Stacking up the Top 50 Optical Retailers COVER TOPIC

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Essilorluxottica 28 May 2019 Update to Credit Analysis Following Affirmation of A2

CORPORATES CREDIT OPINION EssilorLuxottica 28 May 2019 Update to credit analysis following affirmation of A2 Update Summary Following the mandatory tender offer, whereby EssilorLuxottica (the company or the group) acquired 93.3% of Luxottica's shares, the company subsequently launched a sellout and squeeze-out of the remaining shares for a combination of stock issuances and a cash consideration of about €640 million. As of March 5, 2019, EssilorLuxottica controlled all the RATINGS share capital of Luxottica, whose shares have been delisted from the Italian stock exchange. EssilorLuxottica Domicile France EssilorLuxottica's A2 rating continues to reflect (1) its position as the global leader in Long Term Rating A2 corrective lenses and eyewear market by a large margin to its competitors, illustrating the Type LT Issuer Rating - Fgn group's strong innovation capabilities and brand portfolio; (2) the group's wide offering Curr within its product category and its vertical integration, which allow it to cater to a variety Outlook Stable of customers and develop strong relationships with opticians; (3) a very solid track record Please see the ratings section at the end of this report of steady growth and resilient operating performance; and (4) the group's strong financial for more information. The ratings and outlook shown profile, underpinned by a healthy free cash flow (FCF) generation. reflect information as of the publication date. EssilorLuxottica's rating also factors in (1) the group's concentration of sales generated by its corrective lenses and frames business, as well as its relative concentration in the US market; Contacts (2) the still subdued economic environment in some of the group's key markets, which can Knut Slatten +33.1.5330.1077 weigh on lenses' renewal rates or result in some trading down by consumers; (3) the risk of a VP-Senior Analyst competitor making a breakthrough innovation; and (4) a degree of uncertainty around future [email protected] financial policies and the group's appetite for future external growth. -

Dental and Vision Savings

Dental Powered by Aetna Dental Access® 15-50% Save 15 to 50% on dental care, in most instances** Enjoy a Bright Smile at a Lower Cost What Dental Does for You ▶ Save on dental services such as cleanings, X-rays, ▶ Use the discounts as often as needed crowns, root canals and fillings at over 238,000* available dental practice locations nationwide ▶ Use the Dental Price Transparency tool in the New Benefits app to know exactly what procedures cost ▶ Need specialty dental care? Save on orthodontics and before going to the dentist periodontics, too! How your Dental Discounts Compare to Insurance Insurance isn’t the only option when you need dental care. Your dental discounts provide valuable savings for you and your family, with no limit on the number of times you can use them. Dental powered by Aetna Typical Insurance Coverage Dental Access® After hitting your maximum I reached my annual with co-pays and deductibles, Save 15% to 50% off cleanings, maximum, but I need to get additional services or procedures x-rays, fillings, root canals, and a filling. will not be covered for the rest of crowns as often as needed. the plan year. Dependents may be covered My son needs braces, but I’m Save 15% to 50% off orthodontic for an additional cost, but not sure how we can afford services, with dependents orthodontists are not always that right now. covered at no additional cost. covered. Save 15% to 50% off surgical Ouch! I broke my tooth and Surgeries are not covered until procedures with no waiting need surgery. -

KITS: Good Growth, Solid Unit Economics, Aligned Management

Matt Koranda, (949) 720-7119 [email protected] Gustavo Gala, (949) 720-7116 [email protected] Sales (800) 933-6830, Trading (800) 933-6820 COMPANY NOTE | EQUITY RESEARCH | February 16, 2021 Consumer: DTC & Disruptors Initiation of Coverage Kits Eyecare Ltd. | KITS.TO - C$8.13 - TSX | Buy Stock Data 52-Week Low - High C$7.55 - C$10.20 KITS: Good Growth, Solid Unit Economics, Shares Out. (mil) 31.00 Aligned Management; Initiate at Buy Mkt. Cap.(mil) C$252.03 3-Mo. Avg. Vol. NA With its digital-first approach to selling contacts and prescription glasses/ 12-Mo.Price Target C$13.00 sunglasses, we see a long runway of growth ahead as Kits capitalizes on a Cash (mil) C$43.2 steady shift of the USD $35bn North American eyewear market into online Tot. Debt (mil) C$11.0 channels (only 13% sold online in 2021, under-penetrated vs. most consumer Revenue (C$ millions) categories). We like Kits' dual-pronged strategy of converting customers into high-visibility auto-ship programs while driving glasses growth, as these Yr Dec —2020— —2021E— —2022E— improve customer-level profitability. Moreover, management has a track- Curr Curr 1Q NA 22.5E 32.4E record of success and owns ~70% of shares. 2Q NA 32.1E 45.3E ■ 3Q 20.2A 31.8E 44.9E We initiate coverage on Kits Eyecare at Buy with a $13 PT. Kits 4Q 19.6A 30.6E 41.2E offers vision testing, prescription renewals, and products such as contact YEAR 74.5A 116.9E 163.9E lenses and eyeglasses through its website, kits.com. -

