Investor Presentation As of 1Q 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JG Summit Holdings Inc. Annual Report 2020

Annual Report 2020 About the Cover When faced with a monumental challenge, few are able to swiftly form high- impact solutions to make the situation better. It requires agility and adaptability to achieve a transformational outcome. This year, JG Summit swiftly addressed the effects of the pandemic, using its “How to Win” and “Where to Play” strategies to maximum effect. The company was agile in business, as well as steady and firm in uplifting communities to better endure this critical time. By focusing on employee health and safety, operations and supply chain continuity, cash, costs and liquidity management, and helping communities deal with the pandemic, JGS was able to weather the unexpected storm. The company also doubled its efforts to explore new business opportunities. This year’s cover demonstrates the diverse response throughout JG Summit’s businesses - its fluid and agile response that demonstrated firm leadership, mindfulness, and strength to balance business in the face of turmoil and change. 2 Annual Report 2020 Table of Contents JGS at a Glance 4 2020 Key Developments 7 JGS Investment Portfolio 9 Corporate Structure 10 Geographic Presence 12 Chairman’s Message 13 President and CEO’s Report 17 Leadership 21 Our COVID-19 Response 23 Laying the Foundation for the New Normal 27 Strategic Business Units & Investments 38 Strategic Business Units 39 Ecosystem Plays 57 Core Investments 63 Sustainability 65 Sustainability Performance in 2020 66 Gokongwei Brothers Foundation 77 Corporate Governance 86 Financial Statements 96 Contact Info 221 3 Annual Report 2020 JGS at a Glance 4 Annual Report 2020 JGS At A Glance: Key Business Metrics Our portfolio diversity cushioned the impact of COVID-19, driven by The Company’s robust balance sheet provides Continuous shareholder value maximization as JGS’ the resiliency of our food, banking, and office segments, while heavily- enough ballast to weather the pandemic. -

EQUITY MARKET Markets and Securities Regulation Department

PHILIPPINE CAPITAL MARKET AT A GLANCE EQUITY MARKET Markets and Securities Regulation Department 15 September 2020, Tuesday COMPOSITE & SECTOR INDICES The local stock barometer successfully hovered above the 6,000 level on Tuesday, tracking gains across global markets, as investors continued to gain optimism that the economy’s recovery as of market close is picking up pace. Markets are also awaiting the Federal Reserve’s policy meeting on Wednes- day to further gauge the outlook for markets. The PSE index closed at its intraday high of 6,018.21, HIGH: 6,018.21 up by 0.35% or 21.07 points after making a low of 5,947.85 during the day. 6,018.21 OPEN: PREV.CLOSE: 5,989.44 5,997.14 LOW: 5,947.85 Most sector indices closed higher, posting increases of less than 1%. The Holding Firms sector gained the most after adding 0.99% while the Services sector led the decliners after shedding +21.07 1.49%. YTD RETURN: -22.99% 1 YR RETURN: -23.26% +0.35% 47% of the 242 listed issues that were traded today declined while the 32% and 21% advanced Source: Bloomberg and remained unchanged, respectively. Market movers for the day were led by SM, ALI and TEL. 15-Sep-20 Change vs 14-Sep-20 Change vs 13-Mar-20* Local investors accounted for 51.16% of today’s transactions while the 48.84% were traded by Index Type the foreign investors. For three straight days, foreign funds flowed out of the market with today’s Points Points % Points % net sell value amounting to Php791 million. -

