Outline of Company Service Offer PKP Regional Is Responsible

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Another HB Reavis Warsaw Asset Awarded the BREEAM Excellent Certificate

19 October 2015 Press Release Another HB Reavis Warsaw asset awarded the BREEAM Excellent certificate The Warsaw office complex West Station, currently under construction in the direct vicinity of Warszawa Zachodnia railway station, has been awarded the BREEAM Interim certificate at the Excellent level. The project's developer and owner is HB Reavis. The audit was carried out by Go4Energy. This is the third BREEAM certificate granted to a HB Reavis investment in Warsaw, following Gdański Business Center and Postępu 14 which also received the same honour for their sustainable designs. 'West Station’s recent receipt of the BREEAM Interim certificate at the Excellent level is testament that all of HB Reavis’ projects are developed to the highest standard, using top- quality materials, and modern ecological and technological solutions,' said Stanislav Frnka, President of the Management Board at HB Reavis Poland. He added: 'These credentials are particularly satisfactory given the audit resulted in very high grades in two areas of particular importance to our future tenants - the categories pertaining to the development’s accessibility and to the health and well-being of future tenants'. 'BREEAM is the most highly recognised method for assessing the quality of buildings in Europe. The certification process entails the analysis of ten areas including, among others, energy efficiency, location and access to public transportation and all kinds of services, as well as the quality of construction materials employed. The West Station complex received 73.2% of the maximum number of points under BREEAM Interim. This is an impressive result, which is best evidenced by the fact that only a dozen or so office buildings in the city can to date boast a similar grade,' said Tomasz Augustyniak, a licensed BREEAM Accredited Professional. -

„BILET PRZEZ APLIKACJĘ MOBILNĄ” W „PKP INTERCITY” SPÓŁKA AKCYJNA Zwany Dalej Regulaminem Skycash-IC

Tekst ujednolicony obowiązujący od 26 stycznia 2021 r. REGULAMIN USŁUGI „BILET PRZEZ APLIKACJĘ MOBILNĄ” W „PKP INTERCITY” SPÓŁKA AKCYJNA zwany dalej Regulaminem SkyCash-IC § 1. Postanowienia ogólne 1. Na podstawie art. 4 Ustawy z dnia 15 listopada 1984 r. Prawo przewozowe (tekst 17 jednolity Dz. U. z 2020 r. poz. 8.) „PKP Intercity” Spółka Akcyjna ustala Regulamin usługi „Bilet przez aplikację mobilną” w „PKP Intercity” Spółka Akcyjna, zwany dalej Regulaminem SkyCash-IC. 2. Regulamin SkyCash-IC obowiązuje od dnia 7 listopada 2014 r. 3. Akceptując niniejszy Regulamin SkyCash-IC Użytkownik potwierdza jednocześnie 3 akceptację Regulaminu Użytkownika Systemu SkyCash. Jeżeli Użytkownik nie akceptuje przedstawionych warunków lub nie spełnia wymagań technicznych, 18 opisanych w Regulaminie Użytkownika Systemu SkyCash zakup dokumentu przewozu jest niemożliwy. 3a. Dokument przewozu można zakupić z wykorzystaniem urządzeń mobilnych 3 z systemem operacyjnym Android, iOS, po zainstalowaniu aplikacji: a) SkyCash, 18 b) IC Navigator, udostępnionej w sklepie danego systemu. 4. Aby zakupić dokument przewozu, Użytkownik musi dokonać Rejestracji na zasadach 3 określonych w Regulaminie Użytkownika Systemu SkyCash. 18 5. Regulamin SkyCash-IC określa warunki i zasady zakupu dokumentów przewozu 18 w komunikacji krajowej. 6. Postanowienia Regulaminu SkyCash-IC oraz każdą jego zmianę zamieszcza się na stronie internetowej www.intercity.pl 3 7. Skreślony. 8. Użytkownik akceptując Regulamin SkyCash-IC wyraża zgodę na warunki w nim zawarte, która jednocześnie stanowi oświadczenie woli i stwarza prawne zobowiązania między Użytkownikiem a PKP Intercity. 9. Użytkownik może nabywać bilety elektroniczne dla siebie oraz dla innych osób. Za 3 zobowiązania finansowe odpowiada Użytkownik. 10. Dopuszczalne formy płatności wskazane są w Regulaminie Użytkownika Systemu SkyCash. -

