Nexiata-En.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UMTS: Alive and Well

TABLE OF CONTENTS PREFACE…………………………………………………………………...……………………………… 5 1 INTRODUCTION......................................................................................................................... 10 2 PROGRESS OF RELEASE 99, RELEASE 5, RELEASE 6, RELEASE 7 UMTS-HSPA .......... 12 2.1 PROGRESS TIMELINE .................................................................................................................. 12 3 PROGRESS AND PLANS FOR RELEASE 8: EVOLVED EDGE, HSPA EVOLVED/HSPA+ AND LTE/EPC ............................................................................................................................ 19 4 THE GROWING DEMANDS FOR WIRELESS DATA APPLICATIONS ................................... 26 4.1 WIRELESS DATA TRENDS AND FORECASTS ................................................................................. 28 4.2 WIRELESS DATA REVENUE ......................................................................................................... 29 4.3 3G DEVICES............................................................................................................................... 31 4.4 3G APPLICATIONS ...................................................................................................................... 34 4.5 FEMTOCELLS ............................................................................................................................. 41 4.6 SUMMARY ................................................................................................................................. -

GGSN Release 4.0 Command Reference

Cisco IOS Mobile Wireless Command Reference GGSN Release 4.0 Corporate Headquarters Cisco Systems, Inc. 170 West Tasman Drive San Jose, CA 95134-1706 USA http://www.cisco.com Tel: 408 526-4000 800 553-NETS (6387) Fax: 408 526-4100 THE SPECIFICATIONS AND INFORMATION REGARDING THE PRODUCTS IN THIS MANUAL ARE SUBJECT TO CHANGE WITHOUT NOTICE. ALL STATEMENTS, INFORMATION, AND RECOMMENDATIONS IN THIS MANUAL ARE BELIEVED TO BE ACCURATE BUT ARE PRESENTED WITHOUT WARRANTY OF ANY KIND, EXPRESS OR IMPLIED. USERS MUST TAKE FULL RESPONSIBILITY FOR THEIR APPLICATION OF ANY PRODUCTS. THE SOFTWARE LICENSE AND LIMITED WARRANTY FOR THE ACCOMPANYING PRODUCT ARE SET FORTH IN THE INFORMATION PACKET THAT SHIPPED WITH THE PRODUCT AND ARE INCORPORATED HEREIN BY THIS REFERENCE. IF YOU ARE UNABLE TO LOCATE THE SOFTWARE LICENSE OR LIMITED WARRANTY, CONTACT YOUR CISCO REPRESENTATIVE FOR A COPY. The Cisco implementation of TCP header compression is an adaptation of a program developed by the University of California, Berkeley (UCB) as part of UCB’s public domain version of the UNIX operating system. All rights reserved. Copyright © 1981, Regents of the University of California. NOTWITHSTANDING ANY OTHER WARRANTY HEREIN, ALL DOCUMENT FILES AND SOFTWARE OF THESE SUPPLIERS ARE PROVIDED “AS IS” WITH ALL FAULTS. CISCO AND THE ABOVE-NAMED SUPPLIERS DISCLAIM ALL WARRANTIES, EXPRESSED OR IMPLIED, INCLUDING, WITHOUT LIMITATION, THOSE OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT OR ARISING FROM A COURSE OF DEALING, USAGE, OR TRADE PRACTICE. IN NO EVENT SHALL CISCO OR ITS SUPPLIERS BE LIABLE FOR ANY INDIRECT, SPECIAL, CONSEQUENTIAL, OR INCIDENTAL DAMAGES, INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR LOSS OR DAMAGE TO DATA ARISING OUT OF THE USE OR INABILITY TO USE THIS MANUAL, EVEN IF CISCO OR ITS SUPPLIERS HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES. -