Maybank-Philippines Edm 5 Lowres

2015 EDITION MANILA, PHILIPPINES | 25 AUGUST 2015 CAPITALISE ON THE RISE OF THE ASEAN CONSUMER BREAKAWAY IDEAS TO PROFIT FROM THE ASEAN OPPORTUNITY 25 May 2015 | Monday PHILIPPINES: RIDING THE BOOM: ASEAN’s DEMOGRAPHIC DIVIDEND 25 AUGUST 2015 | Tuesday DAY ONE CONFERENCE 7:30am 12:45pm – 1:40pm 1:40pm – 2:30pm REGISTRATION REAPING THE VIEW FROM THE TOP: 8:00am – 8:50am BENEFITS: PRIVATE BREAKFAST SESSIONS PHILIPPINES CEO PLENARY Introduced and Moderated by: Hans Sicat, AND ITS President and CEO, 9:00am – 12:00pm Philippine Stock Exchange DEMOGRAPHIC Panelists: CORPORATE BREAKOUT Jose Ma. A. Concepcion III, President & CEO, SESSIONS DIVIDEND RFM Corporation Introduced and Moderated by: Luz Lorenzo, 11:30am Head of Research, Maybank ATR Kim Eng Anthony T. Huang President, REGISTRATION Panelists: SSI Group For delegates attending the Plenary Session Stuart Jamieson Managing Director, Nielsen Philippines Dr Dennis Mapa, Lorenzo Tan, 11:45am Dean, President & CEO, UP School of Statistics Rizal Commercial LUNCH Banking Corporation Dr Shang-Jin Wei, Chief Economist, Asian Development Bank 12:30pm 2:30pm – 5:30pm OPENING: CORPORATE BREAKOUT Datuk Abdul Farid Alias Group PCEO, SESSIONS Maybank Group 6:00pm – 7:00pm 12:40pm PRE-DINNER COCKTAILS OPENING: Hans Sicat, 7:00pm – 10:30pm President and CEO, Philippine Stock Exchange DINNER: FUN IN MANILA 26 AUGUST 2015 | Wednesday DAY TWO POST –SITE VISIT INDUSTRIAL AN AFTERNOON WITH THE NIGHTCAP: RENAISSANCE: STARS: ABS-CBN AND GMA7 ENTERTAINMENT FIRST PHILIPPINES Visit the Studios, meet their research -

Notice to File Entry, to Pay Duties and Taxes and to Claim Goods Discharged July 29, 2021

NOTICE TO FILE ENTRY, TO PAY DUTIES AND TAXES AND TO CLAIM GOODS DISCHARGED JULY 29, 2021 NO Bill of Lading Discharge Date and Time Consignee Party to Notify 1 ONEYBUEB04496500 29/07/2021 10:51 3 FOR 8 3 FOR 8 2 ONEYBNEB04150800 29/07/2021 11:42 3 FOR 8 TRADING INTERNATIONAL 3 FOR 8 TRADING INTERNATIONAL 3 SNLBNBPLA030124 29/07/2021 23:38 360 DEGREES SYSTEMS CORPORATION LOT SAME AS CNEE 4 SITYKMN2112769 29/07/2021 10:23 4CG CONSUMER GOODS TRADING SUITE 43 SAME AS CONSIGNEE 5 SNLBNBPLB402200 29/07/2021 0:00 5B DYNASTY TRADING5B DYNASTY TRADIN SAME AS CONSIGNEE 6 713110197248 29/07/2021 5:01 A S LAMPS CO INC SAME AS CONSIGNEE 7 721110897501 29/07/2021 21:03 A L E COMPONENT SAME AS CONSIGNEE 8 SE00002404 29/07/2021 11:36 A2Z LOGISTICS INC AMKOR TECHNOLOGY PHILIPPINES INC 9 211497859 29/07/2021 13:35 ABBOTT LABORATORIES VENICE SAME AS CONSIGNEE 10 027B635438 29/07/2021 22:32 ABRIGHT RESOURCES CORPORATION ABRIGHT RESOURCES CORPORATION 11 SNLBNBPLA450942 29/07/2021 23:30 ACASIA IMPEX INC 20 ECANTILLION S SAME AS CONSIGNEE 12 SNLBWHPXCH00063 29/07/2021 11:38 ACASIA IMPEX INC 20 ECANTILLION ST SAME AS CONSIGNEE TEL 6325855237 13 HKGMNL217314 29/07/2021 23:15 ACBEL POLYTECH PHILIPPINES INC SAME AS CONSIGNEE 14 HKG0761582 29/07/2021 22:30 ACCENT SYSTEMS INC 15 1KT154573 29/07/2021 17:51 ACCORD INTERNATIONAL INC 605 ACCORD INTERNATIONAL INC 605 16 1KT157216 29/07/2021 19:30 ACCORD INTERNATIONAL INC BRGY ACCORD INTERNATIONAL INC BRGY 17 NBMNH062921 29/07/2021 15:51 ACE HARDWARE PHILIPPINES INC SAME AS CONSIGNEE 18 NBMNP032221 29/07/2021 16:25 ACE -