Group Vision Plans Simplicity That Makes You Smile

1 Group Vision Plans Simplicity that makes you smile. Last updated 09/2018 On our quest to keep benefits outstanding and simple, we are also looking for easy ways for our brokers to enhance their business too. That’s why we offer a variety of uncomplicated vision plans. Vision plans that are effortless, highly valued and an easy way to enhance your client’s benefits package. They are quick to set up, take little administrative time and are painless to manage. So if you aren’t taking advantage of this simple way to expand your clientele, we think you should be. 01 Table of Contents 02 Why Dental Select 03 National Provider Access 04 Vision Health and Wellness 05 Financial Strength 06 Nationwide Availability 07 Dental Coverage 08 Online and On the Go Group Vision Plans 10 Vis-6 Vision Plan 11 Vis-8 Vision Plan 12 Vis-12 Vision Plan 13 Vis-21 Vision Plan 14 Vision Plan Comparison 15 Vision Plan Notes 16 Participation Requirements Vision Plan Forms 17 New Group Checklist 18 All Group Application 20 Employee Enrollment Form 22 Employee Change Form 27 Group EFT Authorization Form 28 Key Terms 29 FAQs 02 Why Dental Select? We know your clients will take notice of major retail brands like LensCrafters, Pearle Vision, JCPenney, Sears Optical, and Target Optical. Yeah, we’ve got all those. Plus, with the ability to order glasses and contacts online, your clients will easily see our commitment to service and simplicity. Day in and day out, our Dental Select family works hard to bring uncluttered, personable experiences and preferred benefits. -

Stacking up the Top 50 Optical Retailers COVER TOPIC

34 Stacking Up the Top 50 Optical Retailers COVER TOPIC Updated on 5/15/2019 VM’s Ranking Underscores Expansion Among the 10 Leading Players MARGE AXELRAD / SENIOR VP, EDITORIAL DIRECTOR AND MARK TOSH / SENIOR EDITOR U.S. Vision Care Market Mass (in millions) Merchants’ NEW YORK—New attitudes among consumers to- Top 50 Share Top 10 Share Share ward purchasing in general and the rise of digital $14,364.0* $12,561.7* $3,501.5* exploration and purchasing may have upended the general retail marketplace last year with many store closures and reorgs. But as the U.S. economy 40.2% 35.2% 9.8% held its own, the optical industry’s total sales rose just slightly and remained stable. It was new and continued private equity-driven investments in optical and optometric retail and solid organic sales growth from value-sector opti- Total 2018 Market: $35,725** cal retailers that reflected a higher dollar volume * VM Estimate ** Vision care products and services sold at optical retail locations. Source: VisionWatch | The Vision Council among the 50 U.S. Optical Retailers in Vision Mon- Data is from 12ME Dec. 2018 Continued on page 44 VM’s Top 50 Sales Concentration Grows Top 50 Retailers’ Sales (in millions) NEW YORK—There was a higher concentration of sales among the 2019 VM Top Mass Top 10 Share Merchants’ $12,561.7* 50 U.S. Optical Retailers, which assesses estimates of 12 months of calendar sales 24.4% Share 87.5% for the year ending Dec. 2018. The Top 10 optical retailers collectively comprise $3,501.5* 87.5 percent of the Top 50 U.S. -