World Bank Document

Document of The World Bank Public Disclosure Authorized Report No: 34596 IMPLEMENTATION COMPLETION REPORT (TF-29121 FSLT-70540) ON A LOAN Public Disclosure Authorized IN THE AMOUNT OF EUR 110.0 MILLION (US$ 101.0 MILLION EQUIVALENT TO POLSKIE KOLEJE PANSTWOWE S.A. (POLISH STATE RAILWAYS S.A.) WITH THE GUARANTEE OF THE REPUBLIC OF POLAND FOR A RAILWAY RESTRUCTURING PROJECT Public Disclosure Authorized June 13, 2006 Infrastructure Department Poland and Baltic States Country Unit Europe and Central Asia Region Public Disclosure Authorized CURRENCY EQUIVALENTS (Exchange Rate Effective At Completion, December 30, 2005) Currency Unit = Polish Zloty PLN 1 = US$ 0.3099 US$ 1 = PLN 3.2265 US$ 1 = Euro 0.8391 (Exchange Rates Effective at Appraisal, January 31, 2001) PLN 1 = US$ 0.2418 US$ 1 = PLN 4.1350 US$ 1 = Euro 1.0887 FISCAL YEAR January 1 - December 31 ABBREVIATIONS AND ACRONYMS EBRD European Bank for Reconstruction and Development EIB European Investment Bank EIRR Economic Internal Rate of Return FIRR Financial Internal Rate of Return FMS Financial Management System GoP Government of Poland IAS International Accounting Standards IFAC International Federation of Accountants ISPA Instrument for Structural Policies for Pre-accession KBI Capital Investment and Privatization Office KM Warsaw Regional Railways ('Koleje Mazowiekie') KAAZ Agency for Retraining and Reemployment ('Kolejowa Agencja Aktywizacji Zawodowej') LHS Linia Hutniczo-Siarkowa (Broad-gauge Railway between Ukraine and Silesia) LRS Labor Redeployment Services MoI Ministry of Infrastructure MLSP Ministry of Labor and Social Policy MTME Ministry of Transport and Maritime Economy NLO National Labor Office PAD Project Appraisal Document PLK S.A. Polish Railway Infrastructure Joint Stock Company ('Polskie Linie Kolejowe Spolka Akcyjna') PKP Polish State Railways ('Polskie Koleje Panstwowe') PKP S.A. -

Information Systems in Management of Polish Railway Companies of Pkp Group in Aspects of Technology and Economy

INFORMATION SYSTEMS IN MANAGEMENT Information Systems in Management (2015) Vol. 4 (3) 193 −204 INFORMATION SYSTEMS IN MANAGEMENT OF POLISH RAILWAY COMPANIES OF PKP GROUP IN ASPECTS OF TECHNOLOGY AND ECONOMY MICHAŁ HENRYK RUDOWSKI Institute of Computer Science, Warsaw University of Technology Paper presents selected management information systems in the railway industry companies arising from the transformation of the Polish State Rail- ways into PKP Group. Hardware and software solutions used by this systems and benefits of implement them are also pointed out. Takes into account the areas of financial management as well as the areas of operational manage- ment, specific for their activities. These issues are presented in the context of technology and economy. It has been proved that the organizational solu- tions imply the impossibility of efficient use of resources allocated to infor- mation systems due to consummate the benefits of consolidation, virtualiza- tion and cloud computing is impossible. Keywords: managing systems, railway industry, consolidation, virtualization, cloud computing. 1. Introduction IT is a very important part of modern enterprise and its quality and Total Cost of Ownership (TCO) may determine a competitive advantage in the market. IT solutions are particularly significant in companies on the railway market like PKP Group companies. Modern IT has a number of solutions that increase productivity and significantly lowering TCO, which is the sum of capital and operating costs. Currently the leading role is played by systems operating in the cloud environment with the ability to provide both highest availability and highest performance for the various applications while reducing costs thanks to consolidation, virtualization, automation of service delivery and management. -