Winners and Nominees IR Magazine Awards – South East Asia 2019

IR Magazine Awards – South East Asia 2019 Winners and nominees AWARDS BY RESEARCH Best investor relations officer (large cap) Bangkok Dusit Medical Services Ajaya Intaraprasong & Chama Vijitsathean CP All Jiraphan Thongtan WINNER PETRONAS Dagangan Nur Asyirin Ibrahim Singtel Group Sin Yang Fong United Overseas Bank Stephen Lin Best investor relations officer (small to mid-cap) Century Pacific Food Giovanna Vera Frasers Centrepoint Trust Fung-Leng Chen Manulife US REIT Caroline Fong WINNER Metro Pacific Investments Corporation Maricris Aldover-Ysmael AWARDS BY COUNTRY Best in country: Indonesia Bank BTN Bank Central Asia Bank Rakyat Indonesia (Persero) WINNER Sarana Menara Nusantara Best in country: Malaysia PETRONAS Chemicals Group PETRONAS Dagangan WINNER Sunway Group Best in country: Philippines Ayala Land Century Pacific Food Globe Telecom Metro Pacific Investments Corporation WINNER PLDT Semirara Mining & Power Corporation Best in country: Singapore CapitaLand City Developments Frasers Centrepoint Trust Manulife US REIT WINNER Singtel Group Best in country: Thailand Bangkok Dusit Medical Services WINNER CP All Home Product Center PTT Exploration & Production Thai Union Group AWARDS BY NOMINATION Best overall investor relations (large cap) Ayala Corporation Ayala Land CapitaLand WINNER PTT Exploration & Production United Overseas Bank Best overall investor relations (mid-cap) CapitaLand Mall Trust Management City Developments KASIKORNBANK Olam International Thai Union Group WINNER UOL Group Best overall investor relations (small cap) -

Notice to File Entry, to Pay Duties and Taxes and to Claim Goods Discharged September 23, 2020

