Film & Television Industry Booklet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2012

NEWS CORP. ANNU AL REPO RT 2012 NEWSANNUAL REPORT 2012 1211 Avenue of the Americas New York, NY 10036 www.newscorp.com C O RP. 425667.COVER.CX.CS5.indd 1 8/29/12 5:21 PM OUR AIM IS TO UNLOCK MORE VALUE FOR OUR STOCKHOLDERS 425667.COVER.CS5.indd 2 8/31/12 9:58 AM WE HAVE NO INTENTION OF RESTING ON OUR LAURELS WE ARE ALWAYS INVESTING IN THE NEXT GENERATION 425667.TEXT.CS5.indd 2 8/28/12 5:10 PM 425667.TEXT.CS5.indd 3 8/27/12 8:44 PM The World’s LEADER IN QUALITY JOURNALISM 425667.TEXT.CS5.indd 4 8/28/12 5:11 PM A LETTER FROM Rupert Murdoch It takes no special genius to post good earnings in a booming economy. It’s the special company that delivers in a bad economic environment. At a time when the U.S. has been weighed down by its slowest recovery since the Great Depression, when Europe’s currency threatens its union and, I might add when our critics flood the field with stories that refuse to move beyond the misdeeds at two of our papers in Britain, I am delighted to report something about News Corporation you Rupert Murdoch, Chairman and Chief Executive Officer might not know from the headlines: News Corporation In 2012, for the second year in a row, we have brought our stockholders double-digit growth in total segment operating income. FOR THE SECOND We accomplished this because we do not consider ourselves a conventional YEAR IN A ROW, company. -

The Speakers and Chairs 2016

WEDNESDAY 24 FESTIVAL AT A GLANCE 09:30-09:45 10:00-11:00 BREAK BREAK 11:45-12:45 BREAK 13:45-14:45 BREAK 15:30-16:30 BREAK 18:00-19:00 19:00-21:30 20:50-21:45 THE SPEAKERS AND CHAIRS 2016 SA The Rolling BT “Feed The 11:00-11:20 11:00-11:45 P Edinburgh 12:45-13:45 P Meet the 14:45-15:30 P Meet the MK London 2012 16:30-17:00 The MacTaggart ITV Opening Night FH People Hills Chorus Beast” Welcome F Revealed: The T Breakout Does… T Breakout Controller: T Creative Diversity Controller: to Rio 2016: SA Margaritas Lecture: Drinks Reception Just Do Nothing Joanna Abeyie David Brindley Craig Doyle Sara Geater Louise Holmes Alison Kirkham Antony Mayfield Craig Orr Peter Salmon Alan Tyler Breakfast Hottest Trends session: An App Taskmaster session: Charlotte Moore, Network Drinks: Jay Hunt, The Superhumans’ and music Shane Smith The Balmoral screening with Thursday 14.20 - 14.55 Wednesday 15:30-16:30 Thursday 15:00-16:00 Thursday 11:00-11:30 Thursday 09:45-10:45 Wednesday 15:30-16:30 Wednesday 12:50-13:40 Thursday 09:45-10:45 Thursday 10:45-11:30 Wednesday 11:45-12:45 The Tinto The Moorfoot/Kilsyth The Fintry The Tinto The Sidlaw The Fintry The Tinto The Sidlaw The Networking Lounge 10:00-11:30 in TV Formats for Success: Why Branded Content BBC A Little Less Channel 4 Struggle For The Edinburgh Hotel talent Q&A The Pentland Digital is Key in – Big Cash but Conversation, Equality Playhouse F Have I Got F Winning in F Confessions of FH Porridge Adam Abramson Dan Brooke Christiana Ebohon-Green Sam Glynne Alex Horne Thursday 11:30-12:30 Anne Mensah Cathy -

