Shelf Registration in the Philippines Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

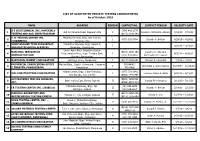

III III III III LIST of ACCREDITED PRIVATE TESTING LABORATORIES As of October 2019

LIST OF ACCREDITED PRIVATE TESTING LABORATORIES As of October 2019 NAME ADDRESS REGION CONTACT NO. CONTACT PERSON VALIDITY DATE A’S GEOTECHNICAL INC. MATERIALS (074) 442-2775 1 Old De Venecia Road, Dagupan City I Dioscoro Richard B. Alviedo 7/16/19 – 7/15/21 TESTING AND SOIL INVESTIGATION (0917) 1141-343 E. B. TESTING CENTER INC. McArthur Hi-way, Brgy. San Vicente, 2 I (075) 632-7364 Elnardo P. Bolivar 4/29/19 – 4/28/21 (URDANETA) Urdaneta City JORIZ GROUND TECH SUBSURFACE MacArthur Highway, Brgy. Surabnit, 3 I 3/20/18 – 3/19/20 AND GEOTECHNICAL SERVICES Binalonan, Pangasinan Lower Agno River Irrigation System NATIONAL IRRIGATION (0918) 8885-152 Ceferino C. Sta. Ana 4 Improvement Proj., Brgy. Tomana East, I 4/30/19 – 4/29/21 ADMINISTRATION (075) 633-3887 Rommeljon M. Leonen Rosales, Pangasinan 5 NORTHERN CEMENT CORPORATION Labayug, Sison, Pangasinan I (0917) 5764-091 Vincent F. Cabanilla 7/3/19 – 7/2/21 PROVINCIAL ENGINEERING OFFICE Malong Bldg., Capitol Compound, Lingayen, 542-6406 / 6 I Antonieta C. Delos Santos 11/23/17 – 11/22/19 (LINGAYEN, PANGASINAN) Pangasinan 542-6468 Valdez Center, Brgy. 1 San Francisco, (077) 781-2942 7 VVH CONSTRUCTION CORPORATION I Francisco Wayne B. Butay 6/20/19 – 6/19/21 San Nicolas, Ilocos Norte (0966) 544-8491 ACCURATEMIX TESTING SERVICES, (0906) 4859-531 8 Brgy. Muñoz East, Roxas, Isabela II Juanita Pine-Ordanez 3/11/19 – 3/10/21 INC. (0956) 4078-310 Maharlika Highway, Brgy. Ipil, (02) 633-6098 9 EB TESTING CENTER INC. (ISABELA) II Elnardo P. Bolivar 2/14/18 – 2/13/20 Echague, Isabela (02) 636-8827 MASUDA LABORATORY AND (0917) 8250-896 10 Marana 1st, City of Ilagan, Isabela II Randy S. -

Group Companies(66KB)

Group Companies (As of December 31, 2016) The Kirin Group is headed by Kirin Holdings Company, Limited, a pure holding company, which has 188 consolidated subsidiaries and 18 affiliated companies accounted for using the equity method. Percentage Company Name Location Description of Business of Holding Japan Integrated Beverages Management and provision of specialized services for Japan Kirin Company, Limited Tokyo, Japan 100.0 Integrated Beverages Business Kirin Brewery Company, Limited Tokyo, Japan Manufacturing and sales of beer and other alcoholic beverages, etc. 100.0 Kirin Beer Marketing Company, Ltd. Tokyo, Japan Marketing and sales promotion for beer and other alcoholic beverages 100.0 Import, manufacturing, and sales of wine and other alcoholic Mercian Corporation Tokyo, Japan 100.0 beverages Kirin Beverage Company, Ltd. Tokyo, Japan Manufacturing and sales of non-alcoholic beverages 100.0 Kirin Beverage Value Vendor Company, Planning and sales of non-alcoholic beverages and food products to Tokyo, Japan 100.0 Limited sell via vending machines Manufacturing of domestically produced whiskey and spirits, etc., Kirin Distillery Co., Ltd. Shizuoka, Japan 100.0 at the Fuji-Gotemba Distillery Development of SPRING VALLEY BREWERY brand craft beer products, SPRING VALLEY BREWERY COMPANY Tokyo, Japan and planning, operation, and management of restaurants attached to 100.0 microbreweries YO-HO BREWING COMPANY* Nagano, Japan Manufacturing and sales of craft beer 33.3 Administration of alcoholic beverages business in China, identification of new investment opportunities and other business development 1 Kirin (China) Investment Co., Ltd. Shanghai, China 100.0 activities in China, sales of Kirin brand products in the Yangtze River Delta Economic Zone Kirin Brewery (Zhuhai) Co., Ltd. -