Turkcell Annual Report 2010

TURKCELL ANNUAL REPORT 2010 GET MoRE oUT of LIfE WITh TURKCELL CoNTENTS PAGE our Vision / our Values / our Strategic Priorities 4 Turkcell Group in Numbers 6 Turkcell: Leading Communication and Technology Company 8 Letter from the Chairman 10 Board Members 12 Letter from the CEo 14 Executive officers 16 Superior Technologies 22 More Advantages 32 Best Quality Service 40 More Social Responsibility 46 Awards 53 Managers of Turkcell Affiliates 54 Subsidiaries 56 human Resources 62 Mobile Telecommunication Sector 66 International Ratings 72 Investor Relations 74 Corporate Governance 78 Turkcell offices 95 Consolidated financial Statement and Independent Audit Report 96 Dematerialization of The Share Certificates of The Companies That Are Traded on The Stock Exchange 204 The Board’s Dividend Distribution Proposal 205 2 3 oUR VISIoN oUR STRATEGIC PRIoRITIES To ease and enrich the lives of our customers with communication and As a Leading Communication and Technology Company, technology solutions. • to grow in our core mobile communication business through increased use of voice and data, • to grow our existing international subsidiaries with a focus on profitability, oUR VALUES • to grow in the fixed broadband business by creating synergy among Turkcell Group companies through our fiber optic infrastructure, • We believe that customers come first • to grow in the area of mobility, internet and convergence through new • We are an agile team business opportunities, • We promote open communication • to grow in domestic and international markets through communications, • We are passionate about making a difference technology and new business opportunities, • We value people • to develop new service platforms that will enrich our relationship with our customers through our technical capabilities. -

3 1 Jan. 2013

KvK Rotterdam/Rotterdam 3 1 JAN. 2013 FINTUR HOLDINGS B.V. CONSOLIDATED FINANCIAL STATEMENfS AT 31 DECEMBER 2011 TOGETHER WITH INDEPENDENf AUDITORS' REPORT adopted by the general meeting of shareholders by resolution passed on 29 Jamuary 2013 vastgesteld door de algemene vergadering van aandeelhouders bij besluit op 29 januari 2013 Prkt.'\\illl:rhou.sc(;oopers A<:countm11s N. \'. For idenlifirolion purpo~ouly lo pwc FINTUR HOLDINGS B.V. CONTENTS CONTENTS PAGES REPORT OF THE BOARD OF DIRECTORS .......................... 3-5 CONSOLIDATED FINANCIAL STATEMENTS................................................................... 6 - 58 CONSOLIDATED BALANCE SHEETS................................................................................. 7 CONSOLIDATED STATEMENTS OF INCOME.................................................................. 9 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME............................. 10 CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY......................................... 11 CONSOLIDATED STATEMENTS OF CASH FLOWS.......................................................... 12 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS.................................... 13-58 NOTE I ORGANISATION AND NATURE OF OPERATIONS............................................................................... 7-8 NOTE 2 BASIS OF PREPARATION AND SUMMARY OF SIGNIFICANT RELEVANT ACCOUNTING POLICIES.......................................................................................................................... 9-33 NOTE 3 SEGMENT -

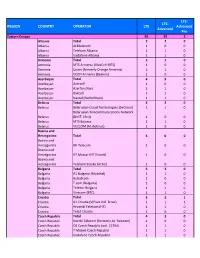

Ready for Upload GCD Wls Networks

LTE‐ Region Country Operator LTE 5G Advanced Eastern Europe 93 60 18 Albania Total 320 Albania ALBtelecom 100 ONE Telecommunications (formerly Albania Telekom Albania) 110 Albania Vodafone Albania 110 Armenia Total 330 Armenia MTS Armenia (Viva‐MTS) 110 Armenia Ucom 110 Armenia VEON Armenia (Beeline) 110 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 431 Belarus A1 Belarus 101 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 110 Belarus MTS Belarus 110 Bosnia‐Herzegovina Total 310 Bosnia‐Herzegovina BH Telecom 110 Bosnia‐Herzegovina HT Mostar (HT Eronet) 100 Bosnia‐Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 331 Croatia A1 Hrvatska (formerly VIPnet/B.net) 110 Croatia Hrvatski Telekom (HT) 111 Croatia Tele2 Croatia 110 Czech Republic Total 433 Czech Republic Nordic Telecom 100 Czech Republic O2 Czech Republic (incl. CETIN) 111 Czech Republic T‐Mobile Czech Republic 111 Czech Republic Vodafone Czech Republic 111 Estonia Total 331 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 111 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom 110 Georgia Ostelecom (MegaFon) (South Ossetia) 100 Georgia -

