Multiple Marriage Planning: His, Hers, Ours and Somebody Else’S

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(#) Indicates That This Book Is Available As Ebook Or E

ADAMS, ELLERY 11.Indigo Dying 6. The Darling Dahlias and Books by the Bay Mystery 12.A Dilly of a Death the Eleven O'Clock 1. A Killer Plot* 13.Dead Man's Bones Lady 2. A Deadly Cliché 14.Bleeding Hearts 7. The Unlucky Clover 3. The Last Word 15.Spanish Dagger 8. The Poinsettia Puzzle 4. Written in Stone* 16.Nightshade 9. The Voodoo Lily 5. Poisoned Prose* 17.Wormwood 6. Lethal Letters* 18.Holly Blues ALEXANDER, TASHA 7. Writing All Wrongs* 19.Mourning Gloria Lady Emily Ashton Charmed Pie Shoppe 20.Cat's Claw 1. And Only to Deceive Mystery 21.Widow's Tears 2. A Poisoned Season* 1. Pies and Prejudice* 22.Death Come Quickly 3. A Fatal Waltz* 2. Peach Pies and Alibis* 23.Bittersweet 4. Tears of Pearl* 3. Pecan Pies and 24.Blood Orange 5. Dangerous to Know* Homicides* 25.The Mystery of the Lost 6. A Crimson Warning* 4. Lemon Pies and Little Cezanne* 7. Death in the Floating White Lies Cottage Tales of Beatrix City* 5. Breach of Crust* Potter 8. Behind the Shattered 1. The Tale of Hill Top Glass* ADDISON, ESME Farm 9. The Counterfeit Enchanted Bay Mystery 2. The Tale of Holly How Heiress* 1. A Spell of Trouble 3. The Tale of Cuckoo 10.The Adventuress Brow Wood 11.A Terrible Beauty ALAN, ISABELLA 4. The Tale of Hawthorn 12.Death in St. Petersburg Amish Quilt Shop House 1. Murder, Simply Stitched 5. The Tale of Briar Bank ALLAN, BARBARA 2. Murder, Plain and 6. The Tale of Applebeck Trash 'n' Treasures Simple Orchard Mystery 3. -

Lunch------1:00 PM 6

ONE-ACT PLAY CENTER 1 - NEW HS AUDITORIUM Time Contest. # Title School # 8:00 AM 1. The Suessification of A Midsummer Night's Dream 27 2. Wonderful Counselor 83 3. The End of Summer 79 --------------------------Break-------------------------- 10:30 AM 4. The Giver 53 5. Superheroes 12 ------------Lunch------------ 1:00 PM 6. Requiem 88 7. 13 Ways to Screw Up Your College Interview 80 8. Check Please 70 --------------------------Break-------------------------- 3:30 PM 9. A Wrinkle in Time 59 ONE-ACT CENTER 2 - HS Little Theatre Time Contest. # Title School # 8:00 AM 1. Drugs Are Bad 63 2. How to Succeed in High School Without Really Trying 90 3. Shoes Along the Highway 44 --------------------------Break-------------------------- 10:30 AM 4. …And Others 85 5. What Are We Going To Do With Mama? 29 ------------Lunch------------ 1:00 PM 6. Cinderella Inc. 58 7. In the Park 49 8. Peter/Wendy 3 --------------------------Break-------------------------- 3:30 PM 9. Rememberin' Stuff 33 Choral Reading CENTER 3 - HS Band Room Time Contest. # Title School # 8:00 AM 1. Life of A Teenager 1 2. Behind the Curtain 79 3. I am NOT 24 4. Behind the Curtain, In the Pantomime 59 5. Nineteen 70 6. Vapor 53 7. High School for Dummies 32 8. We are the Dragons 49 --------------------------Break-------------------------- 10:15 AM 9. There's a Helpful Smile in Every Aisle…Food Glorious Food! 88 10. Mean Girls 48 11. Parents 54 12. The Ones Who Walk Away from Omelas 104 13. Ugly 84 14. How the Grinch Stole Christmas 8 15. No Doesn't Mean Yes 96 ------------Lunch------------ 1:00 PM 16. -