The Deity's Beer List.Xls

Page 1 The Deity's Beer List.xls 1 #9 Not Quite Pale Ale Magic Hat Brewing Co Burlington, VT 2 1837 Unibroue Chambly,QC 7% 3 10th Anniversary Ale Granville Island Brewing Co. Vancouver,BC 5.5% 4 1664 de Kronenbourg Kronenbourg Brasseries Stasbourg,France 6% 5 16th Avenue Pilsner Big River Grille & Brewing Works Nashville, TN 6 1889 Lager Walkerville Brewing Co Windsor 5% 7 1892 Traditional Ale Quidi Vidi Brewing St. John,NF 5% 8 3 Monts St.Syvestre Cappel,France 8% 9 3 Peat Wheat Beer Hops Brewery Scottsdale, AZ 10 32 Inning Ale Uno Pizzeria Chicago 11 3C Extreme Double IPA Nodding Head Brewery Philadelphia, Pa. 12 46'er IPA Lake Placid Pub & Brewery Plattsburg , NY 13 55 Lager Beer Northern Breweries Ltd Sault Ste.Marie,ON 5% 14 60 Minute IPA Dogfishhead Brewing Lewes, DE 15 700 Level Beer Nodding Head Brewery Philadelphia, Pa. 16 8.6 Speciaal Bier BierBrouwerij Lieshout Statiegeld, Holland 8.6% 17 80 Shilling Ale Caledonian Brewing Edinburgh, Scotland 18 90 Minute IPA Dogfishhead Brewing Lewes, DE 19 Abbaye de Bonne-Esperance Brasserie Lefebvre SA Quenast,Belgium 8.3% 20 Abbaye de Leffe S.A. Interbrew Brussels, Belgium 6.5% 21 Abbaye de Leffe Blonde S.A. Interbrew Brussels, Belgium 6.6% 22 AbBIBCbKE Lvivske Premium Lager Lvivska Brewery, Ukraine 5.2% 23 Acadian Pilsener Acadian Brewing Co. LLC New Orleans, LA 24 Acme Brown Ale North Coast Brewing Co. Fort Bragg, CA 25 Actien~Alt-Dortmunder Actien Brauerei Dortmund,Germany 5.6% 26 Adnam's Bitter Sole Bay Brewery Southwold UK 27 Adnams Suffolk Strong Bitter (SSB) Sole Bay Brewery Southwold UK 28 Aecht Ochlenferla Rauchbier Brauerei Heller Bamberg Bamberg, Germany 4.5% 29 Aegean Hellas Beer Atalanti Brewery Atalanti,Greece 4.8% 30 Affligem Dobbel Abbey Ale N.V. -

Province, City, Municipality Total and Barangay Population AURORA

2010 Census of Population and Housing Aurora Total Population by Province, City, Municipality and Barangay: as of May 1, 2010 Province, City, Municipality Total and Barangay Population AURORA 201,233 BALER (Capital) 36,010 Barangay I (Pob.) 717 Barangay II (Pob.) 374 Barangay III (Pob.) 434 Barangay IV (Pob.) 389 Barangay V (Pob.) 1,662 Buhangin 5,057 Calabuanan 3,221 Obligacion 1,135 Pingit 4,989 Reserva 4,064 Sabang 4,829 Suclayin 5,923 Zabali 3,216 CASIGURAN 23,865 Barangay 1 (Pob.) 799 Barangay 2 (Pob.) 665 Barangay 3 (Pob.) 257 Barangay 4 (Pob.) 302 Barangay 5 (Pob.) 432 Barangay 6 (Pob.) 310 Barangay 7 (Pob.) 278 Barangay 8 (Pob.) 601 Calabgan 496 Calangcuasan 1,099 Calantas 1,799 Culat 630 Dibet 971 Esperanza 458 Lual 1,482 Marikit 609 Tabas 1,007 Tinib 765 National Statistics Office 1 2010 Census of Population and Housing Aurora Total Population by Province, City, Municipality and Barangay: as of May 1, 2010 Province, City, Municipality Total and Barangay Population Bianuan 3,440 Cozo 1,618 Dibacong 2,374 Ditinagyan 587 Esteves 1,786 San Ildefonso 1,100 DILASAG 15,683 Diagyan 2,537 Dicabasan 677 Dilaguidi 1,015 Dimaseset 1,408 Diniog 2,331 Lawang 379 Maligaya (Pob.) 1,801 Manggitahan 1,760 Masagana (Pob.) 1,822 Ura 712 Esperanza 1,241 DINALUNGAN 10,988 Abuleg 1,190 Zone I (Pob.) 1,866 Zone II (Pob.) 1,653 Nipoo (Bulo) 896 Dibaraybay 1,283 Ditawini 686 Mapalad 812 Paleg 971 Simbahan 1,631 DINGALAN 23,554 Aplaya 1,619 Butas Na Bato 813 Cabog (Matawe) 3,090 Caragsacan 2,729 National Statistics Office 2 2010 Census of Population and -