Construction of a New Rail Link from Warsaw Służewiec to Chopin Airport and Modernisation of the Railway Line No

Ex post evaluation of major projects supported by the European Regional Development Fund (ERDF) and Cohesion Fund between 2000 and 2013 Construction of a new rail link from Warsaw Służewiec to Chopin Airport and modernisation of the railway line no. 8 between Warsaw Zachodnia (West) and Warsaw Okęcie station Poland EUROPEAN COMMISSION Directorate-General for Regional and Urban Policy Directorate Directorate-General for Regional and Urban Policy Unit Evaluation and European Semester Contact: Jan Marek Ziółkowski E-mail: [email protected] European Commission B-1049 Brussels EUROPEAN COMMISSION Ex post evaluation of major projects supported by the European Regional Development Fund (ERDF) and Cohesion Fund between 2000 and 2013 Construction of a new rail link from Warsaw Służewiec to Chopin Airport and modernisation of the railway line no. 8 between Warsaw Zachodnia (West) and Warsaw Okęcie station Poland Directorate-General for Regional and Urban Policy 2020 EN Europe Direct is a service to help you find answers to your questions about the European Union. Freephone number (*): 00 800 6 7 8 9 10 11 (*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you). Manuscript completed in 2018 The European Commission is not liable for any consequence stemming from the reuse of this publication. Luxembourg: Publications Office of the European Union, 2020 ISBN 978-92-76-17419-6 doi: 10.2776/631494 © European Union, 2020 Reuse is authorised provided the source is acknowledged. The reuse policy of European Commission documents is regulated by Decision 2011/833/EU (OJ L 330, 14.12.2011, p. -

Regulamin Przewozu Osób, Rzeczy I Zwierząt Przez Spółkę „PKP Intercity” (RPO-IC)

Tekst ujednolicony obowiązuje od dnia 4 czerwca 2020 r. „PKP Intercity” Spółka Akcyjna R E G U L A M I N PRZEWOZU OSÓB, RZECZY I ZWIERZĄT przez Spółkę „PKP Intercity” (RPO-IC) Obowiązuje od dnia 16 listopada 2014 r. Regulamin przewozu osób, rzeczy i zwierząt przez Spółkę „PKP Intercity” (RPO-IC) Z chwilą wejścia w życie niniejszych przepisów tracą moc przepisy Regulaminu przewozu osób, rzeczy i zwierząt przez Spółkę „PKP Intercity” (RPO-IC) obowiązującego od dnia 19 marca 2013 r. ZMIANY Podpis osoby Podstawa wprowadzenia zmiany Numer Zmiana wnoszącej zmianę zmiany Uchwała Zarządu PKP Intercity S.A. obowiązuje od dnia Nr Data 1 932/2014 01.12.2014 r. 03.12.2014 r. 2 987/2014 11.12.2014 r. 14.12.2014 r. 3 227/2015 24.03.2015 r. 27.03.2015 r. 4 293/2015 02.04.2015 r. 09.04.2015 r. 5 387/2015 28.04.2015 r. 05.05.2015 r. 6 528/2015 17.06.2015 r. 21.06.2015 r. 7 572/2015 30.06.2015 r. 07.07.2015 r. 8 639/2015 28.07.2015 r. 30.07.2015 r. 9 718/2015 03.09.2015 r. 09.09.2015 r. 10 769/2015 18.09.2015 r. 22.09.2015 r. 11 869/2015 28.10.2015 r. 14.12.2015 r. 12 1011/2015 08.12.2015 r. 13.12.2015 r. 13 1069/2015 22.12.2015 r. 28.12.2015 r. 14 59/2016 04.02.2016 r. 04.02.2016 r. 15 161/2016 15.03.2016 r. -