Turkcell the Digital Operator

Turkcell the Digital Operator Turkcell Annual Report 2018 About Turkcell Turkcell is a digital operator headquartered in Turkey, serving its customers with its unique portfolio of digital services along with voice, messaging, data and IPTV services on its mobile and fixed networks. Turkcell Group companies operate in 5 countries – Turkey, Ukraine, Belarus, Northern Cyprus, Germany. Turkcell launched LTE services in its home country on April 1st, 2016, employing LTE-Advanced and 3 carrier aggregation technologies in 81 cities. Turkcell offers up to 10 Gbps fiber internet speed with its FTTH services. Turkcell Group reported TRY 21.3 billion revenue in FY18 with total assets of TRY 42.8 billion as of December 31, 2018. It has been listed on the NYSE and the BIST since July 2000, and is the only NYSE-listed company in Turkey. Read more at www.turkcell.com.tr/english-support All financial results in this annual report are prepared in accordance with International Financial Reporting Standards (IFRS) and expressed in Turkish Lira (TRY or TL) unless otherwise stated. TABLE OF CONTENTS TRY Turkcell Group 16 Chairman’s Message 21.3 20 Board of Directors 22 Message from the CEO billion 26 Executive Officers 28 Top Management of Subsidiaries REVENUES 30 Turkcell Group 31 Our Vision, Target, Strategy and Approach 32 2018 at a Glance 34 2018 Highlights 36 The World’s 1st Digital Operator Brand: Lifecell 37 Turkcell’s Digital Services 2018 Operations 38 Exemplary Digital Operator 40 Our Superior Technology 41.3% 46 Our Consumer Business EBITDA 52 Our -

Kcell Is a Market Leader Again Mobile Network Antennas: Myths and Reality Dual Carrier: 3G Evolution in Progress Publisher: Apriori Communications LLP

Specialized telecommunication magazine of Kazakhstan september — november / №3 [27] Kcell is a Market Leader Again Mobile Network Antennas: Myths and Reality Dual Carrier: 3G Evolution in Progress Publisher: Apriori Communications LLP Editor-in-chief: Aida Dossayeva Editorial Director: Natalia Yeskova Director: Dinara Sherieva Design: David Djubayev [www.vkartinke.com] Authors of Publications: Natalya Yeskova Ivan Glushchenko Aisha Arynova Sanzhar Bimamirov Dmitriy Paramonov Photographs: Saken Nigmashev Valeriy Ayapov Translation into the Kazakh and English languages: InterBridge-A Translation Bureau Read VOX.com on your mobile phone Address of the Editorial Office: 118 Makatayev str., 6 apt. 050000, Almaty, Republic of Kazakhstan tel.: 8 [727] 232-71-40 mobile.: +7 701 211 31 77 e-mail: [email protected] Printed in Gerona Print House 30a/3 Satpayev str., office 124 Tel.: 7 (727) 250-47-40, 398-94-59, 398-94-60 The magazine is re-registered with the Ministry of Communications and Information of the RoK as of 19.10.2011 under No.12052-Ж CONTENTS NEWS 4 TeliaSonera News 8 Kcell News ANALYTICS 6 Kcell is a Market Leader Again 22 Mobile Network Antennas: Myths and Reality INTERVIEW 26 The Road Project: What Matters Is There's Almost Always a Connection MARKET 12 Kcell Cloud: Taming Clouds 14 Dual Carrier: 3G Evolution in Progress 16 How to Maximize Your Smartphone's Potential 18 Roaming: Make Yourself At Home! 20 A Pretty Number Is Quick and Convenient 34 Smartphones with Dual Carrier Support PHOTO REPORTAGE 30 TEDxAlmaty. Extra is New Rationality 4 5 news TeliaSonera International the interconnection services. The net sales Net sales in the Eurasian branch of Carrier Presents Anywhereization Trend figures remained stable in the local currency, TeliaSonera (BA Eurasia) increased by 11.1 excluding acquisitions and divestments. -