A Large Vision Network Means There's Always a Provider In

Vision Plans Network Options A large vision network means there’s always a provider in sight. UnitedHealthcare knows how important it is to find a provider you can trust who meets your lifestyle, eye care and eyewear needs. With our large national eye care network, Spectera Eyecare Networks, you can choose to get more personalized care from a private practice. Or, take advantage of the convenience retail chains offer with evening and weekend hours. Either way, we’re focused on providing you with a better eye care experience. Well-known practices and brands in our large national network include: • 20/20 Vision Center • Eye Boutique • 3 Guys Optical • EyeCare Associates • AccurateOptical • Eye Express • All About Eyes • eyecarecenter Making it easier for you • Allegany Eyecare • Eyeglass World to find a provider. • America’s Best • EyeMart Express To find the provider who best • Bard Optical • Eyetique meets your needs, login to • BJ’s Optical • For Eyes myuhcvision.com or call • Boscov’s Optical • General Vision Services 1-800-638-3120. • Clarkson Eyecare • H. Rubin Vision Centers Some providers or locations may not participate in your plan. • Co/Op Optical • Henry Ford OptimEyes • Cohen’s Fashion Optical • Horizon Eye Care • Costco Optical • Houston Eye Associates • Crown Vision Center • JC Penney Optical • Dr. Travel Family Eye Care • Midwest Vision Centers CONTINUED • MyEyeDr. • Standard Optical • National Optometry • Stanton Optical • National Vision • Sterling Optical • Nationwide Vision • SVS Vision • NUCROWN • Target Optical (not available for • Optical Shop at Meijer all members) • Optyx • Texas State Optical • Ossip Optometry • The Eye Gallery • Pearle Vision • The Hour Glass • Rosin Eyecare • Thoma & Sutton Optical • RX Optical • Today’s Vision • Sam’s Club • Virginia Eye Institute • Schaeffer Eye Centers • Vision4Less • Sears Optical (not available for • Visionmart Express all members) • Visionworks • See Inc. -

BLANE FRIEST, Individually and on ) ) Behalf of a Class of Similarly Situated Individuals, ) ) Civil Action No

Case 2:16-cv-03327-SDW-LDW Document 18 Filed 12/16/16 Page 1 of 24 PageID: 463 NOT FOR PUBLICATION UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY ___________________________________ ) BLANE FRIEST, individually and on ) ) behalf of a class of similarly situated individuals, ) ) Civil Action No. 2:16-cv-03327-SDW-LDW Plaintiff, ) ) v. ) ) OPINION LUXOTTICA GROUP S.P.A.; ) LUXOTTICA USA, LLC; LUXOTTICA ) RETAIL NORTH AMERICA, INC.; THE ) UNITED STATES SHOE CORP. t/a ) December 16, 2016 LENSCRAFTERS; JOHN DOES 1-5; and ABC CORPS 6-10, ) Defendants. ___________________________________ WIGENTON, District Judge. ) Before this Court is the Motion to Dismiss, pursuant to Federal Rule of Civil Procedure ) 12(b)(6), of Defendants Luxottica Group S.p.A.; Luxottica USA, LLC; Luxottica Retail North America, Inc.; and The United States Shoe Corp. t/a LensCrafters (“LensCrafters”) (collectively “Defendants”). This Court has jurisdiction over this matter pursuant to 28 U.S.C. § 1332. Venue is proper in this District pursuant to 28 U.S.C. § 1391(b). This Court, having considered the parties’ submissions, decides this matter without oral argument pursuant to Federal Rule of Civil Procedure 78. For the reasons stated below, Defendants’ Motion is GRANTED. I. FACTUAL HISTORY Defendants are four companies, one of which, LensCrafters, operates 888 retail prescription eyewear stores throughout the United States, including thirty in New Jersey. (Compl. 1 Case 2:16-cv-03327-SDW-LDW Document 18 Filed 12/16/16 Page 2 of 24 PageID: 464 ¶¶ 12-16.)1 Plaintiff, Blane Friest (“Plaintiff”), a New Jersey resident, purchased prescription eyeglasses from Defendant LensCrafters at an unspecified location on approximately December 22, 2014. -

DISCOUNTS & Savings to Help You and Your Family on Your Path to Wellness

for HMFP members DISCOUNTS & savings To help you and your family on your path to wellness These savings programs are not insurance products. Rather, they are discounts for programs and services designed to help keep members healthy and active. All programs subject to change without advance notice. • Visionworks: Get a free pair of prescription eyeglasses with Vision your covered routine eye exam.1 Also, save 40% on frames. • Vision discounts at popular locations: Save 35% on frames when you buy a complete pair of glasses. Save 20% on any frame or lens options purchased separately, or save 20% on other lens add- ons and services. Locations include: Target Optical, JC Penney Optical, Pearle Vision, Lenscrafters, In Style Optical and other EyeMed access network optical providers.2 • Harvard Vanguard Medical Associates: Save 40% on frames and 20% on prescription sunglasses. • Laser vision correction: Save up to 50% on procedures from Davis Vision, QualSight LASIK and US Laser Network locations in MA, ME, NH and CT. • Amplifon Hearing Health Care: Save on hearing services and save Hearing up to 50% on hearing aids. Plus, one year of follow-up services is included with purchase. Locations nationwide. • Flynn Associates: Save up to $200 per hearing aid, and get free quarterly cleanings, adjustments and more. • Speech-Language and Hearing Associates of Greater Boston, PC: Save up to $200 on each hearing aid purchase. Healthy • DASH for HealthTM: Save 50% on a six-month subscription for Eating this online program to help improve eating and exercise habits. • Eat Right Now: Save 25% on a subscription to this mindful eating app that combines neuroscience and mindfulness to reduce your craving-related eating by 40%. -