The Role of Irish-Language Film in Irish National Cinema Heather

Finding a Voice: The Role of Irish-Language Film in Irish National Cinema Heather Macdougall A Thesis in the PhD Humanities Program Presented in Partial Fulfillment of the Requirements for the degree of Doctor of Philosophy at Concordia University Montreal, Quebec, Canada August 2012 © Heather Macdougall, 2012 ABSTRACT Finding a Voice: The Role of Irish-Language Film in Irish National Cinema Heather Macdougall, Ph.D. Concordia University, 2012 This dissertation investigates the history of film production in the minority language of Irish Gaelic. The objective is to determine what this history reveals about the changing roles of both the national language and national cinema in Ireland. The study of Irish- language film provides an illustrative and significant example of the participation of a minority perspective within a small national cinema. It is also illustrates the potential role of cinema in language maintenance and revitalization. Research is focused on policies and practices of filmmaking, with additional consideration given to film distribution, exhibition, and reception. Furthermore, films are analysed based on the strategies used by filmmakers to integrate the traditional Irish language with the modern medium of film, as well as their motivations for doing so. Research methods included archival work, textual analysis, personal interviews, and review of scholarly, popular, and trade publications. Case studies are offered on three movements in Irish-language film. First, the Irish- language organization Gael Linn produced documentaries in the 1950s and 1960s that promoted a strongly nationalist version of Irish history while also exacerbating the view of Irish as a “private discourse” of nationalism. Second, independent filmmaker Bob Quinn operated in the Irish-speaking area of Connemara in the 1970s; his fiction films from that era situated the regional affiliations of the language within the national context. -

The Finance and Production of Independent Film and Television in the UK: a Critical Introduction

The Finance and Production of Independent Film and Television in the UK: A Critical Introduction Vital Statistics General Population: 64.1m Size: 241.9 km sq GDP: £1.9tr (€2.1tr) Film1 Market share of UK independent films in 2015: 10.5% Number of feature films produced: 201 Average visits to cinema per person per year: 2.7 Production spend per year: £1.4m (€1.6) TV2 Audience share of the main publicly-funded PSB (BBC): 72% Production spend by PSBs: £2.5bn (€3.2bn) Production spend by commercial channels (excluding sport): £350m (€387m) Time spent watching television per day: 193 minutes (3hrs 13 minutes) Introduction This chapter provides an overview of independent film and television production in the UK. Despite the unprecedented levels of convergence that characterise the digital era, the UK film and television industries remain distinct for several reasons. The film industry is small and fragmented, divided across the two opposing sources of support on which it depends: large but uncontrollable levels of ‘inward-investment’ – money invested in the UK from overseas – mainly from the US, and low levels of public subsidy. By comparison, the television industry is large and diverse, its relative stability underpinned by a long-standing infrastructure of 1 Sources: BFI 2016: 10; ‘The Box Office 2015’ [market share of UK indie films] ; BFI 2016: 6; ‘Exhibition’ [cinema visits per per person]; BFI 2016: 6; ‘Exhibition’ [average visits per person]; BFI 2016: 3; ‘Screen Sector Production’ [production spend per year]. 2 Sources: Oliver & Ohlbaum 2016: 68 [PSB audience share]; Ofcom 2015a: 3 [PSB production spend]; Ofcom 2015a: 8. -

Adding Value Report Vol.1

ADDING VALUE a report by Northern Ireland Screen NORTHERN BOOSTING CELEBRATING ENHANCING CONTENTS THE THE THE IRELAND OUR OUR OUR CHILDREN'S ECONOMIC CULTURAL EDUCATIONAL SCREEN ECONOMY CULTURE EDUCATION VALUE VALUE VALUE 08 Large-scale Production 44 Writers 84 Creative Learning Centres 18 Independent Film 46 Short Film 90 Moving Image Arts (MIA) 22 Animation 48 ILBF / CCG 92 After School FilmClub 26 Factual / Entertainment 56 USBF 30 Television Drama 64 Film Culture 34 Gaming and Mobile 74 Heritage and Archive 38 Skills Development 78 Awards 04 05 INTROduCTION As the government-backed lead Of course certain activity intersects In a similar vein, the work of the agency in Northern Ireland for the film, more than one area and the inter- Education Department, with regard to television and digital content industry, connectivity of the agency’s work will its intervention through FilmClub, has Northern Ireland Screen is committed become apparent. For example, the value in both education and culture; as to maximising the economic, cultural development and production funding for children learn through film in a pure and educational value of the screen indigenous projects made in Northern educational sense as well as gain a wider industries for the benefit of Northern Ireland by Northern Ireland film-makers appreciation of film culture and of the Ireland. This goal is pursued through our and shown at a Northern Ireland festival, culture of Northern Ireland through mission to accelerate the development will have value in all areas. An obvious watching content-relevant films. of a dynamic and sustainable screen case in point is the feature film Good industry and culture in Northern Ireland. -