LIST of TOP 100 STOCKHOLDERS As of September 30, 2018

ÿÿ !"ÿ!#ÿ$%%#ÿ ÿ!& "ÿ!ÿ%"'!"()(&(#0ÿ1!%ÿ#ÿ2%(#0ÿ!1ÿ#ÿ1#"ÿ ÿ%'%"##(!"ÿ!#( ÿ(ÿ&&ÿ!%'!%# ("&!"3%"4ÿ(&3 (ÿ1((&ÿ%'!%#"5ÿ6&&ÿ #ÿ!#( ÿ%(ÿ%ÿ'%'% ÿ ÿ"3)7(## ÿ)0ÿ#ÿ ("&!"(ÿ'%#0ÿ#!ÿ#ÿ4 ÿ%ÿ (""7(# ÿ"!&&0ÿ1!%ÿ'3%'!""ÿ!1ÿ(1!%7#(!5ÿ60ÿ83"#(!"ÿ!ÿ#ÿ #ÿ!#( ÿ%(ÿ"!3& ÿ)ÿ %"" ÿ (%#&0ÿ#! #ÿ9!%'!%#ÿ@1!%7#(!ÿA11(%ÿ!1ÿ#ÿ ("&!"(ÿ'%#05 BCCDEFGHÿPCQRECÿPSQTUVÿWFGX BPW Y`aÿbDcGCQcTSHÿdQSeÿ ÿÿfDcgÿQhÿiQUÿ ÿ`gQGpqQCrHSc stutvtwxtyÿtxwÿ ÿuÿtÿsttÿxvtÿst iUHÿQhÿ`HGTSDgDHc d efghgffgi jkl mnogfp jkl dQSÿgqHÿUHSDQrÿHFrHr qgrÿtuvÿwuxy bHcGSDUgDQFÿQhÿgqHÿbDcGCQcTSH ezg{pgÿpggÿ{nn{|ogiÿz}pn~ dDCHrÿQFÿRHqEChÿR EeH f}{ÿ{f}gÿ {d bHcDFEgDQF l nof}giÿgrfgpgdn{n}g COMPANY NAME : ALLIANCE GLOBAL GROUP, INC. Page LIST OF TOP 100 STOCKHOLDERS As Of September 30, 2018 STOCKHOLDER'S NAME OUTSTANDING & OUTSTANDING & TOTAL PERCENTAGE ISSUED SHARES ISSUED SHARES HOLDINGS TO (FULLY PAID) (PARTIALLY PAID) (SUBSCRIBED) TOTAL THE ANDRESONS GROUP, INC. 4,008,078,294 0 4,008,078,294 39.822 PCD NOMINEE CORPORATION (NON-FILIPINO) 2,726,287,722 0 2,726,287,722 27.087 PCD NOMINEE CORPORATION (FILIPINO) 1,332,106,540 0 1,332,106,540 13.235 ALTAVISION RESOURCES, INC. 451,570,334 0 451,570,334 4.487 YORKSHIRE HOLDINGS, INC. 255,773,508 0 255,773,508 2.541 ASIAGROUP HOLDINGS, INC. 220,000,000 0 220,000,000 2.186 GLOBALAND HOLDINGS, INC. 220,000,000 0 220,000,000 2.186 GRAND BELAIR HOLDINGS, INC. 220,000,000 0 220,000,000 2.186 LE BRISTOL HOLDINGS, INC. 216,100,000 0 216,100,000 2.147 CALIFORNIA ORCHARD GROWERS` INVESTMENTS, INC. -