The New Warszawa Zachodnia Station Opens Tomorrow

8 December 2015 Press Release The new Warszawa Zachodnia station opens tomorrow The new Warszawa Zachodnia (Warsaw West) railway station is ready for passengers' use just one year after its construction process begun. The building, which has an area of approx. 1,300 sq m, is located in the immediate vicinity of Aleje Jerozolimskie street in Warsaw, enabling residents from Ochota, Włochy and Mokotów districts to quickly and easily reach the station. The landmark new station’s striking design including a distinctive glass dome is the result of an efficient collaboration partnership between PKP S.A., Xcity Investment, and HB Reavis, an international developer group. As of tomorrow, people travelling from the Warszawa Zachodnia railway station will be able to access this brand new building, situated at Aleje Jerozolimskie street, closer to the tracks where local connections are available. The scheme will expand on the previous facility at Tunelowa street, which will continue to serve passengers. Due to its location, the new railway station will be more easily accessible by public means of transportation. 'This is our first investment undertaken in collaboration with PKP S.A. and we hope that it is not the last as the Warszawa Zachodnia station is great success. Within less than 12 months since construction works began, the building is now ready for use. Without a doubt, passengers will appreciate its striking design, impressive glass dome and surroundings, which already look attractive but will make even more of an impact once the adjacent office buildings are completed,' said Stanislav Frnka, CEO of HB Reavis Poland. -

List of Numeric Codes for Railway Companies (RICS Code) Contact : [email protected] Reference : Code Short

List of numeric codes for railway companies (RICS Code) contact : [email protected] reference : http://www.uic.org/rics code short name full name country request date allocation date modified date of begin validity of end validity recent Freight Passenger Infra- structure Holding Integrated Other url 0006 StL Holland Stena Line Holland BV NL 01/07/2004 01/07/2004 x http://www.stenaline.nl/ferry/ 0010 VR VR-Yhtymä Oy FI 30/06/1999 30/06/1999 x http://www.vr.fi/ 0012 TRFSA Transfesa ES 30/06/1999 30/06/1999 04/10/2016 x http://www.transfesa.com/ 0013 OSJD OSJD PL 12/07/2000 12/07/2000 x http://osjd.org/ 0014 CWL Compagnie des Wagons-Lits FR 30/06/1999 30/06/1999 x http://www.cwl-services.com/ 0015 RMF Rail Manche Finance GB 30/06/1999 30/06/1999 x http://www.rmf.co.uk/ 0016 RD RAILDATA CH 30/06/1999 30/06/1999 x http://www.raildata.coop/ 0017 ENS European Night Services Ltd GB 30/06/1999 30/06/1999 x 0018 THI Factory THI Factory SA BE 06/05/2005 06/05/2005 01/12/2014 x http://www.thalys.com/ 0019 Eurostar I Eurostar International Limited GB 30/06/1999 30/06/1999 x http://www.eurostar.com/ 0020 OAO RZD Joint Stock Company 'Russian Railways' RU 30/06/1999 30/06/1999 x http://rzd.ru/ 0021 BC Belarusian Railways BY 11/09/2003 24/11/2004 x http://www.rw.by/ 0022 UZ Ukrainski Zaliznytsi UA 15/01/2004 15/01/2004 x http://uz.gov.ua/ 0023 CFM Calea Ferată din Moldova MD 30/06/1999 30/06/1999 x http://railway.md/ 0024 LG AB 'Lietuvos geležinkeliai' LT 28/09/2004 24/11/2004 x http://www.litrail.lt/ 0025 LDZ Latvijas dzelzceļš LV 19/10/2004 24/11/2004 x http://www.ldz.lv/ 0026 EVR Aktsiaselts Eesti Raudtee EE 30/06/1999 30/06/1999 x http://www.evr.ee/ 0027 KTZ Kazakhstan Temir Zholy KZ 17/05/2004 17/05/2004 x http://www.railway.ge/ 0028 GR Sakartvelos Rkinigza GE 30/06/1999 30/06/1999 x http://railway.ge/ 0029 UTI Uzbekistan Temir Yullari UZ 17/05/2004 17/05/2004 x http://www.uzrailway.uz/ 0030 ZC Railways of D.P.R.K. -