NOTICE TO FILE ENTRY, TO PAY DUTIES AND TAXES AND TO CLAIM GOODS DISCHARGED SEPTEMBER 23, 2020 NO Bill of Lading Discharge Date and Time Consignee Party to Notify 1 204667998 23/09/2020 5:55 1 ISUMI CORPORATION LCG BUILDING 1 ISUMI CORPORATION WAREHOUSE 4A 2 204667874 23/09/2020 5:56 1 ISUMI CORPORATION LCG BUILDING 1 ISUMI CORPORATION WAREHOUSE 4A 3 HLCUTOR200720865 23/09/2020 8:24 12 24 CARGO EXPRESS CORP JESSIE JEMES LUGTU 4 ONEYHFAA01675400 23/09/2020 10:50 1224 CARGO EXPRESS CORPORATION JESSIE JAMES LUGTU 1224 CARGO EXP 5 ONEYLIVA40120900 23/09/2020 14:51 1224 CARGO EXPRESS CORPORATION 1224 CARGO EXPRESS CORPORATION 6 ONEYHFAA01678700 23/09/2020 17:52 1224 CARGO EXPRESS CORPORATION JESSIE JAMES LUGTU 1224 CARGO EXP 7 ONEYHFAA01674300 23/09/2020 18:17 1224 CARGO EXPRESS CORPORATION JESSIE JAMES LUGTU 1224 CARGO EXP 8 ONEYDUBA03507400 23/09/2020 11:52 168 CMAV ENTERPRISE 168 CMAV ENTERPRISE 9 ONEYFREA09089700 23/09/2020 8:43 168 CMAV ENTERPRISE 168 CMAV ENTERPRISE 10 YGNCB20002755 23/09/2020 10:51 3 FOR 8 TRADING INTERNATIONAL 3 FOR 8 TRADING INTERNATIONAL 11 ONEYDUBA03543400 23/09/2020 11:27 3C MEAT IMPORTS INC 2F ARCTIC COLD 3C MEAT IMPORTS INC 2F ARCTIC COLD 12 ONEYSAOA30060500 23/09/2020 10:20 999 FOOD SOURCE INC 999 FOOD SOURCE INC 13 SGSIN841889A 23/09/2020 6:40 A MENARINI PHILIPPINES INC SAME AS CONSIGNEE 14 SGSIN841889 23/09/2020 6:44 A MENARINI PHILIPPINES INC SAME AS CONSIGNEE 15 WMNL2009116005 23/09/2020 9:11 A2Z LOGISTICS INC SAME AS CONSIGNEE 16 01PEN0170582 23/09/2020 9:31 A2Z LOGISTICS INC SAME AS CONSIGNEE 17 BTLS2009092 -

Notice to File Entry, to Pay Duties and Taxes and to Claim Goods Discharged October 05, 2020

NOTICE TO FILE ENTRY, TO PAY DUTIES AND TAXES AND TO CLAIM GOODS DISCHARGED OCTOBER 05, 2020 NO Bill of Lading Discharge Date and Time Consignee Party to Notify 1 204943955 05/10/2020 16:05 1 ISUMI CORPORATION LCG BUILDING 1 ISUMI CORPORATION WAREHOUSE 4A 2 204944018 05/10/2020 16:09 1 ISUMI CORPORATION LCG BUILDING 1 ISUMI CORPORATION WAREHOUSE 4A 3 TYO200807169 05/10/2020 21:58 3M PHILIPPINES INC SAME AS CONSIGNEE 4 204843558 05/10/2020 20:03 3M PHILIPPINES INC 10TH AND 11TH 3M PHILIPPINES INC 10TH AND 11TH 5 OOCOSHZ200032000 05/10/2020 13:38 A A G MOTOR ENTERPRISES SAME AS CONSIGNEE 6 200810960254 05/10/2020 14:58 A2Z LOGISTICS INC SAME AS CONSIGNEE 7 PTNMNN2090006 05/10/2020 17:55 AAZ88 TRADING SAME AS CONSIGNEE 8 BKKCB20014371 05/10/2020 0:06 AB FOOD AND BEVERAGES PHILS INC AB FOOD AND BEVERAGES PHILS INC 9 204045740 05/10/2020 14:41 ABBOTT LABORATORIES VENICE SAME AS CONSIGNEE 10 DFS075006493 05/10/2020 16:12 ACER PHILIPPINES INC SAME AS CONSIGNEE 11 DFS075006492 05/10/2020 16:57 ACER PHILIPPINES INC SAME AS CONSIGNEE 12 UTLZS2009074 05/10/2020 7:53 ACHIEVERS FOOD AND BAKERY SAME AS CONSIGNEE 13 ACLY005103 05/10/2020 22:51 ACS MANUFACTURING CORPORATION SAME AS CONSIGNEE 14 SNLAJFPL000158 05/10/2020 13:30 ACTIVESTYLE CORP 2 ARMELA COMPOUND SAME AS CONSIGNEE 15 USPHL0000017307 05/10/2020 14:42 AFP FINANCE CENTER AFP FINANCE CENTER 16 HDMULQML7502935 05/10/2020 11:48 AG AND A GENERAL MERCHANDISE AG AND A GENERAL MERCHANDISE 17 XAST016074 05/10/2020 11:03 AGAND A GENERAL MERCHANDISE AGAND A GENERAL MERCHANDISE 18 XAPV020317 05/10/2020 -

