countries, and has approximately 38,000 employees. It determining cumulative effects of common variability manufactures cereals, snacks, yogurt, and other food products under sources on the supply chain performance. such well-known brands as Gold Medal fl our, Annie’s Homegrown, Betty Crocker, Yoplait, Colombo, Totino’s, Pillsbury, Old El Paso, Häagen-Dazs, Nature Valley, Cheerios, Trix, Cocoa Puffs, Wheaties, and Lucky Charms. “These interviews allowed the team members to understand General Mills’ operations with more depth,” said Viola. General Mills supplies major retailers and provides services to its core customers for improving display confi gurations and stocking The Tauber team also created a variability network illustrating cause solutions. The company prides itself on best-in-class customer and effect relationships in the supply chain, and identifi ed key service and continually seeks to improve its service performance. variability sources that affect customer service performance. But over the past three years, variability has increasingly affected “The original project endeavored to establish and quantify linear or customer service performance and cost, while the cumulative nonlinear relationships between variability sources, and intermediate nature of these effects is only partially understood by supply chain and fi nal metrics,” said Viola. -

News Releases Kellogg Company

NEWS RELEASES KELLOGG COMPANY VOLUNTARILY RECALLS SELECT PACKAGES OF KELLOGG'S® CORN POPS®, KELLOGG'S® HONEY SMACKS®, KELLOGG'S® FROOT LOOPS® AND KELLOGG'S® APPLE JACKS® BATTLE CREEK, Mich., June 25 /PRNewswire-FirstCall/ -- Working in consultation with the United States Food and Drug Administration (FDA), Kellogg Company (NYSE: K) is implementing a voluntary recall of certain breakfast cereals due to an uncharacteristic off-flavor and smell coming from the liner in the package. Only products with the letters "KN" following the Better If Used Before Date are included in the recall. Products with a "KM" designation are NOT included in the recall. In addition, no products in Canada are affected. Kellogg's® Apple Jacks® UPC 3800039136 1: 17 ounce package with Better if Used Before Dates between APR 10 2011 and JUN 22 2011 UPC 3800039132 3: 8.7 ounce packages with Better if Used Before Dates between JUN 03 2011 and JUN 22 2011 Kellogg's® Corn Pops® UPC 3800039109 5: 12.5 ounce packages with Better if Used Before Dates between MAR 26 2011 and JUN 22 2011 UPC 3800039111 8: 17.2 ounce packages with Better if Used Before Dates between MAR 26 2011 and JUN 22 2011 UPC 3800039116 3: 9.2 ounce packages with Better if Used Before Dates between APR 05 2011 and JUN 22 2011 Kellogg's® Froot Loops® UPC 3800039118 7: 12.2 ounce packages with Better if Used Before Dates between MAR 26 2011 and JUN 22 2011 UPC 3800039120 0: 17 ounce packages with Better if Used Before Dates between MAR 26 2011 and JUN 22 2011 UPC 3800039125 5: 8.7 ounce packages with Better if Used Before Dates between MAR 26 2011 and JUN 22 2011 Kellogg's® Honey Smacks® UPC 3800039103 3: 15.3 ounce packages with Better if Used Before Dates between MAR 26 2011 and JUN 22 2011 While the potential for serious health problems is low, some consumers are sensitive to the uncharacteristic off-flavor and smell and should not eat the recalled products because of possible temporary symptoms, including nausea and diarrhea. -

Fiscal 2018 Annual Report

FISCAL 2018 ANNUAL REPORT Fiscal 2018 Financial Highlights Change In millions, except per share and 52 weeks ended 52 weeks ended on a constant- profit margin data May 27, 2018 May 28, 2017 Change currency basis* Net Sales $ 15,740 $ 15,620 1% Organic Net Sales* Flat Operating Profit $ 2,509 $ 2,566 (2%) Total Segment Operating Profit* $ 2,792 $ 2,953 (5%) (6%) Operating Profit Margin 15.9% 16.4% -50 basis points Adjusted Operating Profit Margin* 17.2% 18.1% -90 basis points Net Earnings Attributable to General Mills $ 2,131 $ 1,658 29% Diluted Earnings per Share (EPS) $ 3.64 $ 2.77 31% Adjusted Diluted EPS, Excluding Certain $ 3.11 $ 3.08 1% Flat Items Affecting Comparability* Average Diluted Shares Outstanding 586 598 (2%) Dividends per Share $ 1.96 $ 1.92 2% Net Sales Total Segment Adjusted Diluted Free Cash Flow* Dollars in millions Operating Profit* Earnings per Share* Dollars in millions Dollars in millions Dollars $3.11 $3,154 $17,910 $2,218 $17,630 $3,035 $3,000 $3.08 $2,953 $16,563 $2,035 $2,792 $1,959 $15,740 $15,620 $1,936 $1,731 $2.92 $2.86 $2.82 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 *See page 45 of form 10-K herein for discussion of non-GAAP measures. Fiscal 2018 Net Sales $15.7 Billion Total Company Net Sales by Product Platform Total Company Net Sales by Reporting Segment Our portfolio is focused on five global growth In fiscal 2018, we reported net sales in four platforms. -