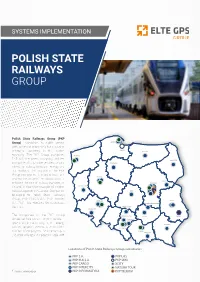

Implementation for Polish State Railways Group

SYSTEMS IMPLEMENTATION POLISH STATE RAILWAYS GROUP Polish State Railways Group (PKP Group) combines its public service GDYNIA with activity characteristic for a modern GDAŃSK enterprise operating in the market OLSZTYN economy. The PKP Group comprises SZCZECIN PKP S.A., the parent company, and ten BIAŁYSTOK companies that provide services, among BYDGOSZCZ others, on railway transport, energy and ICT markets. The mission of the PKP Group companies is to build trust and POZNAŃ improve the image of the railway, so as to SIEDLCE enhance the role of railway transport in WARSZAWA Poland, following the example of modern ZIELONA GÓRA railways operating in Europe. Companies ŁÓDŹ belonging to Polish State Railways Group: PKP CARGO S.A., PKP Intercity WROCŁAW LUBLIN S.A., PKP Linia Hutnicza Szerokotorowa SKARŻYSKO-KAMIENNA Sp. z o.o.. CZĘSTOCHOWA WAŁBRZYCH The companies of the PKP Group TARNOWSKIE GÓRY KIELCE ZAMOŚĆ altogether hire almost 70,000 people – SOSNOWIEC specialists in the railway, IT, ICT, energy RZESZÓW and real property sectors. In terms of the KATOWICE KRAKÓW number of employees, the PKP Group is NOWY SĄCZ the second largest employer in Poland.[1] Locations of Polish State Railways Group subsidiaries. PKP S.A. PKP LHS PKP PLK S.A. PKP SKM PKP CARGO XCITY PKP INTERCITY NATURA TOUR [1] Source: www.pkp.pl PKP INFORMATYKA PKP TELKOM ET GPS Positioning system The ET GPS system is designed to monitor the position of locomotives and wagons. GPS tracker saves the object location, speed, direction of movement and information from sensors and interfaces. The data saved in the internal memory of the GPS tracker are transferred to the monitoring system. -

Special Offer Weekend Ticketmania 1. Entitled Persons

Special Offer Weekend Ticketmania 1. Entitled persons Any person. 2. Scope of validity Tickets according to the special offer Weekend Ticketmania can be purchased for over 50 km class 2 through train journey by national means of communication. a) TLK in accordance with fast train tariffs for trains with carriages with seats, or b) Express InterCity (EIC) in accordance with express tariff and between stations where these trains stop, with the exception of international trains returning from abroad. 3. Terms and Conditions 1) Special offer tickets can be purchased only on Saturday and Sunday for travel on any day – not earlier than 30 days prior to departure and not later than 7 days prior to departure (e.g. on 6 April 2014 one can purchase a ticket for travel on 15 April 2014) - only through a system of online ticket sales (the e-IC system) – under the principles laid down in the Terms and Conditions of online ticket sales in domestic and international communications by PKP Intercity SA (e-IC Terms and Conditions), subject to paragraph 2; 2) Offer cannot be combined with other offers; 3) online ticket in accordance with special offer Weekend Ticketmania is valid only on the day of travel and only to the place therein specified; 4) the number of seats covered by the offer is limited; 5) in matters not covered by these terms and conditions of tariff appropriate provisions of the Terms and Conditions of e-IC shall apply mutatis mutandis; 6) offer is available for sale from 29 March 2014. 4. Fees Tickets issued under special offer Weekend Ticketmania are at a flat rate independent of the tariff distance and the rates are as follows: Type of train Gross Price VAT Net Price class 2 In PLN TLK 29.00 2.15 26.85 EIC 49.00 3.63 45.37 The above prices are not subject to any rebates (legal and commercial) or discounts. -