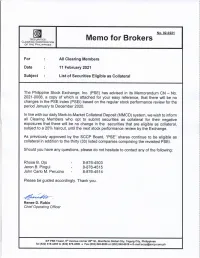

02-0221 List of Securities Eligible As Collateral

CN - No. 2021-0008 INDEX REVIEW TO : INVESTING PUBLIC AND ALL TRADING PARTICIPANTS DATE : February 8, 2021 SUBJECT : RESULTS OF THE REVIEW OF PSE INDICES The Philippine Stock Exchange is announcing the results of the regular review of the PSEi and sector indices covering trading activity for the period January to December 2020. The review of the composition of the indices was based on the revisions to the policy on managing the PSE Index Series. Attached is a list of the companies that will compose the PSEi and sector indices. All changes shall be effected on February 15, 2021, Monday. The list of index members and other index-related information can be accessed on a subscription basis through the Market Data Department at [email protected]. For your information and guidance. (Original Signed) RAMON S. MONZON President and CEO PSEi Company Stock Code 1 Ayala Corporation AC 2 Aboitiz Equity Ventures, Inc. AEV 3 Alliance Global Group, Inc. AGI 4 Ayala Land, Inc. ALI 5 Aboitiz Power Corporation AP 6 BDO Unibank, Inc. BDO 7 Bloomberry Resorts Corporation BLOOM 8 Bank of the Philippine Islands BPI 9 DMCI Holdings, Inc. DMC 10 Emperador Inc. EMP 11 First Gen Corporation FGEN 12 Globe Telecom, Inc. GLO 13 GT Capital Holdings, Inc. GTCAP 14 International Container Terminal Services, Inc. ICT 15 Jollibee Foods Corporation JFC 16 JG Summit Holdings, Inc. JGS 17 LT Group, Inc. LTG 18 Metropolitan Bank & Trust Company MBT 19 Megaworld Corporation MEG 20 Manila Electric Company MER 21 Metro Pacific Investments Corporation MPI 22 Puregold Price Club, Inc. -

Top 50 Companies - Net Income Page 1 Net Income2 2019 Vs

December 2019 Vol. XII, No. 4 Top 50 Companies - Net Income Page 1 Net Income2 2019 vs. Revenues Stockholders' Rank Rank Company Assets Liabilities ROA ROE4 EPS BV Company1 Sector 2019 2018 2019 Equity3 2019 2018 Code (%) (%) (in PHP) (in PHP) (in mil PHP) % change (in mil PHP) (in million pesos) 1 1 SM Investments Corporation SM Hldg 44,568.24 20.20 506,295.01 1,144,164.57 608,013.09 536,151.48 3.90 11.65 37.00 317.64 2 2 BDO Unibank, Inc. BDO Fin'l 44,194.00 35.12 221,193.00 3,188,858.00 2,818,271.00 370,587.00 1.39 11.98 10.09 84.21 3 3 SM Prime Holdings, Inc. SMPH Prop 38,085.60 18.38 120,057.90 667,279.67 364,763.40 302,516.27 5.71 12.66 1.32 10.42 4 4 Ayala Corporation AC Hldg 35,279.33 10.88 330,905.56 1,345,285.96 835,972.40 509,313.56 2.62 10.73 56.30 524.69 5 5 Ayala Land, Inc. ALI Prop 33,188.40 13.50 168,793.71 713,923.28 471,217.71 242,705.57 4.65 15.73 2.25 14.34 6 12 JG Summit Holdings, Inc. JGS Hldg 31,285.25 63.06 307,596.29 928,309.52 519,662.38 408,647.14 3.37 10.26 4.37 42.55 7 6 Bank of the Philippine Islands BPI Fin'l 28,803.00 24.81 129,972.00 2,205,030.00 1,931,996.00 273,034.00 1.31 10.68 6.39 59.81 8 10 Metropolitan Bank & Trust Company MBT Fin'l 28,055.00 27.48 146,105.00 2,450,813.00 2,132,322.00 318,491.00 1.14 9.06 6.24 68.83 9 20 Metro Pacific Investments Corporation MPI Hldg 23,856.00 68.83 129,789.00 611,778.00 365,733.00 246,045.00 3.90 12.49 0.76 6.05 10 8 Manila Electric Company MER Ind'l 23,285.00 1.16 322,593.00 357,019.00 271,778.00 85,241.00 6.52 27.64 20.66 74.73 11 16 LT Group, Inc. -