2016 Annual Report

SULONG 2016 ANNUAL REPORT PHOENIX PETROLEUM PHILIPPINES, INC. INSIDE THIS REPORT 02 About Us 04 Financial Highlights 05 Industry Highlights 06 Philippine Highlights 08 Message to Shareholders 14 Q&A with the Chief Operating Officer 16 Operational Highlights 22 Subsidiaries 26 Corporate Social Responsibility 30 Board of Directors 34 Management Team 37 Corporate Governance 41 Statement of Management’s Responsibility for Financial Statements 42 Report of Independent Auditors 46 Consolidated Financial Statements 51 Management’s Discussion and Analysis of Financial Conditions 55 Our Products 56 Corporate Offices 2016 ANNUAL REPORT “Sulong” is a Filipino term that serves as a rallying cry: “Charge! Move! Onward!” That is also the team’s call to ABOUT action as we unite and work together towards our goal THE COVER to become a bigger player in the industry. In the midst of changes in the political and economic landscape, to be able to quickly act on opportunities is essential. Sulong Phoenix! We’re ready to soar. SULONG PHOENIX VISION To be an indispensable partner in the journey of everyone ABOUT whose life we touch US MISSION • We deliver the best value in products and services to our business partners • We conduct our business with respect, integrity, and excellence • We provide maximum returns to our shareholders and investors • We create opportunities for learning, growth, and recognition to the Phoenix Family • We build programs to nurture the environment and welfare of the communities we serve 02 | 2016 ANNUAL REPORT PHOENIX PETROLEUM PHILIPPINES, INC. Phoenix Petroleum Philippines, Inc. (PNX) is the leading independent and fastest-growing oil company in the Philippines. -

1623400766-2020-Sec17a.Pdf

COVER SHEET 2 0 5 7 3 SEC Registration Number M E T R O P O L I T A N B A N K & T R U S T C O M P A N Y (Company’s Full Name) M e t r o b a n k P l a z a , S e n . G i l P u y a t A v e n u e , U r d a n e t a V i l l a g e , M a k a t i C i t y , M e t r o M a n i l a (Business Address: No. Street City/Town/Province) RENATO K. DE BORJA, JR. 8898-8805 (Contact Person) (Company Telephone Number) 1 2 3 1 1 7 - A 0 4 2 8 Month Day (Form Type) Month Day (Fiscal Year) (Annual Meeting) NONE (Secondary License Type, If Applicable) Corporation Finance Department Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings 2,999 as of 12-31-2020 Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. 2 SEC Number 20573 File Number______ METROPOLITAN BANK & TRUST COMPANY (Company’s Full Name) Metrobank Plaza, Sen. Gil Puyat Avenue, Urdaneta Village, Makati City, Metro Manila (Company’s Address) 8898-8805 (Telephone Number) December 31 (Fiscal year ending) FORM 17-A (ANNUAL REPORT) (Form Type) (Amendment Designation, if applicable) December 31, 2020 (Period Ended Date) None (Secondary License Type and File Number) 3 SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-A ANNUAL REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SECTION 141 OF CORPORATION CODE OF THE PHILIPPINES 1. -

M. Cojuangco, Jr., Chairman and Ceo of San Miguel Corporation, Former Diplomat and Public Servant

EIGHTEENTH CONGRESS OF THE ) REPUBLIC OF THE PHILIPPINES ) Second Regular Session ) RECEIVEDFILED DATC SENATE P.S. Res. No. 449 E4LLS Introduced by SENATOR RAMON BONG REVILLA, JR. RESOLUTION EXPRESSING PROFOUND SYMPATHY AND SINCERE CONDOLENCES OF THE SENATE OF THE PHILIPPINES ON THE DEATH OF EDUARDO "DANDING" M. COJUANGCO, JR., CHAIRMAN AND CEO OF SAN MIGUEL CORPORATION, FORMER DIPLOMAT AND PUBLIC SERVANT 1 WHEREAS, the Senate of the Philippines has, on numerous occasions, 2 recognized and honored distinguished Filipinos for their important contribution to their 3 respective fields and for their positive impact and influence in the development of our 4 society; 5 WHEREAS, Eduardo "Danding" M. Cojuangco, Jr., a former diplomat, public 6 servant, industrialist, businessman, and sports patron, died on 16 June 2020, just a 7 few days after he celebrated his 85th birthday; 8 WHEREAS, he is a well-known and respected businessman who served as 9 Chairman and Chief Executive Officer of San Miguel Corporation, considered as the 10 biggest food and beverage corporation in the Philippines and Southeast Asia, whose 11 several businesses include San Miguel Brewery, Inc., the oldest brewery in Southeast 12 Asia and the largest beer producer in the Philippines, and Ginebra San Miguel, Inc., 13 the largest gin producer in the world by volume1; 14 WHEREAS, under his stewardship, San Miguel Corporation greatly expanded 15 and transformed into a highly diversified conglomerate with valuable investments in 1 https://www.sanmicuel.coin.ph/article/food-and-beverages -