Eyewear Collection - Fall/Winter 2016

EYEWEAR COLLECTION - FALL/WINTER 2016 EYEWEAR COLLECTION - FALL/WINTER 2016 Representing Ralph Lauren’s iconic heritage as a designer and recognized throughout the world, Polo Ralph Lauren reflects a celebrated vision of classic yet spirited American style for men and women. Timeless and authentic, Polo Ralph Lauren is the enduring symbol of modern-day American lifestyle: easy, energetic, young and cool. “I called the line Polo because it had a sensibility that was sporty and international—tweedy and sophisticated. It had an imagery that represented the lifestyle of the ties and the clothes.” –Ralph Lauren POLO INDEX FALL/WINTER 2016 MEN STYLES WOMEN STYLES OPTICAL OPTICAL PH 1168 10 PH 2164 22 PH 2163 11 PH 2165 23 PH 2166 12 PH 2167 23 PH 2168 12 PH 2169 13 SUN PH 4117 26 SUN PH 4118 26 PH 3105 16 PH 4116 17 PH 4119 18 PH 4120 18 POLO KIDS OPTICAL PP 8037 100 PP 8525 100 PP 8526 101 6 POLO INDEX CORE COLLECTION MEN STYLES MEN STYLES OPTICAL PH 1067 30 PH 4095 72 PH 1083 30 PH 4098 72 PH 1117 31 PH 4099 73 PH 1142 31 PH 4102 74 PH 1143 32 PH 4106 74 PH 1144 32 PH 4107 75 PH 1145 33 PH 4108 75 PH 1147 33 PH 4109 76 PH 1148 34 PH 4110 77 PH 1150 34 PH 4113 78 PH 1152 35 PH 4115 78 PH 1153J 35 PH 1157 36 PH 1160 37 PH 1161 37 PH 1162 38 WOMEN STYLES PH 1163 38 PH 1164 39 OPTICAL PH 1165 40 PH 1166 82 PH 1167 41 PH 2127 83 PH 2039 41 PH 2128 83 PH 2046 42 PH 2131 84 PH 2047 42 PH 2135 84 PH 2057 43 PH 2138 85 PH 2058 43 PH 2147 85 PH 2065 44 PH 2148 86 PH 2083 44 PH 2156 86 PH 2085 45 PH 2159 87 PH 2104 45 PH 2160 87 PH 2115 46 RL 6058 88 -

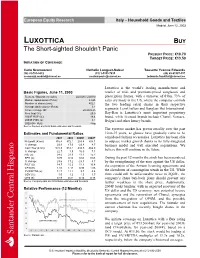

LUXOTTICA BUY the Short-Sighted Shouldn’T Panic PRESENT PRICE: €10.70 TARGET PRICE: €13.50 INITIATION of COVERAGE

European Equity Research Italy – Household Goods and Textiles Madrid, June 12, 2003 LUXOTTICA BUY The Short-sighted Shouldn’t Panic PRESENT PRICE: €10.70 TARGET PRICE: €13.50 INITIATION OF COVERAGE Carlo Scomazzoni Nathalie Longuet-Saleur Tousette Yvonne Edwards (34) 91-701-9432 (33) 1-5353-7435 (49) 69-91507-357 [email protected] [email protected] [email protected] Luxottica is the world’s leading manufacturer and Basic Figures, June 11, 2003 retailer of mid- and premium-priced sunglasses and Reuters / Bloomberg codes: LUX.MI / LUX IM prescription frames, with a turnover of €3bn. 73% of Market capitalisation (€ mn): 4,825 sales are made in the US, where the company controls Number of shares (mn): 452.1 the two leading retail chains in their respective Average daily volume (€ mn): 3.1 52-week range (€): 20.20-9.25 segments: LensCrafters and Sunglass Hut International. Free float (%): 25.0 Ray-Ban is Luxottica’s most important proprietary 2003E ROE (%): 18.4 brand, while licensed brands include Chanel, Versace, 2003E P/BV (x): 3.1 Bvlgari and other luxury brands. 2002-04F PEG: Neg Source: Reuters and SCH Bolsa estimates and forecasts. The eyewear market has grown steadily over the past Estimates and Fundamental Ratios 10-to-15 years, as glasses have gradually come to be 2001 2002 2003E 2004F considered fashion accessories. Luxottica has been able Net profit (€ mn): 316.4 372.1 283.4 308.1 to outpace market growth thanks to its fully-integrated % change: 23.9 17.6 -23.8 8.7 business model and well executed acquisitions. -