Review of the Scottish Animation Sector

__ Review of the Scottish Animation Sector Creative Scotland BOP Consulting March 2017 Page 1 of 45 Contents 1. Executive Summary ........................................................................... 4 2. The Animation Sector ........................................................................ 6 3. Making Animation ............................................................................ 11 4. Learning Animation .......................................................................... 21 5. Watching Animation ......................................................................... 25 6. Case Study: Vancouver ................................................................... 27 7. Case Study: Denmark ...................................................................... 29 8. Case Study: Northern Ireland ......................................................... 32 9. Future Vision & Next Steps ............................................................. 35 10. Appendices ....................................................................................... 39 Page 2 of 45 This Report was commissioned by Creative Scotland, and produced by: Barbara McKissack and Bronwyn McLean, BOP Consulting (www.bop.co.uk) Cover image from Nothing to Declare courtesy of the Scottish Film Talent Network (SFTN), Studio Temba, Once Were Farmers and Interference Pattern © Hopscotch Films, CMI, Digicult & Creative Scotland. If you would like to know more about this report, please contact: Bronwyn McLean Email: [email protected] Tel: 0131 344 -

Trends in TV Production Ofcom, December 2015 Contents

Trends in TV Production Ofcom, December 2015 Contents 1. Summary 2. What were the original aims of intervention? 3. The UK production market 4. How many companies are active in the market? 5. How easy is it to enter? 6. Production sector revenue and flow of funds 7. Production sector consolidation 8. Quotas 9. Regionality 10. Historical context of the US market Summary – the questions asked This pack aims to confirm (or dispel) many of the widely held beliefs about the UK television production sector. Among the questions it seeks to answer are: • What is the intervention (regulation of the sector) meant to do? • How has commissioning developed over time? • How has the number of producers changed over time? • Is it harder to get into the market? • How do terms of trade work? • How has the sector grown? • What has consolidation looked like? • How do quotas work? • How does the sector operate regionally? 3 Summary – caveats This report was produced for Ofcom by Oliver & Ohlbaum Associates Ltd (“O&O”). The views expressed in this report are those of O&O and do not necessarily represent the views of Ofcom. While care has been taken to represent numbers in this report as accurately as possible based on available sources there may be inaccuracies and they may not correspond with Ofcom’s view of the market and cannot be taken as officially representative of Ofcom data. 4 Summary - data sources used • Oliver & Ohlbaum Producer Database, 2006-2015 ₋ BARB data supplied by Attentional and further coded by O&O to include production companies and their status as qualifying or no-qualifying producers, plus their respective turnover bands. -

Chris Travers

Commercials Fact/Ent Asics Your Home Made Perfect - Remarkable CHRIS TRAVERS Rosemary Water with Henry Cavill Your Garden Made - Remarkable Budweiser Live Project Master Chef - Shine TV SOUND RECORDIST Cadbury The Cabin - Big Wheel Film And TV Dior Love Your Garden - Spun Gold TV Burberry The Great Garden Revolution – Rumpus Media Craft Gin Club Documentary Promo / Opener CERN NASA - Fulwell 73 The Third Day - Sky Arts Late Nilsen Files – Wall to Wall Sainsbury’s Active Kids with David Beckham - Fulwell 73 Goddess: The Secret Lives of Marilyn Monroe - Netflix Britain’s Got Talent Openers - Thames TV Noel Clarke - Sky Arts Late The X Factor Openers - Thames TV Peter The Painter - Sky Arts Thorpe Park with Ant & Dec - ITV Studios Trust Your Gut - ABC Strictly Come Dancing Openers - BBC Tim Sleeps With… - Channel 5 The BRIT Awards Opener - Craft Films At Home With Steph & Dom - Studio Lambert Surgu - Craft Films NTA Awards – Indigo Television Sport Soccer Aid - Unicef Entertainment F1 Lotus- F1 Little Mix: The Search - Modest TV F1 Williams Martini Racing - F1 A League Of Their Own – CPL Productions Tottenham Hotspurs FC - EA Sports The Pet Show – ITV Studios Chelsea FC - EA Sports Backstage With Katherine Ryan - Expectation Manchester United - MUFC TV Top Gear & Extra Gear - BBC FIFA - EA Sports Mancs in Mumbai - Multi Story Para Athletics Games - Channel 4 Britain’s Got Talent- Thames TV Ryder Cup - Active Presentation Saturday Night Take Away - ITV Studios SSE Women's FA Cup Roadshow - FA Strictly Come Dancing - BBC Children In Need / -