Tanduay Distillers, Inc

G AINING MOMENTUM 11th Floor Unit 3 Bench Tower, 30th Street corner Rizal Drive Cresent Park West 5, Bonifacio Global City, Taguig City, Philippines ltg.com.ph G AINING MOMENTUM ANNUAL REPORT ANNUAL REPORT 2018 2018 Contents 2 Financial Highlights 3 Our Businesses at a Glance The LT Group Logo 4 Our Partnerships Strength and solidarity. This is the essence of the LT Group (LTG) logo. The 6 clean balance lines and curves are central elements -- a mystical Chairman’s Message symmetrical tree. Drawn in an Eastern-Oriental style, it gives hint to the 8 President’s Message Company’s Chinese heritage. 12 CFO’s Message Tree is life. Life is growth. Like a tree, a company with rm roots, properly 14 Asia Brewery, Inc. nurtured, will continuously grow and give value. 16 Eton Properties Philippines, Inc. The tree’s trunk is upright, and the branches spread out -- a symbolic 18 PMFTC Inc. consolidation of the subsidiaries and stakeholders within two circles, one for continuity, the outer one for solidarity. 24 Philippine National Bank 26 Tanduay Distillers, Inc. 28 Corporate Governance Report VISION 36 Corporate Social Responsibility To be a world-class conglomerate at the forefront of Philippine economic e Tan Yan Kee Foundation, Inc. growth, successfully maintaining a strong presence and dominant position in key Philippine industries while ensuring continuous benets to its Asia Brewery, Inc. consumers, communities, employees, business partnerts, and shareholders. Eton Properties Philippines, Inc. MISSION PMFTC Inc. Anchored to its Vision, the LT Group commits: Philippine National Bank To increase stockholder values through long-term growth in its major Tanduay Distillers, Inc. -

AFE-ADB News No 41.Indd

No. 41 | September 2012 The Newsletter of the Association of Former Employees of the Asian Development Bank People, Places and Passages Chapter News Manila Annual General Meeting IN THIS ISSUE Our Cover No. 41 | September 2012 The Newsletter of the SEPTEMBER 2012 Association of Former Employees of the Asian Development Bank People, Places and Passages 3 AFE–ADB Updates 3 From the Executive Secretary Chapter News 3 ADF XI: ADB Secures More Than $12 Billion to Help Asia’s Poorest 4 ADB Avenue—The Untold Story 5 Chapter Coordinators 6 AFE–ADB Committees Manila 6 What’s New at HQ? Annual General Meeting 7 Manila 2012 7 Chapter Coordinators’ Meeting Above: From Morita’s Asian Eye. 12 AFE–ADB 25th Annual General Meeting Center: New Zealand Chapter. 12 Minutes Background: Taal Lake, Batangas City, 14 Address by the President 15 Executive Secretary’s Report Philippines. 16 Treasurer’s Report 17 Pension Report 17 Insurance Report 18 BPMSD Statements AFE–ADB News 19 Manila Reunion 19 Meetings, Cocktails, and Tours Publisher: Hans-Juergen Springer 27 Participants Editorial Board: Jill Gale de Villa (head), Gam de 28 Chapter News Armas, Wickie Mercado, Stephen Banta, David 28 Indonesia Parker, Hans-Juergen Springer 29 Japan 29 New York–New Jersey Graphic Assistance: Josephine Jacinto-Aquino 30 New Zealand 32 Pakistan Photographs: ADB Photobank, ADB Security Unit, 32 Philippines M. Araki, Raquel Cabiles, Canadian Olympic 33 Singapore Committee, Oscar Colmenar, Rosario Coloma, 33 Southern California Gam de Armas, Michel de Ruffi de Ponteves, 34 Washington DC Satoshi Inoue, Helena Jacinto-Duenas, Shahida Jaffrey, Willy Lim, Jayanta Madhab, Filonila 35 People, Places, and Passages Martin, Rose Misa, Noritada Morita, David 35 Asian Eye Parker, Albertine Santi, Hans-Juergen Springer, 38 South Island, New Zealand Ofelia Sta. -