GEORGIA an Information Ecosystem Assessment

GEORGIA An Information Ecosystem Assessment Report Overview & Part One: Context, Infrastructure, Regulation, and Revenue This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License (CC BY-NC-SA 4.0). February 2021 2 Georgia An Information Ecosystem About This Report Internews’ Information Ecosystem Assessment (IEA) methodology is designed to help understand how information moves and flows through communities. Information ecosystems are more than infrastructure or networks of formal news, media, and other information channels. Informal networks, personal connections, digital and face- to-face channels, and trust-based information flows that are influenced to varying degrees by news or media are all parts of an information ecosystem. To make sense of these dynamic systems a broad view Acknowledgements is needed. Internews’ IEA model goes beyond the traditional ‘supply side’ view of media landscape and media capacity (information infrastructure, Research for this report was led by tools, media, producers, consumer data, curators, a team of researchers in Georgia, and sharers), to encompass a ‘demand side’ Dr. Anna Keshelashvili, perspective, where the human factor is critical for Dr. Maia Mikashavidze, a full understanding of any Information Ecosystem. Ekaterine Basilaia, Teo Kavtaradze, This IEA is a detailed examination of the information Mariam Menabde, ecosystem in Georgia, analyzing the various means of information exchange for the population. The in partnership with the Caucasus report is intended as a practical tool to help inform Research Resource Center, programming priorities and policy approaches. The Koba Turmanidze, Otar Saldadze, Georgia IEA, which was completed with support Kristine Vacharadze, and support from from Facebook, includes an in-depth examination the Internews editorial team, Rafiq of social media. -

Telia Company – Annual and Sustainability Report 2019

BRINGING THE WORLD CLOSER ANNUAL AND SUSTAINABILITY REPORT 2019 CONTENT OUR COMPANY Telia Company in one minute ................................................ 4 2019 in brief ............................................................................ 6 How we create value ............................................................. 8 Comments from the CEO ..................................................... 10 Trends and strategy .............................................................. 12 DIRECTORS' REPORT Group development ............................................................. 16 Country development .......................................................... 32 Sustainability ....................................................................... 41 Risks and uncertainties ....................................................... 62 CORPORATE GOVERNANCE Corporate Governance Statement ....................................... 70 Board of Directors ............................................................... 82 Group Executive Management ............................................ 84 FINANCIAL STATEMENTS Consolidated statements of comprehensive income .......... 86 Consolidated statements of financial position .................... 87 Consolidated statements of cash flows .............................. 88 Consolidated statements of changes in equity ................... 89 Notes to consolidated financial statements ........................ 90 Parent company income statements.................................. 182 Parent company -