Earn 10 Box Tops on These Specially Marked Items at Costco

EARN 10 BOX TOPS ON THESE SPECIALLY MARKED ITEMS AT COSTCO CEREALS SNACKS ¨ Cheerios™ ¨ Nature Valley™ Almond Butter Biscuits ¨ Honey Nut Cheerios™ ¨ Nature Valley™ Oats & Honey Crunchy Granola Bars ¨ Multigrain Cheerios™ ¨ Nature Valley™ Fruit & Nut Chewy Granola Bars ¨ Cinnamon Toast Crunch™ ¨ Nature Valley™ Sweet & Salty Peanut Granola Bars ¨ Lucky Charms™ ¨ Mott’s® Fruit Snacks, 90 ct ¨ Annie’s® Friends Bunnies Organic Cereal ¨ Fruit by The Foot® Fruit Rolls MEALS YOGURT ¨ Annie’s® Mac & Cheese (Variety Pack) ¨ Go-GURT® Simple Yogurt DOWNLOAD BUY & SCAN EARN $ FOR BOX TOPS APP RECEIPT YOUR SCHOOL Offer available at COSTCO NO MORE CLIPPING *For each Box Tops For Education (BTFE) product purchased at Costco between 7/15/19-9/30/19, you can earn 10 Bonus Box Tops for your BTFE-eligible enrolled school. Multi-pack BTFE products purchased at Costco count as 1 participating product for purposes of this offer. To receive your Box Tops, your eligible receipt must be scanned in the App within 14 DAYS of your BTFE product purchase at Costco. Standard data rates may apply. Each product featuring the Box Tops logo is worth 10 cents (unless otherwise specified) to your participating school when you scan your receipt containing the participating product in the free Box Tops App. To join, download the App and support an eligible, enrolled school. Limit $20,000 per school per year for redemptions through the clip and receipt scanning programs. Limit $10,000 per App user per year for redemptions through receipt scanning. See www.BTFE.com for App Terms of Service, Official Program Rules, and Privacy Policy. -

Nutribalance-5000 Nutritional Scale

NutriBalance-5000 Nutritional Scale Carb. Guide Contains over 7000 additional food codes for carbohydrates! oz Max: 11lb d: 0.1oz MR M+ WT 9 Prot 7 8 Cal Sal 0 Tare 6 Fat Carb Col 4 5 Fibr 3 g/oz CLR 2 WT MC 1 How To Use This Manual: This manual provides a cross-reference of carbohydrate codes for the NutriBalance nutritional scale, based on the USDA National Nutrient Database Release 18. When using this manual, only the Carb function of the Nutribalance should be used. All other nutritional buttons such as Fiber, Prot, etc will not display accurate information. 1. To find the Carb Code for a food item, simply use the Acrobat Search function (Ctrl+F or Ctrl+Shift+F). Enter the name of the food item in the Search Field and hit Enter. Give the search time to complete. 2. Once you find your food item in the manual, select your code from the “Code to use” column, or the Code (Fiber Method) column. 3. Place the food item onto the weighing platform and enter the code using the keypad. Now press the Carb button. NOTE: The NutriBalance requires 3-digit input for the code to be accepted. Therefore, if the “Code to use” is 3, you should enter 003, etc. Code to use Code Carbo- Fiber_ Refuse_ Modified ( Fiber hydrt TD Pct Carbs (- Method) fiber) MILK SUBSTITUTES,FLUID,W/ 41 41 6.16 0 0 6.16 LAURIC ACID OIL MILK,WHL,3.25% MILKFAT 85 85 4.52 0 0 4.52 MILK,PRODUCER,FLUID,3.7% 819 819 4.65 0 0 4.65 MILKFAT MILK,RED 819 819 4.68 0 0 4.68 FAT,FLUID,2%MILKFAT,W/ADDED VIT A MILK,RED FAT,FLUID,2% 696 696 4.97 0 0 4.97 MILKFAT,W/ NONFAT MILK SOL&VIT A MILK,RED -

Teaching Case ______Journal of Applied Case Research Sponsored by the Southwest Case Research Association

Teaching Case ______________________________ Journal of Applied Case Research Sponsored by the Southwest Case Research Association Kellogg’s Healthier Cereals: An Ethical Dilemma? Thomas D. Tolleson Texas Wesleyan University The genesis of this case was the result of a class project. The author would like to thank Marco Guzman, Matty Horton, Shayla Impson, Chris Taylor and Courtney Williams for their contributions to this case. © Journal of Applied Case Research Accepted: December 2007 INTRODUCTION Vicki thought of herself as a good mother. She planned her grocery purchases and attempted to provide nutritional food for her husband and son. Her three-year-old son, Chaden, was a “picky” eater, so finding healthy foods that he would eat was a challenge, especially at breakfast. About the only food that Chaden would eat for breakfast was cereal. He was particularly fond of Kellogg’s Frosty Flakes and thought “Tony the Tiger” was super. She had even made Chaden a “Tony the Tiger” costume for Halloween. Vicki could usually get Chaden to eat breakfast when she said that “Tony the Tiger” was proud of him for eating a bowl of Frosty Flakes and milk. Vicki was concerned, however, with the sugar content of Frosty Flakes. She had recently returned to school to pursue a degree in early childhood education and had researched the impact of sugar on children’s health, especially childhood obesity. She was relieved when Kellogg’s introduced a low-sugar version of its Frosty Flakes. Vicki was pleased that Chaden’s favorite cereal was now a healthy choice. Or was it? KELLOGG’S The Beginning During the late 1800’s and early 1900’s, two brothers, Dr.