A Happy Life by C H a R L E S L

This script was freely downloaded from the (re)making project, (charlesmee.org). We hope you'll consider supporting the project by making a donation so that we can keep it free. Please click here to make a donation. A Happy Life by C H A R L E S L . M E E Music. A chair and a divan are on stage. Two men and two women enter dancing. Three of them wear normal street clothes and one of them wears the costume of a classical ballerina. Of the three who wear normal street clothes, the woman has one of the men on a dog leash, and the other man is wearing a crimson prom dress. They dance and dance, and then, finally, they sit, the couple together, in the chair, and the solo man lies down (exhausted) on the divan. The ballerina stands uncertainly to one side. The therapist enters. THE THERAPIST Hello. Can I help you? THE WOMAN HOLDING THE LEASH 1 My husband has a pony tail Kind of ragged and messy And I don’t know if he thinks He is a hippie Or a beatnik...... And my friends wonder Why I married him And I don’t know why I wish I had a brownstone in the West Village And I think I need some help with that. THE MAN ON THE LEASH I worry about the stock market ....global warming The war What war What war is going on now? That’s the one I worry about Plus my own impulses for greed and dishonesty THE MAN IN THE CRIMSON DRESS I have a book store Used books And antiques And used dolls And used necklaces Paper flowers A high chair All for sale And I have a fear of the economy THE BALLERINA I like to dance. -

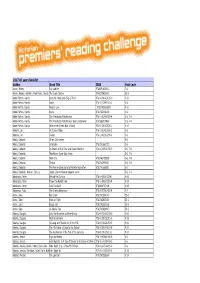

FINAL 2017 All Years Booklist.Xlsx

2017 All years Booklist Author Book Title ISBN Year Level Aaron, Moses Lily and Me 9780091830311 7-8 Aaron, Moses (reteller); Mackintosh, David (ill.)The Duck Catcher 9780733412882 EC-2 Abdel-Fattah, Randa Does My Head Look Big in This? 978-0-330-42185-0 9-10 Abdel-Fattah, Randa Jodie 978-1-74299-010-1 5-6 Abdel-Fattah, Randa Noah's Law : 9781742624280 9-10 Abdel-Fattah, Randa Rania 9781742990188 5-6 Abdel-Fattah, Randa The Friendship Matchmaker 978-1-86291-920-4 5-6, 7-8 Abdel-Fattah, Randa The Friendship Matchmaker Goes Undercover 9781862919488 5-6, 7-8 Abdel-Fattah, Randa Where the Streets Had a Name 978-0-330-42526-1 9-10 Abdulla, Ian As I Grew Older 978-1-86291-183-3 5-6 Abdulla, Ian Tucker 978-1-86291-206-9 5-6 Abela, Deborah Ghost Club series 5-6 Abela, Deborah Grimsdon 9781741663723 5-6 Abela, Deborah In Search of the Time and Space Machine 978-1-74051-765-2 5-6, 7-8 Abela, Deborah Max Remy Super Spy series 5-6, 7-8 Abela, Deborah New City 9781742758558 5-6, 7-8 Abela, Deborah Teresa 9781742990941 5-6, 7-8 Abela, Deborah The Remarkable Secret of Aurelie Bonhoffen 9781741660951 5-6 Abela, Deborah; Warren, Johnny Jasper Zammit Soccer Legend series 5-6, 7-8 Abrahams, Peter Behind the Curtain 978-1-4063-0029-1 9-10 Abrahams, Peter Down the Rabbit Hole 978-1-4063-0028-4 9-10 Abrahams, Peter Into The Dark 9780060737108 9-10 Abramson, Ruth The Cresta Adventure 978-0-87306-493-4 3-4 Acton, Sara Ben Duck 9781741699142 EC-2 Acton, Sara Hold on Tight 9781742833491 EC-2 Acton, Sara Poppy Cat 9781743620168 EC-2 Acton, Sara As Big As You 9781743629697 -

Practical Implications of Current Intimate Partner Violence Research for Victim Advocates and Service Providers

The author(s) shown below used Federal funds provided by the U.S. Department of Justice and prepared the following final report: Document Title: Practical Implications of Current Intimate Partner Violence Research for Victim Advocates and Service Providers Author(s): Barbara J. Hart, J.D., Andrew R. Klein, Ph.D. Document No.: 244348 Date Received: December 2013 Award Number: 2010M_10065 This report has not been published by the U.S. Department of Justice. To provide better customer service, NCJRS has made this Federally- funded grant report available electronically. Opinions or points of view expressed are those of the author(s) and do not necessarily reflect the official position or policies of the U.S. Department of Justice. Practical Implications of Current Intimate Partner Violence Research for Victim Advocates and Service Providers Barbara J. Hart, J.D. Andrew R. Klein, Ph.D. January 9, 2013 Findings and conclusions of the research reported here are those of the authors and do not necessarily reflect the official position of policies of the U.S. Department of Justice or Health and Human Services. This document is a research report submitted to the U.S. Department of Justice. This report has not been published by the Department. Opinions or points of view expressed are those of the author(s) and do not necessarily reflect the official position or policies of the U.S. Department of Justice. Practical Implications of Current Intimate Partner Violence Research for Victim Advocates and Service Providers Table of Contents Introduction: How to Use this Guide ..................................................... 8 I. What is Intimate Partner Violence? ................................................ -

NMI-Core-2020-11-Why

Why We Can't Have Nice Things Team 3 Music by Anton Chesnokov Book & Lyrics by Chie-Hoon Lee Based on the play by Lloyd Suh Anton Chesnokov e [email protected] Chie-Hoon Lee e [email protected] 12 December 2020 (12/12/2020) Characters / cast Andie - 20s-30s, female, any ethnicity Christine Wade Bobby - 20s-30s, male, any ethnicity Benjamin Larson Place A seaside place you'd honeymoon in Time The day after their wedding Today-ish Musical numbers Title Characters script integrated score 1. All of the Things...............Andie & Bobby 2 7 [INSERT VOCAL RANGES] 1 WHY WE CAN'T HAVE NICE THINGS Bobby and Andie on their honeymoon. Bobby on his tablet, Andie relaxing. ANDIE We should get ready. The reef awaits us. BOBBY I've found a Thing! ANDIE Not another one. BOBBY You have to see it. ANDIE We're spending til-death-do-us-part together. You sure you want to have the first fight of our marriage on Day 2? (beat) It really can't wait? BOBBY Not this Thing. (1. All of the Things) WWCHNT (Team 3) 12/12/2020 2 BOBBY HERE IS THE THING OF ALL OF THE THINGS I’VE EVER POSSESSED OR DESIRED ANDIE Uh oh, here we go. BOBBY THIS IS THE THING THAT’S BEGGING THE MOST TO BE IT SIMPLY MUST BE ACQUIRED ANDIE So what is it this time? BOBBY THE RAREST OF THINGS THE SOVIET THING A KGB LISTENING DEVICE A GENUINE COPY PLEASE DON’T BECOME STROPPY IT’S TEN PERCENT OFF THE LIST PRICE BEFORE WE GO SNORKELING PLEASE LET ME BUY THE THING ANDIE I DON’T THINK SO YOU KNOW I KNOW THAT EVERYTHING YOU’VE EVER HAD YOU’VE LOST OR SMASHED TO BITS IF YOU BREAK ANOTHER ONE YOU KNOW I‘LL LOSE MY WITS The answer is “No”. -

Title Author 'Til Death Do Us Part Quick, Amanda, Author. 'Tis Mccourt, Frank. 'Tis Mccourt, Frank. 'Tis Herself O'hara, Maureen

Title Author 'Til death do us part Quick, Amanda, author. 'Tis McCourt, Frank. 'Tis McCourt, Frank. 'Tis herself O'Hara, Maureen, 1920- --and never let her go Rule, Ann. "A" is for alibi Grafton, Sue "B" is for burglar Grafton, Sue "C" is for corpse Grafton, Sue "D" is for deadbeat Grafton, Sue "E" is for evidence Grafton, Sue "F" is for fugitive Grafton, Sue "H" is for homicide Grafton, Sue "I" is for innocent Grafton, Sue. "J" is for judgment Grafton, Sue. "K" is for killer Grafton, Sue. "L" is for lawless Grafton, Sue. "M" is for malice Grafton, Sue. "N" is for noose Grafton, Sue. "O" is for outlaw Grafton, Sue. "O" is for outlaw Grafton, Sue. "P" is for peril Grafton, Sue. "P" is for peril Grafton, Sue. "V" is for vengeance Grafton, Sue. 100-year-old man who climbed out the window and disappeared, The Jonasson, Jonas, 1961- 100 people who are screwing up America--and Al Franken is #3 Goldberg, Bernard, 1945- 100 years, 100 stories Burns, George, 1896- 10th anniversary Patterson, James, 1947- 11/22/63 King, Stephen, 1947- 11th hour Patterson, James, 1947- 1225 Christmas Tree Lane Macomber, Debbie 12th of never Patterson, James, 1947- 13 1/2 Barr, Nevada. 1356 Cornwell, Bernard. 1491 Mann, Charles C. 1493 Mann, Charles C. 14th colony, The Berry, Steve, 1955- author. 14th deadly sin Patterson, James. 15th affair Patterson, James, 1947- 16th Seduction Patterson, James 1776 McCullough, David G. 17th Suspect, The Patterson, James , 1947- , author. 19th Christmas, The Patterson, James , 1947- , author. 1st case Patterson, James , 1947- , author. -