Senate Bill 216 Jason Singh, OD Pearle Vision, Luxottica Retail North America Proponent Testimony April 27, 2016

Senate Bill 216 Jason Singh, OD Pearle Vision, Luxottica Retail North America Proponent Testimony April 27, 2016 Chairman Peterson, Vice Chairman Beagle, Ranking Member Tavares and members of the Senate Ways and Means Committee, thank you for the opportunity to provide testimony in support of Senate Bill 216. My name is Dr. Jason Singh and I am the Vice President of Vision Care for Pearle Vision. Pearle Vision is a part of Luxottica Retail North America. We operate 118 retail optical stores here in Ohio under the LensCrafters, Pearle Vision, Sears Optical and Target Optical brands. We employ 3200 Ohioans, including 400 Ohio licensed dispensing and apprentice opticians. Luxottica’s North American retail offices in Mason, Ohio coordinate over 4,500 stores across the United States. In addition, we operate OneSight, a public charity founded in Cincinnati. OneSight’s vision is to eradicate the global vision care crisis for the 1.1 Billion people around the world who need vision correction and lack the access to it. We accomplish this by mobilizing eye care professionals, industry experts, and volunteers in the U.S. and around the world. In 27 years, we have given the gift of sight to over 9 million people. On behalf of Pearle Vision, Luxottica Retail North America and the patients we serve, I urge your support of Senate Bill 216. SB 216 is an important bill that will make immediate impact for Ohio residents. Statistics show 2/3 Ohio residents require vision correction. Economic barriers, like the sales tax, make it less likely for patients to obtain the care and medical products they need to realize their full potential. -

2011103) Wausau Open Ended Comments (3

Open ended comments: What shopping or service businesses would you like to see locate in the City? "BREAD SMITH" (MILW & APPLETON) ??? 1. CURLING SPORTING GOODS STORE CLOSEST IS STEVES CURLING SUPPLIES IN MADISON. COULD BE ? 2. CHUCK E CHEESE CLOSET IS GREEN BAY RIGHT IN THE NEW CURLING CLUB. 3. CRAFT STORE DOWNTOWN RED LOBSTER. A BARTER (GOODS EXCHANGE) STORE TO HELP ALL. NOT A PWEN OR THRIFT STORE. ENABLES LOW INCOME TO EXCHANGE & WEALTHY TO "RECYCLE". A big box store on old Wausau metal property A BIGGER GROCERY STORE ON THE EASTSIDE. A BIGGER NICER MALL OR ZOO. A DOWNTOWN WALGREEN'S OR SIMILAR STORE. A DRIVE UP GROCERY STORE HAD THEM IN ILLINOIS‐LOVED IT. A GROCERY ON THE SOUTH‐EAST SIDE. A MANED COMMUNCATION CENTER FOR SIMPLE JOBS, BABY SITTING, MOWING, SHOVELING ETC. A@EDICATED CITY MARKET. ACTUALLY WE NEED MORE PLACES TO EAT OUT! additional restaurants (Panera Bread, Pei Wei, Sonic, etc), Target (on west side of city), Burlington Coat, more indoor activities for kids (roller skating, rock wall climbing, laser tag, etc) ALL "B" STORES IN THIS AREA DUMP THE DOWNTOWN ‐‐ TOO MUCH SPENT TO KEEP A DYING AREA!! ANOTHER WALMART‐NORTH. ANTIQUE MALL. ANYONE WHO WOULD PAY TAXES AND MAKE AREA BETTER. anything not in Rib Mt. How about 6th Street? BABIES 'R' US, TOYS 'R' US, BURLINGTON COAT FACTORY. BAGELS,BAKERY/SANDWICH SHOP BASS PRO SHOP Better grocery stores ‐ Whole Foods or Trader Joes. Fewer "big box" retailers. BETTER RESTAURANTS. A GOOD BAKERY. BETTER SPORTING GOODS STORES. BIG & TALL MANS SHOP. BIG LOTS BIGGER HEALTH FOOD STORES BIGGER STORES B'J'S OR COSTCO BURLINGTON AND TGIFRIDAYS Burlingtons Businesses on the East Side of town.