Notice to File Entry, to Pay Duties and Taxes and to Claim Goods Discharged September 02, 2021

NOTICE TO FILE ENTRY, TO PAY DUTIES AND TAXES AND TO CLAIM GOODS DISCHARGED SEPTEMBER 02, 2021 NO Bill of Lading Discharge Date and Time Consignee Party to Notify 1 MEDUV4198937 02/09/2021 3:28 168 CMAV ENTERPRISE 168 CMAV ENTERPRISE 2 MEDUV4199364 02/09/2021 17:08 168 CMAV ENTERPRISE 168 CMAV ENTERPRISE 3 SKMN670661 02/09/2021 14:02 168 MARKETING CORPORATION SAME AS CONSIGNEE 4 PIPCB21000954 02/09/2021 6:04 3 FOR 8 TRADING INTERNATIONAL 3 FOR 8 TRADING INTERNATIONAL 5 MEDUV4243402 02/09/2021 16:34 3C MEAT IMPORTS INC 3C MEAT IMPORTS INC 6 MEDUV4280008 02/09/2021 17:51 3C MEAT IMPORTS INC 3C MEAT IMPORTS INC 7 SNLBQZPL001951 02/09/2021 22:59 ABARGOS CONSUMER GOODS TRADING UNI SAME AS CONSIGNEE 8 SNLBQZPL001952 02/09/2021 23:10 ABARGOS CONSUMER GOODS TRADING UNI SAME AS CONSIGNEE 9 SNLBQZPL001919 02/09/2021 23:13 ABARGOS CONSUMER GOODS TRADING UNI SAME AS CONSIGNEE 10 SNLBQZPL001944 02/09/2021 23:15 ABARGOS CONSUMER GOODS TRADING UNI SAME AS CONSIGNEE 11 SNLBQZPL001968 02/09/2021 15:53 ABARGOS CONSUMER GOODS TRADING UNI SAME AS CONSIGNEE 12 SNLBQZPL001913 02/09/2021 16:44 ABARGOS CONSUMER GOODS TRADING UNI SAME AS CONSIGNEE 13 SNLBQZPL001975 02/09/2021 17:21 ABARGOS CONSUMER GOODS TRADING UNI SAME AS CONSIGNEE 14 SNLBQZPL001972 02/09/2021 17:47 ABARGOS CONSUMER GOODS TRADING UNI SAME AS CONSIGNEE 15 SNLBQZPL001962 02/09/2021 17:51 ABARGOS CONSUMER GOODS TRADING UNI SAME AS CONSIGNEE 16 SNLBQZPL001969 02/09/2021 17:52 ABARGOS CONSUMER GOODS TRADING UNI SAME AS CONSIGNEE 17 SNLBQZPL001937 02/09/2021 18:12 ABARGOS CONSUMER GOODS TRADING UNI -

Money Talks 2013)