Living Arcanis

Living Arcanis Module Name Rounds Location Levels File File Notes Notes LA-AP3-01 Sibling Rivalry 2 1-11 LA-AP3-02 A House Divided 1-13 LA-AP3-02 A House Divided_v12.pdf LA-AP3-02 A House Divided_v12.doc LA-AP3-03 A Pebble Upon Still Water LA-AP3-03 A Pebble upon still water.pdf LA-AP3-03 A Pebble upon still water.doc LA-AP3-03 A Pebble upon still water.zip LA-AP3-04 Convocation of the Divine 1-14 LA-AP3-05 How the Mighty Have Fallen 2 LA-AP4-01 Queen’s Castle QENCS1LA.zip LA-AP4-02 Shadows of a Forsaken Past LA-AP4-03 To Unmake the Noon Day Sun LA-HP1-01 So Shall Ye Reap SoShallYeReap.rtf SoShallYeReap_newer.rtf LA-HP1-02 Temptations of the Flesh 2 LA-HP-2_01 Temptations of the Flesh.pdf LA-HP-2_01 Temptations of the Flesh_2003-03-14.pdf LA-HP-2_01 Temptations of the Flesh_2002-05-26.pdf LA-HP-2_01 Temptations of the Flesh_rd1_2005-05-26.rtf LA-HP-2_01 Temptations of the Flesh_rd2_2005-05-26.rtf LA-HP-2_01 Temptations of the Flesh-pg41_2005-05-26.jpg LA-HP1-03 The Seeds of Our Destruction LA-HP1-04 Drinking Deeply Chalice of Midnight LA-HP1-05 To Reap The Whirlwind LA-HP1-05 To Reap the Whirlwind-RIP.pdf LA-HP1-05 To Reap the Whirlwind-RIP.rtf LA-HP1-06 Assault Upon the Gate of Tears 2 LA-HP-6_01 Assault Upon the Gates of Tears Part 1.pdf LA-HP2-01 As Gray and Cold as Stone LA-HP2-02 Grains of Sand 1-11 LA-HP2-03 Where Illiir's Light Has Never Shone 1-10 LA-HP2-04 Wake LA-HP2-05 To Shake the Pillars of Heaven 2 4+ LA-HP2-05-To_Shake_the_Pillars_of_Heaven.zip LA-HP4-03 Bane of Light LA-Intro Taboo 1-2 TABOO1LA.zip TABOO1LA_2005-07-13.zip -

Wicked, Selfish, and Cruel: an Inquiry Into the Stepmother Narrative

Wicked, Selfish, and Cruel: An Inquiry into the Stepmother Narrative By Arielle A. Silver Submitted in partial fulfillment of the requirements for the degree of Master of Fine Arts in Creative Writing Antioch University Los Angeles Winter/Spring 2015 I have always been fascinated by difficult loves, and stepmothers, as the fairy tales all tell, are inherently a challenge… Andrew Solomon (60) On an early spring morning in 1930, a tiny second-floor apartment in Erie, Pennsylvania erupted in flames. The Mumbulo family—Ralph, Edna, and eleven-year-old Hilda—lived in the one-bedroom space. Ralph was a welder and had already left for work, so when the fire broke out, Edna, whose dressmaking business was based out of the apartment, was at home alone with Hilda. Flimsy composition walls separated them from their neighbors. By the time the fire department arrived, the building was already engulfed in smoke, and most of the tenants were out on the street. Emergency medics found Hilda collapsed on a neighbor’s cot, unconscious from smoke inhalation, with critical burns on her face and body. She was rushed to the local medical center, but four hours later, Hilda died of burn trauma. In the police investigation, traces of gasoline corroborated Edna’s story that the pan of gasoline she had been using to clean a dress had ignited. The exact cause of the fire was not determined, criminal charges were not pressed, and soon thereafter, the investigation officially closed (Laythe 4-6). Later that spring, however, the investigation reopened after a neighbor confided suspicions to the coroner that the fire had been deliberately set. -