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Eastern Europe 92 57 4 3 Albania Total 32 0 0 Albania ALBtelecom 10 0 0 Albania Telekom Albania 11 0 0 Albania Vodafone Albania 11 0 0 Armenia Total 31 0 0 Armenia MTS Armenia (VivaCell‐MTS) 10 0 0 Armenia Ucom (formerly Orange Armenia) 11 0 0 Armenia VEON Armenia (Beeline) 10 0 0 Azerbaijan Total 43 0 0 Azerbaijan Azercell 10 0 0 Azerbaijan Azerfon (Nar) 11 0 0 Azerbaijan Bakcell 11 0 0 Azerbaijan Naxtel (Nakhchivan) 11 0 0 Belarus Total 42 0 0 Belarus A1 Belarus (formerly VELCOM) 10 0 0 Belarus Belarusian Cloud Technologies (beCloud) 11 0 0 Belarus Belarusian Telecommunications Network (BeST, life:)) 10 0 0 Belarus MTS Belarus 11 0 0 Bosnia and Total Herzegovina 31 0 0 Bosnia and Herzegovina BH Telecom 11 0 0 Bosnia and Herzegovina HT Mostar (HT Eronet) 10 0 0 Bosnia and Herzegovina Telekom Srpske (m:tel) 10 0 0 Bulgaria Total 53 0 0 Bulgaria A1 Bulgaria (Mobiltel) 11 0 0 Bulgaria Bulsatcom 10 0 0 Bulgaria T.com (Bulgaria) 10 0 0 Bulgaria Telenor Bulgaria 11 0 0 Bulgaria Vivacom (BTC) 11 0 0 Croatia Total 33 1 0 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 1 0 Croatia Hrvatski Telekom (HT) 11 0 0 Croatia Tele2 Croatia 11 0 0 Czechia Total 43 0 0 Czechia Nordic Telecom (formerly Air Telecom) 10 0 0 Czechia O2 Czech Republic (incl. CETIN) 11 0 0 Czechia T‐Mobile Czech Republic 11 0 0 Czechia Vodafone Czech Republic 11 0 0 Estonia Total 33 2 0 Estonia Elisa Eesti (incl. -

Regulation of Mandatory Access of Mvnos in Georgia Addendum in Response to GNCC’S Statement October 2020

Regulation of mandatory access of MVNOs in Georgia Addendum in response to GNCC’s statement October 2020 Index 1 Summary 3 2 Issues addressed 4 2.1 Our assessment that price points in Georgia are already relative cheap 4 2.2 Our read of the regulatory context 9 2.3 The logic that lead us to conclude that the introduction of MVNO is likely to further concentrate infrastructure investment in the country 11 2.4 Our view that the COVID-19 crisis will make it harder for MVNOs to enter the market 13 3 Appendix 17 3.1 Abbreviations and acronyms 17 3.2 Figure index 18 02 Regulation of mandatory access of MVNOs in Georgia | Addendum | Summary 1 Summary The Georgian National Communications Commission (“GNCC”) published on December 31, 2019 a decision mandating existing Mobile Network Operators (MNOs) to grant MNVO applicants access to their (MNO’s) networks. In this context, Deloitte TMT practice conducted a thorough analysis of the conditions in the Georgian market to assess, from an outside-in perspective, the impacts such regulation is likely to have on the broader mobile industry in Georgia. Our analysis covered the dimensions we considered most relevant such as market structure and its pricing points, appeal for potential applicant MVNOs, investment needs and potential impact from a MVNO initiative, regulatory considerations and the status of the economy, post COVID-19, amongst others, leveraging for this exercise publicly available data. Our conclusions are the result of an independent reflection, based on our expertise in the sector, our detailed analysis and the specific situation of the Georgian mobile market. -

Ready for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced Advanced Pro Eastern Europe 92 55 2 Albania Total 320 Albania ALBtelecom 100 Albania Telekom Albania 110 Albania Vodafone Albania 110 Armenia Total 310 Armenia MTS Armenia (VivaCell‐MTS) 100 Armenia Ucom (formerly Orange Armenia) 110 Armenia VEON Armenia (Beeline) 100 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 420 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 100 Belarus MTS Belarus 110 Belarus VELCOM (A1 Belarus) 100 Bosnia and Herzegovina Total 300 Bosnia and Herzegovina BH Telecom 100 Bosnia and Herzegovina HT Mostar (HT Eronet) 100 Bosnia and Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 321 Croatia A1 Croatia (VIPnet incl. B.net) 111 Croatia Hrvatski Telekom (HT) 110 Croatia Tele2 Croatia 100 Czech Republic Total 430 Czech Republic Nordic Telecom (formerly Air Telecom) 100 Czech Republic O2 Czech Republic (incl. CETIN) 110 Czech Republic T‐Mobile Czech Republic 110 Czech Republic Vodafone Czech Republic 110 Estonia Total 330 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 110 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom