Newell Brands Inc. (Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Newell Brands Annual Report 2020

Newell Brands Annual Report 2020 Form 10-K (NASDAQ:NWL) Published: March 2nd, 2020 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ___________________ FORM 10-K ___________________ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED COMMISSION FILE NUMBER December 31, 2019 1-9608 ___________________ NEWELL BRANDS INC. (EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER) ___________________ Delaware 36-3514169 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 6655 Peachtree Dunwoody Road, 30328 Atlanta, Georgia (Zip Code) (Address of principal executive offices) Registrant’s telephone number, including area code: ( 770) 418-7000 Securities registered pursuant to Section 12(b) of the Act: TITLE OF EACH CLASS TRADING SYMBOL NAME OF EACH EXCHANGE ON WHICH REGISTERED Common Stock, $1 par value per share NWL Nasdaq Stock Market LLC Securities registered pursuant to Section 12(g) of the Act: None ___________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Company Match List 2020

Employer Matching Company List 3Com Corporation Alco Standard Fdn. 3M Company AlCOA Foundation Abacus Capital Investments Alexander and Baldwin Inc. Abbot Laboratories Alexander and Baldwin Foundation Alexander Haas Martin and Partners Alexander Hamilton Life Accenture Foundation, Inc. Allegro Microsystems Inc. Access Fund Allegiance Corp. and Baxter International Allendale Insurance Foundation Allendale Mutual Insurance Co. AllianceBernstein ACE INA Foundation Alliance Capital Management L.P. Alliance Coal LLC Adams Harkness and Hill Inc. Alliant Techsystems Adaptec Foundation AlliedSignal Inc. ADC Foundation Allstate Foundation, The Allstate Giving Campaign ADC Telecommunications Altera Corp. Contributions Program Adobe Systems Inc. Altria Employee Involvement ADP Foundation Programs A & E Television Networks Altria Group AMBAC Indemnity Corporation AEGON TRANSAMERICA AMD Corporate Giving Program AEP American Express Co AES Corporation American Fidelity Corp. A.E. Staley Manufacturing Co. American General Corp. Aetna Foundation, Inc. American Honda Motor Co. Inc. AG Communications Systems American National Bank and Trust Co. of Chicago Agilent Technologies American Standard Foundation Aid Association for Lutherans American Stock Exchange AIG Matching Grants Program Air Liquide America Corporation Aileen S. Andrew Foundation Air Products and Chemicals Inc. Albemarle Corp. AIM Foundation Ameriprise Financial Ameritech Corp. Amgen Center American Inter Group Amgen Foundation Amgen Inc. Employer Matching Company List American International Group, Inc. Aspect Telecommunications Associates Corp. of North America AMSTED Industries Inc. Astra Merck Inc. AMN Healthcare Services, Inc. AstraZeneca Pharmaceutical LP Atapco Amylin Pharmaceuticals, Inc. Corp. Giving ATK Foundation Program Anadarko Petroleum Corp. Analog Devices Atlantic Data Services Inc. Analytics Operations Engineering Analog Devices Atochem North America Foundation ATOFINA Inc. Chemicals, Inc. Anchor/Russell Capital Advisors Inc. -

2020 Corporate Citizenship Report 2

Building Better Together 2020 Corporate Citizenship Report 2 Contents Moving onwards and upwards ....................................... 3 Reducing our environmental impact ............................. 31 Letter from our President & CEO ........................................................... 4 Carbon emissions and energy use ......................................................33 2020 highlights ......................................................................................... 6 Our sustainability goals .........................................................................35 A culture of sustainability .....................................................................39 Embarking on a new era ..................................................7 Innovation, sustainable design and circularity ..................................40 Our company and brands ....................................................................... 9 Product safety .........................................................................................44 Our values ................................................................................................11 Corporate citizenship philosophies .....................................................12 Sourcing responsibly and ethically ............................... 46 Corporate governance ...........................................................................13 Standards of integrity ............................................................................48 Ethics and compliance ..........................................................................15 -