NEGLECT! 25 Plot! 9 770966 849166

WITH KILLER 7-DAY AT TACK LACHLAN ON CAIN! CORNERED! TVGUIDE! 2 Toyah Johnny TRAPS Carla’s Peter! WICKED NEGLECT! 25 plot! 9 770966 849166 Claudia STEALS s!JEAN’S IS MICK Maria from ABUSE SECRET! IN TOO DEEP? Audrey! Issue 25 • 23 - 29 June 2018 Battersby! Really, what was she thinking?! This baby Yo u r s t a r s situation was a tram crash sually in soap, you just want to grab them waiting to happen. But this week! you feel sorry by the shoulders, look sometimes the fun comes for characters them straight in the eye from waiting for that tram to 38 wheen they make and scream: “Did you really crash, and enjoying all the some huge, fallout that comes with it! hoorrible mistake. The episodes where Peter Yoou understand “Really, what was found out what Toyah had their motivation, Toyah thinking?!” done were classic Corrie, annd you can and worth all the energy sympathise with think that this wasn’t how we’d exuded shouting at thhem as they this was going to end, you our tellies over the course faace the terrible total imbecile! Have you of this year. (Toyah’s consqeunces never even seen a soap?!” still a right idiot, though! Tony Clay off their actions. Well, today we’d like Steven Murphy, Editor “We’ll see Halfway But at other times, to say hello to Toyah [email protected] being manipulated by his brother!” The BIG 20 42 stories... Coronation Street 4 Simon robs and attacks Flora! My father is Steve accidentally proposes! 7 called ‘Toadie’? The other 18 Beth spies on Alya for Carla kids at the creche will 24 Johnny reports Eva to social -

Contemporary Realistic Fiction

Abela, Deborah 1. Mission: in Search of the Time and Space Machine 2. Mission: Spy Force Revealed 3. Mission: The Nightmare Vortex 4. Mission: Hollywood Alender, Katie 1. Bad Girls Don’t Die 2. From Bad to Cursed 3. As Dead As It Gets Angleberger, Tom Origami Yoda Book 1. The Strange Case of Origami Yoda 2. Darth Paper Strikes Back 3. The Secret of Fortune Wookie 4. The Surprise Attack of Jabba the Puppet Ardagh, Philip The Eddie Dickens Trilogy 1. A House Called Awful End 2. Dreadful Acts 3. Terrible Times Avi 1. S.O.R. Losers 2. Romeo and Juliet, Together (and Alive) at Last JAE Rev. 69 2/24/15 Bacon, Lee Joshua Dread series 1. Joshua Dread (ordered) 2. The Nameless Hero (ordered) Banks, Piper 1. Geek High 2. Geek Abroad Bauer, Joan 1. Rules of the Road 2. Best Foot Forward Bateman, Colin Eddie and the Gang with No Name series 1. Running with the Reservoir Pups 2. Bring Me the Head of Oliver Plunkett Bennett, Olivia 1. The Allegra B. Biscotti Collection 2. The Allegra B. Biscotti Collection: Who, What, Wear (ordered) (paperback only) 3. The Allegra Biscotti Collection: Bedazzled (ordered) (paperback only) Bennett, Sophia 1. Sequins, Secrets, & Silver Linings Bingham, Kelly 1. Shark Girl 2. Formerly Shark Girl Birdsall, Jeanne 1. The Penderwicks 2. The Penderwicks on Gardam Street 3. The Penderwicks at Point Mouette Blake, Emily 1. Little Secrets: Playing with Fire 2. Little Secrets: No Accidents Blume, Judy 1. Tales of a Fourth Grade Nothing 2. Superfudge 3. Fudge-a-mania 4. -

9780838997239 Excerpt.Pdf

Pam Spencer Holley is a former school librarian and retired coordinator of school libraries for Fairfax County (Virginia) Public Schools. She is the author of What Do Children and Young Adults Read Next? volumes 1–6, and now contributes to the online version called Books and Authors. Holley originated and wrote the “Audiobooks It Is!” column for Voice of Youth Advocates, 2003–2007, and is a former chair of Best Books for Young Adults and the 2004 Printz Award and a past president of the Young Adult Library Ser vices Association. While extensive effort has gone into ensuring the reliability of information appearing in this book, the publisher makes no warranty, express or implied, on the accuracy or reliability of the information, and does not assume and hereby disclaims any liability to any person for any loss or damage caused by errors or omissions in this publication. The paper used in this publication meets the minimum requirements of American National Standard for Information Sciences—Permanence of Paper for Printed Library Materials, ANSI Z39.48-1992. Library of Congress Cataloging-in-Publication Data Quick and popular reads for teens / edited by Pam Spencer Holley for the Young Adult Library Ser vices Association. p. cm. Includes bibliographical references and index. ISBN 978-0-8389-3577-4 (alk. paper) 1. Teenagers—Books and reading—United States. 2. Reading promotion—United States. 3. Young Adult Library Ser vices Association. 4. Young adults’ libraries— United States—Book lists. 5. Young adult literature—Bibliography. I. Holley, Pam Spencer, 1944– Z1037.A1Q53 2009 028.5'5—dc22 2008049691 Copyright © 2009 by the American Library Association.