Rediscover Northern Ireland Report Philip Hammond Creative Director

REDISCOVER NORTHERN IRELAND REPORT PHILIP HAMMOND CREATIVE DIRECTOR CHAPTER I Introduction and Quotations 3 – 9 CHAPTER II Backgrounds and Contexts 10 – 36 The appointment of the Creative Director Programme and timetable of Rediscover Northern Ireland Rationale for the content and timescale The budget The role of the Creative Director in Washington DC The Washington Experience from the Creative Director’s viewpoint. The challenges in Washington The Northern Ireland Bureau Publicity in Washington for Rediscover Northern Ireland Rediscover Northern Ireland Website Audiences at Rediscover Northern Ireland Events Conclusion – Strengths/Weaknesses/Potential Legacies CHAPTER III Artist Statistics 37 – 41 CHAPTER IV Event Statistics 42 – 45 CHAPTER V Chronological Collection of Reports 2005 – 07 46 – 140 November 05 December 05 February 06 March 07 July 06 September 06 January 07 CHAPTER VI Podcasts 141 – 166 16th March 2007 31st March 2007 14th April 2007 1st May 2007 7th May 2007 26th May 2007 7th June 2007 16th June 2007 28th June 2007 1 CHAPTER VII RNI Event Analyses 167 - 425 Community Mural Anacostia 170 Community Poetry and Photography Anacostia 177 Arts Critics Exchange Programme 194 Brian Irvine Ensemble 221 Brian Irvine Residency in SAIL 233 Cahoots NI Residency at Edge Fest 243 Healthcare Project 252 Camerata Ireland 258 Comic Book Artist Residency in SAIL 264 Comtemporary Popular Music Series 269 Craft Exhibition 273 Drama Residency at Catholic University 278 Drama Production: Scenes from the Big Picture 282 Film at American Film -

The Role of Psbs in the UK TV Production Sector

Small Screen: Big Debate Consultation – Annex 7. The role of PSBs in the UK TV production sector A7. The role of PSBs in the UK TV production sector Overview The TV production sector is a UK success story. The skill base of UK TV production companies has attracted valuable inward investment and global sales of UK programmes have boosted the image of the UK. The UK TV production sector consists of a mixture of large and small independent producers which operate alongside production companies owned by UK broadcasters. This successful production sector has attracted significant inward investment, from foreign broadcasters and streaming services. The UK independent TV production sector is not a product of the market alone; it has been supported and nurtured by the rules and obligations placed on the PSBs over the years. Rules on external commissioning, IP rights and regional quotas have played a vital role in the emergence and development of the independent TV production sector in the UK. UK TV production industry A7.1 The UK TV production sector has changed dramatically over the last 20 years. In 2004, the Public Service Broadcasters (PSBs) accounted for around 87% of all UK commissions.1 The PSBs also dominated content production, accounting for over half (56%) of all UK production.2 A7.2 Fast forward to now, the sector is diverse, competitive, and internationally successful. It has almost doubled in size over this period with commissioning spend on UK productions estimated to range between £4.5bn and £5bn in 2018.3 A7.3 In 2018, UK producers were responsible for almost half of all peak-time shows in major international markets.4 Formats such as Love Island and Strictly Come Dancing/Dancing with the Stars and The Office originated in the UK and have gone on to be global hits. -