Kirin Report 2016

KIRIN REPORT 2016 REPORT KIRIN Kirin Holdings Company, Limited Kirin Holdings Company, KIRIN REPORT 2016 READY FOR A LEAP Toward Sustainable Growth through KIRIN’s CSV Kirin Holdings Company, Limited CONTENTS COVER STORY OUR VISION & STRENGTH 2 What is Kirin? OUR LEADERSHIP 4 This section introduces the Kirin Group’s OUR NEW DEVELOPMENTS 6 strengths, the fruits of the Group’s value creation efforts, and the essence of the Group’s results OUR ACHIEVEMENTS and CHALLENGES to OVERCOME 8 and issues in an easy-to-understand manner. Our Value Creation Process 10 Financial and Non-Financial Highlights 12 P. 2 SECTION 1 To Our Stakeholders 14 Kirin’s Philosophy and TOPICS: Initiatives for Creating Value in the Future 24 Long-Term Management Vision and Strategies Medium-Term Business Plan 26 This section explains the Kirin Group’s operating environment and the Group’s visions and strate- CSV Commitment 28 gies for sustained growth in that environment. CFO’s Message 32 Overview of the Kirin Group’s Business 34 P. 14 SECTION 2 Advantages of the Foundation as Demonstrated by Examples of Value Creation Kirin’s Foundation Revitalizing the Beer Market 47 Todofuken no Ichiban Shibori 36 for Value Creation A Better Green Tea This section explains Kirin’s three foundations, Renewing Nama-cha to Restore Its Popularity 38 which represent Group assets, and provides Next Step to Capture Overseas Market Growth examples of those foundations. Myanmar Brewery Limited 40 Marketing 42 Research & Development 44 P. 36 Supply Chain 46 SECTION 3 Participation in the United Nations Global Compact 48 Kirin’s ESG ESG Initiatives 49 This section introduces ESG activities, Human Resources including the corporate governance that —Valuable Resource Supporting Sustained Growth 50 supports value creation. -

JG Summit Holdings Inc. Annual Report 2020

Annual Report 2020 About the Cover When faced with a monumental challenge, few are able to swiftly form high- impact solutions to make the situation better. It requires agility and adaptability to achieve a transformational outcome. This year, JG Summit swiftly addressed the effects of the pandemic, using its “How to Win” and “Where to Play” strategies to maximum effect. The company was agile in business, as well as steady and firm in uplifting communities to better endure this critical time. By focusing on employee health and safety, operations and supply chain continuity, cash, costs and liquidity management, and helping communities deal with the pandemic, JGS was able to weather the unexpected storm. The company also doubled its efforts to explore new business opportunities. This year’s cover demonstrates the diverse response throughout JG Summit’s businesses - its fluid and agile response that demonstrated firm leadership, mindfulness, and strength to balance business in the face of turmoil and change. 2 Annual Report 2020 Table of Contents JGS at a Glance 4 2020 Key Developments 7 JGS Investment Portfolio 9 Corporate Structure 10 Geographic Presence 12 Chairman’s Message 13 President and CEO’s Report 17 Leadership 21 Our COVID-19 Response 23 Laying the Foundation for the New Normal 27 Strategic Business Units & Investments 38 Strategic Business Units 39 Ecosystem Plays 57 Core Investments 63 Sustainability 65 Sustainability Performance in 2020 66 Gokongwei Brothers Foundation 77 Corporate Governance 86 Financial Statements 96 Contact Info 221 3 Annual Report 2020 JGS at a Glance 4 Annual Report 2020 JGS At A Glance: Key Business Metrics Our portfolio diversity cushioned the impact of COVID-19, driven by The Company’s robust balance sheet provides Continuous shareholder value maximization as JGS’ the resiliency of our food, banking, and office segments, while heavily- enough ballast to weather the pandemic.