Food and beverage sector Food for thought By Marian Rose C. Ang Based on the Household Final Consumption Expenditure data, food and non-alcoholic consumption grew by a slower 4.63% in 2014 (from 5.58% in 2013) but slightly faster than the per capita Gross Domestic Product (GDP) growth of 3% (from 6.87% in MONEY TALKS 2013). In terms of percentage contribution of food and non-alcoholic beverage to total household final consumption, it barely changed over the last five years, hovering around 41-42% in spite of the increase in per capita GDP. This may be attributable to the fact that the Philippines’ poverty levels have stagnated much over the years. Generally, spending on food as share of total income drops as incomes rise. In our country’s case, majority of Filipinos’ income is still not high enough to encourage them to allot a bigger portion of their budget on non-essentials or what others call discretionary spending such as entertainment, travel, etc. Food and beverage remains a priority but as income increases, there is a shift in demand from cheaper to more expensive and better quality products. Food and beverage continues to account for a bigger bulk of expenditure in the country and this trend is likely to persist in the near-term. Household Final Consumption Expenditure (Percent Contribution) 2010 2011 2012 2013 2014 Food and Non-alcoholic Beverages 41.88 42.06 41.86 41.84 41.53 Alcoholic Beverage, Tobacco 1.49 1.42 1.43 1.35 1.42 Clothing and Footwear 1.77 1.73 1.68 1.61 1.61 Housing, water, electricity, gas and other fuels 11.30 -

Notice to File Entry, to Pay Duties and Taxes and to Claim Goods Discharged April 28, 2021

NOTICE TO FILE ENTRY, TO PAY DUTIES AND TAXES AND TO CLAIM GOODS DISCHARGED APRIL 28, 2021 NO Bill of Lading Discharge Date and Time Consignee Party to Notify 1 293343426 28/04/2021 22:18 3 FOR 8 TRADING INTERNATIONAL SAME AS CONSIGNEE 2 002BA07317 28/04/2021 22:08 5B DYNASTY TRADING SAME AS CONSIGNEE 3 GLXD21040017 28/04/2021 2:21 5B DYNASTY TRADING 5B DYNASTY TRADING 4 TPKAOMNL21040374 28/04/2021 3:46 5B DYNASTY TRADING SAME AS CONSIGNEE 5 TPKAOMNL21040294 28/04/2021 18:04 5B DYNASTY TRADING SAME AS CONSIGNEE 6 LHV2468849 28/04/2021 17:47 999 FOOD SOURCE INC 999 FOOD SOURCE INC 7 OOLU4051038458 28/04/2021 3:26 999 FOOD SOURCE INC 999 FOOD SOURCE INC 8 SG100007790 28/04/2021 4:32 A MENARINI PHILIPPINES INC A MENARINI PHILIPPINES INC 9 MNN004200012021 28/04/2021 16:05 A2Z LOGISTICS INC SAME AS CONSIGNEE 10 047BA03234 28/04/2021 9:23 AAZ88 TRADING AAZ88 TRADING 11 GDYS21013473 28/04/2021 3:38 AB FOOD AND BEVERAGES PHIL INC AB FOOD AND BEVERAGES PHIL INC 12 GDYS21013475 28/04/2021 3:57 AB FOOD AND BEVERAGES PHIL INC AB FOOD AND BEVERAGES PHIL INC 13 SZVL21040061 28/04/2021 16:59 ABENSON VENTURES INC SAME AS CONSIGNEE 14 S00108026 28/04/2021 21:09 ABENSON VENTURES INC SAME AS CONSIGNEE 15 TPE210450728 28/04/2021 14:35 ACBEL POLYTECH PHILIPPINES INC SAME AS CONSIGNEE 16 PNH0065303 28/04/2021 16:18 ADIDAS PHILIPPINES INC SAME AS CONSIGNEE 17 MAA8055451 28/04/2021 8:48 ADIDAS PHILIPPINES INC SAME AS CONSIGNEE 18 209996008 28/04/2021 6:46 ADRIATIC MACHINERY TRADER ADDRESS SAME AS CONSIGNEE 19 ONEYSINB11143703 28/04/2021 7:57 AFREIGHT PHILS INC