The PKP Group 2016 About the PKP Group 3

2016 Contents 2 1. About the PKP Group 2. Scheme of the PKP Group 3. The Main Companies of the PKP Group: • PKP S.A. • PKP PLK • PKP Cargo • PKP Intercity • PKP LHS • PKP SKM • PKP Informatyka • Xcity Investment The PKP Group 2016 About the PKP Group 3 The PKP Group was established in 2001 as a result of the restructuring process of the Polskie Koleje Państwowe (Polish State Railways) the State Owned Enterprise. Polskie Koleje Państwowe Spółka Akcyjna was established on 1 January 2001 as a result of the commercialization of the Polskie Koleje Państwowe SOE and entered into the rights and obligations of its predecessor. On the basis of the Polskie Koleje Państwowe SOE a number of companies were established in 2001 in the areas of: railway passenger transport; freight transport; railway infrastructure management; in addition, the following entities were established: • nine companies providing services for infrastructure renovations and repairs; • two companies dealing with rolling stock repairs; • three companies operating in secondary areas, such as training, pharmacy and supplies; • five companies operating in other areas related to railway services. The PKP Group 2016 About the PKP Group 4 As the result of the ownership changes, including privatization and restructuring in 2016 the PKP Group consisted of: Polskie Koleje Państwowe Spółka Akcyjna – the Parent Company in the PKP Group; PKP Intercity S.A. and PKP Szybka Kolej Miejska w Trójmieście Sp. z o.o. (also being the infrastructure manager of No. 250 Urban Line) – the passenger transport operator; PKP CARGO S.A. and PKP Linia Hutnicza Szerokotorowa Sp. z o.o. -

ELECTRIC MULTIPLE UNIT FLIRT PKP Intercity, Poland

ELECTRIC MULTIPLE UNIT FLIRT PKP Intercity, Poland In November 2013, PKP Intercity ordered 20 electric multiple unit FLIRTs from the delivery consortium of Stadler Polska Sp. z.o.o. and Newag SA. Stadler will also be responsible for technical maintenance of the vehicles for 15 years. The trains are for the main Warsaw, Szczecin, Gdynia, Olsztyn, Katowice and Kraków lines. They are designed for a speed of 160 km/h and fitted with ETCS Level 2 automatic train control. The trains, which are totally barrier-free, feature first- and second-class compartments and a bistro. The generous, air-conditioned interior allows the passengers to travel in comfort. A visual and acoustic passenger information system provides travellers with relevant information. www.stadlerrail.com Stadler Rail Group Stadler Polska Sp. z o.o. Ernst-Stadler-Strasse 1 ul. Targowa 50 CH-9565 Bussnang PL-08-110 Siedlce Phone +41 71 626 21 20 Phone +48 25 746 50 00 [email protected] [email protected] Technical features Vehicle data Technology – Lightweight car bodies in integral aluminium design in line with Customer PKP Intercity S.A. the latest standards for crashworthiness (EN 15227) and car Area serviced Poland body strength (EN 12663) Gauge 1435 mm – Autocoupler Designation ED160 – Multiple unit train control with two vehicles Supply voltage 3 kVDC – Motor bogies and trailer bogies with pneumatic suspension Axle arrangement Bo' 2' 2' 2' 2' + 2' 2' 2' 2' Bo' – Modern vehicle control system Number of vehicles 20 Commissioning 2015 Comfort Seats First