In Re: Appraisal of Jarden Corporation

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE : IN RE: APPRAISAL OF : CONSOLIDATED JARDEN CORPORATION : C.A. No. 12456-VCS : MEMORANDUM OPINION Date Submitted: May 1, 2019 Date Decided: July 19, 2019 Stuart M. Grant, Esquire, Cynthia M. Calder, Esquire, Kimberly A. Evans, Esquire, Kelly L. Tucker, Esquire and Vivek Upadhya, Esquire of Grant & Eisenhofer P.A., Wilmington, Delaware, Attorneys for Petitioners. Srinivas M. Raju, Esquire, Brock E. Czeschin, Esquire, Robert L. Burns, Esquire, Sarah A. Clark, Esquire and Matthew W. Murphy, Esquire of Richards, Layton & Finger, P.A., Wilmington, Delaware and Walter W. Davis, Esquire, Michael J. McConnell, Esquire and Robert A. Watts, Esquire, of Jones Day, Atlanta, Georgia, Attorneys for Respondent Jarden Corporation. SLIGHTS, Vice Chancellor This statutory appraisal action arises from a merger whereby Newell Rubbermaid, Inc. (“Newell”) acquired Jarden Corporation (“Jarden” or the “Company”) (the “Merger”) for cash and stock totaling $59.21 per share (the “Merger Price”). Petitioners, Verition Partners Master Fund Ltd., Verition Multi-Strategy Master Fund Ltd., Fir Tree Value Master Fund, LP and Fir Tree Capital Opportunity Master Fund, LP (together “Petitioners”), were Jarden stockholders on the Merger’s effective date and seek a judicial appraisal of the fair value of their Jarden shares as of that date. At the close of the trial, I observed, “[w]e are in the classic case where . very-well credentialed experts are miles apart. There’s some explaining that is required here to understand how it is that two very well-credentialed, I think, well- intended experts view this company so fundamentally differently.”1 This observation was prompted by the all-too-frequently encountered disparity in the experts’ opinions regarding Jarden’s fair value. -

Newell Brands Inc. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED COMMISSION FILE NUMBER DECEMBER 31, 2017 1-9608 NEWELL BRANDS INC. (EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER) DELAWARE 36-3514169 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 221 River Street Hoboken, New Jersey 07030 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (201) 610-6600 Securities registered pursuant to Section 12(b) of the Act: TITLE OF EACH CLASS NAME OF EACH EXCHANGE ON WHICH REGISTERED Common Stock, $1 par value per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). -

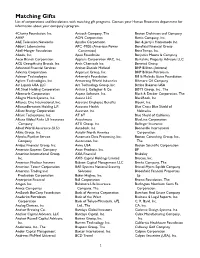

Matching Gifts List of Corporations and Foundations with Matching Gift Programs

Matching Gifts List of corporations and foundations with matching gift programs. Contact your Human Resources department for information about your company’s program. 4Charity Foundation, Inc. Antioch Company, The Becton Dickinson and Company AARP AON Corporation Bemis Company, Inc. A&E Television Networks Apache Corporation Ben & Jerry’s Homemade Inc. Abbott Laboratories APC -MGE (American Power Beneficial Financial Group Abell-Hanger Foundation Conversion) BeneTemps, Inc. Aboda, Inc. Apex Foundation Benjamin Moore & Company Acco Brands Corporation Applera Corporation ARC, Inc. Berkshire Property Advisors LLC ACE GroupAcuity Brands, Inc. Arch Chemicals Inc. Berwind Group Advanced Financial Services Archer-Daniels Midland BHP Billiton (Arizona) Advanta Corporation Argonaut Group, Inc. BHP Billiton Petroleum Advisor Technologies Arkwright Foundation Bill & Melinda Gates Foundation Agilent Technologies, Inc. Armstrong World Industries Biltmore Oil Company Air Liquids USA LLC Art Technology Group, Inc. Bimbo Bakeries USA AK Steel Holding Corporation Arthur J. Gallagher & Co. BISYS Group, Inc., The Albemarle Corporation Aspect Software, Inc. Black & Decker Corporation, The Allegro Micro Systems, Inc. Assent LLC BlackRock, Inc. Alliance One International, Inc. Assurant Employee Benefits Blount, Inc. AllianceBernstein Holding L.P. Assurant Health Blue Cross Blue Shield of Alliant Energy Corporation Assurant, Inc. Nebraska Alliant Techsystems, Inc. AT &T Blue Shield of California Allianz Global Risks US Insurance Attachmate BlueLinx Corporation Company ATX Group, Inc. Bollinger Insurance Allied World Assurance (U.S.) Autodesk, Inc. Bonneville International Altria Group, Inc. Autoliv North America Corporation Alyeska Pipeline Service Automatic Data Processing, Inc. Boston Consulting Group, Inc., Company Autonation, Inc. The Ambac Financial Group, Inc. Aviva USA Boston Scientific Corporation American Express Company Avon Products, Inc. -