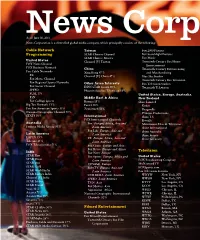

Filmed Entertainment Television Dire Sate Cable Network Programming

AsNews of June 30, 2011 Corporation News Corporation is a diversified global media company, which principally consists of the following: Cable Network Taiwan Fox 2000 Pictures KTXH Houston, TX Asia Australia Programming STAR Chinese Channel Fox Searchlight Pictures KSAZ Phoenix, AZ Tata Sky Limited 30% Almost 150 national, metropolitan, STAR Chinese Movies Fox Music KUTP Phoenix, AZ suburban, regional and Sunday titles, United States Channel [V] Taiwan Twentieth Century Fox Home WTVT Tampa B ay, FL Australia and New Zealand including the following: FOX News Channel Entertainment KMSP Minneapolis, MN FOXTEL 25% The Australian FOX Business Network China Twentieth Century Fox Licensing WFTC Minneapolis, MN Sky Network Television The Weekend Australian Fox Cable Networks Xing Kong 47% and Merchandising WRBW Orlando, FL Limited 44% The Daily Telegraph FX Channel [V] China 47% Blue Sky Studios WOFL Orlando, FL The Sunday Telegraph Fox Movie Channel Twentieth Century Fox Television WUTB Baltimore, MD Publishing Herald Sun Fox Regional Sports Networks Other Asian Interests Fox Television Studios WHBQ Memphis, TN Sunday Herald Sun Fox Soccer Channel ESPN STAR Sports 50% Twentieth Television KTBC Austin, TX United States The Courier-Mail SPEED Phoenix Satellite Television 18% WOGX Gainesville, FL Dow Jones & Company, Inc. Sunday Mail (Brisbane) FUEL TV United States, Europe, Australia, The Wall Street Journal The Advertiser FSN Middle East & Africa New Zealand Australia and New Zealand Barron’s Sunday Mail (Adelaide) Fox College Sports Rotana 15% -

WILL ING Writer

WILL ING Writer Television 2020- CHANNEL HOPPING WITH JON RICHARDSON 2021 Rumpus Media 2019- THERE’S SOMETHING ABOUT MOVIES 2021 CPL Productions/ Sky1 2018- A LEAGUE OF THEIR OWN 2021 CPL Productions/Sky1 8 OUT OF 10 CATS DOES COUNTDOWN Zeppotron, 2012-19 2019- GOLDIES OLDIES 2020 Viacom 2019 WHAT HAPPENS IF Screen Glue 2017 ZAPPED Co-Creator & Co-Writer (with Paul Powell and Will Ing) of a high-concept series Black Dog Television and Baby Cow Productions for UKTV (2 series) 8 OUT OF 10 CATS Zeppotron/More 4 THE ROYAL VARIETY PERFORMANCE ITV UNSPUN WITH MATT FORDE Avalon (Series 2) BIG STAR’S LITTLE STAR 12 Yard/ITV (Series 4 & 5) A LEAGUE OF THEIR OWN CPL Productions/Sky1 FABLE Pilot script in development with Baby Cow/Microsoft LAST IN LINE Co-Creator & Co-Writer (with Paul Powell and Dan Gaster) of pilot script Black Dog Television / Kudos MY FAMILY AND OTHER IDIOTS Co-Creator & Co-Writer (with Paul Powell and Dan Gaster) of pilot script Black Dog Television NICE GUY EDDIE Co-Creator & Co-Writer (with Paul Powell and Dan Gaster) of pilot script Black Dog Television 2015 8 OUT OF 10 CATS CHRISTMAS SPECIAL Zeppotron/Channel 4 BIG STAR’S LITTLE STAR 12 Yard/ITV WHAT PLANET ARE YOU ON? BBC Earth 2014 YOU SAW THEM HERE FIRST Three Series, ITV RELATIVELY CLEVER Scriptwriter, John Stanley Productions/Sky LIVE AT THE APOLLO Additional material, Open Mike/BBC COMEDY PLAYHOUSE Writing for Victoria Wood WILD THINGS Additional material, IWC Media/Sky 1 OPERATION OUCH Two Series for CBBC/Maverick LET ME ENTERTAIN YOU STV/ITV HOLLYWOOD SQUARES Non-TX Pilot for Group M MARCEL LE CONT SHOW Non-TX Pilot for BBC, 2014 2013 10 O’CLOCK LIVE Two Series, Zeppotron, 2012-2013 SHOW ME THE TELLY ITV HOW TO WIN EUROVISION BBC WHEN MIRANDA MET BRUCE BBC SECRET EATERS Endemol/Channel 4 FAKE REACTION Two Series for STV Productions/ITV, 2011-2013 AND YOU ARE? Co-Creator & Co-Writer, hosted by Miranda Hart.