NEWELL BRANDS INC. (Exact Name of the Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM SD SPECIALIZED DISCLOSURE REPORT NEWELL BRANDS INC. (Exact name of the registrant as specified in its charter) Delaware 1-9608 36-3514169 (State or other jurisdiction of (Commission (IRS Employer incorporation or organization) File Number) Identification No.) 6655 Peachtree Dunwoody Rd. Atlanta, GA 30328 (Address of principal executive offices) (Zip code) Bradford R. Turner (770) 418-7000 (Name and telephone number, including area code, of the person to contact in connection with this report) Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies: ☒ Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2020 Section 1 – Conflict Minerals Disclosure Item 1.01 Conflict Minerals Disclosure and Report This Specialized Disclosure Report on Form SD and the Conflict Minerals Report, filed as Exhibit 1.01 hereto, are publicly available on the Newell Brands Inc. website at http://ir.newellbrands.com/investor-relations/sec-filings/default.aspx . The content on, or accessible through, any website referred to in this Form SD or the attached Conflict Minerals Report is included for general information only and is not incorporated by reference in this Form SD or the attached Conflict Minerals Report. Item 1.02 Exhibits The Conflict Minerals Report as required by Item 1.01 is filed as Exhibit 1.01 to this Form SD. Section 3 – Exhibits Item 3.01 Exhibits Exhibit 1.01 Newell Brands Inc. -

Jarden Home Brands Releases 37Th Edition of the Ball Blue Book® Guide to Preserving, the Essential Guide for New and Experienced Home Canners

Jarden Home Brands Releases 37th Edition Of The Ball Blue Book® Guide To Preserving, The Essential Guide For New And Experienced Home Canners July 1, 2015 The iconic home canning guide refreshes with 75 new recipes, makes preserving easier for all FISHERS, Ind., June 1, 2015 /PRNewswire/ -- With spring produce filling farmers markets, home gardens and CSA shares nationwide, many are interested in learning how to savor the fresh flavors of the season. Jarden Home Brands, leaders in advancing the art of home canning and makers of Ball brand home canning products, today announced the release of the 37th Edition of the Ball Blue Book® Guide to Preserving providing safe ways to start fresh preserving. The most trusted resource in home canning for over 100 years, the 2015 release of the Ball Blue Book is its largest update since the first edition in 1909. Expanding 56% from the previous edition, the 37th edition of the Ball Blue Book includes 75 new recipes, pictorial step by step guides for beginners, a special section for Meal Creations and unique "You Choose" and "Our Tip" recommendations where creative variations and helpful techniques are listed for creating your own signature foods. "Our community cherishes the Ball Blue Book as the go-to guide for safe and reliable home canning instruction and we're thrilled to release this new edition that's better than ever," said Steve Hungsberg, Director of Marketing at Jarden Home Brands. "Food safety is the highest priority when home canning and our specialists have diligently reviewed and refreshed the content to not only provide home canners with contemporary and creative recipes, but to also make the home canning process safer and easier than ever." While there are many exciting updates throughout the 200-page guide, below are tips about fresh preserving that may even surprise experienced canners: Tip #1: Safety is just as important as taste. -

Ball® Fresh Preserving Celebrates the 135Th Anniversary of the Ball® Jar with Newly Released Vintage Jars and New Canning Recipes

Ball® Fresh Preserving Celebrates the 135th Anniversary of the Ball® Jar with Newly Released Vintage Jars and New Canning Recipes June 5, 2019 New products and recipes will inspire foodies and home canners everywhere to create seasonal flavors that cannot be bought in a store FISHERS, Ind., June 5, 2019 /PRNewswire/ -- Today, Ball® Fresh Preserving is celebrating 135 years of Ball® Jars helping foodies and home canners everywhere bring fresh, fun flavors to the kitchen. This celebration is marked by the reintroduction of the brand's vintage aqua blue jars, the creation of new recipes, and the launch of additional new canning products just in time for peak produce season. The 2019 products that are joining the Ball® Fresh Preserving family include: The Collector's Edition Ball® Aqua Vintage Jars are designed with the aesthetics of the past. The rounded shoulders, aqua color and Ball® logo date back to usage from 1910-1923. Ball® Aqua Vintage Jars are available in Half Pint, Pint, and Quart Sizes. For anyone new or aspiring to try home canning, the new Ball® Preserving Starter Kit is an all-in-one solution designed for first time canners that includes all the essential tools for easy preserving. The new Ball® Leak-Proof Storage Lids are perfect for anyone who loves using Ball® Jars for carrying food and drinks on-the-go. The lids are also freezer safe for jams, sauces and soups, and the airtight seal is perfect for storing herbs and spices. Home canners will also enjoy the new Ball® Utensil Set, which is a convenient solution for the existing canner who is looking for replacement utensils. -

Jarden Home Brands Introduces New Ball® Brand Products for Canners, Gardeners and Everyday Cooks

Jarden Home Brands Introduces New Ball® Brand Products For Canners, Gardeners And Everyday Cooks February 25, 2016 Feb 25, 2016 The authority in home canning, and makers of the iconic mason jar, celebrates the joys of fresh preserving with product expansion FISHERS, Ind., Feb. 25, 2016 /PRNewswire/ -- Jarden Home Brands, makers of Ball® brand home canning products, today announced the introduction of six new items joining the fresh preserving family in 2016. Knowing more than half (57%) of Americans already have at least one mason jar in their home, Jarden is offering canners, gardeners and food lovers even more ways to eliminate food waste and eat fresh year-round. "This year we're excited to offer even more resources to make preserving simple and easy for everyone. Whether an avid home canner, urban gardener, meal prepper or simply someone who finds themselves with a few too many tomatoes after a trip to the farmers market, we have a solution," says Janine Moore, Senior Brand Manager, Fresh Preserving at Jarden Home Brands. "Our community is constantly providing feedback on what they need in their kitchens, from products that help reduce food waste to better organization. We've listened and are thrilled to be able to provide something to satisfy everyone." The following new introductions will be available online and in stores this spring: Collection Elite® Series: The popular Ball® Collection Elite® Color Series delivers a pop of vibrant blue with a new line of colored jars in several never-before released sizes: Wide Mouth Pint and Regular Mouth Half Pint. Wide Mouth Quart will also be available as a popular size favored by 30% of users. -

NEWELL BRANDS INC. (Exact Name of Registrant As Specified in Its Charter) Delaware 36-3514169 (State Or Other Jurisdiction of (I.R.S

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q ☒ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the Quarterly Period Ended June 30, 2020 Commission File Number 1-9608 NEWELL BRANDS INC. (Exact name of registrant as specified in its charter) Delaware 36-3514169 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 6655 Peachtree Dunwoody Road, Atlanta, Georgia 30328 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (770) 418-7000 Securities registered pursuant to Section 12(b) of the Act: TITLE OF EACH CLASS TRADING SYMBOL NAME OF EXCHANGE ON WHICH REGISTERED Common stock, $1 par value per share NWL Nasdaq Stock Market LLC Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. -

List Was Compiled Using Other Lists Found Online and May Not Be Comprehensive

Double your donation! A matching gift is a donation made by a company, foundation, or organization on behalf of an employee when that employee makes a donation to a nonprofit organization. When you make a gift to The Health Trust, your employer may be willing to match all or part of your donation helping to create an event bigger impact on our community! To the best of our knowledge, the following companies offer a matching gift program to their employees. This list was compiled using other lists found online and may not be comprehensive. Please contact your Human Resources Team for more information regarding your company’s matching gift program. # Air Liquide America Corporation 3Com Corporation Air Products and Chemicals Inc. 3M Company Albermarle Corp. Alco Standard Foundation A AlCOA Foundation Alexander and Baldwin Inc. Abacus Capital Investments Alexander and Baldwin Foundation Abbot Laboratories Alexander Haas Martin and Partners Accenture Foundation, Inc. Alexander Hamilton Life Access Fund Allegro Microsystems Inc. ACE INA Foundation Allegiance Corp. and Baxter Adams Harkness and Hill Inc. International Adaptec Foundation Allendale Insurance Foundation ADC Foundation Allendale Mutual Insurance Co. ADC Telecommunications AllianceBernstein Adobe Systems Inc. Alliance Capital Management L.P. ADP Foundation Alliance Coal LLC A&E Television Networks Alliant Techsystems AEGON TRANSAMERICA Allied Signal Inc. AEP Allstate Foundation, The AES Corporation Allstate Giving Campaign A.E. Staley Manufacturing Co. Altera Corp. Contributions Program Aetna Foundation, Inc. Altria Employee Involvement Programs AG Communications Systems Altria Group Agilent Technologies AMBAC Indemnity Corporation Aid Association for Lutherans AMD Corporate Giving Program AIG Matching Grants Program American Express Co.